Private Equity Market Snapshot

October 2022

Private equity has a long history of adapting as market conditions change. And the macroeconomic environment in Europe has certainly changed a great deal from 2021: interest rates that had seemed anchored to the floor have jumped, bank debt is pricier and harder to find, inflation has risen fast, and a squeeze on household budgets has further hit business confidence. The approaching winter will not help, in spite of efforts in Germany to fill strategic energy reserves and the UK Government’s cheque book response to household energy costs.

Yet, private equity investment activity has shown remarkable resilience. According to EY, the average monthly number of deals valued at over $100mn was 53 (globally) in the first half of 2022, down from some 70 in a typical month last year. However, 2021 is an unfair benchmark, and activity remains well up on pre-pandemic levels when 40-45 investments might have been the norm in any given month1. In Europe, activity levels have similarly dropped back to pre-pandemic levels, and larger – rather than more – deals have dominated the agenda, with private equity and venture capital firms continuing to pursue investments but remaining cautious about the worsening outlook.

Economists polled by Bloomberg now put the probability of recession in the Eurozone at 80%, with Germany’s economy already forecast to be shrinking2, as the bloc battles rising energy prices and potential shortages. High inflation and weak spending figures are also raising expectations of recession in the UK which, combined with the appointment of a new Prime Minister and a package of proposed tax cuts, pushed sterling to its lowest ever level against the dollar, although it has since recovered some ground3.

Sponsors Carefully Weigh European Investment Opportunities

The strong dollar and weakening European currencies create an attractive tailwind for U.S. private equity firms, or other dollar investors, looking into Europe. European stocks have also declined amid the uncertainty, with the FTSE 100 down by over 4% and the Stoxx 600 some 8% lower since late August. On the downside, the potential for energy disruption and protracted recession create risks for buyers, particularly when weighed against potential opportunities in the U.S. or other markets outside Europe that are expected to weather the conditions better.

Against this backdrop, there is a bifurcation in approaches. Some private equity firms are opting to make a bet on the continent, viewing the current dislocation as a golden opportunity to enter at more attractive valuations, while others are effectively pausing European investment until the outlook becomes clearer. It will be very interesting to see which approach dominates in the final quarter of the year.

CVC and CDP Equity teamed up to acquire fast-growing Italian IT group Maticmind, whose offerings include intelligence, cybersecurity, internet of things, and cloud services. Following six bolt-on acquisitions for Maticmind in two years, CVC aims to support the company’s aim to be a leader in Italy’s digital transformation, targeting opportunities in connectivity infrastructure, support for the digitization of businesses and the public sector, and strengthening of digital security. On completion, CVC will own 70% of the company, with CDP Equity and Maticmind chairman Carmine Saladino each owning 15%4.

Valuation Expectations Continue to Diverge

Public-to-private transactions have continued to provide a rich seam of investments for sponsors in 2022, such as Permira’s takeover of UK-based and Nasdaq-listed software group Mimecast in May, and the takeover of Italy’s Falck Renewables in February by a J.P. Morgan-advised vehicle. Increasingly, however, private equity firms are prepared to walk away from transactions on conducting deeper due diligence. Thoma Bravo pulled out of talks for UK-listed cybersecurity group Darktrace in early September after failing to reach an agreement on terms, its announcement coinciding with the company admitting to a £3.8mn prior accounting error5. Despite ending its pursuit of Darktrace, Thoma Bravo is targeting more opportunities in Europe and has opened an office in London to serve as a platform for investment across the continent6.

Valuation caution is also reflected in private transactions, with some indications that sellers are finally starting to reduce pricing expectations from 2021 levels. Due to the lag in private equity valuations, many advisers are expecting a reset in asset carrying values when figures to end-July are released7, which may help to bridge differences between buyers and sellers.

VC Investment Rounds Get Larger as Funds Focus on the Best

Despite the threat of down rounds and softening valuations, the trend to larger but fewer investments is being echoed in the venture capital space. According to Pitchbook, the median early-stage investment increased by 32% in the first half of 2022, while the median late-stage investment rose 38%8. Among them, UK-based payments company SumUp raised €590mn at an €8bn valuation in June.

While overall data shows that investment in hot sectors like fintech has declined to pre-2021 levels9, other parts of the market are up. Deeptech, which is not as reliant on consumer spending and less impacted by macro conditions, has seen €12.3bn invested year-to-date – according to Dealroom data – putting it on track to beat last year10.

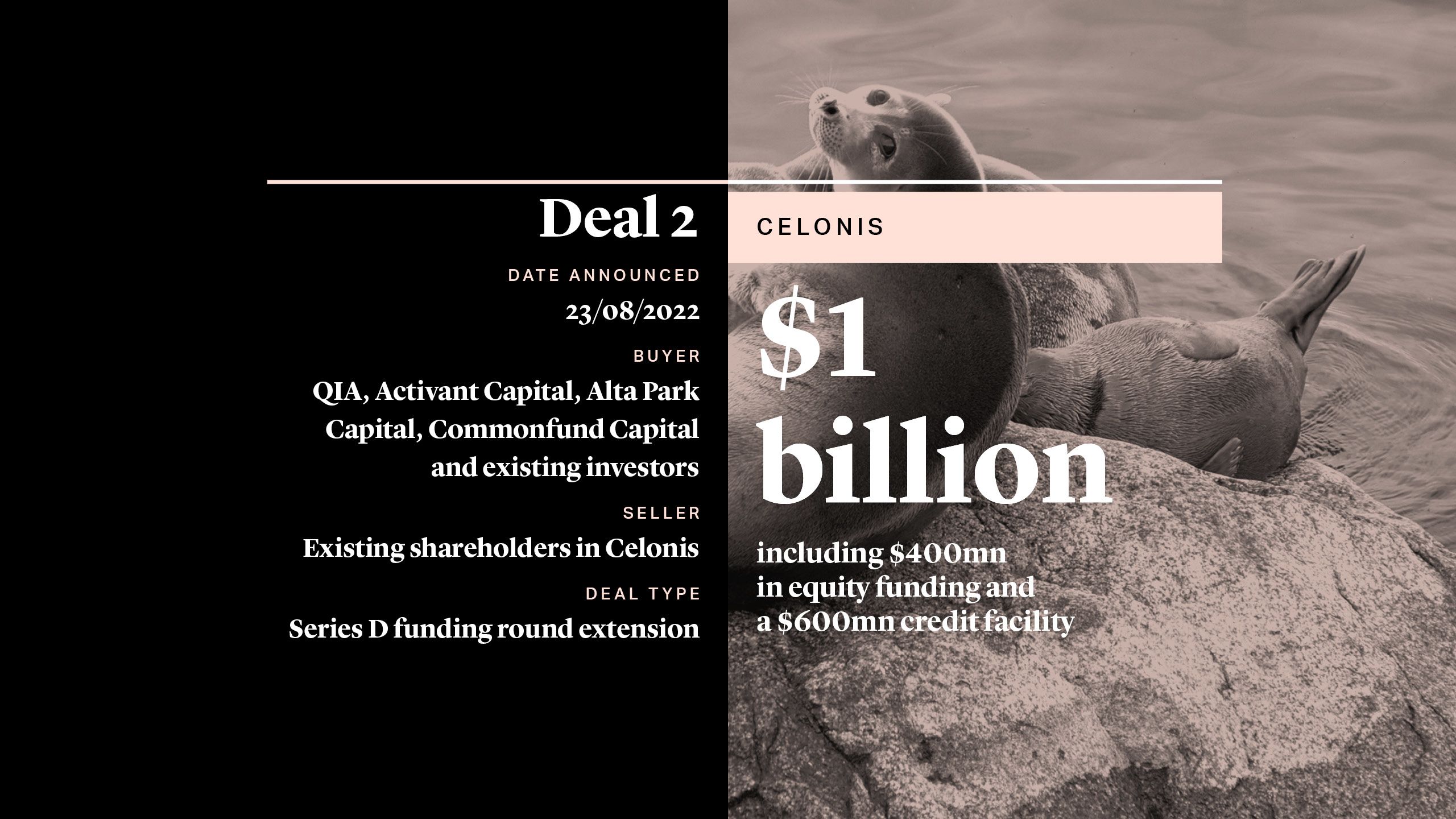

The Munich and New York-headquartered software group raised $1bn from new and existing investors at a $13bn valuation, cementing its position as a leading European decacorn. Celonis deploys process mining tools to help companies fix inefficiencies, such as supply chain or invoicing issues, with the company’s co-CEO Alex Rinke reporting that it is experiencing strong demand from customers to fix process issues that can result in time and cash savings. The funding was secured at a higher valuation than the start-up’s prior funding round in 2021, which valued it at $11bn.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE