GenAI: Opportunities and Risks for Private Equity Firms and Portfolio Companies

December 2024

As generative AI (GenAI) gains traction across industries, private equity firms are looking to leverage its potential to unlock efficiencies, enhance decision-making and drive value creation both within their own operations and those of their portfolio companies.

Recent surveys indicate that over 64% of private equity firms are looking to acquire new GenAI technology or products as part of their firm’s AI strategy1,with another study indicating that up to 75% of private equity firms are already utilising AI in their portfolio companies or plan to do so in the next 12 months2.

In 2023, private equity firms invested a reported total of $2.18Bn in GenAI, more than double the previous year’s total of $1Bn. Projections indicate that investments in GenAI will comfortably surpass this amount in 20243.

As generative AI (GenAI) gains traction across industries, private equity firms are looking to leverage its potential to unlock efficiencies, enhance decision-making and drive value creation both within their own operations and those of their portfolio companies.

Recent surveys indicate that over 64% of private equity firms are looking to acquire new GenAI technology or products as part of their firm’s AI strategy1, with another study indicating that up to 75% of private equity firms are already utilising AI in their portfolio companies or plan to do so in the next 12 months2.

In 2023, private equity firms invested a reported total of $2.18Bn in GenAI, more than double the previous year’s total of $1Bn. Projections indicate that investments in GenAI will comfortably surpass this amount in 20243.

Opportunities Abound for GenAI Use in Portfolio Companies

The business impact of GenAI is being realised by organisations through a growing list of use cases and strategic initiatives, and opportunities for private equity firms to deploy GenAI in the operations of their portfolio companies are already emerging, including:

Increasing Productivity through Automation

One of the most immediate benefits of GenAI is its ability to automate repetitive, time-consuming tasks. Portfolio companies can adopt AI-powered automation tools to streamline operations, reduce manual errors, and cut operational costs, freeing up key worker hours.

Personalising Customer Engagement

GenAI tools can take in vast amounts of structured and unstructured data to enable portfolio companies to deliver tailored marketing messages, product recommendations and support to customers, ultimately improving customer satisfaction and driving revenue growth.

Identifying Opportunities for Innovation

By analysing market trends and consumer behaviour, GenAI can identify gaps in the markets and industries in which portfolio companies operate, providing insights that help drive the development of new products and services.

Enhancing Learning and Development

GenAI can enhance learning, development and training efforts within portfolio companies by making them more custom-tailored to each employee, improving worker development and expertise.

Augmenting Problem-Solving Capabilities

GenAI can act as an effective strategist, an iterative co-pilot, and a source of knowledge, enabling workers to perform higher order problem-solving both individually and collaboratively.

Streamlining Internal and External Communication

GenAI is an effective drafter and editor of communications – workers can prompt GenAI tools to propose first drafts of emails and internal memoranda, and leverage GenAI to make the communications of portfolio companies more concise and effective.

…As Well as Opportunities for the House

Performance Monitoring

AI tools have been developed to make it easier for private equity firms to monitor the performance of their portfolio companies by automating data collection and reporting processes, providing real-time performance insights. This analysis can be fed back rapidly to the portfolio companies, as well as being aggregated with other datasets to potentially provide deeper insights into performance trends.

Optimising Target Selection and Exit Planning

The analytical capabilities of GenAI can also be deployed to support the capital allocation process for private equity firms. By using predictive analytics and training GenAI on historical data, private equity professionals can forecast market trends within the industries of their existing portfolio companies and analyse both macro trends and the performance of specific investment targets, helping firms identify the right moment to exit existing investments and to enter into new ones.

…As Well as Opportunities for the House

Performance Monitoring

AI tools have been developed to make it easier for private equity firms to monitor the performance of their portfolio companies by automating data collection and reporting processes, providing real-time performance insights. This analysis can be fed back rapidly to the portfolio companies, as well as being aggregated with other datasets to potentially provide deeper insights into performance trends.

Optimising Target Selection and Exit Planning

The analytical capabilities of GenAI can also be deployed to support the capital allocation process for private equity firms. By using predictive analytics and training GenAI on historical data, private equity professionals can forecast market trends within the industries of their existing portfolio companies and analyse both macro trends and the performance of specific investment targets, helping firms identify the right moment to exit existing investments and to enter into new ones.

The Legal and Regulatory Risk Landscape for GenAI

While GenAI holds significant promise for private equity firms, its development, deployment and use needs to be considered in the context of existing and emerging legal frameworks, particularly with respect to intellectual property, data protection, privacy and legal privilege, as well as emerging regulatory initiatives in various jurisdictions. Awareness of, and early engagement with, potential legal and regulatory concerns is key for both portfolio companies and their private equity owners to implement GenAI effectively without attracting liability or regulatory scrutiny down the line.

Some of the most significant issues which private equity firms and their portfolio companies should consider in the implementation of GenAI include:

The Legal and Regulatory Risk Landscape for GenAI

While GenAI holds significant promise for private equity firms, its development, deployment and use needs to be considered in the context of existing and emerging legal frameworks, particularly with respect to intellectual property, data protection, privacy and legal privilege, as well as emerging regulatory initiatives in various jurisdictions. Awareness of, and early engagement with, potential legal and regulatory concerns is key for both portfolio companies and their private equity owners to implement GenAI effectively without attracting liability or regulatory scrutiny down the line.

Some of the most significant issues which private equity firms and their portfolio companies should consider in the implementation of GenAI include:

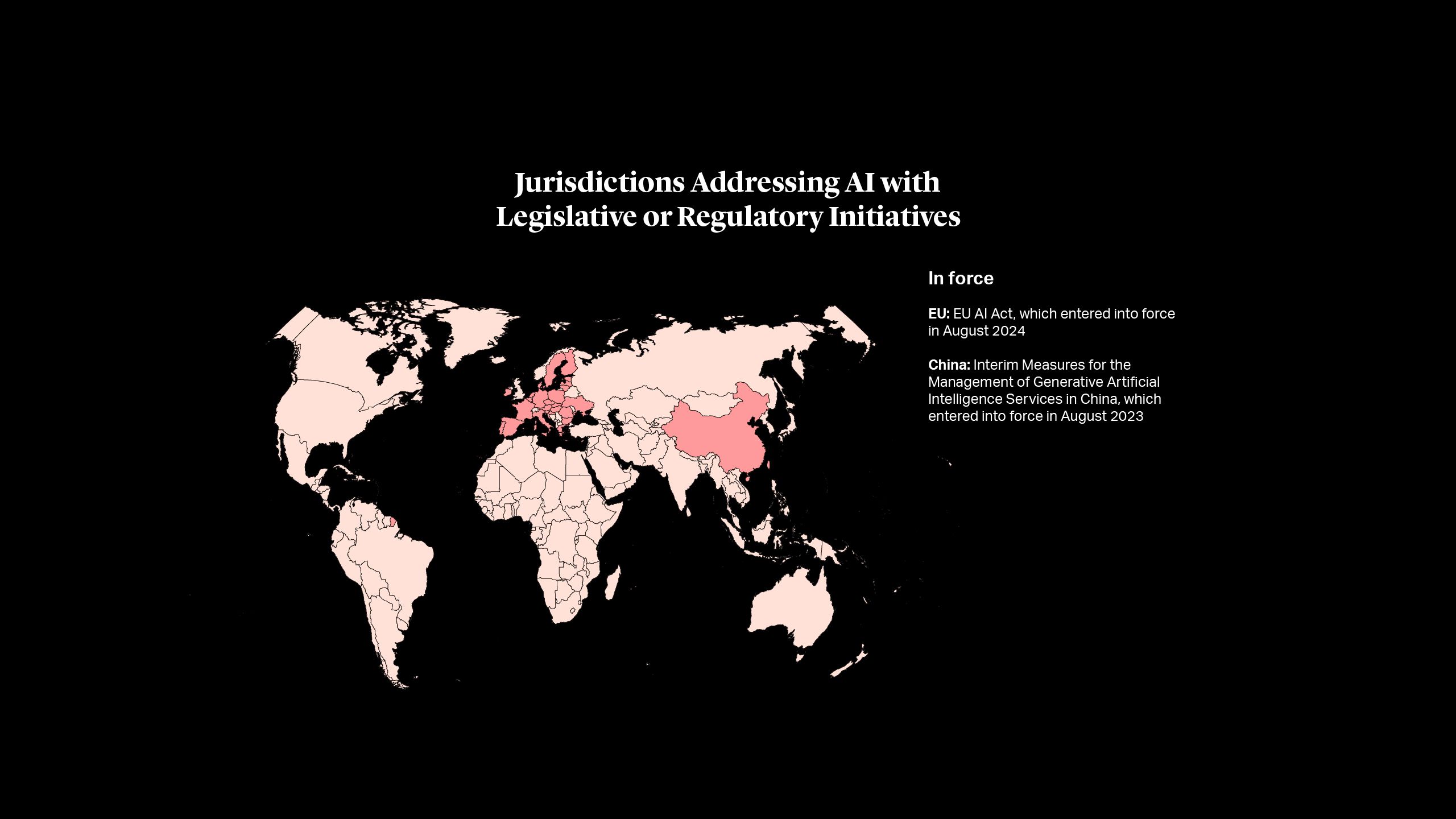

AI-Specific Regulatory Initiatives are Emerging

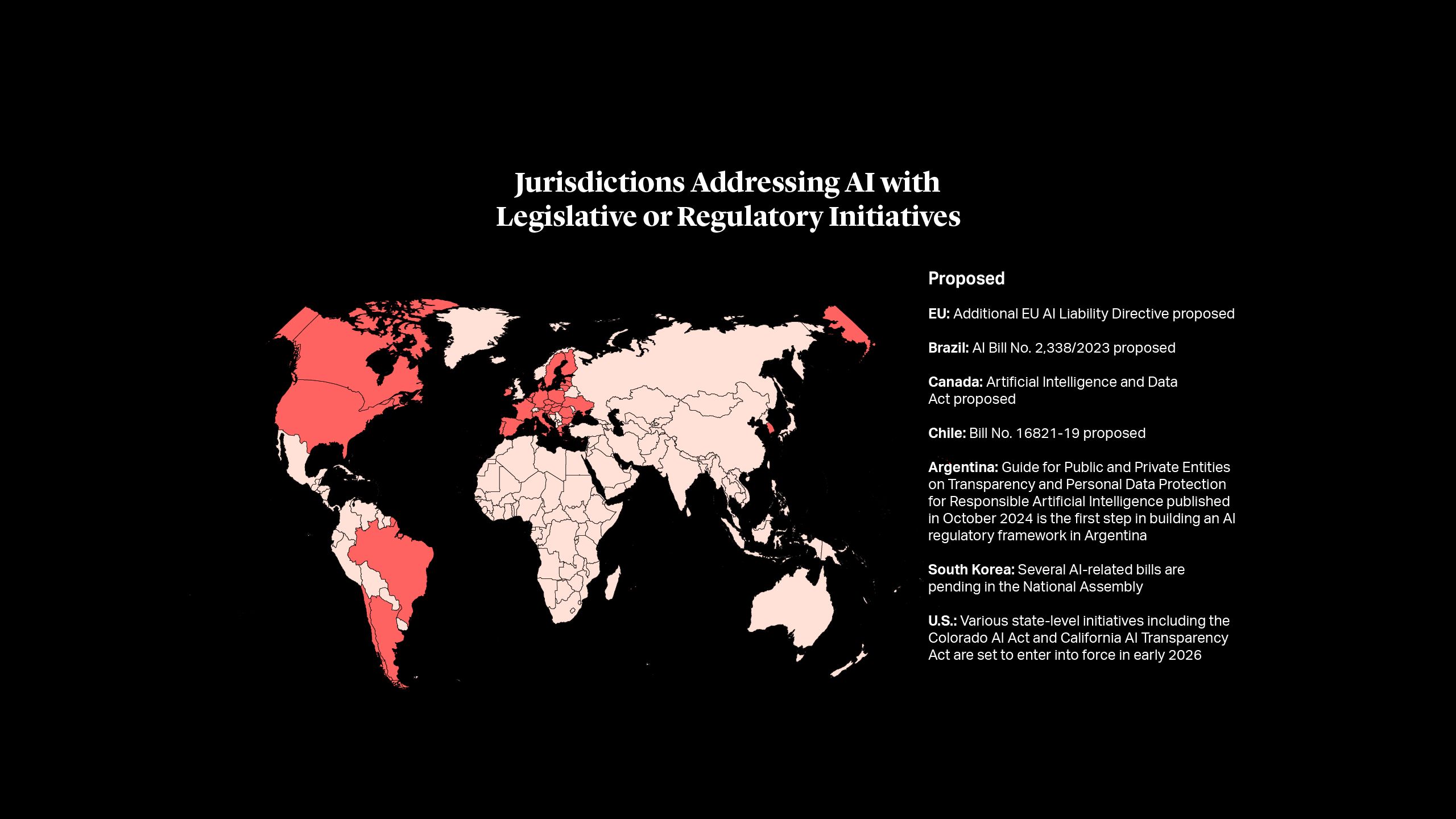

Given the potentially far-reaching capabilities of AI and the uncertainties and complexities it raises under existing legal frameworks, many jurisdictions are now looking to regulate its development and use. Jurisdictions that have already proposed legislative or regulatory initiatives to address AI specifically include Argentina, Brazil, Chile, Canada, China, EU, South Korea, and the U.S.

Given the interest of governments and regulators around the world in AI, investors in, and users of AI technology, should expect further rules and guidance around AI to emerge in the coming years. Some of the legislative initiatives that are already being discussed in the public domain include:

- The EU AI Act, which establishes a comprehensive, risk-based framework for artificial intelligence in the EU market. The AI Act entered into force in August 2024 with a gradual phase-in of its substantive requirements over the following three years and will apply, among other entities, to companies that provide, deploy, distribute, import or develop AI systems and models in the EU4.

- The proposed EU AI Liability Directive (AILD), which is intended to make it easier for consumers to bring claims against AI providers for a range of alleged harms caused by AI systems5.

- Brazil’s proposed AI Bill No. 2,338/2023, which aims to establish a rights-based and risk-based regulatory framework for the development, implementation, and use of AI systems with various similarities to the EU AI Act.

Given the interest of governments and regulators around the world in AI, investors in, and users of AI technology, should expect further rules and guidance around AI to emerge in the coming years. Some of the legislative initiatives that are already being discussed in the public domain include:

- The EU AI Act, which establishes a comprehensive, risk-based framework for artificial intelligence in the EU market. The AI Act entered into force in August 2024 with a gradual phase-in of its substantive requirements over the following three years and will apply, among other entities, to companies that provide, deploy, distribute, import or develop AI systems and models in the EU4.

- The proposed EU AI Liability Directive (AILD), which is intended to make it easier for consumers to bring claims against AI providers for a range of alleged harms caused by AI systems5.

- Brazil’s proposed AI Bill No. 2,338/2023, which aims to establish a rights-based and risk-based regulatory framework for the development, implementation, and use of AI systems with various similarities to the EU AI Act.

- Canada’s proposed Artificial Intelligence and Data Act (AIDA), which aims to establish common requirements for the design, development, and use of AI systems and to regulate certain conduct in relation to AI systems, particularly with respect to “high-impact” AI systems.

- The Interim Measures for the Management of Generative Artificial Intelligence Services in China, which came into effect in August 2023 and regulate the use of GenAI technologies to provide services to the public in China by imposing various obligations (including with respect to security and transparency) on GenAI service providers.

- Various initiatives at the U.S. state level – Colorado and California have taken the lead in regulating AI via legislation focused on risk mitigation (e.g., the Colorado AI Act) and transparency requirements (e.g. California AI Transparency Act) set to enter into force in early 2026.

- Various international initiatives such as the Council of Europe Framework Convention on Artificial Intelligence and Human Rights, Democracy and the Rule of Law – the first international treaty governing the safe use of artificial intelligence signed by 11 signatories to date (including the UK, U.S. and EU6) – and the Hiroshima Process International Code of Conduct for Organizations Developing Advanced AI Systems and International Guiding Principles for Advanced AI Systems published by the G7 leaders7.

- Canada’s proposed Artificial Intelligence and Data Act (AIDA), which aims to establish common requirements for the design, development, and use of AI systems and to regulate certain conduct in relation to AI systems, particularly with respect to “high-impact” AI systems.

- The Interim Measures for the Management of Generative Artificial Intelligence Services in China, which came into effect in August 2023 and regulate the use of GenAI technologies to provide services to the public in China by imposing various obligations (including with respect to security and transparency) on GenAI service providers.

- Various initiatives at the U.S. state level – Colorado and California have taken the lead in regulating AI via legislation focused on risk mitigation (e.g., the Colorado AI Act) and transparency requirements (e.g. California AI Transparency Act) set to enter into force in early 2026.

- Various international initiatives such as the Council of Europe Framework Convention on Artificial Intelligence and Human Rights, Democracy and the Rule of Law – the first international treaty governing the safe use of artificial intelligence signed by 11 signatories to date (including the UK, U.S. and EU6) – and the Hiroshima Process International Code of Conduct for Organizations Developing Advanced AI Systems and International Guiding Principles for Advanced AI Systems published by the G7 leaders7.

GenAI Risk: A Bespoke Assessment is Required

GenAI holds great potential to unlock efficiencies, enhance decision-making and drive value creation for private equity firms and their portfolio companies. The increasing adoption of GenAI tools, however, should be accompanied by careful consideration of the potential implications under existing legal frameworks and the rapidly changing regulatory landscape.

GenAI Risk: A Bespoke Assessment is Required

GenAI holds great potential to unlock efficiencies, enhance decision-making and drive value creation for private equity firms and their portfolio companies. The increasing adoption of GenAI tools, however, should be accompanied by careful consideration of the potential implications under existing legal frameworks and the rapidly changing regulatory landscape.

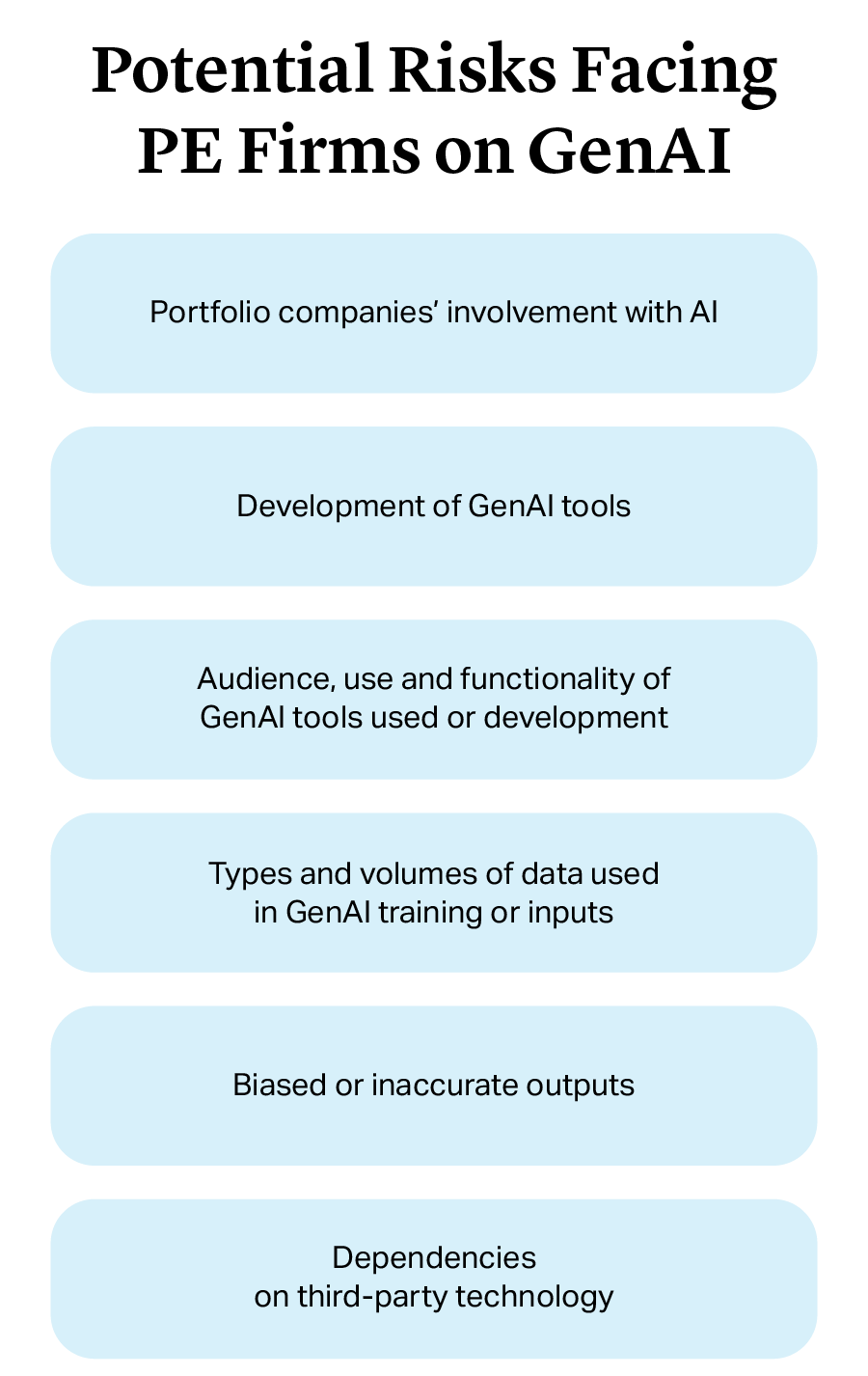

On a practical level, the GenAI risk exposure of private equity firms is likely to vary on a case-by-case basis depending on various factors. These include the level of their portfolio companies’ involvement at the different phases of the GenAI lifecycle – from development of GenAI tools (including fine-tuning or modifying) to deployment, hosting and/or ongoing monitoring, as well as the audience, use and functionality of the relevant GenAI tools used or developed. The types and volumes of data used in training or as inputs are also relevant factors, as are any risks that a GenAI tool may produce biased or inaccurate outputs and any dependencies on third-party technology.

To generate a more complete assessment of the risks involved, which will only become more important as GenAI increases in prevalence throughout sectors and industries, private equity firms should:

- at the investment stage, conduct tailored due diligence into the target’s use of GenAI; and

- on an ongoing basis, analyse portfolio company arrangements with third parties for the use of GenAI tools and seek appropriate contractual protections.

This article was prepared with contributions from Cleary associates Nicola Duemler, Axel Nordlöf and Ilona Logvinova, Director of Practice Innovation.