Rise of GP-Led Transactions

Reshapes Private

Equity Secondaries

Once a low-profile corner of the market where LPs could seek liquidity by quietly selling fund participations and commitments to other investors, the private equity secondaries market has evolved into a sizeable and visible asset class.

While LPs need for liquidity remains a driver of activity, other key, more recent considerations are the rebalancing of portfolios and the reduction of exposure to private equity. Coupled with this, GPs are increasingly taking control via continuation funds and tail-end portfolio transactions which allow some investors to divest their positions while enabling others to hold on – alongside the manager – for a potentially more profitable exit. As economic conditions worsen and weigh on private equity exit pipelines, secondaries are moving up the agenda for LPs and GPs alike.

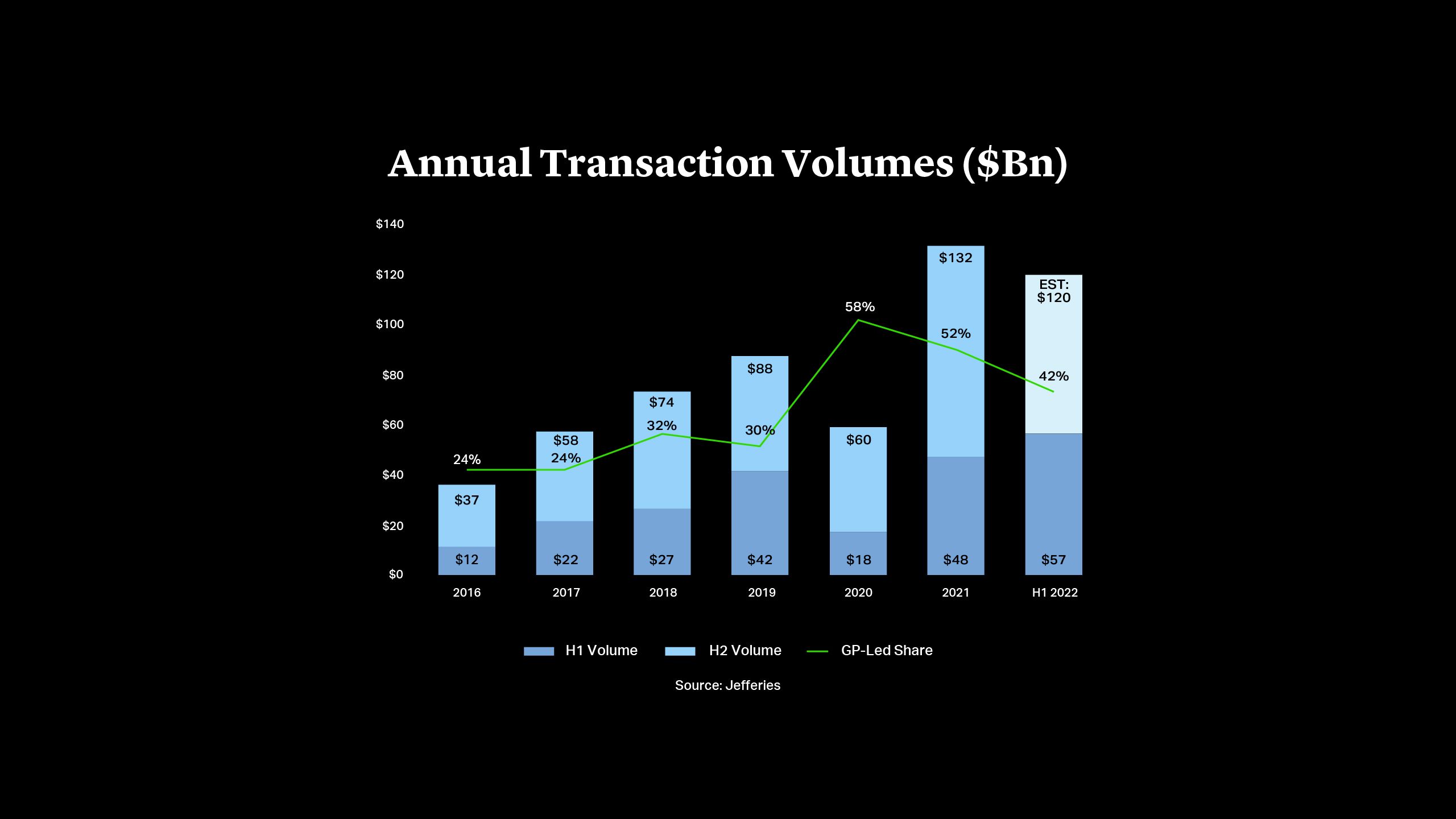

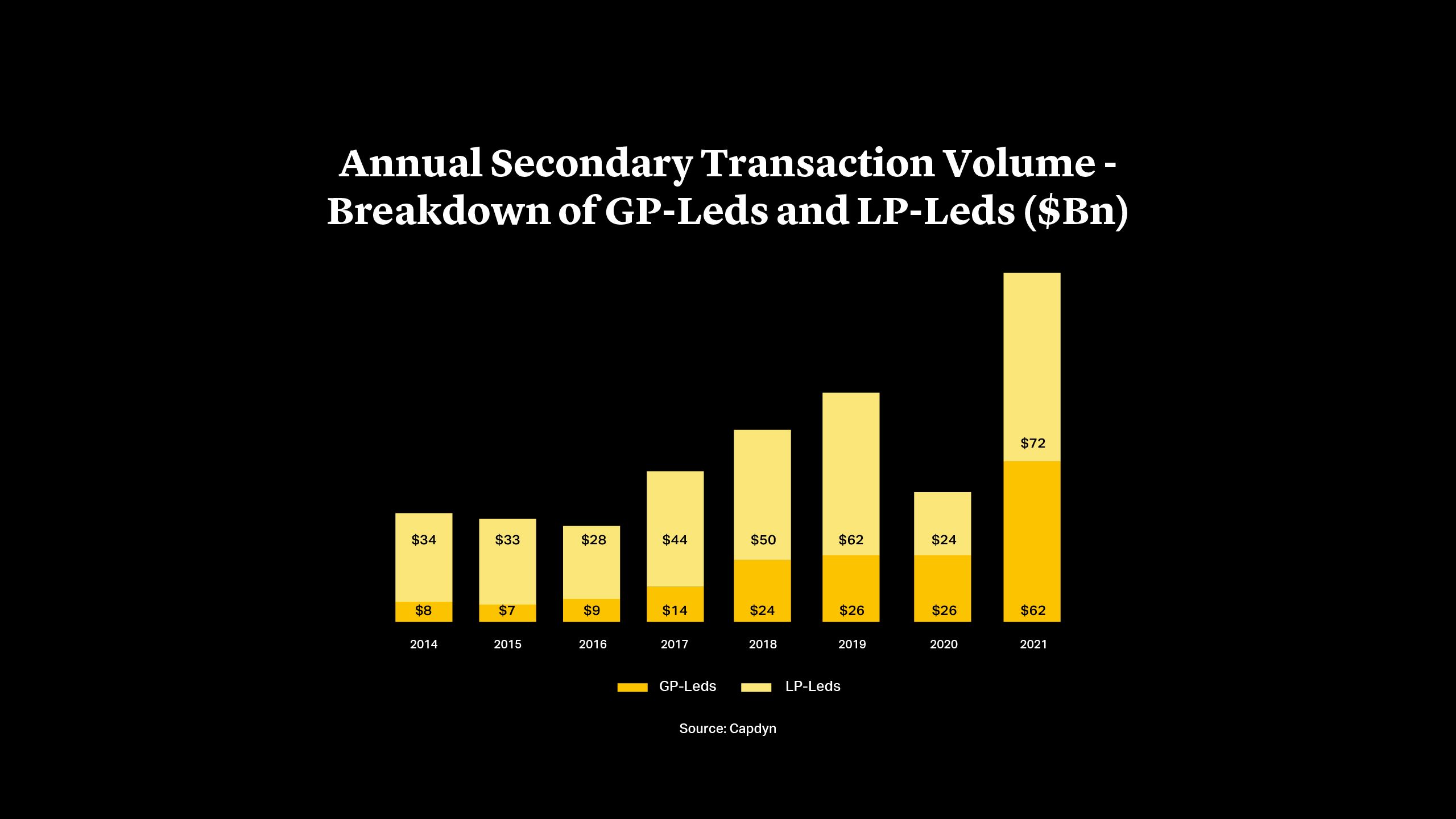

Private Equity Secondaries Market Reaches New Highs

Global secondaries reached a record of $132bn in 2021, according to Jefferies data1, echoing the new investment peak for the private equity market more broadly. However, as private equity activity has weakened in 2022, secondaries have so far bucked the trend, with transactions globally growing by 19% in the first half to $57bn. While Jefferies forecasts a deceleration in the second half as uncertain conditions dampen deal flow, some expect a strong rebound next year. Cari Lodge, Head of Secondaries at Commonfund Capital, a manager of private equity portfolios for investors, predicted a record year in 2023 as LPs turn to the secondaries market for liquidity and sponsors look to hold onto high-quality assets for longer2.

Liquidity and Allocation Pressures Keep LP Selling Activity Strong

LP-led secondaries increased sharply in the first half of the year to $33bn, with pension funds accounting for 65% of deal volume, Jefferies data shows. The so-called “denominator effect” was an important driver as many large funds found themselves overallocated to private equity when public market valuations fell. The scale of pension fund allocations to private equity has meant very sizeable secondaries disposals. U.S. state pension fund CalPERS completed the sale of $6bn of assets in early July, the largest secondaries transaction ever recorded3.

Other investors are responding to the dislocation by increasing their allocation limits for private equity. Texas Employees Retirement Systems approved an increase in its target private equity allocation to 16%, although its target continued to lag its actual allocation4. Persistent market volatility is likely to drive more LPs into the secondary market to seek liquidity and/or balance their portfolios, with Canada’s PSP Investments reported to be considering the sale of $2bn in assets5.

While many investors opt to exit in GP-leds, those wishing to hold onto companies are allocating more capital to such transactions. More than half of respondents in Eaton Partners’ September survey said they had put more than $100mn into GP-leds in the first half of 20228, while 11% put over $500mn into such deals. Those figures are significantly higher than investor forecasts in April, when only 36% expected to deploy $100mn or more, and 7% over $500mn. As a result, almost two-thirds expect to increase the amount of capital they commit to GP-led secondaries in the second half9. Momentum in the space means that Jefferies expects GP-leds to account for 50% or more of volume in 2022.

Growth in Alternatives Drives New Secondaries Segments

Driven by the scale of funds and the size of portfolio companies involved, buyouts account for about 85% of GP-led secondaries investment, Jefferies data shows. However, growth in other alternative asset strategies is driving more and larger deals in other segments. Earlier this year, HV Capital launched a €430mn continuation vehicle for a portfolio of long-held start-up assets – this a first of its kind in German VC10.

Exponential growth in private debt funds, recently put at $1.2tn globally by Preqin11, is similarly driving increased demand for credit secondaries. Earlier this year, Coller Capital raised $1.4bn for Coller Credit Opportunities, beating initial expectations, after it led a $680mn deal for a portfolio of credit assets from the overseas investment arm of Chinese insurer Ping An12. Others have raised credit secondaries funds targeted at the growing opportunity in both LP and GP-led deals. Pantheon estimates that global private debt secondary deal flow reached a record $18bn in 2021, a figure that it expects to increase13.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

London

T: +44 20 7614 2219

mjames@cgsh.com

V-Card

Kimberly Lee

Associate

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE