Private Equity

Market Snapshot:

September 2022

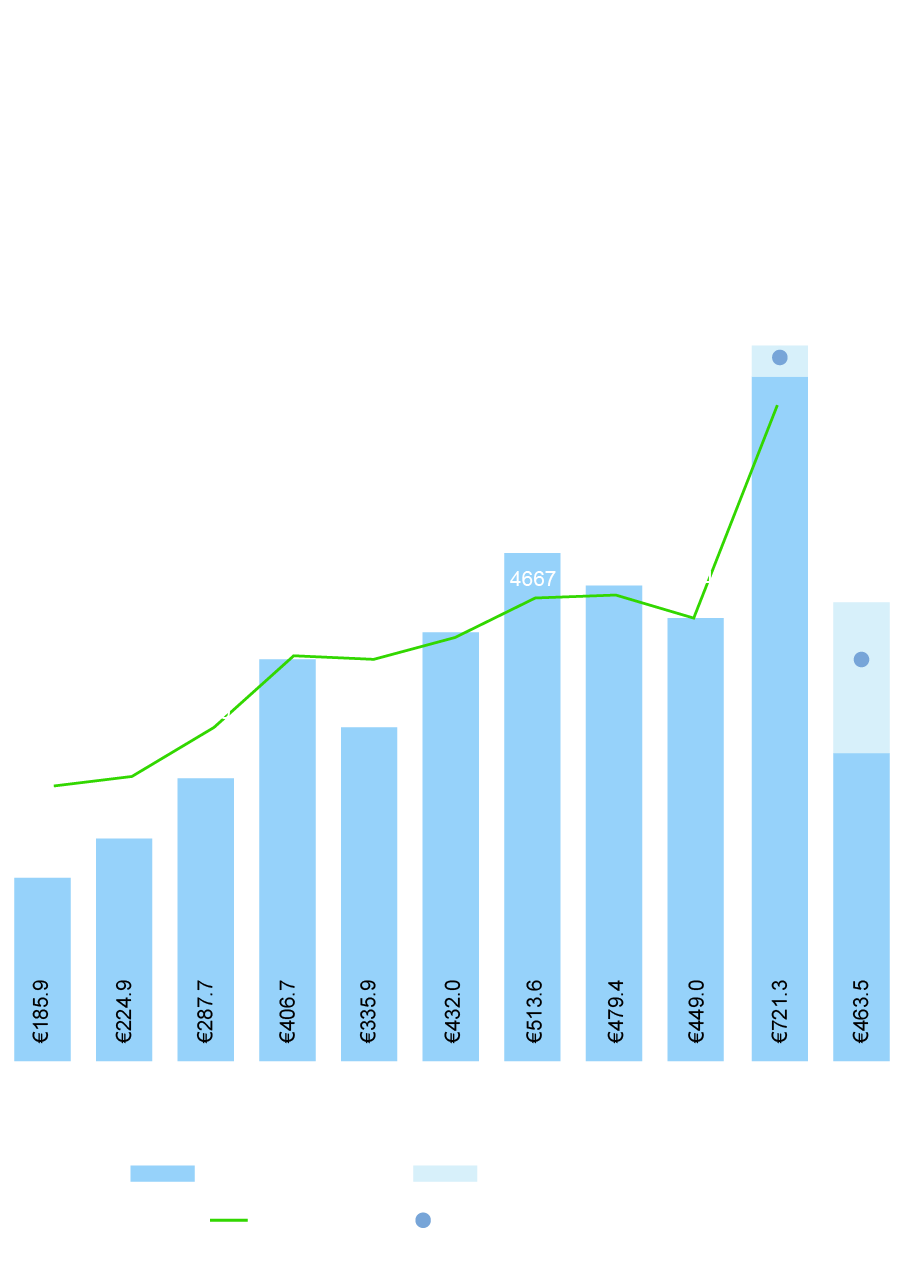

Private equity activity has remained remarkably resilient in Europe in 2022, despite the pressures of rising inflation and interest rates, combined with persistent concerns about the effect of the ongoing Ukraine conflict. In fact, the value of investments in Europe actually accelerated during the first half of the year, with activity up 35% on the same period in 2021 to €463.5bn, according to PitchBook.

Large investments were the clear driver of European deals as the number of transactions increased at a lower rate. Blackstone’s recapitalization of Dutch logistics business Mileway stood as the largest deal of the first half of the year at €21bn, a figure which could be exceeded should the firm’s bid for Italian infrastructure group Atlantia alongside the Benetton family go ahead at an expected valuation of €54bn.

Economic Conditions Cast Uncertainty on Investment Outlook

Working through deals in progress or already planned should take the industry well into the second half. However, questions about the strength of the pipeline for late 2022 and early 2023 are getting louder as macro conditions remain highly uncertain.

The European Commission’s consumer sentiment reading dropped to -27 in July, its lowest ever level, over concerns about high inflation and weakening economic growth1. In the face of reduced gas supply, German authorities have discussed potential energy rationing for businesses and consumers2. UK consumers and businesses face similar challenges from spiralling costs, with the Bank of England warning of a protracted recession as inflation exceeded 10% for the first time in the current crisis3. Winter in Europe could be a challenging period.

Against this backdrop, companies that have the ability to pass on higher prices, such as inflation-linked infrastructure assets, or healthcare businesses, remain firmly in focus for sponsors. Companies with secular tailwinds are also seen as more attractive. While interest in oil and gas businesses has been renewed by higher commodity prices and demand, firms are also investing more in renewable energy. Through late May, global investment in the renewable energy space was up 144% to $12bn, according to S&P Global Market Intelligence data4.

Deal Multiples Decline as Debt Funding Tightens

Although investment activity has remained robust throughout the first half, asset prices have come under increasing pressure. Median European deal multiples that reached 14x EBITDA in 2021 amid the COVID-19 recovery, softened to 11.4x in the first half of 2022, PitchBook data shows. The fall was entirely due to a contraction in the debt multiple from 7.5x to 4.8x, while equity multiples remained in line with recent trends5.

Banks in Europe and the U.S. are reported to be offering discounts to investors for debt still on their books which was lent before the sharp spike in interest rates, leading to heavy losses on some deals6, including Clayton, Dubilier & Rice’s £10bn take-private of UK supermarket Wm Morrison last year7. As a result, traditional bank lending for leveraged buyouts can be hard to secure, with private equity firms turning to private debt funds for alternative financing. In some instances, sponsors are funding the entire acquisition with equity in the expectation of securing debt financing in the future.

We continue to see robust valuations for the most resilient and in-demand companies, but equally have witnessed price renegotiations between buyers and sellers for businesses expected to be impacted by deteriorating conditions. It is also clear that multiples for deals in the mid-market space are dropping. The Argos Index (from Argos Wityu and Epsilon Research) shows multiples of 10x EBITDA in the second quarter, down 14% from a year earlier, with the number of investments concluded at less than 7x increasing to some 20% of all European investments8.

Exits Diminish, Reducing Investor Appetite for New Funds

Exits have decelerated in 2022 as many firms opt to hold onto assets for longer – either until valuations improve or businesses trade through challenging periods. Global exit value fell 37% in the first half of 2022 to $338bn, according to Bain & Co, with public market divestments particularly hard hit9. EY data shows that all European IPOs raised just €4.8bn in the first half, a 10-year low, with the largest listings in the second quarter dominated by special purpose acquisition companies (SPACs)10.

The reduction in distributions, combined with the denominator effect weighing on large institutional investors, is beginning to impact appetite for new funds. Fundraising fell by $122bn to $337bn in the first half of the year, with large fund closings accounting for 40% of the total, according to PEI, as investors prioritize commitments to existing GP relationships11.

The flipside is that the very conditions that are restraining fundraising are leading to a rise in secondaries activity as investors trade positions in funds and GPs pursue options to extend their portfolio company holdings. Jefferies estimated that global secondaries activity hit a record $57bn in the first half and could reach $120bn for the year12.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

London

T: +44 20 7614 2219

mjames@cgsh.com

V-Card

Paul Gilbert

Partner

London

T: +44 20 7614 2335

pgilbert@cgsh.com

V-Card

Olisa Maduegbuna

Associate

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE