There is a global rallying call for environmental, social and governance (ESG) investing. Money managers globally are embedding ESG into their core strategies, earmarking vast pools of capital to invest in sustainable assets. According to the latest Refinitiv data, the number of green, social and sustainability-related deals each hit an all-time high throughout 2020{{1}}{{{ESG Investing Came Of Age In 2020 - Millennials Will Continue To Drive It In 2021

Source: Forbes}}}. But very little of this capital finds its way to African markets, despite this market’s significant investment needs.

According to the United Nations, the 2015 sustainable development goals (SDGs) – widely viewed as a full list of this generation’s development challenges – will require some $5 tn to $7tn of capital per year; and in Africa there is an annual investment gap of $500 billion to $1.2tn{{2}}{{{Africa and the Sustainable Development Goals: A long way to go

Source: Brookings}}}.

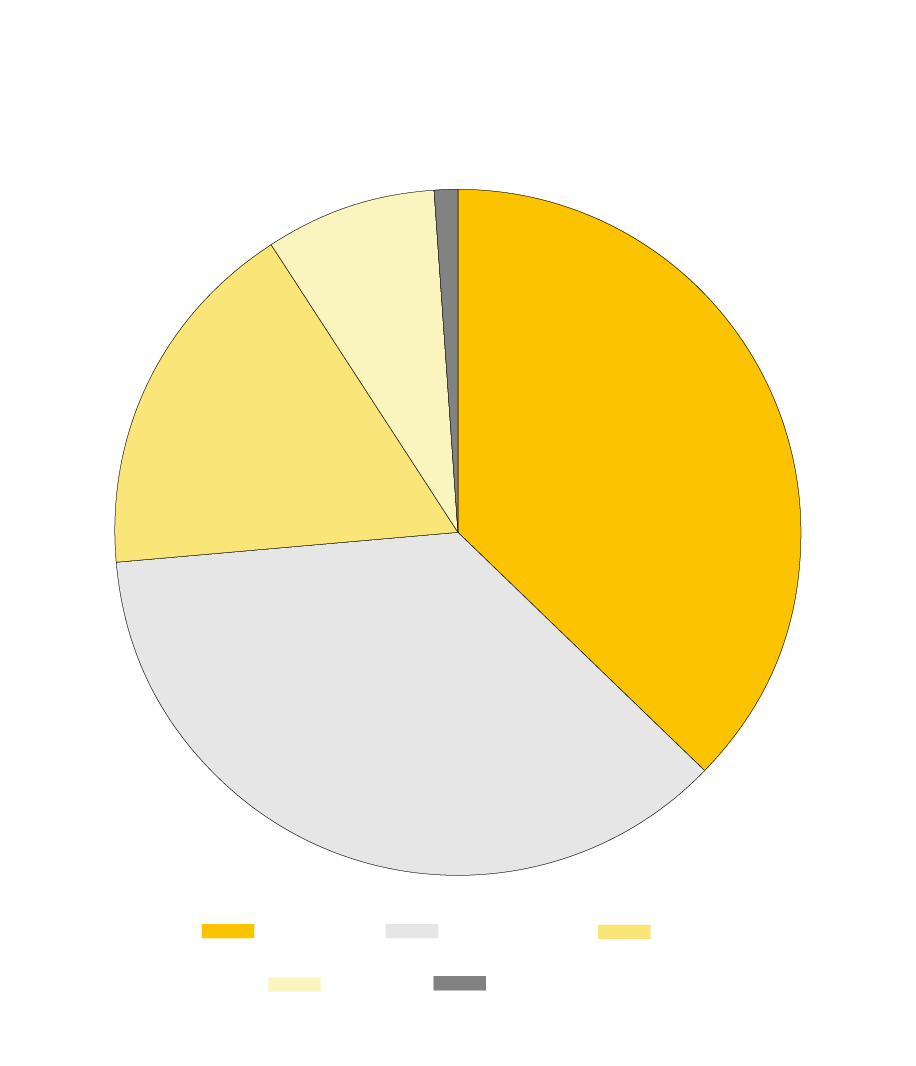

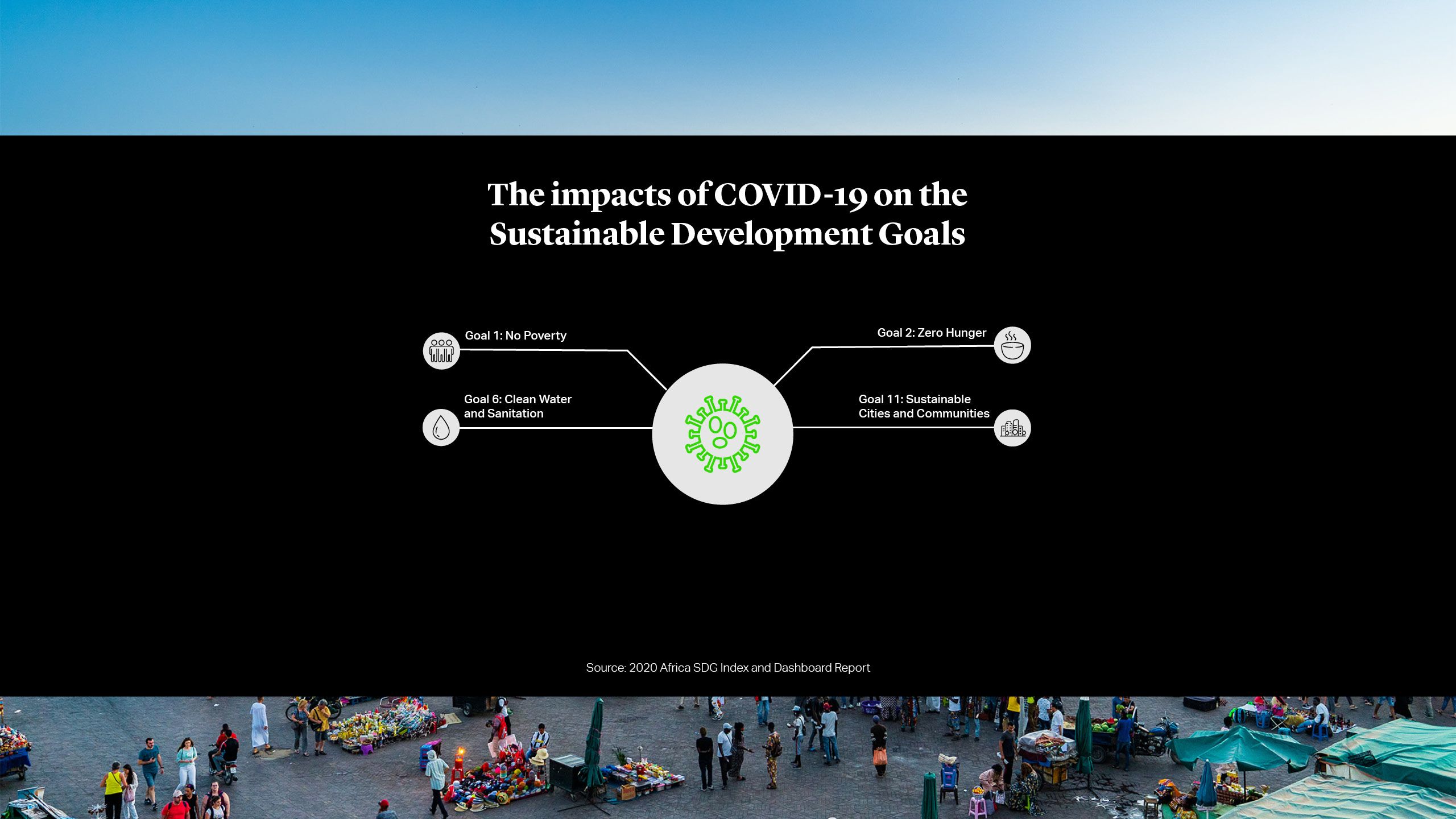

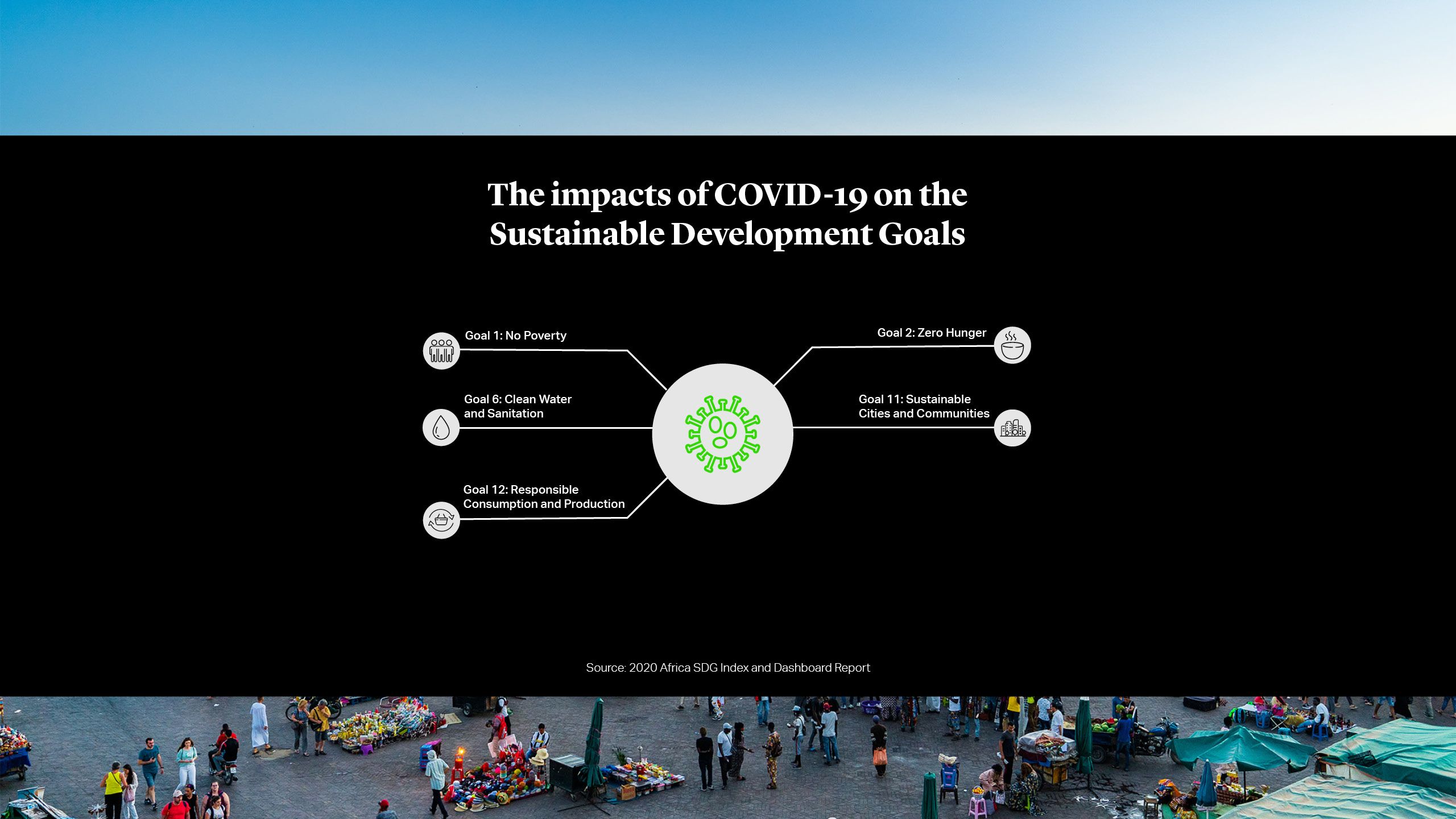

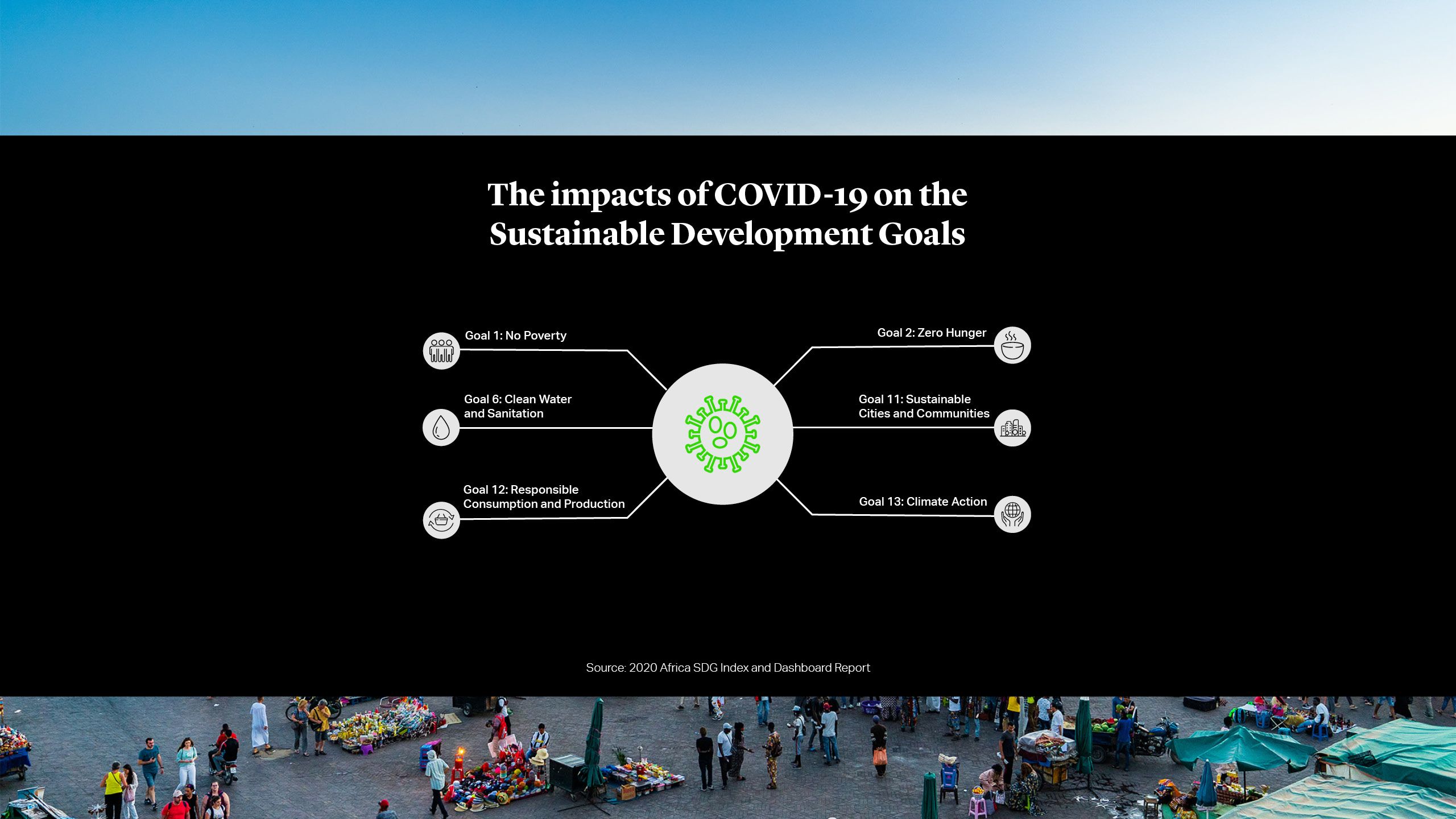

23 million people or more could be pushed into extreme poverty

73 million Africans are forecast to be food insecure

Inadequate basic services hinder the capacity of vulnerable people to follow basic, effective prevention measures against the virus

Short term reduction in pollution improves air quality

Increase in urban poverty

Enhanced responsible consumption due to locally-sourced production

Increase in single use plastics

Decrease in GHG emissions

Efforts to meet the climate commitments threatened by economic recession

There is a global rallying call for environmental, social and governance (ESG) investing. Money managers globally are embedding ESG into their core strategies, earmarking vast pools of capital to invest in sustainable assets. According to the latest Refinitiv data, the number of green, social and sustainability-related deals each hit an all-time high throughout 2020{{1}}{{{ESG Investing Came Of Age In 2020 - Millennials Will Continue To Drive It In 2021

Source: Forbes}}}. But very little of this capital finds its way to African markets, despite this market’s significant investment needs.

According to the United Nations, the 2015 sustainable development goals (SDGs) – widely viewed as a full list of this generation’s development challenges – will require some $5tn to $7tn of capital per year; and in Africa there is an annual investment gap of $500 billion to $1.2tn{{2}}{{{Africa and the Sustainable Development Goals: A long way to go

Source: Brookings}}}.

23 million people or more could be pushed into extreme poverty

73 million Africans are forecast to be food insecure

Inadequate basic services hinder the capacity of vulnerable people to follow basic, effective prevention measures against the virus

Short term reduction in pollution improves air quality

Increase in urban poverty

Enhanced responsible consumption due to locally-sourced production

Increase in single use plastics

Decrease in GHG emissions

Efforts to meet the climate commitments threatened by economic recession

The COVID-19 pandemic has exacerbated this crisis in Africa. An additional 60 million Africans could be pushed into poverty and food insecurity is expected to nearly double, the Sustainable Development Goals Center for Africa estimates{{3}}{{{2020 Africa SDG Index and Dashboards Report

Source: The Sustainable Development Goals for Africa}}}.

Lack of funding and resources is one of the most important challenges both in terms of SDG implementation and monitoring. How can sustainable finance be scaled across Africa and impact capital be channelled to the places where it is needed most?

GSS Bonds

Issuance of debt where the proceeds will be used to fund green, social and sustainable (GSS) projects is gaining momentum in some of Africa’s 54 markets. In South Africa, the Johannesburg Stock Exchange launched a sustainability segment for green bonds in June 2020, while in Nigeria – which was the first African country to issue a sovereign green bond in 2017 – the Nigerian Stock Exchange established its Green Bond Market on which there are four listed bonds{{4}}{{{First Kenyan shilling green bond lists on London Stock Exchange

Source: Euromoney}}}.

The African Development Bank (AfDB) has a well-established social bond programme, and in March 2020 it issued the largest US dollar-denominated social bond in the capital markets, a $3bn “Fight COVID-19” social bond{{5}}{{{African Development Bank launches record breaking $3 billion “Fight COVID-19” Social Bond

Source: African Development Bank Group}}}. AfDB has also raised the equivalent of $2bn in social bonds denominated in euros and Norwegian krone since 2017.

In the West African Economic and Monetary Union Zone, which has established a legal framework for green bonds, Cote d’Ivoire gathered experts from the Climate Bond Initiative and government officials for a “boot-camp” in April 2020 to discuss ways green bonds could accelerate the country’s climate action plans{{6}}{{{Cote d’Ivoire looks to green bonds to finance its NDC

Source: NDC Support Programme}}}.

But Africa’s GSS bond market remains small and several key issues are holding back development for both sovereign and corporate issuers.

GSS Bonds

Issuance of debt where the proceeds will be used to fund green, social and sustainable (GSS) projects is gaining momentum in some of Africa’s 54 markets. In South Africa, the Johannesburg Stock Exchange launched a sustainability segment for green bonds in June 2020, while in Nigeria – which was the first African country to issue a sovereign green bond in 2017 – the Nigerian Stock Exchange established its Green Bond Market on which there are four listed bonds{{4}}{{{First Kenyan shilling green bond lists on London Stock Exchange

Source: Euromoney}}}.

The African Development Bank (AfDB) has a well-established social bond programme, and in March 2020 it issued the largest US dollar-denominated social bond in the capital markets, a $3bn “Fight COVID-19” social bond{{5}}{{{African Development Bank launches record breaking $3 billion “Fight COVID-19” Social Bond

Source: African Development Bank Group}}}. AfDB has also raised the equivalent of $2bn in social bonds denominated in euros and Norwegian krone since 2017.

In the West African Economic and Monetary Union Zone, which has established a legal framework for green bonds, Cote d’Ivoire gathered experts from the Climate Bond Initiative and government officials for a “boot-camp” in April 2020 to discuss ways green bonds could accelerate the country’s climate action plans{{6}}{{{Cote d’Ivoire looks to green bonds to finance its NDC

Source: NDC Support Programme}}}.

But Africa’s GSS bond market remains small and several key issues are holding back development for both sovereign and corporate issuers.

Lack of Standardisation

GSS bonds are flourishing as investors look to incorporate ESG issues into their portfolios. But the complexity of the market, plus the perception of onerous upfront costs and reporting requirements is still keeping some borrowers on the side-lines.

Issuing GSS bonds also exposes borrowers to higher levels of scrutiny and reputational risk should things go wrong, which can be off-putting.

The asset class is not yet standardised with social, green, sustainable, impact, development, COVID-19 and vaccine bonds all falling under the GSS bond umbrella. Choosing the most appropriate projects, publishing a bond framework and securing third party certification can be a baffling process for issuers.

Initiatives like ICMA’s Green and Social Bond Principles, which provide voluntary guidelines for issuers focussed on transparency, reporting and disclosure, are going some way to ease the process for issuers, while third party endorsement from the likes of the Climate Bond Initiative, Sustainalytics and more recently JP Morgan offer a clear set of guidelines for issuers and investors to follow.

As the range of GSS bond issuers has broadened, investors have become more engaged with the general ESG characteristics of sovereigns and corporates. It is not unusual for investors to contact issuers directly with detailed questions about their ESG reporting and policies.

This pressure is likely to increase as the EU framework on ESG disclosure requirements for asset managers comes into force in March 2021. At the product level, managers will need to decide, for each financial product they sell whether to “comply or explain” by assessing the sustainability risks of the product.

The World Economic Forum has released a set of universal ESG metrics, offering clearer guidance for corporates{{7}}{{{Measuring Stakeholder Capitalism: Top Global Companies Take Action on Universal ESG Reporting</br>Source: World Economic Forum}}}while the Sustainability Accounting Standards Board (SASB) Standards and other similar guidance provide requirements for listed companies, but as of yet, there is no common taxonomy for sovereign issuers. Recently the UN’s Global Investors for Sustainable Development Group has called upon the G20 to push for the establishment of global ESG disclosure standards.

Many African sovereigns don’t have the infrastructure or technical capacity required to ring fence bond proceeds and identify green, social or sustainable assets. Once the bond is issued, further internal resources are needed to collate and provide up to date ESG. For sovereigns that already have and report this data, the incremental burden is low. But for many African countries, the data doesn’t exist or the data systems are too complicated.

Standardisation and oversight from a single body would make it much simpler for sovereigns to navigate ESG requirements and encourage more to issue GSS bonds, while helping investors better measure performance and benchmark against clear objectives.

Principles of Governance

The definition of governance is evolving as organizations are increasingly expected to define and embed their purpose at the centre of their business. But the principles of agency, accountability and stewardship continue to be vital for truly “good governance”.

Planet

An ambition to protect the planet from degradation, including through sustainable consumption and production, sustainably managing its natural resources and taking urgent action on climate change, so that it can support the needs of the present and future generations.

People

An ambition to end poverty and hunger, in their forms and dimensions, and to ensure that all human beings can fulfil their potential in dignity and equality and in a healthy environment.

Prosperity

An ambition to ensure that all human beings can enjoy prosperous and fulfilling lives and that economic, social and technological progress occurs in harmony with nature.

Lack of Standardisation

GSS bonds are flourishing as investors look to incorporate ESG issues into their portfolios. But the complexity of the market, plus the perception of onerous upfront costs and reporting requirements is still keeping some borrowers on the side-lines.

Issuing GSS bonds also exposes borrowers to higher levels of scrutiny and reputational risk should things go wrong, which can be off-putting.

The asset class is not yet standardised with social, green, sustainable, impact, development, COVID-19 and vaccine bonds all falling under the GSS bond umbrella. Choosing the most appropriate projects, publishing a bond framework and securing third party certification can be a baffling process for issuers.

Initiatives like ICMA’s Green and Social Bond Principles, which provide voluntary guidelines for issuers focussed on transparency, reporting and disclosure, are going some way to ease the process for issuers, while third party endorsement from the likes of the Climate Bond Initiative, Sustainalytics and more recently JP Morgan offer a clear set of guidelines for issuers and investors to follow.

As the range of GSS bond issuers has broadened, investors have become more engaged with the general ESG characteristics of sovereigns and corporates. It is not unusual for investors to contact issuers directly with detailed questions about their ESG reporting and policies.

This pressure is likely to increase as the EU framework on ESG disclosure requirements for asset managers comes into force in March 2021. At the product level, managers will need to decide, for each financial product they sell whether to “comply or explain” by assessing the sustainability risks of the product.

The World Economic Forum has released a set of universal ESG metrics, offering clearer guidance for corporates{{7}}{{{Measuring Stakeholder Capitalism: Top Global Companies Take Action on Universal ESG Reporting

Source: World Economic Forum}}}while the Sustainability Accounting Standards Board (SASB) Standards and other similar guidance provide requirements for listed companies, but as of yet, there is no common taxonomy for sovereign issuers. Recently the UN’s Global Investors for Sustainable Development Group has called upon the G20 to push for the establishment of global ESG disclosure standards.

