Success Breeds

Success as

European VC

Comes of Age

The tech sector has entered 2021 on a high. COVID-19 has accelerated many secular trends, such as online shopping and remote working, resulting in strong performance for a whole range of companies, including ecommerce platforms, payments processors, enterprise software and video conferencing. That success is flowing through to the venture capital firms that back innovative start-ups and encouraging more investors to enter the market in search of growth businesses and high returns potential.

European Tech Sector Matures

In the face of uncertainty and volatility, the global technology sector has continued to attract sizeable volumes of capital. Venture capital recorded two successive record quarters for investment at the end of 2020, with average deal sizes also hitting new highs{{1}}{{{Preqin Data, Venture Capital Overview}}}. However, Silicon Valley is increasingly facing competition from Europe, as start-ups and the capital sources to fund them expand internationally.

VC investment in Europe hit a record €43 billion in 2020, according to Pitchbook, with German biopharma firm CureVac securing the largest funding round, raising €560 million in the summer ahead of its New York IPO{{2}}{{{European Venture Report, 2020 Annual</br>Source: Pitchbook}}}. Across Europe, companies including UK sportswear group Gymshark, German air taxi developer Lilium and French online marketplace software provider Mirakl, achieved unicorn status with valuations exceeding $1 billion.

Successful start-ups also became successful exits. The HUT Group’s IPO in September was the biggest London flotation since 2015, while the listing of Polish ecommerce platform Allegro the following month was the largest ever listing on the Warsaw Stock Exchange. A number of other companies are reported to be preparing for their own IPOs , including as part of “dual track” processes, to take advantage of buoyant public and private markets.

Large Sponsors and Investors Target European Start-ups

The appeal and potential of European start-ups is drawing capital from a wider range of firms that have not traditionally focused on VC or growth investing. In January, The Carlyle Group co-led a €7.5 million funding round for French AI-based investment analytics developer SESAMm, a company for which it had previously been a customer. Increasingly, the size of later stage financings has brought large investors with large cheques. Among last year’s deals, Blackstone’s recently formed growth division led a $200 million investment into Swedish oat milk maker Oatly.

Sovereign wealth funds are also looking to join funding rounds or invest directly. Total European VC deal activity involving non-traditional investors – including sovereigns, family offices and corporate venture capital, as well as private equity – reached €32 billion in 2020, according to Pitchbook{{3}}{{{European Venture Report, 2020 Annual

Source: Pitchbook}}}, accounting for the majority of VC investment. Qatar Investment Authority participated in CureVac’s 2020 round, Singapore’s Temasek has an established team dedicated to VC, and Ontario Municipal Employees Retirement System (OMERS) launched a €300 million fund for European VC investments in 2019.

UK Leads the European VC and Start-up Ecosystem

Europe offers a broad landscape for VC investment. Stockholm has produced some of the largest start-ups of recent years, including payments group Klarna and music streaming service Spotify. Berlin and Paris have both also gained reputations as hubs for venture capital activity.

In 2019, Africa also produced its first domestically grown unicorn, Interswitch, a Nigerian digital payments provider which sold a 20% stake to Visa at a $1 billion valuation. Unlike Europe, however, VC activity on the continent was severely curtailed by the outflow of capital from emerging markets in the first half of 2020 but is expected to rebound in 2021 as risk appetite returns.

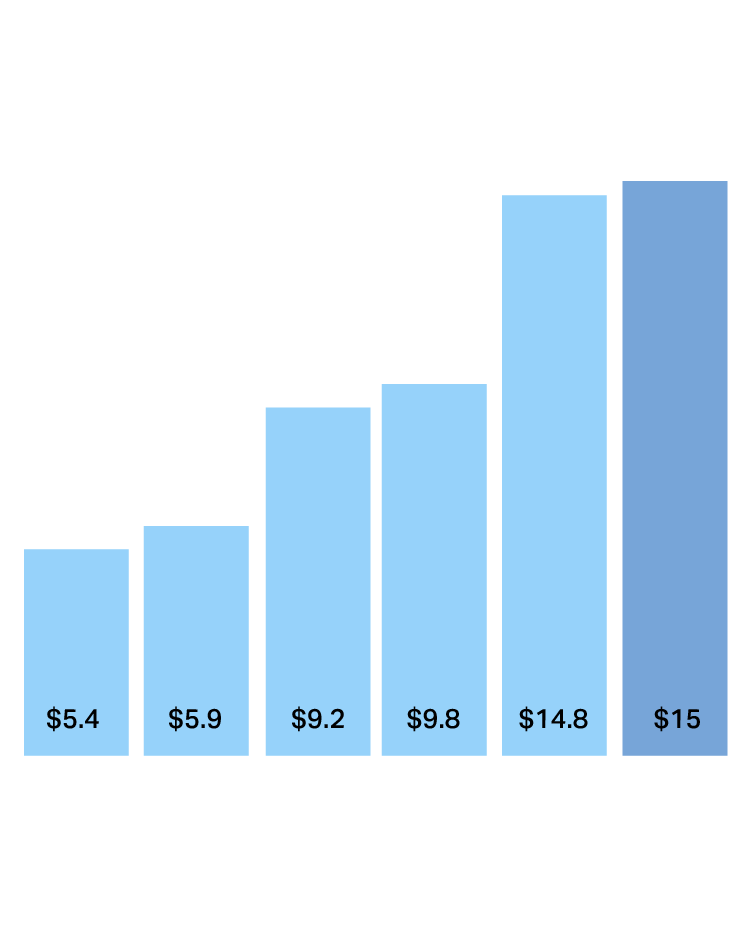

Despite the spread of VC activity in Europe, the UK has developed a lead in London and around universities in Oxford and Cambridge. UK start-up investment hit a record $15 billion in 2020{{4}}{{{Record UK VC funding tops $15B for the first time in 2020</br>Source: Dealroon.co}}}, according to Dealroom, with large funding rounds including $500 million for challenger bank Revolut and $84 million for DNA sequencer Oxford Nanopore. They featured among the UK’s 80 unicorns at the end of 2020, more than twice the number of Germany. Critically, there is little evidence as yet that access to talent or ability to raise funds has been curtailed by Brexit.

UK Leads the European VC and Start-up Ecosystem

Europe offers a broad landscape for VC investment. Stockholm has produced some of the largest start-ups of recent years, including payments group Klarna and music streaming service Spotify. Berlin and Paris have both also gained reputations as hubs for venture capital activity.

In 2019, Africa also produced its first domestically grown unicorn, Interswitch, a Nigerian digital payments provider which sold a 20% stake to Visa at a $1 billion valuation. Unlike Europe, however, VC activity on the continent was severely curtailed by the outflow of capital from emerging markets in the first half of 2020 but is expected to rebound in 2021 as risk appetite returns.

Despite the spread of VC activity in Europe, the UK has developed a lead in London and around universities in Oxford and Cambridge. UK start-up investment hit a record $15 billion in 2020{{4}}{{{Record UK VC funding tops $15B for the first time in 2020</br>Source: Dealroon.co}}}, according to Dealroom, with large funding rounds including $500 million for challenger bank Revolut and $84 million for DNA sequencer Oxford Nanopore. They featured among the UK’s 80 unicorns at the end of 2020, more than twice the number of Germany. Critically, there is little evidence as yet that access to talent or ability to raise funds has been curtailed by Brexit.

Attractive Arbitrage Opportunity in Europe

While the number of start-ups raising large capital rounds has increased, the continent is still far behind the U.S. and China in terms of valuations. That disconnect is increasingly drawing investors from the U.S. to deploy their capital in Europe as they see certain sectors in Europe – and London in particular – as an arbitrage play. They can access start-ups developing similar tech and biotech solutions to their Silicon Valley peers at substantially lower valuations – providing them with lower-risk entry points and the potential for higher returns on exit.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner