Private Equity

Market Snapshot

2022 Review

Against the confidence and optimism that defined last year’s rebound, 2022 has been marked by volatility and uncertainty. Conflict in Ukraine, energy supply shocks, spiraling inflation, pull-back of the debt markets and fears of an economic downturn have been persistent issues throughout the year, exacerbated by surprises such as Liz Truss’s short-lived premiership in the UK and poorly received budget plans. Despite the challenges, private equity activity decelerated rather than halted, and significant deals were still successfully executed. Data from Invest Europe shows that private equity investment fell back to €57bn in the first half of the year, below both halves of 2021, but nonetheless higher than any other six-month period on record1. But activity levels were still trending down, and further statistics from PitchBook illustrated this, as deal volume in the three months to the end of September slipped by 32% quarter-on-quarter, while deal count declined by 10%2.

The slowdown had an impact on transaction timelines. Auction processes generally lengthened, as buyers spent more time on due diligence, scrutinizing risks and synergies. The position on risk allocation broadly stayed the same, however, with warranty & indemnity insurance largely holding its footing as the primary means of buyer recourse, although practice was more mixed than in 2021. Top-quality assets continued to attract a strong field of suitors, and European public companies drew international attention, including dollar buyers for whom sterling’s weakness provided a tailwind. Nevertheless, valuations declined as sellers’ price expectations began to soften to reflect increased buyer caution, the weakening economic outlook and the decline in the availability of debt finance. The Argos Wityu index for mid-market private equity deals showed that deal values fell from a peak of 11.6x EBITDA in late 2021 to 10x in the third quarter of 20223.

The management of Biffa, a UK-listed waste management company, agreed to Energy Capital Partners’ (ECP) £1.3bn offer in September. ECP was attracted by Biffa’s prominent position in the UK waste management sector, along with the business’s long-term growth potential stemming from the sustainability objectives of the UK Government. Nonetheless, ECP reduced its original offer, reflecting the rising interest rate environment and weakening economic backdrop, combined with private equity firms’ desire to avoid overpaying for assets.

Debt Markets Dry Up as Sponsors Turn to Direct Lenders

Interest rate uncertainty and hung loans weighed on lending markets throughout the year. After banks took a hit on the syndication of debt for Clayton, Dubilier & Rice’s 2021 takeover of supermarket chain Morrisons, private equity firms faced diminished appetite for leveraged loans4. Many deals stayed on bank balance sheets until a market thaw in November allowed lenders to syndicate loans for companies perceived to be less exposed to a downturn, such as TV ratings group Nielsen5, acquired by Brookfield and Elliott Management for $16bn.

As traditional sources of financing became harder to secure, alternative lenders stepped in to fill at least part of the void by providing debt packages on fairly traditional terms. As during the period of uncertainty that followed the outbreak of COVID-19 in 2020, some buyers also turned to hybrid liquidity solutions. The use of preferred equity, with or without warrants, rose sharply, giving hybrid lenders the opportunity to enjoy the downside protection of loans, as well as the potential upside of equity conversion.

Blackstone led a group of investors in a €21bn recapitalization of Mileway, the Netherlands-based owner and operator of last-mile logistics assets, which the firm described as the largest ever private equity real estate transaction, according to Dealogic data. The deal demonstrated the continued appetite for large investments in the early part of 2022, as well as the firepower of the largest firms even as conditions in Europe began to worsen.

Consortium Deals and Co-Sponsors Bring More Equity to Investments

The appetite to do deals in dislocated markets drove not only new approaches to debt, but also to equity. Large buyout firms with sizeable funds were increasingly prepared to fund purchases using a greater amount of up-front equity, in the hope of securing back-leverage or syndicating the equity cheque at a later date.

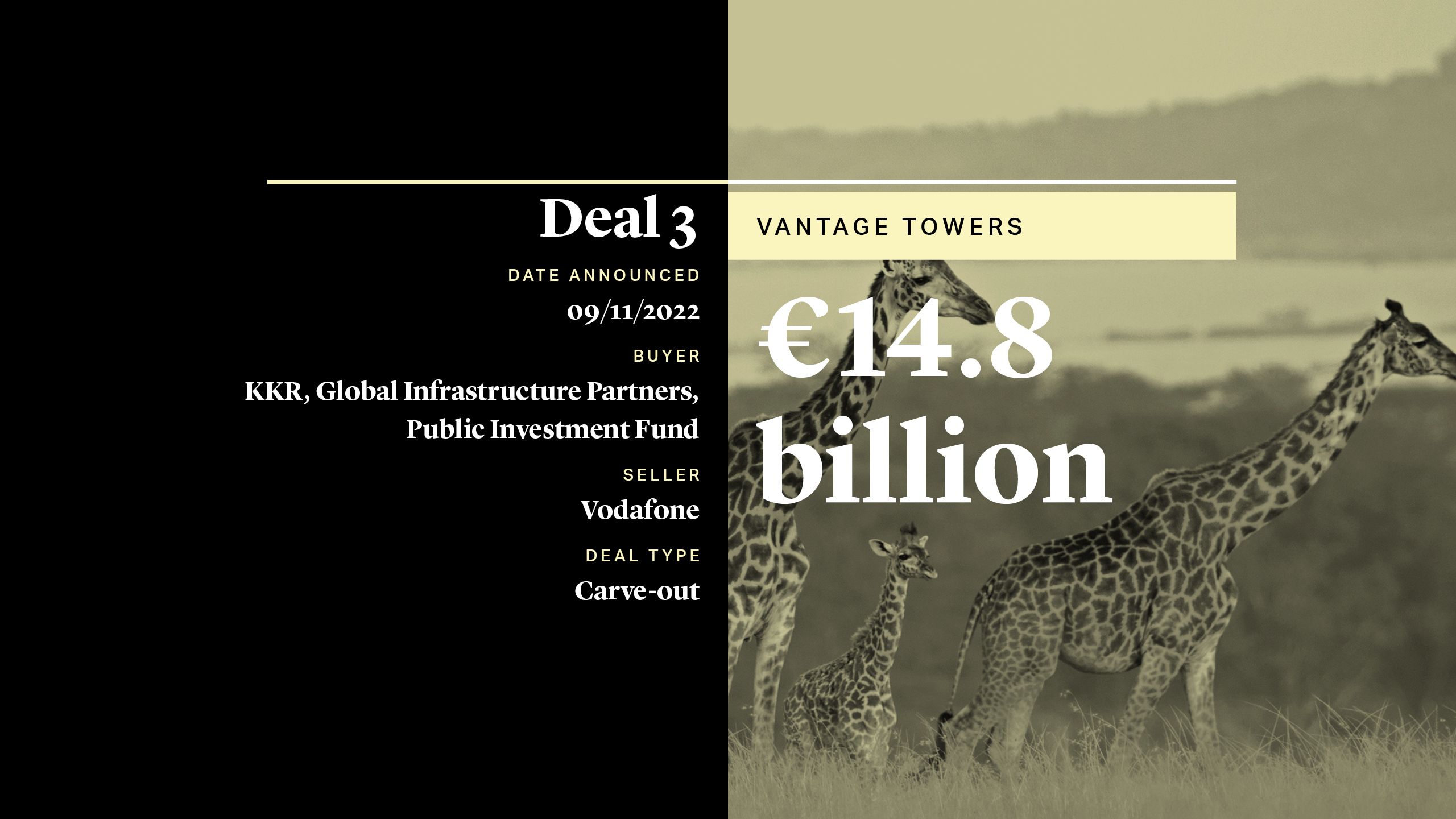

Some firms teamed up to split equity requirements. Sovereign wealth funds played a large part in this story, and their average exposure to private markets has grown from 8% in 2013 to 22% 2021, according to Invesco6, a period when the scale of their overall assets under management also increased sharply. Large Middle East investment funds were especially active in 2022, deploying capital boosted by rising oil revenues and the strong dollar, both in Europe as well as the U.S. ADIA and GIC’s partnered with Blackstone to buy U.S. firm Emerson Electric7, which included a seller loan, while Saudi Arabia’s Public Investment Fund (PIF) partnered with KKR and GIP for Vodafone’s mobile phone towers business.

Saudi Arabia’s PIF teamed up with KRR and Global Infrastructure Partners to carve out Vodafone’s Vantage Towers business, which owns and operates thousands of masts across 10 European countries. Vodafone and the consortium will co-own the towers business, allowing Vodafone to free up cash to deleverage while giving PIF an opportunity to deploy sizeable capital reserves into a stable long-term investment.

Avoiding Tough Exit Markets with Continuation Funds and GP-Led Secondaries

Increased uncertainty also weighed on private equity firms’ ability to make divestments. As markets tightened, firms opted to hold onto assets for longer to optimize their exits and maximize returns. One route was to establish continuation funds for single or multiple assets. Among the largest vehicles to hit the market this year, Northern Europe-focused firm Triton launched a $1bn-plus continuation fund for a portfolio of four 2013 fund assets in July8.

While deals continued to be concluded throughout 2022, continuation funds started to face some weakening of demand from investors, in line with the deterioration in primary fundraising markets. According to research from Lazard, LPs speaking for an estimated 90% of sell-side volume in GP-led secondaries opted to exit during the process9 – a figure the bank expected to remain high as LPs sought liquidity to reinvest into other commitments, or to reduce private equity exposure as more liquid non-private equity assets were marked down.

Deutsche Private Equity (DPE) sealed Germany’s largest GP-led secondary transaction, establishing a continuation fund for two of its strongly performing IT consultancy businesses – Eraneos and valantic, both of which have increased revenues by over 200% during DPE’s ownership. The deal involved leading secondaries players AlpInvest, HarbourVest and Pantheon, and included several new and existing investors, at once underlining the ongoing trend to large GP-led processes, as well as many investors’ desire to secure liquidity from private equity assets.

Impact Funds Buck the Declining Trend

Fundraising remained robust throughout the first half of 2022, with data from Invest Europe showing European capital raising close to last year’s record level at €64bn10. However, the pace of activity decelerated in the second half, with publicly listed funds warning that fundraising processes would take longer than initially expected.

In contrast, funds with social and environmental purpose, in addition to a focus on financial returns, performed relatively strongly. Summa Equity raised Europe’s largest impact fund to date in January, gathering €2.3bn in just four months11. Demand from investors spurred new entrants, including consumer-focused firm L Catterton, which launched its impact platform in October12. New data from GIIN – the Global Impact Investing Network – showed that impact assets under management globally hit $1.16trn at the end of 2021, the first time the figure had breached the $1trn mark13.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE