Balancing ESG

The backlash against ESG seems to have grown in recent months, with prominent voices speaking out against “woke” investing culture from all across the political spectrum and all around the world1.

Pinched in the middle of the fight, ESG-conscious private equity firms must navigate difficult waters.

ESG Foes vs. ESG Fans

ESG Foes

The Market Adds Pressure on Financial Returns

ESG-friendly asset managers are being pressured to deliver on the promise that sustainability delivers positive impacts as well as sound financial returns. Several in the industry have rowed back from their prior positions.

Before the start of this proxy season, BlackRock (an early outspoken supporter of sustainable investing) announced that they would be supporting fewer climate-related shareholder proposals because “many are too prescriptive or constraining on companies and may not promote long-term shareholder value.“”2. Meanwhile the CEO of a prominent bank defended the need for fossil fuel investment as a way to protect economic growth and reduce emissions over the longer term.

Vivek Ramaswamy’s financial firm Strive raised $300mn this year with a primary mission: urging portfolio companies not to get involved in social, political and environmental issues3. For Vivek, “stakeholder capitalism” is the fiduciary problem of our times.

Investors Grow Skeptical About Real ESG Impact

Investors most focused on positive impact also have become increasingly skeptical.

“Green” fund labels and ESG ratings often exclusively focused on ESG risk – and not also ESG impact – have fueled confusion about what “sustainable investing” should be. Widely talked about episodes such as Tesla being dropped from S&P’s 500 ESG index (which still includes oil & gas giants)4, or Morningstar removing 1,200 self-labelled “green funds” from its sustainable funds list5, have raised investor concerns and accusations of greenwashing.

The lack of uniform ESG data and metrics, as well as rising compliance burdens and fees for “green” funds, has done little to alleviate this.

Local Communities Side With Local Industries

Industries caught on the losing side of the sustainability battle are also reacting, and local “anti-ESG” politics is on the rise.

Since the start of the year, several U.S. States have used their legislative power to resist ESG investing, due to impacts on their local economies6. The anti-ESG bills seen so far vary widely in scope and the kinds of restrictions they place on firms.

Several prohibit the use of state funds for purposes other than the maximization of investment returns. Others go as far as directly targeting financial institutions that are seen to “boycott” or “discriminate against” certain industries – such as fossil fuels7 or firearms8 – by either barring public entities from investing in them, or excluding them from public contracts.

In a similar vein, states have picked fights with the rules being proposed at the federal level on funds’ ESG disclosures, arguing that “imposing new carbon-related disclosure requirements on public companies exceeds the agency’s authority, violates the First Amendment, and is arbitrary and capricious”9.

In August, Texas’ Comptroller of Public Accounts accused 10 financial groups (including BlackRock and the 350+ investment funds they manage) of “boycotting energy companies”. Such accusations could bring the funds in scope of the state’s divestment statute, forcing public funds (such as state-backed pension plans) to divest10. Texas – which produces over 40% of U.S. oil and 25% of its natural gas – is also home to some of the largest institutional investors in the world, such as Teacher Retirement System of Texas.

Should Republicans take control of both houses in the November mid-term elections, the anti-ESG movement is expected to also grow at the federal level.

ESG Fans

Much of the Industry Strikes Back

The investment industry has, in part, struck back against ESG bans and criticism.

In her reply to a letter from 19 state Attorney Generals – accusing it of “using the hard-earned money of our states’ citizens to circumvent the best possible return on investment”11– BlackRock’s Senior Managing Director and Head of External Affairs Dalia Blass noted the firm’s duty to “provide clients with our perspective on matters that can affect asset prices and to help them navigate constantly evolving industries and markets”, and stated that the firm’s commitment to clients’ financial interests is “unwavering and undivided”12.

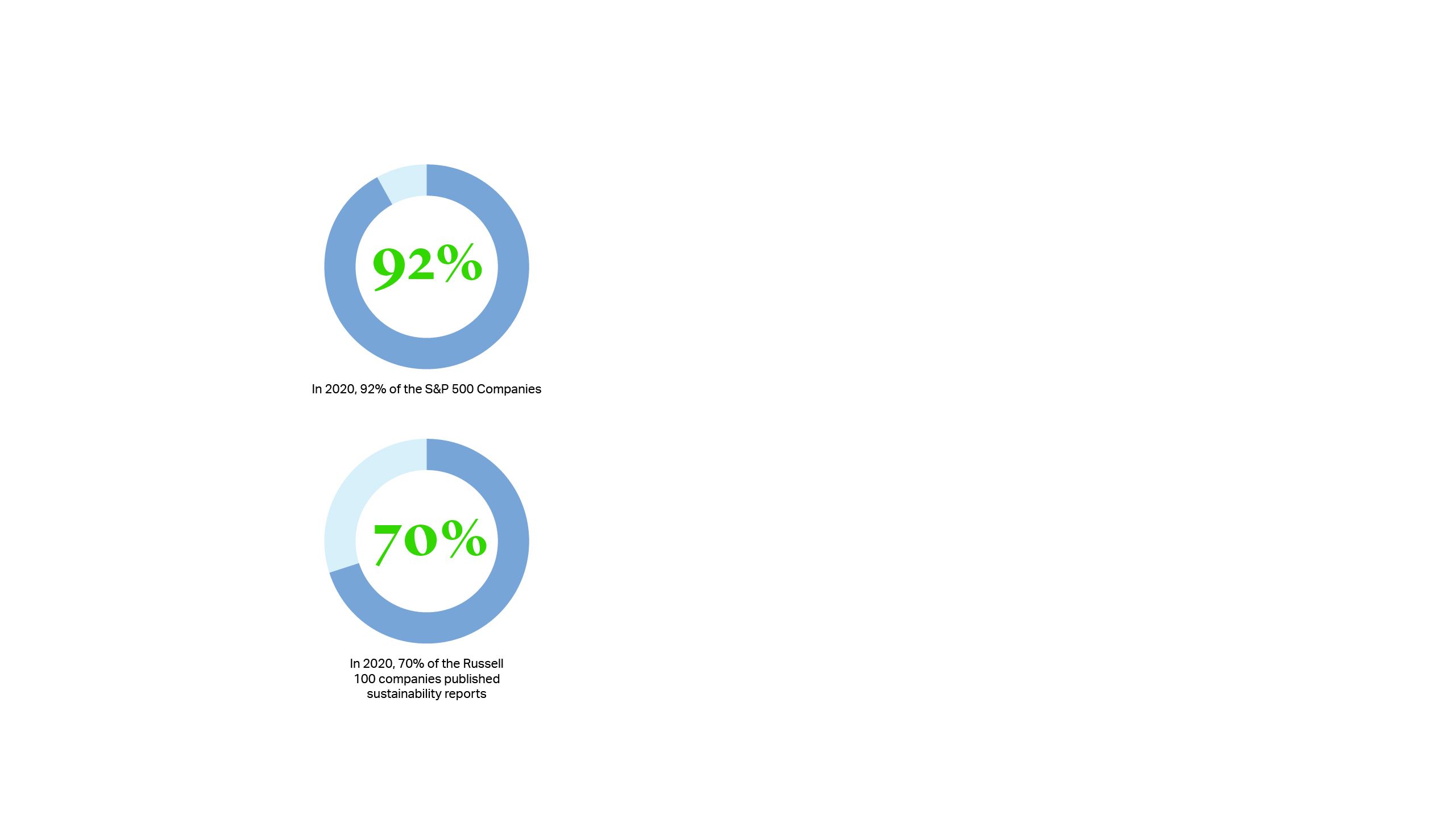

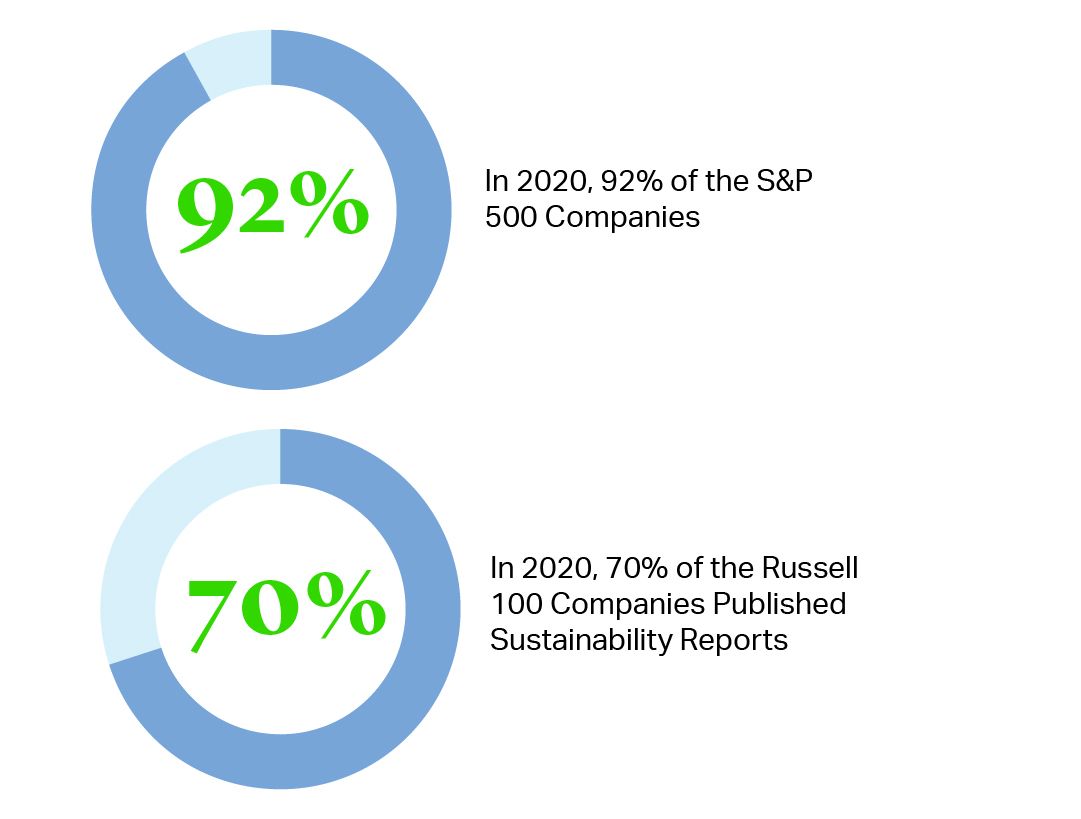

As Dalia Blass notes, BlackRock’s views on the investment risks and opportunities posed by climate change and the low-carbon transition are by no means unique. Adoption of voluntary ESG reporting frameworks has risen steadily over recent years. Already in 2020, 92% of the S&P 500 and 70% of the Russell 1000 companies published sustainability reports (up from 90% and 65% the prior year).

More Regulators Place ESG Risk at the Top of Their Agenda

Regulators across the globe are also increasingly focused on the systemic risk that might arise (in particular) from climate-related concerns.

European regulators have been first in line, from mandating ESG disclosures from asset managers, banks and industry players alike, to stress testing financial institutions against climate change risk13. The Bank of England warned that firms that fail to manage climate risks could face a 10-15% reduction in annual profits and higher capital requirements14.

The U.S. SEC was the last to propose rules on standardized climate-related disclosures for issuers and asset management firms (in March and May 2022). Over the same period, it investigated companies for ESG misstatements and began inspecting policies for handling climate risks15. Finally, at the end of September, the Federal Reserve announced that it would kick off climate stress testing in 202316.

After some hesitation, U.S. federal regulators seem to be aligning to their EU and UK counterparts, as to the supervision of ESG risk.

Growing Evidence of ESG Investments’ Outperformance

Finally, there is a growing body of evidence that investments made through an ESG lens outperform those without.

