High Yield Bridge Loans

in Leveraged Buyouts

The growth in private equity deal sizes has meant that buyout financing needs often push beyond the limits of what is possible in the leveraged loan markets. In addition to offering access to a broader investor base, high yield bonds also have other advantages which made them a popular source of leveraged buyout (LBO) financing in 2021. A fixed interest rate debt instrument may prove very useful against a macro backdrop of inflation and rate hikes.

But whilst high yield bonds may offer more scale for private equity buyouts, they often struggle to meet the time constraints of auction processes, which usually require a buyer to have fully committed financing in place when making a binding offer. High yield bridge loans can meet the challenges of fast-moving private equity processes, but bring different considerations for borrowers and lenders.

High Yield Bridge Loans Incentivise Quick Bond Issuance

High yield bridge loans are committed in the same way as a Term Loan B via a commitment letter and a long-form term sheet. But the terms differ in certain key respects, ultimately because neither the borrower nor the underwriters want to actually fund the bridge loan. In an ideal world, the high yield bond take-out issuance will be completed in the period between the signing and closing of the acquisition. If that is not possible and the bridge loan facility is funded, all parties will want to issue the high yield bond take-out as soon as possible. And the terms of a high yield bridge loan are designed to incentivise the borrower to do just that.

Key Considerations for Borrowers

· Get help from the target: To launch, market and issue a high yield bond in the window before the acquisition closes, a borrower will need to secure the support of the target’s management team. This can mean placing a detailed provision in the purchase agreement which requires the selling shareholder to ensure that the necessary support is provided before closing. However, this provision for cooperation needs to be balanced against the overriding desire to make the bid attractive to the vendor.

· Securities demand: Typically contained in the fee letter, this is a provision that allows the bridge loan underwriters to force the borrower to issue a high yield bond in certain circumstances. The borrower must ensure that it can only be forced into an issuance on certain terms, most importantly:

- That the demand comes from a majority of bridge underwriters and on no more than two to three occasions.

- That a period of at least 30-60 days post-deal closing has elapsed.

- That the bond should only be issued after a reasonable marketing period.

- Certain key terms of the issuance should be spelled out clearly, such as the currency, maximum interest rate, minimum maturity and non-call periods.

- The regulatory and expected listing framework for any issuance should also be set out explicitly.

If the borrower fails to comply with a demand to issue, it is usually referred to as a ‘Demand Failure Event’. As a result, the Conversion Date will be deemed to have occurred, the rollover fee will be payable, and the borrower’s consent right to any lender transfers of the bridge loans will be diluted.

· Control of lender transfers: The ability to control lender transfers has become increasingly important, particularly for financial sponsors. Unlike term loans, the borrower’s consent right for transfers typically falls away over time and as certain key dates are passed. Before the Conversion Date, the borrower will need to give consent for transfers in most cases. However, after the Conversion Date and once loans are converted into exchange notes, borrowers usually have little or no control over transfers.

Key Considerations for Borrowers

· Get help from the target: To launch, market and issue a high yield bond in the window before the acquisition closes, a borrower will need to secure the support of the target’s management team. This can mean placing a detailed provision in the purchase agreement which requires the selling shareholder to ensure that the necessary support is provided before closing. However, this provision for cooperation needs to be balanced against the overriding desire to make the bid attractive to the vendor.

· Securities demand: Typically contained in the fee letter, this is a provision that allows the bridge loan underwriters to force the borrower to issue a high yield bond in certain circumstances. The borrower must ensure that it can only be forced into an issuance on certain terms, most importantly:

- That the demand comes from a majority of bridge underwriters and on no more than two to three occasions.

- That a period of at least 30-60 days post-deal closing has elapsed.

- That the bond should only be issued after a reasonable marketing period.

- Certain key terms of the issuance should be spelled out clearly, such as the currency, maximum interest rate, minimum maturity and non-call periods.

- The regulatory and expected listing framework for any issuance should also be set out explicitly.

If the borrower fails to comply with a demand to issue, it is usually referred to as a ‘Demand Failure Event’. As a result, the Conversion Date will be deemed to have occurred, the rollover fee will be payable, and the borrower’s consent right to any lender transfers of the bridge loans will be diluted.

· Control of lender transfers: The ability to control lender transfers has become increasingly important, particularly for financial sponsors. Unlike term loans, the borrower’s consent right for transfers typically falls away over time and as certain key dates are passed. Before the Conversion Date, the borrower will need to give consent for transfers in most cases. However, after the Conversion Date and once loans are converted into exchange notes, borrowers usually have little or no control over transfers.

Fees for High Yield Bridge Loans

Term loans are typically subject to a single arrangement and underwriting fee. In contrast, fees for high yield bridge loans are split into different components to allow for the offset of fees related to the planned high yield bond offering.

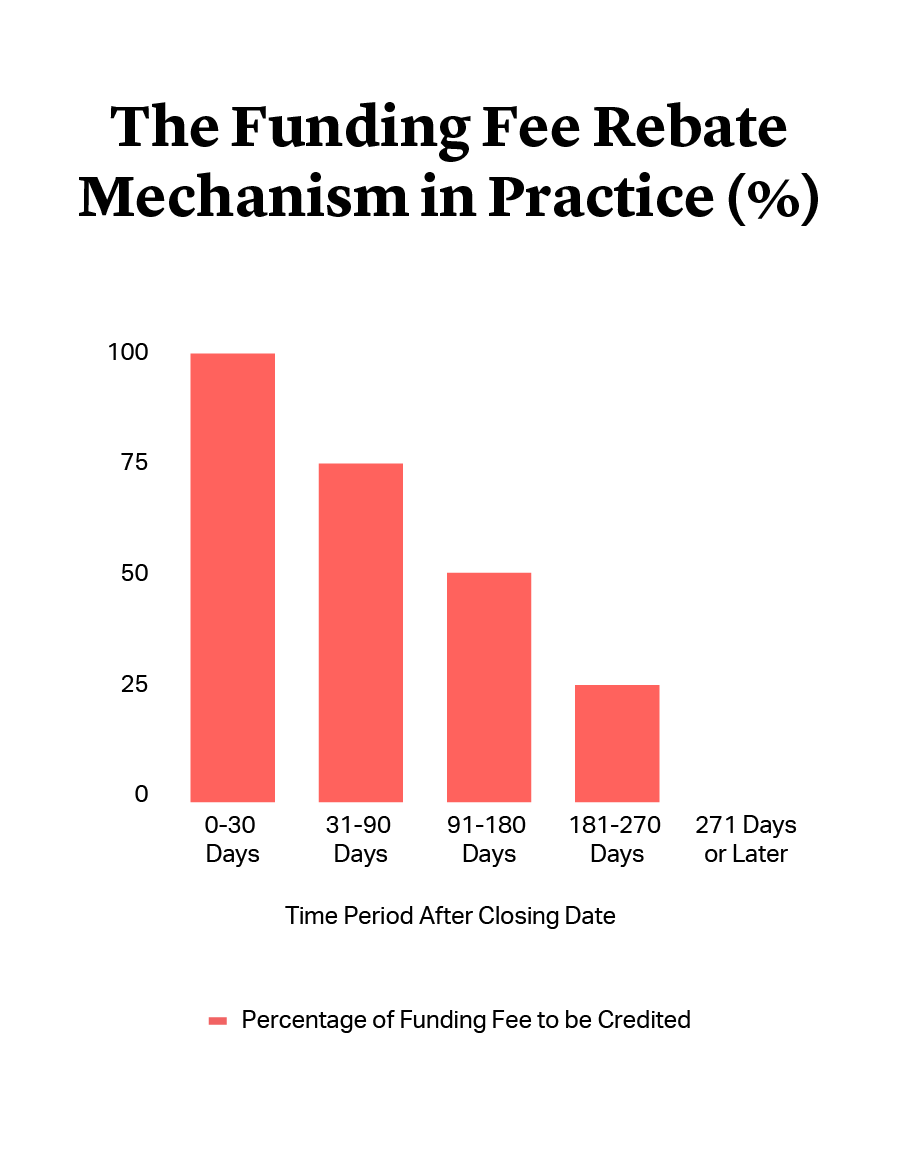

The funding fee is usually subject to a time-based rebate mechanism. The earlier the high yield bond is completed, the more of the bridge loan funding fees will be credited against the fees of the high yield underwriters. This tapering of the fees is usually subject to negotiation, but by way of example:

Borrowers can also expect to pay:

- Rollover or Conversion Fee: Payable if the bridge loan maturity is extended on the Conversion Date, and subject to similar credit mechanisms as the funding fee.

- Alternative Transaction Fee: Sometimes called a ‘tail fee’, this is payable, under certain conditions, if the borrower terminates the high yield bond engagement letter and finances the deal with a similar package provided by other underwriters.

Documentation for high yield bridge facilities is relatively standard. However, as the private equity buyout market evolves in terms of deal sizes and buyer and seller demands, we expect market terms to continue to develop and evolve.

For more detailed information, please see our white paper, or get in touch with our specialist financing and restructuring team.

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE