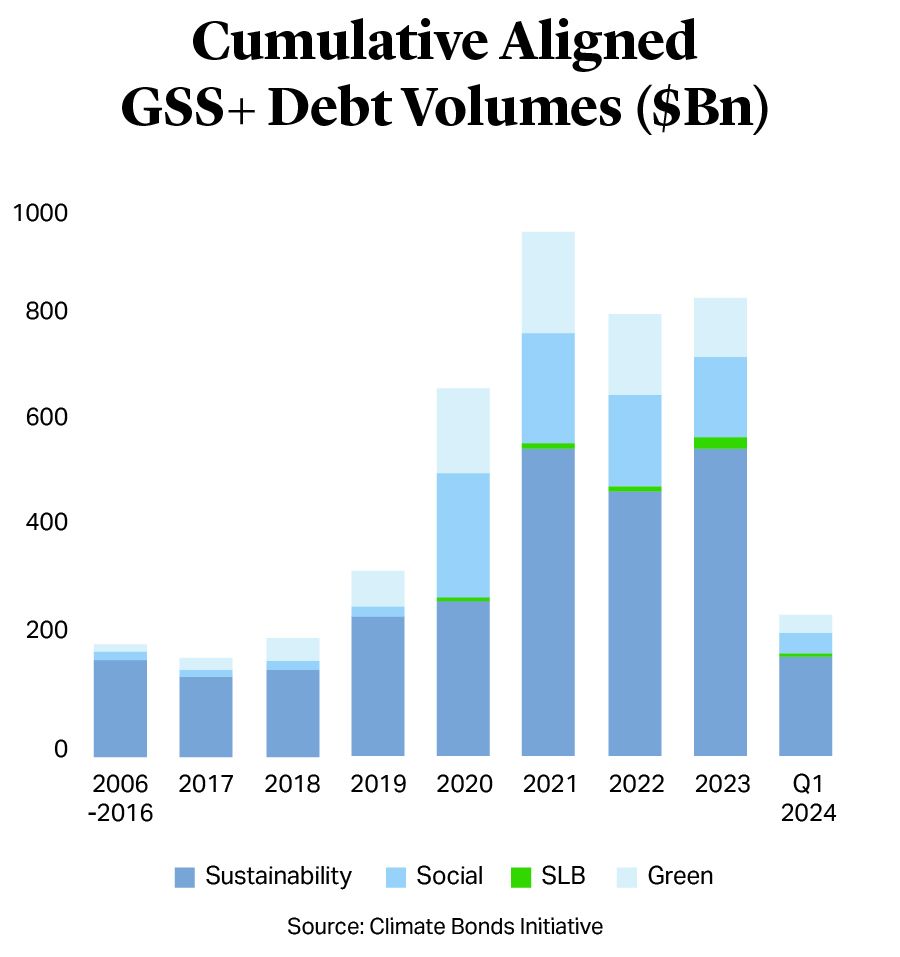

The first quarter of 2024 was the most prolific on record for sustainable finance volumes worldwide. According to the London-based non-profit Climate Bonds Initiative, $272.7bn of aligned green, social, sustainability, sustainability-linked, and transition bonds were issued globally in the first quarter of this year – 15% more than the $237.2bn sold in the same period in 20231.

There is also the sense that African sovereign issuers are waking up to the opportunities offered by green and sustainable instruments. For issuers, green and sustainable bonds are often seen as a way of raising money from the markets at a slightly lower cost – dubbed the “greenium”. Debt instruments structured this way are typically priced a couple of basis points lower, while providing investors with a means to align their asset allocations with sustainability objectives in a meaningful way.

Although there is a noticeable trend towards ESG-linked instruments, which indicates a shift towards sustainability-focused products in Sub-Saharan Africa (SSA), African sovereign issuers have so far lagged behind the rest of the world in issuance of sustainable debt instruments. Europe sold $309.6bn in green bonds in 2023, Asia-Pacific issued $190.2bn in green debt and Latin America sold $4.9bn2.

A cumulative total of $2.97bn of green bond issuance from Africa (as of the end of the first quarter of 2024) suggests a market that has been muted due to lower credit ratings (sustained partly by the lack of reliable data, unsuitable methodologies, and an historical perception of risk3) and comparatively high costs of borrowing4. But after only $500mn in green bond issuance by African sovereign issuers in 2022 from South Africa and Angola, and a combined $1.9bn in 2023, as a result of continued global economic uncertainties and slower than expected economic recovery mainly due to the ongoing hangover from the COVID-19 slowdown and high interest rates, geopolitical tensions, and high inflation rates, there are indications that 2024 could be another bumper year for issuance of such instruments.

After starting the year with a €533mn sustainable 15-year loan partially guaranteed by the African Development Bank5, to date the only sovereign bond issuer has been Côte d’Ivoire, which successfully reopened the Eurobond market for SSA issuers after a long hiatus at the end of January with a $1.1bn 7.625% sustainability bond due January 2033 listed on the London Stock Exchange’s Sustainable Bond Market6.

Although there is a noticeable trend towards ESG-linked instruments, which indicates a shift towards sustainability-focused products in Sub-Saharan Africa (SSA), African sovereign issuers have so far lagged behind the rest of the world in issuance of sustainable debt instruments. Europe sold $309.6bn in green bonds in 2023, Asia-Pacific issued $190.2bn in green debt and Latin America sold $4.9bn2.

A cumulative total of $2.97bn of green bond issuance from Africa (as of the end of the first quarter of 2024) suggests a market that has been muted due to lower credit ratings (sustained partly by the lack of reliable data, unsuitable methodologies, and an historical perception of risk3) and comparatively high costs of borrowing4. But after only $500mn in green bond issuance by African sovereign issuers in 2022 from South Africa and Angola, and a combined $1.9bn in 2023, as a result of continued global economic uncertainties and slower than expected economic recovery mainly due to the ongoing hangover from the COVID-19 slowdown and high interest rates, geopolitical tensions, and high inflation rates, there are indications that 2024 could be another bumper year for issuance of such instruments.

After starting the year with a €533mn sustainable 15-year loan partially guaranteed by the African Development Bank5, to date the only sovereign bond issuer has been Côte d’Ivoire, which successfully reopened the Eurobond market for SSA issuers after a long hiatus at the end of January with a $1.1bn 7.625% sustainability bond due January 2033 listed on the London Stock Exchange’s Sustainable Bond Market6.

Sustainable Bonds and Loans in Africa

African sovereigns have structured their green issuance in innovative ways from the beginning. The first sovereign green bond out of Africa came in 2017 from Nigeria – a $30mn 13.48% five-year domestic issue to help the country manage its climate mitigation and adaptation targets7.

This was followed in 2018 by the pioneering and much-copied $15mn 6.5% 10-year blue bond issuance from the Seychelles and then in 2022 by Gabon with the first-ever debt-for-nature swap transaction in continental Africa in a $500mn 6.097% 2038 bond deal. Both deals commit to protecting freshwater systems and the ocean8.

In July 2021, Benin sold the continent's inaugural Sustainable Development Goals bond – a €500mn 5.25% 12.5 year bond under Benin’s newly published sustainable framework. This transaction was a success, and the bond priced inside Benin’s own curve9. This was followed in July 2023 with a €350mn sovereign green loan under the sustainable framework, the proceeds of which are intended to be used to install rooftop solar panels on elementary school buildings in Benin.

Egypt has issued several sustainable instruments. Following an inaugural $750mn 5.25% five-year issue in 2020 – the first from a North African nation – Egypt most recently sold an Rmb3.5bn ($480mn) three-year 3.51% private placement sustainable Panda bond in October last year, which was guaranteed by the African Development Bank and the Asian Infrastructure Investment Bank.

Other African nations tapping the sustainable finance market include Senegal in March 2024, which made its entry into the sustainable loan market with a €400mn partial credit guarantee from the African Development Bank10.

Most recently of all, as it was not just hosting but lifting the Africa Cup of Nations, in January this year Côte d’Ivoire reopened African sovereign markets after a nearly two-year period of limited accessibility and printed a successful $1.1bn 7.625% amortizing sustainability note due 2033 – the first dollar-denominated issuance from the country since 2017 and the country’s first transaction on the Eurobond market since the beginning of 202111.

This was followed in 2018 by the pioneering and much-copied $15mn 6.5% 10-year blue bond issuance from the Seychelles and then in 2022 by Gabon with the first-ever debt-for-nature swap transaction in continental Africa in a $500mn 6.097% 2038 bond deal. Both deals commit to protecting freshwater systems and the ocean8.

In July 2021, Benin sold the continent's inaugural Sustainable Development Goals bond – a €500mn 5.25% 12.5 year bond under Benin’s newly published sustainable framework. This transaction was a success, and the bond priced inside Benin’s own curve9. This was followed in July 2023 with a €350mn sovereign green loan under the sustainable framework, the proceeds of which are intended to be used to install rooftop solar panels on elementary school buildings in Benin.

Egypt has issued several sustainable instruments. Following an inaugural $750mn 5.25% five-year issue in 2020 – the first from a North African nation – Egypt most recently sold an Rmb3.5bn ($480mn) three-year 3.51% private placement sustainable Panda bond in October last year, which was guaranteed by the African Development Bank and the Asian Infrastructure Investment Bank.

Other African nations tapping the sustainable finance market include Senegal in March 2024, which made its entry into the sustainable loan market with a €400mn partial credit guarantee from the African Development Bank10.

Most recently of all, as it was not just hosting but lifting the Africa Cup of Nations, in January this year Côte d’Ivoire reopened African sovereign markets after a nearly two-year period of limited accessibility and printed a successful $1.1bn 7.625% amortizing sustainability note due 2033 – the first dollar-denominated issuance from the country since 2017 and the country’s first transaction on the Eurobond market since the beginning of 202111.

The Outlook for Sustainable Sovereign Issuance in Africa

The outlook for sovereign sustainable issuance from Africa remains positive, primarily because of the social and economic development initiatives and projects that many of the governments have embraced and need to fund.

Côte d’Ivoire’s National Development Plan for the 2021-2025 period is specifically aimed at transforming the country into an upper middle-income nation13.

There was a new enthusiasm for sovereign supranational agency issuance driven by a number of factors including easing inflation concerns, governmental and corporate initiatives to address climate challenges, and more favorable financial conditions14. This is encouraging corporate issuers to enter international capital markets such as the Development Bank of Rwanda’s RWFR30bn (c. $24.8mn) sustainability-linked bond in September 2023 supported by a credit enhancement mechanism structured and funded by the World Bank and Zambia’s Copperbelt Energy Corporation’s US$54mn green bond in December 2023 to fund an expansion of the company’s solar PV generation capacity15. Borrowers in Sub-Saharan Africa increased green bond issuance last year by 125%, albeit from very low levels. It reached $1.4bn from $600mn in 2022, according to the Emerging Market Green Bonds report from the International Finance Corporation and Amundi16.

The issue of greenwashing that has plagued much sustainable issuance from the rest of the world has been headed off at the pass by the African Development Bank as well17. In response to investors’ need for greater transparency on the use of proceeds and requests to develop guidance for impact reporting, the organization joined a World Bank Treasury working group together with the European Investment Bank and International Finance Corporation to develop the first Harmonized Framework for Impact Reporting. Together they have collaborated to update the framework under the leadership of the International Capital Market Association18.

The remaining months of 2024 could see further activity in African sovereign markets. South Africa has made it clear that it is looking at a sustainability-linked bond later this year. Kenya is also currently working with the World Bank on a sustainability-linked bond that will target nature conservation. And Jose Lima de Massano, Minister of State for Economic Coordination in Angola, made it clear at the end of 2023 that the country intended to sell its first green bonds of up to $1bn this year to finance environmental impact projects.

Africa might have been slow to embark on the journey of green and sustainable bond issuance, but now that it has started, there is little that will likely derail its progress.

The Outlook for Sustainable Sovereign Issuance in Africa

The outlook for sovereign sustainable issuance from Africa remains positive, primarily because of the social and economic development initiatives and projects that many of the governments have embraced and need to fund.

Côte d’Ivoire’s National Development Plan for the 2021-2025 period is specifically aimed at transforming the country into an upper middle-income nation13.

There was a new enthusiasm for sovereign supranational agency issuance driven by a number of factors including easing inflation concerns, governmental and corporate initiatives to address climate challenges, and more favorable financial conditions14. This is encouraging corporate issuers to enter international capital markets such as the Development Bank of Rwanda’s RWFR30bn (c. $24.8mn) sustainability-linked bond in September 2023 supported by a credit enhancement mechanism structured and funded by the World Bank and Zambia’s Copperbelt Energy Corporation’s US$54mn green bond in December 2023 to fund an expansion of the company’s solar PV generation capacity15. Borrowers in Sub-Saharan Africa increased green bond issuance last year by 125%, albeit from very low levels. It reached $1.4bn from $600mn in 2022, according to the Emerging Market Green Bonds report from the International Finance Corporation and Amundi16.

The issue of greenwashing that has plagued much sustainable issuance from the rest of the world has been headed off at the pass by the African Development Bank as well17. In response to investors’ need for greater transparency on the use of proceeds and requests to develop guidance for impact reporting, the organization joined a World Bank Treasury working group together with the European Investment Bank and International Finance Corporation to develop the first Harmonized Framework for Impact Reporting. Together they have collaborated to update the framework under the leadership of the International Capital Market Association18.

The remaining months of 2024 could see further activity in African sovereign markets. South Africa has made it clear that it is looking at a sustainability-linked bond later this year. Kenya is also currently working with the World Bank on a sustainability-linked bond that will target nature conservation. And Jose Lima de Massano, Minister of State for Economic Coordination in Angola, made it clear at the end of 2023 that the country intended to sell its first green bonds of up to $1bn this year to finance environmental impact projects.

Africa might have been slow to embark on the journey of green and sustainable bond issuance, but now that it has started, there is little that will likely derail its progress.