Private Equity

Market Snapshot

February 2022

Private equity ended 2021 on a high note, powering through the disruption and uncertainty of the pandemic to achieve new record investment levels for buyouts and venture capital in Europe, as well as globally. Overall private equity activity jumped sharply to €392bn in Europe, according to data from Unquote1. Similarly, European start-ups enjoyed a glut of funding with investment estimated by venture capital group Atomico to reach $121bn for the year2.

The discovery of the Omicron COVID-19 variant in Europe prompted a tightening of restrictions in December as countries including Austria and the Netherlands reintroduced lockdowns, while others such as France and Germany enhanced travel restrictions. By early January, those rules were easing again as the increasing weight of evidence pointed to less severe health effects from the variant.

Despite a slight deceleration in activity in the fourth quarter, private equity firms in Europe largely looked through the impact of the latest COVID-19 wave at the longer-term outlook for companies. KKR continued to push ahead with its €33bn buyout offer for Telecom Italia – if successful, the largest ever private equity buyout in Europe.

The international interest in Italian companies was echoed by strong appetite for leading companies in all of Europe’s largest economies, including France, Germany and Spain. In addition to take-privates, there is significant appetite for corporate carve-outs and partnerships. In December, Spain’s electricity grid operator REE agreed to sell a 49% stake in Reintel, its telecoms infrastructure unit, to KKR for almost €1bn3 .

UK Companies Remain in Focus for International Buyers

Prospective buyers continue to scour UK public companies for opportunities as share prices still trail pre-COVID peaks, despite a strong performance through December and early January. In contrast, Europe’s flagship Stoxx 600 index is about 13% above its pre-COVID high point, while the U.S. S&P 500 is almost 40% higher than its February 2020 level.

Interest in megadeals also remains high in the UK. Bain and CVC are reported to be considering a joint bid for UK pharmacy and retail chain Boots, which is currently owned by U.S. group Walgreens. The company was previously taken private by KKR in 2007 in one of the largest pre-Global Financial Crisis deals, valued at about £11bn.

Triton, which invests in mid-market deals primarily across northern Europe, launched a recommended offer for Clinigen, a UK pharmaceutical group in December. It further received backing from two prominent shareholder advisory firms in January. However, as with increasing numbers of public-to-private bids in the UK, the deal has met some resistance from shareholders. Activist investor Elliott Management has dismissed the offer as undervaluing Clinigen and, by mid-January, had built a stake of 11.4% in the company, potentially creating pressure for a higher offer from Triton or a competing bid.

Venture Investment Starts 2022 Strongly

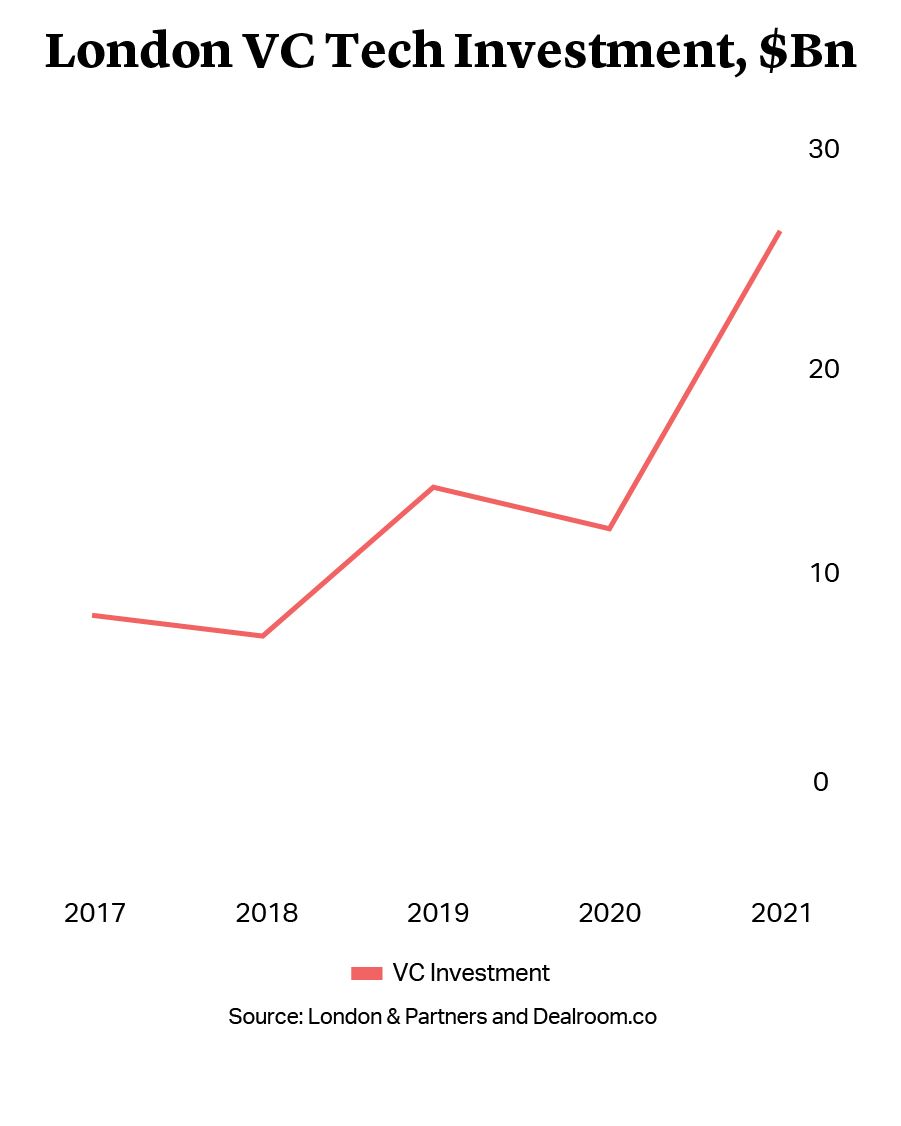

The explosion in venture capital investment in 2021 resulted in the strongest ever year for many European countries and their tech hubs. Data from London & Partners and data provider Dealroom showed that London led other European cities with $25.5bn in fresh tech investment 2021. The capital was fourth globally behind Silicon Valley, New York and Boston4.

French venture investment started 2022 particularly strongly with a host of funding rounds for start-ups, including e-commerce platform Ankorstore and online bank Qonto. Together, French start-ups raised almost €1.5bn in the first two weeks of January, more than the total for all 20165. Appetite to invest in start-ups remains strong with Europe having now largely proved its credentials in identifying and growing leading tech firms.

The French refurbisher and reseller of tech equipment, mostly smartphones, achieved a valuation of €5.7bn in the Series E funding round, making it France’s most valuable tech start-up. The deal followed Back Market’s Series D funding round in May which raised $310mn. The company aims to increase consumer confidence in buying second-hand phones, thanks to its low failure and return rate, which it also sees as a way of reinforcing the circular economy.

Caution Grows About Corporate Credit

While confidence in the market for private equity deals remains strong, buyers see a growing number of risks within the European – and global – economy that may cause them to be more circumspect. Inflation, rising interest rates, the end of government support schemes for employers, and uncertain economic activity are increasingly clouding the outlook in 2022, and have led to increased market volatility.

The proliferation of covenant-lite funding throughout the pandemic has ensured a high degree of protection for private equity sponsors in the event of a downturn. However, there are more voices expressing concern about the high level of corporate debt across the economy and how those leveraged companies might fare in a downturn. Companies globally have raced to secure financing before interest rates rise, raising $101bn on bond markets in the first week of January alone. During the same week, new equity issuance was just $7bn, down from $22bn for the same period last year6.

Distressed investment activity has been muted throughout the pandemic due to the monetary and fiscal support that buoyed business and consumer activity. However, sponsors active in Europe expect more distressed opportunities in 2022 as the gradual tightening of monetary policy unfolds and businesses continue to grapple with supply chain issues and the disruption of Brexit.

Read more below about why high yield bonds became a popular source of leveraged buyout funding in 2021.

Societe Generale’s ALD division agreed to buy European car leasing group LeasePlan to create one of the world’s largest vehicle leasing groups, with 3.5m vehicles. The French bank views the investment as creating a third pillar for the business alongside its traditional retail and investment banking operations. Car leasing is seen as more profitable than most banking operations, with Societe Generale’s ALD having generated historical returns on equity in the mid-teens. Private equity firm TDR Capital and its consortium members will reinvest to hold approximately 31% of the new leasing business.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE