Strong Valuations Have Mixed Consequences for Private Equity

Set against the volatile performance of global public markets, private equity portfolios held up relatively strongly in 2022. As leading equities benchmarks registered double-digit declines in the second quarter of the year amid spiking inflation and rapidly rising interest rates, private equity valuations saw only a moderate decline of 3.2%, according to PitchBook figures1.

Given the lag in private equity reporting timelines, more recent data is yet to be released. However, the anecdotal evidence from LPs and GPs is that the private equity valuation reset for 2022 will be much more modest than the almost 20% fall in the MSCI ACWI global equities benchmark. While continued robustness in private equity asset valuation levels is a performance boost for sponsors and their investors, it has consequences – both positive and negative – for activity across new investments, exits and fundraising.

High Valuations Create Bottlenecks in GP-Led Secondaries

IPO markets were largely shut throughout 2022, while tight debt markets and uncertain macroeconomic conditions curtailed exits via trade sales and secondary buyouts. As a result, more private equity firms explored GP-led secondaries for portfolios of assets and some single companies. However, persistently strong valuations have stemmed deal flow as investors have been cautious about pricing.

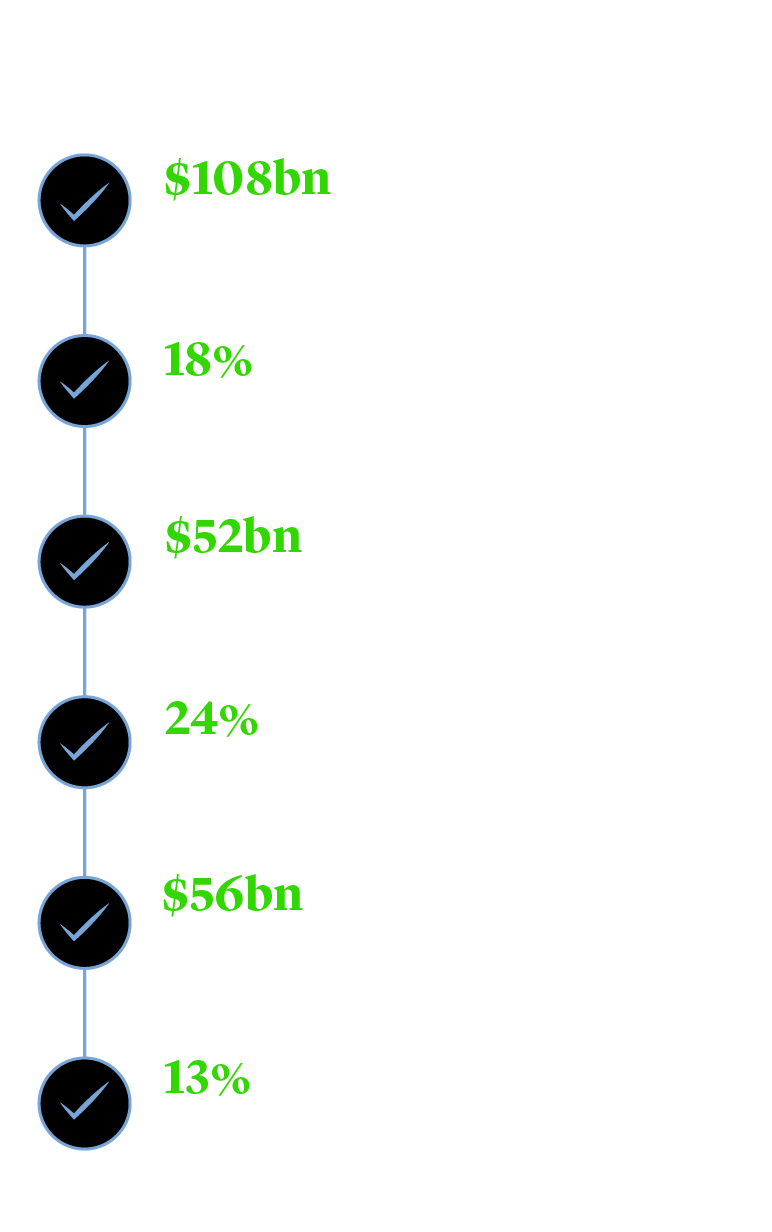

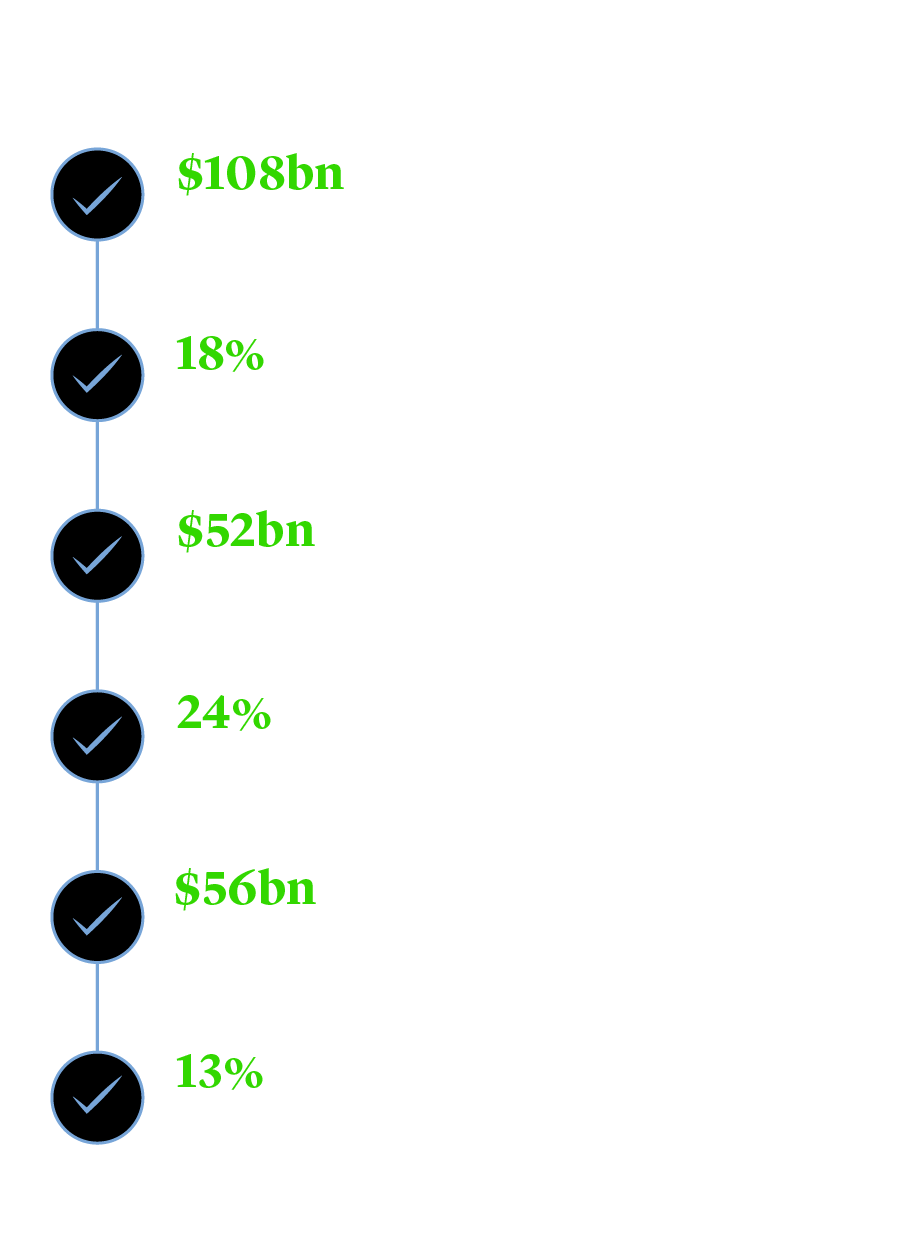

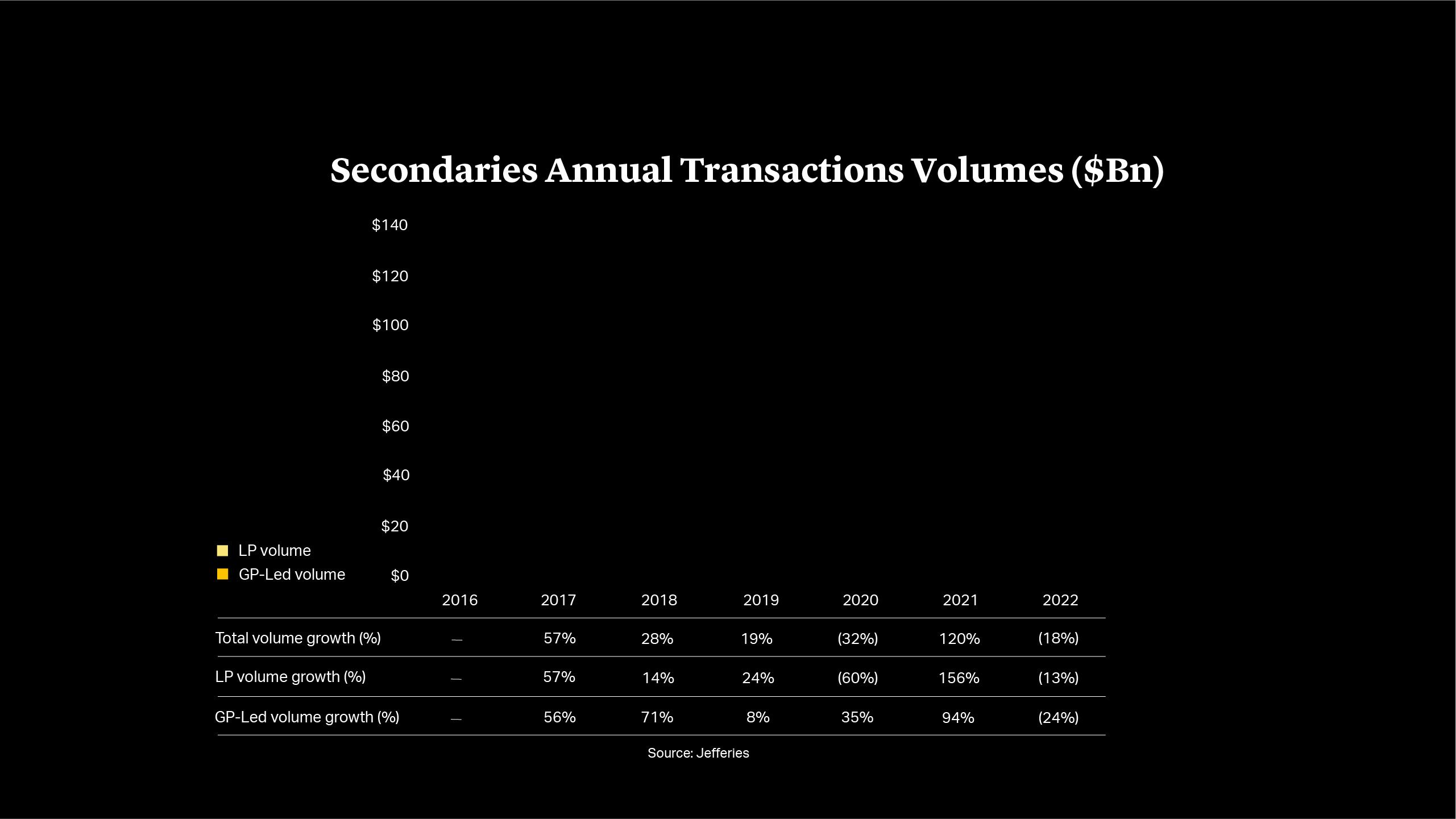

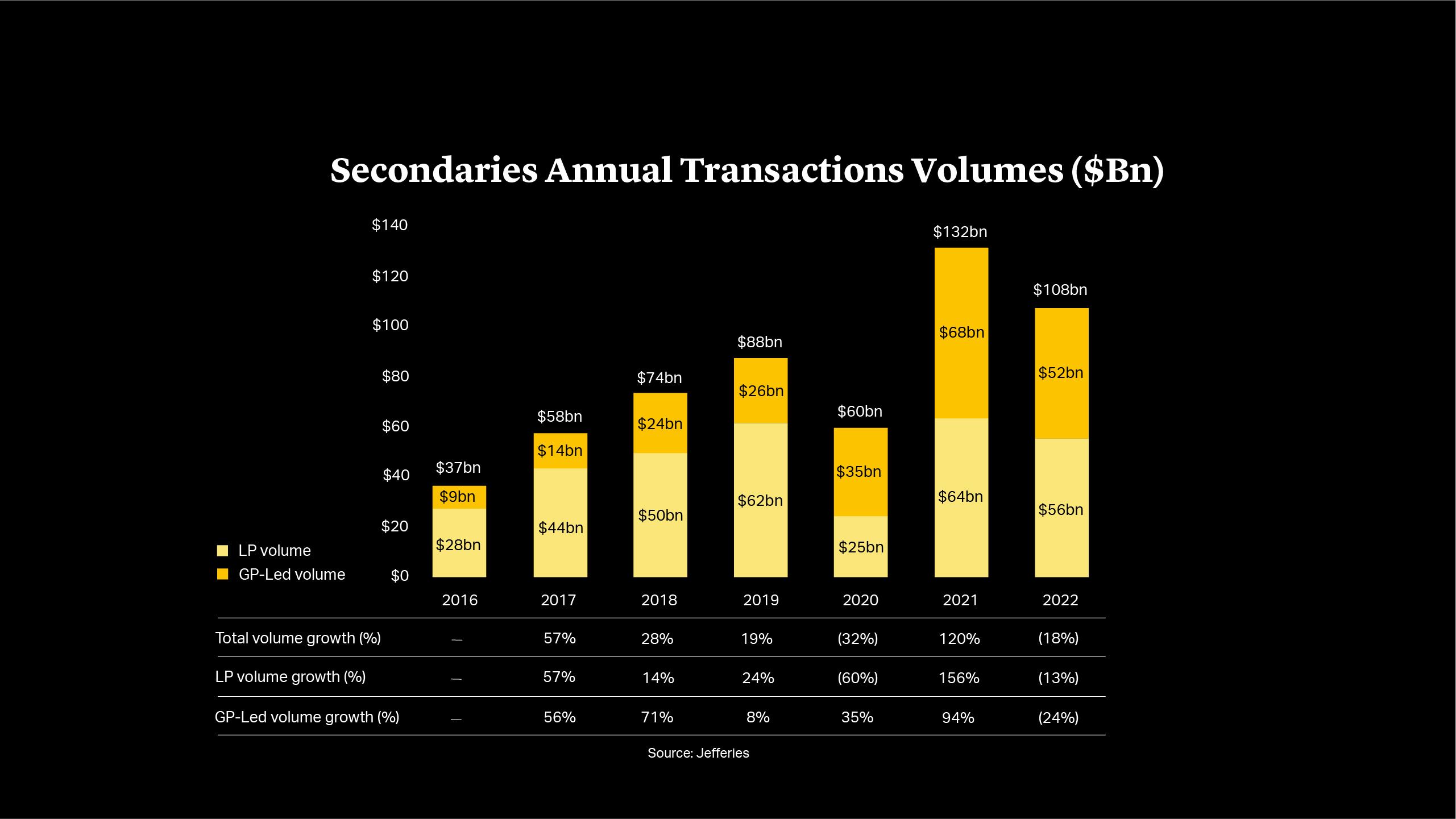

Data from Jefferies showed that GP-led secondaries declined by 24% in 2022 to $52bn against a more modest decline of 13% for LP-led secondaries2. While there are many factors at work in determining investment appetite in secondaries, valuations are central to the investment case. According to Jefferies, LP portfolios priced on average at 81% of the last reported NAV. In contrast, some 60% of GP-leds were reported to have to been priced within 5% of par, indicating higher valuation levels for many transactions.

While there is still clear appetite for GP-leds, with 2022 the second-best year on record for such processes, there is some increased caution among buyers. We are seeing secondaries specialist funds committing smaller cheques, and co-leading – rather than leading – transactions. As a result, GPs are casting the net wider for investors, and combining secondaries processes with more traditional M&A. KKR’s recapitalization of its e-commerce platform software company Internet Brands in July last year included re-investment from KKR and Temasek, alongside a new group of investors led by Warburg Pincus3. We expect that trend to continue for so long as secondaries valuation levels remain robust.

High Valuations Create Bottlenecks in GP-Led Secondaries

IPO markets were largely shut throughout 2022, while tight debt markets and uncertain macroeconomic conditions curtailed exits via trade sales and secondary buyouts. As a result, more private equity firms explored GP-led secondaries for portfolios of assets and some single companies. However, persistently strong valuations have stemmed deal flow as investors have been cautious about pricing.

Data from Jefferies showed that GP-led secondaries declined by 24% in 2022 to $52bn against a more modest decline of 13% for LP-led secondaries2. While there are many factors at work in determining investment appetite in secondaries, valuations are central to the investment case. According to Jefferies, LP portfolios priced on average at 81% of the last reported NAV. In contrast, some 60% of GP-leds were reported to have to been priced within 5% of par, indicating higher valuation levels for many transactions.

While there is still clear appetite for GP-leds, with 2022 the second-best year on record for such processes, there is some increased caution among buyers. We are seeing secondaries specialist funds committing smaller cheques, and co-leading – rather than leading – transactions. As a result, GPs are casting the net wider for investors, and combining secondaries processes with more traditional M&A. KKR’s recapitalization of its e-commerce platform software company Internet Brands in July last year included re-investment from KKR and Temasek, alongside a new group of investors led by Warburg Pincus3. We expect that trend to continue for so long as secondaries valuation levels remain robust.

Denominator Effect

Constricts Fundraising

Resilient performance from private equity does also have benefits for investors in times of market uncertainty. Private markets have helped to rebalance portfolios for many pension funds and insurers, offsetting more volatile stocks and bonds and enabling them to deliver a smoother returns profile.

This has also presented something of a ‘Catch-22’ situation by contributing to the denominator effect whereby investors may also find themselves overallocated to the very asset class that is outperforming. As a result, private equity firms that are on the fundraising trail are finding that it takes longer to raise new funds.

In January, EQT warned that private equity fundraising would be slower, as it seeks to gather €20bn for its latest buyout fund4, following The Carlyle Group which asked investors for more time to raise capital for its $22bn flagship vehicle5. Across the board, more protracted processes are leading to a sharp contraction in fundraising with Preqin estimating a 22% dip in fundraising for 20226, while S&P Global reported a total of 481 new private equity funds launched in 2022 compared with almost 1,500 in 20217.

Buyout Purchase Prices Ease

as Falling VC Valuations

Kickstart M&A

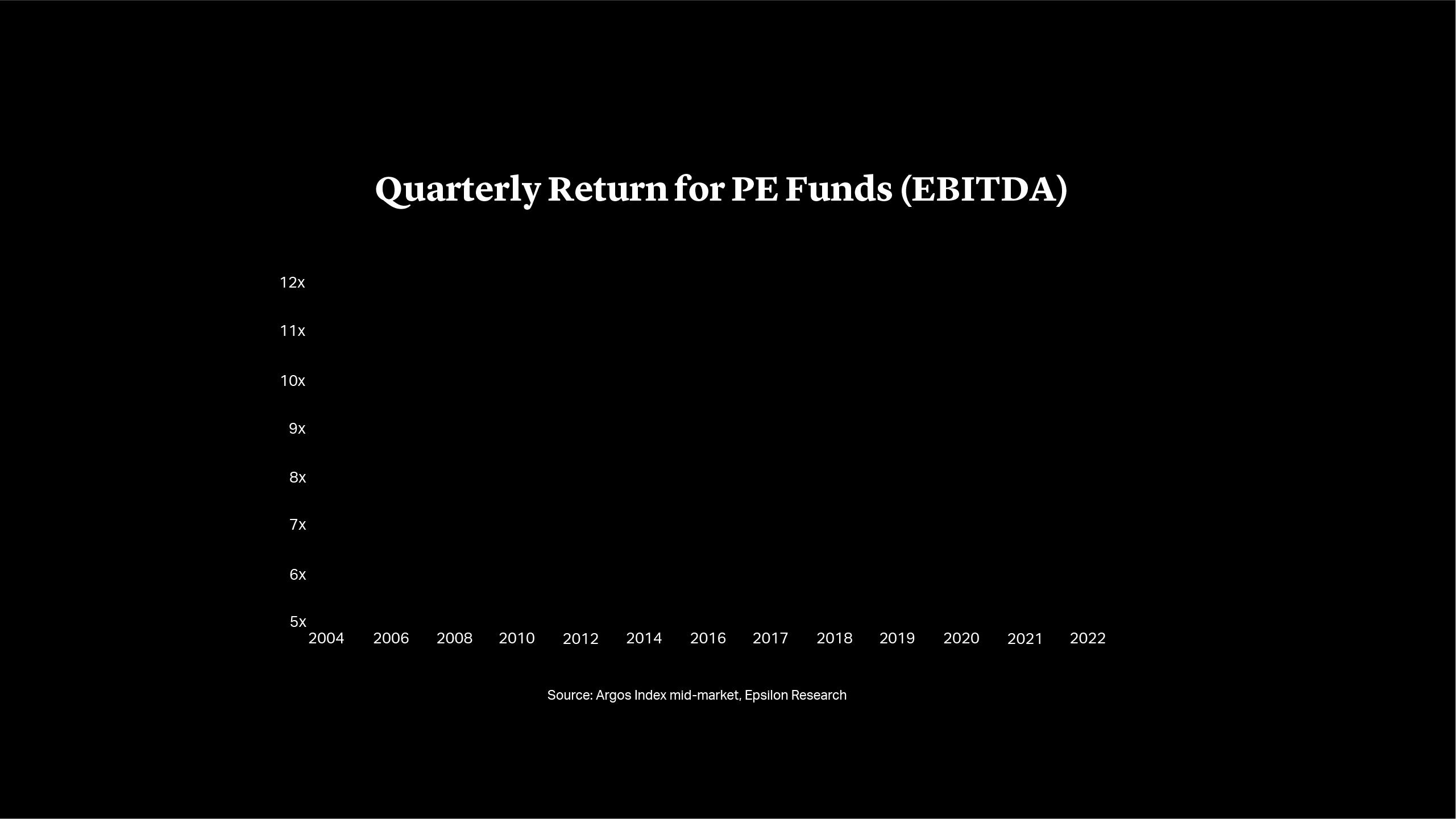

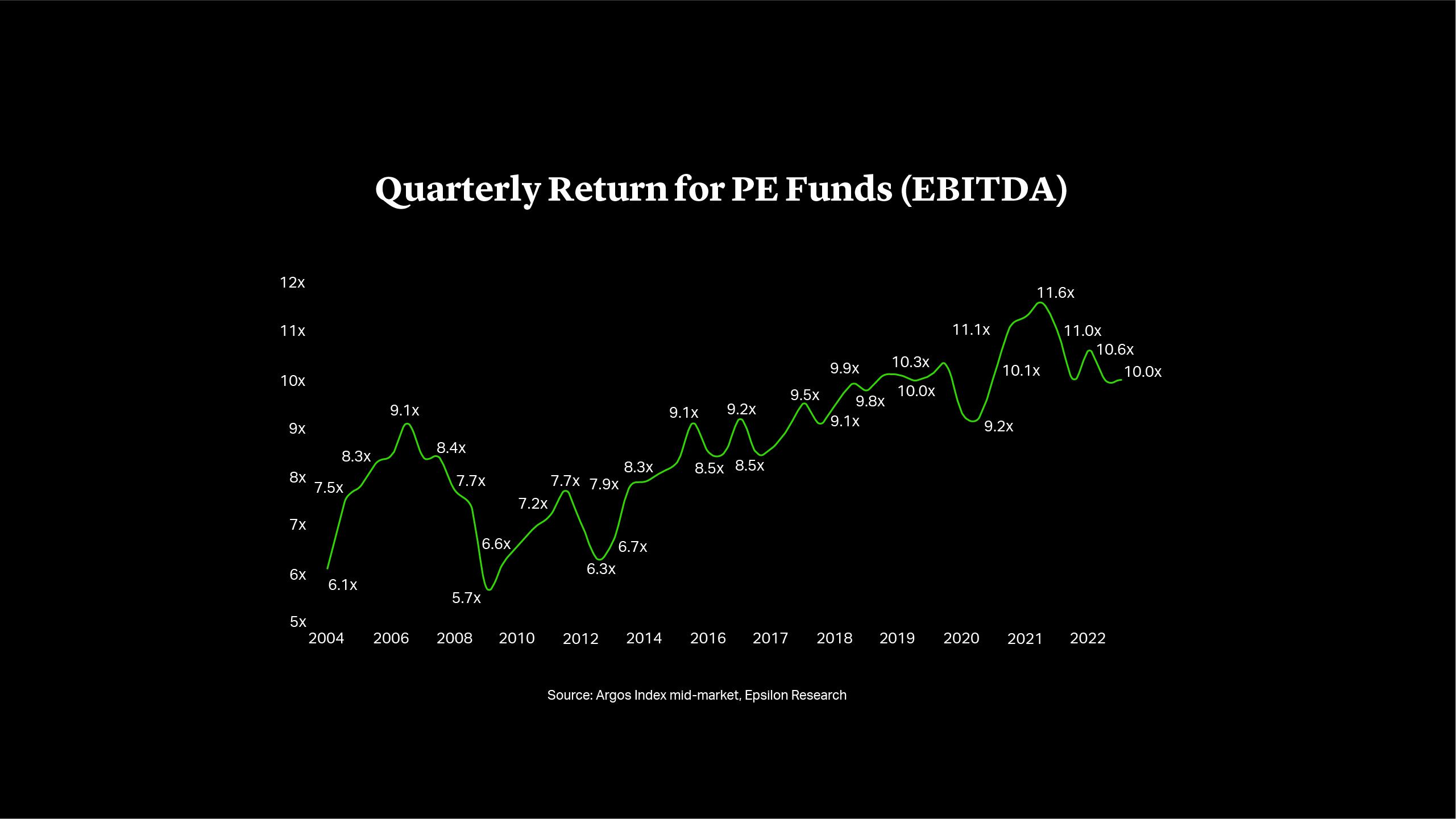

Rising interest rates and reduced availability of debt financing have a direct impact on deal valuations. From a high of 11.6x EBITDA in 2021, mid-market buyout valuations have slipped back to 10x in the third quarter of 2022 – in line with pre-COVID valuation levels8. The figures conceal quite a large divergence in pricing, however, with the highest-quality assets changing hands for 12x, while multiples for assets which may be perceived as lesser quality have continued to contract to 8.9x.

In practical terms, potential buyers are spending more time challenging sellers’ valuation expectations for assets, and companies with weaker performance are generally not being brought to market. Where they are, they present openings for more opportunistic buyers to explore more imaginative capital structures including preferred equity and warrants that offer greater downside protection for the uncertain conditions.

The need to raise working capital more frequently is also increasing pressure on start-ups – and their existing investors – to accept running funding rounds at lower valuations. Among the highest profile was Swedish fintech Klarna that took its valuation from $46bn to under $7bn in July last year9.

The prospect of lower valuations is encouraging some entrepreneurs and VCs to accept M&A deals. January was a record month for acquisitions involving European start-ups, according to data from Dealroom. A total of 378 deals were reported, including the acquisition of AI systems provider InstaDeep by Germany’s BioNTech for €362mn, and the buyout of 3D-mapping platform FATMAP by activity tracking app Strava10. More deals are likely as acquisitive companies and their backers see the opportunity to buy up rivals and acquire new technology.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group: