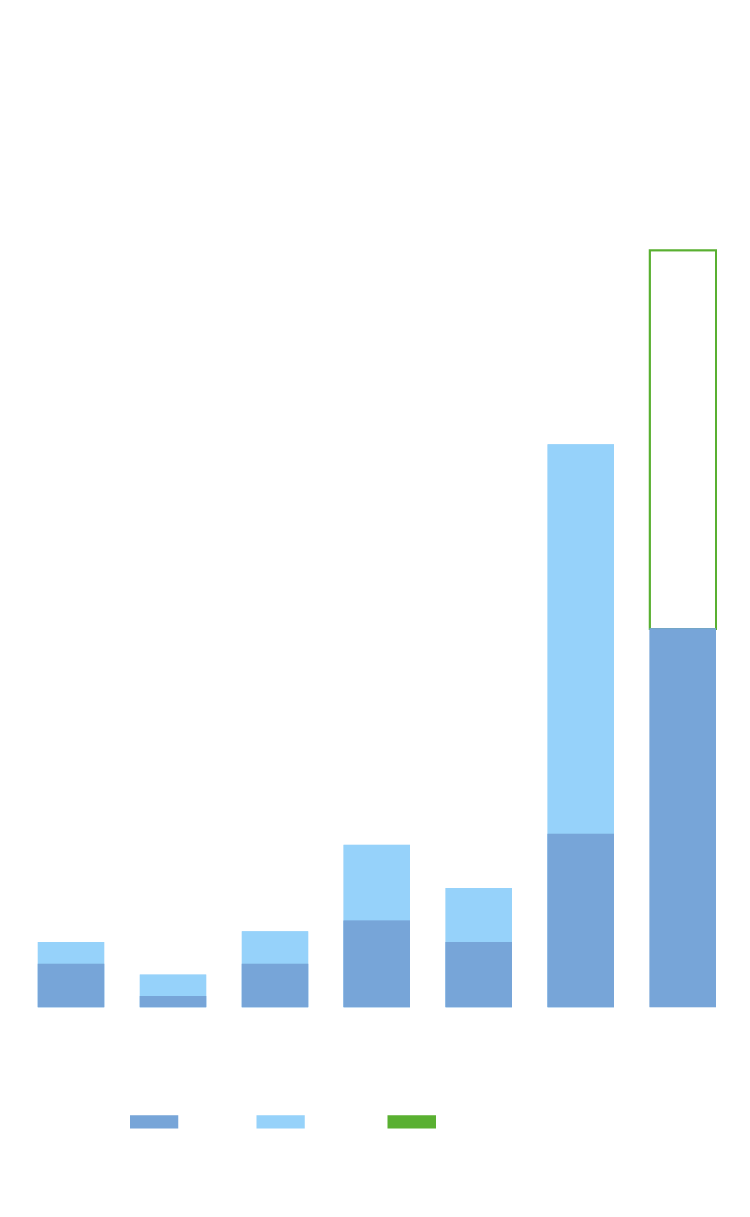

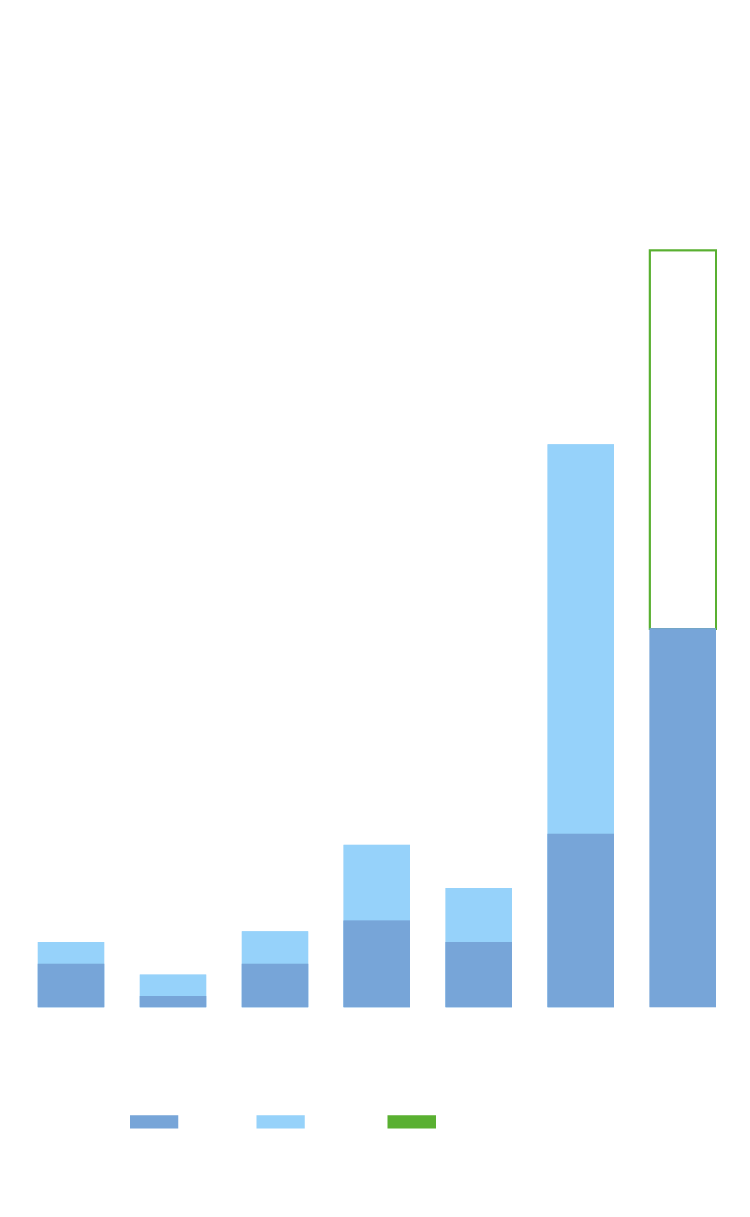

Private capital investment in Africa reported its strongest ever start to the year in 2022, with $7.2bn raised in the first three quarters of the year1. The $4.7bn raised in the first half is almost double the $2.4bn raised in the same period in 2021, in what turned out to be the busiest year in African private capital markets on record. But while hopes for record volumes in 2022 remain bolstered by stronger than ever venture capital demand, private capital markets face major headwinds in 2023.

With the war in Ukraine ongoing, exacerbating global energy and food security concerns, the rising inflation, stronger dollar and global growth concerns which blighted markets in 2022 look set to remain key drivers of investor behavior in 2023.

While global PE activity in core markets like the U.S. and Europe has been impacted by these challenges, deal activity in 2022 remained relatively robust. The impact on African private markets has been greater, with investors following the usual pattern of seeking safe harbors in the tempest. Particular concerns around investment on the continent included the fear that the stronger U.S. dollar would hit the region harder, with most borrowing being U.S. dollar denominated, and most earnings being in local currencies. These factors have raised questions about global demand for African PE heading into 2023.

Private capital investment in Africa reported its strongest ever start to the year in 2022, with $7.2bn raised in the first three quarters of the year1. The $4.7bn raised in the first half is almost double the $2.4bn raised in the same period in 2021, in what turned out to be the busiest year in African private capital markets on record. But while hopes for record volumes in 2022 remain bolstered by stronger than ever venture capital demand, private capital markets face major headwinds in 2023.

With the war in Ukraine ongoing, exacerbating global energy and food security concerns, the rising inflation, stronger dollar and global growth concerns which blighted markets in 2022 look set to remain key drivers of investor behavior in 2023.

While global PE activity in core markets like the U.S. and Europe has been impacted by these challenges, deal activity in 2022 remained relatively robust. The impact on African private markets has been greater, with investors following the usual pattern of seeking safe harbors in the tempest. Particular concerns around investment on the continent included the fear that the stronger U.S. dollar would hit the region harder, with most borrowing being U.S. dollar denominated, and most earnings being in local currencies. These factors have raised questions about global demand for African PE heading into 2023.

VC for Victory

One area less likely to be impacted by these negative headwinds however is the continent’s effervescent VC market.

Driven in part by the efforts of African governments in recent years to nurture vibrant and supportive markets for startups, entrepreneurship and investment in the continent has thrived. Reforms include the Zambian government’s bid to transform the country into a regional startup hub2 and other initiatives like Silicon Zanzibar, a public-private initiative led by the Zanzibar Ministry of Investment & Economic Development to encourage tech companies to relocate to the island3.

Such an enabling environment put 2022 on track to be the busiest year on record for VC deals on the African continent. Analysts at the Africa Venture Capital Association (AVCA) predicted that VC firms will have raised around $7bn via 900 deals during the course of 2022, an increase of 38% on the 650 deals valued at $5.2bn a year earlier4.

According to AVCA’s report, the top sector for VC investment remains financials, which drew around 32% of volume and 44% of deal value in the first half of 2022. The low penetration of traditional banks in Africa means that financial services are ripe for disruption and that growth opportunities are strong.

Fundraising

As a leading indicator, the subdued fundraising environment in 2022 hints at a challenging year for deal making in 2023 and beyond. When final numbers are confirmed, it is expected that private capital fundraising in Africa will have declined substantially in 2022 from the $4.4bn raised in the whole of 20215. However, a couple of unusually large closes, such as Development Partners International’s $900mn ADPIII Fund, do distort the 2021 numbers6.

The decline on the continent mirrors trends in the global fundraising market. Notably, global private equity fundraising fell by nearly $100bn in 2022, with 1,520 funds closed raising $727.3bn, though the period still accounts for the third highest total on record7.

While the rise of ESG and impact investing will likely bolster support for African funds, some warn that an inflexible approach to reporting ESG data – as regulations tighten to require greater disclosure on environmental and social indicators – may bring about unintended consequences and drive capital away from Africa.

Exits

Early indicators in 2022 showed a fairly vibrant exit market with exit volumes holding up well compared to the global context. The most common exit routes remained sales to trade buyers and secondary sales to other PE firms and financial institutions. Private capital investors achieved 22 full exits between January and June 2022, a 29% increase compared to 2021 H18.

Notable exits in the second half of the year include Carlyle’s agreement to sell its majority stake in Amrod, the South Africa-based promotional product supplier, to Oppenheimer Partners Ltd9 in November and, in the same month, the approval of the initial public offering of Akdital, a private clinic group, on the Casablanca Stock Exchange10.

Multinational strategic buyers have continued to show interest in Africa and represent the largest portion of trade buyers, indicating the continent is still seen as an attractive region for expansion, AVCA says. In September for example, Shell bought 100% of the shares in West African solar company DaystarPower11, while in April Old Mutual finalized its sale of glass maker Consol Holdings to Luxembourg-based Ardagh Group.

The mix of buyers in 2023 is unlikely to change significantly, although trade buyers play a greater role compared with 2023 given the more challenging capital raising environment and debt markets for private equity buyers. Development finance institutions (DFIs) such as the International Finance Corporation are also expected to play an important role in this space, recognizing the need to deploy capital on the continent to help offset the impact cause by turbulence in global markets.

Sector Spotlight: Financials Continue to Dominate

Industrials, consumer discretionary, information technology and healthcare all remain key areas of interest for fund managers, but one sector continues to dominate deal flow: financials. The enormous scope for growth in financial services has given rise to a huge number of fintechs looking to challenge and even displace Africa’s incumbent banking sector.

McKinsey analysis suggests financial services revenues in Africa are expected to grow by 10% a year until 2025, with payments and wallets the fastest growing products12. Multinationals like Visa are looking to capitalize on this rapid growth in digital payments – Visa in December announced plans to invest $1bn over the next five years in Africa13.

Financials attracted 30% of the continent’s deals by volume, securing $1.8bn in the first half of 2022 with venture capital accounting for $1.3bn of this14. Industrials, the next busiest sector over the same time period, raised $0.8bn. Nigeria continues to be the African continent’s most vibrant ecosystem for fintech with 35 deals signed in the first half of the year alone.

Other deals of note include Nigerian digital bank Umba’s raise of a $15mn Series A round in April 2022 to expand into three new African markets, before announcing in August its acquisition of Kenyan community microfinance bank Daraja15.

This sector is unlikely to be toppled in 2023, with the sector fundamentals continuing to hold the same appeal.

Sector Spotlight: Climate Finance

The UN’s COP27 climate gathering in Sharm El-Sheikh has sharpened the focus on Africa’s energy transition, as well as funding needs for both climate resilience and mitigation. Private capital is set to play an essential role in financing national sustainable development plans and cleaner energy solutions, and COP27 saw a raft of commitments from private providers as well as concessional sources such as DFIs and multilateral funds.

In December, the U.S. government announced plans to stimulate private investment in large-scale climate solutions under its Climate Action Infrastructure Facility (CAIF) as part of plans to provide at least $1.1bn to support Africa-led sustainability efforts16. In November, the African Development Bank made a $20mn equity investment in Evolution Fund III, a pan-African clean and sustainable energy private equity fund managed by Inspired Evolution Investment Management. The fund is looking to mobilize around $400mn into renewable energy and resource-efficiency assets across sub-Saharan Africa over the next 10 years17.

But climate-related deals were a key focus even before COP27 – 79 deals to the value of $1.3bn were signed in the first three quarters of 2022.

Notable deals include Kenya’s Sun King, one of the largest solar companies in Africa and Asia, in a $260mn Series D round18 and Ghana’s PEG Africa, an energy distribution provider in West Africa, which was bought by UK-based power company Bboxx in September19.

Venture Capital comprised the largest share (73%) of climate-related investments, reflecting trends in Africa’s wider private capital market20. Early and later stage investment in clean and climate tech look set to continue to be a strong theme in 2023.