Private Equity

Snapshot

February 2021

Private equity activity in Europe has started off very strongly in 2021, following on from a busy finish to 2020. European private equity deals exceeded $64 billion{{1}}{{{Private equity activity by value Q1 2019 – Q4 2020</br>Source: White & Case}}}in the last three months of 2020, according to Mergermarket data, making it one of strongest quarters since 2007. That confidence in the outlook has continued in January with sponsors looking through the renewed disruption caused by the winter resurgence in COVID-19 and Brexit.

Investment Activity Begins to Broaden

Investment activity in technology remains strong, as is appetite for healthcare sector opportunities, and in particular companies at the intersection of the two. These areas have been resilient through 2020 and show good potential for generating earlier-than-usual exits, with news that Advent International is preparing the sale of a large part of British electronics group Laird just three years after it took the company private.

At the same time, there are signs that appetite is broadening as sponsors anticipate recovery across a wider range of sectors. BC Partners’ completion of its take-private of Italian packaging machine maker IMA exposes it to consumer markets for food and hot beverages, in addition to medication. Meanwhile, Blackstone, Global Infrastructure Partners and Bill Gates’ wealth manager Cascade had a £3.5 billion bid for UK-listed Signature Aviation approved by the company, highlighting investor interest in the aviation services market for private jets.

Supply of Capital Builds

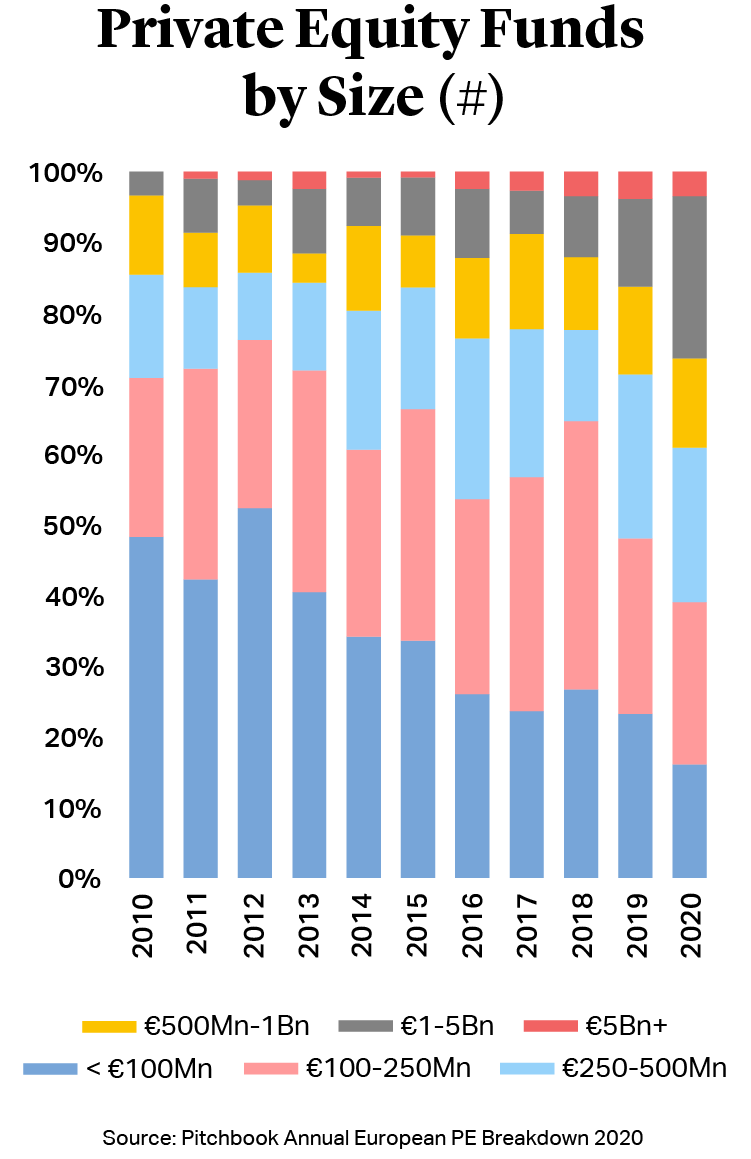

Activity is strong but, in many ways, appetite is stronger. Auction processes for top assets remain heated and competitive, with terms and timelines mainly favourable to sellers. The desire to deploy funds is driven in large part by the sizeable supply of dry powder. The average size of all European private equity funds raised exceeded €1billion for the first time in 2020, according to Pitchbook{{2}}{{{European PE Breakdown, 2020 Annual</br>Source: Pitchbook}}}, giving managers significant amounts of money and impetus to invest.

Dealmaking is also being propelled by low interest rates and demand from banks and investors to deploy their capital into leveraged loans and high-yield bonds. Blackstone was reported to have received €8.2 billion in demand for its €2.3 billion loan and bond offerings for Ancestry.com in November{{3}}{{{2021 European Private Capital Outlook</br>Source: Pitchbook}}}.

Despite renewed virus-related restrictions in Europe, as well as questions over vaccine rollouts and new COVID-19 variants, the mood is positive. The spike in investment activity also reflects some sponsors’ belief that competition and asset values will be even higher later in the year when the anticipated recovery strengthens, and life returns towards normality.

Dealmaking is also being propelled by low interest rates and demand from banks and investors to deploy their capital into leveraged loans and high-yield bonds. Blackstone was reported to have received €8.2 billion in demand for its €2.3 billion loan and bond offerings for Ancestry.com in November{{3}}{{{2021 European Private Capital Outlook</br>Source: Pitchbook}}}.

Despite renewed virus-related restrictions in Europe, as well as questions over vaccine rollouts and new COVID-19 variants, the mood is positive. The spike in investment activity also reflects some sponsors’ belief that competition and asset values will be even higher later in the year when the anticipated recovery strengthens, and life returns towards normality.

IPO Markets Drive Exits

Optimism is also manifesting elsewhere, with IPO activity starting to take off. Online greetings card maker Moonpig listed at a valuation of £1.2 billion at the start of February, following hot on the heels of British bootmaker Dr. Martens, which floated at £3.7 billion. A host of other private equity and VC-backed companies are hiring banks to investigate IPOs, such as UK-based money transfers firm Transferwise and German car sales platform Auto 1.

IPOs are providing an avenue for attractive exits in buoyant public markets. However, despite the fact that Dr Martens’ shareholders saw their retained shares climbed by over 30% in the week following the listing, many sponsors continue to prefer the certainty of a full exit. As a result, we are seeing, and expect to continue to see, many processes pursuing a dual track strategy to capture the potential benefits of strong appetite for secondary buyouts from other private equity firms, as well as corporates seeking transformational M&A deals, and drive value-creating tension between the two processes.

Private Equity Firms Seek Fundraising Flexibility

As with investments and exits, private equity fundraising finished 2020 strongly. European fundraising reached €92 billion, the second highest total ever, according to Pitchbook data{{4}}{{{European PE Breakdown, 2020 Annual</br>Source: Pitchbook}}}. The flow of new funds coming to market continues to look strong with terms and conditions often designed to give sponsors greater flexibility.

Buyout firms continue to take advantage of, and seek to expand, buckets within their funds to execute non-control deals for minority stakes in privately-owned businesses, and even publicly listed corporations. Many large GPs are also seeking the flexibility to invest more freely across the capital structure to allow themselves to access a wider range of opportunities presenting themselves within the range of their target ticket sizes.

As well as a marked increase in the prevalence of long-life funds and similar programmes (for example Silver Lake’s announced partnership with Mubadala to invest $2 billion over a 25-year period), firms are also looking at mechanisms for holding un-exited assets at the end of a fund’s life and continuation funds and similar GP-led secondary transactions look to be a trend that will continue into 2021.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner