Special purpose acquisition companies (SPACs), or newly formed companies listed for the purpose of acquiring or combining with another entity, have surged in popularity over the last couple of years. SPACs are proving an increasingly common way for an existing private company to become publicly traded without undergoing a traditional initial public offering, and for investors in public markets to invest in growth-stage companies.

SPACs were first created in the 1990s, but didn’t gain popularity with blue-chip investors until recently. Now high-profile investors, global private equity firms, banks, companies, and even celebrities are driving a surge in SPAC creation, offering owners of private companies an attractive source of capital.

SPACs offer private companies the potential to sell themselves at a higher price than a traditional IPO as well as offering more certainty on pricing and a faster route to completion. Fast-growing companies may also benefit from being able to use forward-looking financial statements to market future earnings potential while more complex private companies can sell themselves to SPACs fronted by highly experienced managers who may be able to better value their businesses1.

The SPAC proposition is also hugely attractive to early SPAC investors and SPAC sponsors. For early SPAC investors, SPACs offer favourable economic terms (compared with the eventual public offer price) with a high level of down-side protection. Investors buy into a SPAC at a fixed dollar entry price, usually $10 per share, and also receive warrants to buy shares in future at this entry price. The expectation is that the SPAC will trade strongly above the entry valuation upon the completion of the “de-SPAC”, and often this occurs even before the SPAC has identified a target or has completed an acquisition. Rules requiring SPACs to acquire their target (the “de-SPAC” transaction) within 24 months of listing and return money not invested are attractive downside features. The early SPAC investor will also have an opportunity to redeem its investment (and get its money back) prior to the closing of a de-SPAC transaction. However, these investors will keep their warrants – that’s a free upside, if the de-SPAC goes well. For sponsors, who usually take a 20% stake in the SPAC for a minimal investment, a successful de-SPAC transaction can be a huge earner.

SPACS in Action

As the SPAC boom continues to sweep across the U.S. and Europe, there are increasing signs that Africa may experience some overflow of SPAC related investment, which could bring about a number of positive outcomes for businesses and investors in the region.

Special purpose acquisition companies (SPACs), or newly formed companies listed for the purpose of acquiring or combining with another entity, have surged in popularity over the last couple of years. SPACs are proving an increasingly common way for an existing private company to become publicly traded without undergoing a traditional initial public offering, and for investors in public markets to invest in growth-stage companies.

SPACs were first created in the 1990s, but didn’t gain popularity with blue-chip investors until recently. Now high-profile investors, global private equity firms, banks, companies, and even celebrities are driving a surge in SPAC creation, offering owners of private companies an attractive source of capital.

SPACs offer private companies the potential to sell themselves at a higher price than a traditional IPO as well as offering more certainty on pricing and a faster route to completion. Fast-growing companies may also benefit from being able to use forward-looking financial statements to market future earnings potential while more complex private companies can sell themselves to SPACs fronted by highly experienced managers who may be able to better value their businesses1.

The SPAC proposition is also hugely attractive to early SPAC investors and SPAC sponsors. For early SPAC investors, SPACs offer favourable economic terms (compared with the eventual public offer price) with a high level of down-side protection. Investors buy into a SPAC at a fixed dollar entry price, usually $10 per share, and also receive warrants to buy shares in future at this entry price. The expectation is that the SPAC will trade strongly above the entry valuation upon the completion of the “de-SPAC”, and often this occurs even before the SPAC has identified a target or has completed an acquisition. Rules requiring SPACs to acquire their target (the “de-SPAC” transaction) within 24 months of listing and return money not invested are attractive downside features. The early SPAC investor will also have an opportunity to redeem its investment (and get its money back) prior to the closing of a de-SPAC transaction. However, these investors will keep their warrants – that’s a free upside, if the de-SPAC goes well. For sponsors, who usually take a 20% stake in the SPAC for a minimal investment, a successful de-SPAC transaction can be a huge earner.

SPACS in Action

As the SPAC boom continues to sweep across the U.S. and Europe, there are increasing signs that Africa may experience some overflow of SPAC related investment, which could bring about a number of positive outcomes for businesses and investors in the region.

SPACs in the U.S. and in Europe

The dominance of SPACs in the U.S. IPO market is staggering, despite recent scrutiny from the U.S. Securities and Exchange Commission2 and an apparent cooling of the pace of SPAC transactions after the unprecedented surge over the past 12 to 18 months3.

Last year, 248 U.S. SPAC vehicles raised over $83 billion, more than six times the record set in the previous year, according to data from SPAC Insider. That activity has accelerated in 2021, with almost $86 billion raised by 264 SPAC listings by mid-March, though concerns over frothy valuations on Wall Street saw a sell-off of several SPACs, raising concerns of a bubble.

European equity markets are struggling to catch up with their U.S. counterpart: so far this year, SPACs have raised about $2.2 billion in Europe, compared with the $95 billion raised by 315 SPACs in the U.S. over the same period, according to Refinitiv data. Nevertheless, SPAC architects are looking to spark interest in the nascent European market. For instance, Hedosophia, a fund manager run by Ian Osborne, the investor at the forefront of the U.S. SPAC boom, plans to raise €400 million for a special purpose acquisition company in Amsterdam which will target tech companies with a value up to €5 billion4.

Paris and London continue to make efforts to attract SPAC listings, though Amsterdam is clearly emerging as the European “place to SPAC”. As of April 2021, the UK’s Financial Conduct Authority (FCA) estimates that there are 33 SPACs listed in the UK, and the FCA recently issued new rules to encourage SPACs to list in London in a bid to attract the fast-growing companies that have fled to New York and Amsterdam. Under the new regime, one key rule change means that SPACs which offer higher levels of investor protection would no longer be subjected to suspension when a target is identified, which would allow early SPAC investors the ability to redeem5. This is a key feature of the SPAC model, and such a rule change would likely encourage greater interest in London as a viable SPAC market.

SPACs in the U.S. and in Europe

The dominance of SPACs in the U.S. IPO market is staggering, despite recent scrutiny from the U.S. Securities and Exchange Commission2 and an apparent cooling of the pace of SPAC transactions after the unprecedented surge over the past 12 to 18 months3.

Last year, 248 U.S. SPAC vehicles raised over $83 billion, more than six times the record set in the previous year, according to data from SPAC Insider. That activity has accelerated in 2021, with almost $86 billion raised by 264 SPAC listings by mid-March, though concerns over frothy valuations on Wall Street saw a sell-off of several SPACs, raising concerns of a bubble.

European equity markets are struggling to catch up with their U.S. counterpart: so far this year, SPACs have raised about $2.2 billion in Europe, compared with the $95 billion raised by 315 SPACs in the U.S. over the same period, according to Refinitiv data. Nevertheless, SPAC architects are looking to spark interest in the nascent European market. For instance, Hedosophia, a fund manager run by Ian Osborne, the investor at the forefront of the U.S. SPAC boom, plans to raise €400 million for a special purpose acquisition company in Amsterdam which will target tech companies with a value up to €5 billion4.

Paris and London continue to make efforts to attract SPAC listings, though Amsterdam is clearly emerging as the European “place to SPAC”. As of April 2021, the UK’s Financial Conduct Authority (FCA) estimates that there are 33 SPACs listed in the UK, and the FCA recently issued new rules to encourage SPACs to list in London in a bid to attract the fast-growing companies that have fled to New York and Amsterdam. Under the new regime, one key rule change means that SPACs which offer higher levels of investor protection would no longer be subjected to suspension when a target is identified, which would allow early SPAC investors the ability to redeem5. This is a key feature of the SPAC model, and such a rule change would likely encourage greater interest in London as a viable SPAC market.

SPACs in Africa

SPACs first emerged on the African continent in 2015. Renergen Limited, a South African investments company focused on the alternative and renewable energy sectors in South Africa and sub-Saharan Africa, became the first primary listed SPAC on the Johannesburg Stock Exchange (JSE) in June 20156. Since then, there have been a handful of SPACs listed on the JSE.

So far in 2021, investors have poured $560 million into two Africa-focused SPACs, which have been listed on the NYSE or NASDAQ:

- South African entrepreneur and founder of pan-African investment platform InvestAfrica, Robert Hersov took this approach when he raised $360 million with NYSE-listed African Gold Acquisition Corp in February 2021. Hersov’s is the first SPAC focused on African mining and will target gold assets on the continent.

- TCP sponsored TB SA Acquisition Corp raised $200 million in March 2021 and is listed on the NASDAQ. The SPAC, which is affiliated to TowerBrook Capital Partners L.P., intends to identify a potential initial business combination target with a focus on African companies that promote ESG principles.

These SPACs potentially offer investors exposure to African businesses without having to navigate complex and sometimes tricky regulatory environments across multiple markets to find attractive and profitable investments, and at the same time offer them some down-side protection inherent in the structure of the SPAC.

Other than the handful of SPAC listings on the JSE, there are no reported cases of SPAC listing on some of Africa’s smaller stock exchanges. Most African stock exchanges are yet to provide a supportive regulatory environment for SPACs, but an increase of SPAC listings on domestic exchanges may also offer some advantages. The question is whether such exchanges are likely to follow the example of London and explore regulatory reform.

SPACs in Africa

SPACs first emerged on the African continent in 2015. Renergen Limited, a South African investments company focused on the alternative and renewable energy sectors in South Africa and sub-Saharan Africa, became the first primary listed SPAC on the Johannesburg Stock Exchange (JSE) in June 20156. Since then, there have been a handful of SPACs listed on the JSE.

So far in 2021, investors have poured $560 million into two Africa-focused SPACs, which have been listed on the NYSE or NASDAQ:

- South African entrepreneur and founder of pan-African investment platform InvestAfrica, Robert Hersov took this approach when he raised $360 million with NYSE-listed African Gold Acquisition Corp in February 2021. Hersov’s is the first SPAC focused on African mining and will target gold assets on the continent.

- TCP sponsored TB SA Acquisition Corp raised $200 million in March 2021 and is listed on the NASDAQ. The SPAC, which is affiliated to TowerBrook Capital Partners L.P., intends to identify a potential initial business combination target with a focus on African companies that promote ESG principles.

These SPACs potentially offer investors exposure to African businesses without having to navigate complex and sometimes tricky regulatory environments across multiple markets to find attractive and profitable investments, and at the same time offer them some down-side protection inherent in the structure of the SPAC.

Other than the handful of SPAC listings on the JSE, there are no reported cases of SPAC listing on some of Africa’s smaller stock exchanges. Most African stock exchanges are yet to provide a supportive regulatory environment for SPACs, but an increase of SPAC listings on domestic exchanges may also offer some advantages. The question is whether such exchanges are likely to follow the example of London and explore regulatory reform.

SPAC Benefits

If African-focused SPACs gain momentum, they may well become a viable source of capital for often cash-strapped African businesses, while broadening the opportunity for exits for private-equity sponsors.

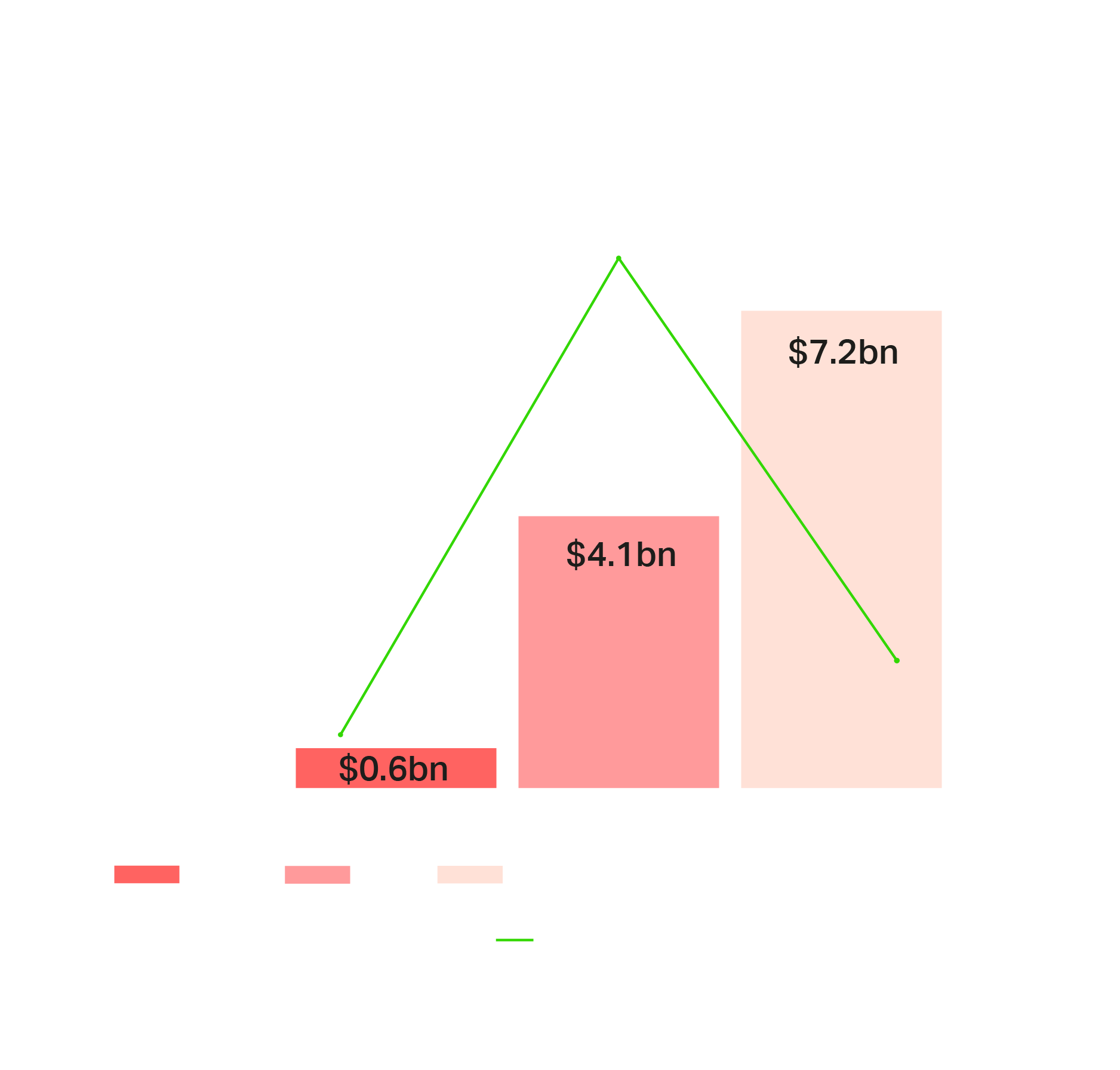

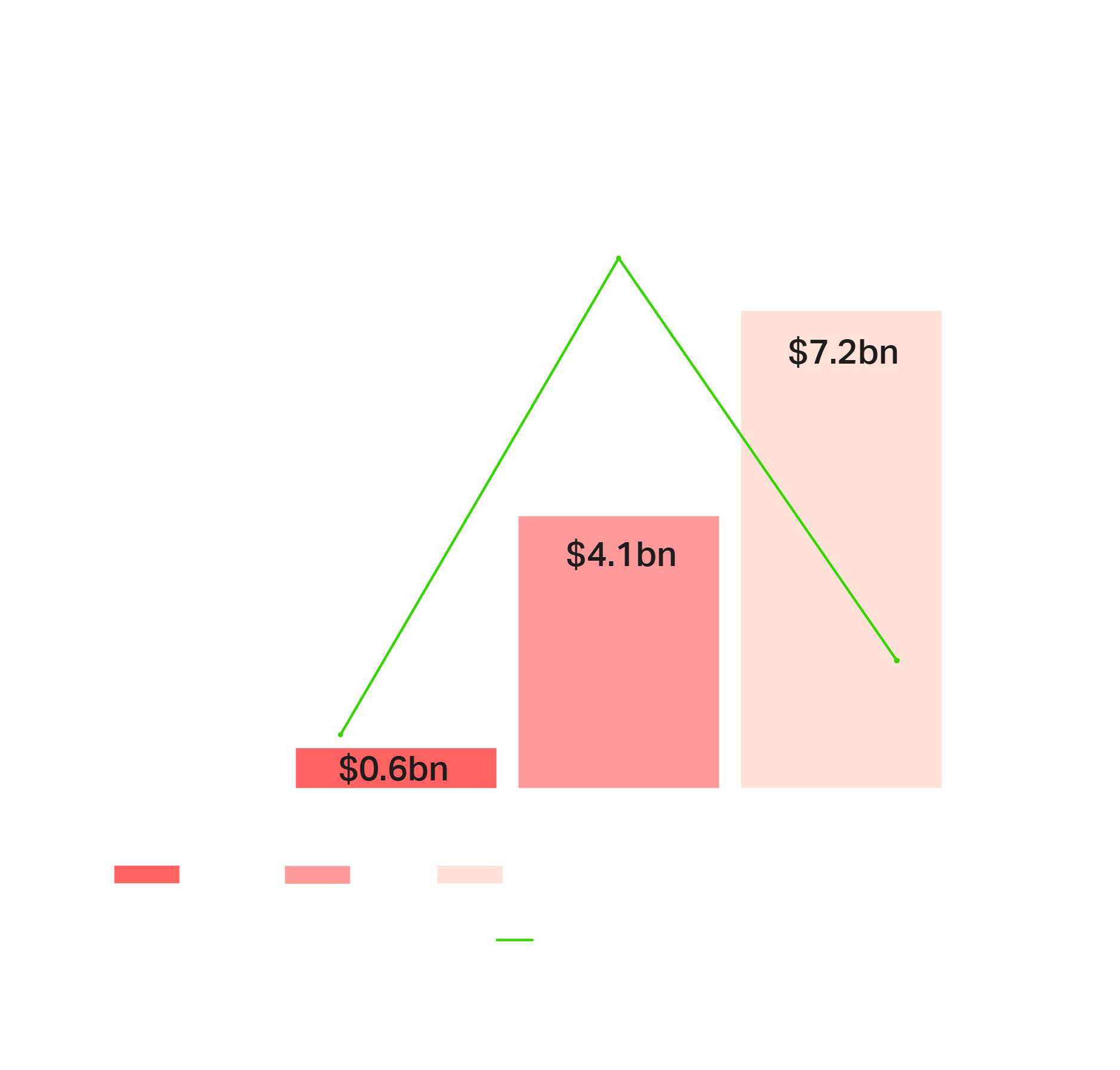

Capital on the continent is scarce. High transaction costs and small deal sizes have kept many international investors on the sidelines while local capital markets outside of South Africa often offer limited liquidity. Equity capital markets activity fell to a decade low in 2020 with only five IPOs on the continent, raising just $600 million, while follow-ons raised $4.1 billion7.

SPACs offer an emerging alternative for corporate growth. For mid-size companies on the continent, which largely slip through the net of international investors and may not pass the reporting or cost-hurdles associated with an IPO, becoming listed through a “de-SPACing” could provide a viable source of liquidity. Another key benefit for founder-led or family run-businesses is the ability for existing companies to retain a stake.

For businesses and investors alike, access to highly experienced managers is a major draw. For business owners, high-profile financial heavyweights bring access to a much wider base of investors as well as expertise they would not otherwise have had access to. For investors eyeing the continent, being able to place their trust in highly sophisticated managers saves extensive and costly due diligence.

Growth of sector-focused SPACs is set to unlock new sources of capital and ignite interest in high-growth and emerging sectors like tech. On the tech side, only Flutterwave, Jumia, Fawry and Interswitch currently have billion-dollar valuations, two of which are already listed. Andela, Branch, Gro Intelligence and TymeBank, each carrying a valuation above $500mn, may also be attractive targets to SPACs willing to take-on more early stage tech businesses.

SPAC Benefits

If African-focused SPACs gain momentum, they may well become a viable source of capital for often cash-strapped African businesses, while broadening the opportunity for exits for private-equity sponsors.

Capital on the continent is scarce. High transaction costs and small deal sizes have kept many international investors on the sidelines while local capital markets outside of South Africa often offer limited liquidity. Equity capital markets activity fell to a decade low in 2020 with only five IPOs on the continent, raising just $600 million, while follow-ons raised $4.1 billion7.

SPACs offer an emerging alternative for corporate growth. For mid-size companies on the continent, which largely slip through the net of international investors and may not pass the reporting or cost-hurdles associated with an IPO, becoming listed through a “de-SPACing” could provide a viable source of liquidity. Another key benefit for founder-led or family run-businesses is the ability for existing companies to retain a stake.

For businesses and investors alike, access to highly experienced managers is a major draw. For business owners, high-profile financial heavyweights bring access to a much wider base of investors as well as expertise they would not otherwise have had access to. For investors eyeing the continent, being able to place their trust in highly sophisticated managers saves extensive and costly due diligence.

Growth of sector-focused SPACs is set to unlock new sources of capital and ignite interest in high-growth and emerging sectors like tech. On the tech side, only Flutterwave, Jumia, Fawry and Interswitch currently have billion-dollar valuations, two of which are already listed. Andela, Branch, Gro Intelligence and TymeBank, each carrying a valuation above $500mn, may also be attractive targets to SPACs willing to take-on more early stage tech businesses.

Barthélemy Faye

Partner

Paris

T: +33 1 40 74 68 00

bfaye@cgsh.com

V-Card

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Mohamed Taha

Associate

London

T: +44 20 7614 2321

mtaha@cgsh.com

V-Card

Pap Diouf

Associate

Paris

T: +33 1 40 74 68 00

pdiouf@cgsh.com

V-Card

Anton Nothias

Associate