How the Marketing Rule Impacts the Use of Placement Agents

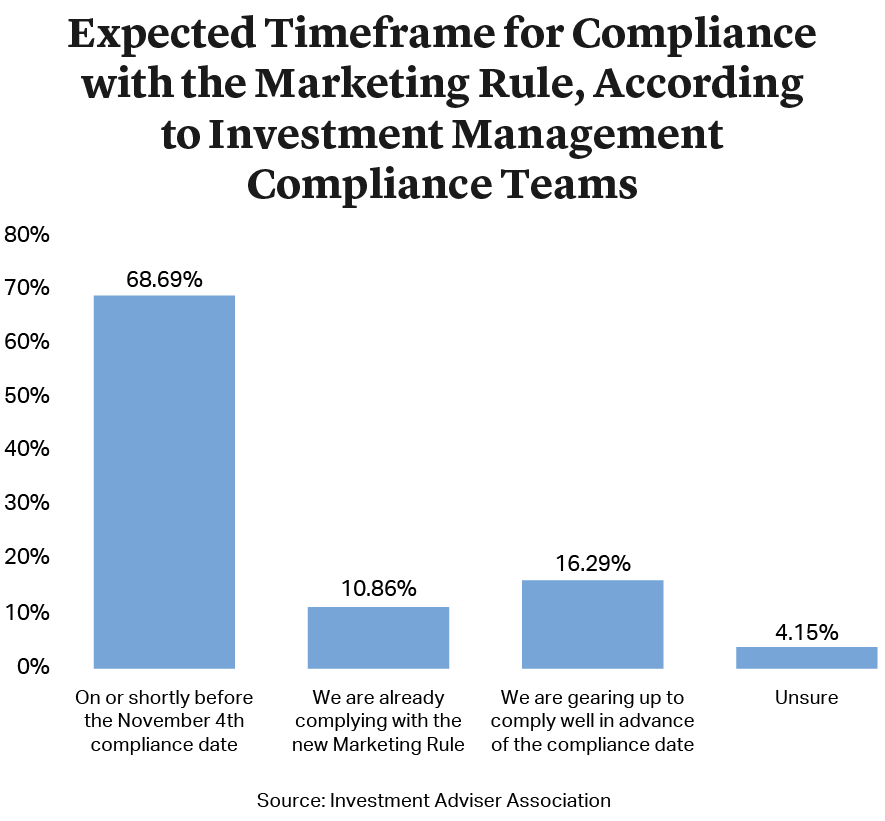

The countdown has begun. Starting on November 4, 2022, registered investment advisers must comply with the SEC’s new Marketing Rule. This replaces not only the prior Advertising Rule and Solicitation Rule, but also roughly 200 interpretive letters and other guidance released by the Staff over the 40 plus years since the Advertising Rule and Solicitation Rule were originally adopted1.

Although the SEC has stated that the Marketing Rule is intended to consolidate prior guidance and reflect a “principles-based” approach, it includes substantive new requirements that advisers will need to navigate. The application of these requirements to fundraising practices has led to interpretive questions and varying schools of thought in the industry, particularly around the presentation of performance information. The Staff has provided very little in the way of guidance beyond the rule’s 430-page adopting release. FAQs on the Marketing Rule2 and the Staff’s September 19, 2022 Risk Alert on the Marketing Rule3 do not wade into the more complicated questions of application. The Risk Alert did, however, put advisers on notice that the Division of Examinations will begin targeted sweeps shortly after the compliance date.

While advisers and their counsel have likely spent substantial time analyzing the implications of the Marketing Rule on presentation of performance, especially the net performance requirement, the impact of the rule on placement agent agreements has garnered less fanfare to date. As advisers solidify their approach to performance information presentation, more will now be turning their attention to the rule’s considerable shift in requirements relating to placement agents and related interpretive questions.

Although the SEC has stated that the Marketing Rule is intended to consolidate prior guidance and reflect a “principles-based” approach, it includes substantive new requirements that advisers will need to navigate. The application of these requirements to fundraising practices has led to interpretive questions and varying schools of thought in the industry, particularly around the presentation of performance information. The Staff has provided very little in the way of guidance beyond the rule’s 430-page adopting release. FAQs on the Marketing Rule2 and the Staff’s September 19, 2022 Risk Alert on the Marketing Rule3 do not wade into the more complicated questions of application. The Risk Alert did, however, put advisers on notice that the Division of Examinations will begin targeted sweeps shortly after the compliance date.

![[22nd December 2020 - SEC adopts the new Marketing Rule],[4th May 2021 - Marketing rule comes into effect, with 18-month transition period for RIAs],[4th November 2022 - Marketing Rule compliance deadline]](./assets/RnjYb1TLhX/ai_globalprivatefunds_marketingrule-901x939.png)

While advisers and their counsel have likely spent substantial time analyzing the implications of the Marketing Rule on presentation of performance, especially the net performance requirement, the impact of the rule on placement agent agreements has garnered less fanfare to date. As advisers solidify their approach to performance information presentation, more will now be turning their attention to the rule’s considerable shift in requirements relating to placement agents and related interpretive questions.

The Requirements

The prior Solicitation Rule applied only to the solicitation of direct advisory “clients”, and did not extend to the solicitation of private fund investors. The Marketing Rule closes this loophole and defines “advertising” to include solicitation activities by placement agents. Because the typical placement agent arrangement will now be considered a compensated “endorsement” under the rule, they will be subject to the following requirements:

Disclosure

The rule requires clear and prominent (and succinct) disclosure of:

- the status of the promoter, i.e. whether the endorsement is by a person who is or is not a current client or investor in the fund

- that cash or non-cash compensation was provided to the promoter for the endorsement

- a brief statement of any material conflicts of interest the promoter has as a result of its relationship with the adviser

Plus, more detailed disclosure (which may be provided by cross reference) of:

- the material terms of the compensation arrangement, including both direct and indirect compensation: If a specific amount of cash compensation is paid, the disclosure should include that amount, and if the compensation is a percentage of the total advisory fee over a period of time, then the disclosure should include the percentage and time period

- any material conflicts of interest the promoter has as a result of its relationship with the adviser

Exemptions

Affiliates

The disclosure requirements do not apply where the promoter is an affiliate of the adviser, as long as the affiliation is readily apparent or disclosed at the time of the endorsement

Broker Dealers

If the promoter is a registered broker dealer and the recipient is a:

- “retail customer” covered by Regulation Best Interest, then these disclosure requirements do not apply

- not a “retail customer” under Regulation Best Interest, then just the clear and prominent disclosure requirements apply

The disclosure must be provided at the time the endorsement is disseminated, either by the adviser or the promoter, if the adviser reasonably believes the promoter is providing the required disclosure at the time of dissemination.

Oversight

The adviser must also have:

- a reasonable basis for believing the endorsement complies with the rule

- a written agreement with the promoter that covers the scope of activities and compensation (subject to limited exemptions)

Disqualification

The adviser is prohibited from compensating a promoter (directly or indirectly) if the adviser knows, or in the exercise of reasonable care should know, that the promoter is an “ineligible person” at the time the endorsement is disseminated.

- The disqualifying events in the rule are slightly broader than those under the former Solicitation Rule, but matters that occurred prior to the May 4, 2021 effective date of the Marketing Rule that would not have disqualified the promoter under the Solicitation Rule will not disqualify it under the Marketing Rule.

- This requirement is subject to some exceptions where other disqualification provisions apply, such as when; the promoter is covered by, and not disqualified under, Rule 506(d) of Regulation D, or the promoter is a registered broker dealer that is not subject to disqualification under the Exchange Act.

Disclosure

The rule requires clear and prominent (and succinct) disclosure of:

- the status of the promoter, i.e. whether the endorsement is by a person who is or is not a current client or investor in the fund

- that cash or non-cash compensation was provided to the promoter for the endorsement

- a brief statement of any material conflicts of interest the promoter has as a result of its relationship with the adviser

Plus, more detailed disclosure (which may be provided by cross reference) of:

- the material terms of the compensation arrangement, including both direct and indirect compensation: If a specific amount of cash compensation is paid, the disclosure should include that amount, and if the compensation is a percentage of the total advisory fee over a period of time, then the disclosure should include the percentage and time period

- any material conflicts of interest the promoter has as a result of its relationship with the adviser

Exemptions

Affiliates

The disclosure requirements do not apply where the promoter is an affiliate of the adviser, as long as the affiliation is readily apparent or disclosed at the time of the endorsement

Broker Dealers

If the promoter is a registered broker dealer and the recipient is a:

- “retail customer” covered by Regulation Best Interest, then these disclosure requirements do not apply

- not a “retail customer” under Regulation Best Interest, then just the clear and prominent disclosure requirements apply

The disclosure must be provided at the time the endorsement is disseminated, either by the adviser or the promoter, if the adviser reasonably believes the promoter is providing the required disclosure at the time of dissemination.

Oversight

The adviser must also have:

- a reasonable basis for believing the endorsement complies with the rule

- a written agreement with the promoter that covers the scope of activities and compensation (subject to limited exemptions)

Disqualification

The adviser is prohibited from compensating a promoter (directly or indirectly) if the adviser knows, or in the exercise of reasonable care should know, that the promoter is an “ineligible person” at the time the endorsement is disseminated.

- The disqualifying events in the rule are slightly broader than those under the former Solicitation Rule, but matters that occurred prior to the May 4, 2021 effective date of the Marketing Rule that would not have disqualified the promoter under the Solicitation Rule will not disqualify it under the Marketing Rule.

- This requirement is subject to some exceptions where other disqualification provisions apply, such as when; the promoter is covered by, and not disqualified under, Rule 506(d) of Regulation D, or the promoter is a registered broker dealer that is not subject to disqualification under the Exchange Act.

The endorsement framework makes sense in the context of a single interaction with the investor or social media post. It makes a lot less sense in the context of the typical placement agent arrangement.

The role of a placement agent has changed significantly over time. When originally adopted, the former Solicitation Rule targeted limited interaction solicitations, whether that constituted a mail-out or a traditional introduction by a placement agent who would then fade into the background. Today, placement agents are more deeply integrated in the fundraising process, with multiple touchpoints with investors from first interaction through to commitment. Under the new Marketing Rule, the disclosure required for compensated endorsements must be provided at the time “an” endorsement is “disseminated”. It is unclear which of a placement agent’s many interactions with investors are “endorsements” triggering the Marketing Rule requirements.

When and how many times does this disclosure need to be provided to the investor? Is it once at the initial outreach, at the time of each communication between the placement agent and the investor, or somewhere in between? Advisers, promoters and their counsel will need to work together to formulate an approach to these questions that is reasonable and can be applied consistently.

Under the Marketing Rule, the disclosure required for compensated endorsements must be provided by the adviser, or alternatively the promoter, provided that the adviser “reasonably believes” that the promoter is making the disclosure at the time the endorsement is disseminated. This is another departure from the former Solicitation Rule, which was consistent with the historical practice of the “solicitor” providing the disclosure.

An adviser that wants to provide the required disclosure itself may face resistance from the placement agent, who will likely want to maintain control over its investor relationships. The adviser also may not be best positioned to know when endorsements are “disseminated”. If an adviser chooses instead to delegate this responsibility to the placement agent, the adviser will need to determine and document the basis for its reasonable belief that the placement agent is complying with the rule. Which leads to the next question.

An adviser must keep a record of all advertisements that it disseminates, directly or indirectly, together with any separately provided disclosures, as well as documentation substantiating the adviser’s reasonable basis for believing that any compensated endorsements comply with the rule. The adopting release suggests that “substantiation” might include periodic inquiries of solicited investors, certain terms in the written agreement with the promoter or implementing other policies and procedures for establishing a reasonable basis. However, the SEC notes that a written agreement by itself would not satisfy the first prong of the oversight requirement.

Placement agent agreements will likely need to be updated to include the following.

- To support that the adviser has a “reasonable belief” of compliance in accordance with its oversight obligation: representations and covenants regarding the placement agent’s compliance with the Marketing Rule provisions regarding endorsements, although as noted above, this alone will not be sufficient to substantiate the adviser’s belief.

- To support that the adviser has a “reasonable belief” that disclosures will be made in compliance with the rule: provisions specifying which party will provide the disclosures and, if the adviser delegates this responsibility to the placement agent, additional representations and agreements. The parties should agree on when an endorsement will be deemed “disseminated” and corresponding disclosures made. Advisers should also consider what level of oversight they want over disclosures, which could be the right to review and pre-approve such disclosures, or covenants regarding compliance, plus some agreement for additional diligence and monitoring of the placement agent’s disclosures, as the SEC would likely view a covenant alone as insufficient.

- To support that the adviser is exercising the required “reasonable care” to determine whether the placement agent is an “ineligible person”: representations and covenants regarding the placement agent’s current status and any future change in status. The adopting release indicates that some level of monitoring is also required. This could include periodic attestations and/or legal searches for the placement agent and its key persons.

- To comply with the recordkeeping provisions of the Marketing Rule: provisions on which party will be responsible for retaining copies of all compensated endorsements distributed by the placement agent.

The Questions

When Does the “Endorsement” Occur?

The endorsement framework makes sense in the context of a single interaction with the investor or social media post. It makes a lot less sense in the context of the typical placement agent arrangement.

The role of a placement agent has changed significantly over time. When originally adopted, the former Solicitation Rule targeted limited interaction solicitations, whether that constituted a mail-out or a traditional introduction by a placement agent who would then fade into the background. Today, placement agents are more deeply integrated in the fundraising process, with multiple touchpoints with investors from first interaction through to commitment. Under the new Marketing Rule, the disclosure required for compensated endorsements must be provided at the time “an” endorsement is “disseminated.” It is unclear which of a placement agent’s many interactions with investors are “endorsements” triggering the Marketing Rule requirements.

When and how many times does this disclosure need to be provided to the investor? Is it once at the initial outreach, at the time of each communication between the placement agent and the investor, or somewhere in between? Advisers, promoters and their counsel will need to work together to formulate an approach to these questions that is reasonable and can be applied consistently.

Who Should Provide the Disclosure?

Under the Marketing Rule, the disclosure required for compensated endorsements must be provided by the adviser, or alternatively the promoter, provided that the adviser “reasonably believes” that the promoter is making the disclosure at the time the endorsement is disseminated. This is another departure from the former Solicitation Rule, which was consistent with the historical practice of the “solicitor” providing the disclosure.

An adviser that wants to provide the required disclosure itself may face resistance from the placement agent, who will likely want to maintain control over its investor relationships. The adviser also may not be best positioned to know when endorsements are “disseminated”. If an adviser chooses instead to delegate this responsibility to the placement agent, the adviser will need to determine and document the basis for its reasonable belief that the placement agent is complying with the rule. Which leads to the next question.

How Should the Adviser Document Compliance With Its Obligations?

An adviser must keep a record of all advertisements that it disseminates, directly or indirectly, together with any separately provided disclosures, as well as documentation substantiating the adviser’s reasonable basis for believing that any compensated endorsements comply with the rule. The adopting release suggests that “substantiation” might include periodic inquiries of solicited investors, certain terms in the written agreement with the promoter or implementing other policies and procedures for establishing a reasonable basis. However, the SEC notes that a written agreement by itself would not satisfy the first prong of the oversight requirement.

Placement agent agreements will likely need to be updated to include the following.

- To support that the adviser has a “reasonable belief” of compliance in accordance with its oversight obligation: representations and covenants regarding the placement agent’s compliance with the Marketing Rule provisions regarding endorsements, although as noted above, this alone will not be sufficient to substantiate the adviser’s belief.

- To support that the adviser has a “reasonable belief” that disclosures will be made in compliance with the rule: provisions specifying which party will provide the disclosures and, if the adviser delegates this responsibility to the placement agent, additional representations and agreements. The parties should agree on when an endorsement will be deemed “disseminated” and corresponding disclosures made. Advisers should also consider what level of oversight they want over disclosures, which could be the right to review and pre-approve such disclosures, or covenants regarding compliance, plus some agreement for additional diligence and monitoring of the placement agent’s disclosures, as the SEC would likely view a covenant alone as insufficient.

- To support that the adviser is exercising the required “reasonable care” to determine whether the placement agent is an “ineligible person”: representations and covenants regarding the placement agent’s current status and any future change in status. The adopting release indicates that some level of monitoring is also required. This could include periodic attestations and/or legal searches for the placement agent and its key persons.

- To comply with the recordkeeping provisions of the Marketing Rule: provisions on which party will be responsible for retaining copies of all compensated endorsements distributed by the placement agent.

These negotiations are likely to be difficult. Placement agents may understand the adviser’s need for these changes, but still have issues with implementing them. Placement agents have their own internal policies and procedures that may be inconsistent with some of the adviser’s requests, and may not be amenable or able to vary those policies and procedures for a particular product. An additional wrinkle may be differing approaches to the presentation of performance information under the Marketing Rule.

Presentation of

Performance Information

Advisers should be prepared to discuss the presentation of performance information with their placement agents and consider how they will address any divergence between the adviser’s and the placement agent’s interpretation of the rule’s performance requirements.

The good news is that investment advisers and placement agents are having constructive discussions about compliance with the Marketing Rule. Until such time as the Staff issues additional guidance on the questions around the application of the Marketing Rule to such arrangements, or the market otherwise coalesces around a particular approach to compliance, we encourage these conversations to continue.

Robin Bergen

Partner

Washington, D.C.

T: +1 202 974 1514

rbergen@cgsh.com

V-Card

Adrian Rae Leipsic

Partner

New York

T: +1 212 225 2504

aleipsic@cgsh.com

V-Card