Private Equity

Snapshot

May 2022

Private equity activity has remained resilient in the face of intensifying pressures. While global M&A decelerated in the first quarter, new data from Refinitiv shows that private equity investment actually enjoyed its strongest ever start to the year. Globally, firms agreed $347bn of investments in the first quarter, including almost $97bn across Europe – a 17% regional increase on the same period of 2021.

Buyers clearly remain circumspect given the geopolitical situation, which has contributed to significant supply chain disruption and rising energy costs, with inflation jumping sharply. The path of COVID globally, while a much less significant consideration than in the past, remains in the background as a source of some uncertainty. The banks are still lending, although there is greater caution and diligence of business risks, resulting in higher pricing, higher fees and potentially increased security. To finance deals, sponsors are increasingly considering private debt, or a combination of private debt and bank loans, such as the finance package raised for KKR’s reported bid for Spanish fertility clinic Ivirma, valued at up to €3bn1.

Take-Private Appetite Returns

After a brief hiatus, private equity interest in listed companies has picked up. UK equity markets strengthened in the first quarter, with the FTSE 100 up almost 2% as many other indices around the world declined. Nevertheless, shares are below their pre-COVID highs, and this has continued to attract international sponsors to UK-listed companies that benefit from international footprints. Bidders might feel that the more challenging economic outlook could have dented the confidence of company boards.

Around the end of March, a consortium of Elliott Management’s private equity arm and Brookfield agreed a $16bn takeover of UK-based TV ratings group Nielsen2. A go-shop clause valid for 45 days allows Nielsen’s advisers to seek a higher potential bid, potentially from rival private equity firms. Fashion company Ted Baker announced plans to put itself up for sale in early April after attracting no fewer than three private equity bids, including one from the former owner of the Kurt Geiger and Nine West chains, Sycamore Partners. The take-private path is not always smooth, however: around the same time as the bid for Nielsen was agreed, after a number of approaches, Apollo Management declared its decision to walk away from a £7bn bid for listed UK education group Pearson3.

While it is expected that 2022 will not see the same number of “mega-deals” as 2021, appetite for large take-privates has not disappeared. Elon Musk’s bid for Twitter captured global media attention and stimulated talk of private equity interest. It was not the only potentially ground-breaking pursuit of a listed target. In early April, the holding company for the Benetton family confirmed that it was investigating a bid for Italian infrastructure group Atlantia – in which it is a major shareholder4 – alongside Blackstone, which resulted in a bid giving the company an enterprise value €54bn5. If successful, it would be Europe’s largest private equity-backed buyout by some margin, with the approach reported to have flushed out competing interest from other private equity firms, as well as strategic buyers.

There is also significant appetite for large private companies in core sectors such as technology. EQT and partner TA Associates agreed to sell a large minority stake in Swedish-founded enterprise software firm IFS to Hg at a $10bn valuation6. The deal includes WorkWave, a provider of software solutions for field service management that has a particular stronghold in the U.S. pest control industry.

VC Investment Moves Across Europe

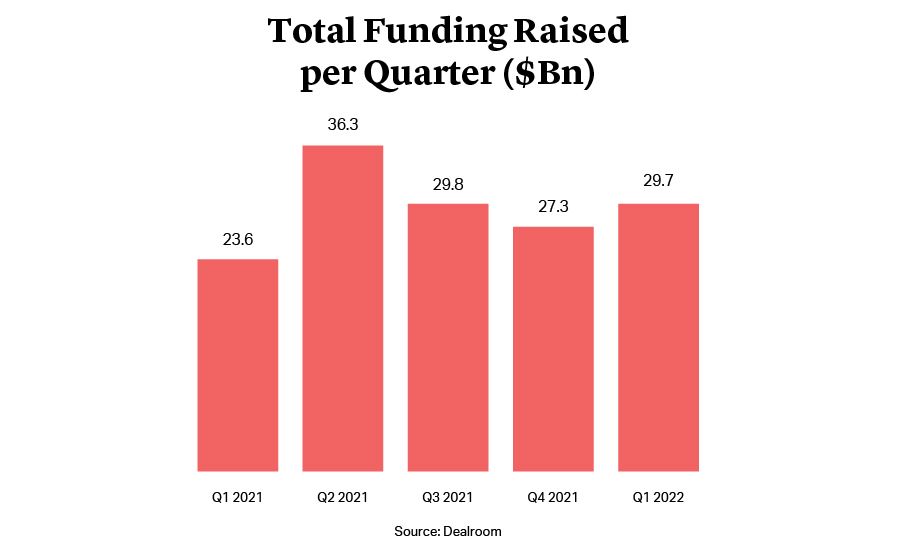

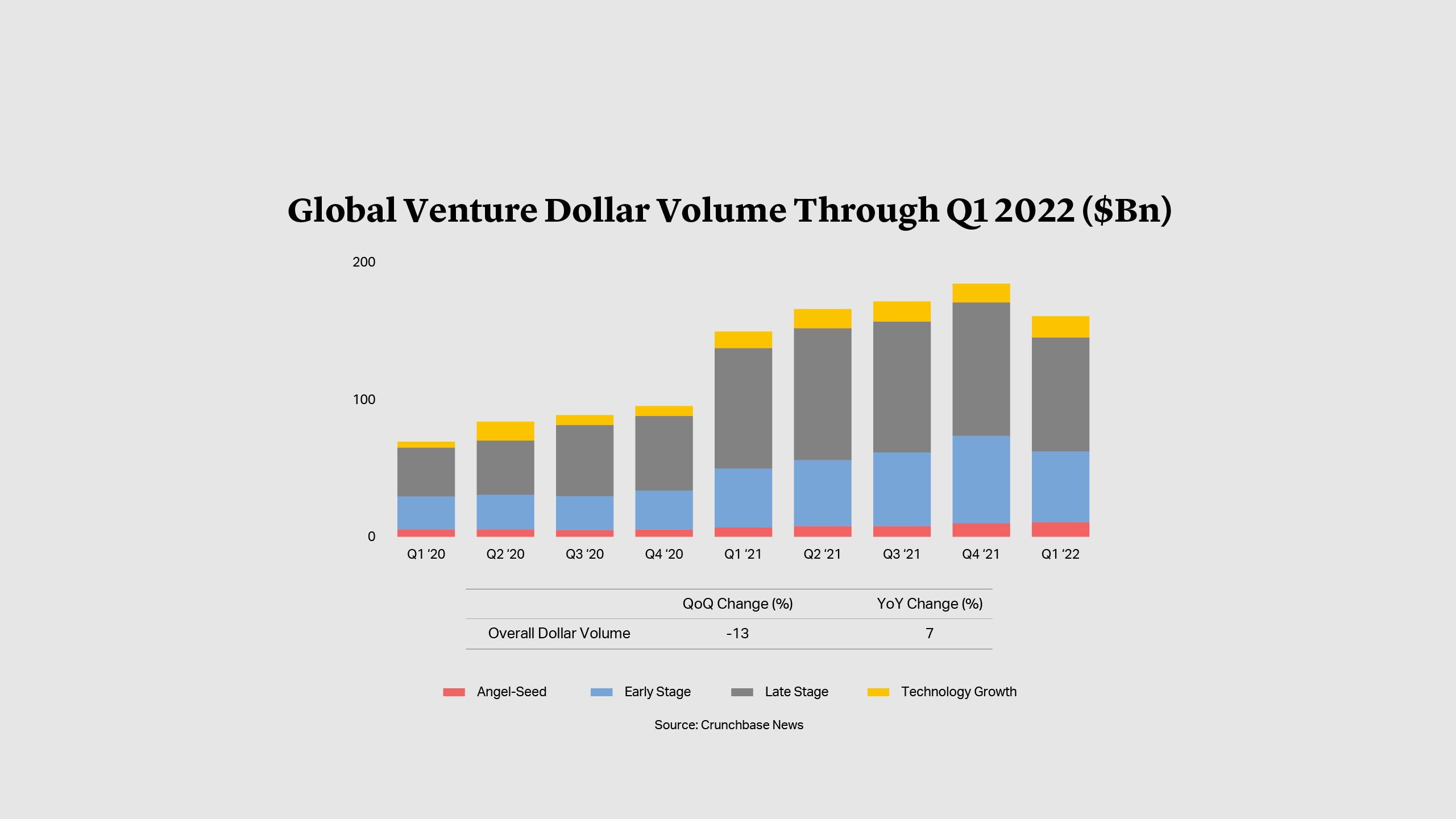

VC activity has decelerated compared with the fast-paced funding rounds witnessed towards the end of 2021. According to Crunchbase data, the first quarter was down 13% on the final quarter of last year at $160bn globally. However, it was up 7% on the first quarter of 20217. Europe is similarly off to a strong start with $30bn invested and 17 new unicorns created, based on Dealroom research cited by Sifted8.

The continent continues to carve a strong position in fintech. UK start-ups in the space raised $11.6bn in 2021, far ahead of other European markets, and over 200% more than in 2020. However, they still lagged the U.S. fintechs which raised $46bn last year9.

While the UK remains a dominant force in venture, thanks in large part to the Golden Triangle uniting the university hubs of London, Oxford and Cambridge, other European countries are rising fast. According to data from EY, Germany was Europe’s second country for venture investment in 2021 with a record figure of €17.4bn, a 229% increase on the prior year, and hosted half of the ten largest capital raisings10.

Late-stage funding in Germany has continued strongly in 2022 with electric flying taxi developer Volocopter raising $170mn at a $1.7bn valuation in March, while supply chain and digitised freight forwarding solutions provider Forto raised $250mn at a $2.1bn valuation from investors including Japan’s SoftBank.

Strong Fundraising Fuels Investment Demand

With IPO markets in Europe effectively closed due to market volatility, the prospect of postponed listings is high. However, continued strong fundraising means that start-ups should be able to access further private funding and avoid cash shortages. U.S. VCs had their strongest fundraising quarter on record in the first three months of 2022, raising $74bn, according to Pitchbook and the National Venture Capital Association11. Many of those funds look into Europe to access start-ups at potentially lower valuations than available in the US.

Fundraising for private equity is set to be competitive in 2022. Blackstone revealed that its latest fundraising cycle should see it seek $150bn across funds and strategies, with reports suggesting that its ninth global private equity fund could target $30bn, with a similar ambition expected for Hellman & Friedman when it launches its next fund later this year12. Meanwhile, Advent International is said to be nearing the close of its $23bn tenth fund13. With large volumes of capital to deploy, we expect strong continued appetite for investment across Europe.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE