China

A range of new digital-specific laws are under consideration in China, including rules to tackle self-preferencing and exploitation of data advantages by dominant digital platforms. The timing of their adoption is currently uncertain. Meanwhile, the Chinese competition authority has ramped up enforcement using existing competition laws.

Authored by Huanbing Izzy Xu & Yiming Sun

China

A range of new digital-specific laws are under consideration in China, including rules to tackle self-preferencing and exploitation of data advantages by dominant digital platforms. The timing of their adoption is currently uncertain. Meanwhile, the Chinese competition authority has ramped up enforcement using existing competition laws.

Authored by Huanbing Izzy Xu & Yiming Sun

-

1. What rules govern competition in digital markets in China?

-

There is currently no standalone digital-specific competition legislation in China. Digital firms are subject to general competition, consumer protection, and data security laws applicable to all firms, which may contain competition-related provisions specific to online platform operators.1

The main governing competition law in China is the Anti-Monopoly Law (“AML”). The first major amendments since AML’s enactment (“AML Amendments”), which include digital-specific provisions, took effect on August 1, 2022. The AML is supplemented by a number of implementing regulations and guidelines, including the Antitrust Guidelines for Online Platforms that provide guidance on the application of AML to online platforms. The AML Amendments are vague and designed to be supplemented by updates to various pieces of guidance and implementing regulations.

-

2. What is the status of any forthcoming digital markets regulation in

China?

-

The AML Amendments, which include digital-specific provisions, took effect on August 1, 2022. The AML Amendments are vague and designed to be supplemented by updates to various pieces of guidance and implementing regulations, which the Chinese competition authority has been updating, including:

- Draft updates to the Regulation on Prohibition of Abuse of Dominant Market Position (“Abuse of Dominance Regulation”), which propose to add a provision prohibiting dominant platform firms from self-preferencing and using non-public data of platform participants.

- Draft updates to the Regulation on Prohibition of Monopolistic Agreements, which propose to add a provision prohibiting firms from entering into monopolistic agreements via data, advantage in algorithm, technologies or capital, or platform rules.

Although it remains uncertain when the draft updates will be adopted, they reflect the Chinese competition authority’s enforcement practices in digital markets.

Numerous other digital-specific regulations are under consideration in China, but it is currently uncertain whether and when they will take effect. In particular:

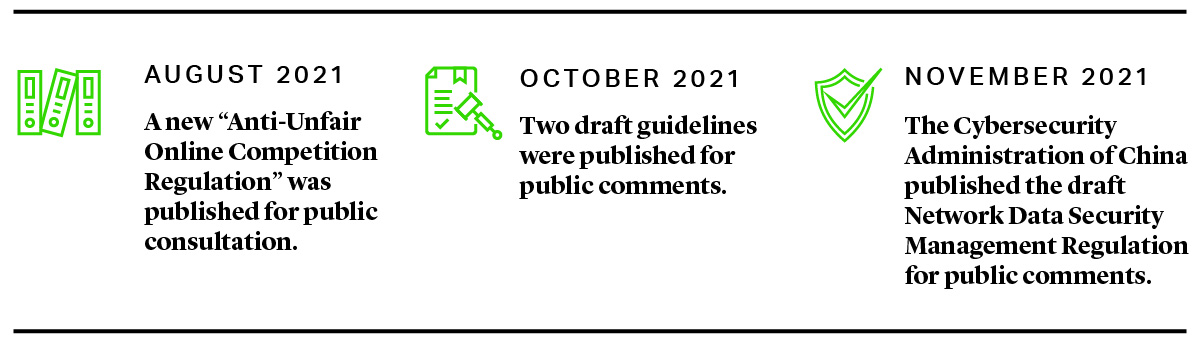

- In August 2021, a new Anti-Unfair Online Competition Regulation was published for public consultation. The draft regulation covers conduct including online false advertising, online defamation, and exclusive dealing. It requires that online platform operators enforce against unfair behavior on their platforms by participants such as vendors.

- In October 2021, two draft guidelines were published for public comments proposing to adopt an online platform classification regime (“Platform Classification Regime”) where platforms would be classified based on factors such as main business area, number of active users, and market capitalization. Based on their classifications, platforms would be subject to different obligations in the areas of data protection, fair competition, and labor treatment.

- In November 2021, the Cybersecurity Administration of China published the draft Network Data Security Management Regulation (“Data Security Regulation”) for public comments. The draft regulation focuses on cybersecurity and privacy but also includes competition rules, such as those that prohibit online platform operators from taking advantage of data for unfair discriminatory practices against users or vendors using the platform.

-

3. How are the proposed rules expected to be enforced?

-

The AML and the accompanying antitrust regulations and guidelines are enforced by the State Anti-Monopoly Bureau of China’s State Administration for Market Regulation (“SAMR”) and its local branches.2 Anti-monopoly Enforcement Division I of the State Anti-Monopoly Bureau has also set up a department dedicated to enforcement against online platforms.

The enforcement of competition rules under the other digital legislation may involve other authorities, such as the Cybersecurity Administration of China.

-

4. To which firms will the proposed rules apply?

-

The AML is applicable to all firms. Certain provisions in the accompanying regulations and guidelines apply to operators of online platforms, which are defined as “a form of business organization that enables bilateral or interdependent parties across the platform to interact through network information technology under the rules and facilitation provided by a specific carrier, thereby creating value together.”3

The proposed Anti-Unfair Online Competition Regulation would apply to all firms that carry out activities online.

The proposed Platform Classification Regime covers all operators of online platforms. Platforms that are classified as “super large platforms” would face additional obligations. Super large platforms are those with more than 500 million global annual active users, are active in multiple business areas, and have a market capitalization of more than CNY 1 trillion (c. USD 16 billion).

The proposed Data Security Regulation covers all online data processing and management activities within China.

-

5. What are the main substantive rules that would govern firms

covered by the proposed rules?

-

The various proposals under consideration in China (see Question 2 above) include a mix of new rules that would apply to various classes of digital firms. For example:

- Self-preferencing. The draft updates to the Abuse of Dominance Regulation, an AML implementing regulation, for example, propose to add a provision on self-preferencing that would prohibit dominant online platforms from, without justification, (1) giving priority to the display or order of their own products, or (2) using the non-public data of operators on the platform for the development of their own products or to inform their decision-making. Under the Platform Classification Regime, those firms operating what are deemed super large platforms would also be prohibited from using non-public data of operators on platforms without justification in competition with these operators.

- Interoperability. Under the Platform Classification Regime, those firms operating super large platforms would be subject to obligations to ensure interoperability with other platforms. For example, super large platforms may be required to offer multiple e-payment options at checkout, including those offered by rivals.

- Unfair data practices. The draft Data Security Regulation prohibits online platform operators from engaging in a range of anti-competitive or unfair competition practices concerning data. Several of these rules mirror proposals in other jurisdictions, like the EU, (but go even further). Proposed rules include addressing platforms from taking advantage of data for unfair discriminatory practices, unfair competition against vendors within the platform, impairing users’ right to make decisions about the processing of their data, processing data without user consent, and unreasonably restricting small-to-medium sized enterprises on the platform from fairly obtaining industry and market data generated by the platform.

- Digital-Based Monopolistic Agreements. The draft updates to Regulation on Prohibition of Monopolistic Agreements, another AML implementing regulation, propose to add a provision that would prohibit firms from entering into monopolistic agreements via data, advantage in algorithm, technologies or capital, or platform rules.

-

6. Are there specific rules governing digital platforms’

relationships with publishers?

-

No.

-

7. Will SAMR need to show anticompetitive effects in

order to establish a breach of the proposed rules?

-

Under the AML and their accompanying regulations, SAMR generally needs to establish anti-competitive effects in order to prove an infringement, although effects can be presumed for the most serious anticompetitive conduct (e.g., price-fixing cartels).

Under the draft competition-related provisions of the proposed digital-specific rules, authorities may not need to establish the effects of certain conduct in order to establish a breach. For example, the proposed Platform Classification Regime requires that super large platforms avoid self-preferencing and promote interoperability with other platforms, regardless of the conduct’s effect on competition.

-

8. Will firms be able to defend or objectively justify their conduct

under the proposed rules?

-

Under the AML, firms may defend against an abuse of dominance allegation by showing justifiable reasons for their conduct.4

Firms will also be able to defend themselves based on justifications under the proposed updates to the Abuse of Dominance Regulation. The proposed updates provide that potential legitimate justifications may include that the display or order of products is based on fair, reasonable, and non-discriminatory terms, the conduct is consistent with industry standards or transaction norms, and other justifications support the reasonableness of the conduct.

Whether such a defense is available under the proposed Anti-Unfair Online Competition Regulation and Platform Classification Regime varies between the specific provisions.5

-

9. What procedural safeguards will there be under the proposed rules?

-

Under the AML and the accompanying regulations, a firm may appeal SAMR’s decisions via administrative reconsideration or litigation pursuant to the Administrative Procedure Law.6 Prior to a penalty decision, a firm has the right to be informed of the facts and reasons against it, state its case, put forward a defense, and apply for a hearing according to laws.7 To date, few parties have pursued administrative appeals, which ended either in dismissal or affirmation of the penalty decisions.

A decision under the proposed Anti-Unfair Online Competition Regulation and the draft Data Security Regulation may also be appealed via administrative reconsideration or litigation pursuant to the Administrative Procedure Law, which also provides for the right to be informed, the right to put forward a defense, and the right to request a hearing.

It is unclear at this time what procedural safeguards would be available under the proposed Platform Classification Regime.

-

10. What kinds of penalties or remedies will SAMR be able to impose

following a breach of the proposed rules?

-

Under the AML, a firm may be fined 1-10% of its turnover for implementing monopolistic agreements based on either horizontal violations or abuse of dominance violations. For severe violations or repeat offenders, the AML now allows SAMR to impose a fine two to five times the statutory limit.

The proposed Anti-Unfair Online Competition Regulation provides that most violations would be subject to fines up to CNY 5 million (c. USD 740,000) pursuant to China’s Anti-Unfair Competition Law. Violations that constitute abuse of dominance should be fined in accordance with the AML.8 In 2021, Alibaba was fined CNY 18.228 billion (c. USD 2.8 billion) and Meituan was fined CNY 3.44 billion (c. USD 534 million) for abuse of dominance based on platform exclusive dealing requirements (see further Question 14).

The draft Data Security Regulation provides for fines of up to CNY 10 million (c. USD 1.5 million), suspension or termination of operation, and revocation of business licenses.

It remains unclear what penalties or remedies can be imposed under the Platform Classification Regimes.

-

11. Has the SAMR issued any guidance or reports regarding the

proposed rules?

-

No. However, the Anti-Monopoly Committee of the State Council has issued the Antitrust Guidelines for Online Platforms that provide guidance on the application of AML to online platforms.9

-

12. Will the new regime be competition based, or will it target

other types of conduct, such as consumer protection, moderation of

content, or privacy?

-

The AML Amendments and the accompanying guidelines and regulations are competition based.

The proposed Anti-Unfair Online Competition Regulation covers a wide range of issues, including competition, consumer protection, moderation of content, and data usage.

The proposed Platform Classification Regime likewise touches on a wide range of issues, including fair competition, anti-monopoly, data protection, cybersecurity, credit rating, anti-monopoly, intellectual property, privacy, and consumer protection.

The proposed Network Data Security Management Regulation focuses on cybersecurity and privacy.

-

13. What is the current enforcement practice with respect to conduct

that is expected to be addressed by the proposed rules?

-

Antitrust enforcement against Chinese internet platforms has been an enforcement focus of SAMR since 2020. SAMR has issued a handful of penalty decisions under the current AML, focusing on the imposition of exclusive dealing contracts on platforms’ business users. For example:

- Abuse of dominance fine against Alibaba. In April 2021, SAMR imposed a record CNY 18.228 billion (c. USD 2.8 billion) fine against Alibaba for abuse of dominance in the market for internet retail platform services by forcing exclusive contracts on vendors and restricting vendors from multi-homing on other platforms via incentive and penalty mechanisms.

- Abuse of dominance fine against Meituan. In October 2021, SAMR fined Meituan CNY 3.44 billion (USD 534 million) for abuse of its dominant position in the Chinese market for online food delivery platform services by forcing exclusive dealing contracts on vendors and restricting vendors from participating on rival food delivery platforms by charging non-exclusive high commission fees, giving lower promotional priority, and other differential conditions.

-

14. Are there merger rules specific to digital platforms in China?

-

Recent AML amendments specify that SAMR has the power to investigate transactions that fall below the notification thresholds if they have anticompetitive effects. This power was previously specified in the AML implementing regulations, and its recent statutory footing reflects the growing appetite in China to enforce merger control rules against so-called “killer acquisitions”.

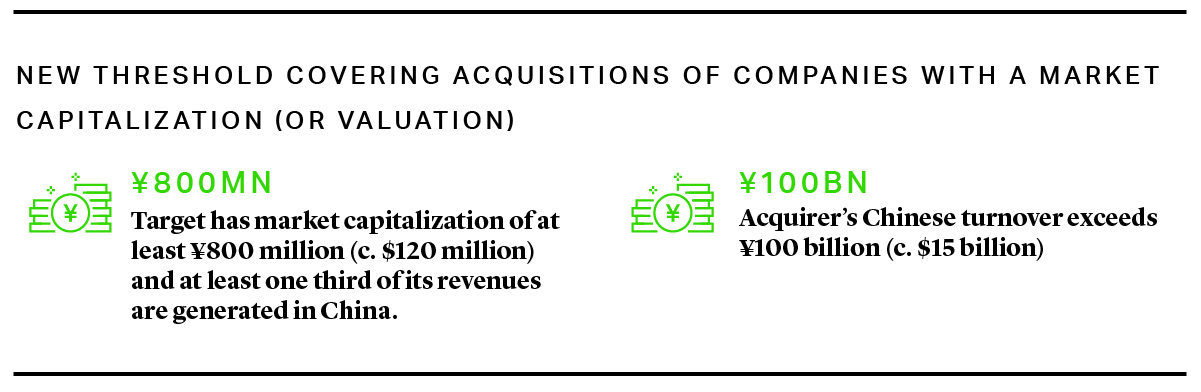

SAMR has also proposed amendments, via AML implementing regulations, to the current merger filing thresholds that are generally applicable to all firms, though are clearly targeted at acquisitions of smaller companies by larger Chinese technology firms. The proposed amendments include a new threshold covering acquisitions of companies with a market capitalization (or valuation) no lower than 800 million (c. USD 120 million) and at least one third of its revenues generated in China by a company with China turnover exceeding RMB 100 billion (c. USD 15 billion). The amendments also propose to increase the current turnover thresholds applicable to all transactions.

Contacts

Cunzhen Huang

Counsel

Washington, D.C.

T: +1 202 974 1657

Beijing

T: +86 10 5920 1000

chuang@cgsh.com

V-Card

Huanbing Xu

Associate

Yiming Sun

Associate