Private Equity

Market Snapshot

November 2022

After the record levels seen in 2021, private equity investment is slowing down. Globally, firms agreed $81bn of investments in the third quarter of 2022, roughly half of what they concluded in the prior three-month period, according to Preqin. Yet, on some metrics, activity is still robust with over 1,700 deals globally, higher than most pre-crisis quarters.

In the face of constrained financing, rising interest rates and valuation uncertainty, deal processes continue to launch and be completed. However, there is increased caution and sponsors that made approaches or offers earlier in the year may be looking to renegotiate terms. In late September, UK-listed recycling firm Biffa recommended a £1.3bn bid from Energy Capital Partners priced at 410 pence a share, down from the previously indicated 445 pence, but nonetheless almost 30% higher than the share price prior to the offer1.

After the record levels seen in 2021, private equity investment is slowing down. Globally, firms agreed $81bn of investments in the third quarter of 2022, roughly half of what they concluded in the prior three-month period, according to Preqin. Yet, on some metrics, activity is still robust with over 1,700 deals globally, higher than most pre-crisis quarters.

In the face of constrained financing, rising interest rates and valuation uncertainty, deal processes continue to launch and be completed. However, there is increased caution and sponsors that made approaches or offers earlier in the year may be looking to renegotiate terms. In late September, UK-listed recycling firm Biffa recommended a £1.3bn bid from Energy Capital Partners priced at 410 pence a share, down from the previously indicated 445 pence, but nonetheless almost 30% higher than the share price prior to the offer1.

Private Equity Views on UK and Euro Markets Diverge

There is growing bifurcation in private equity approaches to market turmoil in Europe. Some firms are stepping back from the region as the worsening economic conditions, persistently high inflation, and unfolding energy crisis make it difficult to assess the outlook for companies and the region more broadly. Others are eyeing opportunities accentuated by the depreciation of sterling and the euro versus the dollar.

Speaking at a Financial Times event in October, Blair Jacobson, co-head of European credit at Ares, said “everything in the UK is on sale”, and added that he expected to see more U.S.-based, dollar-denominated funds investing in the UK2. Despite rallying from near parity, the pound is at its lowest level against the dollar since the 1980s. The euro is similarly at levels not seen in two decades.

The counterpoint to potential FX savings is that private equity sponsors have to closely evaluate companies to assess whether they are strong enough to withstand the threat of recession, and if sterling and euro earnings are at risk of further erosion. Global funds may see potential for faster recovery and better performance in other jurisdictions, in particular in the U.S.

In addition, approximately three-quarters of large companies that went public in the U.S. between 2019 and 2021 are currently trading below their IPO price, Financial Times analysis of Dealogic data shows, signalling potential buying opportunities3.

Private Equity Views on UK and Euro Markets Diverge

There is growing bifurcation in private equity approaches to market turmoil in Europe. Some firms are stepping back from the region as the worsening economic conditions, persistently high inflation, and unfolding energy crisis make it difficult to assess the outlook for companies and the region more broadly. Others are eyeing opportunities accentuated by the depreciation of sterling and the euro versus the dollar.

Speaking at a Financial Times event in October, Blair Jacobson, co-head of European credit at Ares, said “everything in the UK is on sale”, and added that he expected to see more U.S.-based, dollar-denominated funds investing in the UK2. Despite rallying from near parity, the pound is at its lowest level against the dollar since the 1980s. The euro is similarly at levels not seen in two decades.

The counterpoint to potential FX savings is that private equity sponsors have to closely evaluate companies to assess whether they are strong enough to withstand the threat of recession, and if sterling and euro earnings are at risk of further erosion. Global funds may see potential for faster recovery and better performance in other jurisdictions, in particular in the U.S.

In addition, approximately three-quarters of large companies that went public in the U.S. between 2019 and 2021 are currently trading below their IPO price, Financial Times analysis of Dealogic data shows, signalling potential buying opportunities3.

Firms Scour UK Public Markets for Untapped Value

Public-to-private investment activity remained robust in the early phases of 2022 with large deals including Brookfield and Elliott’s $16bn buyout of UK-based ratings company Nielsen, which completed in October. Through the second quarter of 2022 and into early Summer, appetite dipped due to increased volatility and higher stock prices. However, since mid-August, the FTSE 100 has fallen by over 8%, while the Stoxx 600 is over 10% lower. This, combined with weakening European currencies, is drawing renewed interest in public markets.

Some sponsors are combing through listed stocks for businesses where value is unrecognized. One focus is companies that have strong earnings overseas in dollars or other currencies that are performing better than sterling or the euro. Another is businesses that have technology or operations that are portable, and which may be moved to another region where economic weakness and currency volatility will be less of a concern.

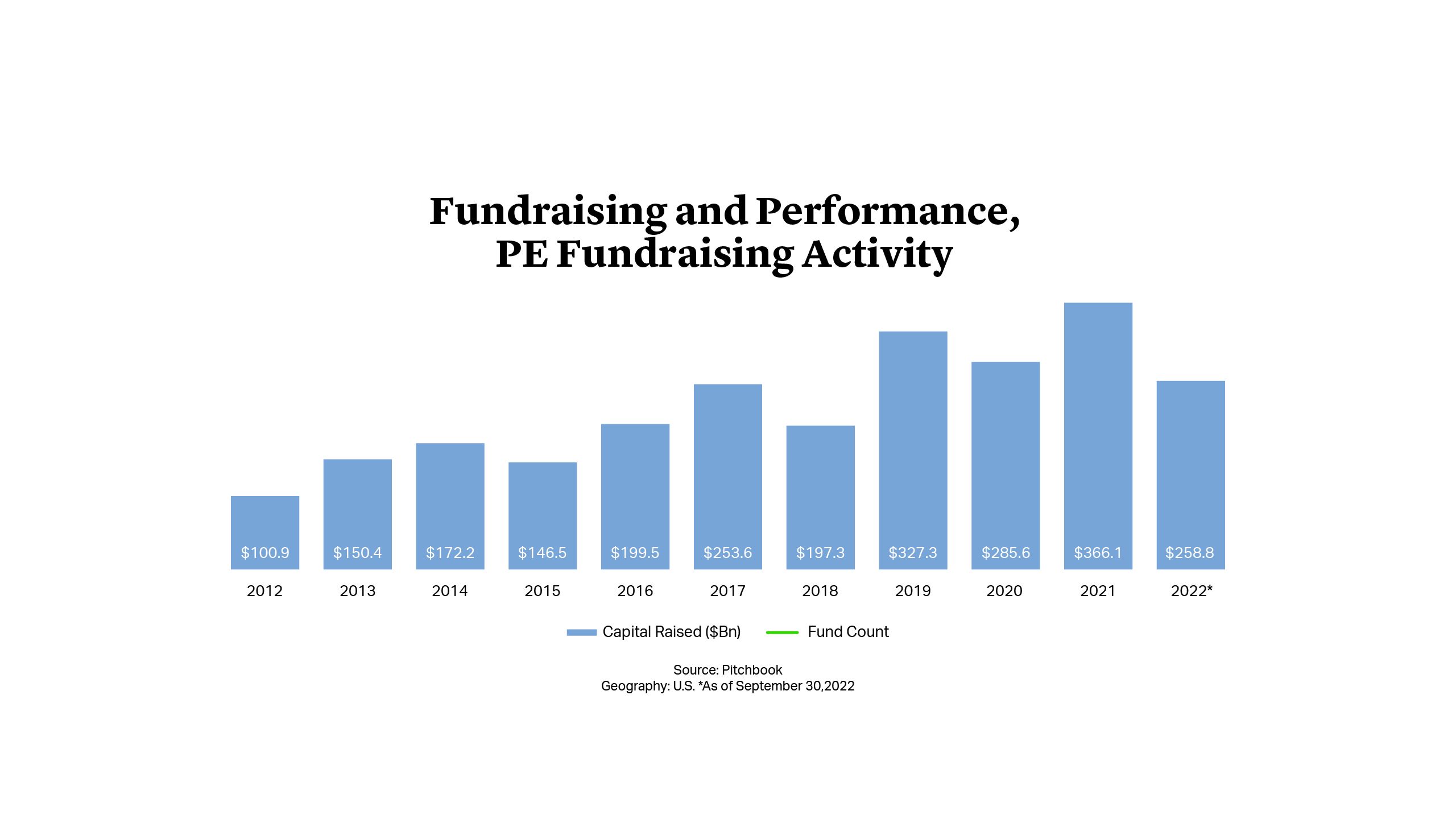

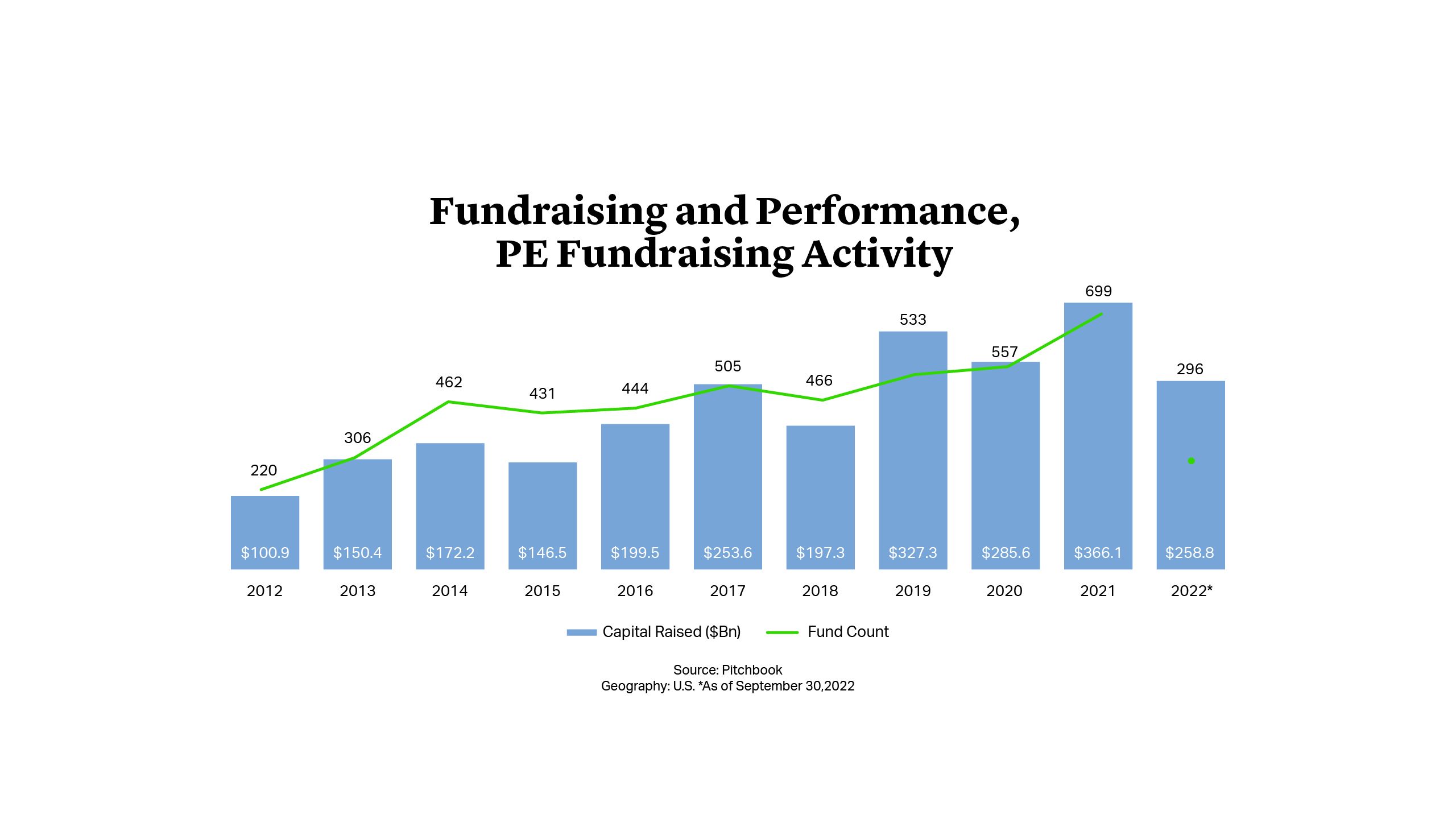

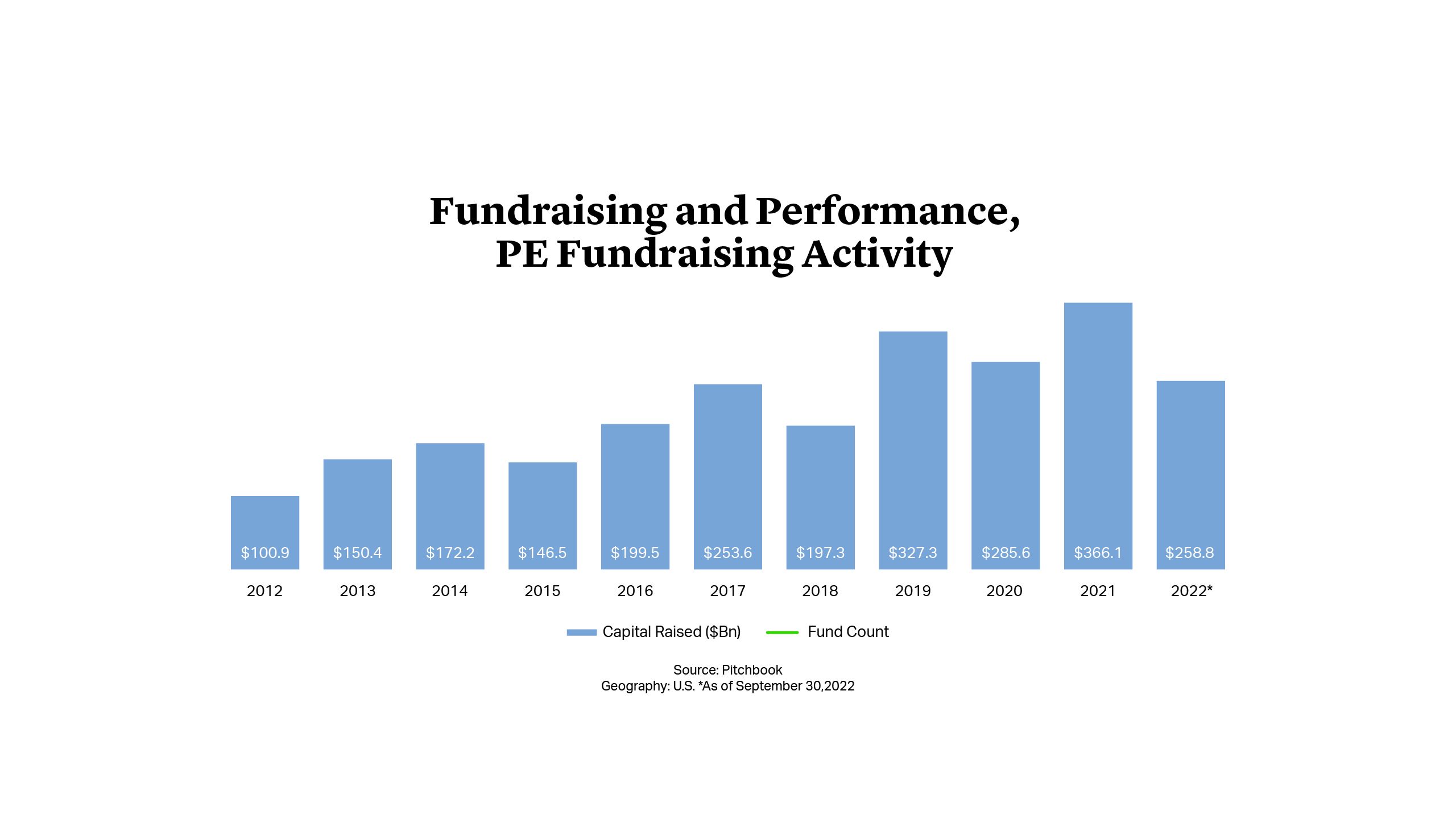

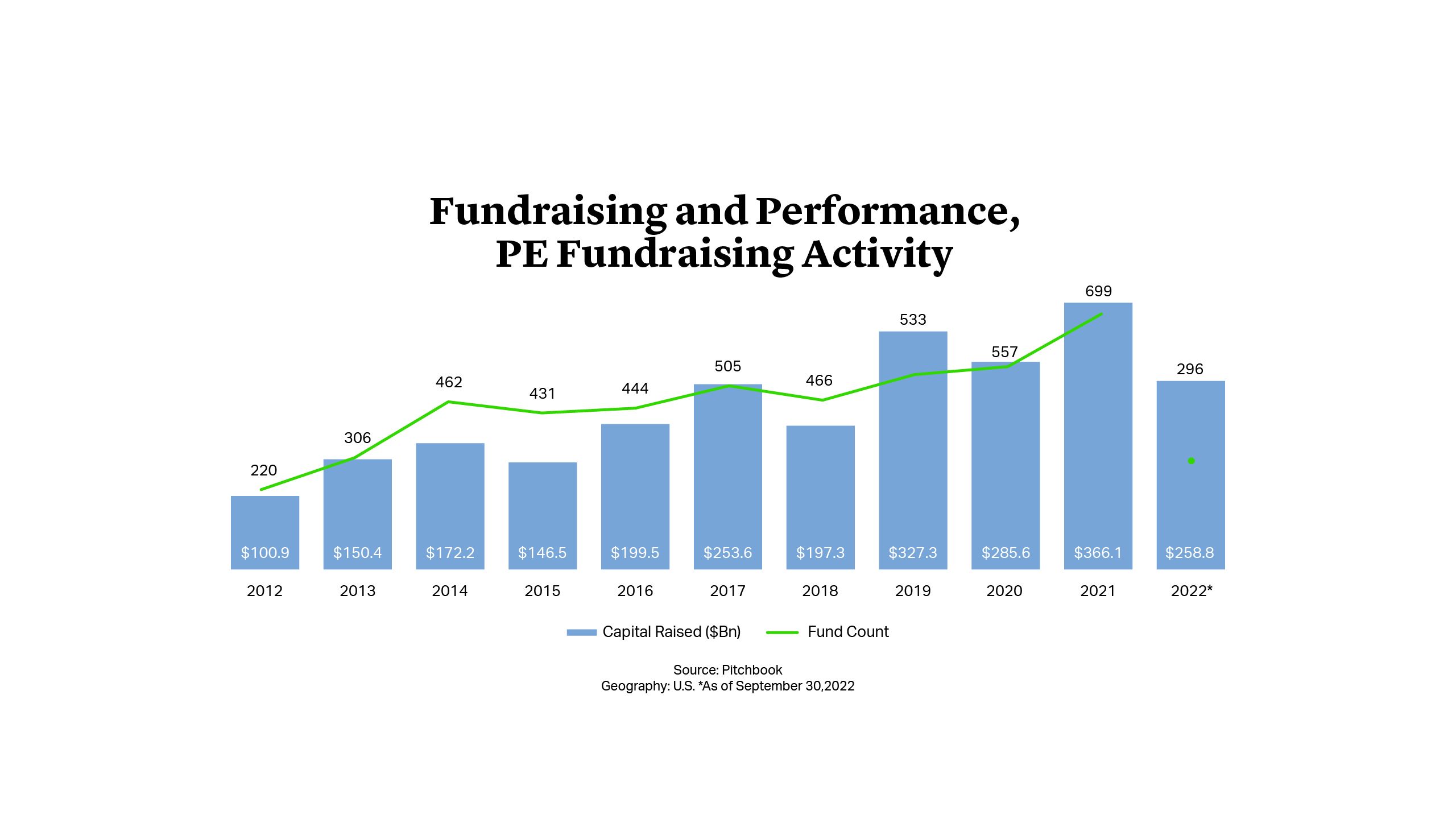

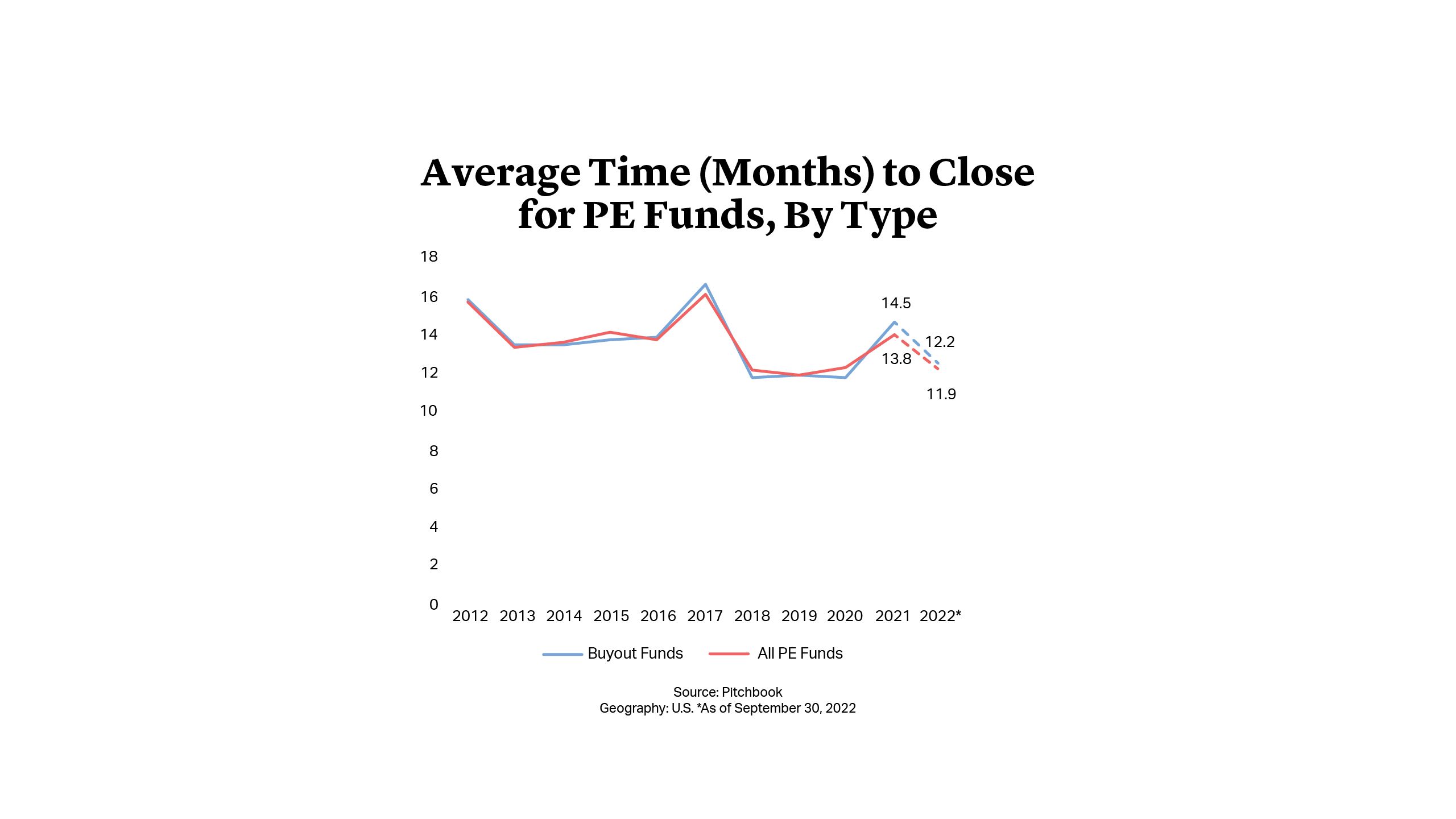

Mixed Picture for Fundraising

As with investment, private equity fundraising has painted a mixed picture in 2022. Large pension funds and sovereign wealth funds have increasingly pivoted towards private markets, with Bloomberg estimating that the ten largest global funds have doubled exposure to alternatives since the financial crisis4. U.S. private equity fundraising – including funds with global investment remits – totalled $259bn in the first three quarters of 2022, in line with last year, according to PitchBook data5. However, the expectation of write-downs and the denominator effect are weighing on short-term allocations to private equity, with fundraising expected to slow. Across the first nine months of the year, 143 U.S. funds sized between $100mn and $5bn raised a total of $119bn, down from 268 funds and $197bn for the same period last year, PitchBook shows6.

In Europe, popular funds with strong track records continue to attract significant LP appetite. Nordic Capital is reported to be nearing a €9bn final close for its eleventh flagship fund, which would be 50% larger than its predecessor7. However, there are also signs of cooling demand as large publicly listed funds tell markets that they are extending fundraising timetables8, while anecdotally private equity professionals say that fewer funds are reaching their hard caps. We expect to see a number of large fundraisings to be pushed back into 2023 as firms respond to pressure on LP allocations.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE