Across Africa, tech-enabled companies are springing up to enhance access to learning across the continent. African EdTech is increasingly big business and has captured the attention of some of the world’s most influential capital providers. In June this year, Chinese tech giant Tencent made its second investment in African EdTech, this time co-leading a $6mn Series A investment round into Kukua, a Nairobi and London based educational entertainment company1.

The deal comes less than six months after Tencent helped two year old Nigerian business uLesson land the largest ever disclosed investment in an African EdTech startup. The $15mn Series B funding round, closed in December 2021, saw Tencent and Nielsen Ventures join existing investors Owl Ventures, TLcom Capital and Founder Collective2.

Companies like uLesson – which provides pre-recorded educational videos for K-12 students (primary and secondary level education), along with quizzes and a homework feature via its app – are part of a growing universe of startups and more established companies looking to leverage technology to improve access to education on the African continent. More than two thirds of Honlon IQ’s list of 50 of the most promising EdTech startups across Sub-Saharan Africa – which have collectively raised over $200mn – are less than six years old, showing how active the Africa EdTech ecosystem is.

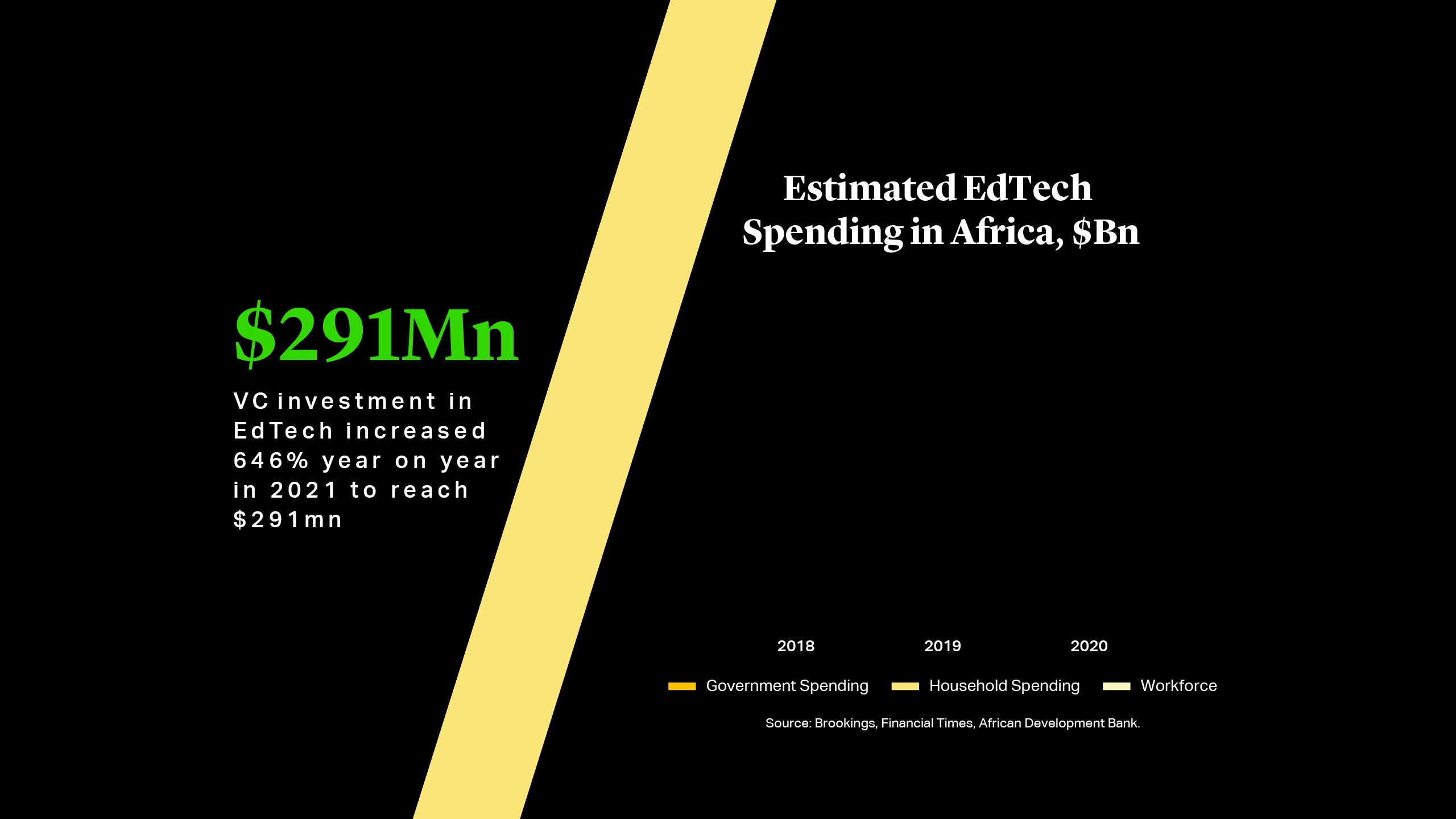

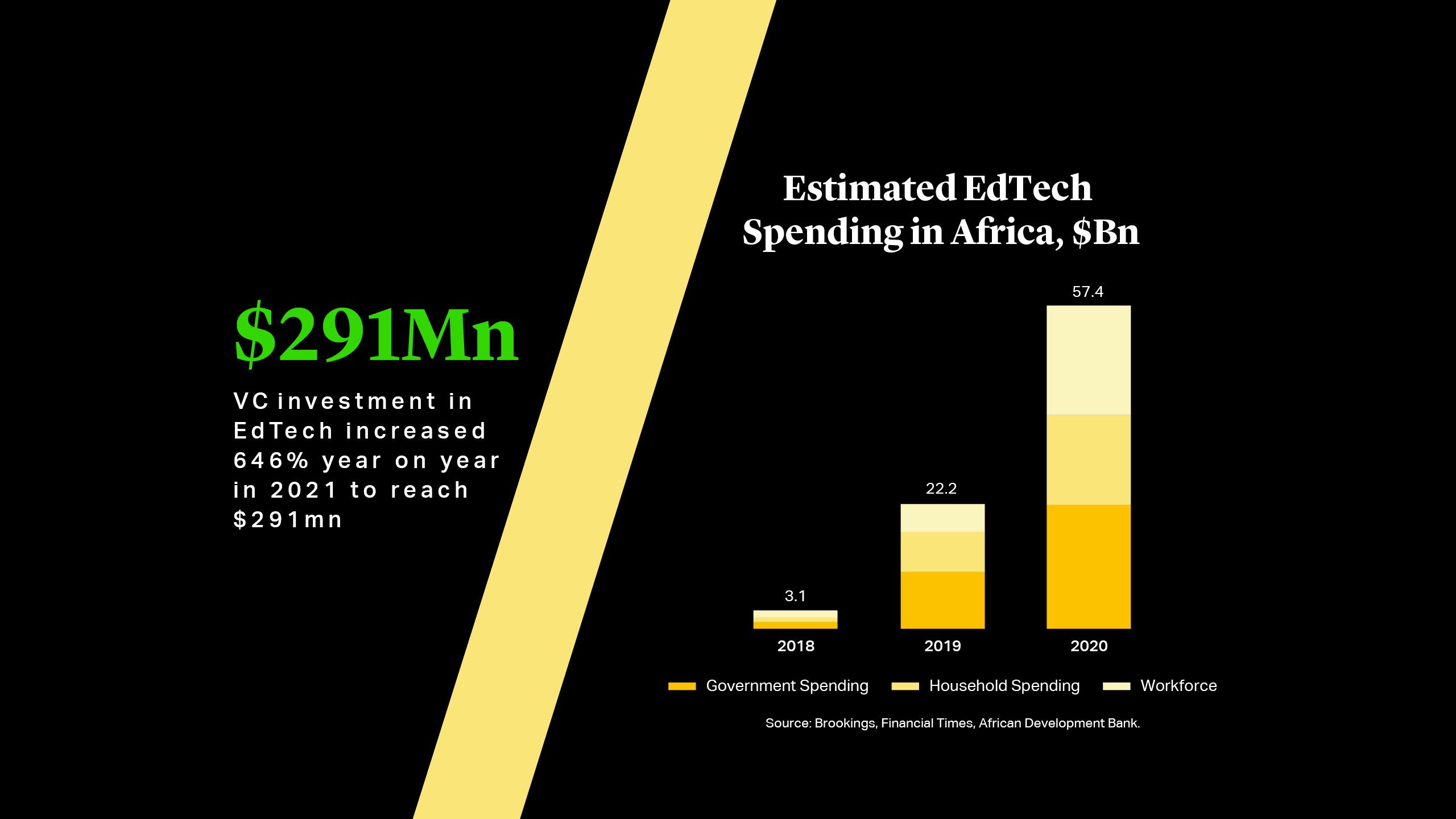

Investment in African EdTech makes up a small fraction of the overall market for VC – attracting only $20mn of funding between January 2019 and August 20213– but it is expected to grow rapidly amid increased recognition of the benefits of remote learning during the COVID-19 pandemic. VC investment in EdTech increased 646% year on year in 2021 to reach $291mn, according to analysis by Partech’s Africa Tech Venture Capital Report 20214. The sector took 6% of all VC funding on the African continent in 2021, behind FinTech (62%) and LogisticTech (7%).

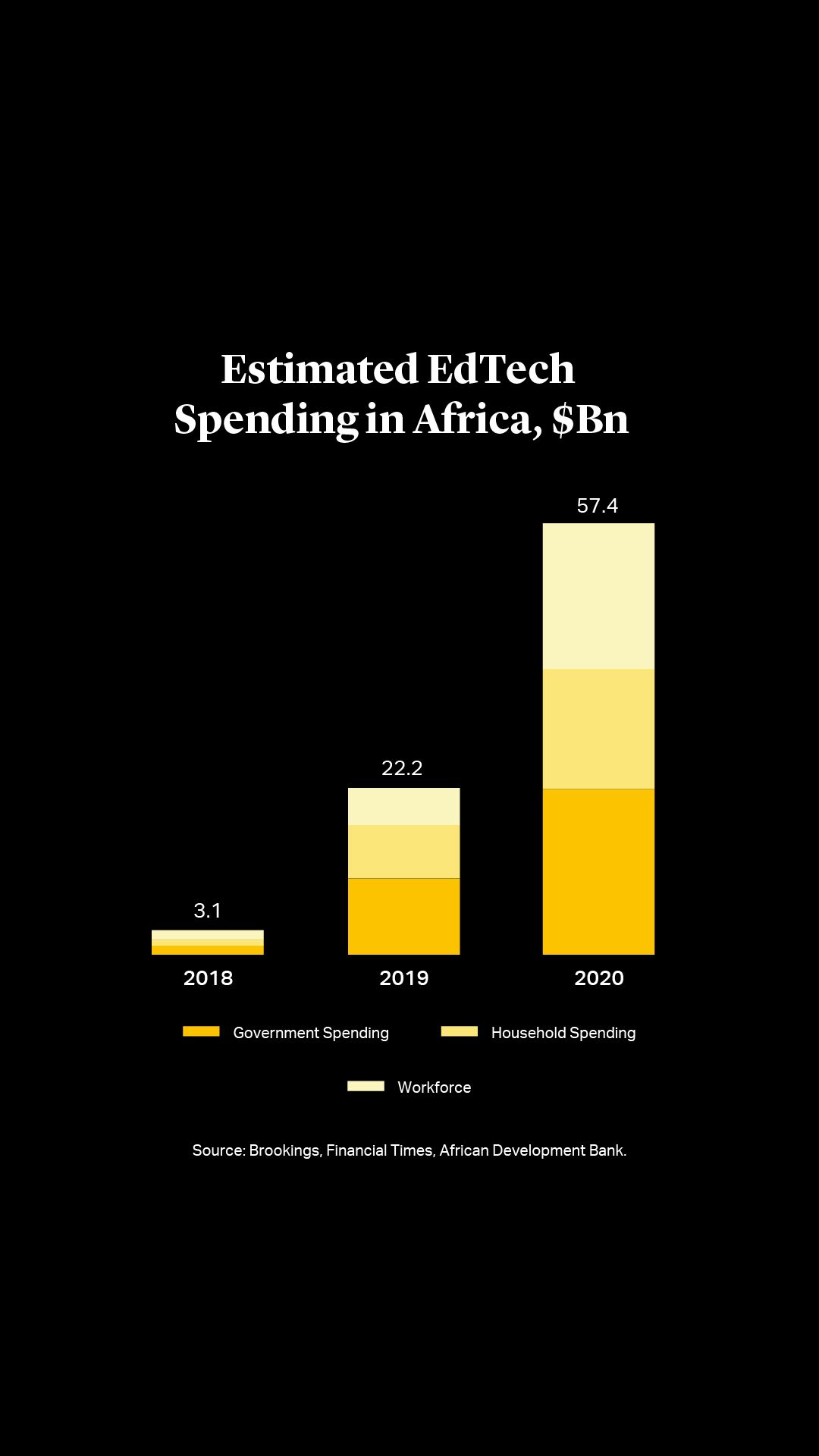

GSV Ventures projects spend on education in Africa to grow from $224bn today to $740bn by 2030. Of this, it expects investment in EdTech across the continent to grow from $3bn in August 2021 to reach $57bn in 20305. Globally, EdTech is expected to attract $404bn of capital by 2025, says data provider Preqin.

Across Africa, tech-enabled companies are springing up to enhance access to learning across the continent. African EdTech is increasingly big business and has captured the attention of some of the world’s most influential capital providers. In June this year, Chinese tech giant Tencent made its second investment in African EdTech, this time co-leading a $6mn Series A investment round into Kukua, a Nairobi and London based educational entertainment company1.

The deal comes less than six months after Tencent helped two year old Nigerian business uLesson land the largest ever disclosed investment in an African EdTech startup. The $15mn Series B funding round, closed in December 2021, saw Tencent and Nielsen Ventures join existing investors Owl Ventures, TLcom Capital and Founder Collective2.

Companies like uLesson – which provides pre-recorded educational videos for K-12 students (primary and secondary level education), along with quizzes and a homework feature via its app – are part of a growing universe of startups and more established companies looking to leverage technology to improve access to education on the African continent. More than two thirds of Honlon IQ’s list of 50 of the most promising EdTech startups across Sub-Saharan Africa – which have collectively raised over $200mn – are less than six years old, showing how active the Africa EdTech ecosystem is.

Investment in African EdTech makes up a small fraction of the overall market for VC – attracting only $20mn of funding between January 2019 and August 20213– but it is expected to grow rapidly amid increased recognition of the benefits of remote learning during the COVID-19 pandemic. VC investment in EdTech increased 646% year on year in 2021 to reach $291mn, according to analysis by Partech’s Africa Tech Venture Capital Report 20214. The sector took 6% of all VC funding on the African continent in 2021, behind FinTech (62%) and LogisticTech (7%).

GSV Ventures projects spend on education in Africa to grow from $224bn today to $740bn by 2030. Of this, it expects investment in EdTech across the continent to grow from $3bn in August 2021 to reach $57bn in 20305. Globally, EdTech is expected to attract $404bn of capital by 2025, says data provider Preqin.

The Need for EdTech

Similar to healthcare, technology applied to education offers the opportunity to reach previously underserved populations and improve on outcomes, particularly for lower and middle-income groups. Rates of learning poverty remain high in Africa. A source estimates there are currently some 34 million out-of-school children across the African continent, and many of those who are in school suffer from limited resources. School enrolment, literacy rates, mathematics and reading scores lag other regions globally6.

Policymakers are working to address these imbalances, creating a strong tailwind for private sector investment in the digital learning sector. EdTech is a key priority under the World Bank’s Western and Central Africa Education Strategy 2022-2025, which sets out a roadmap to address the learning challenges in the region7. The strategy identifies the limited use of digital technology in teaching and learning as one of the contributors to poor outcomes in basic and secondary education in the region, identifying EdTech tools and learning resources as a key pillar for positive impact.

Deals

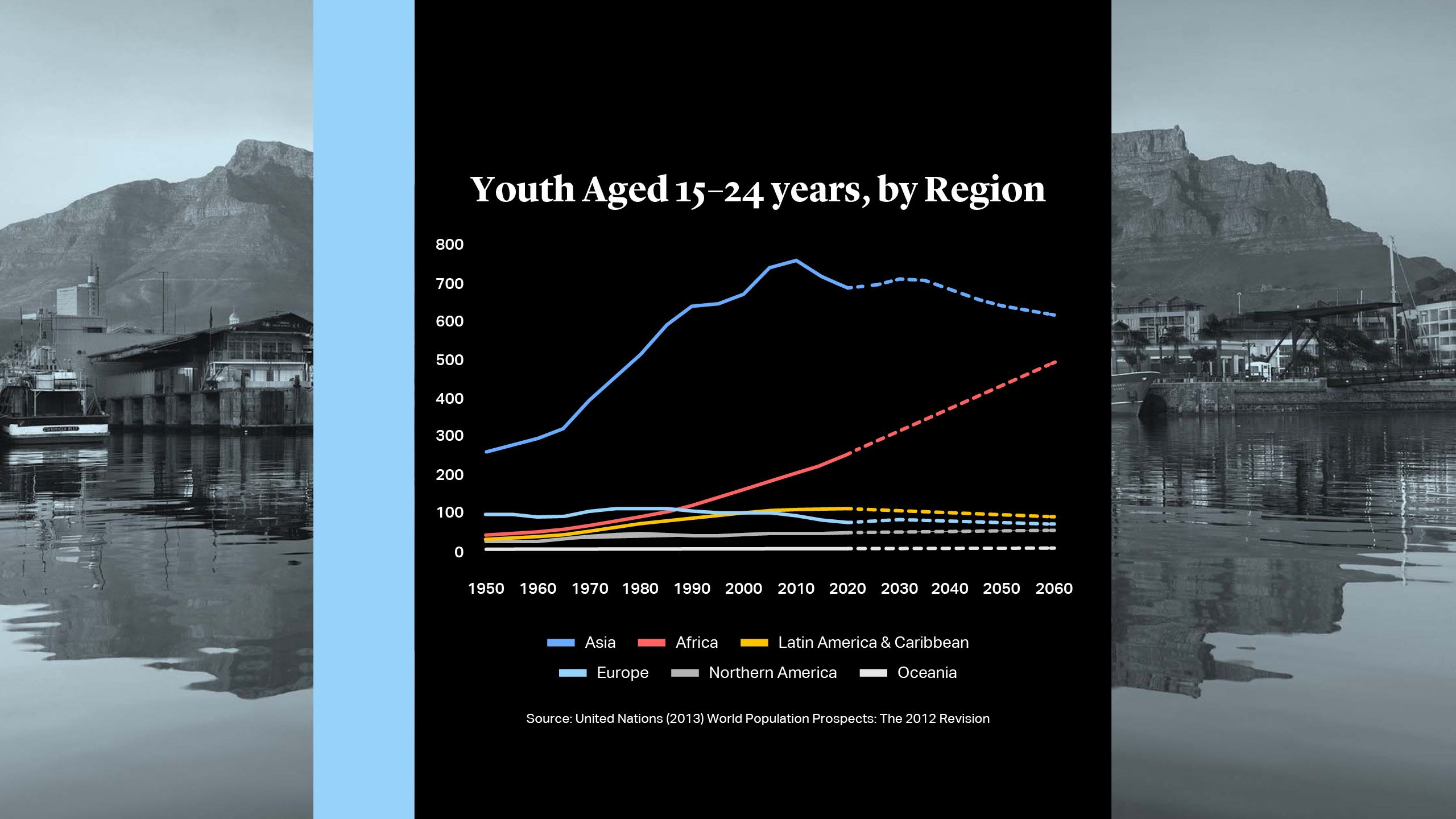

Deal momentum has continued since uLesson’s $15mn fund raise. In June, Tunisian EdTech startup GOMYCODE raised $8mn to expand across Africa and the Middle East8, representing the largest Series A EdTech funding round on the continent as of July 2022. The UN predicts that by 2030, the number of people between the ages of 15 and 24 in Africa will increase by 42% – GOMYCODE is looking to address the need to upskill a growing population by offering 30 learning tracks from digital marketing and data science to AI.

In May Foondamate, which uses a WhatsApp chatbot to provide lessons to users, raised $2mn9. The round was led by UK-based firm LocalGlobe, with participation from Emerge Education, FirstCheckAfrica, Future Africa, and LoftyInc, including a couple of angel investors.

As for those waiting in the wings, more than 50% of businesses listed are focused on digital content and STEAM (science, technology, engineering, arts and maths) while a large number of startups are concentrating on adult education, namely on workforce digital skills.

One notable exit in the education space was TPG’s sale of its maiden investment in Africa, Holding Générale d’Education, a K-12 private education group in Morocco and Tunisia, to SPE Capital10. A good reminder that well-run brick and mortar education structures interest investors globally, too.

Potential Problems

However, while investment in EdTech is expected to solve issues of access, quality, and affordability, it is these factors which may also hold back the expansion of the sector.

In July, Human Rights Watch warned EdTech led to, in some cases, violations of children’s rights while directly advancing bad teaching practices in U.S. schools11. HRW assessed 164 EdTech products and found 89% engaged in data practices that risked or infringed on children’s rights by monitoring or having the capacity to monitor children as well as collecting, processing and receiving children’s data without their consent12.

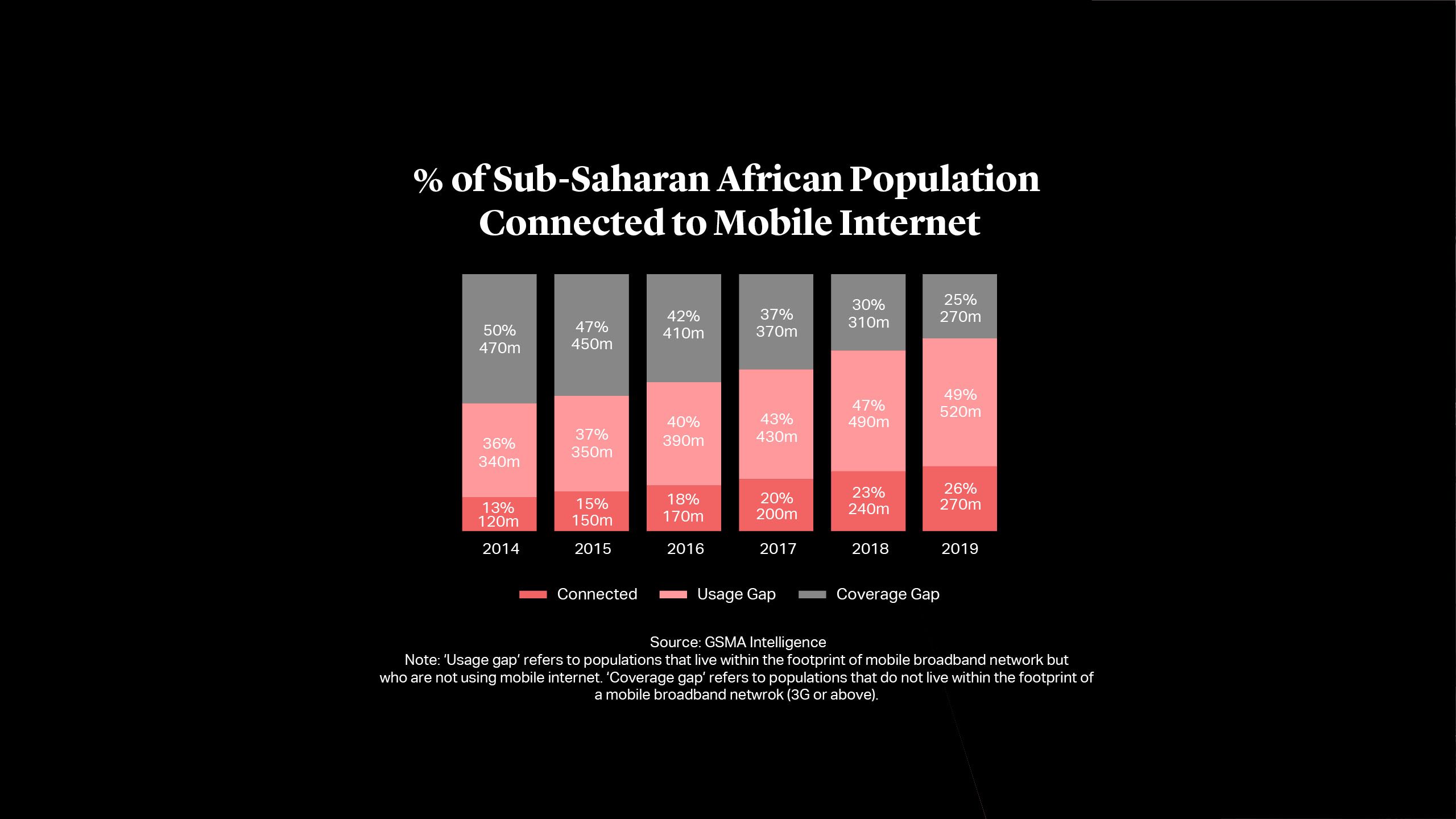

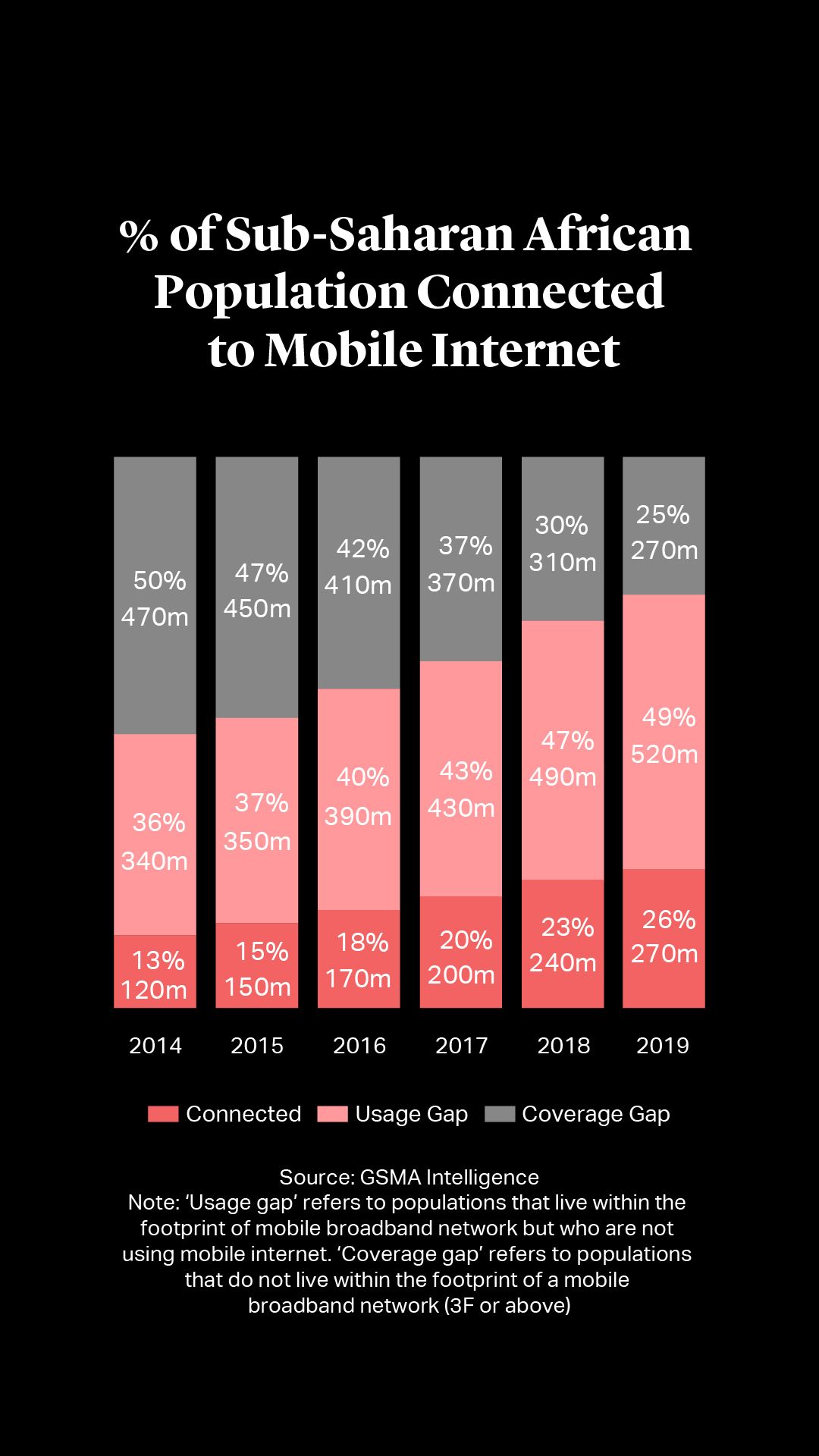

Improving internet infrastructure will be critical to ensuring wider adoption of EdTech products and services. Sub-Saharan Africa has the world’s most expensive data prices, which is widening the “digital divide” in terms of data access, according to the United Nations13. Low coverage and high hardware costs are also key concerns, meaning that for many, there is still a long way to go to achieve universal mobile internet access. Mobile and internet connectivity in sub-Saharan Africa is still low as well, at 26% as of 2019, up from 13% in 201414.

EdTech in Africa is already benefiting from growing interest from investors and influential capital providers, but the potential for further expansion isn’t assured. However, if these challenges around access and affordability can be overcome, there could a bright future in store.

Potential Problems

However, while investment in EdTech is expected to solve issues of access, quality, and affordability, it is these factors which may also hold back the expansion of the sector.

In July, Human Rights Watch warned EdTech led to, in some cases, violations of children’s rights while directly advancing bad teaching practices in U.S. schools11. HRW assessed 164 EdTech products and found 89% engaged in data practices that risked or infringed on children’s rights by monitoring or having the capacity to monitor children as well as collecting, processing and receiving children’s data without their consent12.

Improving internet infrastructure will be critical to ensuring wider adoption of EdTech products and services. Sub-Saharan Africa has the world’s most expensive data prices, which is widening the “digital divide” in terms of data access, according to the United Nations13. Low coverage and high hardware costs are also key concerns, meaning that for many, there is still a long way to go to achieve universal mobile internet access. Mobile and internet connectivity in sub-Saharan Africa is still low as well, at 26% as of 2019, up from 13% in 201414.

EdTech in Africa is already benefiting from growing interest from investors and influential capital providers, but the potential for further expansion isn’t assured. However, if these challenges around access and affordability can be overcome, there could a bright future in store.

Barthélemy Faye

Partner

Paris

T: +33 1 40 74 68 00

bfaye@cgsh.com

V-Card

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Anton Nothias

Associate