SFDR and Investor

Demand Put ESG

in Focus

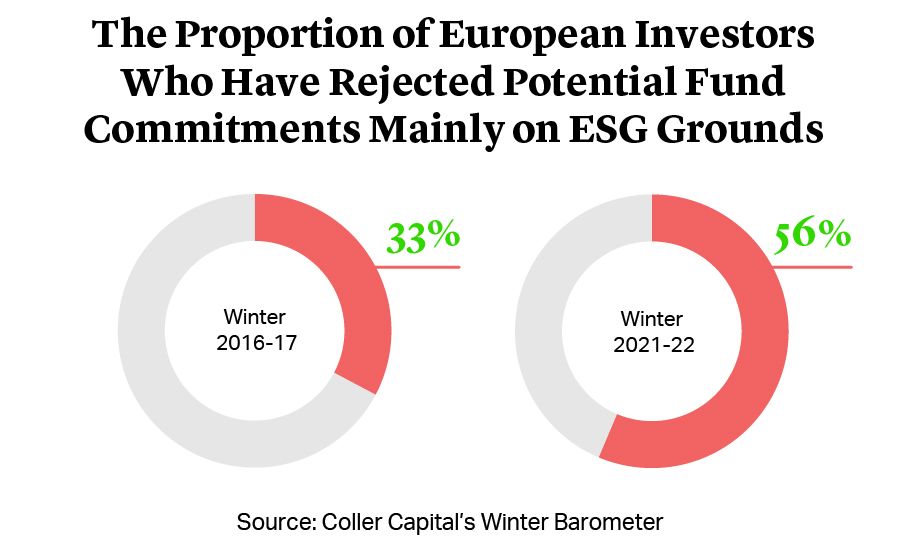

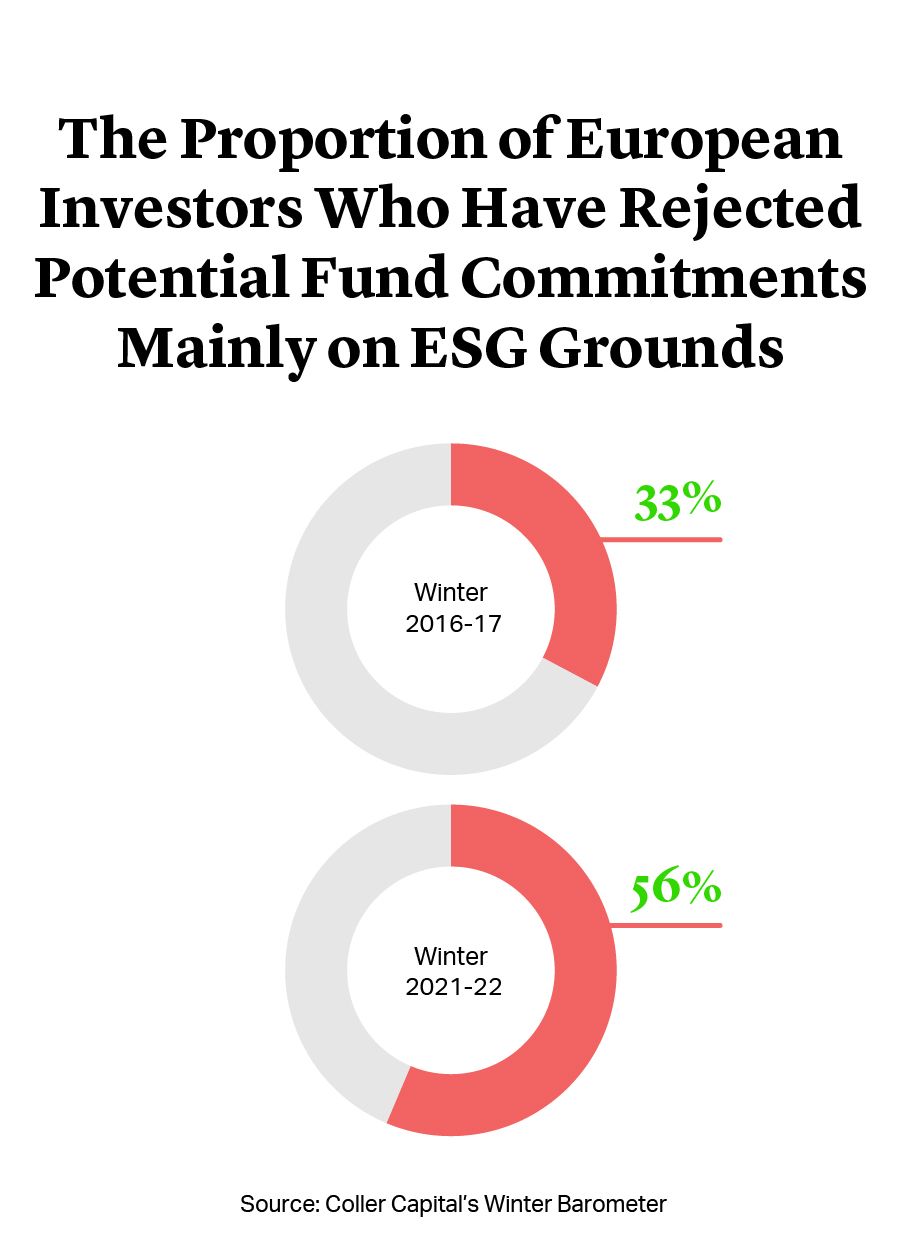

Environmental, Social and Governance (ESG) factors have risen up the agenda for private equity firms, with Europe clearly at the vanguard of the trend. The proportion of European investors who have rejected potential fund commitments mainly on ESG grounds has grown to 56%, according to Coller Capital’s Winter Barometer for 2021-22, up from around a third of investors in the winter of 2016-171.

Regulation is also driving the adoption of ESG across the private equity industry. The implementation of the EU’s Sustainable Finance Disclosure Regulation (SFDR) – introduced one year ago in March 2021 – was followed by the Taxonomy in January 2022. Together, they provide specific disclosure requirements for funds operating in the EU, as well as a framework for what constitutes sustainable investment.

Large international private equity managers have been among the earliest to embrace the rise of ESG with new commitments to climate change and social initiatives. Market leaders including TPG, Apollo Management, EQT and KKR have gone further with the creation of impact funds that seek to deliver environmental and social benefits alongside financial returns. KKR’s $1.3bn fund is focused on investment opportunities within companies whose core business focus and model provide commercial solutions to either environmental or social challenges2.

This growing focus on ESG is leading to new opportunities for firms but also comes with changes in the way they select investments and conduct due diligence, as well as how they manage their funds and investments.

Responsible Investment Initiatives Multiply

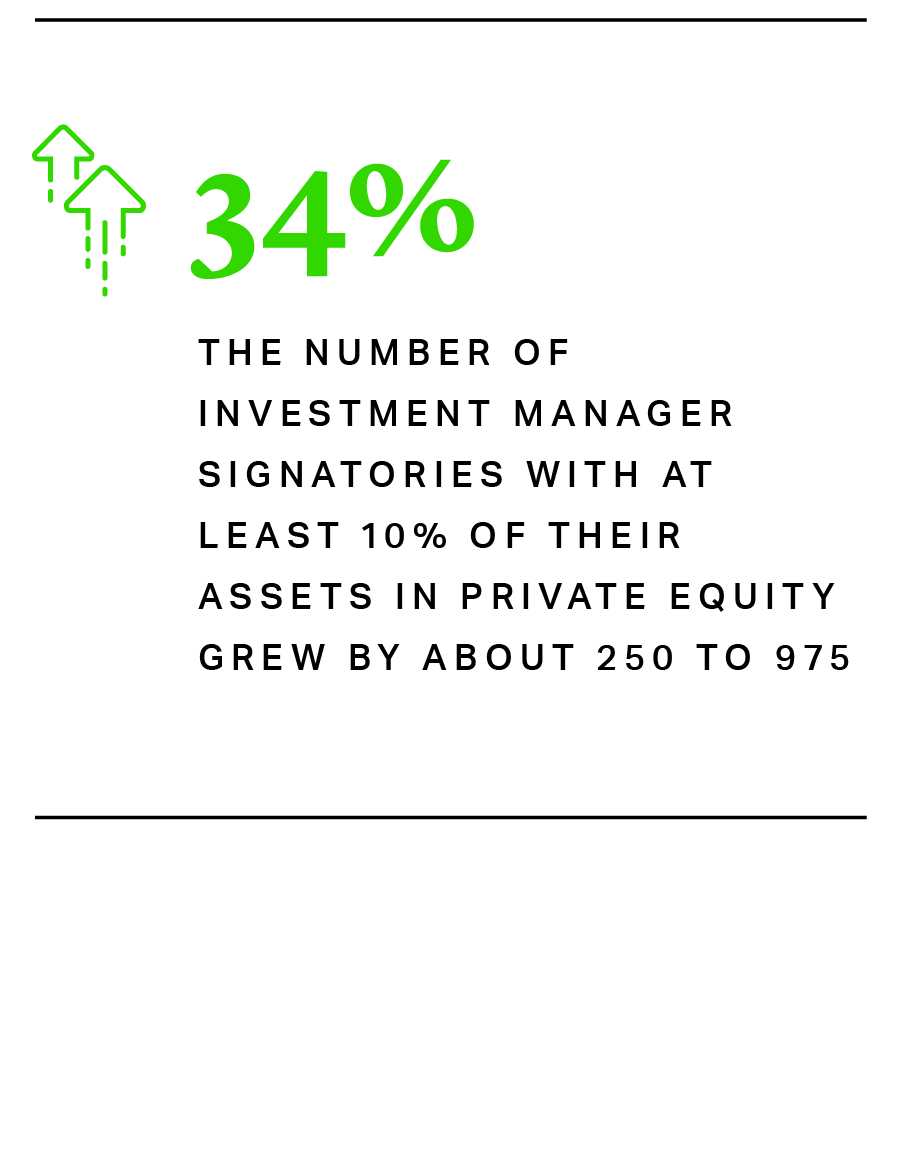

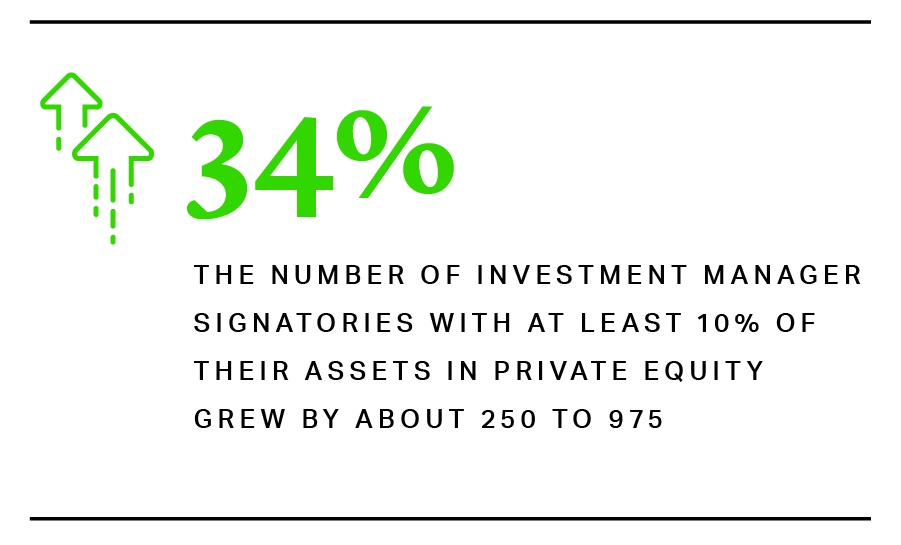

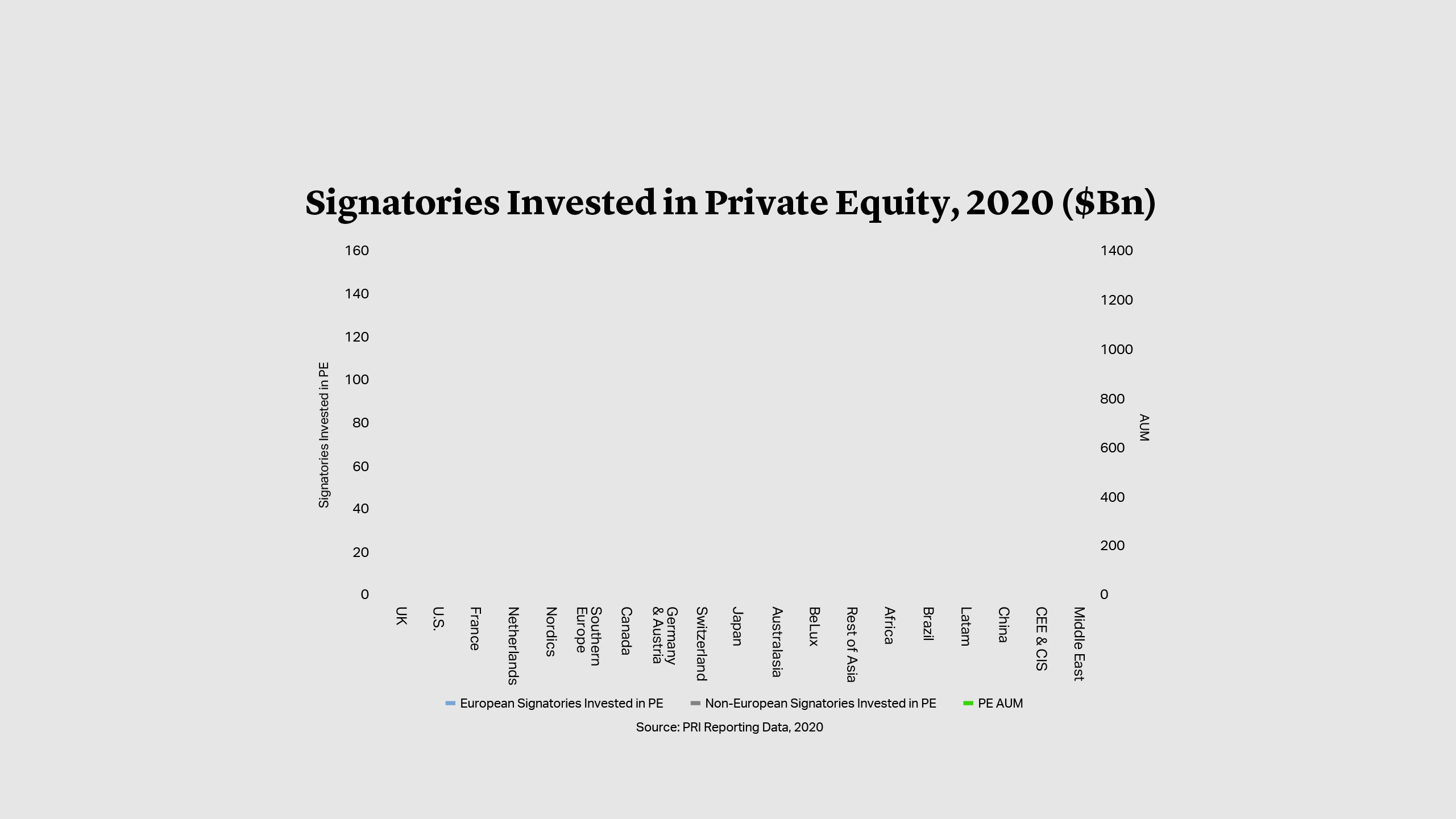

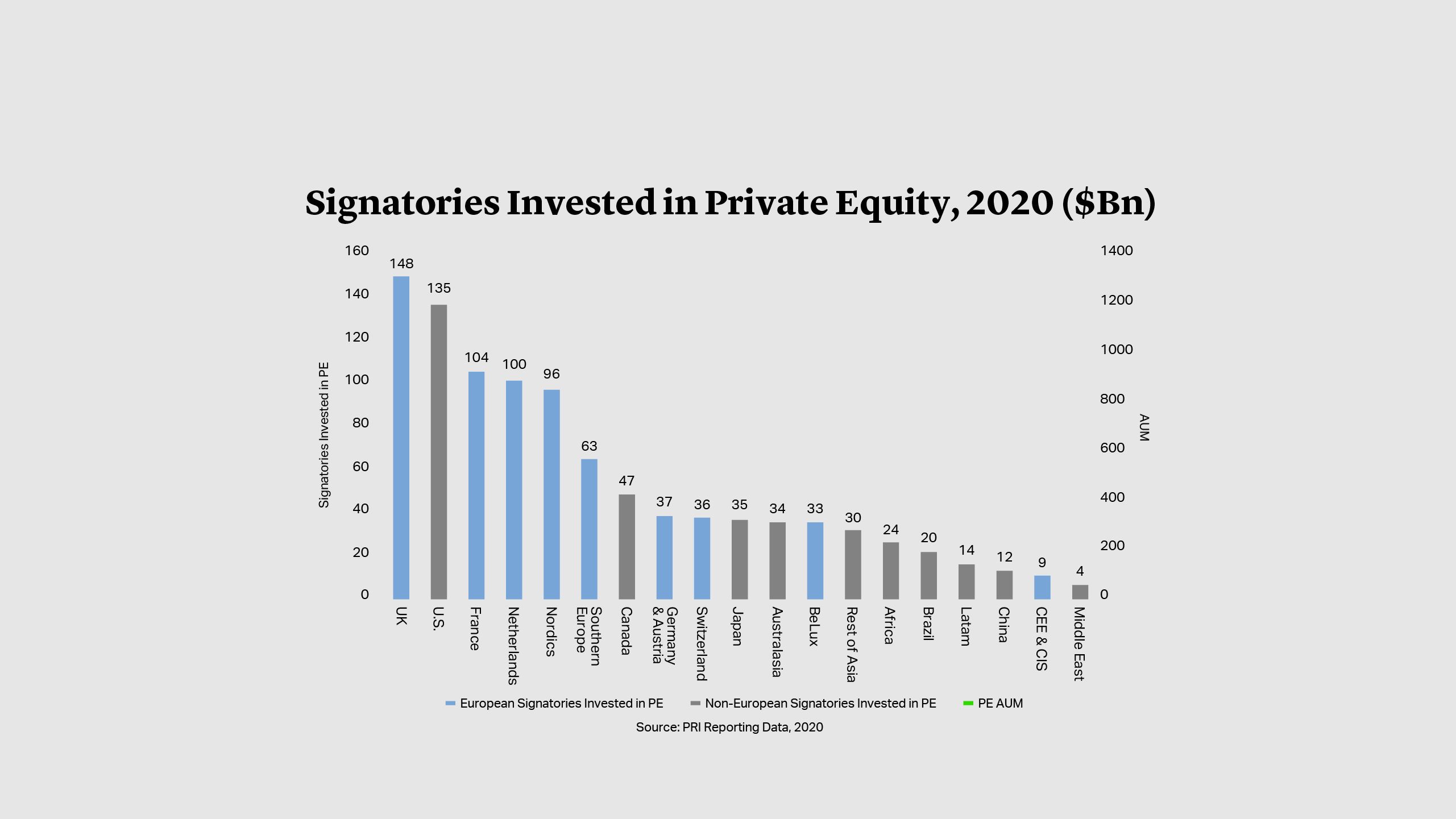

Private equity’s commitment to responsible investment went through a step change in 2021. According to the Principles for Responsible Investment (PRI), the number of investment manager signatories with at least 10% of their assets in private equity grew by about 250 to 975 – approximately two-thirds of the group’s private equity signatories are based in Europe3.

Those that sign up to PRI commit to six principles that include incorporating ESG in investment analysis and seeking appropriate disclosure from the businesses in which they invest. Many firms are making further commitments to sustainability. In February, Carlyle Group pledged to achieve net zero greenhouse gas emissions across its portfolio by 2050 or sooner. Others, including EQT, have committed to science-based targets for portfolio emissions in line with the 1.5C pathway outlined by the Paris agreement.

Alternative initiatives target the underrepresentation of women in private equity as well as diversity more generally. The Institutional Limited Partners Association has created a framework for investors and private equity firms that includes measures to track and measure employment by gender and ethnicity4.

Meeting the Rising Burden of Regulation

Pledges to achieve sustainability or diversity targets create a requirement to track performance and a responsibility to deliver results. The SFDR further places requirements on private equity managers to explain their sustainability practices and includes a classification system for their funds, labelled either Article 6, Article 8 or Article 9.

The focus of funds often depends on their size. According to EY’s 2022 Global Private Equity Survey, 52% of general partners with over $15bn in assets under management are focused on ESG initiatives and offerings, compared with just 36% of firms with less than $2.5bn in AUM.

Smaller private equity managers often do not have the infrastructure to support the higher levels of ESG analysis and disclosure. They need to weigh the increased cost and complexity of complying with Article 8 or 9 standards against the potential benefits they might enjoy in terms of greater market access. As a result, many currently choose to operate under the least onerous conditions of Article 6 and therefore do not actively promote their ESG processes, even if they have these in place.

In addition, markets like the UK and U.S. are also ramping up the fight against greenwashing and other ESG misconduct, increasing sponsors’ exposure to enforcement risk.

Incorporating ESG Into Investment Processes

Regardless of the regulatory requirements, private equity firms see financial implications in ESG considerations. Environmental, social or governance issues can create risks that could damage asset value and potential returns. The other side of the coin is the ability to identify opportunities that can transform businesses and materially add value.

ESG opportunities and risks are addressed as an important part of the due diligence process for most sponsors. Increasingly, private equity firms are using specialist ESG advisors to supplement the information gathered by their legal teams and bankers. Questions may dig deep into the target’s ESG compliance programme. Gaps or risks that are identified may not necessarily block an investment but can help shape strategies to get the company up to speed. As a consequence, deal teams are increasingly focused on ESG issues in the investment process, in order to ensure that these issues are managed.

Institutional investors will increasingly conduct their own ESG due diligence on private equity managers, and closely monitor firms’ performance. Their expectations are also increasing. Where investors were previously willing to accept confirmation that a sponsor seeks to take account of ESG considerations as part of their investment processes, many investors are now requiring active monitoring of investments for potential ESG risks and regular reporting on the implementation of ESG processes within portfolio companies. This is placing a higher standard of disclosure and transparency before all investors.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

London

T: +44 20 7614 2219

mjames@cgsh.com

V-Card

Ferdisha Snagg

Partner

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE