Private Equity

Market Snapshot

March 2022

The pace of private equity activity eased in January as volatility on international markets, inflation and interest rate rises created a degree of uncertainty for buyers and sellers alike. Global private equity investment declined by 55% to $42bn against a fast-paced December and was down 15% versus the opening month of 2021, according to Refinitiv data1. However, perspective is needed: the high benchmark of deal activity in 2021 accentuated the appearance of slowing activity, with January 2022 nevertheless standing as the third strongest start to the year since Refinitiv’s records began in 1980.

Analysis of private equity activity in 2021 continues to underscore how high the benchmark has been set. Overall UK private equity investment reached £159bn2, and behind headline-grabbing mega-deals, a record year for UK mid-market private equity deals was set, KPMG research shows. The number of investments in the mid-market was up 40% to 803, while mid-market capital invested hit £47bn. Sponsors’ focus on technology companies has been intense, particularly fintech in which Europe and the UK have been carving a niche. KPMG also reports that global fintech investment reached $210bn in 2021, with UK investment increasing sevenfold to $37bn – five of the ten largest EMEA deals in the sector were completed in the UK3. Britain is not the only country to see a leap in startup investment though, with venture capital investment in the Netherlands trebling to €5.3bn in 2021, according to the Dutch Startup Association and Techleap.nl4.

Mid-market private equity firm Inflexion bought Enviolo, a U.S. and Netherlands-based manufacturer of transmission systems for e-bikes. The company has a strong portfolio of products that it provides to local and international brands. The investment will enable Inflexion to tap into the growth in e-bikes and demand for more sustainable mobility. Meanwhile, the company will benefit from Inflexion’s network in large markets including the U.S., China and India.

Investment Expected to Remain Robust as Sources of Uncertainty Change

Rising interest rates have the potential to weigh on valuations and dealmaking in the technology and growth space. The Bank of England raised interest rates for the second time in three months in early February to tackle persistent inflation, marking a divergence in policy from continental Europe. However, while there is new uncertainty over the trajectory of economic growth, the withdrawal of restrictions in the fight against COVID-19 is removing other sources of volatility.

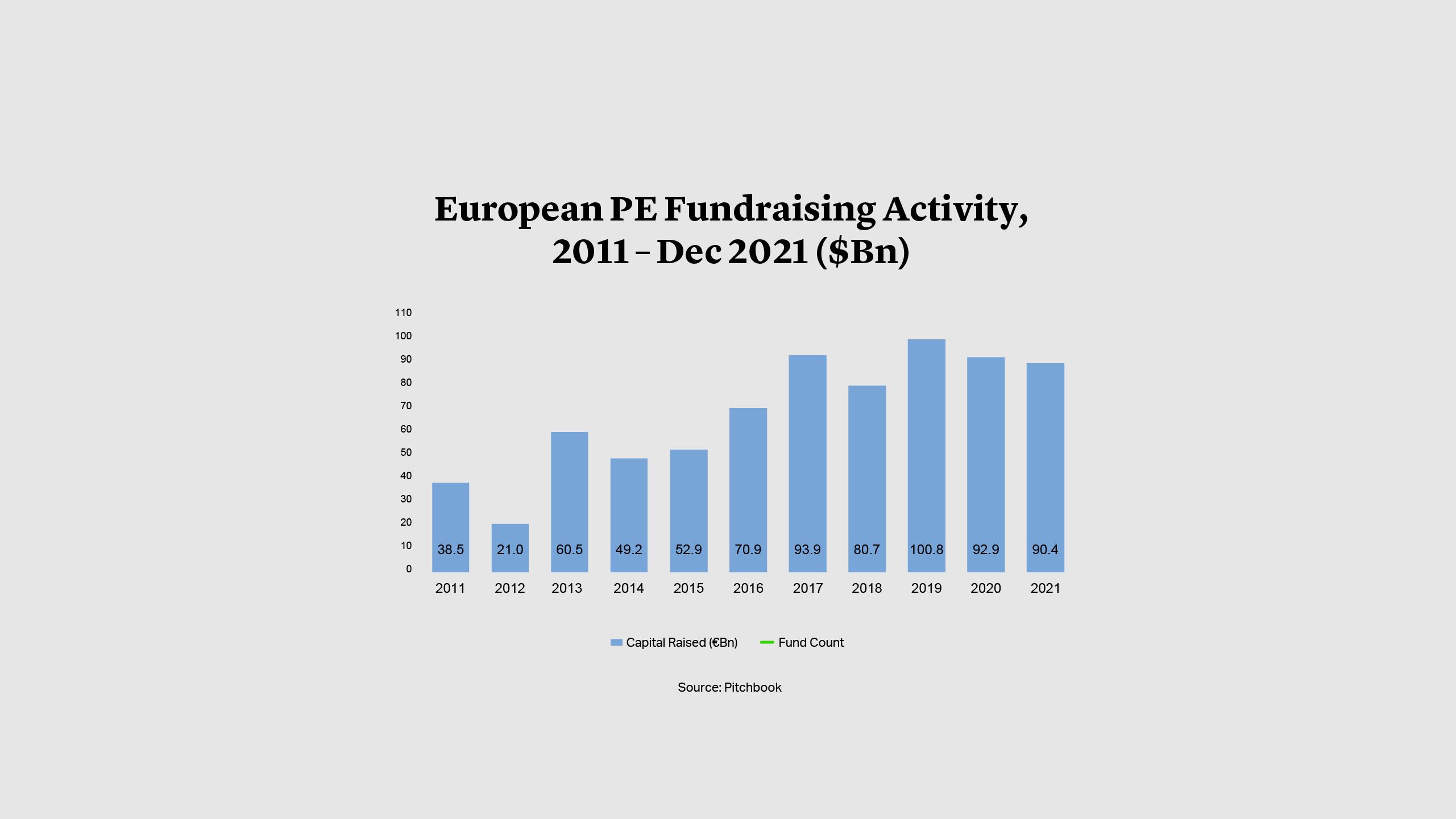

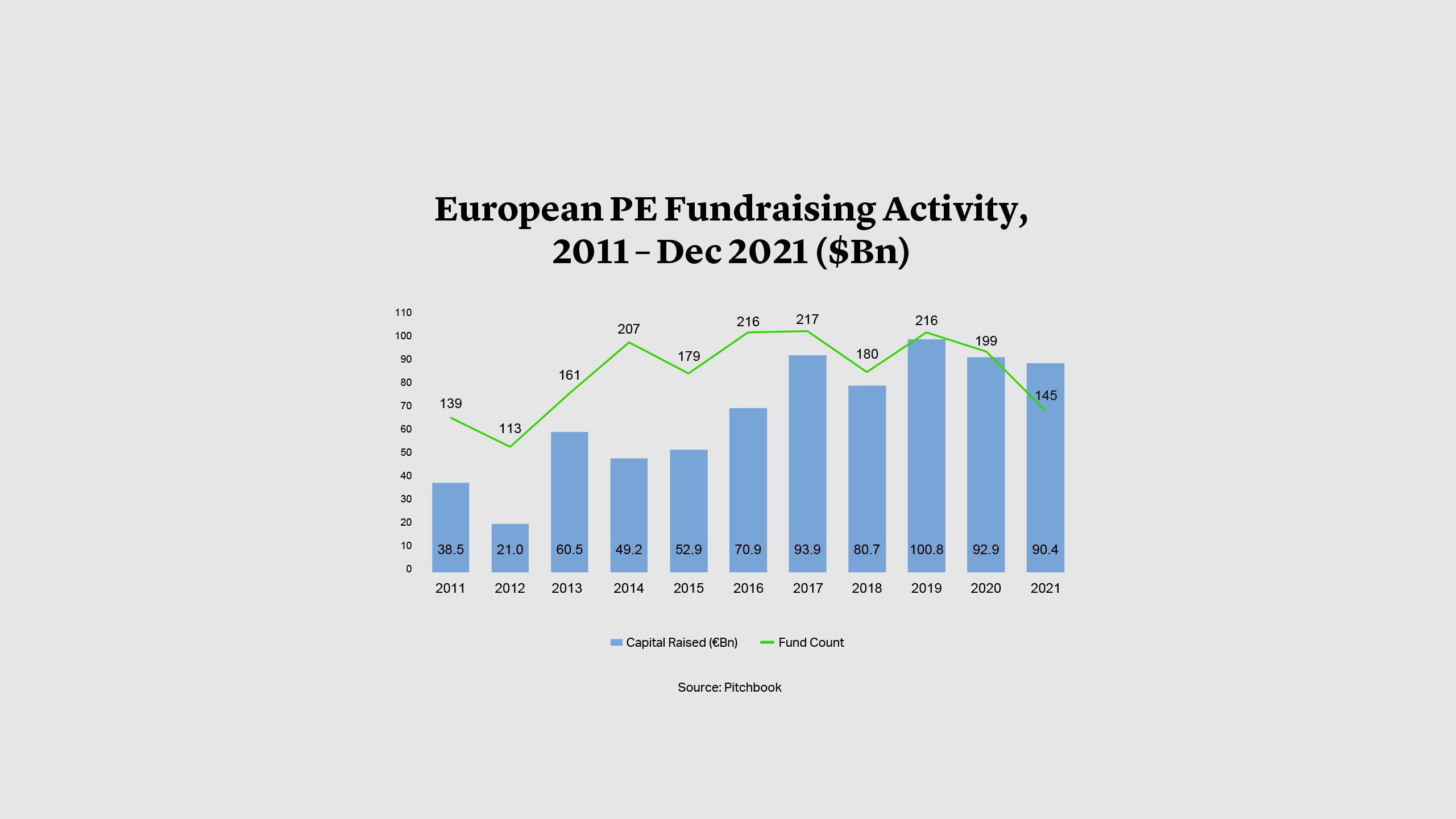

Many drivers of activity remain strong. Capital raised by European private equity was over €90bn in 2021, keeping dry powder close to its historic high at €269bn – with large amounts of capital committed in 2019 and 2020 still to invest, PitchBook data shows5. Moreover, over 40% of the capital in 2021 was allocated to just four firms – in keeping with the global trend of concentrating funds in the hands of large managers – maintaining sponsors’ impetus to do large deals6. While many commentators believe that 2022 will struggle to match the highs of 2021, we do see a restart of deal processes that were put on pause as 2021 drew to a close, indicating that high levels of both exit and investment activity will continue.

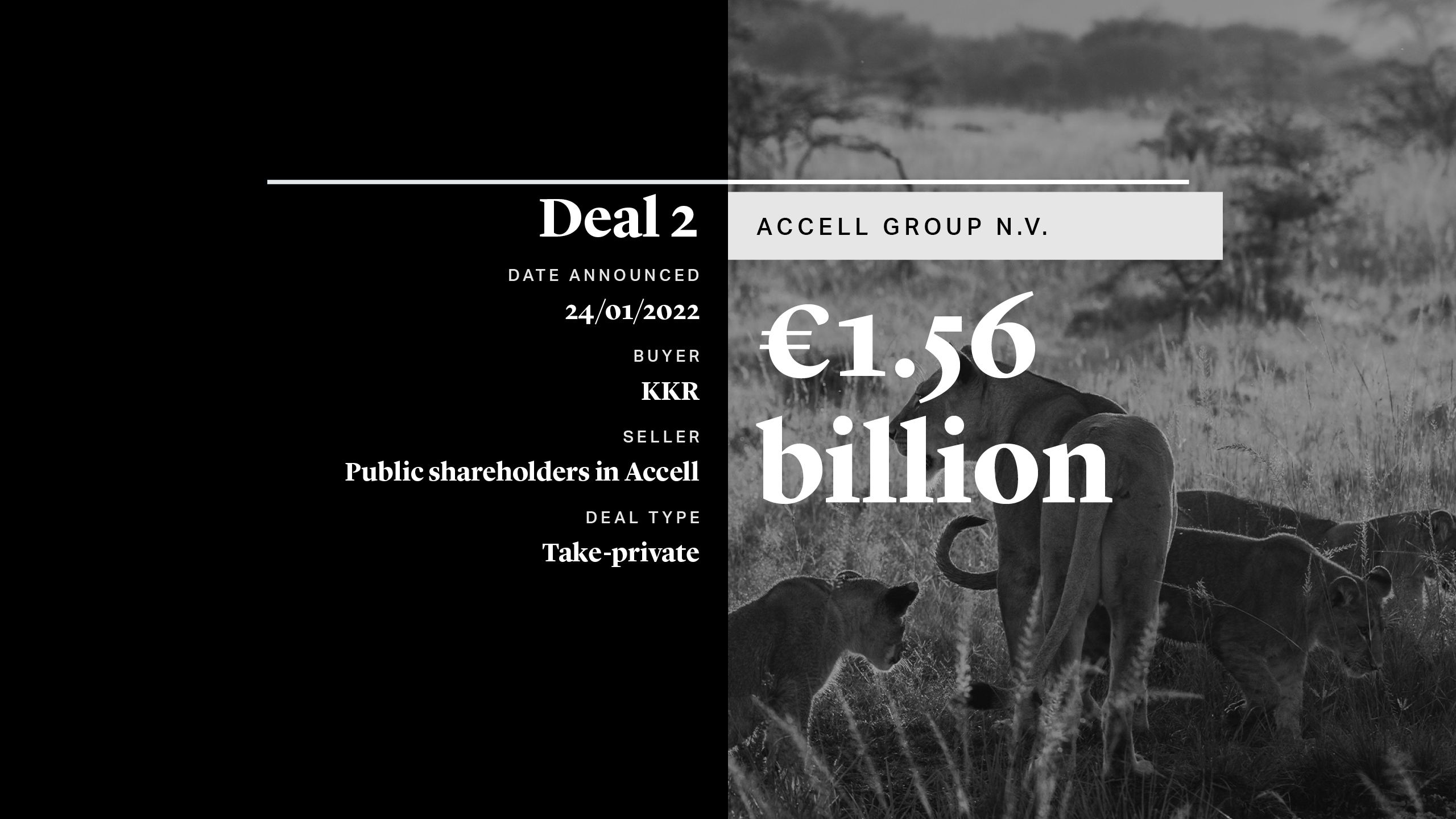

KKR put forward an offer for the Dutch listed owner of the Raleigh bicycles brand that was priced some 42% above the company’s recent average share price and 21% above its highest-ever price7. The proposed investment comes with working capital to help finance inventories and smooth the pressures of supply chain bottlenecks for parts. An approved deal would see Ton Anbeek stay in place as CEO of the private company. In an interview promoting the investment, Anbeek welcomed the long-term view of private equity, which he differentiated from the short-term approach taken by public markets8.

Investor Activism Driving Investment Opportunity

The rise in investor activism in Europe is beginning to create new opportunities for private equity. One driver is ESG concerns among investors that are leading to the spin-off of unwanted businesses. For example, hedge fund Third Point has built up a stake in Royal Dutch Shell and is calling for the oil and gas major to separate its legacy fossil fuels business from its more attractive renewable energy division. Such spin-offs have provided a rich seam of activity for sponsors.

Another is more simply the extraction of value from underperforming shares. Corporate advisory firm Alvarez & Marsal estimates that 148 European companies are at risk of being targeted by activist investors over the next 12 months, a 10% increase since its last market update in April 20219. As a result, private equity sponsors are poised for opportunities. The co-head of Carlyle Group’s European buyouts said that the firm is on the lookout for large carve-out deals10, and many in the industry are similarly keeping an eye on corporate Europe.

Among those receiving attention is UK pharma group GSK, which rejected a £50bn bid for its consumer healthcare division from consumer goods group Unilever, itself the focus of activist investors. Banks have been reported to be working on a financing package of up to £25bn should private equity firms be interested in bidding for the business11. While by no means certain, a private equity deal would far eclipse the €17bn pre-pandemic buyout of Thyssenkrupp’s elevators division by Advent International and Cinven in early 2020.

Activism is also stirring the rise in deal structures that seek to bridge the valuation gap between buyers and public shareholders.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE