While the human and economic cost of COVID-19 cannot be underestimated, many parts of the African continent were comparatively less impacted by the pandemic than other parts of the world. Private equity dealmaking held up well through much of 2020, despite the 3.4% decline in GDP and massive fall in foreign direct investment, evidencing the long-term commitment of the highly engaged GPs active in the continent.

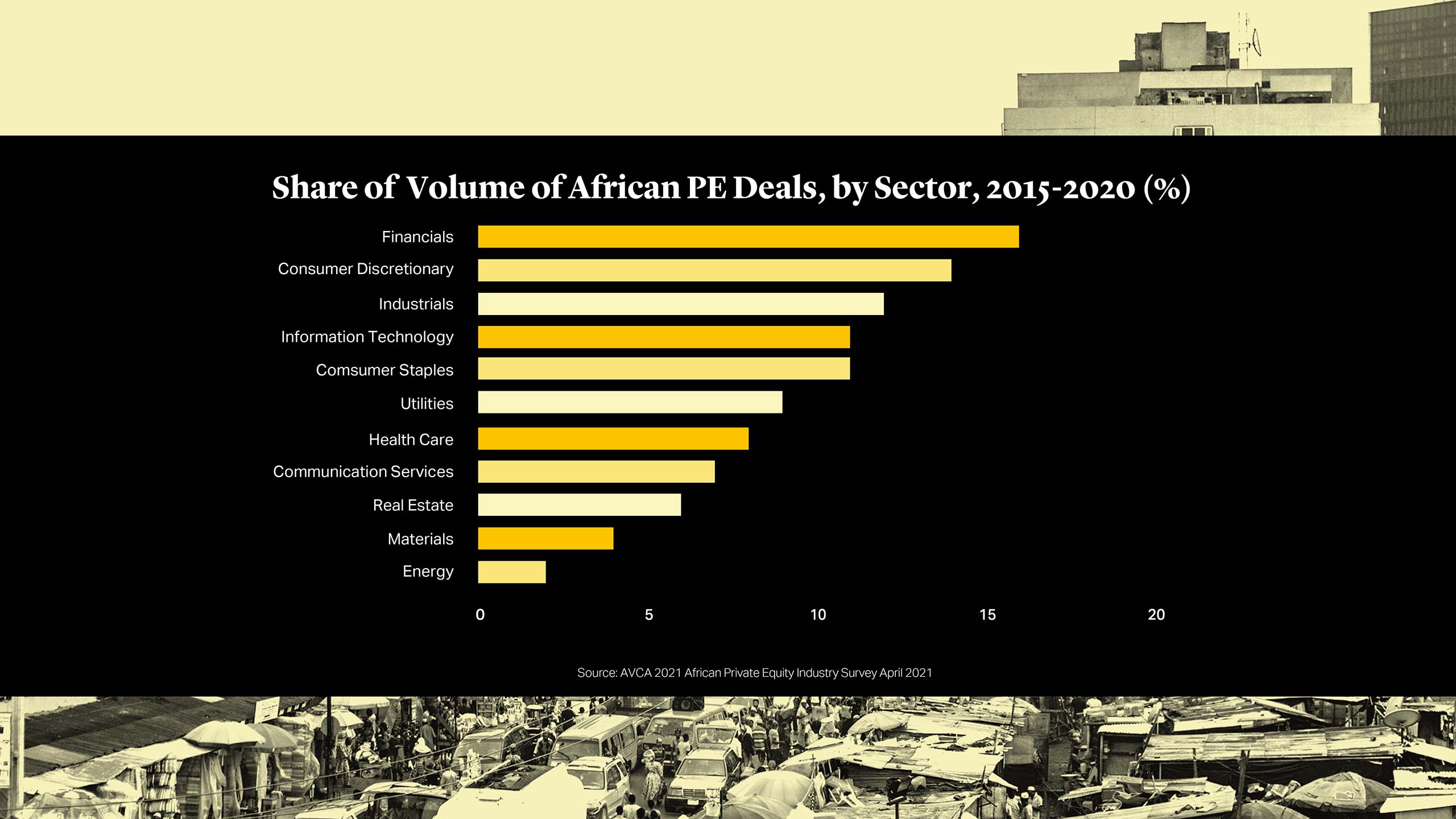

According to the Africa Venture Capital Association’s Annual Private Equity Data Tracker 2020, Financials, Information Technology and Consumer Discretionary were the most active sectors in 2020 attracting 47% of deals by volume, AVCA says, while deals in tech-enabled companies represented more than half (55%) of the investments recorded in Africa in 2020. As the continent has sought to shake off the economic impact of the pandemic and begins to live with a new reality where digital services and tech-enabled solutions providers play an ever-larger role, much of the deal activity in 2021 has largely followed the same investment trends as last year.

While the human and economic cost of COVID-19 cannot be underestimated, many parts of the African continent were comparatively less impacted by the pandemic than other parts of the world. Private equity dealmaking held up well through much of 2020, despite the 3.4% decline in GDP and massive fall in foreign direct investment, evidencing the long-term commitment of the highly engaged GPs active in the continent.

According to the Africa Venture Capital Association’s Annual Private Equity Data Tracker 2020, Financials, Information Technology and Consumer Discretionary were the most active sectors in 2020 attracting 47% of deals by volume, AVCA says, while deals in tech-enabled companies represented more than half (55%) of the investments recorded in Africa in 2020. As the continent has sought to shake off the economic impact of the pandemic and begins to live with a new reality where digital services and tech-enabled solutions providers play an ever-larger role, much of the deal activity in 2021 has largely followed the same investment trends as last year.

Fundraising

One part of the PE market particularly hard-hit by COVID-19 in 2020 was fundraising. Although a recent AVCA survey shows an increase in LPs planning to increase their PE allocation to Africa in the next three years (65% from 58% a year earlier), the continent is yet to see a return to the pre-pandemic levels of fundraising activities.

There have however been a number of notable fund closings reported this year. Lagos-based CardinalStone Capital Advisers closed its maiden private equity fund at $64 million in March1 while Kenya-based Ascent raised $100 million for the first close of its Ascent Rift Valley II Fund, which will invest in SMEs in East Africa, $20 million higher than its initial target. Uhuru Investment Partners, a middle-market private equity firm, also announced a first close of its Uhuru Growth Fund I at $113 million, with capital support from CDC Group2. Uhuru Growth Fund I is targeting a final close of $200 million.

Venture capital fund raising and investment have also seen an uptick. Cairo-based VC firm Sawari Ventures announced a final-close if its Egypt-focused VC fund at around $69 million and Samurai Incubate closed its second Africa fund at c. $18.7 million.

Improved LP sentiment and continued easing of COVID-19 related restrictions, coupled with a resumption of fundraising activities, should provide more hope for the latter part of the year.

Impact Funds

A global trend towards ESG-focused investment has had an important impact on investments in Africa.

The rise of ESG investing has led to a series of strategic partnerships and strategic reorganizations calibrated to focus on impact investment. In March, Singaporean investment group Temasek formed a $500 million strategic partnership with Leapfrog Investments, a leading global impact investment firm3, while private bank and asset management firm LGT has, also this year, spun off its direct impact investing activities into a global private equity partnership called Lightrock4.

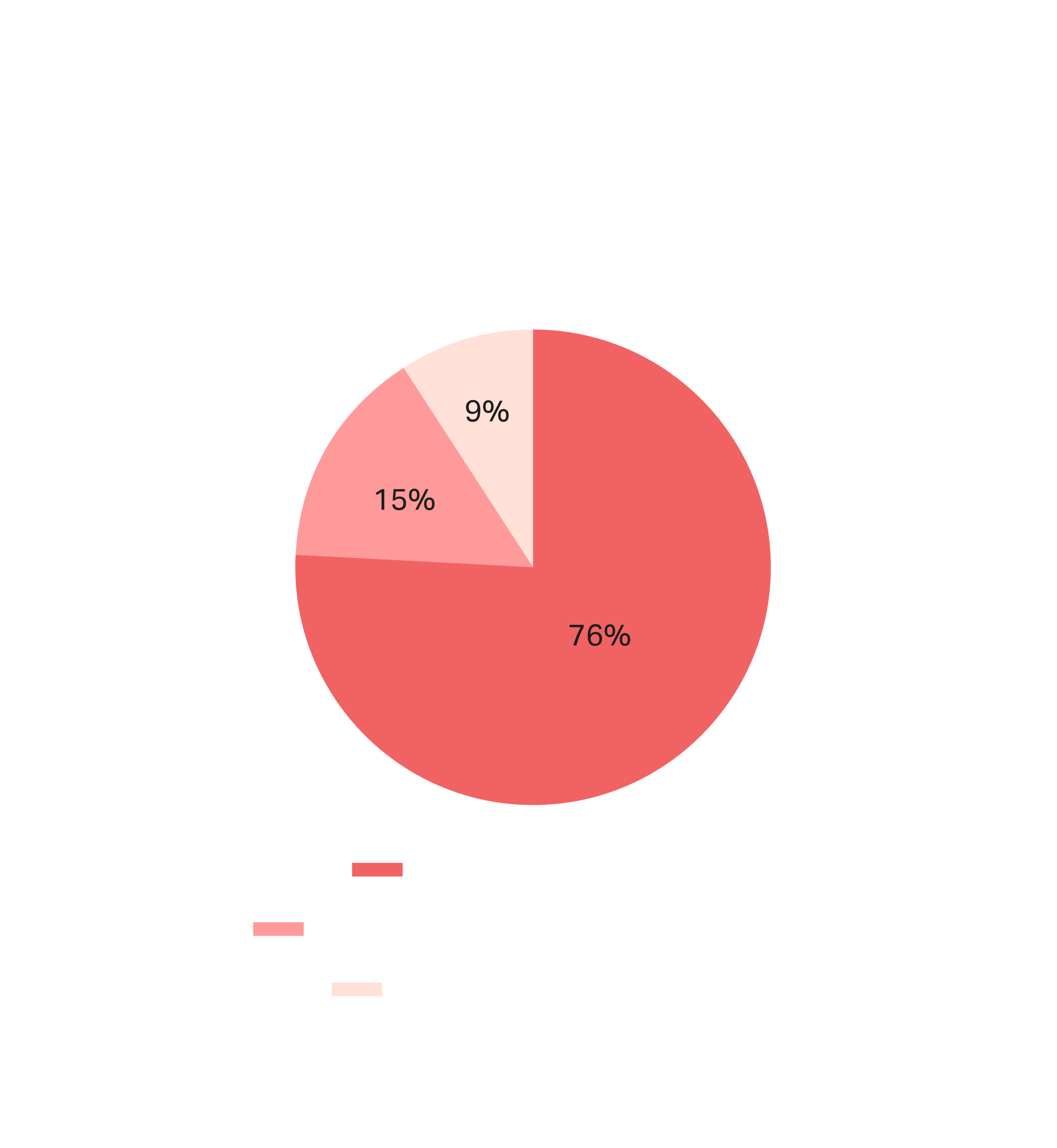

Of the LPs recently surveyed by AVCA, 76% have a responsible investment or ESG policy in place while 62% say ESG considerations feature prominently in their investment mandate5.

Impact Funds

A global trend towards ESG-focused investment has had an important impact on investments in Africa.

The rise of ESG investing has led to a series of strategic partnerships and strategic reorganizations calibrated to focus on impact investment. In March, Singaporean investment group Temasek formed a $500 million strategic partnership with Leapfrog Investments, a leading global impact investment firm3, while private bank and asset management firm LGT has, also this year, spun off its direct impact investing activities into a global private equity partnership called Lightrock4.

Of the LPs recently surveyed by AVCA, 76% have a responsible investment or ESG policy in place while 62% say ESG considerations feature prominently in their investment mandate5.

Reaching the Unbanked

Amid the global economic slowdown, two sectors rose to prominence for PE investors in 2020: technology and healthcare. Both have continued to attract significant volumes of investment this year.

Fintech, mobile money and digital payments firms across the continent have been a key focus for both VC and PE firms. Low banking penetration in many countries points to high growth opportunities – of Nigeria’s population of 200 million, 40% are still excluded from mainstream banking infrastructure -- while the wider adoption of digital financial services throughout COVID-19 is not expected to reverse. Governments are looking to introduce policy changes to enable technological innovation. While regulators in Kenya and Nigeria have indicated that they are looking to take in hand the rapid growth of fintech firms, such regulation is expected to bolster rather than hinder stronger players6.

Mobile money continues to draw high profile investments from international capital as Africa’s mobile operators ramp up plans to bring banking services to millions. In March, TPG’s The Rise Fund and MasterCard invested $200 million and $100 million respectively in Africa Airtel’s mobile money business, valuing the business at $2.65 billion7. Now South African operator MTN is expected to spin-off its mobile money arm, valued at $5bn, though MTN may alternatively choose to list the business on the public markets, according to Bloomberg8.

After U.S. payment giant Stripe’s acquisition of Paystack for a rumoured $200 million in October of 2020, it is promising to see several follow-on transactions in payments and digital banking. Nigeria’s Flutterwave gained “unicorn” status after raising $170 million in a round led by Avenir Growth Capital and Tiger Global in March9, while neobank Kuda raised $25 million in a Series A round led by Valar Ventures. Paymob, an Egypt-based digital payments provider, also raised $15 million of new capital from existing investors in a second tranche of its Series A fundraising round.

Reaching the Unbanked

Amid the global economic slowdown, two sectors rose to prominence for PE investors in 2020: technology and healthcare. Both have continued to attract significant volumes of investment this year.

Fintech, mobile money and digital payments firms across the continent have been a key focus for both VC and PE firms. Low banking penetration in many countries points to high growth opportunities – of Nigeria’s population of 200 million, 40% are still excluded from mainstream banking infrastructure -- while the wider adoption of digital financial services throughout COVID-19 is not expected to reverse. Governments are looking to introduce policy changes to enable technological innovation. While regulators in Kenya and Nigeria have indicated that they are looking to take in hand the rapid growth of fintech firms, such regulation is expected to bolster rather than hinder stronger players6.

Mobile money continues to draw high profile investments from international capital as Africa’s mobile operators ramp up plans to bring banking services to millions. In March, TPG’s The Rise Fund and MasterCard invested $200 million and $100 million respectively in Africa Airtel’s mobile money business, valuing the business at $2.65 billion7. Now South African operator MTN is expected to spin-off its mobile money arm, valued at $5bn, though MTN may alternatively choose to list the business on the public markets, according to Bloomberg8.

After U.S. payment giant Stripe’s acquisition of Paystack for a rumoured $200 million in October of 2020, it is promising to see several follow-on transactions in payments and digital banking. Nigeria’s Flutterwave gained “unicorn” status after raising $170 million in a round led by Avenir Growth Capital and Tiger Global in March9, while neobank Kuda raised $25 million in a Series A round led by Valar Ventures. Paymob, an Egypt-based digital payments provider, also raised $15 million of new capital from existing investors in a second tranche of its Series A fundraising round.

Inclusive Economies

Tech-enabled businesses in a variety of sectors have also benefitted from the digital shift, as well as from the rise of investing aligned with the United Nations Sustainable Development Goals which has prompted a focus on companies solving for future resilience. Agritech, insurtech, meditech and e-commerce have been key focus areas this year. Benefiting from this trend, Gro Intelligence, a Kenya based company which provides decision-making tools, solutions and analytics to address food security and climate risk, raised $85 million in Series B Funding co-led by multiple parties including Africa Internet Ventures (a strategic partnership between TPG Growth and EchoVC)10.

Continuing the theme of economic and social inclusion, IFC invested €20 million in Bolt, a company which aims to improve access to mobility and investment services in underserved urban areas in Africa and Eastern Europe11. In the logistics sector, Convergence Partners, a leading tech investor in Africa, made its first investment under its Convergence Partners Digital Infrastructure Fund (CPDIF) by acquiring 100% of Ctrack in Africa and the Middle East12.

Inclusive Economies

Tech-enabled businesses in a variety of sectors have also benefitted from the digital shift, as well as from the rise of investing aligned with the United Nations Sustainable Development Goals which has prompted a focus on companies solving for future resilience. Agritech, insurtech, meditech and e-commerce have been key focus areas this year. Benefiting from this trend, Gro Intelligence, a Kenya based company which provides decision-making tools, solutions and analytics to address food security and climate risk, raised $85 million in Series B Funding co-led by multiple parties including Africa Internet Ventures (a strategic partnership between TPG Growth and EchoVC)10.

Continuing the theme of economic and social inclusion, IFC invested €20 million in Bolt, a company which aims to improve access to mobility and investment services in underserved urban areas in Africa and Eastern Europe11. In the logistics sector, Convergence Partners, a leading tech investor in Africa, made its first investment under its Convergence Partners Digital Infrastructure Fund (CPDIF) by acquiring 100% of Ctrack in Africa and the Middle East12.

Healthcare

When the pandemic exposed inadequacies in many domestic healthcare systems and put a stop to medical tourism - the issue became too large for the continent’s elite and the rest of the world to ignore. UNECA’s pre-pandemic Healthcare and Economic Growth in Africa report estimates a health financing gap of $66 billion per annum in Africa13.

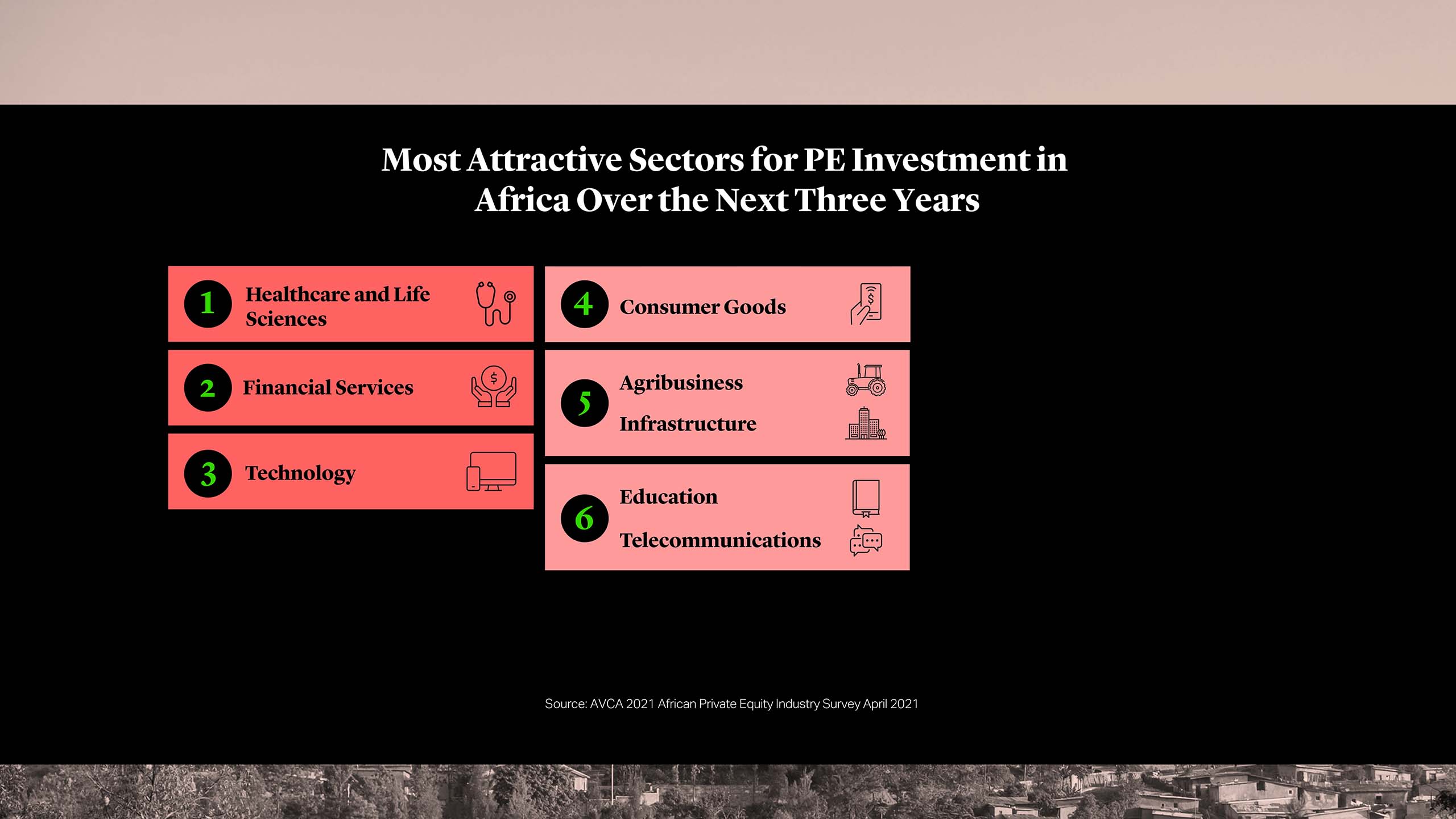

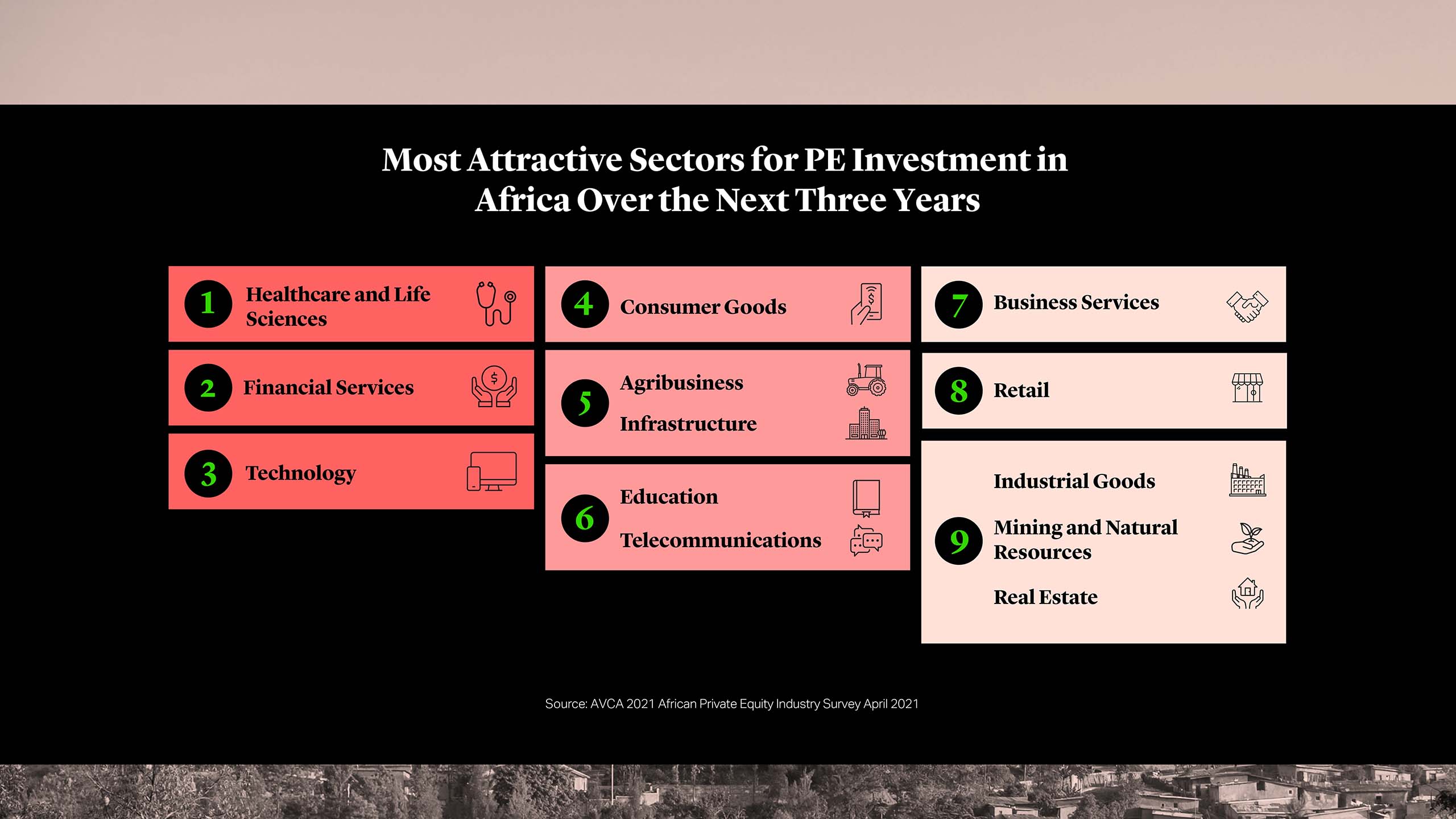

More traditionally led by public funded development finance institutions (DFIs) like the UK’s CDC and France’s Propaco, the sector is seeing increasing interest from private sector finance, despite the deep-seated challenges of access and affordability of private healthcare. Between 2015 and 2020, PE and VC fund investments in healthcare in Africa totalled $1.3 billion. A recent AVCA survey identifies the healthcare and life sciences industries as the most attractive sector for PE investments in Africa over the next three years by the majority of GPs and LPs, ahead of technology, financial services and consumer goods.

While DFIs continue to lead the way, we are seeing an increasing number of co-investments and partnerships involving DFIs and PE and VC Investors. CDC recently completed a $100 million minority equity investment in Alfa Medical Group alongside Africa Platform Capital, the family office of Simon Rowlands, the co-founder of the global private equity firm Cinven. CDC also announced an investment in a $300 million fund from Adjuvant Capital in February this year which will invest in cutting-edge research to address diseases like malaria and tuberculosis, and are a co-investor in TPG and the Rise Fund’s Evercare Group which opened a world-class multi-speciality hospital in Lagos in the same month.

Healthcare

When the pandemic exposed inadequacies in many domestic healthcare systems and put a stop to medical tourism - the issue became too large for the continent’s elite and the rest of the world to ignore. UNECA’s pre-pandemic Healthcare and Economic Growth in Africa report estimates a health financing gap of $66 billion per annum in Africa13.

More traditionally led by public funded development finance institutions (DFIs) like the UK’s CDC and France’s Propaco, the sector is seeing increasing interest from private sector finance, despite the deep-seated challenges of access and affordability of private healthcare. Between 2015 and 2020, PE and VC fund investments in healthcare in Africa totalled $1.3 billion. A recent AVCA survey identifies the healthcare and life sciences industries as the most attractive sector for PE investments in Africa over the next three years by the majority of GPs and LPs, ahead of technology, financial services and consumer goods.

While DFIs continue to lead the way, we are seeing an increasing number of co-investments and partnerships involving DFIs and PE and VC Investors. CDC recently completed a $100 million minority equity investment in Alfa Medical Group alongside Africa Platform Capital, the family office of Simon Rowlands, the co-founder of the global private equity firm Cinven. CDC also announced an investment in a $300 million fund from Adjuvant Capital in February this year which will invest in cutting-edge research to address diseases like malaria and tuberculosis, and are a co-investor in TPG and the Rise Fund’s Evercare Group which opened a world-class multi-speciality hospital in Lagos in the same month.

Sports

Sports investing, which was hitherto perceived as a relatively niche area, has seen an increased focus from private equity firms globally. This interest, partly driven by the acceleration of digital sport consumption and mobile-friendly digital content platforms globally, has been further heightened by the drastic revenue crunch experienced by some major sporting leagues and organisations around the world. The global sports market, including spectator and participatory sports, declined by over 15% in 2020 to $388 billion in yearly revenue, according to the Sports Global Market Opportunities and Strategies report, but is expected to rebound to yearly revenues of $440 billion in 2021, before growing to $600 billion in 2025 and $826 billion by 203014. This creates an ideal opportunity for PE to deploy their stash of dry powder. This increasing interest seems to have spilled over to Africa, albeit by using a relatively novel structure. In May this year, Helios announced that it had led the formation investment round in a newly formed entity called NBA Africa, in partnership with the National Basketball Association. NBA Africa is reported to have an enterprise value of $1 billion and will conduct the league’s business on the continent as well as overseeing the ongoing, inaugural season of the Basketball Africa League.