2025 Predictions for AI and Private Funds: The Rise of Agents

March 2025

The rapid emergence of Artificial Intelligence (AI) has been likened to the industrial revolution and the invention of electricity, ushering in a new era of productivity and possibility. Generative AI presents an opportunity for transformation, particularly with advancements enabling it to iterate, derive context, and generate increasingly nuanced output.

The Emergence of AI Agents

2023 introduced generative AI and its broad potential, and 2024 saw organizational use cases being tested with proofs of concept and pilots. 2025 will likely be ‘the year of agents’, a pivotal time in demonstrating the capabilities of tailored AI tools. The rapid evolution and growing sophistication of the technology (with notable advances in the accuracy and capabilities of large language models (LLMs)), expands the opportunity to enhance organizational workflows with AI agents.

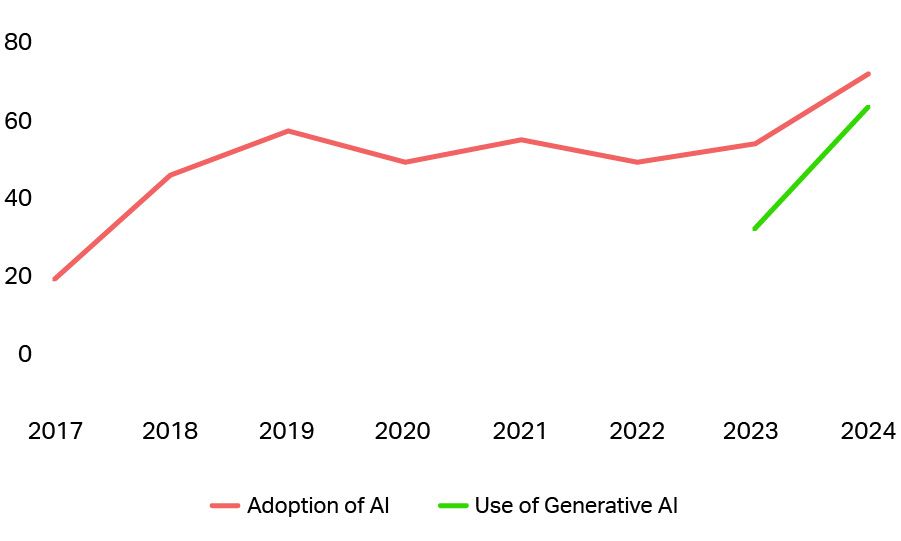

Global AI Adoption by Business in at Least One Function

Source: McKinsey

An AI agent is an AI system that can perform certain pre-programmed tasks (where the tasks are specific or ‘verticalized’ and strategically tailored to the use case). AI agents have the ability to learn independently, adapt their learning process to better understand context, and continuously improve their performance without human intervention. AI agents learn from data that they are given from various sources, analyze that information, and make decisions, all while continuously refining their algorithms to increase accuracy.

AI agents can be individually incorporated into organizational workflows or can be organized into groups that mimic human organizational structures. For example, a supervisory AI agent could oversee a group of task-specific agents, much like a manager oversees a team. The tasks assigned to AI agents can focus on responsibilities where the work is more rote and repetitive, or more impactfully, where the work is more data-centric and would benefit from continuous data analysis and insight generation.

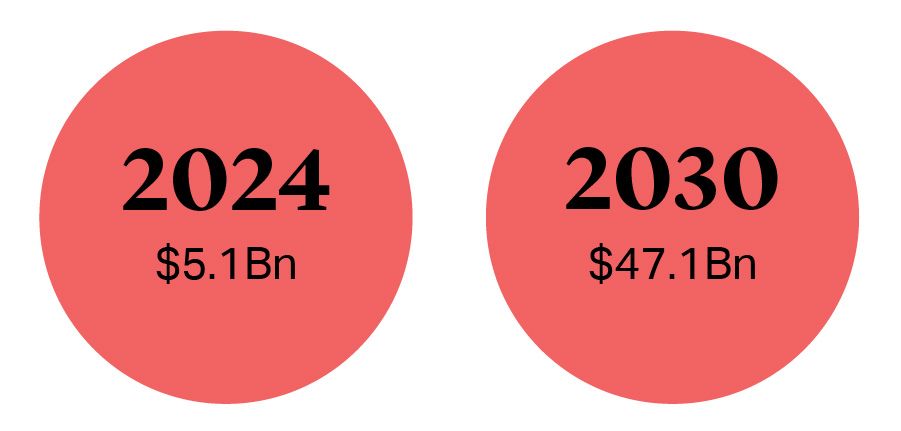

The AI Agents Market is

Expected to Grow

Source: SG Analytics and MarketsAndMarkets

The Emergence of AI Agents

2023 introduced generative AI and its broad potential, and 2024 saw organizational use cases being tested with proofs of concept and pilots. 2025 will likely be ‘the year of agents’, a pivotal time in demonstrating the capabilities of tailored AI tools. The rapid evolution and growing sophistication of the technology (with notable advances in the accuracy and capabilities of large language models (LLMs)), expands the opportunity to enhance organizational workflows with AI agents.

Global AI Adoption by Business in at Least One Function

Source: McKinsey

An AI agent is an AI system that can perform certain pre-programmed tasks (where the tasks are specific or ‘verticalized’ and strategically tailored to the use case). AI agents have the ability to learn independently, adapt their learning process to better understand context, and continuously improve their performance without human intervention. AI agents learn from data that they are given from various sources, analyze that information, and make decisions, all while continuously refining their algorithms to increase accuracy.

AI agents can be individually incorporated into organizational workflows or can be organized into groups that mimic human organizational structures. For example, a supervisory AI agent could oversee a group of task-specific agents, much like a manager oversees a team. The tasks assigned to AI agents can focus on responsibilities where the work is more rote and repetitive, or more impactfully, where the work is more data-centric and would benefit from continuous data analysis and insight generation.

The AI Agents Market is Expected to Grow

Source: SG Analytics and MarketsAndMarkets

What This Means for Private Funds

In addition to investing in AI-focused businesses and deploying AI agents at portfolio companies, fund sponsors may benefit from introducing AI agent infrastructures within their own operations. Examples of use cases where agents could add organizational and strategic value at fund sponsors, include:

Portfolio Management

AI agents might be deployed to analyze large amounts of data to identify key risks and opportunities in a portfolio, accelerating the capabilities of traditional methods. For example, AI agents might monitor data points and trends like interest rate and currency exposures, counterparty risks, and other considerations based on real-time data and predictive analytics. These trends can be analyzed by one or a series of verticalized agents, depending on the breadth and complexity of the analytics.

AI agents might also be used to stress test portfolios against various events, both by considering types of events to test against (leveraging broad-based data sets and trend monitoring) and assessing the impact of an event or series of events on a portfolio.

Due Diligence and Research

AI agents might be deployed to assist in the due diligence process by quickly processing and synthesizing large sets of data related to potential investments, including financial reports, market data, and key contracts. Again, depending on the level of complexity in the diligence and the scope of review, this could be completed by one AI agent or a series of AI agents. This series of AI agents might then be deployed to build financial models based on the derived insights, to help underwrite potential investment performance across a set of scenarios.

Client Relations

AI agents could be deployed to assist with investor relations functions. Examples might include agents that provide investors with custom reporting about the performance of their investments, and agents that can handle more common or routine investor inquiries. With AI-enhanced capabilities, responses could be custom-tailored to the specifications of that particular client.

Portfolio Management

AI agents might be deployed to analyze large amounts of data to identify key risks and opportunities in a portfolio, accelerating the capabilities of traditional methods. For example, AI agents might monitor data points and trends like interest rate and currency exposures, counterparty risks, and other considerations based on real-time data and predictive analytics. These trends can be analyzed by one or a series of verticalized agents, depending on the breadth and complexity of the analytics.

AI agents might also be used to stress test portfolios against various events, both by considering types of events to test against (leveraging broad-based data sets and trend monitoring) and assessing the impact of an event or series of events on a portfolio.

Due Diligence and Research

AI agents might be deployed to assist in the due diligence process by quickly processing and synthesizing large sets of data related to potential investments, including financial reports, market data, and key contracts. Again, depending on the level of complexity in the diligence and the scope of review, this could be completed by one AI agent or a series of AI agents. This series of AI agents might then be deployed to build financial models based on the derived insights, to help underwrite potential investment performance across a set of scenarios.

Client Relations

AI agents could be deployed to assist with investor relations functions. Examples might include agents that provide investors with custom reporting about the performance of their investments, and agents that can handle more common or routine investor inquiries. With AI-enhanced capabilities, responses could be custom-tailored to the specifications of that particular client.

Fund Formation

AI agents could be deployed to assist with the fund formation and marketing process. For example, agents might assist with the creation and review of pitch books and other marketing materials.

On the legal side, AI agents might be used by counsel to help review, analyze and summarize investor comments and side letter requests, and to assist with the investor subscription process.

Contract Monitoring

AI agents could be deployed to help monitor obligations under contracts once they are executed. For example, a credit fund might deploy agents to ensure that its outstanding loans are being properly paid in accordance with the terms of the loan documents. Similarly, fund managers could utilize agents to help ensure they are complying with the terms of their own contractual arrangements, such as fund LPAs and side letters.

Fund Formation

AI agents could be deployed to assist with the fund formation and marketing process. For example, agents might assist with the creation and review of pitch books and other marketing materials.

On the legal side, AI agents might be used by counsel to help review, analyze and summarize investor comments and side letter requests, and to assist with the investor subscription process.

Contract Monitoring

AI agents could be deployed to help monitor obligations under contracts once they are executed. For example, a credit fund might deploy agents to ensure that its outstanding loans are being properly paid in accordance with the terms of the loan documents. Similarly, fund managers could utilize agents to help ensure they are complying with the terms of their own contractual arrangements, such as fund LPAs and side letters.

Considerations for Counsel

As AI transforms the operations of private funds, counsel must evolve their approach to provide comprehensive guidance that aligns AI integration with the sponsor’s strategic goals and regulatory obligations. Counsel will need to navigate evolving regulatory landscapes, ensuring that AI strategies (including implementing AI agents) comply with laws, regulations, ethical standards, emerging industry best practices, and contractual terms. Counsel will also need to ensure that contracts and disclosures accurately reflect AI’s role in organizational and decision-making processes.

While AI agents present meaningful opportunities, the ultimate success of an AI-focused strategy heavily depends on implementation. Thoughtful consideration of strategically tailored and identified use cases, embedding of appropriate human oversight, integration of responsible AI principles, and operationalization of risk mitigation is critical for developing a successful and sustainable AI architecture.

As private funds venture further into AI integration, close alignment between an organization’s AI strategy and legal expertise will be foundational in shaping future success.

Considerations for Counsel

As AI transforms the operations of private funds, counsel must evolve their approach to provide comprehensive guidance that aligns AI integration with the sponsor’s strategic goals and regulatory obligations. Counsel will need to navigate evolving regulatory landscapes, ensuring that AI strategies (including implementing AI agents) comply with laws, regulations, ethical standards, emerging industry best practices, and contractual terms. Counsel will also need to ensure that contracts and disclosures accurately reflect AI’s role in organizational and decision-making processes.

While AI agents present meaningful opportunities, the ultimate success of an AI-focused strategy heavily depends on implementation. Thoughtful consideration of strategically tailored and identified use cases, embedding of appropriate human oversight, integration of responsible AI principles, and operationalization of risk mitigation is critical for developing a successful and sustainable AI architecture.

As private funds venture further into AI integration, close alignment between an organization’s AI strategy and legal expertise will be foundational in shaping future success.