Private Equity

Market Snapshot:

October 2024

Will H2 2024 Mark the

Private Equity Rebound?

The first half of 2024 returned a somewhat mixed performance for global private equity deal activity. According to Bain & Company’s 2024 Private Equity Midyear Report, year-on-year global buyout count declined by 4% between May 2023 and May 2024, while annualized global sponsor exits were also largely flat1.

The drop in UK private equity investment was more pronounced, as uncertainty created by the election and prospective government change compounded with general macroeconomic and geopolitical challenges. UK mid-market sponsor deal count in H1 2024 declined by 11% compared to H1 2023, while overall UK sponsor deal count in H1 2024 was down 20% against H1 20232.

The first half of 2024 returned a somewhat mixed performance for global private equity deal activity. According to Bain & Company’s 2024 Private Equity Midyear Report, year-on-year global buyout count declined by 4% between May 2023 and May 2024, while annualized global sponsor exits were also largely flat1.

The drop in UK private equity investment was more pronounced, as uncertainty created by the election and prospective government change compounded with general macroeconomic and geopolitical challenges. UK mid-market sponsor deal count in H1 2024 declined by 11% compared to H1 2023, while overall UK sponsor deal count in H1 2024 was down 20% against H1 20232.

An increase in deal value during this period suggests, however, that global private equity M&A activity may have reached an inflection point. The second quarter of 2024 saw the highest sponsor activity by value since the downturn began in 2022, with total deal value of $159bn representing a 66% increase from $96bn in Q1 20243. This return was boosted by several $10bn+ “mega-deals”, which were rare in the market in 2023 and indicate increasing confidence in market direction and the strength of the debt markets. Global deal value in 2024 is tracking to be 18% higher than in 2023 which, although driven by a higher average deal size rather than increased volume, may be a tentative sign of revival4.

Take-privates have also seen a strong resurgence, with more than $100bn of sponsor-led take privates announced in Q2 2024, double what was seen in Q1 20245.

An increase in deal value during this period suggests, however, that global private equity M&A activity may have reached an inflection point. The second quarter of 2024 saw the highest sponsor activity by value since the downturn began in 2022, with total deal value of $159bn representing a 66% increase from $96bn in Q1 20243. This return was boosted by several $10bn+ “mega-deals”, which were rare in the market in 2023 and indicate increasing confidence in market direction and the strength of the debt markets. Global deal value in 2024 is tracking to be 18% higher than in 2023 which, although driven by a higher average deal size rather than increased volume, may be a tentative sign of revival4.

Take-privates have also seen a strong resurgence, with more than $100bn of sponsor-led take privates announced in Q2 2024, double what was seen in Q1 20245.

An Improving Outlook

While private equity dealmaking is still well short of the levels seen in 2021 and 2022, there remains a general sentiment that the market is gaining momentum and deal pipelines are starting to fill. According to KPMG’s survey of over 200 U.S. M&A dealmakers, 54% of private equity respondents expect their next deal to complete in 2024 (with nearly 40% expecting at least one large, transformational transaction), and 84% expect their 2025 deal count to outpace their 2024 deal count6. Similarly, 73% of respondents to EY’s quarterly survey of private equity GPs expect investment activity to increase over the next six months7.

An Improving Outlook

While private equity dealmaking is still well short of the levels seen in 2021 and 2022, there remains a general sentiment that the market is gaining momentum and deal pipelines are starting to fill. According to KPMG’s survey of over 200 U.S. M&A dealmakers, 54% of private equity respondents expect their next deal to complete in 2024 (with nearly 40% expecting at least one large, transformational transaction), and 84% expect their 2025 deal count to outpace their 2024 deal count6. Similarly, 73% of respondents to EY’s quarterly survey of private equity GPs expect investment activity to increase over the next six months7.

LPs have also allocated more capital to private equity than ever before, with $2.3tn of global private equity allocations by the top 100 investors as of December 31, 2023, representing an 8.5% increase to the $2.12tn allocated in the previous year8. GPs globally are now sitting on $3.9tn of dry powder – $1.1tn of which is in private equity buyout funds – and face increasing pressure to put this capital to work9.

The increased focus and pace of capital deployment is expected to become more evident as valuation gaps narrow and interest rates continue to ease. Ares, Apollo, Blackstone, and KKR are reported to have invested a combined $162bn between April and June this year, with Blackstone’s president Jon Gray noting that the firm is expecting a rise in deal activity in the coming months: “The fact that we’re seeing interest rates coming down, markets being more conducive, more people thinking about selling assets, I think as the IPO market reopens we should see more”10.

LPs have also allocated more capital to private equity than ever before, with $2.3tn of global private equity allocations by the top 100 investors as of December 31, 2023, representing an 8.5% increase to the $2.12tn allocated in the previous year8. GPs globally are now sitting on $3.9tn of dry powder – $1.1tn of which is in private equity buyout funds – and face increasing pressure to put this capital to work9.

The increased focus and pace of capital deployment is expected to become more evident as valuation gaps narrow and interest rates continue to ease. Ares, Apollo, Blackstone, and KKR are reported to have invested a combined $162bn between April and June this year, with Blackstone’s president Jon Gray noting that the firm is expecting a rise in deal activity in the coming months: “The fact that we’re seeing interest rates coming down, markets being more conducive, more people thinking about selling assets, I think as the IPO market reopens we should see more”10.

Searching for Resilient Sectors

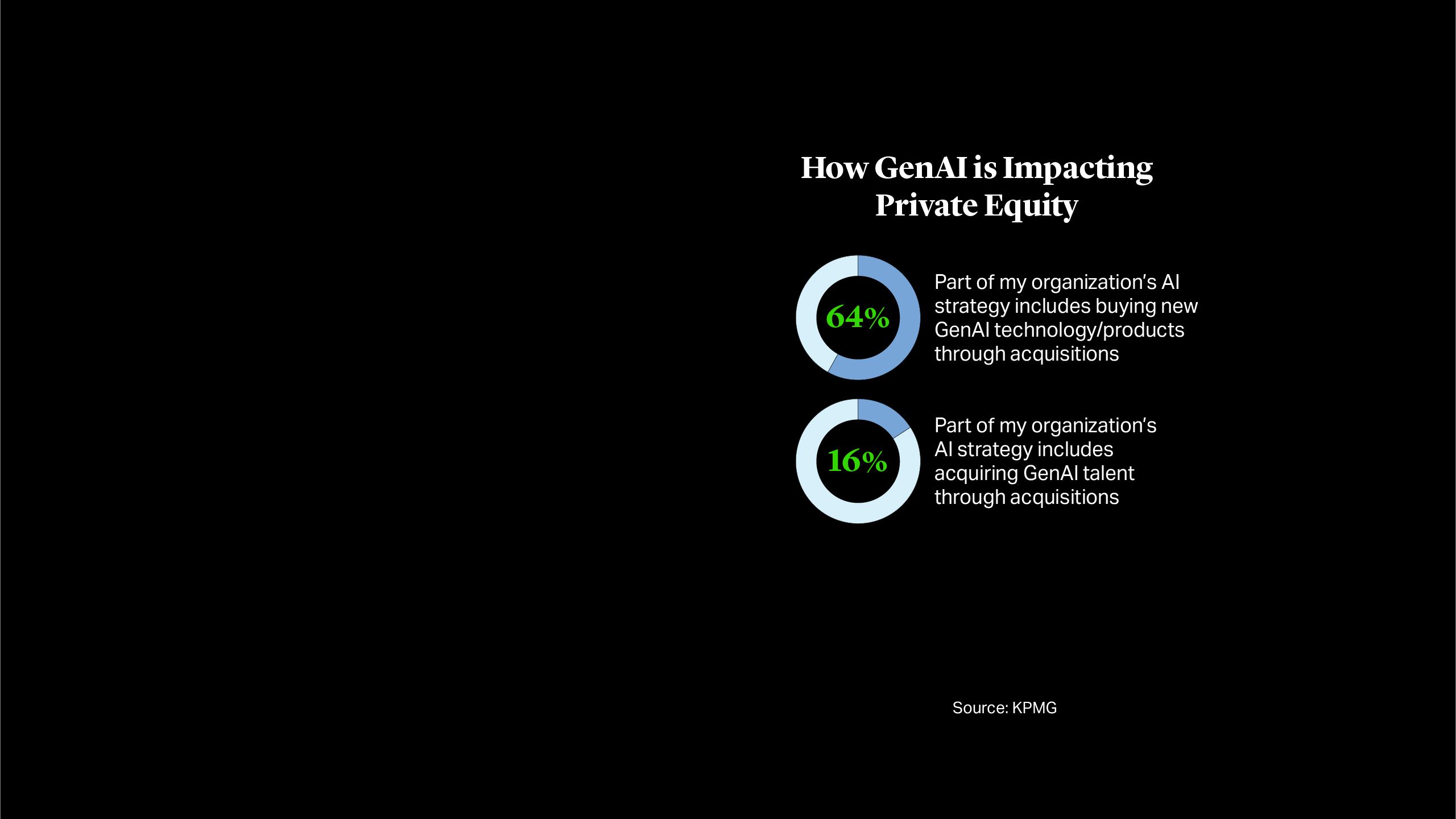

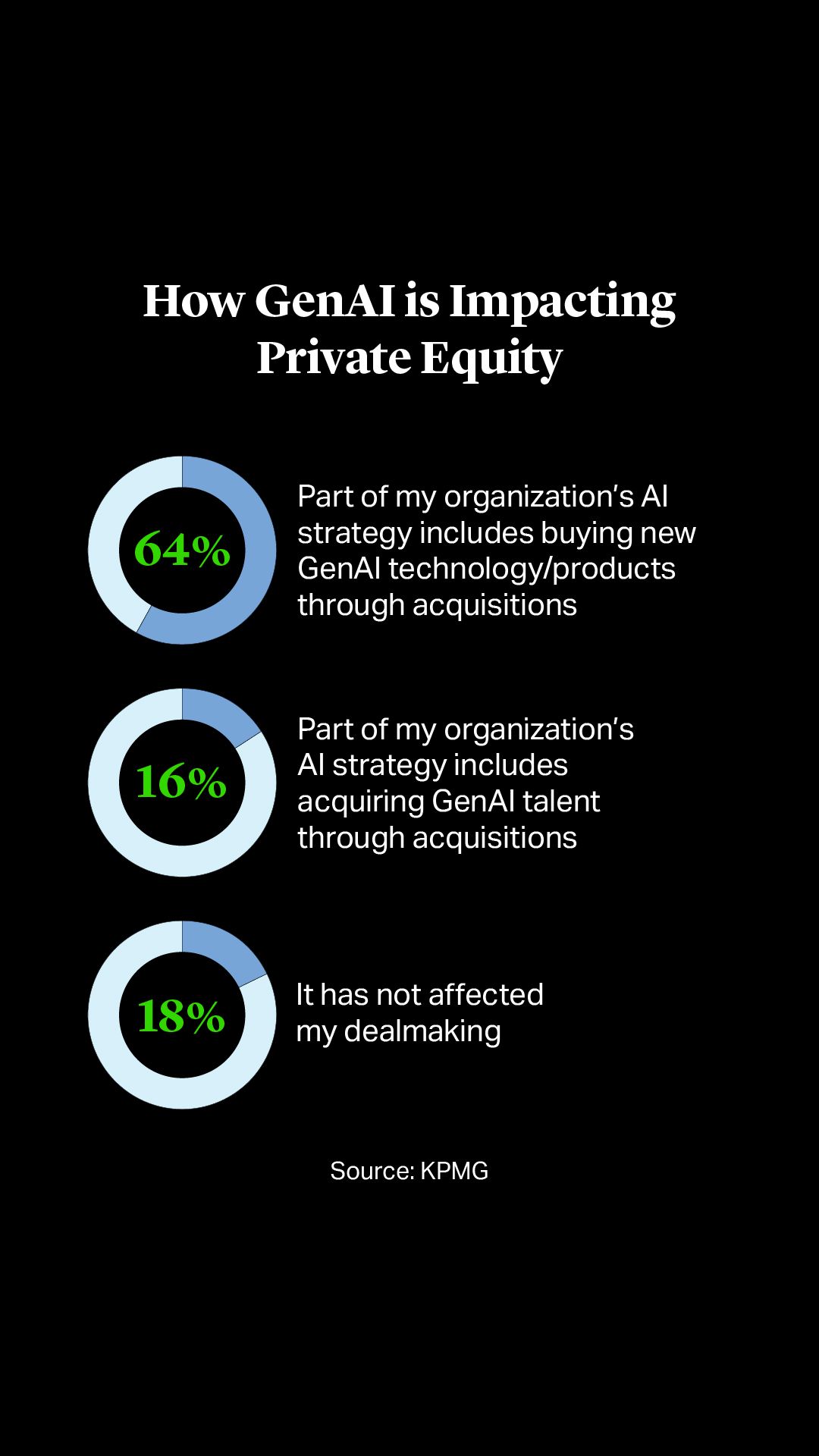

Private equity firms, while cautiously optimistic, are continuing to seek investment opportunities in more resilient sectors, including some technology, healthcare and infrastructure, as well as high potential areas such as AI and sports. 64% of U.S. private equity firms surveyed by KPMG view acquisition of new GenAI technology/products as part of their AI strategy11, while sports remain the current hot topic in private equity. EY reported a 30% increase in sports M&A during the last 12 months, at a time when the broader M&A market contracted significantly12. See our article on Private Equity’s Winning Formula for Sports Investment. Healthcare also continues to perform strongly, as does climate impact investment (although more so in Europe than in the U.S.).

In the UK, an increase in deal activity in Q4 2024 and Q1 2025 is anticipated, with a number of transactions launching or expected to launch in September and October and M&A bankers reporting rapidly filling calendars. While there is a degree of concern around what the Autumn Budget might have in store, especially when it comes to capital gains tax risk13, and regulators’ increasing focus on private equity leverage, we expect to see a continued uplift in sponsor activity during the balance of 2024 as market conditions improve globally and the deals that have been backing up over the last couple of years are finally brought to market. Read our articles on:

This article was prepared with contributions from Cleary associates Jasmine Luo, Andrea Neoh and Augusta Wills.

Searching for Resilient Sectors

Private equity firms, while cautiously optimistic, are continuing to seek investment opportunities in more resilient sectors, including some technology, healthcare and infrastructure, as well as high potential areas such as AI and sports. 64% of U.S. private equity firms surveyed by KPMG view acquisition of new GenAI technology/products as part of their AI strategy11, while sports remain the current hot topic in private equity. EY reported a 30% increase in sports M&A during the last 12 months, at a time when the broader M&A market contracted significantly12. See our article on Private Equity’s Winning Formula for Sports Investment. Healthcare also continues to perform strongly, as does climate impact investment (although more so in Europe than in the U.S.).

In the UK, an increase in deal activity in Q4 2024 and Q1 2025 is anticipated, with a number of transactions launching or expected to launch in September and October and M&A bankers reporting rapidly filling calendars. While there is a degree of concern around what the Autumn Budget might have in store, especially when it comes to capital gains tax risk13, and regulators’ increasing focus on private equity leverage, we expect to see a continued uplift in sponsor activity during the balance of 2024 as market conditions improve globally and the deals that have been backing up over the last couple of years are finally brought to market. Read our articles on:

This article was prepared with contributions from Cleary associates Jasmine Luo, Andrea Neoh and Augusta Wills.