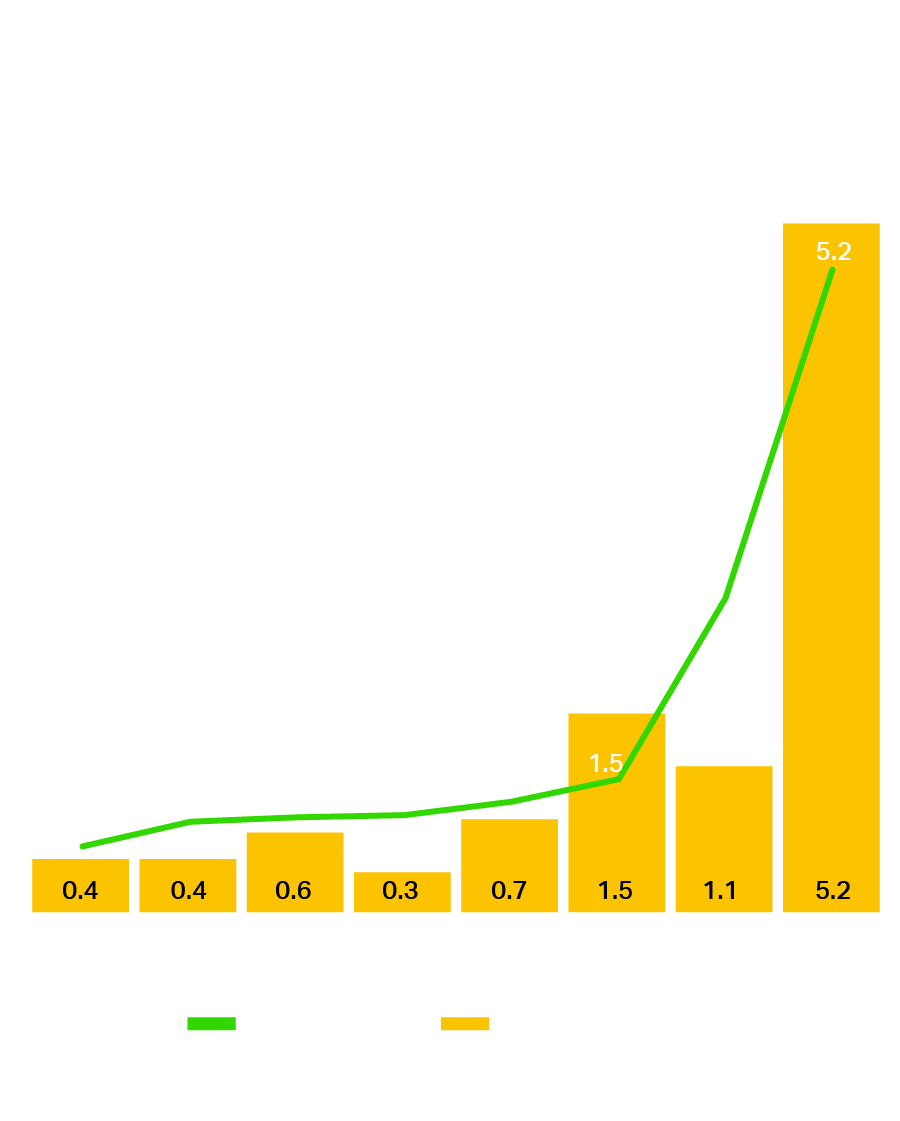

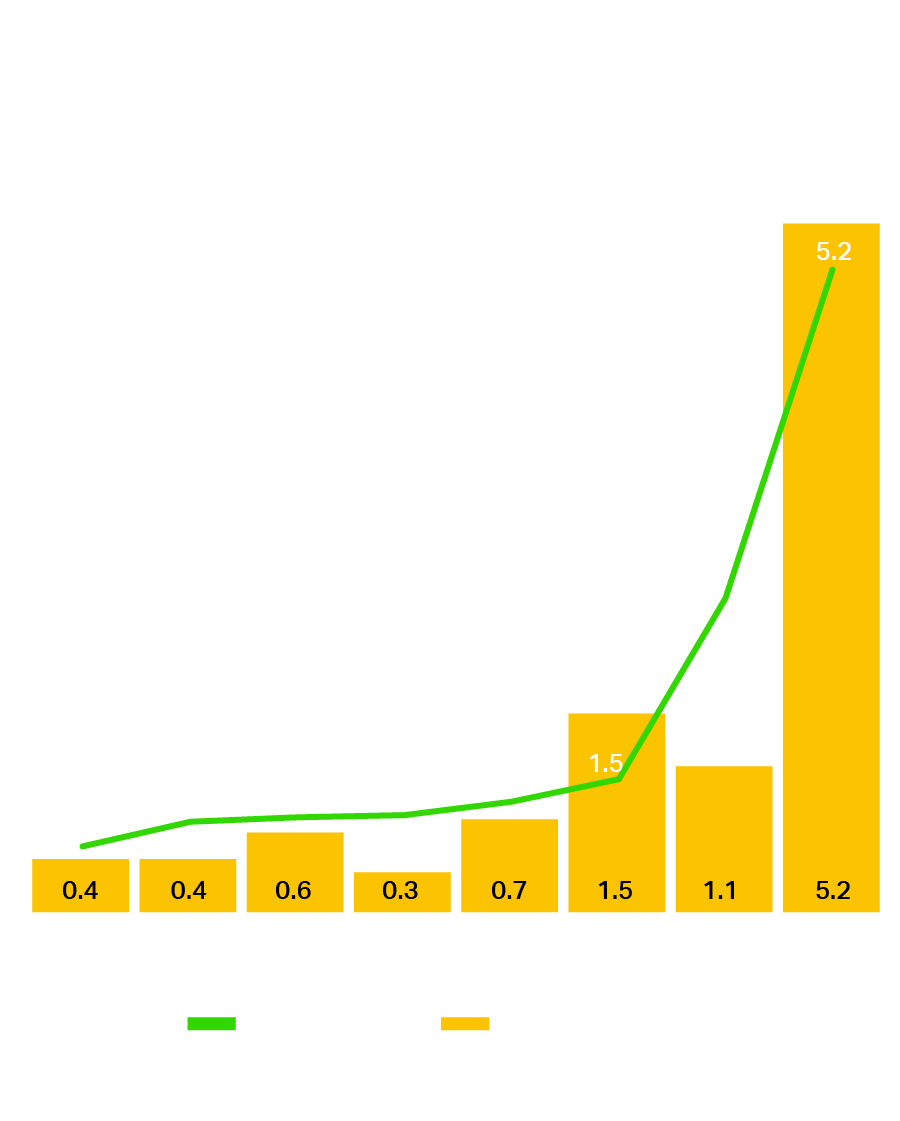

The African startup scene emerged in 2021 from a steady but small market on the cusp of growth to a dynamic ecosystem where billion-dollar valuations, global market potential and competitive ROI are key features. Venture capitalists put more money to work in African startups in 2021 than the preceding seven years combined1 and if the momentum seen in the first half of the year is anything to go by, this is set to continue well into 2022.

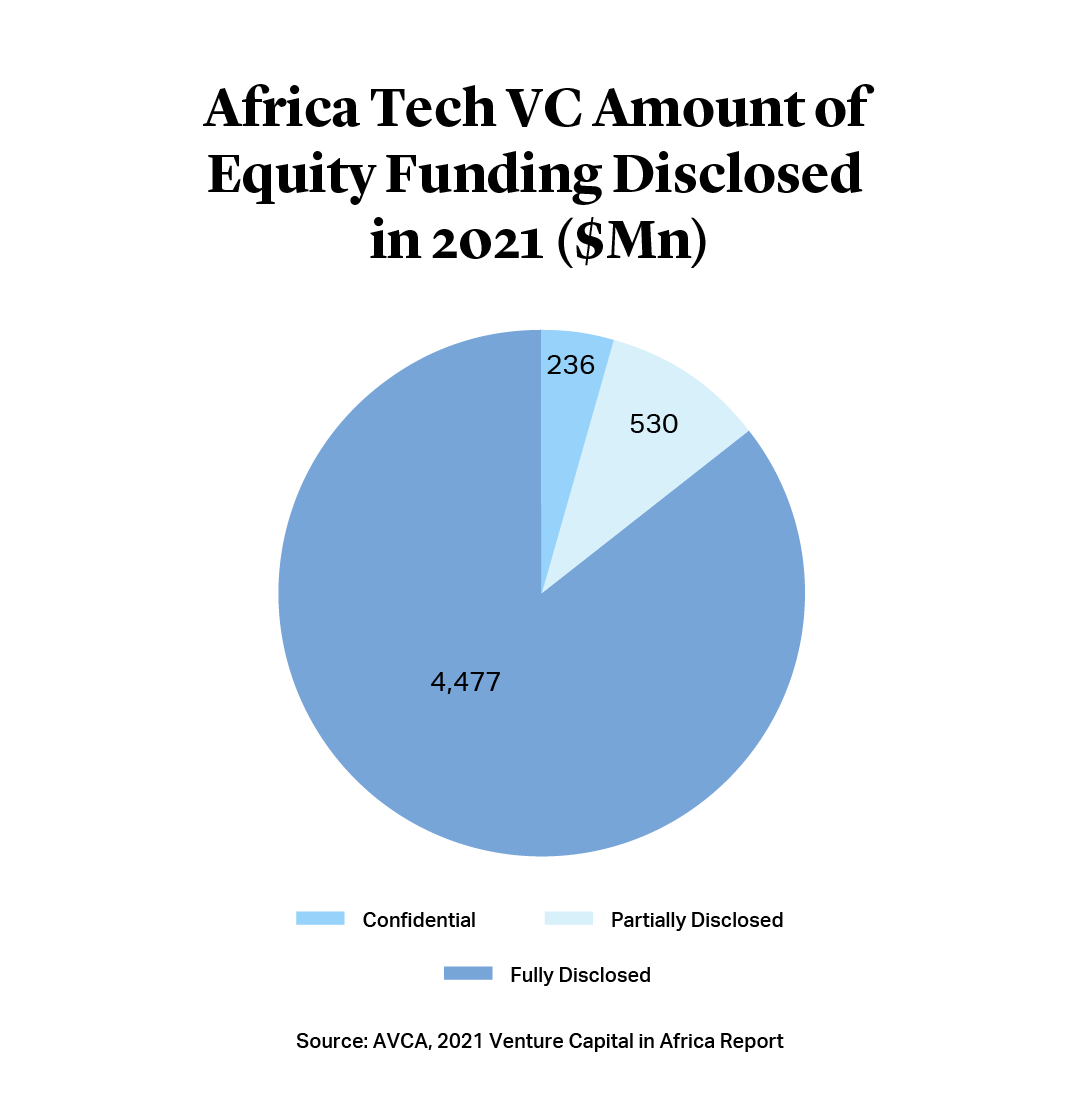

African startups had raised over $2.3bn from global investors by the end of June this year, building on the record breaking $5.2bn raised from 604 unique companies in 20222. With average funding round sizes also up, an abundance of mega deals above $100mn and a growing global investor base, this growth trend looks set to persist.

Drivers of this momentum are varied, but in addition to the favorable demographics, strong growth potential and the opportunity to reach populations underserved by current educational resources, a key factor is the growth of enabling legislation which supports entrepreneurship in particular in Egypt, Kenya, South Africa and Nigeria. In Egypt, new legislation introduced in September 2021 saw banking licenses allocated to FinTechs3, while in South Africa the government introduced a startup visa programme to enable entrepreneurs to live and grow businesses in the country4. In Kenya, the Capital Markets Authority is working closely with fintech founders5 and has admitted nine firms to its regulatory sandbox6. Meanwhile, Nigeria’s Startup Bill was a step closer to becoming enshrined into law after passing the Nigerian Senate in July, following Senegal which ratified its own Startup Act in 20217.

The African startup scene emerged in 2021 from a steady but small market on the cusp of growth to a dynamic ecosystem where billion-dollar valuations, global market potential and competitive ROI are key features. Venture capitalists put more money to work in African startups in 2021 than the preceding seven years combined1 and if the momentum seen in the first half of the year is anything to go by, this is set to continue well into 2022.

African startups had raised over $2.3bn from global investors by the end of June this year, building on the record breaking $5.2bn raised from 604 unique companies in 20222. With average funding round sizes also up, an abundance of mega deals above $100mn and a growing global investor base, this growth trend looks set to persist.

Drivers of this momentum are varied, but in addition to the favorable demographics, strong growth potential and the opportunity to reach populations underserved by current educational resources, a key factor is the growth of enabling legislation which supports entrepreneurship in particular in Egypt, Kenya, South Africa and Nigeria. In Egypt, new legislation introduced in September 2021 saw banking licenses allocated to FinTechs3, while in South Africa the government introduced a startup visa programme to enable entrepreneurs to live and grow businesses in the country4. In Kenya, the Capital Markets Authority is working closely with fintech founders5 and has admitted nine firms to its regulatory sandbox6. Meanwhile, Nigeria’s Startup Bill was a step closer to becoming enshrined into law after passing the Nigerian Senate in July, following Senegal which ratified its own Startup Act in 20217.

Larger Ticket Sizes Attracting More Foreign Investment

As well as a 104% year on year increase in the number of deals to 650 from 319 in 2020, so called “mega deals” – those with valuations of over $100mn – are becoming much more common on the continent. In 2021, a record five African startups reached “unicorn status” by completing fundraises that pushed their valuations to over a billion dollars. Flutterwave, a payments provider raised $170mn, mobile money providers OPay and Wave raised $400mn and $200mn respectively, Andela, a job placement network raised $200mn, and Chipper, a cross-border payments provider raised $150mn. Egypt’s Swvl, a ridehailing startup, and Nigeria’s Kuda, a digital bank, are both expected to reach unicorn status this year8.

Larger ticket sizes and funding rounds will likely further bolster the region’s attractiveness to the growing number of international investors looking to take advantage of the strong growth opportunities for tech enabled businesses. There were 21 funding rounds of above $50mn in Africa tech VC in 2021, more than 10 times as many than in 2020, and 14 rounds of above $100mn according to Partech9.

As well as reporting an increase in the diversification of those who invest and operate in the industry, the AVCA reports that three quarters of investors active in Africa’s VC landscape in 2021 were international – from Japan, China, Singapore, the UK and the U.S. – while just a quarter were African VCs10.

In addition to investments from several multi-billion dollar VC fund managers from the U.S., American high net worth investors are also making investments in Africa. Jack Dorsey, who runs financial services firm Block, has invested in pan-African cryptocurrency exchange Yellow Card as part of a $15mn Series A funding round11. Jeff Bezos, is an investor in Chipper Cash12 and Justin Mateen has made several investments through his JAM Fund, including Kenya’s e-commerce platform Tushop and Kibanda TopUp13 which is digitalizing the supply chain for small restaurants in Africa and most recently raised $1.7mn in seed funding in May 202214.

Another company which has attracted high profile investment from the U.S. is Nigerian payments startup Flutterwave, which is now valued at more than $3bn after raising $250mn in February. This fundraising round was led by investors including Facebook Inc co-founder Eduardo Saverin’s venture capital firm B Capital Group, and Boston-based hedge fund Whale Rock Capital Management15.

And as Tencent’s second investment in Nigerian EdTech uLesson earlier this year attests, investors from the Asia-Pacific region appear keen to make repeat investments in the region as well. Softbank also made two investments via Softbank Vision Fund 2: in OPay and Andela16.

The increasing popularity of impact investment strategies – those prioritizing both financial and social returns – is also likely to ensure a growing investor base for African deals. More than 260 deals on the continent in 2021 were backed by at least one impact investor last year, according to the AVCA17.

Larger Ticket Sizes Attracting More Foreign Investment

As well as a 104% year on year increase in the number of deals to 650 from 319 in 2020, so called “mega deals” – those with valuations of over $100mn – are becoming much more common on the continent. In 2021, a record five African startups reached “unicorn status” by completing fundraises that pushed their valuations to over a billion dollars. Flutterwave, a payments provider raised $170mn, mobile money providers OPay and Wave raised $400mn and $200mn respectively, Andela, a job placement network raised $200mn, and Chipper, a cross-border payments provider raised $150mn. Egypt’s Swvl, a ridehailing startup, and Nigeria’s Kuda, a digital bank, are both expected to reach unicorn status this year8.

Larger ticket sizes and funding rounds will likely further bolster the region’s attractiveness to the growing number of international investors looking to take advantage of the strong growth opportunities for tech enabled businesses. There were 21 funding rounds of above $50mn in Africa tech VC in 2021, more than 10 times as many than in 2020, and 14 rounds of above $100mn according to Partech9.

As well as reporting an increase in the diversification of those who invest and operate in the industry, the AVCA reports that three quarters of investors active in Africa’s VC landscape in 2021 were international – from Japan, China, Singapore, the UK and the U.S. – while just a quarter were African VCs10.

In addition to investments from several multi-billion dollar VC fund managers from the U.S., American high net worth investors are also making investments in Africa. Jack Dorsey, who runs financial services firm Block, has invested in pan-African cryptocurrency exchange Yellow Card as part of a $15mn Series A funding round11. Jeff Bezos, is an investor in Chipper Cash12 and Justin Mateen has made several investments through his JAM Fund, including Kenya’s e-commerce platform Tushop and Kibanda TopUp13 which is digitalizing the supply chain for small restaurants in Africa and most recently raised $1.7mn in seed funding in May 202214.

Another company which has attracted high profile investment from the U.S. is Nigerian payments startup Flutterwave, which is now valued at more than $3bn after raising $250mn in February. This fundraising round was led by investors including Facebook Inc co-founder Eduardo Saverin’s venture capital firm B Capital Group, and Boston-based hedge fund Whale Rock Capital Management15.

And as Tencent’s second investment in Nigerian EdTech uLesson earlier this year attests, investors from the Asia-Pacific region appear keen to make repeat investments in the region as well. Softbank also made two investments via Softbank Vision Fund 2: in OPay and Andela16.

The increasing popularity of impact investment strategies – those prioritizing both financial and social returns – is also likely to ensure a growing investor base for African deals. More than 260 deals on the continent in 2021 were backed by at least one impact investor last year, according to the AVCA17.

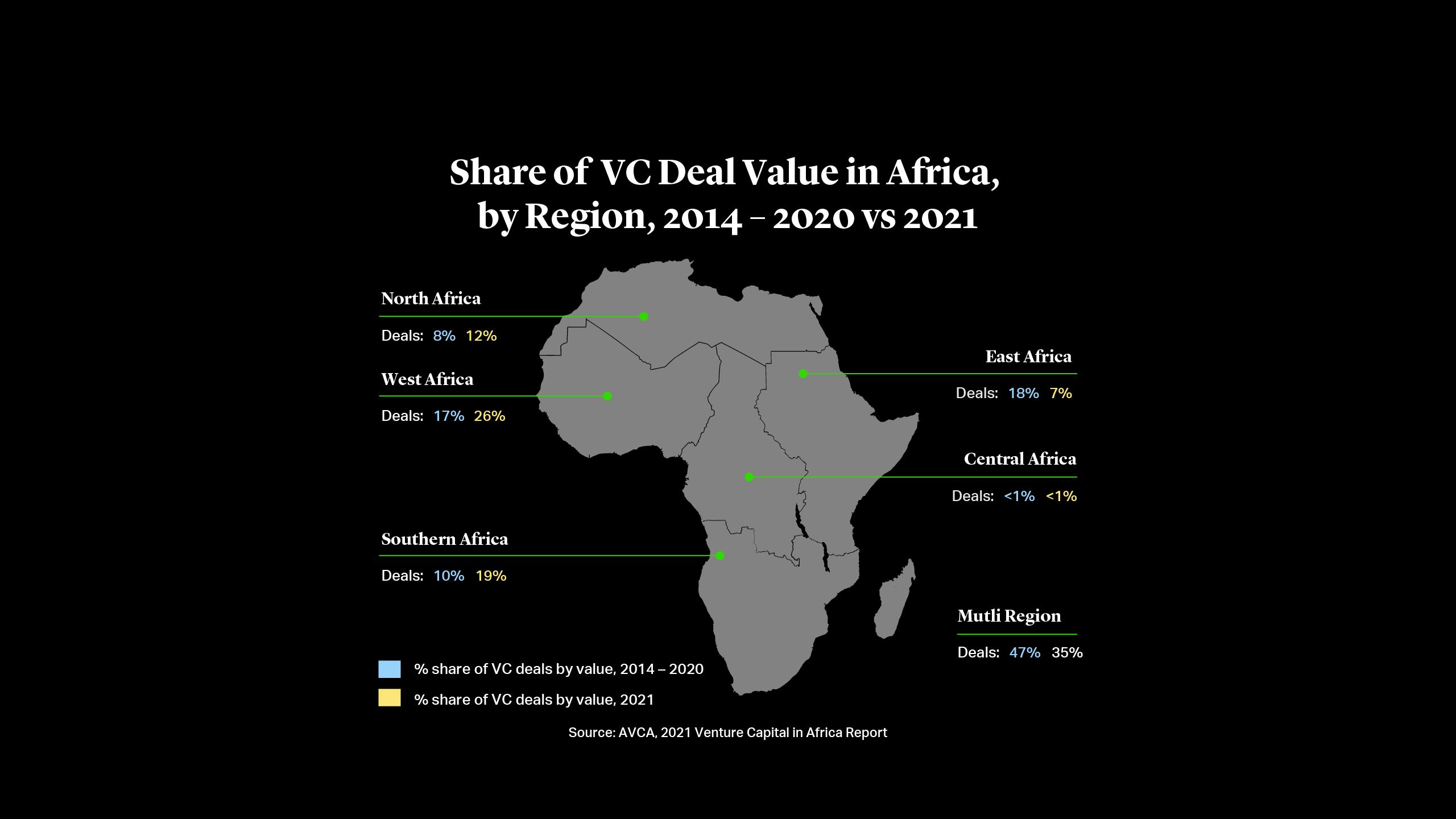

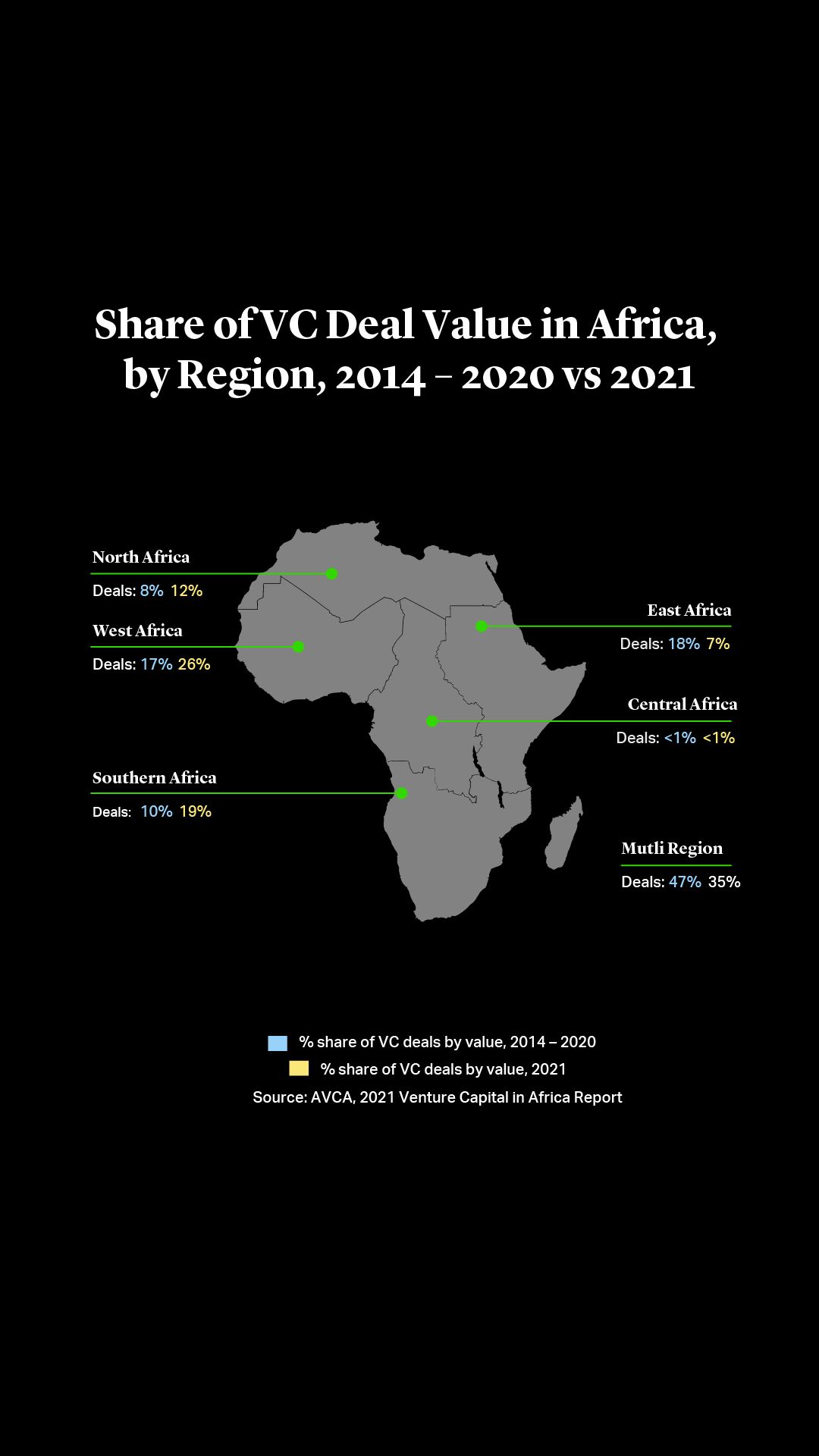

Sector and Regional Trends

FinTech still remains by far the most attractive sector. A large portion of Africa’s population is unbanked and traditional lenders have been slow to adapt18. Many of these startups are now forging partnerships with nimble and fast-growing companies in payments, e-commerce, microfinance and mobile banking, offering an attractive exit route for investors. The AVCA says the financial sector accounted for 60% of the investments by value and nearly a third of deals by volume. Information technology and consumer discretionary were the next most popular sectors by volume at 16% of deals each.

By region, West Africa attracted the highest volume of deals, with Nigeria continuing to prove Africa’s most vibrant and attractive market. In fact, $1.8bn was invested in Nigeria in 2021, representing 34% of all African equity funding and making it Africa’s fastest growing market with equity financing growing 486% year on year, according to analysis by Partech.

Mobile money provider OPay became the fastest Nigerian startup to gain unicorn status after raising $400mn in Series C funding in September 2021. The payments provider announced a partnership with Mastercard in May this year which enables OPay customers to use the Mastercard payment solution, regardless of whether they have a bank account19.

South Africa and Egypt also proved to be effervescent markets. Egyptian startups raised $652mn via 140 deals, representing 21% of total deal count on the continent, according to Partech.

With a multitude of deals already taking place throughout Africa in recent months and growing interest from investors around the globe, we can expect ongoing VC interest in the continent for the months to come.

Sector and Regional Trends

FinTech still remains by far the most attractive sector. A large portion of Africa’s population is unbanked and traditional lenders have been slow to adapt18. Many of these startups are now forging partnerships with nimble and fast-growing companies in payments, e-commerce, microfinance and mobile banking, offering an attractive exit route for investors. The AVCA says the financial sector accounted for 60% of the investments by value and nearly a third of deals by volume. Information technology and consumer discretionary were the next most popular sectors by volume at 16% of deals each.

By region, West Africa attracted the highest volume of deals, with Nigeria continuing to prove Africa’s most vibrant and attractive market. In fact, $1.8bn was invested in Nigeria in 2021, representing 34% of all African equity funding and making it Africa’s fastest growing market with equity financing growing 486% year on year, according to analysis by Partech.

Mobile money provider OPay became the fastest Nigerian startup to gain unicorn status after raising $400mn in Series C funding in September 2021. The payments provider announced a partnership with Mastercard in May this year which enables OPay customers to use the Mastercard payment solution, regardless of whether they have a bank account19.

South Africa and Egypt also proved to be effervescent markets. Egyptian startups raised $652mn via 140 deals, representing 21% of total deal count on the continent, according to Partech.

With a multitude of deals already taking place throughout Africa in recent months and growing interest from investors around the globe, we can expect ongoing VC interest in the continent for the months to come.

Barthélemy Faye

Partner

Paris

T: +33 1 40 74 68 00

bfaye@cgsh.com

V-Card

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Anton Nothias

Associate