Drilling Into Oil

& Gas Opportunities

in Europe

Rising commodity prices are fuelling new opportunities for private equity in the European oil and gas industry, with the protracted conflict in Ukraine and sanctions on Russia further exacerbating issues of supply. While sustainability and the reduction of fossil fuel consumption remain paramount for many investors and sponsors, the use of fossil fuels will remain a practical reality until alternative energy sources are sufficient to meet demand. Rising prices, as well as concerns in many parts of Europe over energy security, are accordingly driving more investment into fossil fuel assets.

The squeeze on energy prices started last year as the recovery in demand for energy following COVID-19 highlighted weaknesses in the transition to renewable energy. With Europe focused on climate goals, including a 55% reduction in greenhouse gas emission by 2030 compared with 1990 levels, stockpiles of natural gas dropped to 56% of capacity at the end of 2021, some 15 percentage points lower than usual1. Conflict has further constricted energy supply and sent commodities prices even higher. The price of Brent Crude – the global benchmark – is up some 30% this year, briefly peaking at its highest level since the global financial crisis2. Meanwhile, natural gas prices have climbed more than 70% year-to-date and are up 150% for the year3.

Private Equity Moves Back Into Fossil Fuels

Private equity investment in the oil and gas sector picked up in 2021 as overall investment soared. By the close of the year, buy-side deals in the energy and power sector totalled $149.3bn globally, according to Refinitiv data. In Europe, these included U.S. firm Postlane Partners’ acquisition of the Danske Shell refinery, and the $1bn purchase of Spirit Energy’s Norwegian oil and gas operations by Sval Energi, a company backed by Norwegian private equity firm HitecVision4.

A strong start to 2022, with $35.5bn worth of international private equity investment, suggests this trend could continue. Citing issues of energy security, Sval Energi announced in early April that it would double gas production from its Duva field almost immediately, releasing enough energy to heat an additional 350,000 UK homes per day5. Other investors are expanding their reach in Europe. In April, Israeli conglomerate Delek Group, a major player in the Levant Basin, announced its $1.5bn acquisition of Siccar Point Energy – backed by Blackstone and Bluewater – taking it into the Cambo oil field near Shetland.

Investors have responded to the uptick in activity in the sector and the political demand for secure lines of supply for domestic energy consumption. Private equity firms are citing increased investor interest and are raising new funds to tap into opportunities6. U.S.-based infrastructure fund I Squared Capital has said it is looking for investments in the LNG sector in Europe after raising $15bn for its latest fund, exceeding its initial target by 25%7.

Negative Perceptions Require Planning for the Future

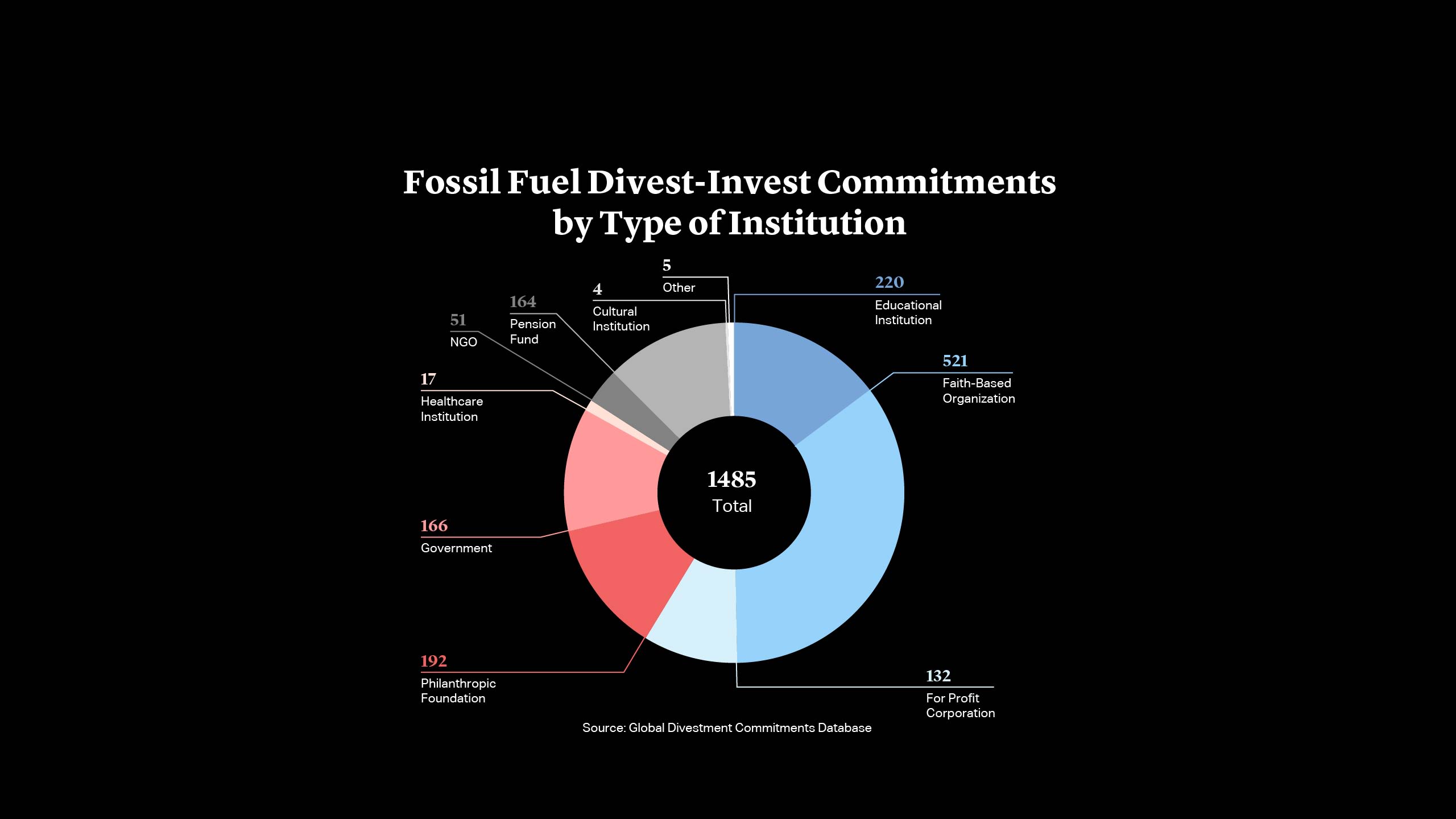

The investment story is not without complexity. Rising opportunities and need for investment in oil and gas comes as many large institutional investors seek to exit fossil fuels. Dutch pension fund ABP announced a plan last October to divest €15bn of coal, oil and gas assets by 2023, joining some 1,500 organisations around the world who have pledged to dispose of $39tn of assets in the sector, according to data from DivestInvest8. Having publicly committed to divestments and carbon reduction, many of these institutional investors are unlikely to pivot back to investment in fossil fuels, irrespective of the changing geopolitical landscape.

Private equity investment in the sector is also drawing some negative public attention. The Private Equity “Dirty Dozen” report published by the Private Equity Stakeholder Project highlighted the fossil fuel assets of 10 of the largest private equity groups9. Individuals in the private equity industry have faced protest and negative press with activists demanding that the John F. Kennedy Center for the Performing Arts in Washington drop The Carlyle Group co-founder, David Rubenstein, from the board trustees over the firm’s involvement in fossil fuels10.

Longer term, the potential for stranded and/or underperforming assets as a result of public pressure needs to be taken into account by private equity sponsors. Some are developing dual-track strategies to address this: for example, at the same time as investing in oil and gas production for now, HitecVision is also focusing on renewable energy for the future. In March, the firm announced the creation of a new venture alongside power company TrønderEnergi with an initial investment capacity of up to NOK20bn (€2.1bn). Other investors are looking to transition fossil fuel assets to more renewable sources. Postlane, for example, plans to transform the Danske refinery, which can handle 3.4 million tons of crude oil annually, into a carbon-neutral facility for biofuels and green hydrogen.

Opportunities in the European oil and gas industry have become more attractive for private equity sponsors. Nevertheless, buyers need to be aware of the challenges and negative attention the sector generates, and have a clear strategy in mind for the future of their assets.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE