Insurance and Private Markets:

A Mutually Beneficial Relationship

March 2025

Appetite amongst insurers for exposure to private markets has increased significantly in recent years as it has become clear that investment in low-risk portfolios, tilted towards fixed-income securities, is failing to deliver required returns and that more sophisticated strategies involving alternative assets are necessary to outpace inflation and preserve capital.

Appetite amongst insurers for exposure to private markets has increased significantly in recent years as it has become clear that investment in low-risk portfolios, tilted towards fixed-income securities, is failing to deliver required returns and that more sophisticated strategies involving alternative assets are necessary to outpace inflation and preserve capital.

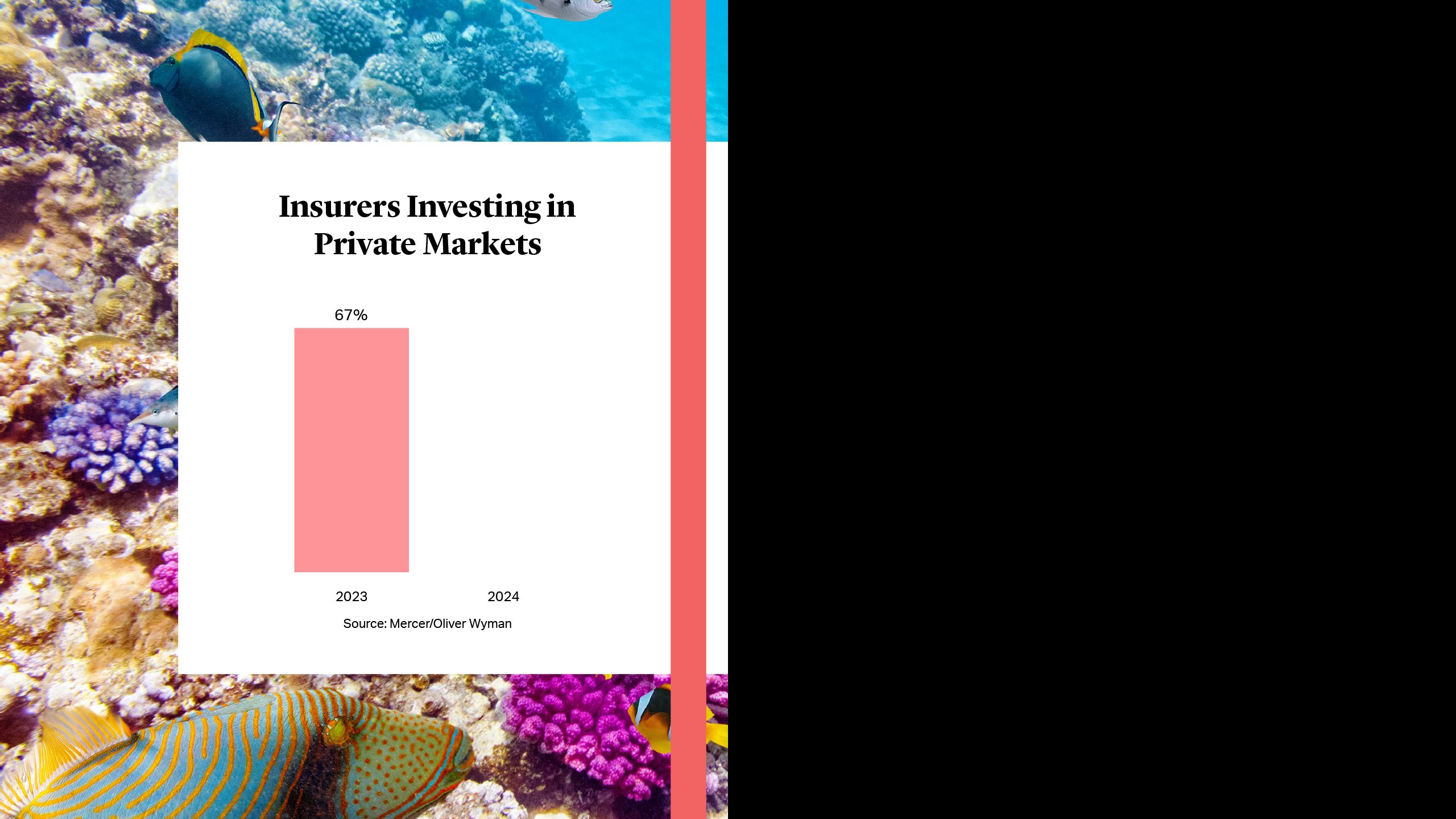

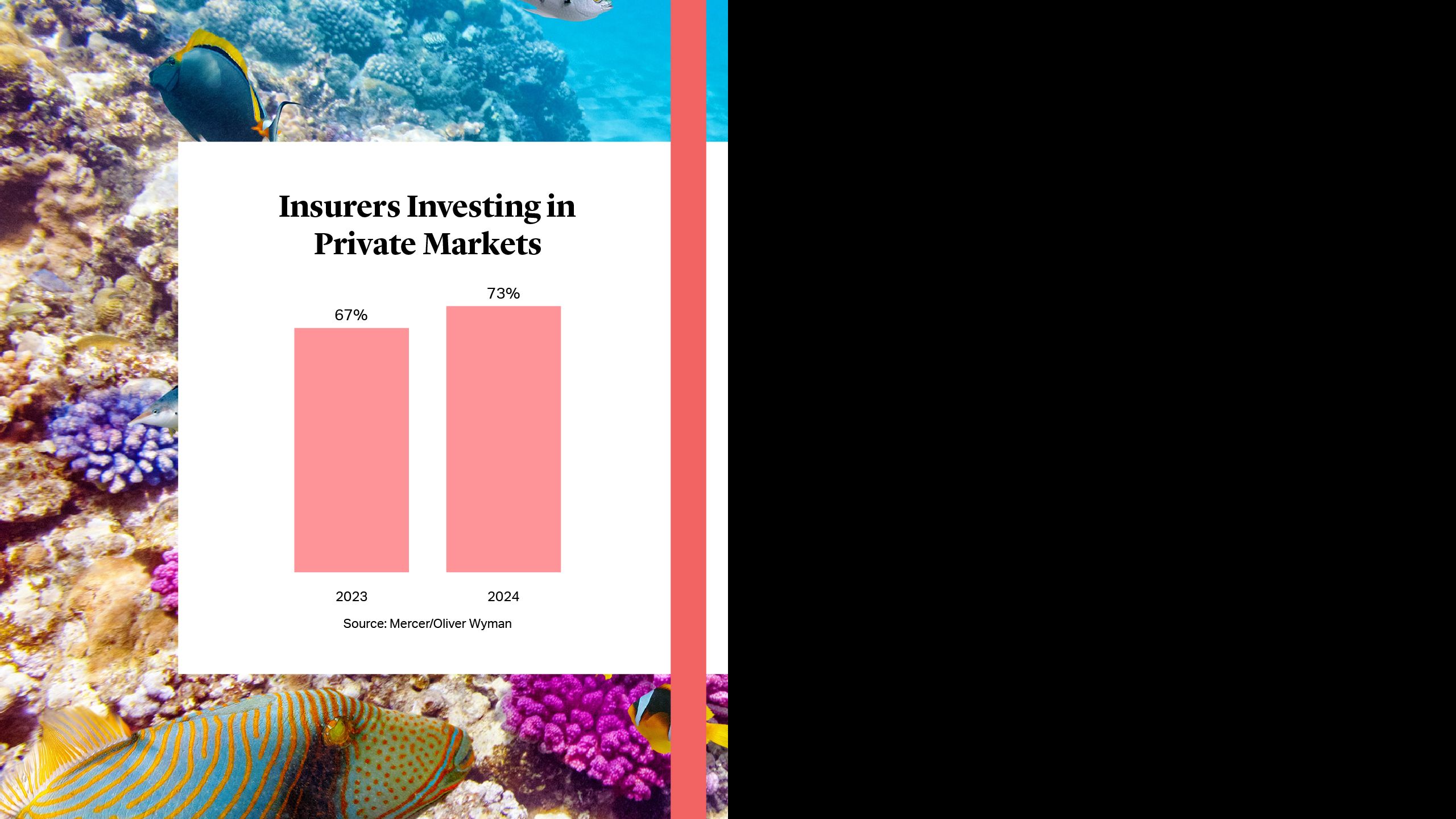

A recent survey conducted by Mercer and Oliver Wyman found that almost three-quarters of insurance companies currently invest in private markets. There are no signs of that appetite slowing.

A survey of 410 insurance companies representing nearly $27tn in assets under management, conducted by BlackRock in October last year, found that an overwhelming 91% of insurance investors plan to increase their allocations to private markets over the next two years1. Diversification and the opportunity to invest in new asset classes were cited as the primary motivations for accessing private markets. However, respondents to both surveys also highlighted the need to meet climate targets and other ESG-related objectives as key drivers.

Private equity and private credit in particular are attracting insurers’ attention. U.S. insurers’ private equity holdings hit $146.2bn in 2023, an increase of just over 40% in two years2 , and a 2024 Moody’s survey found that almost 80% of respondents are planning to increase their holdings in at least one class of private credit, with insurers having already grown their private credit holdings in the U.S. to 36% of their total investment3.

A recent survey conducted by Mercer and Oliver Wyman found that almost three-quarters of insurance companies currently invest in private markets. There are no signs of that appetite slowing.

Insurers Investing in Private Markets

Source: Mercer/ Oliver Wyman

A survey of 410 insurance companies representing nearly $27tn in assets under management, conducted by BlackRock in October last year, found that an overwhelming 91% of insurance investors plan to increase their allocations to private markets over the next two years1. Diversification and the opportunity to invest in new asset classes were cited as the primary motivations for accessing private markets. However, respondents to both surveys also highlighted the need to meet climate targets and other ESG-related objectives as key drivers.

Private equity and private credit in particular are attracting insurers’ attention. U.S. insurers’ private equity holdings hit $146.2bn in 2023, an increase of just over 40% in two years2 , and a 2024 Moody’s survey found that almost 80% of respondents are planning to increase their holdings in at least one class of private credit, with insurers having already grown their private credit holdings in the U.S. to 36% of their total investment3.

Accessing Insurers

Alternative asset managers have stepped up efforts to gain access to the $30tn global insurance industry in response to this increased demand, pursuing a variety of different approaches.

Increasingly, asset managers have looked to acquire controlling interests in insurers, both using their own balance sheets or as portfolio companies of managed funds, or to make non-controlling investments coupled with long-term strategic asset management partnerships. Indeed, private equity has been a driving force in insurance M&A over the past few years.

Accessing Insurers

Alternative asset managers have stepped up efforts to gain access to the $30tn global insurance industry in response to this increased demand, pursuing a variety of different approaches.

Increasingly, asset managers have looked to acquire controlling interests in insurers, both using their own balance sheets or as portfolio companies of managed funds, or to make non-controlling investments coupled with long-term strategic asset management partnerships. Indeed, private equity has been a driving force in insurance M&A over the past few years.

In addition, asset managers are also building specialist investor relations resources targeting insurance companies as third-party investors, in much the same way that they have historically courted pension plans, sovereign wealth funds, and high net worth individuals.

A degree of specialization is required in the IR function because of insurance companies’ specific investment objectives, capital requirements, and other evolving regulatory requirements. These factors will often lead to insurance companies choosing to invest through bespoke structures that other private fund investors are less well accustomed to. For instance, insurance companies will often invest through investment management agreements granting private fund managers discretionary investment authority, where the insurance companies maintain the custody of the assets, or through rated note feeders which seek to achieve the desired capital treatment.

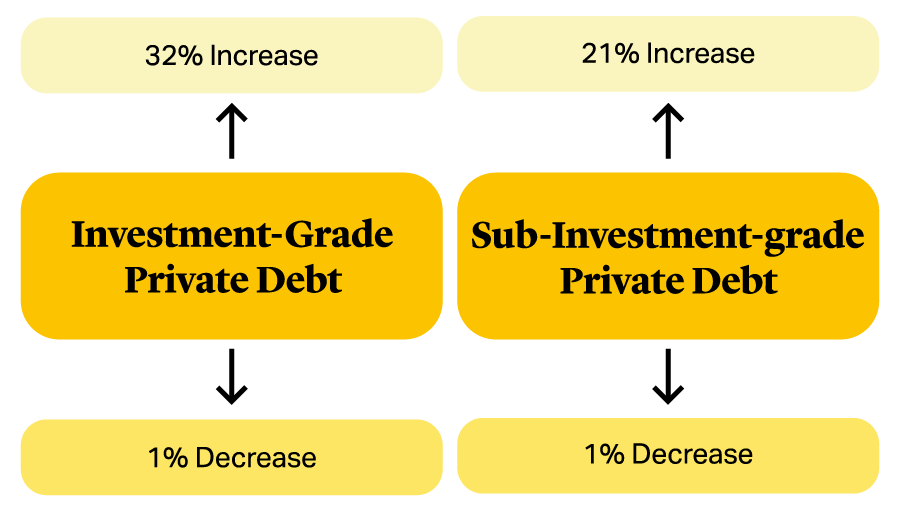

The Mercer and BlackRock surveys both reveal that private debt strategies, including direct lending and asset-based financing, are proving the most popular. This reflects the preferential treatment under capital adequacy rules, as well as the need for long-term assets to support long-term liabilities, to secure income, gain diversification, and to achieve structural protections.

In addition, asset managers are also building specialist investor relations resources targeting insurance companies as third-party investors, in much the same way that they have historically courted pension plans, sovereign wealth funds, and high net worth individuals.

A degree of specialization is required in the IR function because of insurance companies’ specific investment objectives, capital requirements, and other evolving regulatory requirements. These factors will often lead to insurance companies choosing to invest through bespoke structures that other private fund investors are less well accustomed to. For instance, insurance companies will often invest through investment management agreements granting private fund managers discretionary investment authority, where the insurance companies maintain the custody of the assets, or through rated note feeders which seek to achieve the desired capital treatment.

The Mercer and BlackRock surveys both reveal that private debt strategies, including direct lending and asset-based financing, are proving the most popular. This reflects the preferential treatment under capital adequacy rules, as well as the need for long-term assets to support long-term liabilities, to secure income, gain diversification, and to achieve structural protections.

New Role in the Market?

Insurers are also becoming increasingly active in providing fund finance. Supply and demand dynamics in the subscription finance space are expected to be strained once fundraising returns to normal levels. Insurers may be able to fill this gap.

This trend is currently more prevalent in Europe than in the U.S., but we expect this to develop over time as subscription lines begin being rated by rating agencies. Sponsors have already begun including necessary flexibility in their documents in contemplation of this.

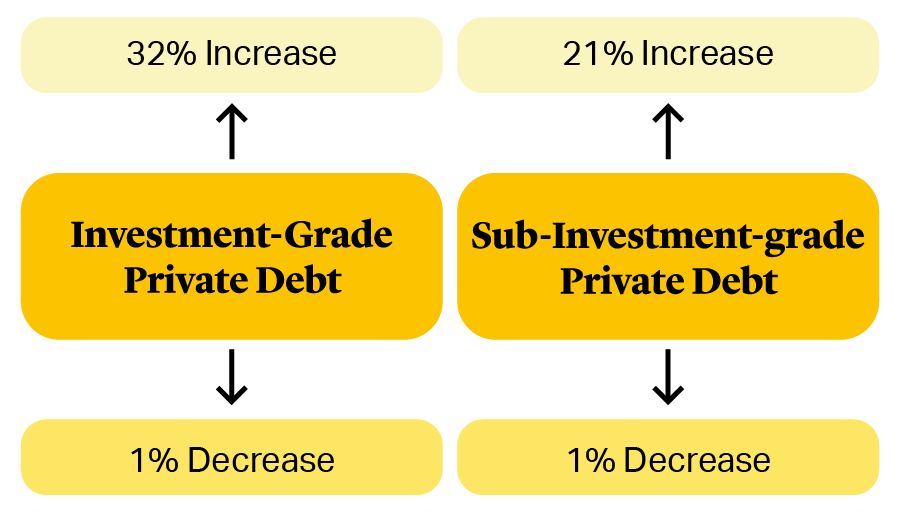

Private Debt Proves a Popular Choice for Insurers

*Chart shows insurers planning to increase or decrease their asset allocation ‘over the next 12 months’. Information is based on a survey conducted in Q4 2023

Source: Mercer/Oliver Wyman

New Role in the Market?

Insurers are also becoming increasingly active in providing fund finance. Supply and demand dynamics in the subscription finance space are expected to be strained once fundraising returns to normal levels. Insurers may be able to fill this gap.

This trend is currently more prevalent in Europe than in the U.S., but we expect this to develop over time as subscription lines begin being rated by rating agencies. Sponsors have already begun including necessary flexibility in their documents in contemplation of this.

Private Debt Proves a Popular Choice for Insurers

*Chart shows insurers planning to increase or decrease their asset allocation ‘over the next 12 months’. Information is based on a survey conducted in Q4 2023

Source: Mercer/Oliver Wyman

Looking to the Future

It is clear that insurance companies are becoming increasingly active and important in the private markets.

The global insurance industry represents a massive and still largely untapped potential pool of capital for private markets firms, while access to private markets offers insurers the ability to forge partnerships that can help them generate the returns they need to match their liabilities.

In many respects, it is a mutually beneficial, symbiotic relationship, but it also requires flexibility, ingenuity, and a willingness to think outside the box in order to make these relationships work.

Looking to the Future

It is clear that insurance companies are becoming increasingly active and important in the private markets.

The global insurance industry represents a massive and still largely untapped potential pool of capital for private markets firms, while access to private markets offers insurers the ability to forge partnerships that can help them generate the returns they need to match their liabilities.

In many respects, it is a mutually beneficial, symbiotic relationship, but it also requires flexibility, ingenuity, and a willingness to think outside the box in order to make these relationships work.