Is the Sun Setting on Solar Energy?

February 2025

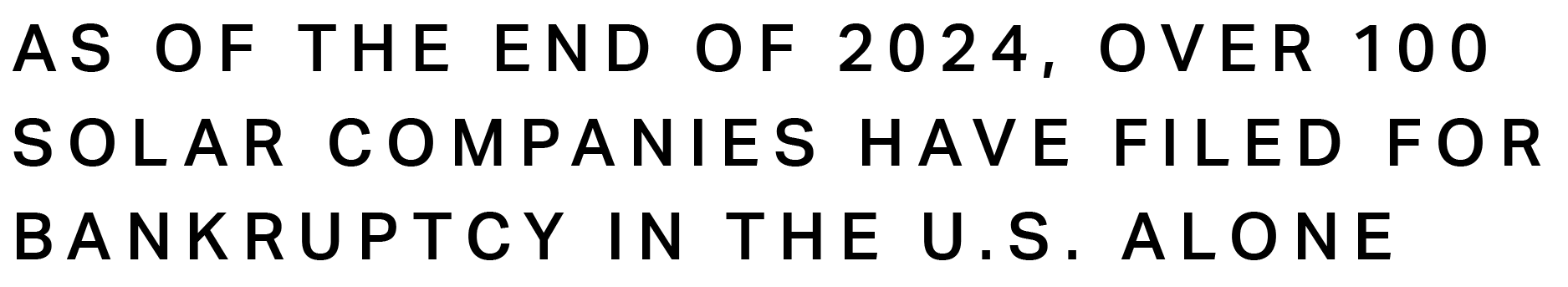

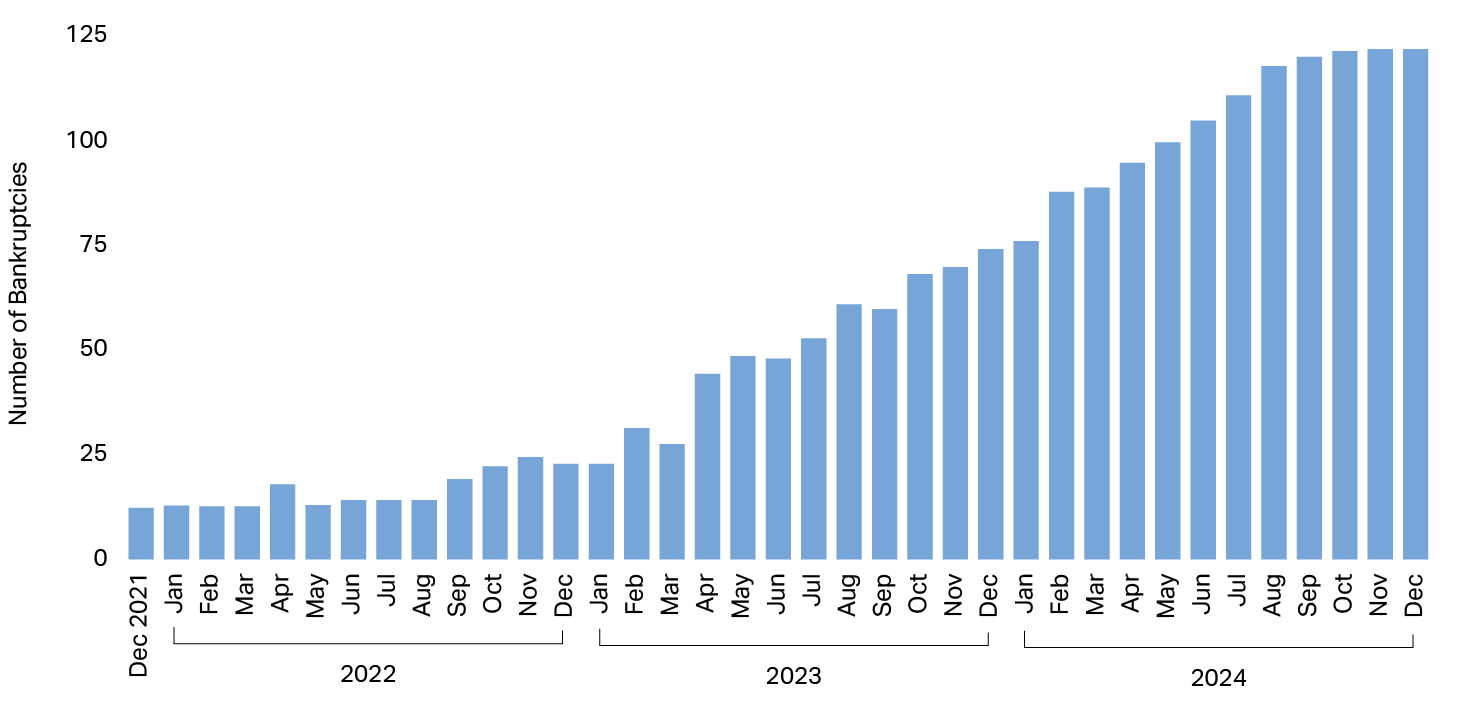

The solar energy industry saw significant distress in 2024, bringing the total number of companies having filed for bankruptcy in the U.S. alone to over 1001. This trend is particularly notable given prior years of rapid growth, with industry publications declaring 2023 as the “industry’s biggest year by far” for solar energy2.

Although, as in all commercial bankruptcies, there are company-specific issues that contributed to distress, a review of some of the larger 2024 solar energy industry bankruptcies also suggests that macroeconomic trends, as well as already-effective and anticipated changes in U.S. energy policy are likely to result in continued distress in the solar energy space in other renewable energy segments going into 2025 and beyond.

That said, the benefits afforded to buyers and sellers under the Bankruptcy Code have enabled some of the largest companies to conduct a value-maximizing sale process that was not otherwise feasible in an out-of-court basis.

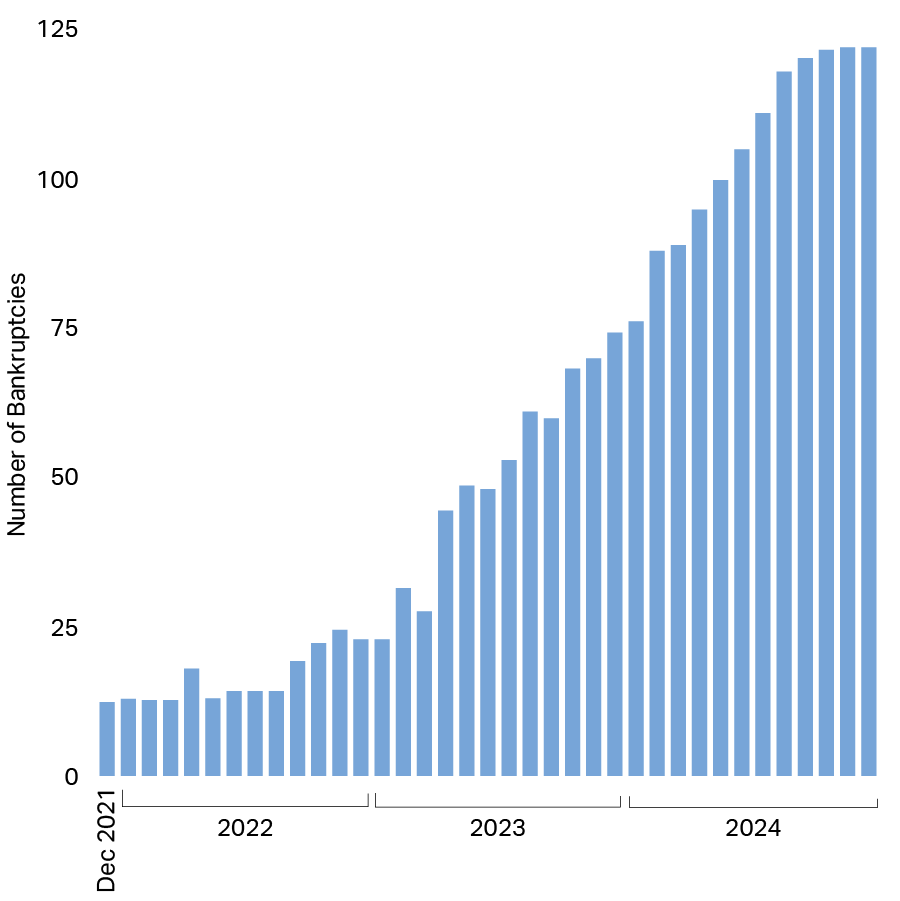

The solar energy industry saw significant distress in 2024, bringing the total number of companies having filed for bankruptcy in the U.S. alone to over 1001. This trend is particularly notable given prior years of rapid growth, with industry publications declaring 2023 as the “industry’s biggest year by far” for solar energy2.

Although, as in all commercial bankruptcies, there are company-specific issues that contributed to distress, a review of some of the larger 2024 solar energy industry bankruptcies also suggests that macroeconomic trends, as well as already-effective and anticipated changes in U.S. energy policy are likely to result in continued distress in the solar energy space in other renewable energy segments going into 2025 and beyond.

That said, the benefits afforded to buyers and sellers under the Bankruptcy Code have enabled some of the largest companies to conduct a value-maximizing sale process that was not otherwise feasible in an out-of-court basis.

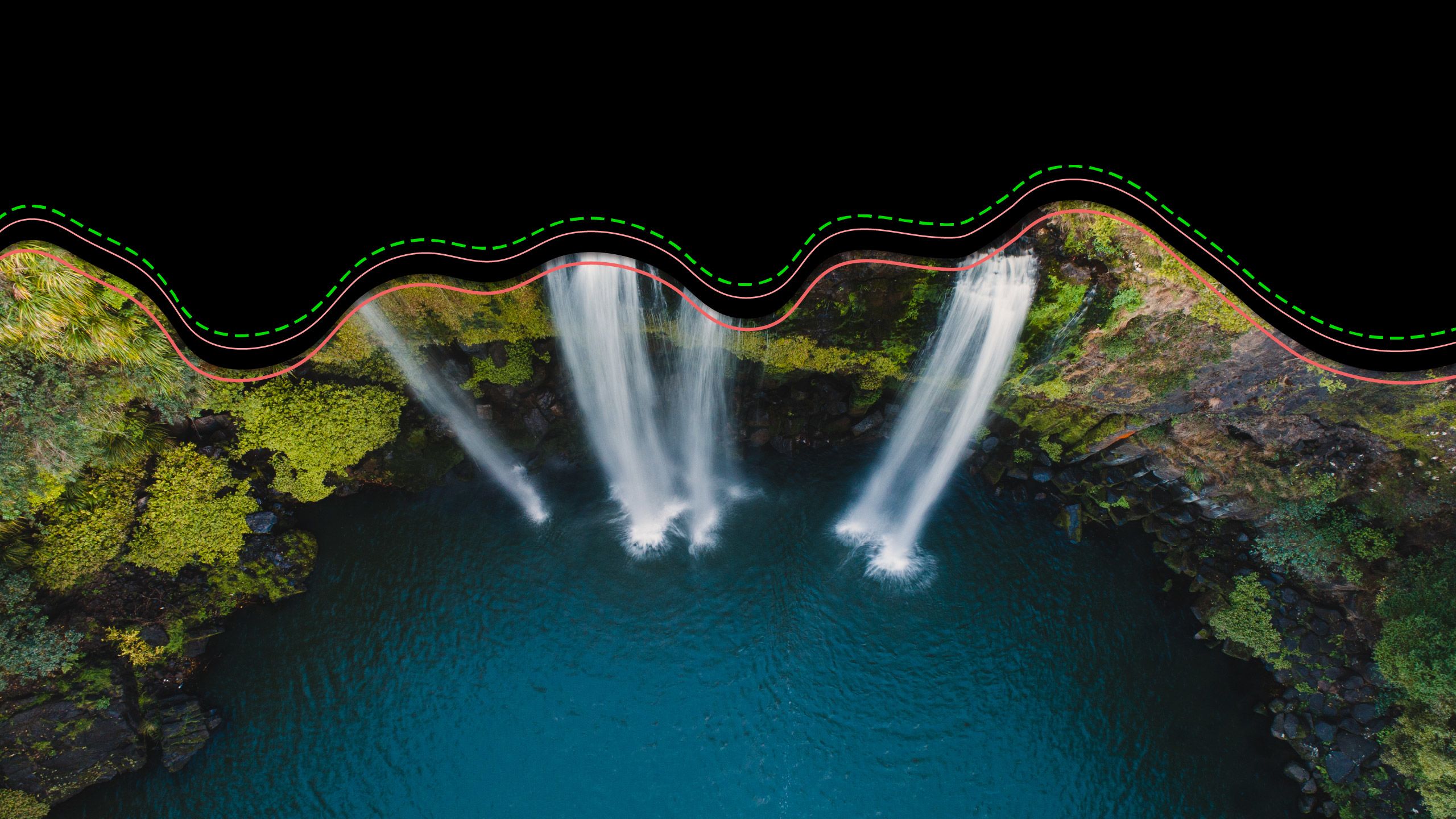

Number of Solar Bankruptcies

Source: SolarInsure

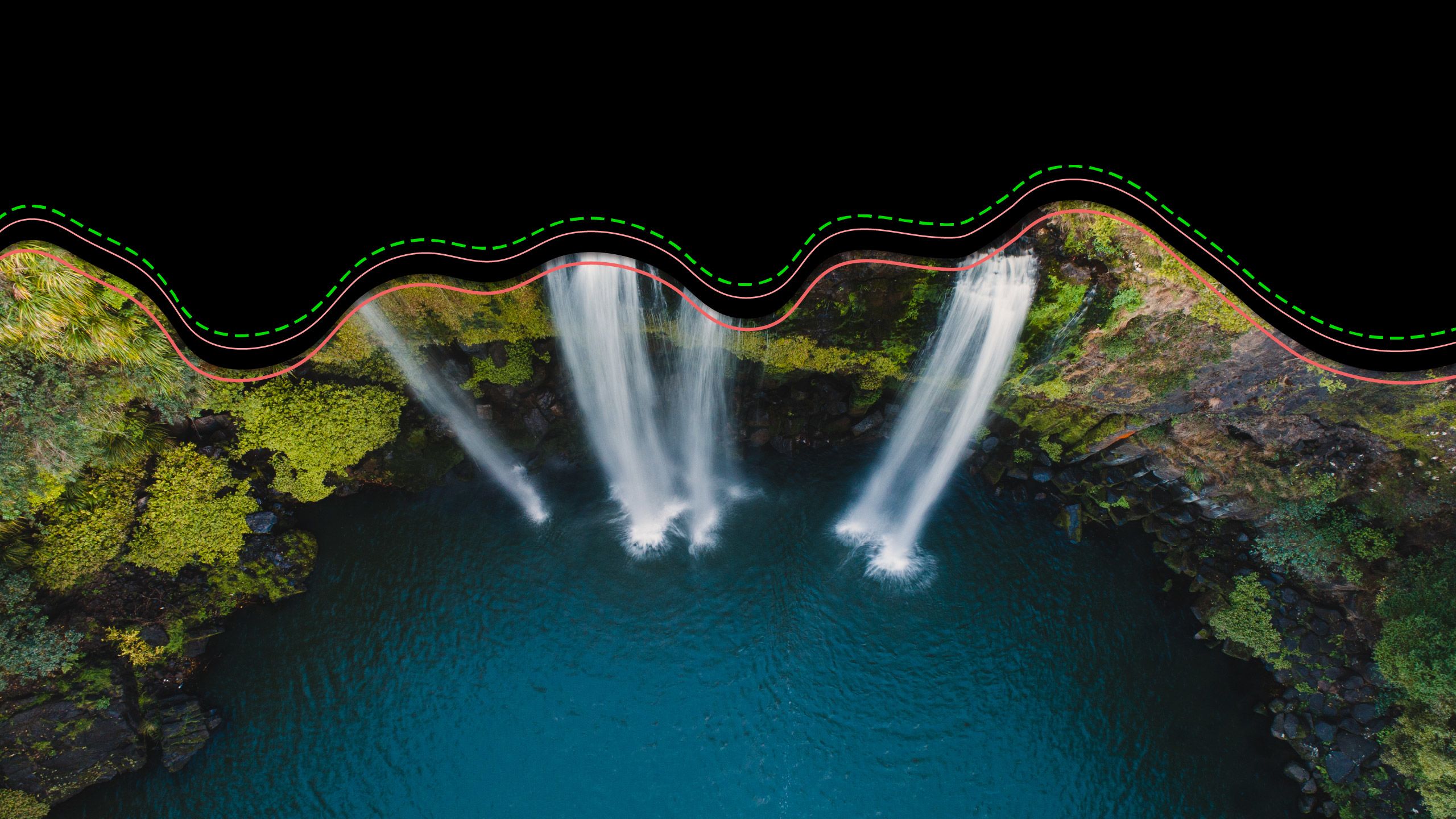

Number of Solar Bankruptcies

Source: SolarInsure

The Solar Energy Industry

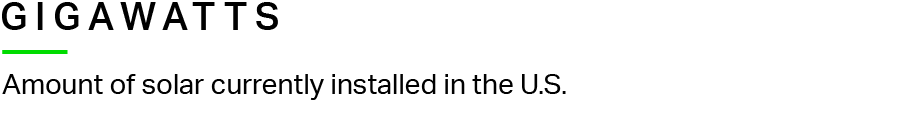

The solar energy industry broadly includes companies that provide goods and services related to solar energy for residential or commercial use in the form of, among other things, the manufacture and sale of solar panels and related storage devices and the creation and maintenance of supply chains and energy grids. According to industry data, there are approximately 280,000 people employed by the U.S. solar energy industry and the value of the U.S. solar energy market is approximately $63.6bn3.

The U.S. Solar Industry in Figures

Source: SEIA

The Solar Energy Industry

The solar energy industry broadly includes companies that provide goods and services related to solar energy for residential or commercial use in the form of, among other things, the manufacture and sale of solar panels and related storage devices and the creation and maintenance of supply chains and energy grids. According to industry data, there are approximately 280,000 people employed by the U.S. solar energy industry and the value of the U.S. solar energy market is approximately $63.6bn3.

The U.S. Solar Industry in Figures

Source: SEIA

Within this larger context, there are three main segments based on the amount of energy generated and that energy’s ultimate use. On one end of the spectrum is residential or “rooftop” solar, where solar panels are installed on an individual residential or commercial property and provide energy to supplement or replace energy needs. In the middle are “community solar projects” which are free-standing arrays of solar panels that provide energy to multiple homes or businesses. And at the other end are utility scale projects, which are connected to the larger electrical grid and sell the energy generated from the projects back to the local electrical utility. 2024 saw an uptick in bankruptcy filings in each of these three sub-categories.

The solar energy industry is subject to both federal and state regulations and policies that have significantly impacted the economics and demand for solar energy. For example, the U.S. federal government passed the Inflation Reduction Act in 2022, which provided for a 10-year extension of a tax credit for solar as well as certain additional bonus tax credits.

At the state level, California implemented new “net metering payback rules” in 2023. Such rules provide individual energy customers with financial credits on their electric bills for surplus energy provided back to the utility company. California’s changes in 2023 reduced the rates of such credits, effectively extending the time that it would take an individual solar consumer to effectively earn back the upfront installation costs of solar projects. This appeared to have significantly reduced demand in California specifically, with at least 25 California-based companies focused on solar filing for bankruptcy in 2023 and 2024.

Within this larger context, there are three main segments based on the amount of energy generated and that energy’s ultimate use. On one end of the spectrum is residential or “rooftop” solar, where solar panels are installed on an individual residential or commercial property and provide energy to supplement or replace energy needs. In the middle are “community solar projects” which are free-standing arrays of solar panels that provide energy to multiple homes or businesses. And at the other end are utility scale projects, which are connected to the larger electrical grid and sell the energy generated from the projects back to the local electrical utility. 2024 saw an uptick in bankruptcy filings in each of these three sub-categories.

The solar energy industry is subject to both federal and state regulations and policies that have significantly impacted the economics and demand for solar energy. For example, the U.S. federal government passed the Inflation Reduction Act in 2022, which provided for a 10-year extension of a tax credit for solar as well as certain additional bonus tax credits.

At the state level, California implemented new “net metering payback rules” in 2023. Such rules provide individual energy customers with financial credits on their electric bills for surplus energy provided back to the utility company. California’s changes in 2023 reduced the rates of such credits, effectively extending the time that it would take an individual solar consumer to effectively earn back the upfront installation costs of solar projects. This appeared to have significantly reduced demand in California specifically, with at least 25 California-based companies focused on solar filing for bankruptcy in 2023 and 2024.

Major U.S. Solar Bankruptcies in 2024

Case Studies

Of the numerous solar energy Chapter 11 filings in 2024, four of the largest (with liabilities of more than approximately $50mn) are instructive and evidence the negative impact that sustained interest rates can have on consumer-facing sectors as well as the advantages of an in-court sale process where out-of-court options have been unsuccessful.

First, although not necessarily unique to the solar energy industry, higher interest rates have been cited by multiple debtors as the basis for their decisions to file Chapter 11 cases in 2024. As noted in the first day declarations filed in the Chapter 11 cases of Lumio Holdings, Inc. (Bankr. D. Del.), iSun, Inc. (Bankr. D. Del.), and SunPower Corp. (Bankr. D. Del.), because most residential consumers finance the purchase of residential solar, higher interests directly led to a significant reduction in demand as the upfront costs to consumers was comparatively higher, with costs further compounded by the state-level metering changes noted above that make the timeline to recoup those costs lengthier.

Second, in addition to iSun, Sunpower, and Lumio, Oya Renewables Development LLC (Bankr. D. Del), a large provider of community solar installations, sought immediate approval of sales of all or certain assets pursuant to section 363 of the Bankruptcy Code, which enables debtors to sell assets “free and clear” of any existing liens or encumbrances. Notably, in each of those cases there had been some manner of unsuccessful prepetition sale process or out-of-court restructuring, but each debtor had nonetheless filed for Chapter 11 with a designated stalking horse bidder.

Looking specifically at the process in Lumio, the debtors determined that an out-of-court transaction was not actionable because a strategic buyer would either need to already possess state and local licenses and permits in order to operate Lumio’s business or would alternatively need to obtain such licenses, which would create uncertainties for Lumio’s vendors, customers, and employees. In each of these cases, the in-court sale process was ultimately successful, demonstrating that the protections afforded to buyers under section 363 of the Bankruptcy Code can result in the preservation of value not practicable in an out-of-court scenario, particularly where there may be regulatory complexity that limits the pool of potential strategic alternatives.

Further, an orderly Chapter 11 sale process maximizes value to all creditors, particularly in comparison to liquidations under Chapter 7, for which a number of solar companies filed in 2024, and that would be less likely to provide similar recoveries to creditors.

That said, in-court sale processes are not necessarily without risk, as the Lumio case again demonstrates. There, the debtors’ initial stalking horse bidder declined to consummate the purchase, and a creditors’ committee that formed subsequently moved to convert the Chapter 11 cases to cases under Chapter 7. Fortunately for all interested parties, the same day that the aforementioned conversion motion was filed, the debtors announced a new third-party buyer, and the sale was ultimately successful.

First, although not necessarily unique to the solar energy industry, higher interest rates have been cited by multiple debtors as the basis for their decisions to file Chapter 11 cases in 2024. As noted in the first day declarations filed in the Chapter 11 cases of Lumio Holdings, Inc. (Bankr. D. Del.), iSun, Inc. (Bankr. D. Del.), and SunPower Corp. (Bankr. D. Del.), because most residential consumers finance the purchase of residential solar, higher interests directly led to a significant reduction in demand as the upfront costs to consumers was comparatively higher, with costs further compounded by the state-level metering changes noted above that make the timeline to recoup those costs lengthier.

Second, in addition to iSun, Sunpower, and Lumio, Oya Renewables Development LLC (Bankr. D. Del), a large provider of community solar installations, sought immediate approval of sales of all or certain assets pursuant to section 363 of the Bankruptcy Code, which enables debtors to sell assets “free and clear” of any existing liens or encumbrances. Notably, in each of those cases there had been some manner of unsuccessful prepetition sale process or out-of-court restructuring, but each debtor had nonetheless filed for Chapter 11 with a designated stalking horse bidder.

Looking specifically at the process in Lumio, the debtors determined that an out-of-court transaction was not actionable because a strategic buyer would either need to already possess state and local licenses and permits in order to operate Lumio’s business or would alternatively need to obtain such licenses, which would create uncertainties for Lumio’s vendors, customers, and employees. In each of these cases, the in-court sale process was ultimately successful, demonstrating that the protections afforded to buyers under section 363 of the Bankruptcy Code can result in the preservation of value not practicable in an out-of-court scenario, particularly where there may be regulatory complexity that limits the pool of potential strategic alternatives.

Further, an orderly Chapter 11 sale process maximizes value to all creditors, particularly in comparison to liquidations under Chapter 7, for which a number of solar companies filed in 2024, and that would be less likely to provide similar recoveries to creditors.

That said, in-court sale processes are not necessarily without risk, as the Lumio case again demonstrates. There, the debtors’ initial stalking horse bidder declined to consummate the purchase, and a creditors’ committee that formed subsequently moved to convert the Chapter 11 cases to cases under Chapter 7. Fortunately for all interested parties, the same day that the aforementioned conversion motion was filed, the debtors announced a new third-party buyer, and the sale was ultimately successful.

Conclusion

As demonstrated by these case studies, the solar energy industry will likely continue to see further bankruptcy filings in 2025 as a result of the Federal Reserve’s intended pause on federal-funds rate cuts and with inflation remaining above the target of 2%. In addition, uncertainty regarding tariffs proposed by the U.S. federal government and their impact on inflation and rates could further chill consumer demand for solar energy financing and the cost of capital for solar energy companies. These macroeconomic conditions may also contribute to increased filings in other industrial sectors with significant consumer-facing segments that rely on consumer financing.

Finally, as these case studies suggest, distressed solar companies may continue to choose to take advantage of a sale pursuant to Chapter 11 of the Bankruptcy Code to provide a value-maximizing resolution.