Research from the European Securities and Markets Authority found that UCITS funds with an ESG strategy outperformed their non-ESG peers in 2020 and were cheaper17. There are also examples of responsible and sustainable investment delivering strong performance in private equity. According to a 2020 report by Morningstar, almost six out of every 10 sustainable investment funds have delivered higher returns over a period of 10 years, compared to conventional funds18. Emerging markets-focused impact investing firm Leapfrog reported 27% revenue growth across its portfolio companies in 2021 with a lower loss rate than the industry average19.

ESG Fans

Much of the Industry Strikes Back

The investment industry has, in part, struck back against ESG bans and criticism.

In her reply to a letter from 19 state Attorney Generals – accusing it of “using the hard-earned money of our states’ citizens to circumvent the best possible return on investment”11– BlackRock’s Senior Managing Director and Head of External Affairs Dalia Blass noted the firm’s duty to “provide clients with our perspective on matters that can affect asset prices and to help them navigate constantly evolving industries and markets”, and stated that the firm’s commitment to clients’ financial interests is “unwavering and undivided”12.

As Dalia Blass notes, BlackRock’s views on the investment risks and opportunities posed by climate change and the low-carbon transition are by no means unique. Adoption of voluntary ESG reporting frameworks has risen steadily over recent years. Already in 2020, 92% of the S&P 500 and 70% of the Russell 1000 companies published sustainability reports (up from 90% and 65% the prior year).

More Regulators Place ESG Risk at the Top of Their Agenda

Regulators across the globe are also increasingly focused on the systemic risk that might arise (in particular) from climate-related concerns.

European regulators have been first in line, from mandating ESG disclosures from asset managers, banks and industry players alike, to stress testing financial institutions against climate change risk13. The Bank of England warned that firms that fail to manage climate risks could face a 10-15% reduction in annual profits and higher capital requirements14.

The U.S. SEC was the last to propose rules on standardized climate-related disclosures for issuers and asset management firms (in March and May 2022). Over the same period, it investigated companies for ESG misstatements and began inspecting policies for handling climate risks15. Finally, at the end of September, the Federal Reserve announced that it would kick off climate stress testing in 202316.

After some hesitation, U.S. federal regulators seem to be aligning to their EU and UK counterparts, as to the supervision of ESG risk.

Growing Evidence of ESG Investments’ Outperformance

Finally, there is a growing body of evidence that investments made through an ESG lens outperform those without.

Research from the European Securities and Markets Authority found that UCITS funds with an ESG strategy outperformed their non-ESG peers in 2020 and were cheaper17. There are also examples of responsible and sustainable investment delivering strong performance in private equity. According to a 2020 report by Morningstar, almost six out of every 10 sustainable investment funds have delivered higher returns over a period of 10 years, compared to conventional funds18. Emerging markets-focused impact investing firm Leapfrog reported 27% revenue growth across its portfolio companies in 2021 with a lower loss rate than the industry average19.

The Balancing Act

Whatever one’s view on stakeholder capitalism and financial resilience in the face of ESG risk, the fact remains that market demand for ESG investing is holding unwaveringly strong.

According to a report by Morningstar, ESG-labelled funds passed the 50% mark in Europe this year – despite the entry into force last year of the world’s most ambitious regulations to date on ESG disclosures20. Impact funds in particular (so-called “dark-green” or “Article 9”) were the only type of fund to attract net positive capital inflows in the EU for every single month of 2021 and particularly 2022 – otherwise a very difficult season for the industry21. Globally, ESG assets are set to balloon to $50tn by 2025, from about $35tn22. In and of itself, this will blow wind (and move capital) in favor of “sustainable” economic activities.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

London

T: +44 20 7614 2219

mjames@cgsh.com

V-Card

Sophie Smith

Counsel

London

T: +44 20 7614 2380

sosmith@cgsh.com

V-Card

Christy O'Connell

Counsel

London

T: +44 20 7847 2293

choconnell@cgsh.com

V-Card