Germany

Effective January 2021, Germany has introduced new rules for undertakings with “paramount cross-market significance.” The provisions, which target large digital platforms, enable the Federal Cartel Office to prohibit forms of conduct legally defined as problematic without the need to prove anticompetitive harm. General competition rules have been extended and remain applicable in parallel. On November 7, 2023, further amendments entered into force to further strengthen the FCO’s enforcement powers.

Authored by Romina Polley, Philipp Kirst, & Hendrik Wendland

Updated as of December 2023

Germany

Effective January 2021, Germany has introduced new rules for undertakings with “paramount cross-market significance.” The provisions, which target large digital platforms, enable the Federal Cartel Office to prohibit forms of conduct legally defined as problematic without the need to prove anticompetitive harm. General competition rules have been extended and remain applicable in parallel. On November 7, 2023, further amendments entered into force to further strengthen the FCO’s enforcement powers.

Authored by Romina Polley, Philipp Kirst, & Hendrik Wendland

Updated as of December 2023

-

1. What rules govern competition in digital markets in Germany?

-

In January 2021, the 10th Amendment of the Act against Restraints of Competition (“ARC”) came into effect. Focusing on competition in the digital sector, the ARC contains a new regulatory framework targeting large digital platforms, along with a revised legal framework for abuse of dominance.

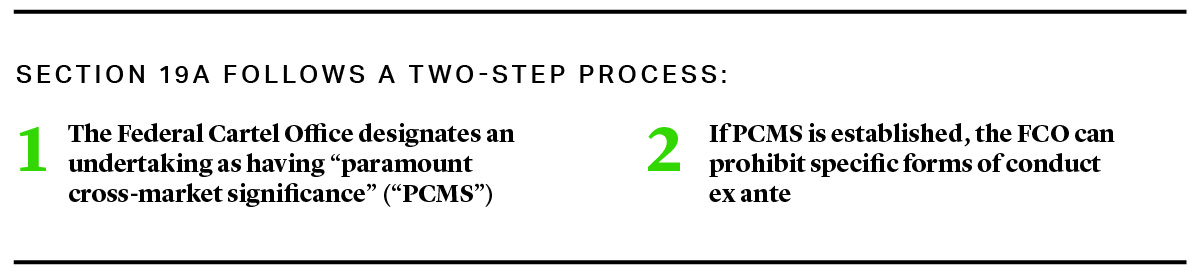

With Section 19a ARC, the German legislator has enabled the Federal Cartel Office (“FCO”) to intervene in digital markets without establishing anticompetitive effects, going beyond existing rules on abuse of dominance. Section 19a follows a two-step process:

- First, the FCO designates an undertaking as having “paramount cross-market significance” (“PCMS”) based on a set of qualitative criteria without having to prove dominance in any specific market. Undertakings found to have PCMS, will be subject to a five-year monitoring period.

- Second, if PCMS is established, the FCO can prohibit specific forms of conduct ex ante (i.e., conduct deemed, in principle, harmful to competition without a finding of anticompetitive effects).

Digital undertakings remain subject to the existing provisions prohibiting the abuse of dominance. The 10th Amendment introduced several changes directed specifically at abusive conduct in digital markets, including the following:

- The relatively strict causality required between an undertaking's dominant position and exploitative conduct like excessive contract terms has been abolished.1 Under the new rules,2 a normative causal link between the dominant position and the anticompetitive conduct is sufficient to establish an exploitative abuse. In practice, this means that conduct that the undertaking is only able to enforce due to its dominant position, (e.g., contractual terms that violate other legal requirements) may be regarded as abusive, even if smaller competitors engage in the same conduct.3

- The 10th Amendment clarifies that the essential facilities doctrine applies not only to physical assets, but also to data4. Access to data can be required if it is objectively indispensable for the requesting party to compete on the upstream or downstream market. Dominant undertakings may refuse access to their data only if they can show an objective justification.

- New criteria were introduced for the assessment of relative dominance of intermediaries.5

- Existing rules on abusive conduct by undertakings with relative market power were extended to capture relative dominance based on access to data6. This can capture scenarios where data has not been shared with any third party in the past.

In addition, the 10th Amendment introduced a provision enabling the FCO to counter the so-called “tipping” of markets towards a company that benefits from strong network effects.7 The new provision prohibits undertakings from hindering competitors from achieving their own network effects if fair competition is significantly impeded. This applies not only to undertakings with dominance but also with relative or superior market power.

Aside from the ARC, digital undertakings can be subject to sector-specific regulations such as the German Telemedia and Telecommunications Acts and general consumer and data protection laws (e.g., consent requirements for data processing, the requirement to provide a masthead on websites, and various customer protection provisions). The Network Enforcement Act requires digital platforms to moderate content, in particular to remove illegal content. Recently, Germany introduced the Telecommunications-Telemedia Data Protection Act, implementing the rules for tracking “cookies” under the EU ePrivacy Directive (EU/2002/58).

Moreover, on July 5, 2023, the German Parliament (Bundestag) passed the Competition Enforcement Act, amending the ARC for the 11th time (“11th Amendment”).8 The new law entered into force on November 7, 2023 and introduces the following changes:9

- Sector inquiries. The FCO is now able to impose structural remedies, independent of an abuse, when a significant and continuous, or repeated distortion of competition is identified during a sector inquiry. As a last resort, the FCO may order the divestment of shares or assets if the company holds a dominant market positions or has been designated as an undertaking with PCMS, the sales price amounts to at least 50% of the value of the shares or assets and those shares or assets have been acquired more than ten years prior to the investigation and cleared under German or EU merger control rules.10 Following a sector inquiry, the FCO can order undertakings active in this sector to notify acquisitions where the target’s turnover is more than EUR 1 million.11

- Profit skimming. The new rules introduce a presumption that an undertaking violating competition rules has obtained a profit of at least 1% of its domestic turnover with the affected product over the entire duration of the infringement. At the same time, the maximum profit that can be skimmed off is capped at 10% of the worldwide turnover of the undertaking.12

- Digital Markets Act enforcement. While the European Commission remains the sole enforcement authority for the DMA, the new rules authorize the FCO to assist the European Commission by reviewing compliance with Articles 5-7 of the DMA. The FCO can also publish reports on undertakings’ compliance with the DMA. To facilitate private enforcement of the DMA in Germany, the 11th Amendment extends the provisions transposing the Damages Directive to the DMA where appropriate.13

-

2. What is the status of any forthcoming digital regulation in this

jurisdiction?

-

- On November 6, 2023, the Ministry for Economic Affairs and Climate Action has launched a public consultation on the modernization of the competition law. The consultation aims at “improving the framework conditions for fair competition”, while integrating “aspects of innovation, sustainability, consumer protection and social justice”.14

-

3. How are competition rules in digital markets enforced?

-

Only the FCO can prohibit conduct under Section 19a ARC. The provision is not self-executing, meaning changes in market conduct are only required following an order from the FCO. Using the new powers set out in Section 19a ARC, the FCO has so far determined that Google (Alphabet), Amazon, Apple, and Meta have PCMS, and has initiated related investigations into their conduct. In its investigations, the FCO can employ a wide range of measures, ranging from requests for information or surrender of documents to the right to search business premises, homes, land, and objects.15

PCMS designation and prohibition of conduct can be combined in one decision, but the FCO has not done this in any PCMS decisions to date (see Question 12).

The FCO also enforces general provisions against abuse of dominance by ordering undertakings to cease problematic conduct and by imposing fines. However, in practice abuse of dominance provisions, including the new provisions on data access, tipping, and intermediation power, are mainly enforced by private parties before German civil courts without an intervention by the FCO. By contrast, private parties can only enforce Section 19a ARC before courts after the FCO has imposed a prohibition decision.

The Draft Amendment strengthens the FCO’s role as the primary enforcer of German competition law, especially with regard to its proposed new power to impose structural remedies following sector inquiries.16 In addition, with the entry into force of the EU Digital Markets Act the FCO could become the central national authority in all related enforcement matters (e.g., assisting the European Commission in its investigations or investigating DMA violations at national level).

-

4. Which firms does Section 19a ARC apply to?

-

Section 19a ARC applies to undertakings that are found to have PCMS.17 The provision is aimed mainly at digital platforms.18 For a finding of PCMS, the FCO takes into account in particular the following (non-exhaustive) factors:

- an undertaking’s dominant position on one or several markets;

- the undertaking's financial strength or access to other resources;

- vertical integration and activities in related markets;

- access to data relevant for competition; and

- relevance of the undertaking's activities for third party access to supply and its related influence on the business activities of third parties.

The FCO has designated Apple, Amazon, Google, and Meta as undertakings that have PCMS (see also Question 12). Amazon and Apple have appealed the designation decision to the Federal Court of Justice. A designation investigation against Microsoft is currently ongoing.

The rules on abuse of dominance apply to all undertakings with a dominant market position, including undertakings in the digital sector. As a special feature of German competition law, the ARC’s provisions are also aimed at undertakings with relative market power that are not dominant in absolute terms but only in relation inter partes to other market participants. Some factors are of particular relevance for digital companies, such as the “access to competitively relevant data,” which is listed as a factor to determine PCMS and can also support a finding of relative market power.19

-

5. What are the main substantive rules that govern the firms covered

by Section 19a ARC?

-

When the FCO has designated an undertaking to have PCMS, the FCO can prohibit the following conducts:

- Self-preferencing20, i.e., giving preferential treatment to the firm’s own products or services to the detriment of those offered by the firm's rivals, in particular by preferential display of the firm's own services on its platform or exclusive pre-installation or integration of its own services.

- Exclusionary conduct targeting companies active on upstream and downstream markets if the platform with PCMS is relevant for access to those markets,21 i.e., hindering market access by using mandatory pre-installation or integration of software or by creating hurdles for other companies to advertise or to contact new customers outside the platform.

- Leveraging or “market roll up”,22 i.e., hindering competitors on markets into which the undertaking could quickly expand its position (e.g., through tying or bundling).

- Impediment of competition through data processing,23 i.e., increasing entry barriers or otherwise hindering rivals through the processing of competitively relevant data or requiring users to consent to such processing, in particular:

- Making the use of a service conditional on the user agreeing to the processing of data from other services of the undertaking or a third party provider without giving the user sufficient choice as to whether, how, and for what purpose such data are processed; and

- Processing competitively sensitive data received from other undertakings for purposes other than those necessary for the provision of the firm’s own services to these undertakings without giving these undertakings sufficient choice as to whether, how, and for what purpose such data are processed.

- Hampering interoperability or data portability, thereby impeding competition.24 This rule aims to prevent lock-in effects that discourage consumers and/or commercial customers from switching between different platforms or services or to use multiple services or platforms in parallel.

- Withholding information,25 i.e., making it difficult for commercial customers to assess the value of the services they provide (e.g., by giving insufficient information on scope, quality, and performance of the service).

- Demanding disproportionate fees or conditions for displaying the offers of another undertaking (e.g., by requiring the transfer of rights or data not required for their display).26

If the FCO establishes that the requirements of one or more of the conducts listed above are met, it can prohibit that conduct if the undertaking in question fails to establish that its conduct is objectively justified (see Question 8). Violating a legally binding order can lead to fines of up to 10% of the undertaking’s worldwide turnover in the previous business year (see Question 10).

-

6. Are there specific rules governing digital platforms’

relationships with publishers in Germany?

-

Under German copyright law, press publishers have a right to collect fees from digital platforms if the platforms access or use their content for commercial purposes (e.g., search engines that show extracts of press articles in their search results).27 However, in 2019 the European Court of Justice held that this provision is inapplicable because Germany failed to notify the European Commission contrary to obligations under the Transparency Directive.28

Media platforms and intermediaries are also subject to specific rules laid down in the “State Media Treaty” (Medienstaatsvertrag).29 These provisions are not primarily focused on maintaining effective competition in media or digital markets, but instead aim to ensure plurality of opinions and diversity of media offerings. Although there are some overlaps between the two regimes, the rules against abuse of dominance and Section 19a ARC remain applicable in parallel.30 Accordingly, the FCO has initiated an investigation under Section 19a ARC regarding alleged unlawful discrimination against individual news publishers. The investigation was concluded in December 2022 when the FCO accepted Google’s commitment not to integrate News Showcase in Google Search.31

-

7. Does the FCO need to establish the effects of certain conduct in

order to establish a breach of Section 19a ARC?

-

When an undertaking has been designated as having PCMS, the FCO can prohibit certain conduct without having to show that the conduct has resulted in anticompetitive effects, as long as specific conditions are met (e.g., some of the relevant conducts result in hindrance of other companies). The legislator considers all forms of conduct listed in Section 19a ARC to be capable of preventing competition on the merits. The FCO will, however, have to consider pro-competitive effects as potential objective justifications (see Question 8).

-

8. Can firms defend or objectively justify their conduct under

Section 19a ARC?

-

Yes, under Section 19a(2) ARC. The burden of proof for the justification lies with the undertaking under investigation. Whether the conduct in question was objectively justified is ultimately determined in an overall assessment balancing various interests, taking into account the regulatory objective to ensure undistorted competition.

-

9. What procedural safeguards does Section 19a ARC include?

-

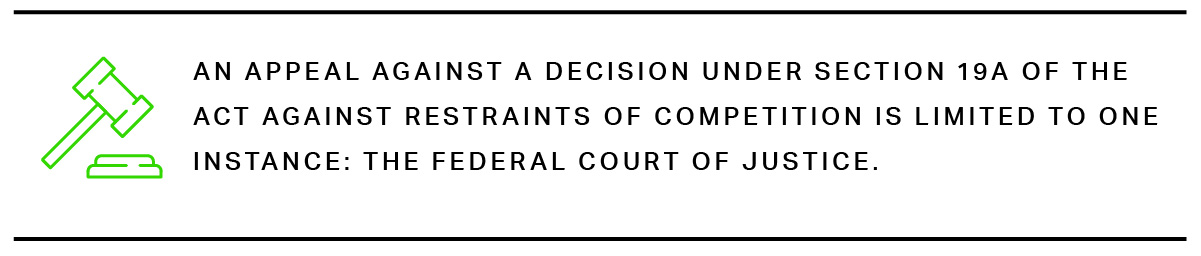

If the FCO intends to prohibit a specific form of conduct under Section 19a ARC, there is no statutory requirement to issue a written statement of objections before it adopts a decision. However, during the investigation, the FCO must respect parties’ procedural rights, including the right of access to file and the right to be heard. In practice, the FCO shares a statement of objections subject to a relatively short deadline for the response (e.g., one month).

An appeal against a Section 19a ARC decision is limited to one instance: the Federal Court of Justice. The judicial review is therefore significantly shortened compared to other FCO proceedings. Both the decision finding an undertaking to have PCMS and the prohibition decision(s) can be appealed on the merits. In addition, the undertaking can apply for suspension of the FCO order.

In the course of the FCO’s proceedings, the undertaking under investigation can offer to enter into commitments that are capable of resolving the FCO’s concerns.32

-

10. What kinds of penalties or remedies can be imposed following a

breach of Section 19a ARC?

-

Under Section 19a ARC, an undertaking can be fined for violating a binding FCO order prohibiting certain conduct. Fines can amount to 10% of the undertaking’s worldwide turnover in the previous business year. Personal fines against individuals are capped at EUR 1 million. In addition, the FCO may require undertakings to commit to all necessary and proportionate behavioral or structural remedies to end an infringement effectively. The FCO may also impose interim measures if they are deemed necessary to protect competition or other undertakings from serious harm.33

The 11th Amendment introduces a presumption that an undertaking violating the competition rules has obtained a profit of at least 1% of its domestic turnover from the affected product over the entire duration of the infringement. At the same time, the maximum profit that can be skimmed off is capped at 10% of the worldwide turnover of the undertaking.34

-

11. Has the FCO issued any guidance or reports regarding

Section 19a ARC?

-

The FCO has not published any specific guidance for undertakings operating in the digital sector regarding Section 19a ARC. It has so far only issued press releases on the progress of its ongoing investigations and case summaries.35 The FCO has to date published decisions designating Google (Alphabet), Amazon, Apple, and Meta as undertakings with PCMS.36

-

12. Has the authority issued any decisions under Section 19a ARC?

-

The FCO has determined that Google (Alphabet), Amazon, Apple, and Meta have PCMS.37 The FCO has not yet issued a prohibition decision regarding specific conduct under Section 19a ARC. It has, however, accepted commitments in the Google News Showcase investigation (see Question 6). It has also accepted commitments by Alphabet to provide users choice options to consent to the cross-use of their data in separate services offered by Google.38

Separately, the new provision aiming to prevent “tipping”39 of markets has been applied in several related court cases by the Berlin Regional Court40 and the Berlin Court of Appeal.41 The courts found that the “list-first” rebates granted by leading real estate comparison platform, Immoscout, were abusive because smaller competitors were hindered from establishing their own network effects and fair competition was restricted.

-

13. Is Section 19a ARC competition based, or does it target other

types of conduct, such as consumer protection, moderation of content, or

privacy?

-

Section 19a ARC is principally competition based, though there is some theoretical debate as to whether it should be considered as part of the body of competition law in Germany or as a form of ex ante regulation.

Even prior to the entry into force of Section 19a ARC, the FCO had taken into account goals adjacent to effective competition in its analyses in competition cases, (e.g., privacy and consumer protection). For example, in 2019, the FCO found that Meta abused its alleged dominance through cross-service combination of user data without user consent, in violation of the GDPR.42The EU Court of Justice subsequently confirmed that national competition authorities can consider data protection compliance in abuse of dominance investigations.43

-

14. What is the current enforcement practice with respect to conduct

addressed by Section 19a ARC or 11th Amendment to the ARC?

-

The FCO has not yet issued a decision prohibiting a specific conduct listed in Section 19a ARC. Based on its previous findings of PCMS, the FCO is conducting the following proceedings:

- In May 2021, the FCO initiated a proceeding to determine whether Google’s cross-service data processing conditions sufficiently take into account user choice. It issued a Statement of Objections on December 23, 2022.44 The FCO accepted Alphabet’s commitments in October 2023 (see Question 12). On December 21, 2022, the FCO concluded by way of commitments an investigation into Google’s alleged self-preferencing of it’s own services and discrimination of individual news publishers in the “Google News Showcase” (see Question 6).45 On 21 June, 2023, the FCO issued a Statement of Objections against Google in relation to the bundling of Maps, Assistant, and Play with its Android Automotive Operating System.46

- In the case of Meta, the FCO is examining the linking of Oculus’ virtual reality products with Meta's Facebook platform. After the 10th Amendment of the ARC entered into force, the FCO extended its investigation under the regular abuse of dominance framework to cover the new Section 19a provision.47

- In June 2022, the FCO initiated a proceeding to investigate Apple’s tracking rules for third party apps and its “App Tracking Transparency Framework,” which raised concerns about self-preferencing and/or impediment of other companies.48

- In November 2022, the FCO extended two open investigations into Amazon (regarding its alleged influence on resale pricing of independent merchants and agreements between Amazon and branded goods manufacturers) which were initially launched under existing abuse of dominance rules to the new rules under Section 19a ARC.49

The 11th Amendment to the ARC aims to increase the efficiency and impact of the FCO’s sector inquiries to improve consumer protection. The number of these inquiries can therefore be expected to increase.

The FCO has previously conducted several sector inquiries into comparison websites, and 50 mobile apps,51 In March 2022, the FCO launched a further sector inquiry into the procedures of merchants for the verification of consumer solvency when shopping online.52 In May 2023, the FCO published its report in the sector inquiry on messenger and video services.53

-

15. Are there merger rules specific to digital platforms in Germany?

-

Undertakings designated as having PCMS are not subject to additional merger control obligations. However, the 10th and 11th Amendments modified the merger control regime to introduce new rules designed to capture acquisitions by large digital platforms that may not have been caught by existing jurisdictional thresholds:

- First, new powers were introduced enabling the FCO to order undertakings subject to a sector inquiry to notify transactions where the target’s turnover exceeds EUR 1 million if the FCO sees “indications that future concentrations will impede competition”.54 The purchaser must have had domestic sales exceeding EUR 50 million in the last financial year.

- Second, a transaction must also be notified to the FCO despite the merger not meeting traditional turnover thresholds if (1) the transaction’s consideration (i.e., “all assets and other monetary benefits” that the seller will receive in connection with the transaction) exceeds EUR 400 million at the date of closing; and (2) the target has significant market activity in Germany.

Contacts

Romina Polley

Partner

Wolfgang Deselaers

Partner

Cologne

T: +49 221 80040 200

Brussels

T: + 32 2 287 2042

wdeselaers@cgsh.com

V-Card

Philipp Kirst

Senior Attorney

Hendrik M. Wendland

Associate