Private Equity

in Africa:

Outlook for 2021

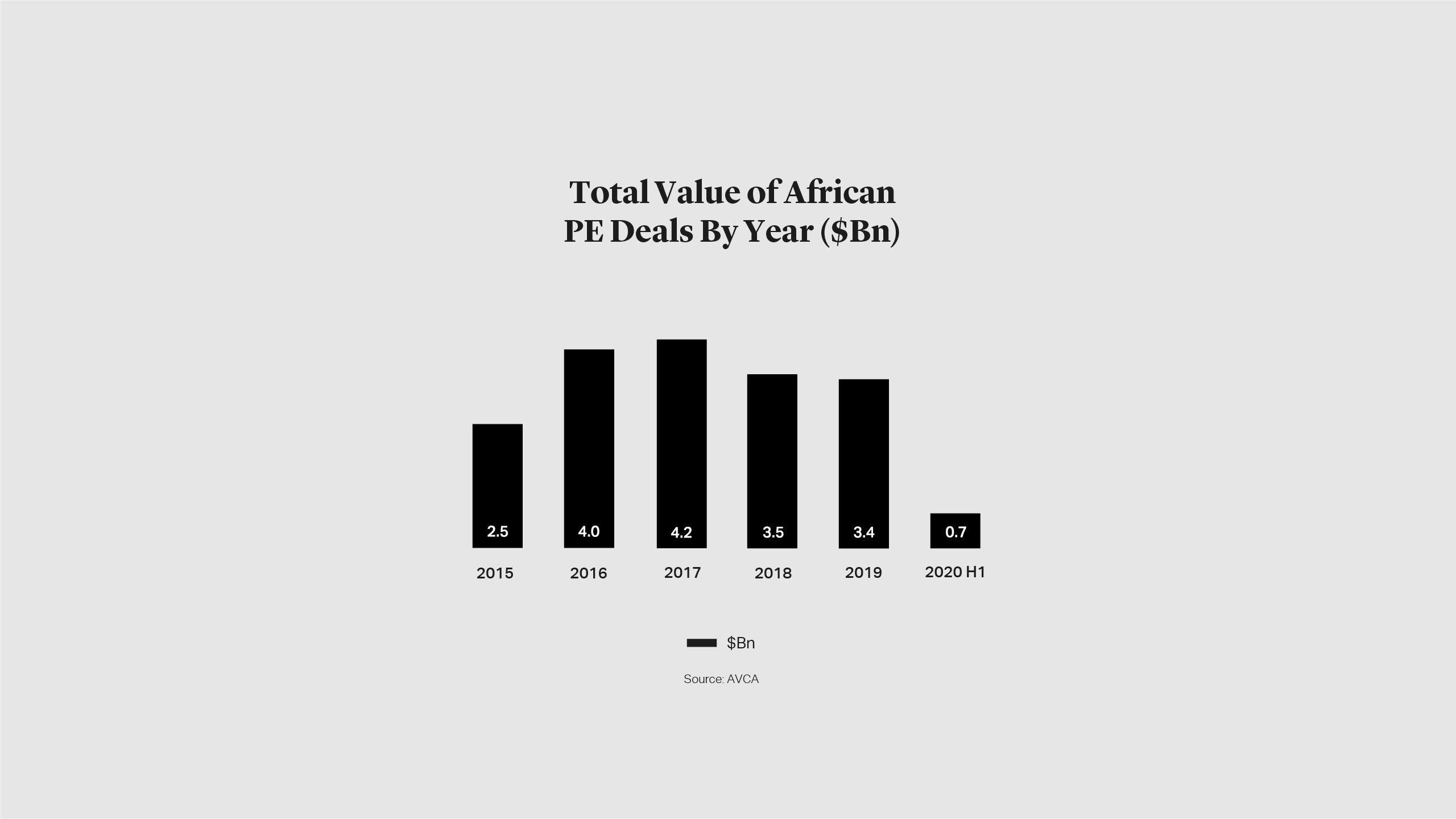

In 2012, rockstar-turned-activist Sir Bob Geldof addressed the SuperReturn conference in Berlin, urging the global private equity industry to turn its attention to Africa. He highlighted the opportunities to generate returns while leaving behind “firms, farms and factories” essential for the continent’s development. Eight years later and many sponsors have been drawn by Africa’s expanding economic growth and its youthful and rapidly growing population, finding opportunities in fast-growing sectors including technology and healthcare. Fundraising for the continent reached $3.8 billion in 2019 according to the AVCA, the best year since 2015, while the number of successfully executed deals has risen consistently.

2020 has brought a unique and unprecedented set of challenges for countries and businesses globally. Although the worst fears about the impact of COVID-19 on the continent have not materialised, the economic impact on many African countries and businesses has been severe. Sponsors have seen fundraising and deal timelines pushed back, and have grappled with reduced growth prospects for their portfolio companies. Fundraising was down by over 130% in the first half of 2020, compared to the same period in 2019, while firms have spent considerable time on portfolio management and protection, addressing cash flow and liquidity issues, in response to challenges posed by the pandemic.

DFIs’ Central Role in African Private Equity

Development Finance Institutions (DFIs), the largest investor group in African private equity, have played a unique role supporting sponsors and their portfolio companies during the pandemic. Several DFIs have worked with private equity firms to provide relief facilities to assist portfolio companies, as well as operational support and know-how. DFIs are expected to continue to play a leading role, not only by providing funding, but also by increasing direct investments, mobilising third-party capital, and advocating for favourable regulatory change.

Covid-Resilient Sectors Offer Opportunities as VC Funding Grows

Financial services, information technology (including communications) and healthcare have shown resilience, both in Africa and around the world. According to the AVCA, these industries together accounted for about 37% of total PE deal value between 2014 and 2019, and 54% in the first half of the year. Growing demand for telecoms, electronic payments, consumer credit and internet services has been accelerated by COVID-19. We expect that these sectors will continue to create investment opportunities in Africa, and be the emphasis of venture capital funding for start-ups.

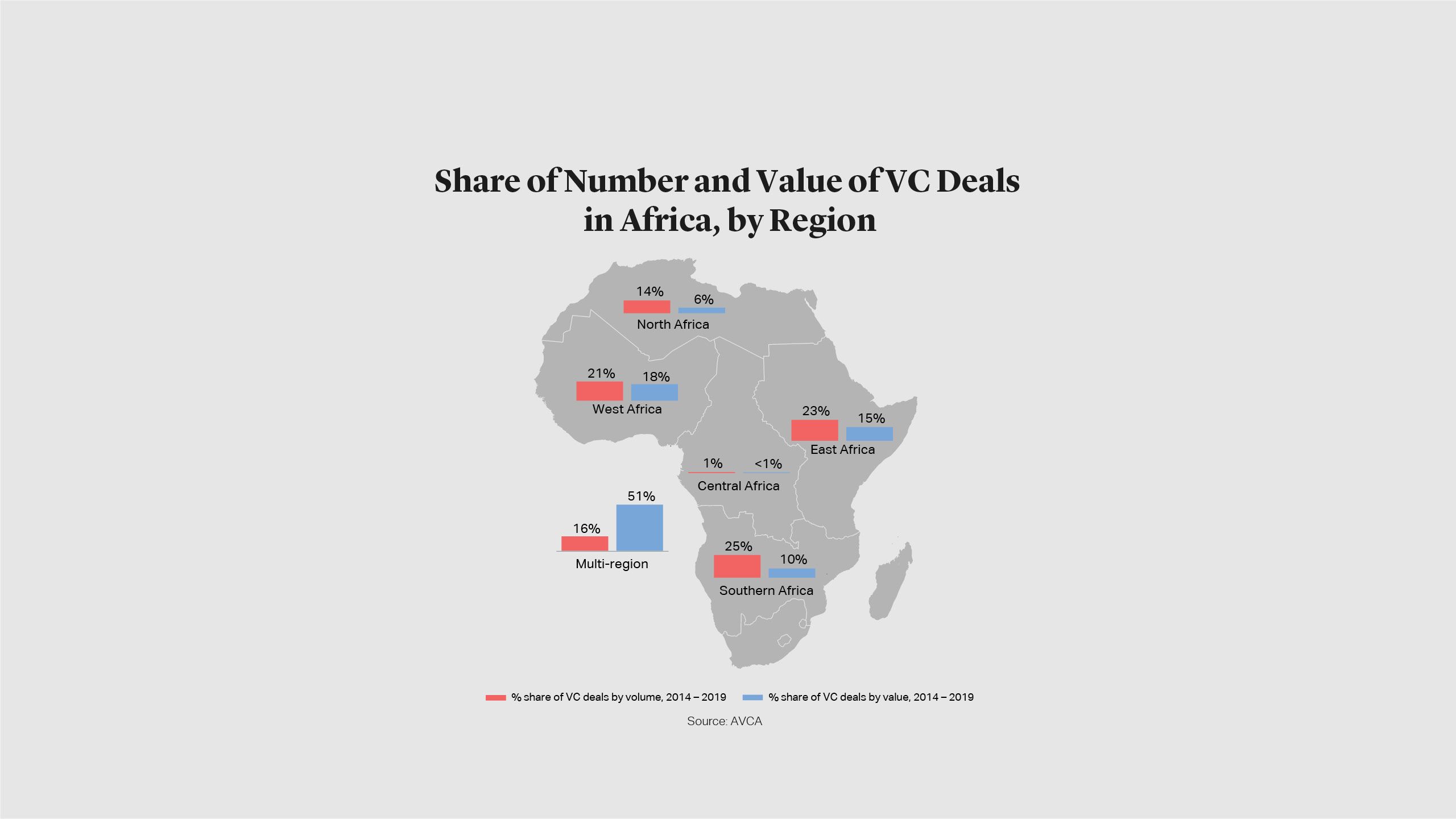

Venture capital accounted for one-third (34%) of deal volume in 2019, with an increasing share of funding pouring into fintech and e-commerce, as well as businesses focused on developing technology solutions for sectors including energy, agriculture, utilities and logistics. Notwithstanding the drop in activity this year, we expect growth in VC investment to resume in 2021. The continued proliferation of VC-backed technology and technology-enabled start-ups should create a considerable number of scalable businesses, which can later attract more mainstream private equity funds. Such companies may also be particularly attractive to strategic buyers looking for footholds in Africa. US group Stripe’s acquisition of Nigerian payments company Paystack, announced in October and reported to be worth about $200 million, enables the two businesses to step up their service across Africa, while creating an exit opportunity for a number of Paystack’s early VC investors.

Access to New Sources of International Finance

Private equity firms have continued to look to diverse and alternative sources of funding as more traditional investment contracted during 2020. There has been a significant increase in fundraising for special acquisition vehicles (SPACs), particularly in the US. Such vehicles may provide an interesting source of funding for African and African-focused PE sponsors, and offer an alternative to the IPO exit route.

Some groups are showing there is appetite among a wide range of international investors for African assets. Pan-African firm Helios recently announced an agreement with Fairfax Africa, majority-owned by Canadian financial services group Fairfax, to create an Africa focused alternative asset manager listed on the Toronto Stock Exchange. The new vehicle will bring access to an enlarged and permanent capital base to finance investments on the continent, and highlights the potential for consolidation in the African private equity market.

Recovery on the Horizon

The near-term outlook for the many countries across the continent remains uncertain. However, we expect to see a recovery in sponsor activity as COVID-19 retreats, countries continue to open up and investment conditions improve. That recovery is expected to be slower in some large economies such as South Africa, Nigeria and Angola, which experienced a number of significant challenges prior to the onset of the pandemic. Nonetheless, favourable social and economic conditions mean these countries will continue to offer great opportunities for private equity.

Other high-growth economies, such as Kenya, Ethiopia, Ghana and Cote d’Ivoire, are also projected to see a slowdown in growth, but will nevertheless outperform the global economy. These countries have attracted growing private equity attention in recent years, a trend we expect to continue in 2021 and beyond.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner