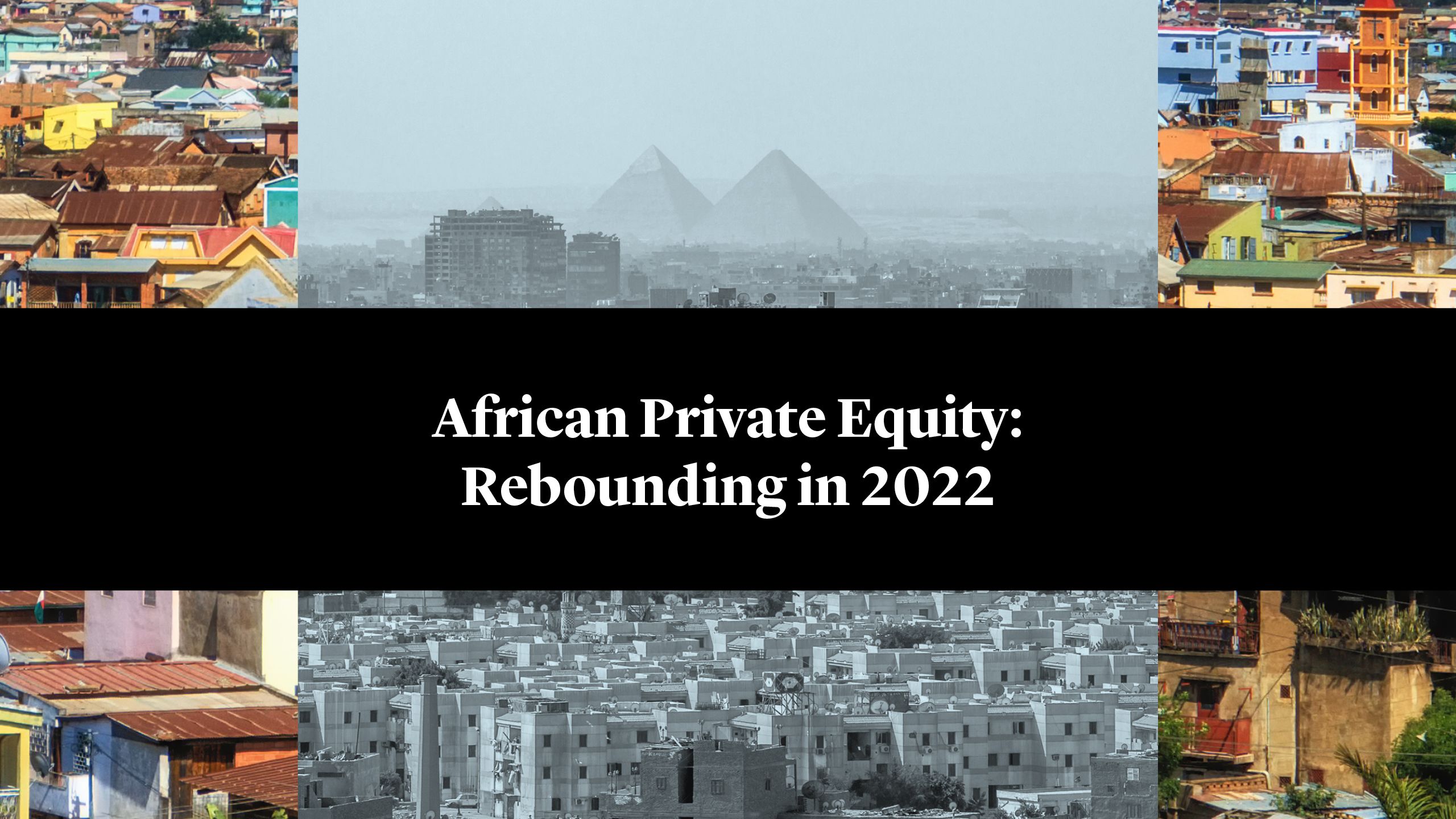

African private equity is expected to rebound in 2022 as the continent begins to benefit from the market conditions which fuelled the explosive rise in global private equity in 2021. Regional growth, digitalisation and an uptick in intercontinental trade will provide key investment drivers, while attractive valuations, a resumption of transactions shelved during the pandemic and opportunities to pick up distressed assets will promote deal activity1.

Global private equity had a stellar year in 2021, with pent up demand driving deal volumes to record highs of $2.04tn2. As the world emerged from lockdown, historic levels of monetary and fiscal stimulus and low interest rates drove a rebound in appetite for deal-making, with GPs itching to put dry powder to work after a year of crisis management.

Though African PE is unlikely to experience the same stratospheric growth, market participants expect fundraising – boosted in 2021 by the closure of the near $1bn African Development Partners III (ADPIII) Fund – and investment to pick up in 2022. Eastern and South Africa are expected to see the most activity, though the smaller deal sizes that were typical of transactions between 2014 and 2019 are expected to continue3. With the pandemic serving to accelerate some of the trends which have made the continent attractive for investment – in particular, the digitalisation of its economy – opportunities in financial technology and other tech-enabled businesses such as health-tech and ed-tech will be key areas of focus. However, new variants of COVID-19, and other geopolitical instability such as the Ukraine conflict, may yet cloud this outlook.

African private equity is expected to rebound in 2022 as the continent begins to benefit from the market conditions which fuelled the explosive rise in global private equity in 2021. Regional growth, digitalisation and an uptick in intercontinental trade will provide key investment drivers, while attractive valuations, a resumption of transactions shelved during the pandemic and opportunities to pick up distressed assets will promote deal activity1.

Global private equity had a stellar year in 2021, with pent up demand driving deal volumes to record highs of $2.04tn2. As the world emerged from lockdown, historic levels of monetary and fiscal stimulus and low interest rates drove a rebound in appetite for deal-making, with GPs itching to put dry powder to work after a year of crisis management.

Though African PE is unlikely to experience the same stratospheric growth, market participants expect fundraising – boosted in 2021 by the closure of the near $1bn African Development Partners III (ADPIII) Fund – and investment to pick up in 2022. Eastern and South Africa are expected to see the most activity, though the smaller deal sizes that were typical of transactions between 2014 and 2019 are expected to continue3. With the pandemic serving to accelerate some of the trends which have made the continent attractive for investment – in particular, the digitalisation of its economy – opportunities in financial technology and other tech-enabled businesses such as health-tech and ed-tech will be key areas of focus. However, new variants of COVID-19, and other geopolitical instability such as the Ukraine conflict, may yet cloud this outlook.

A Solid 2021

Relative to global standards, the $2.1bn of African private equity deals closed in H1 2021 might seem lacklustre. However, this was a decent halftime result given that deal making on the continent has hovered at just above $3bn per annum for the past four years, with $3.3bn of African deals closed in the whole of 2020 and $3.4bn in 20194.

The availability of capital is largely expected to improve in 2022, with Development Finance Institutions continuing to be the preferred source of third-party funding. Investors plan to increase their allocation to Africa in the next three years, according to AVCA’s industry survey published in April 20215. However, fundraising timelines are expected to lengthen as currency depreciation, Covid-related travel restrictions and slower economic recovery in some regions keep funders cautious6. The conflict between Russia and Ukraine may also have an impact, with global risk appetite taking a knock. Fundraising in 2021 surpassed 2020 ($1.2bn) volumes, though the total was boosted by a number of flagship funds in the second half of the year, including the close by London-based Development Partners International (DPI) of a $900mn fund in October 20217.

The last time that an Africa-focused fund closed at a similar size was in 2015 when Helios Investment Partners raised $1.1bn8. Although short of this mark, DPI’s ADPIII fund has attracted a broad range of investors – including 25 LPs who are partnering with DPI for the first time – offering a vote of confidence for African PE investment. ADPIII will focus on companies promoting digital transformation and industries that benefit from Africa’s fast-growing middle class9.

Other notable fundraising in the second half of 2021 included Convergence Partners’ $120mn first close of its third fund focussing on the technology sector across sub-Saharan Africa in July, BluePeak Private Capital’s $115mn first close of its flagship private credit and mezzanine fund in September, and African Infrastructure Investment Managers (AIIM)’s successful raising of ZAR5.5bn (c.$370mn) for its flagship sustainable infrastructure fund in October.

The number of exits in the first half of 2021 remained slight, with just 16 reported10, though several notable deals took place in the second half of the year which mainly consisted of trade sales to large strategic buyers. In July, Alterra Capital Partners (Carlyle Group’s Africa spinout) and Ethos Private Equity sold Mozambique transport firm J&J to Imperial Logistics for $300mn. In September, Helios Investment Partners sold its 49% stake in consumer goods distributor GBfoods Africa to its manufacturer partner, exiting a four-year joint venture. Finally, in November, the Ardagh Group acquired glass packaging producer Consol Holdings Proprietary Ltd for $1bn from a consortium of PE investors including South Africa-based Brait PE and Sphere PE. In 2022, exits are expected to favour strategic buyers or secondary sales to private equity11.

Financing the Climate Challenge

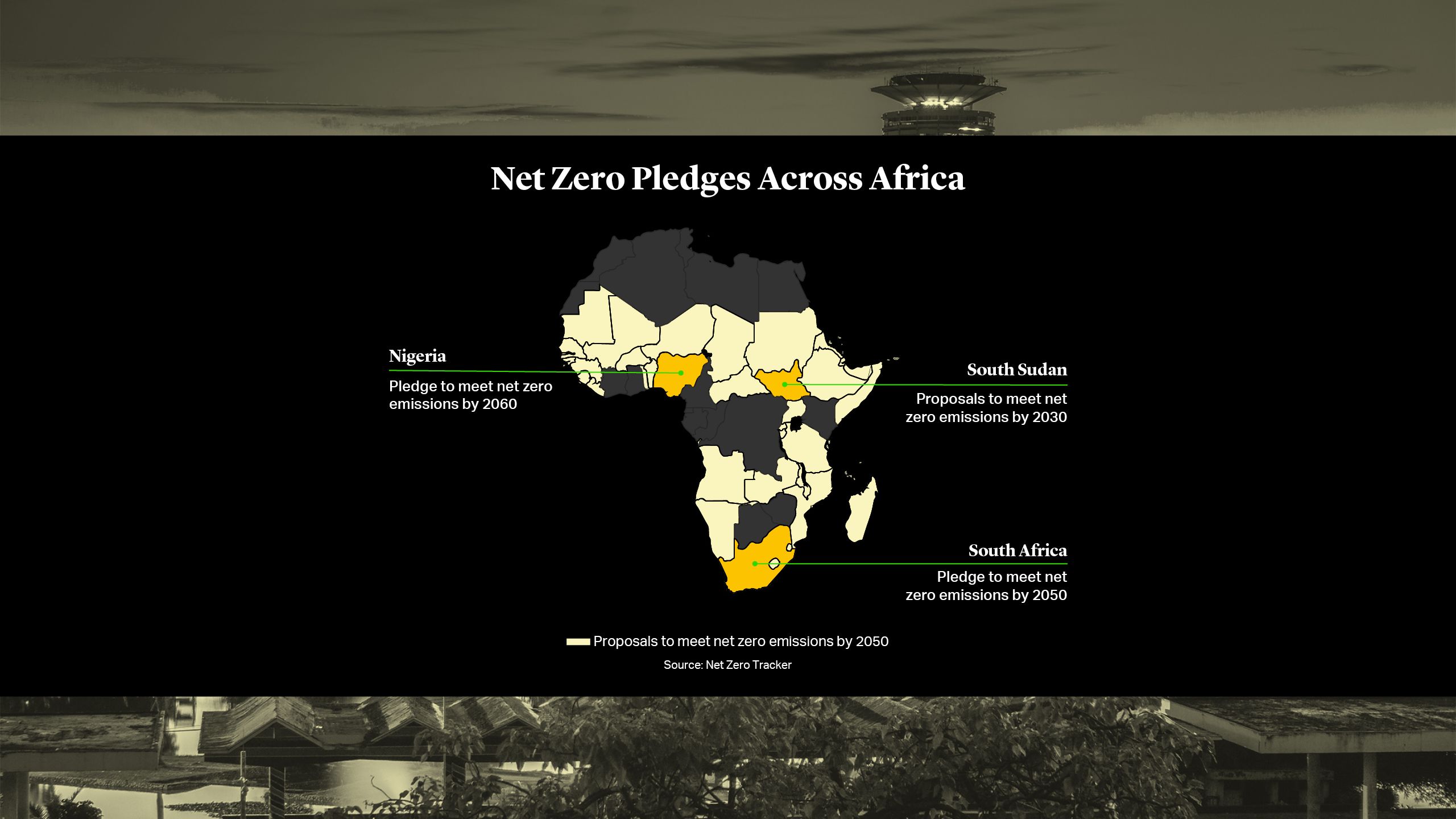

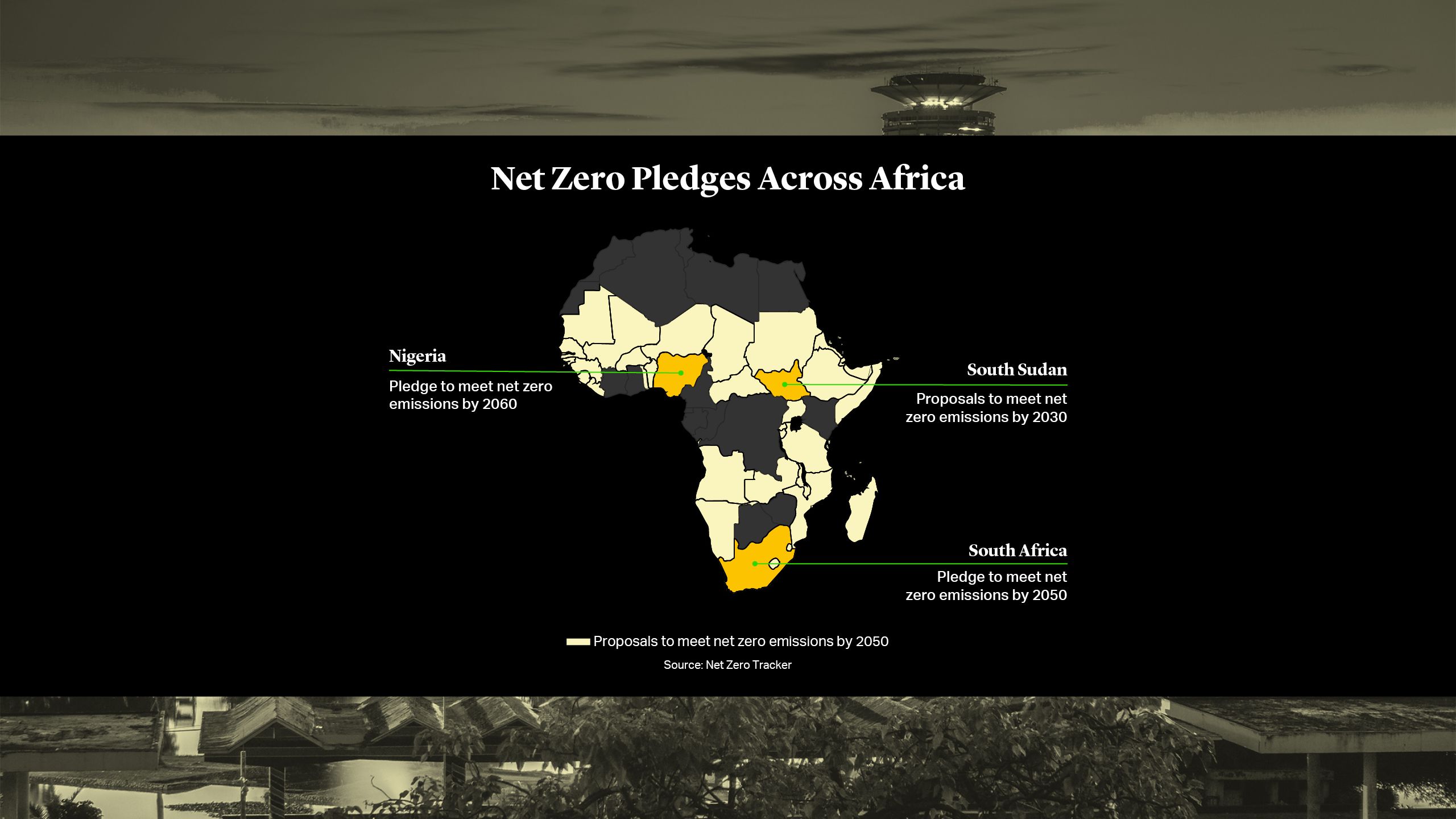

As with other parts of the world, the African continent is grappling with the challenge of decarbonising its economy. South Africa has pledged to reach net-zero emissions by 2050, while oil-producing Nigeria says that it will meet this benchmark by 2060. The cost of transition will be vast, with some estimates that trillions of dollars of annual investment will be needed to help emerging market countries align with the ambitions of the Paris Agreement12. A significant portion of this investment is likely to be mobilised through the private sector, giving private equity an opportunity to play an important role.

To this end, last year’s COP26 saw the announcement of a number of Africa climate-related investments and strategies, adding to the general growth in global climate-focused fundraising efforts from which Africa is likely to benefit through 2022 and beyond.

The UK’s development finance institution, CDC Group (rebranding as British International Investment in April 2022), committed to delivering more than £3bn of climate financing for green growth initiatives in Africa and Asia over the next five years. This includes £200mn for a new Climate Innovation Facility to support the scaling-up of technologies that will help communities deal with the impacts of climate change13. The first beneficiary of the new fund is Pula, a Kenya-based agri-tech business, with the capital it receives to be used to finance its “Pay-at-Harvest” insurance product. CDC Group also invested $37mn in the Africa Renewable Energy Fund II, a fund that invests in small hydro, wind, geothermal and solar projects across sub-Saharan Africa.

Also at COP26, Helios Investment Partners and public-private sector partnership fund InfraCo Africa announced a new climate-focused investment vehicle called Climate, Energy Access and Resilience (CLEAR), with a fundraising goal of $350mn. CLEAR will fund climate-aligned infrastructure and growth businesses in Africa whilst also working towards achieving the UN Sustainable Development Goals. As reported by Helios, the new investment vehicle will tap into growing demand from domestic and international investors for sustainable investment opportunities to help close the infrastructure and productivity gap in Africa14.

CLEAR follows other new investment opportunities, such as the September launch of Africa Finance Corporation (AFC)’s independent asset management arm, AFC Capital Partners, which is looking to raise $500mn in the next twelve months and $2bn over the next three years with its debut Infrastructure Climate Resilient Fund. The fund will invest in projects enhancing the quality of African infrastructure and clean energy in the face of climate change-induced rises in temperatures and sea levels. In the same month, Meridiam raised €500mn for its second infrastructure fund, Meridiam Infrastructure Africa Fund II (MIAF II), towards a €750mn target, and €290mn for its Urban Resilience Fund (TURF) impact fund which will support cities in both Africa and Europe investing in critical resilient infrastructure projects15. [In July, TPG announced the first close of its Rise Climate Fund at $5.4bn, which will focus on five climate sub-sectors, including clean energy, green industrials and agriculture and natural solutions. With TPG’s strong track record in Africa, this fund could provide further opportunities for investment on the continent]16.

Transport and Logistics

With the continent looking to strengthen its global trade position by organising into a single trading bloc known as the African Continental Free Trade Area, investment is needed to support the expansion and development of key infrastructure, as well as the modernisation of ports and inland logistics.

Large public investment is expected to support these developments. In October of last year, DP World, an investment vehicle of the government of Dubai, and the UK’s CDC Group announced plans to jointly invest up to $1.72bn in logistics infrastructure in Africa, starting with the ports of Dakar (Senegal), Sokhna (Egypt) and Berbera (Somaliland). Venture capital funding is also fuelling initiatives in this space. Cairo-headquartered Trella, an operator of a B2B technology platform for the hiring of shipping and trucking services, raised $42mn in its June 2021 Series A round, and the Nigerian mobility start-up Moove collected $23.2mn in a Series A funding round in August. In total, the Baobab Network, an accelerator that backs early stage start-ups in Africa, estimates that the transport and logistics sector raised more than $217mn in venture capital financing in the first three quarters of 2021, a trend that is likely to continue in 202217.

Fintech Continues to Grow

Tech-enabled businesses, which were less impacted by pandemic-induced lockdowns and disruption, are set to remain a key focus for investors. African start-ups drew $5bn of investment in 2021, with financial technology making up the bulk of this record figure18.

Low banking penetration in many countries points to high growth opportunities, and challenger banks and mobile-money operators continue apace to draw in customers. Africa can now claim at least five fintech unicorns in this space – OPay, Interswitch, Flutterwave, Wave Mobile Money and Fawry – putting the continent well and truly on the radar of some of the world’s biggest investors.

In October of last year, Google announced its intention to commit $1bn over the next five years in tech-led initiatives in Africa19. In August, SoftBank made its first Africa bet on Nigerian mobile-payments firm OPay, leading a funding round of $400mn which valued the business at $2bn, while Senegal-based fintech Wave Mobile Money became the first-ever unicorn in Francophone Africa after a group of U.S. VC funds, including Sequoia Capital, joined Stripe in investing $200mn in a Series A fundraising.

Also on the hunt for the next unicorn, U.S. firm Tiger Global made three major investments in African fintech in a matter of months: it backed payment technology company Flutterwave in its $170mn Series C round in March20, mobile banking platform FairMoney’s $42mn Series B round in July21 and the financial data start-up Mono’s $15mn Series A round in October22.

Other notable raises in the fintech sector include the $200mn Series E for Andela, the $100mn Series C for MFS Africa, the $55mn Series B for Kuda Bank and the $120mn injection in MNT Halan by a consortium of investors including DPI and Apis Partners.