2020 Private

Equity Market

Roundup

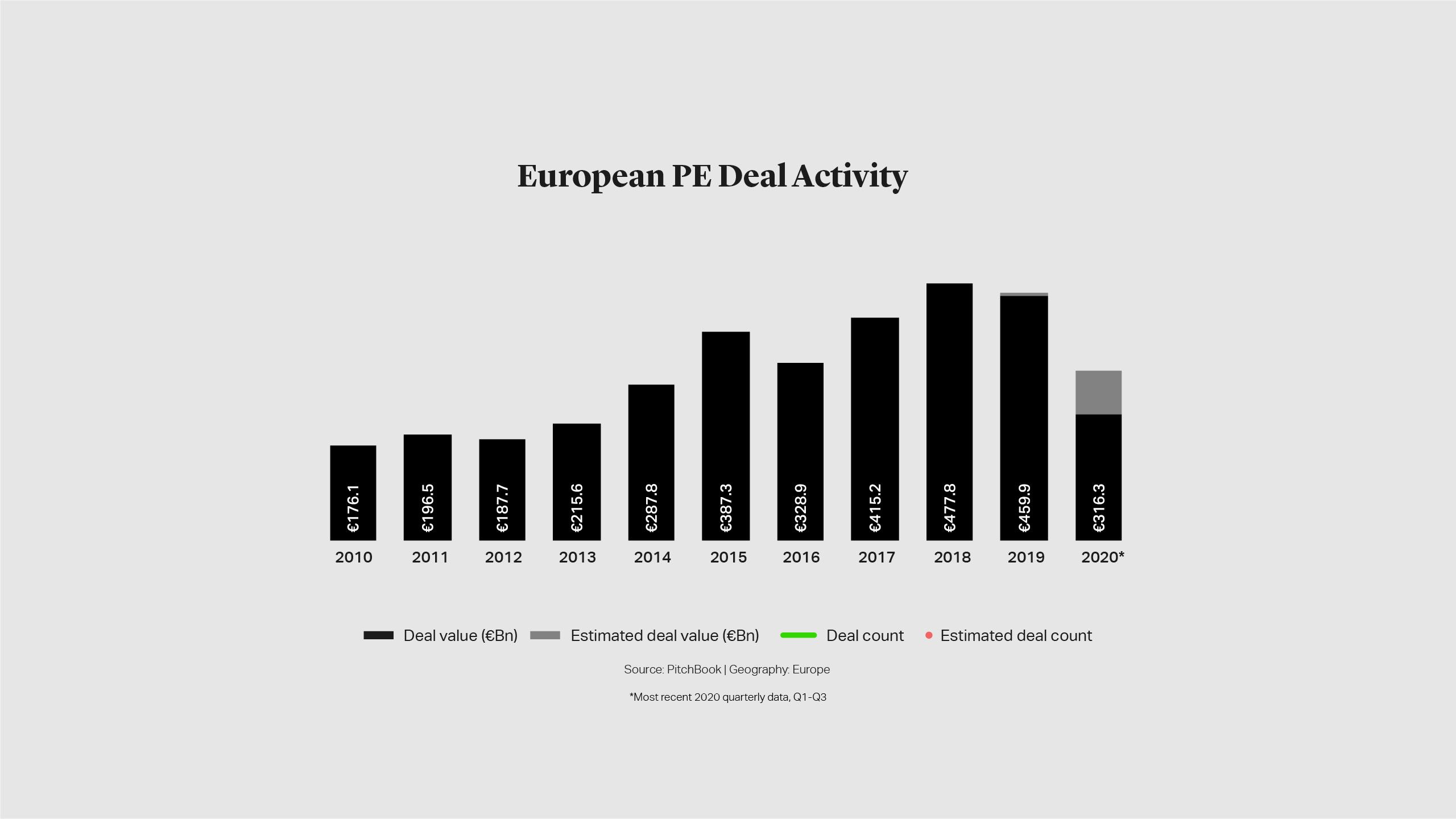

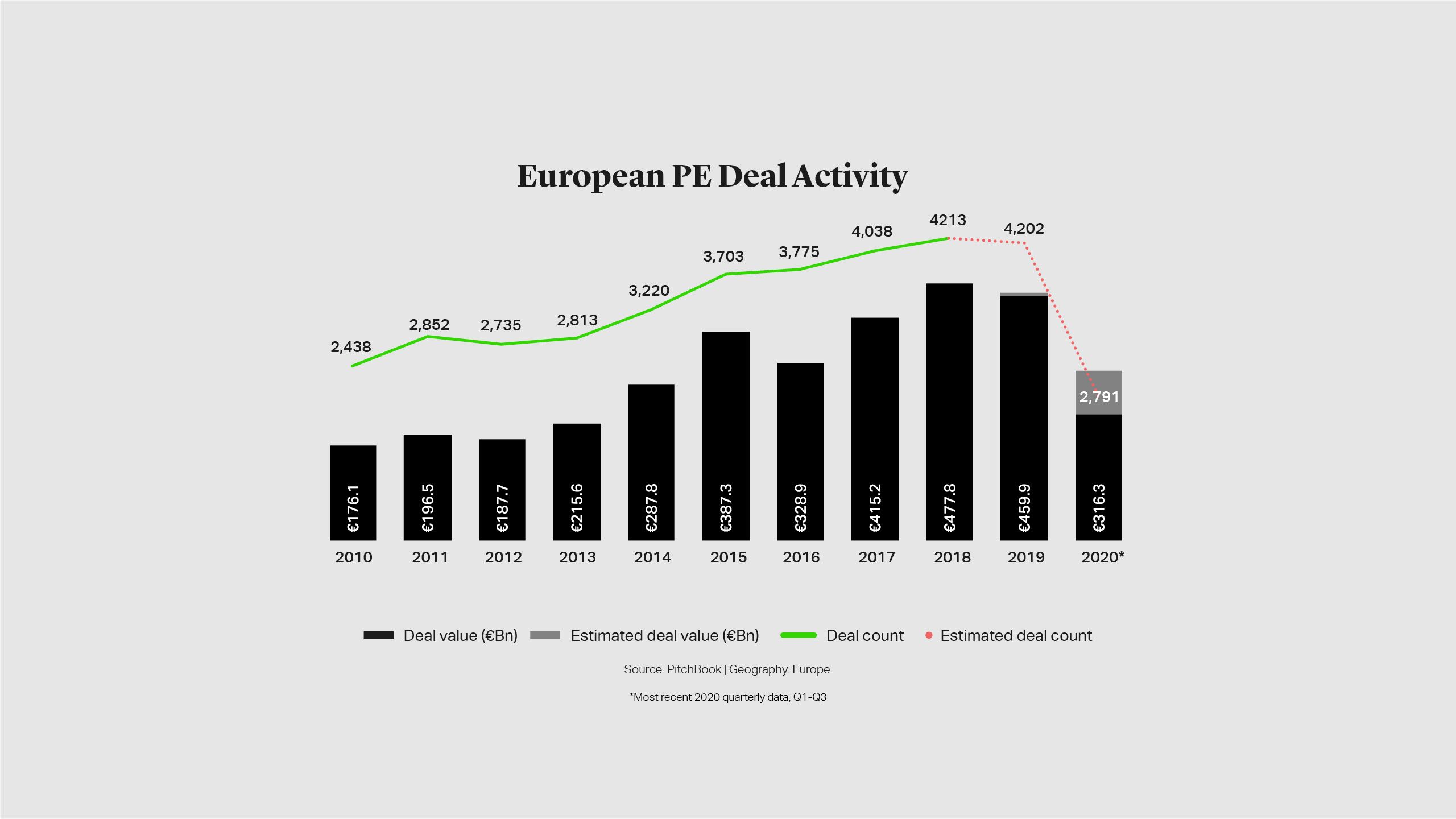

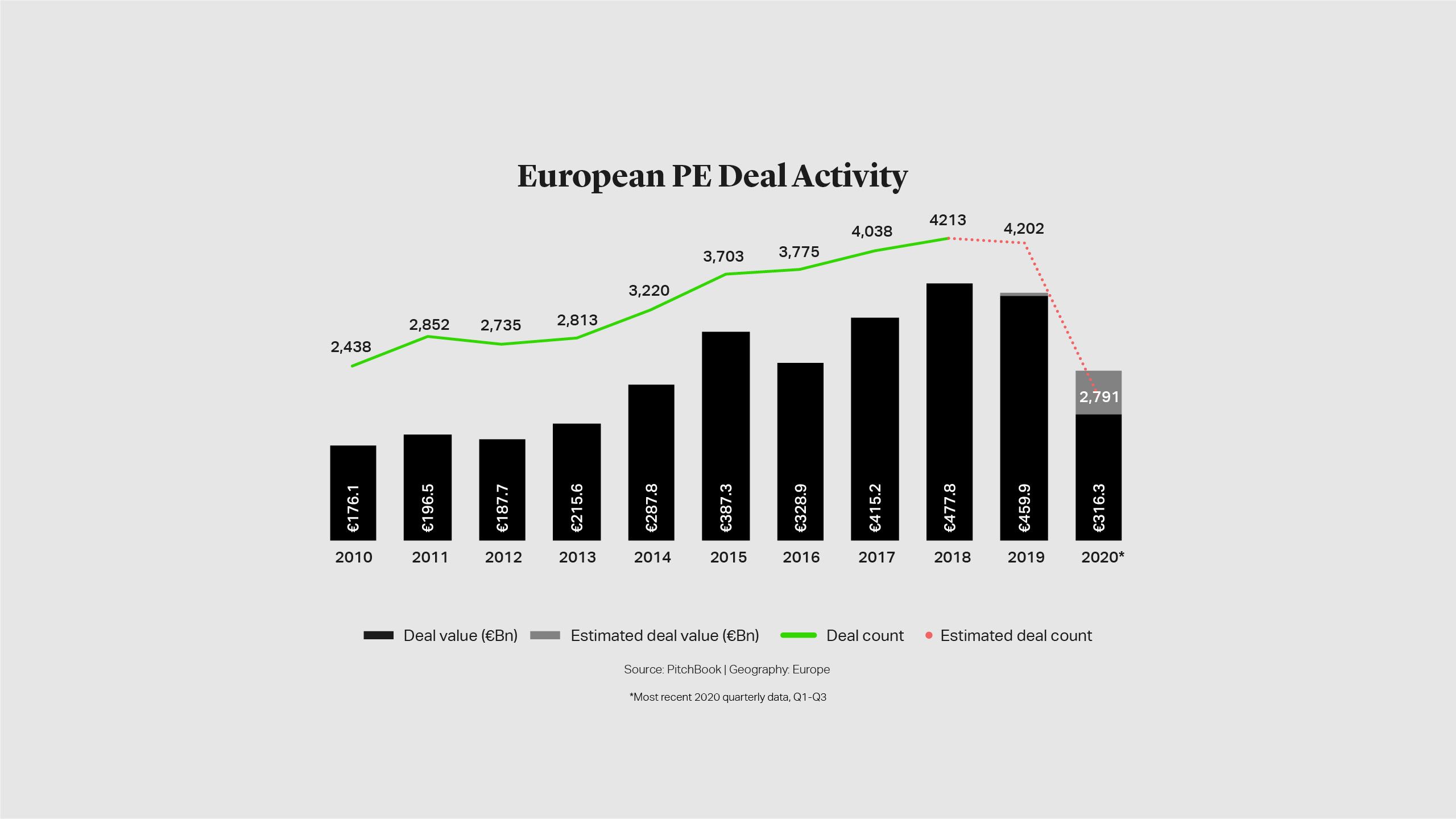

The impact of COVID-19 on the economy and private equity activity in 2020 was abrupt and severe. From the high point of the €17 billion deal for ThyssenKrupp’s elevators division in February (see Top 10 deals for 2020), investment slowed sharply in March as lockdown and the ensuing economic downturn forced prospective buyers to tear up their forecasts. Some buyers could and did renegotiate deal terms and pricing, while others less advanced in their processes chose to walk away. At the same time, the turmoil caused many sponsors to turn their attention to capital raising and ensuring that existing portfolio companies had sufficient liquidity to weather the crisis.

After the uncertainty of the early spring, came a summer rebound. Deal pipelines filled and activity picked up as lockdowns eased, resulting in a marked improvement in investment in the third quarter. By the end of October, European private equity investment had hit €316 billion for the first nine months, with deal sizes 21% smaller than last year and another €144 billion needed to match 2019’s total, according to Pitchbook data. Then, as European countries were re-implementing restrictions to counter a resurgence in COVID-19 cases, breakthroughs in vaccine development prompted renewed optimism and lifted markets.

The year has presented undoubted challenges for sponsors. Principal among those is the valuation gap between buyers and sellers, with EBITDA expectations as much as 30% apart. However, we have also seen resilience in parts of the market and the emergence of new trends as firms have adapted to the conditions.

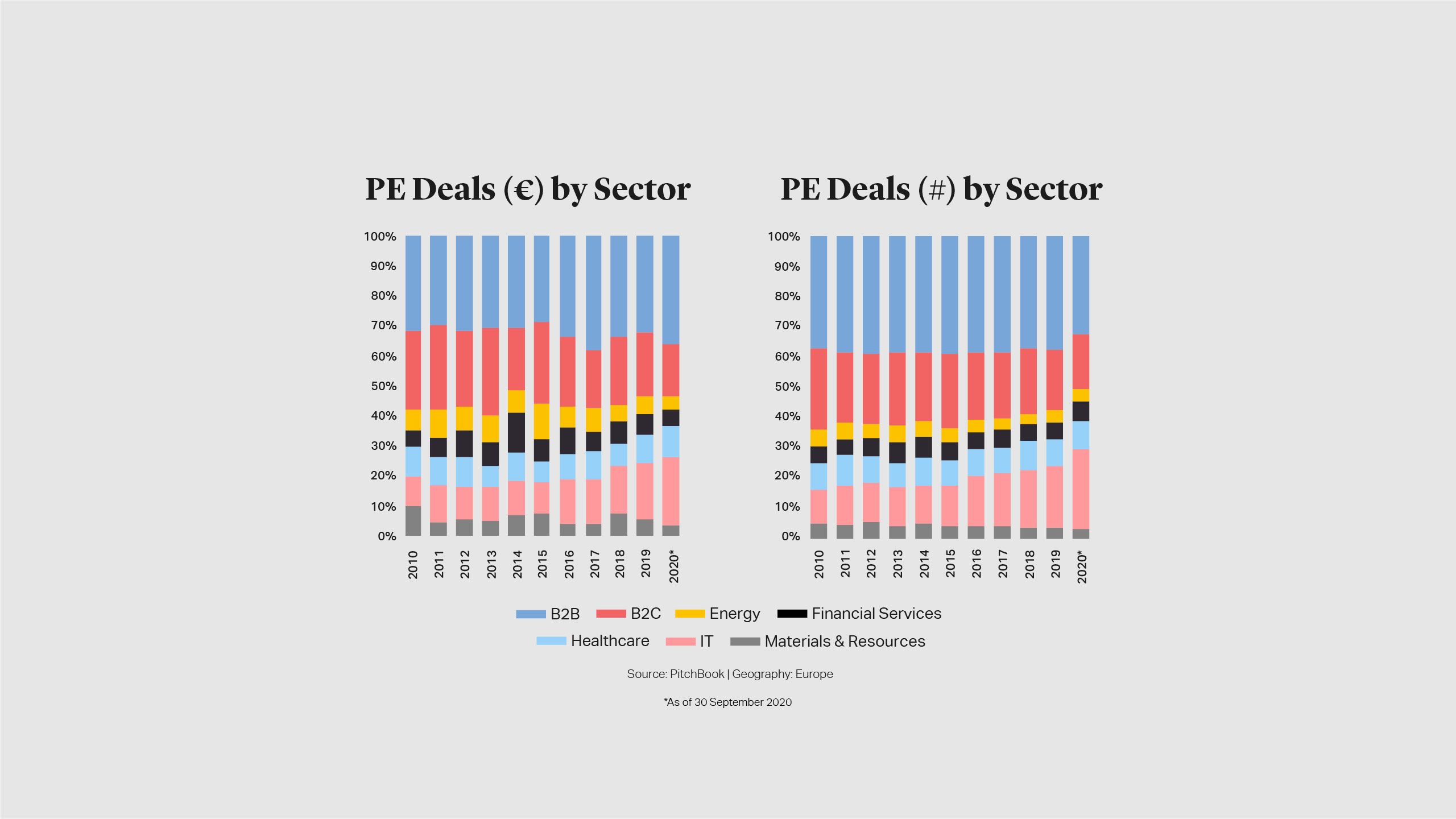

Tighter Sector Focus

The pandemic response has created winners and losers at a business and sector level. Sponsors have focused their attention on a narrower range of sectors, principally:

- Technology, including AI

- Healthcare, including vaccine development and long-term healthcare provision

- Supply chain and distribution, including real estate assets and ecommerce and systems for online sales

The result has been a concentration of competition in processes for resilient, high quality assets. At $12.2 billion, the Hg-led investment in Nordic enterprise software group Visma in August marked the world’s largest ever software buyout. In some cases, we have seen knockout bids, such as KKR and Ardian’s pre-emption of the expected $3.5 billion auction by CVC in July for French clinics chain Elsan. Other sectors – such as travel and leisure – have fallen out of favour, while companies with impacted performance or a less clear outlook have struggled to attract buyer interest.

Imaginative Deal Structuring

The crisis has highlighted some of the risks of equity ownership, leading private equity firms to come up with solutions more tailored to the environment, whether that be hybrid instruments or minority investments. As a result, we have seen growth in investment structures that can mitigate downside risks for sponsors, while providing companies the funding they need. These have included:

Private equity firms have shown flexibility by moving around the capital and ownership structure, giving them and their target companies more flexibility. The sale of a minority stake in UK online sports brand GymShark attracted a wide range of offers, leading to the investment by General Atlantic at a £1 billion valuation, while Ardian completed a complex deal to carve out a minority position in Telecom Italia’s towers operations in June.

Distressed Opportunities Have Not Fully Materialised Yet

While many companies and sectors experienced a sharp downturn in sales in the first and second quarters, the quick and sizeable infusion of fiscal and monetary support by Governments helped stave off default for many of the worst affected. France and Germany have put in place company employee support schemes to the end of 2021, while the UK has extended its furlough schemes to the end of March, as well as making various business support loans available.

The impact has been sizeable for large industries like aviation, with UK schemes supporting the salaries of 55,000 furloughed workers, while providing £1.8 billion for businesses through COVID Corporate Financing. A Global Travel Taskforce is investigating ways to facilitate international travel, including a better test and trace regime, but when financial support packages roll off, distress is likely to be much more visible in travel, as in other hard-hit sectors.

Unlike the Great Financial Crisis, the credit system has not displayed significant dislocation. Companies and sponsors can continue to raise funds at attractive pricing. However, borrowing from traditional lenders will get tougher for companies experiencing the greatest challenges in the trading environment.

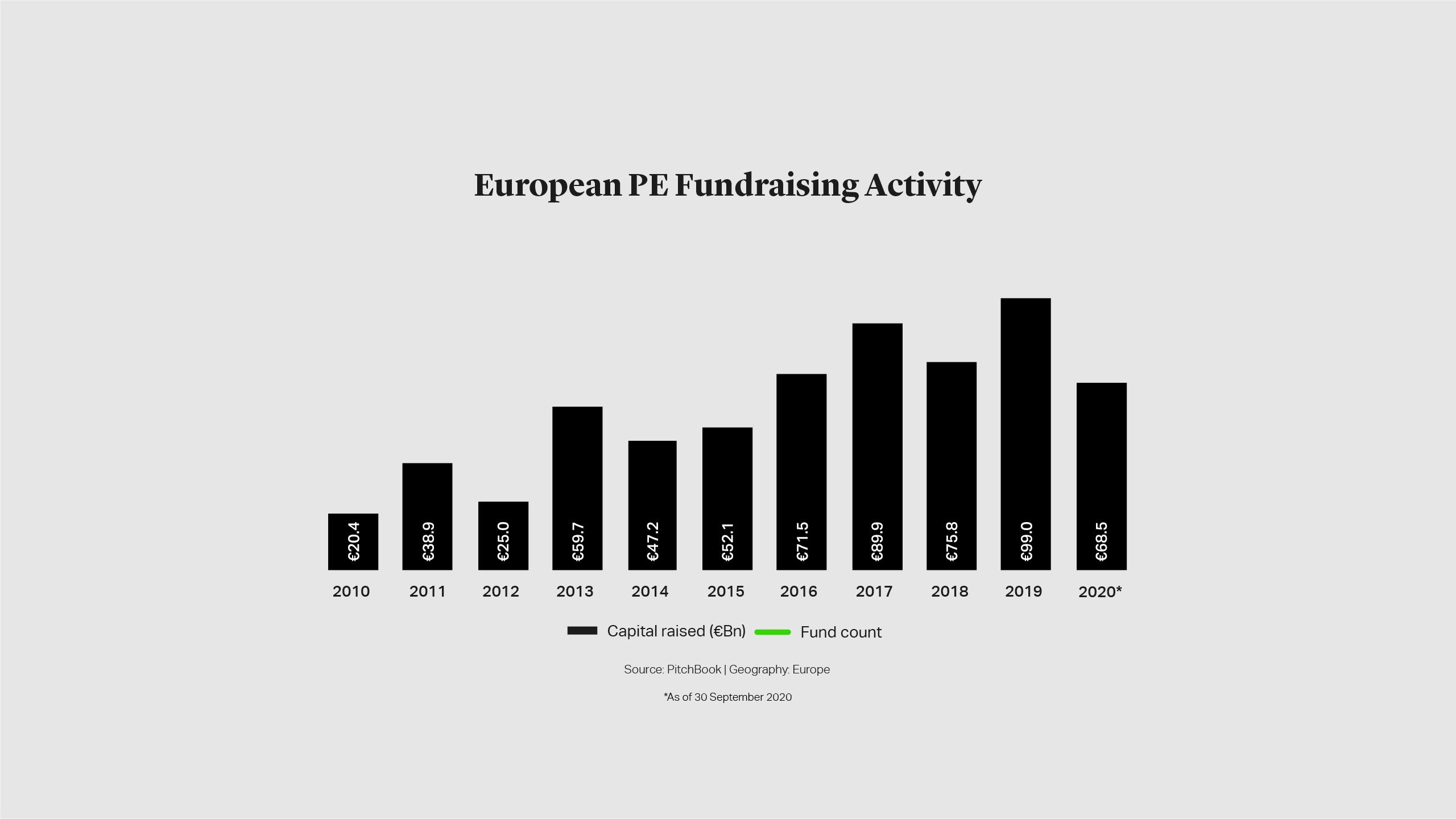

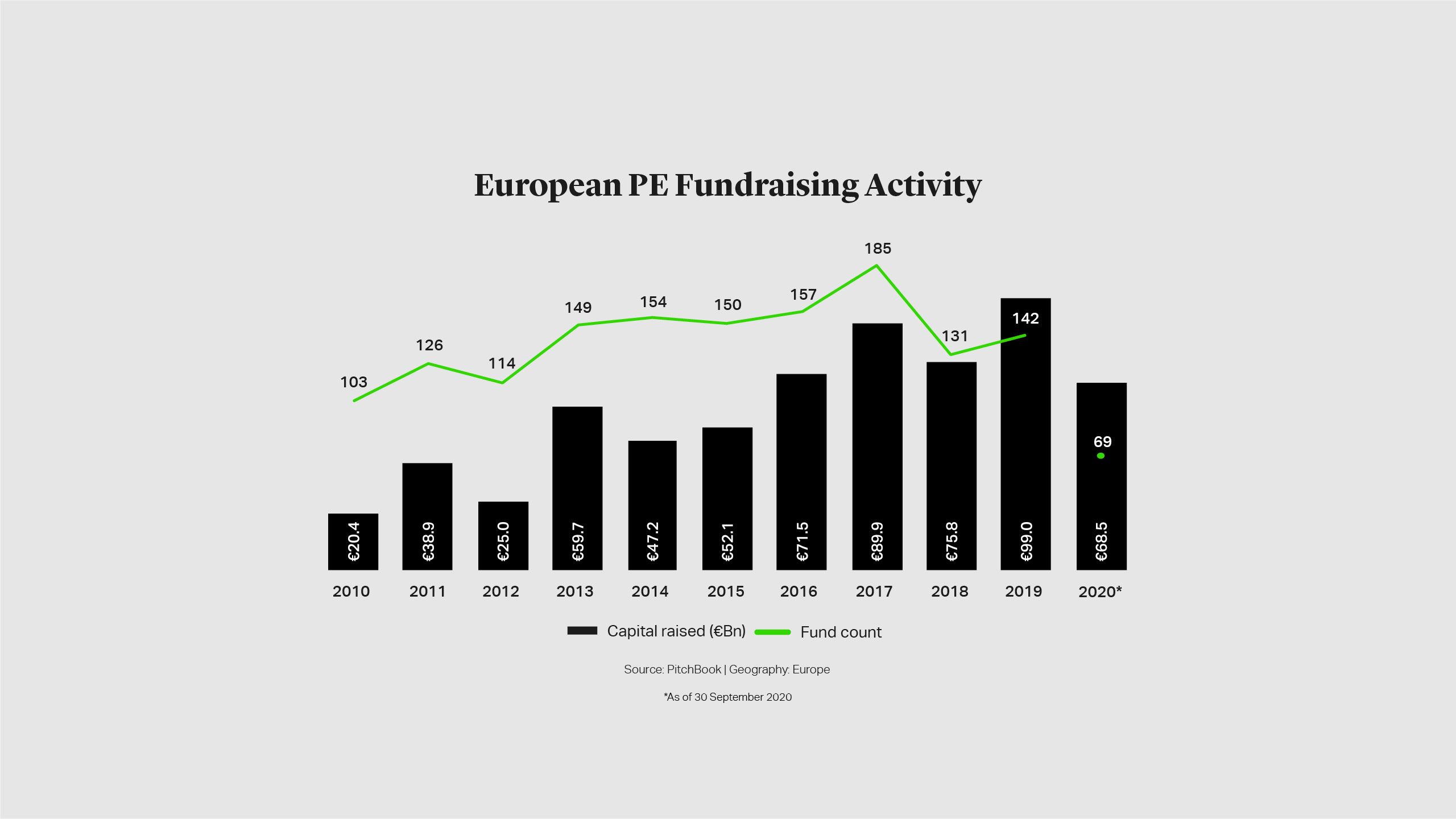

Robust Investor Appetite Continues

Fundraising for European private equity continued strongly, driven by demand from investors as well as large funds coming back to market. European fundraising reached €49 billion in the first half of 2020, largely in line with the 2019 level, according to Invest Europe data. The total for the year will be boosted by CVC’s largest ever buyout fund at €21 billion, while Nordic Capital managed to raise €6 billion in less than six months in an entirely virtual fundraise. Terms have continued to be favourable to GPs, and GPs have sought more flexible terms to extend investment and realisation periods, and also permit more capital recycling.

Appetite for private equity has continued to manifest itself through co-investment demand. Large deals – including ThyssenKrupp elevators and Visma – have seen sovereign wealth funds join as co-sponsors. However, the majority of deals we have seen in 2020 have involved co-investments from across the LP base as sponsors have regularly syndicated equity participation at, or shortly after, completion – a trend we expect to continue.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

London

T: +44 20 7614 2219

mjames@cgsh.com

V-Card