Many African sovereigns don’t have the infrastructure or technical capacity required to ring fence bond proceeds and identify green, social or sustainable assets. Once the bond is issued, further internal resources are needed to collate and provide up to date ESG. For sovereigns that already have and report this data, the incremental burden is low. But for many African countries, the data doesn’t exist or the data systems are too complicated.

Standardisation and oversight from a single body would make it much simpler for sovereigns to navigate ESG requirements and encourage more to issue GSS bonds, while helping investors better measure performance and benchmark against clear objectives.

Principles of Governance

The definition of governance is evolving as organizations are increasingly expected to define and embed their purpose at the centre of their business. But the principles of agency, accountability and stewardship continue to be vital for truly “good governance”.

Planet

An ambition to protect the planet from degradation, including through sustainable consumption and production, sustainably managing its natural resources and taking urgent action on climate change, so that it can support the needs of the present and future generations.

People

An ambition to end poverty and hunger, in their forms and dimensions, and to ensure that all human beings can fulfil their potential in dignity and equality and in a healthy environment.

Prosperity

An ambition to ensure that all human beings can enjoy prosperous and fulfilling lives and that economic, social and technological progress occurs in harmony with nature.

Risk Perception

Another issue is that much of the GSS bond capital raised globally is deployed in developed or high-grade markets; the perceived risks of investing in sub-investment grade frontier markets like sub-Saharan Africa are deemed too high.

For many African sovereigns and corporates, issuing in a foreign currency adds a lot of risk to their balance sheet. The bond size also needs to be substantial to attract international ESG investors, making it hard for issuers who have less room for debt on their balance sheet or who don’t have large projects identified.

Some institutions are proposing ways to reduce these hurdles to accessing the ESG market. JP Morgan’s new Development Finance Institution aims to crowd-in sizeable private sector investors while creating a tradeable asset class development finance products by measuring and certifying the development intensity of projects{{8}}{{{JPMorgan’s fresh idea for development finance

Source: Euromoney}}}.

Global investment banks like Citigroup are proposing blended finance structures to crowd in funds targeting investment grade products. These funds would be structured to protect private-sector creditors while multilaterals like the World Bank would absorb the first loss{{9}}{{{How investment banks can help finance Africa’s Covid-19 fight

Source: Euromoney}}}.

What Can Investors Do to Support ESG Development?

Bondholders can play an important role in driving change and shaping ESG outcomes through their investment decisions, according to a new report by Principals for Responsible Investment{{10}}{{{ESG engagement for sovereign debt investors

Source: Principles for Responsible Investment}}}.

When a devastating forest fire swept through the Amazon rainforest in 2019, Nordea Asset Management suspended the purchasing of Brazilian government bonds before meeting with government officials in Helsinki to discuss the firm’s concerns about deforestation. Later in July this year, institutional investors managing $4.6tn in assets urged Brazil to halt deforestation.

Why Bother? What are the Potential Benefits of GSS Bond Issuances for Sovereigns?

- Reduce funding costs

- Strengthen long-term investor loyalty

- Access to both broader and new investor base

- Preserve/secure long-term capital flows and market access

- Create direct link between sustainability and financing strategies

What Can Investors Do to Support ESG Development?

Bondholders can play an important role in driving change and shaping ESG outcomes through their investment decisions, according to a new report by Principals for Responsible Investment{{10}}{{{ESG engagement for sovereign debt investors

Source: Principles for Responsible Investment}}}.

When a devastating forest fire swept through the Amazon rainforest in 2019, Nordea Asset Management suspended the purchasing of Brazilian government bonds before meeting with government officials in Helsinki to discuss the firm’s concerns about deforestation. Later in July this year, institutional investors managing $4.6tn in assets urged Brazil to halt deforestation.

Why Bother? What are the Potential Benefits of GSS Bond Issuances for Sovereigns?

- Reduce funding costs

- Strengthen long-term investor loyalty

- Access to both broader and new investor base

- Preserve/secure long-term capital flows and market access

- Create direct link between sustainability and financing strategies