Which ESG Box To Check? Implications of How an Adviser Labels a Fund’s ESG Goals

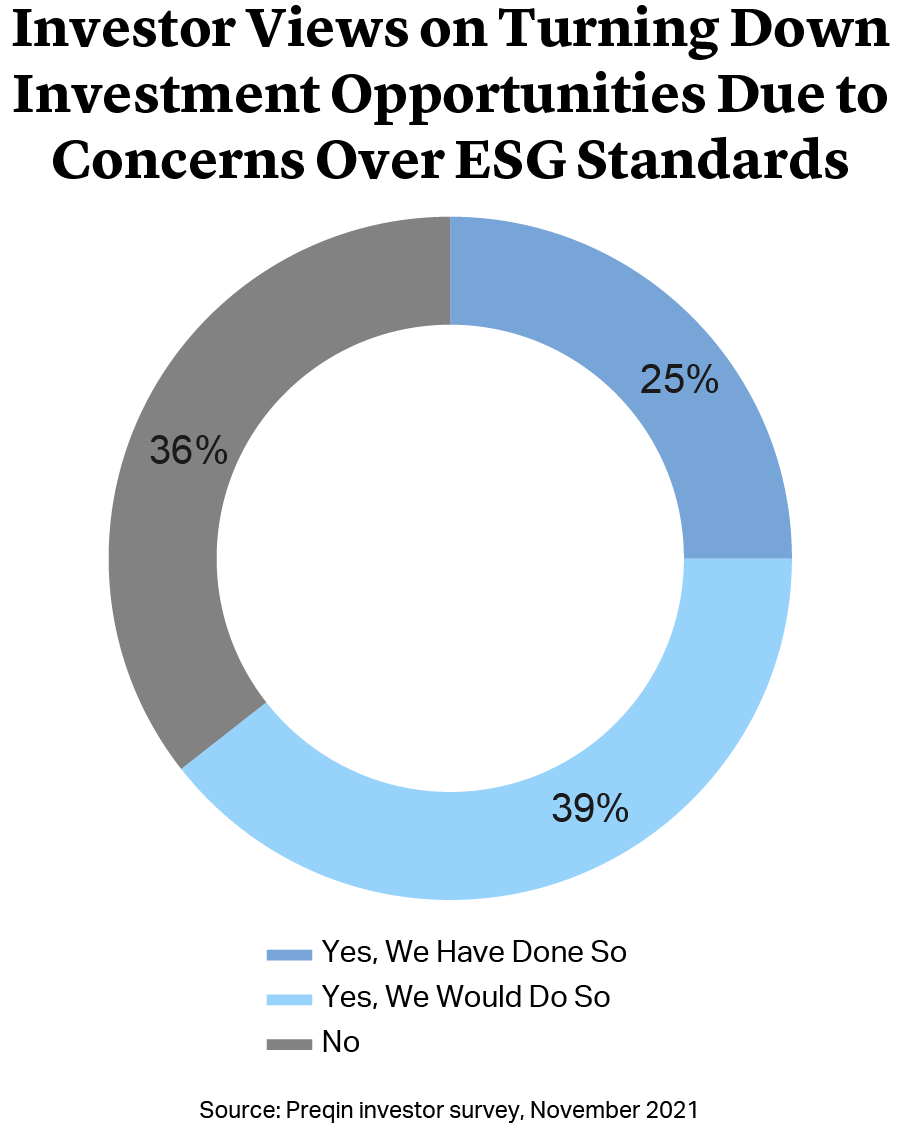

ESG fundraising is on the rise. By the end of 2021, 42% of global assets under management – equal to $4.37tn – were in private funds with an ESG commitment, a 17% increase from 20201. The increase is largely the result of a seismic shift in investor sentiment. In a November 2021 global investor survey, 65% of respondents said they either have turned down or would turn down an investment opportunity because of ESG concerns2.

Such meteoric growth has drawn the attention of the SEC, which has proposed new ESG disclosure requirements with respect to investment advisers and registered investment companies (the “Proposal”)3. The Proposal is intended to increase transparency regarding the use of ESG factors and to ensure that an investment adviser’s ESG claims are adequately supported by action – in other words, to prevent “greenwashing”.

The rise in ESG investing has also sparked political backlash. Several U.S. states, most notably Texas and Florida, have recently taken steps to block state pension plans from investing in funds or with investment advisers that consider ESG factors in their investing. The move echoes a Trump-era federal rule enacted by the Department of Labor, directing ERISA plans to focus solely on pecuniary factors.

And there is mounting backlash to the backlash. The Biden administration has suspended enforcement of the Department of Labor rule and is proposing its elimination. A working group of private fund managers has amassed to combat anti-ESG initiatives. States like New York are even putting pressure on some advisers to renew their commitments to ESG in the face of opposition.

While ESG initiatives have faced less political opposition in Europe, the detailed, top-down ESG disclosure requirements of the EU’s new Sustainable Finance Disclosure Regulation (the “SFDR”) have led to much criticism. As regulators increasingly weigh in on the issue of transparency and greenwashing, the existence of multiple, potentially overlapping regimes poses an additional layer of complication for global investment advisers.

The rise in ESG investing has also sparked political backlash. Several U.S. states, most notably Texas and Florida, have recently taken steps to block state pension plans from investing in funds or with investment advisers that consider ESG factors in their investing. The move echoes a Trump-era federal rule enacted by the Department of Labor, directing ERISA plans to focus solely on pecuniary factors.

And there is mounting backlash to the backlash. The Biden administration has suspended enforcement of the Department of Labor rule and is proposing its elimination. A working group of private fund managers has amassed to combat anti-ESG initiatives. States like New York are even putting pressure on some advisers to renew their commitments to ESG in the face of opposition.

While ESG initiatives have faced less political opposition in Europe, the detailed, top-down ESG disclosure requirements of the EU’s new Sustainable Finance Disclosure Regulation (the “SFDR”) have led to much criticism. As regulators increasingly weigh in on the issue of transparency and greenwashing, the existence of multiple, potentially overlapping regimes poses an additional layer of complication for global investment advisers.

The SEC’s Proposal

In the U.S., the SEC’s May 2022 Proposal would require additional disclosure in an adviser’s Form ADV about its consideration of ESG factors4. This would include:

In Part 1 of the Form ADV5:

Responses to questions about the ESG strategies and services employed to manage each of the adviser’s private funds, including:

- whether the adviser considers ESG factors as part of one or more significant investment strategies or methods of analysis in the advisory services provided to the private fund (and if so, whether it focuses on environmental, social, governance or some combination of the three)

- whether the strategy employs an “ESG integration” approach (i.e., ESG factors are considered, but not determinative) or an “ESG-focused” approach (i.e., ESG factors are a significant or main consideration behind investment decisions), and if so whether it also seeks to achieve a specific ESG “impact”

- additional questions regarding whether the adviser or any of its related persons is an ESG consultant or ESG service provider

In Part 2 of the Form ADV (the “Brochure”)6:

Additional narrative disclosure regarding:

- for each significant investment strategy or method of analysis for which the adviser considers ESG factors, the ESG factors considered (including whether such factors are considered on an integration, ESG-focused and/or ESG-impact basis), as well as a description of the criteria or methodology used for evaluating, selecting or excluding investments

- any material relationship or arrangement between the adviser and any related person that is an ESG consultant or ESG service provider

- any voting policies or procedures that include ESG considerations

As a result, the Proposal would effectively create four categories of funds:

- Non-ESG: ESG factors are not considered in investment decisions

- ESG Integration: One or more ESG factors are considered along with other, non-ESG factors in investment decisions, but those ESG factors are generally no more significant than other factors in the investment selection process, such that ESG factors may not be determinative in deciding to include or exclude any particular investment

- ESG Focused: One or more ESG factors are a significant or main consideration in either selecting investments or engaging with portfolio companies

- ESG Impact: The fund or strategy has a stated goal of achieving a specific ESG impact or impacts that generate specific ESG-related benefits.

These categories loosely correlate to those under the SFDR, with “non-ESG” resembling Article 6 funds, “ESG Integrated” resembling Article 8 funds and “ESG focused” resembling Article 9 funds (including the additional impact overlay).

The SEC’s Proposal

In the U.S., the SEC’s May 2022 Proposal would require additional disclosure in an adviser’s Form ADV about its consideration of ESG factors4. This would include:

In Part 1 of the Form ADV5:

Responses to questions about the ESG strategies and services employed to manage each of the adviser’s private funds, including:

- whether the adviser considers ESG factors as part of one or more significant investment strategies or methods of analysis in the advisory services provided to the private fund (and if so, whether it focuses on environmental, social, governance or some combination of the three)

- whether the strategy employs an “ESG integration” approach (i.e., ESG factors are considered, but not determinative) or an “ESG-focused” approach (i.e., ESG factors are a significant or main consideration behind investment decisions), and if so whether it also seeks to achieve a specific ESG “impact”

- additional questions regarding whether the adviser or any of its related persons is an ESG consultant or ESG service provider

In Part 2 of the Form ADV (the “Brochure”)6:

Additional narrative disclosure regarding:

- for each significant investment strategy or method of analysis for which the adviser considers ESG factors, the ESG factors considered (including whether such factors are considered on an integration, ESG-focused and/or ESG-impact basis), as well as a description of the criteria or methodology used for evaluating, selecting or excluding investments

- any material relationship or arrangement between the adviser and any related person that is an ESG consultant or ESG service provider

- any voting policies or procedures that include ESG considerations

As a result, the Proposal would effectively create four categories of funds:

- Non-ESG: ESG factors are not considered in investment decisions

- ESG Integration: One or more ESG factors are considered along with other, non-ESG factors in investment decisions, but those ESG factors are generally no more significant than other factors in the investment selection process, such that ESG factors may not be determinative in deciding to include or exclude any particular investment

- ESG Focused: One or more ESG factors are a significant or main consideration in either selecting investments or engaging with portfolio companies

- ESG Impact: The fund or strategy has a stated goal of achieving a specific ESG impact or impacts that generate specific ESG-related benefits.

These categories loosely correlate to those under the SFDR, with “non-ESG” resembling Article 6 funds, “ESG Integrated” resembling Article 8 funds and “ESG focused” resembling Article 9 funds (including the additional impact overlay).

Considerations When Checking the Box

The SEC proposals, should they be adopted, may present investment advisers with some tough choices on how to categorize their funds and strategies. The way an adviser describes a fund or strategy in its Form ADV has clear regulatory implications beyond the filing itself. In an exam, the SEC might review an adviser’s Form ADV disclosures for consistency with other statements made on the adviser’s website and in its marketing materials. The SEC might also use Form ADV responses to identify targets for ESG-related sweeps.

As a result, advisers may want to consider the following pros and cons of ESG classification.

As noted above, the existence of the parallel SFDR regime may be another factor in determining how to characterize a fund or strategy. The disclosure requirements under the SFDR are detailed and prescriptive – in many ways more onerous than the SEC’s proposed disclosure regime. It remains to be seen whether decisions taken in one jurisdiction (such as the U.S.) will impact a fund’s ESG status in the other (such as the EU). In any event, advisers with transatlantic business should consider an integrated, or at least not inconsistent, approach.

While the SEC’s Proposal has yet to be adopted, and may be subject to future litigation, it seems likely that regulatory scrutiny surrounding ESG investing will continue. If enacted as proposed, advisers will have to carefully weigh the regulatory and commercial pros and cons of how they categorize their funds and strategies.

Elizabeth Lenas

Partner

New York

T: +1 212 225 2612

elenas@cgsh.com

V-Card

Jamal Fulton

Partner

New York

T: +1 212 225 2988

jfulton@cgsh.com

V-Card

Sophie Smith

Counsel

London

T: +44 20 7614 2380

sosmith@cgsh.com

V-Card