Large Target

The Growing Opportunity for Private

Equity Investment in Sport

Once considered a trophy asset for select ultra-high-net-worth individuals, sports investments have moved into the mainstream as private equity firms target global sports franchises. A wave of deal activity that rose to prominence during the pandemic has continued – but private equity interest in the sector has been around for much longer.

CVC was an early entrant into the space with its backing of the Formula 1 series in 2006, an investment reported to have generated a return of 450% for the firm by the time of its exit ten years later1. Since then, the business of sport has drawn investment from private equity sponsors across Europe and globally, who have demonstrated rising appetite for a wide range of professional games – from football and rugby to volleyball and cricket. However, rather than involvement in day-to-day league and team activities, private equity firms are principally eyeing commercial rights licensing opportunities stemming from rising demand for content among increasing numbers of fans around the world, who are using technology to access sport in new and varied ways.

COVID-19 Accelerates Appetite for Sports Investment

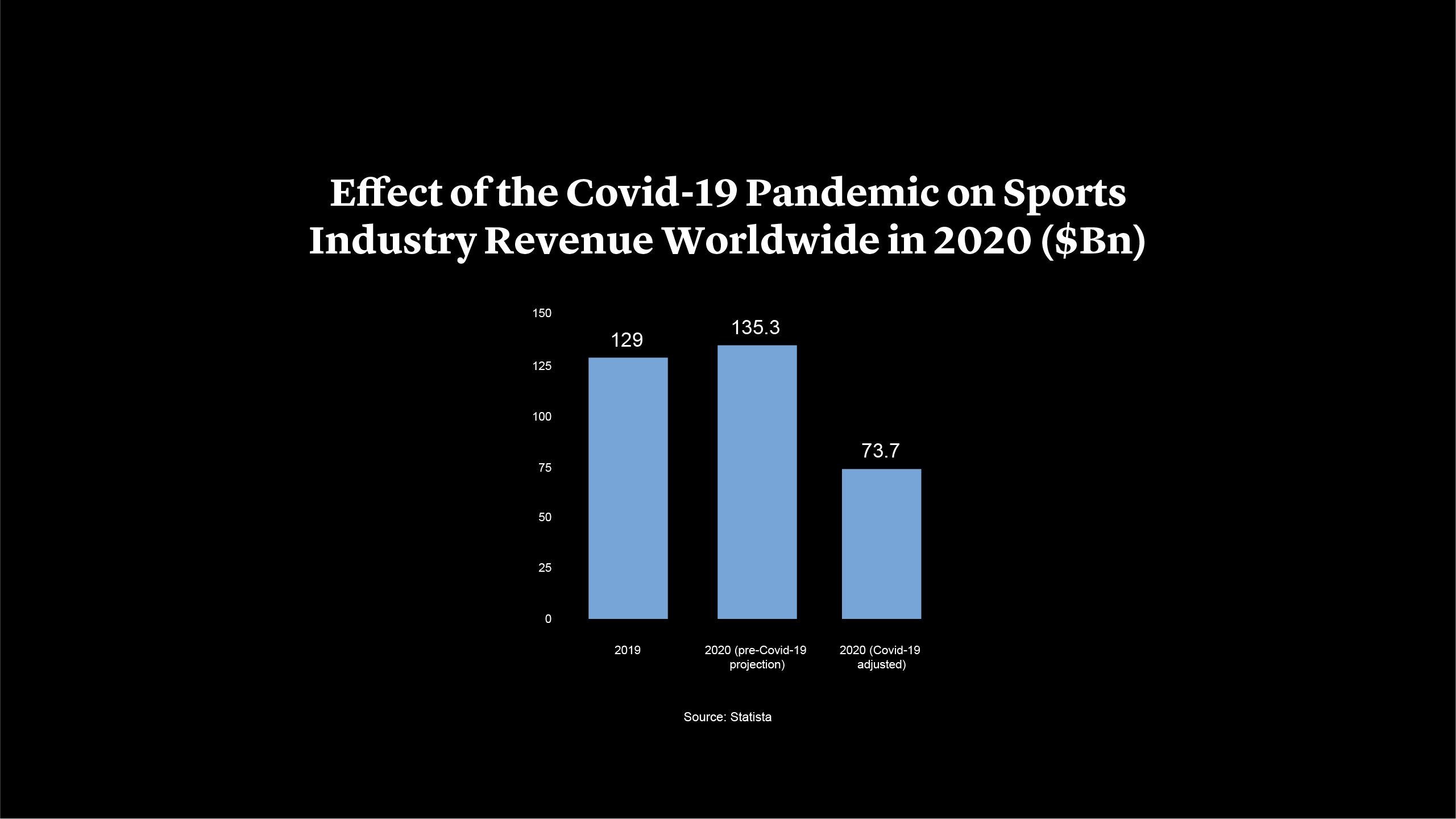

Already on the rise over the last five years, the COVID-19 pandemic served as an accelerant for private equity investment in sports. On the one hand, lockdowns hit revenues from traditional sources, such as gate receipts, putting pressure on team finances which in some cases were already struggling due to high spending on top talent. On the other, they highlighted the seemingly insatiable demand for sports content – often through digital channels. Fans might not have been moving through turnstiles, but they had not abandoned their favorite teams.

The global sports market contracted by 15% to $388bn in 2020, according to Sports Global Market Report 2021: COVID-19 Impact and Recovery to 2030 from the Business Research Company. However, the market rapidly recovered lost ground in 2021 when in-person attendance returned. It is now expected to reach $600bn by 2025 and $826bn by 2030 as new avenues to distribute sports and leverage brands are developed2.

Private equity has responded to the long-term opportunities with $51bn invested in sports deals globally in 2021, including $22bn in Europe alone, according to PitchBook. Among those was CVC’s £365mn investment in Europe’s Six Nations rugby tournament, increasing its investment across rugby’s ecosystem, and its backing of the Swiss-headquartered International Volleyball Federation.

Activity has continued strongly in 2022 with some of the continent’s largest football leagues and teams in the spotlight. Clearlake Capital backed Todd Boehly’s £4.25bn takeover of Chelsea, while Sixth Street agreed a $360mn investment with Spain’s Real Madrid for a range of business activities at the club’s Bernabeu stadium3. Sixth Street followed that investment with the acquisition of a 25% share of FC Barcelona’s LaLiga television rights4.

Women’s Sports Present High-Growth Opportunities

In addition to helping established sports franchises recover from the effects of the pandemic and access new opportunities, private equity firms are exploring new and emerging fields. Women’s sport is benefitting from exponential growth in fan bases and a rapidly increasing public profile. The final of the women’s European Championship in July was the most watched women’s football game in British history with 17.4 million viewers on BBC One and a further 5.9 million on digital platforms5. At the time of broadcast, it was the BBC’s most watched programme of any kind in 20226.

Research from The Sports Consultancy and advisory firm BDO indicates that women’s sport could in fact be a better long-term investment given the greater opportunity for growth and development and the more flexible business structures relative to more established men’s sport7. Revenues from women’s sport are expected to reach £1bn by 2030 from £350mn in 2021, representing a faster growth rate than for the overall sports market8.

Investments in tournaments like The Six Nations, or Silver Lake’s backing of the holding group behind Manchester City, have included support for female teams and games as part of the overall package. Increasingly, however, private equity is eying more direct opportunities in women’s sports organizations. While the UK’s Football Association is said to have turned down private equity offers for involvement in a new entity to hold the Women’s Super League and Championship in favor of other financing options9, CVC is reported to be close to a £150mn investment in the Women’s Tennis Association – tennis has created several of the most globally recognized female athletes and greater gender parity on prize money compared to other sports10.

Not all opportunities are in sports primarily followed in Western markets. The world’s largest domestic cricket tournament, the Indian Premier League, is set to launch a women’s competition, tapping into appetite for the sport in a market with over one billion potential followers11.

Structures Focused on Commercial Rights and Revenues

Although some large investments have focused on big-brand-name sports teams, private equity typically avoids involvement in day-to-day club operations and finances. Nevertheless, private equity investment in sport creates complexities and can be met with some resistance from fans, players and teams themselves.

Having discussed investment with a range of private equity sponsors, clubs in Germany’s Bundesliga last year initially rejected a deal for the sale of a share in the Bundesliga’s media rights, partly due to concerns about the impact on the league’s fan-led governance model, before reopening talks in August 202212. Meanwhile, private equity investment in Spain’s LaLiga has faced legal challenges from teams including Barcelona, Real Madrid and Athletic Bilbao13.

Where investments have been successfully made, they typically target commercial rights and revenues. The growth opportunities offered by these revenue streams include bringing first class technology and marketing strategies to bear to help reach, energize and monetize wider audiences. Structures include minority stakes in new entities that manage the commercial arms of leagues, potentially including lucrative broadcasting rights, or may be structured as preference shares that are linked to specific commercial revenue streams.

For the leagues, such investments can provide a cash infusion for the promotion and expansion of sports, while ensuring that day-to-day decision-making remains with teams and the leagues themselves. The best deals involve sporting authorities and private equity investors operating in sync towards a shared vision of sustainable growth.

However, complications can emerge if strategic action (or inaction) or poor cost control by sporting governing bodies and individual clubs leads to high profile mishaps, such as club or franchise bankruptcies. Such mishaps in isolation can be managed, but if not kept in check they may eventually impact the viability and attractiveness of the sporting league, both to fans and investors14.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

London

T: +44 20 7614 2219

mjames@cgsh.com

V-Card

Paul Gilbert

Partner

London

T: +44 20 7614 2335

pgilbert@cgsh.com

V-Card

Olisa Maduegbuna

Associate

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE