2023 Private

Equity Outlook

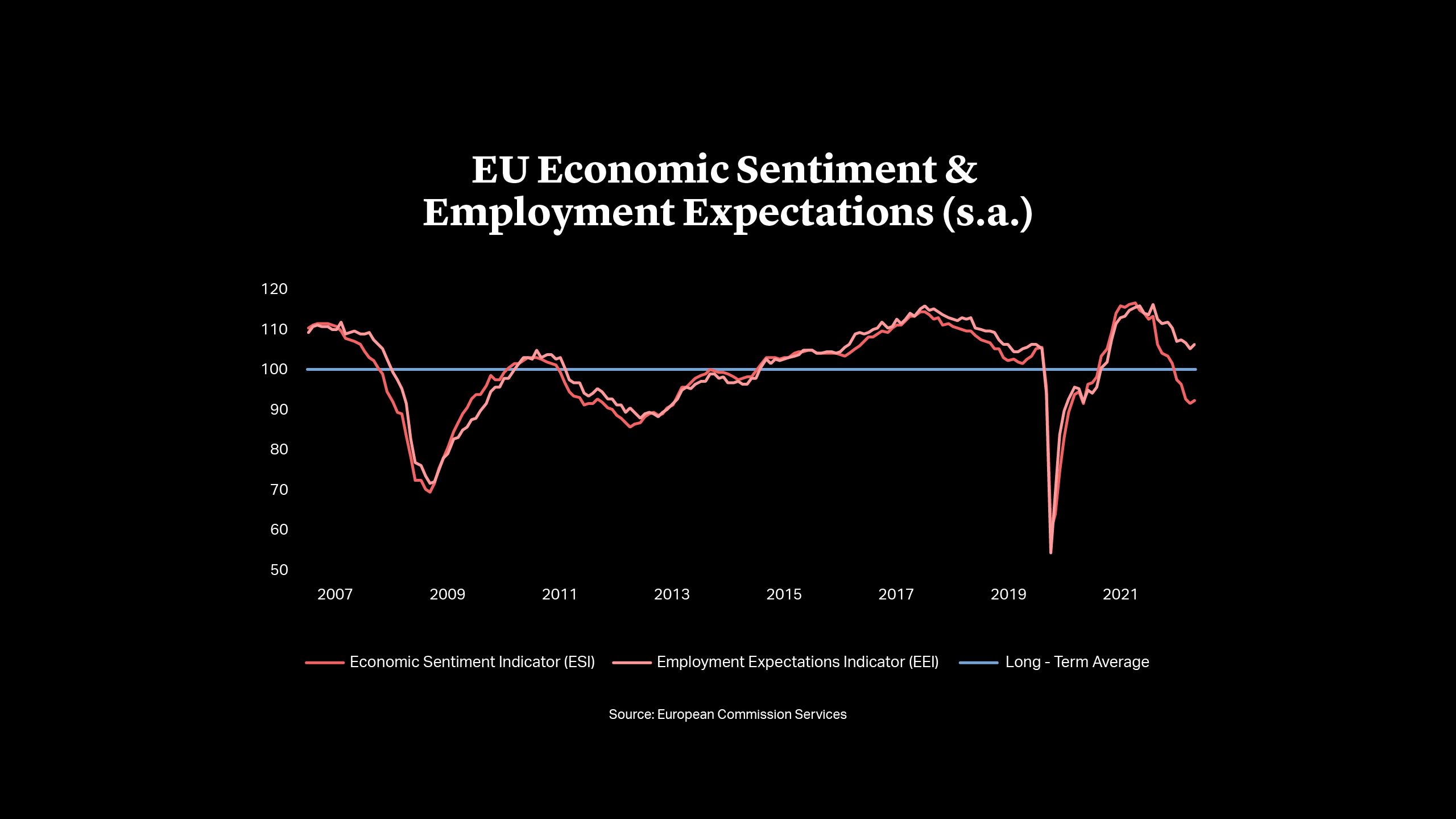

Sentiment has moved a long way over the course of the past year. Having swung strongly into positive numbers following the pandemic, the EU’s consumer confidence index has spent most of the year deep in negative territory. It improved slightly in November to hit a reading of -25.8, below the troughs caused by COVID-19, the financial crisis and Europe’s sovereign debt crisis1. It remains to be seen if an increase noted towards the end of 2022 marks the start of a new recovery.

Expectations that inflation may be coming under control in Europe, and that the bulk of the Federal Reserve’s interest rate rises have been made, are bringing some confidence back to markets, as are hopes that a relatively mild winter could ease energy supply concerns for businesses and consumers across the continent. Europe’s benchmark, the Stoxx 600, has recovered almost 15% since the end of September.

The UK faces greater inflationary pressure than the EU, yet it has managed to stabilize sterling and market jitters with a package of austerity measures under new Chancellor Jeremy Hunt. While the lack of visibility persists, a period of relative calm towards the end of 2022 has enabled deals to be finalized and even new processes to be considered. A €14.8bn deal by KKR, Global Infrastructure Partners and Saudi Arabia’s Public Investment Fund for a joint controlling interest in Vodafone’s towers business marked one of the largest investments of the year.

Sentiment has moved a long way over the course of the past year. Having swung strongly into positive numbers following the pandemic, the EU’s consumer confidence index has spent most of the year deep in negative territory. It improved slightly in November to hit a reading of -25.8, below the troughs caused by COVID-19, the financial crisis and Europe’s sovereign debt crisis1. It remains to be seen if an increase noted towards the end of 2022 marks the start of a new recovery.

Expectations that inflation may be coming under control in Europe, and that the bulk of the Federal Reserve’s interest rate rises have been made, are bringing some confidence back to markets, as are hopes that a relatively mild winter could ease energy supply concerns for businesses and consumers across the continent. Europe’s benchmark, the Stoxx 600, has recovered almost 15% since the end of September.

The UK faces greater inflationary pressure than the EU, yet it has managed to stabilize sterling and market jitters with a package of austerity measures under new Chancellor Jeremy Hunt. While the lack of visibility persists, a period of relative calm towards the end of 2022 has enabled deals to be finalized and even new processes to be considered. A €14.8bn deal by KKR, Global Infrastructure Partners and Saudi Arabia’s Public Investment Fund for a joint controlling interest in Vodafone’s towers business marked one of the largest investments of the year.

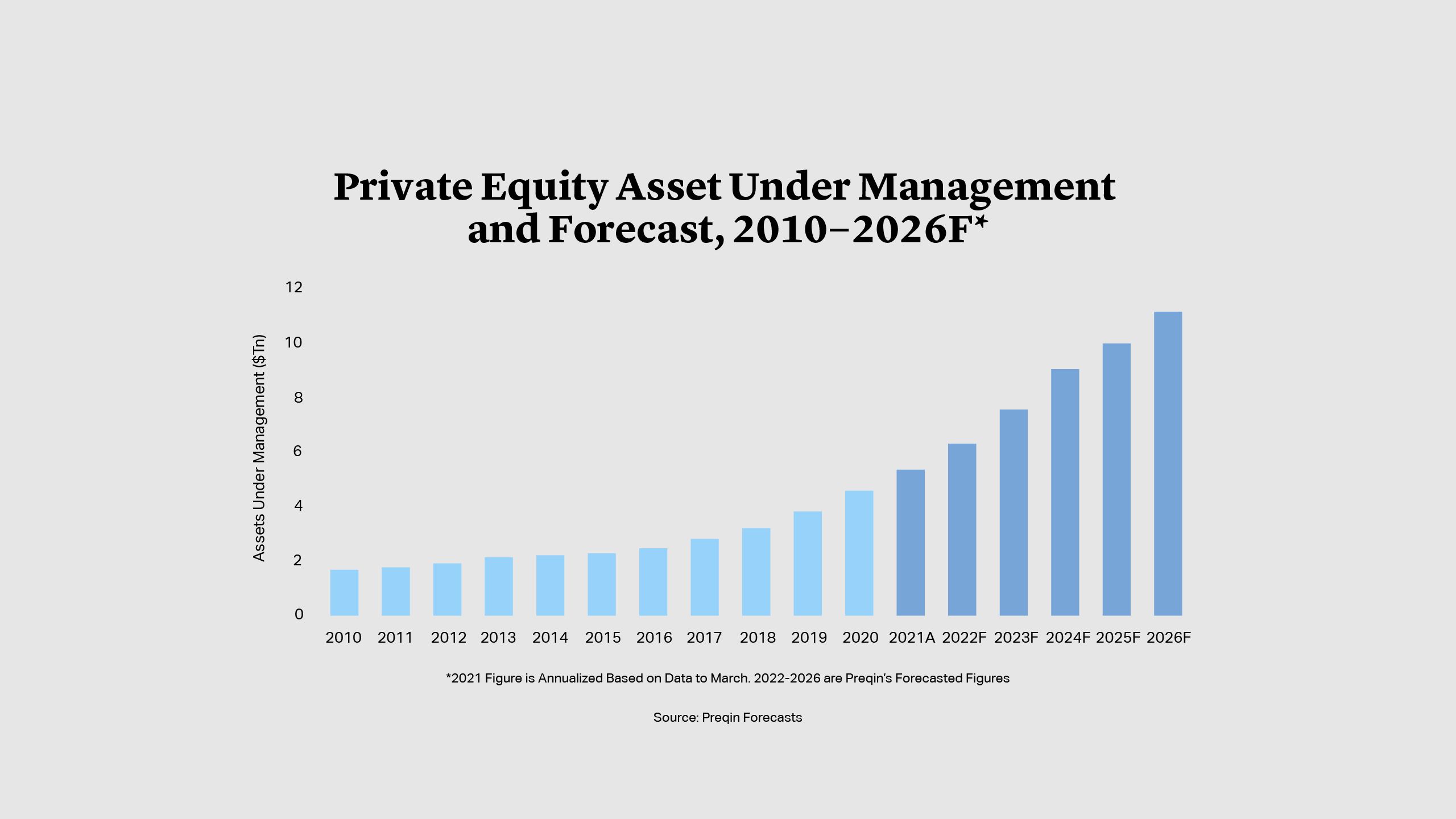

Dry Powder Supports Investment Appetite

High levels of dry powder should help to underpin investment, even as debt markets have weakened. According to Preqin, despite a much slower pace of fundraising, capital available for investment continues to expand, reaching $1.3tn globally in June 20222. Figures for Europe specifically show the same direction of travel, if a more modest total. Data from Invest Europe put dry powder for buyouts, growth capital and venture capital at a record €285bn in 20213.

At the same time, a contraction in valuations and increased financial stress on businesses is creating opportunities. Oaktree founder Howard Marks is among those expecting “great bargains” in discounted assets or loans made on more favorable terms4. Tight financing conditions will put the impetus on private equity firms to use more creative funding solutions, as well as using a greater proportion of equity. Software and technology focused firm Thoma Bravo is reported to have sealed two deals in the U.S. – the $2.3bn purchase of ForgeRock and the $1.3bn takeover of UserTesting – using all equity5. Sponsors with sizeable uncalled capital to deploy, the flexibility to invest using more creative investment structures, and a good network of co-investment partners, are likely to be best positioned to take advantage of market opportunities in H1 2023.

We expect investment activity to remain relatively calm through the first quarter of 2023. However, any improvement in macro conditions could set off a new spell of active dealmaking, which would likely be mirrored by an improvement in lending appetite by banks and bond markets.

Some Pivot to Earlier-Stage Investments

The current constriction of debt markets and caution about the macroeconomic environment is leading to a change in approach among some sponsors. In keeping with the increased prevalence of all-equity deals, firms with a wide remit to invest across the capital structure and stages of company development are showing greater interest in venture capital and growth investments.

European start-ups have faced many of the macro concerns affecting large businesses throughout 2022 but have also been prepared to accept steep valuation haircuts. Data from PitchBook suggests that almost 20% of VC funding in Q3 was made at a lower valuation than the previous funding round. In some cases this was extreme: Swedish fintech Klarna saw its valuation cut to $6.7bn from $45.6bn in July6, after previously announcing a 10% cut in jobs. These conditions are forcing many startups to focus on revenue generation sooner, rather than growth at all costs, which may make them less speculative and more attractive to investors.

Long-Term Opportunities in Agriculture and Infrastructure

The desire for yield, steady cash flows and inflation protection has helped lift the profile of infrastructure, resulting in some of the largest deals of 2022 – including Blackstone and the Benetton family’s takeover of Italian roads operator Atlantia at an enterprise value of some €54bn. Others have involved carve-outs from large utilities, such as Macquarie and British Columbia Investment Management Corporation’s joint deal to buy a 60% stake in National Grid’s gas transmission and metering business at a valuation of about £9.6bn7, which received anti-trust clearance in the UK in November. The trend is likely to continue in 2023 as corporates look for ways to realize cash to reduce their rising debt bills, and large sovereigns and private equity firms seek secure income streams tied to essential European businesses and services.

Private equity firms are also increasing their presence in other relatively unexplored areas, including farmland. Having traditionally been a low-yielding long-term investment area, farming is benefitting from the application of technology to boost production, as well as increased attention on food security, climate change and managing the natural environment. Sixth Street has become one of the largest owners of Avocado farms in the U.S. since entering the space in 20148, while in Europe, AXA and Unilever have teamed up with Tikehau Capital on an impact fund they hope will raise €1bn to invest in regenerative agriculture9.

Brighter Outlook Could Unleash Investment

Expectations for Europe’s economy entering 2023 are more pessimistic than they were 12 months ago. Visibility is low and uncertainty is high. A lot will depend on how European countries weather this winter, and if energy concerns become a new energy crisis. Nonetheless, private equity activity is set to continue – albeit at a more moderate pace – as firms find creative solutions to invest in more attractively valued businesses in spite of financing constraints. Should the outlook brighten in the near-term, then pent-up private equity demand could unleash a new wave of investment across Europe.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE