Over the past 20 years, several major Latin American countries have transformed their bankruptcy codes in order to foster more business reorganizations rather than liquidations. Brazil, for example, enacted a complete overhaul of its bankruptcy code in 2005 and then made additional major modifications to it in 2020-2021. Chile made substantial changes to its insolvency regime in 2014, and Mexico implemented significant reforms to its code in 2000, 2007 and 2014. Many of the modifications reflected concepts and mechanisms prevalent in Chapter 11 of the U.S. Bankruptcy Code in the hopes of increasing process certainty and improving creditor recoveries.

Notwithstanding these overhauls, the past two years have seen a significant number of large Latin American companies in distress, with or without substantial operations in the U.S., choose to restructure their business through Chapter 11 rather than filing for bankruptcy in their home countries. Avianca, the Colombian airline, filed for bankruptcy in U.S. courts in 2020, quickly followed by Aeromexico that same year, while LATAM, the airline giant from Chile, recently emerged from Chapter 11 proceedings. Similarly, CorpGroup Banking, the Chilean bank holding company, Automotores Gildemeister, the Chilean automobile company, Alto Maipo, the Chilean hydroelectric power generator, Stoneway Capital, the Argentine power generator, Grupo Posadas, the Mexican hotel operator, and AlphaCredit, the Latin America-focused financial services company, have all opted to restructure in U.S. courts in the past few years.

Over the past 20 years, several major Latin American countries have transformed their bankruptcy codes in order to foster more business reorganizations rather than liquidations. Brazil, for example, enacted a complete overhaul of its bankruptcy code in 2005 and then made additional major modifications to it in 2020-2021. Chile made substantial changes to its insolvency regime in 2014, and Mexico implemented significant reforms to its code in 2000, 2007 and 2014. Many of the modifications reflected concepts and mechanisms prevalent in Chapter 11 of the U.S. Bankruptcy Code in the hopes of increasing process certainty and improving creditor recoveries.

Notwithstanding these overhauls, the past two years have seen a significant number of large Latin American companies in distress, with or without substantial operations in the U.S., choose to restructure their business through Chapter 11 rather than filing for bankruptcy in their home countries. Avianca, the Colombian airline, filed for bankruptcy in U.S. courts in 2020, quickly followed by Aeromexico that same year, while LATAM, the airline giant from Chile, recently emerged from Chapter 11 proceedings. Similarly, CorpGroup Banking, the Chilean bank holding company, Automotores Gildemeister, the Chilean automobile company, Alto Maipo, the Chilean hydroelectric power generator, Stoneway Capital, the Argentine power generator, Grupo Posadas, the Mexican hotel operator, and AlphaCredit, the Latin America-focused financial services company, have all opted to restructure in U.S. courts in the past few years.

In the past, we have written about Latin American companies initiating bankruptcy proceedings significantly later than U.S. companies after signs of financial distress1. In addition to benefiting from starting bankruptcy proceedings earlier, Latin American companies may benefit from choosing to restructure in the U.S., taking advantage of Chapter 11 protections, rather than filing for bankruptcy at home.

Although each company has its own reasons for choosing in which jurisdiction to restructure, certain characteristics of Chapter 11 make the process appealing to many: the automatic injunction against all creditor actions, management’s ability to continue operating the company, access to capital, flexibility, and – perhaps most importantly – the speed of the process. Companies looking for quick resolution will likely seek to restructure in the U.S. given the perception that Chapter 11 resolves cases more quickly than local proceedings.

In this article, we examine empirical data of how in-court restructurings in four of the largest Latin American economies – Brazil, Mexico, Chile and Argentina – have fared compared to those in the U.S. along one dimension in particular: case duration. We also take a look at the relative efficiency of prepackaged proceedings in such jurisdictions from a timing perspective.

In addition to being easily quantifiable, the length of an in-court proceeding has a direct bearing on outcomes for stakeholders. Benefits from a shorter case include, among others:

We started from the hypothesis that bankruptcy cases in Latin American countries take significantly longer to reach resolution than Chapter 11 cases in the U.S. To test this hypothesis, we looked at the timeline of a subset of bankruptcy cases in Argentina, Brazil, Mexico and Chile and compared them to a subset of Chapter 11 cases2. Our analysis only includes debtors of significant size (at least $100mn) in order to focus on complex cases in which sophisticated investors were involved. We then subdivided these proceedings in each jurisdiction between prepackaged bankruptcies and non-prepackaged bankruptcies. For both types of proceedings, we measured the ‘case duration’ as the number of days from the petition date until the confirmation date3.

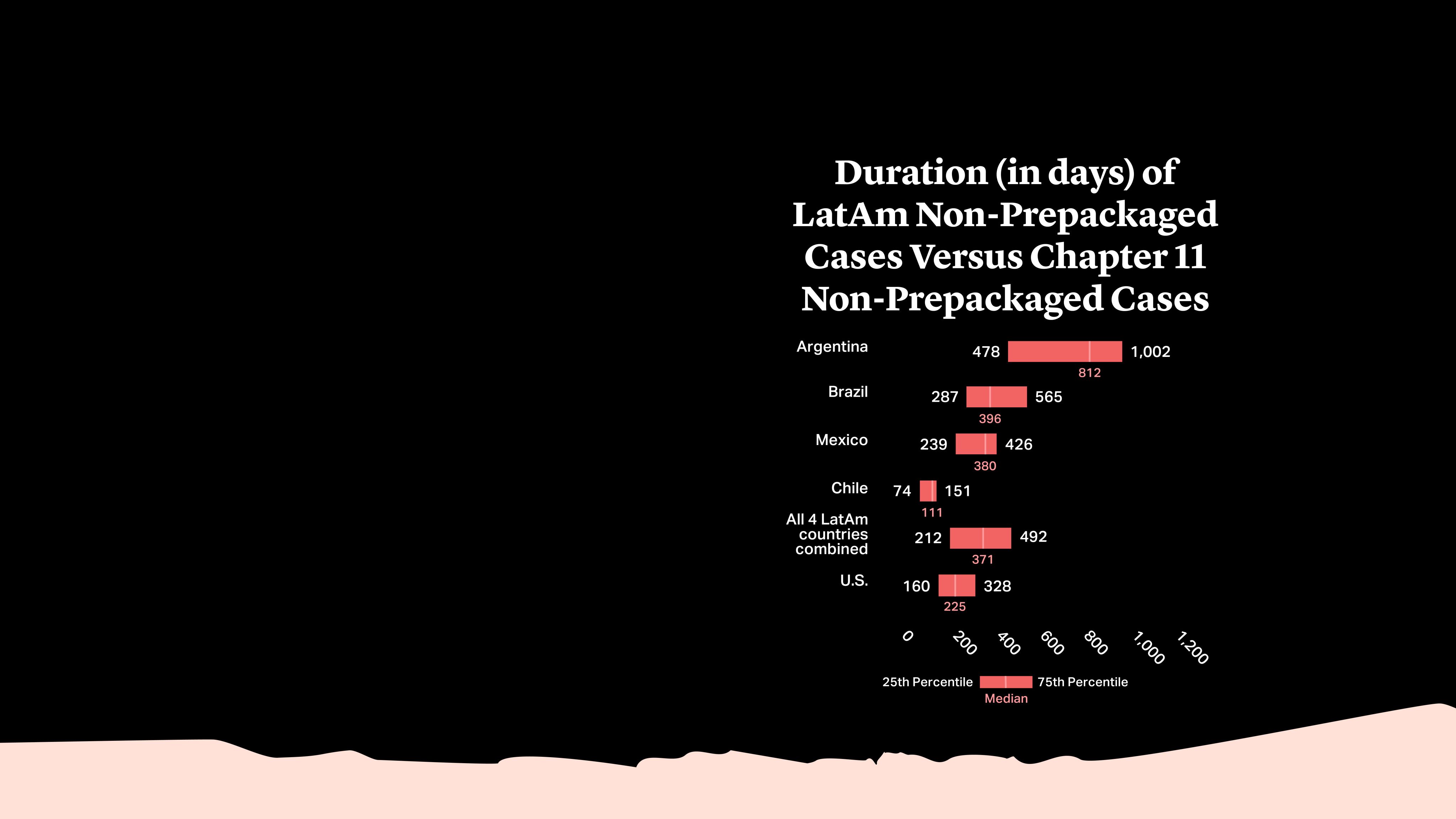

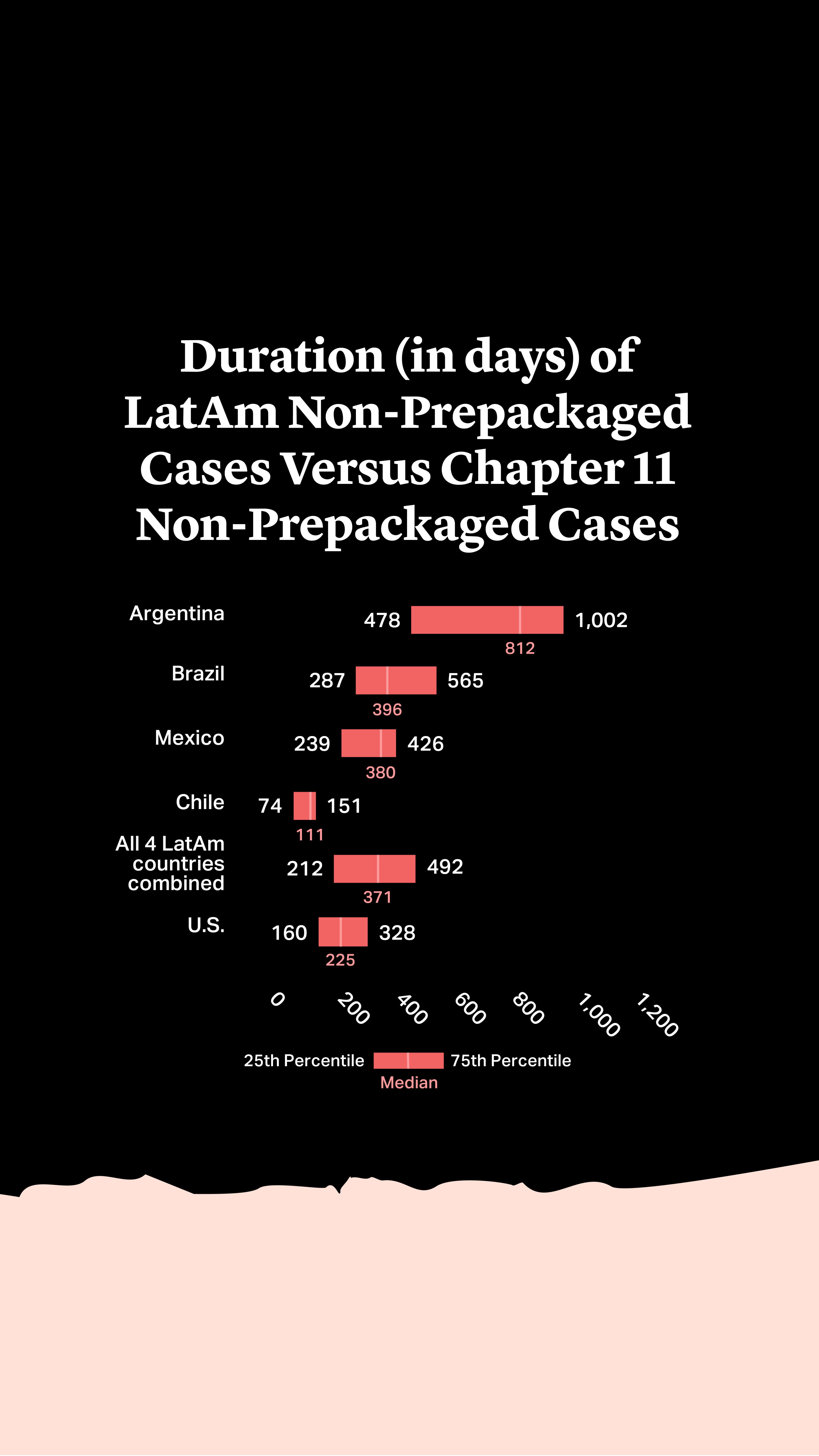

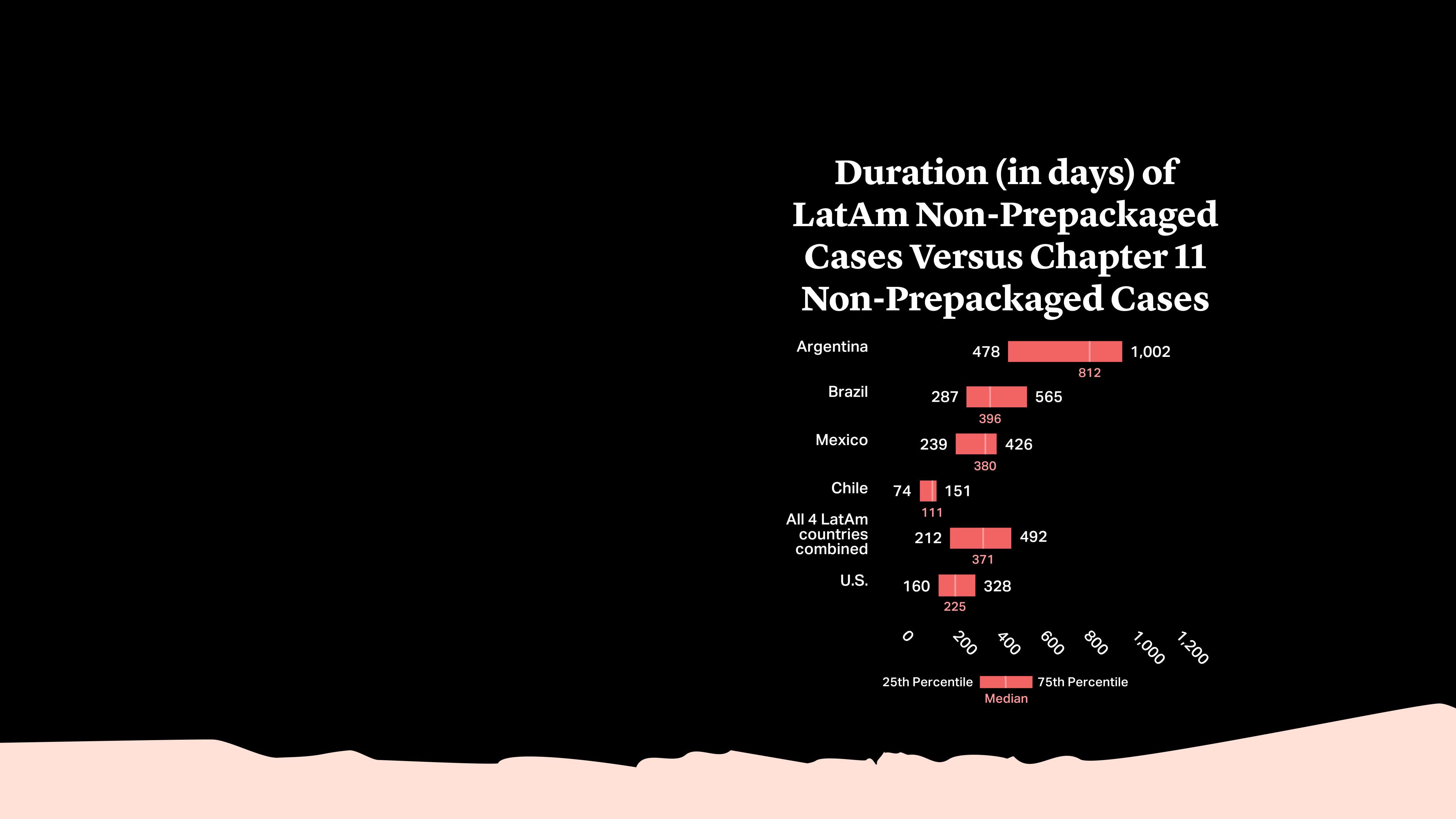

The results largely confirmed our hypothesis: with the exception of Chile, companies that restructure through Chapter 11 proceedings tend to come out of bankruptcy significantly sooner than companies that choose to restructure in their home countries in Latin America. The below chart shows the duration of regular bankruptcy cases in Argentina, Brazil, Mexico, Chile and the U.S. (Chapter 11)4:

In the aggregate, non-prepackaged cases in the four highlighted Latin American jurisdictions had a median duration of 371 days, which is 65% higher than that of Chapter 11 proceedings (225 days). Indeed, the duration of the fastest 25% of cases in these countries (212 days) was similar to the median duration for the U.S.

Not only do companies typically remain in Latin American bankruptcy courts significantly longer than companies in Chapter 11 – in many instances, the process also far exceeds the deadlines stipulated by law.

- The Mexican insolvency regime states that if a plan of reorganization has not been approved within one year of the petition date, the debtor must liquidate. Notwithstanding this provision, 55% of the Mexican bankruptcies in our sample set (excluding prepackaged cases) took longer than one year.

- The Argentine bankruptcy code stipulates that if a plan of reorganization is not approved within 90 days of the petition date, the court must commence a process akin to liquidation. Nevertheless, none of the Argentine companies in our sample set came close to meeting this deadline, and we are unaware of the deadline ever being invoked in a major case.

- Brazilian law stipulates that a debtor must liquidate if a plan of reorganization is not approved within 180 days of the petition date. When this limit was tested in the early days of the 2005 bankruptcy code, courts creatively interpreted “180 days” to mean “180 business days”. Later, when cases started to push up against the 180-business-day mark, courts simply ignored the deadline altogether.

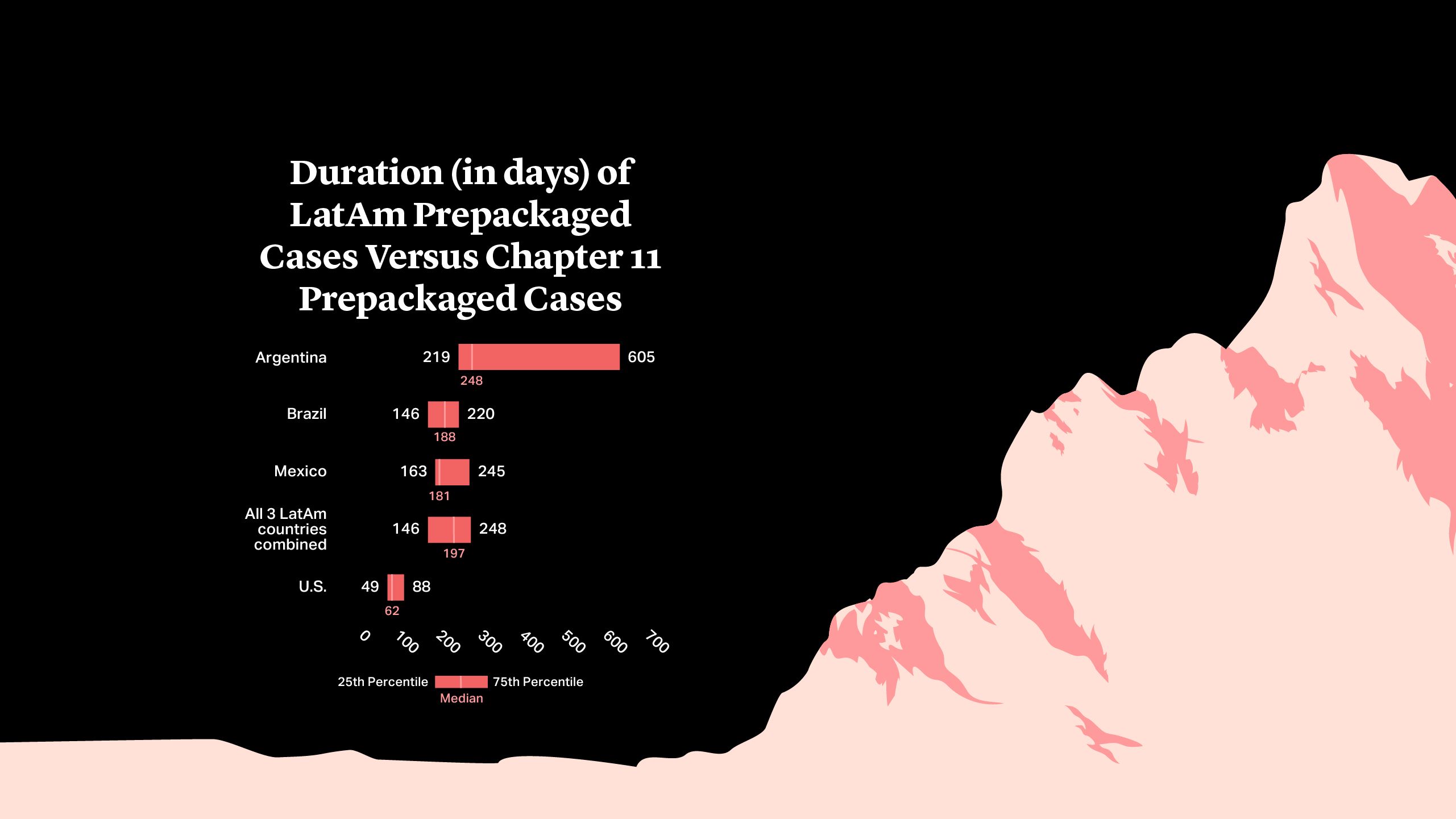

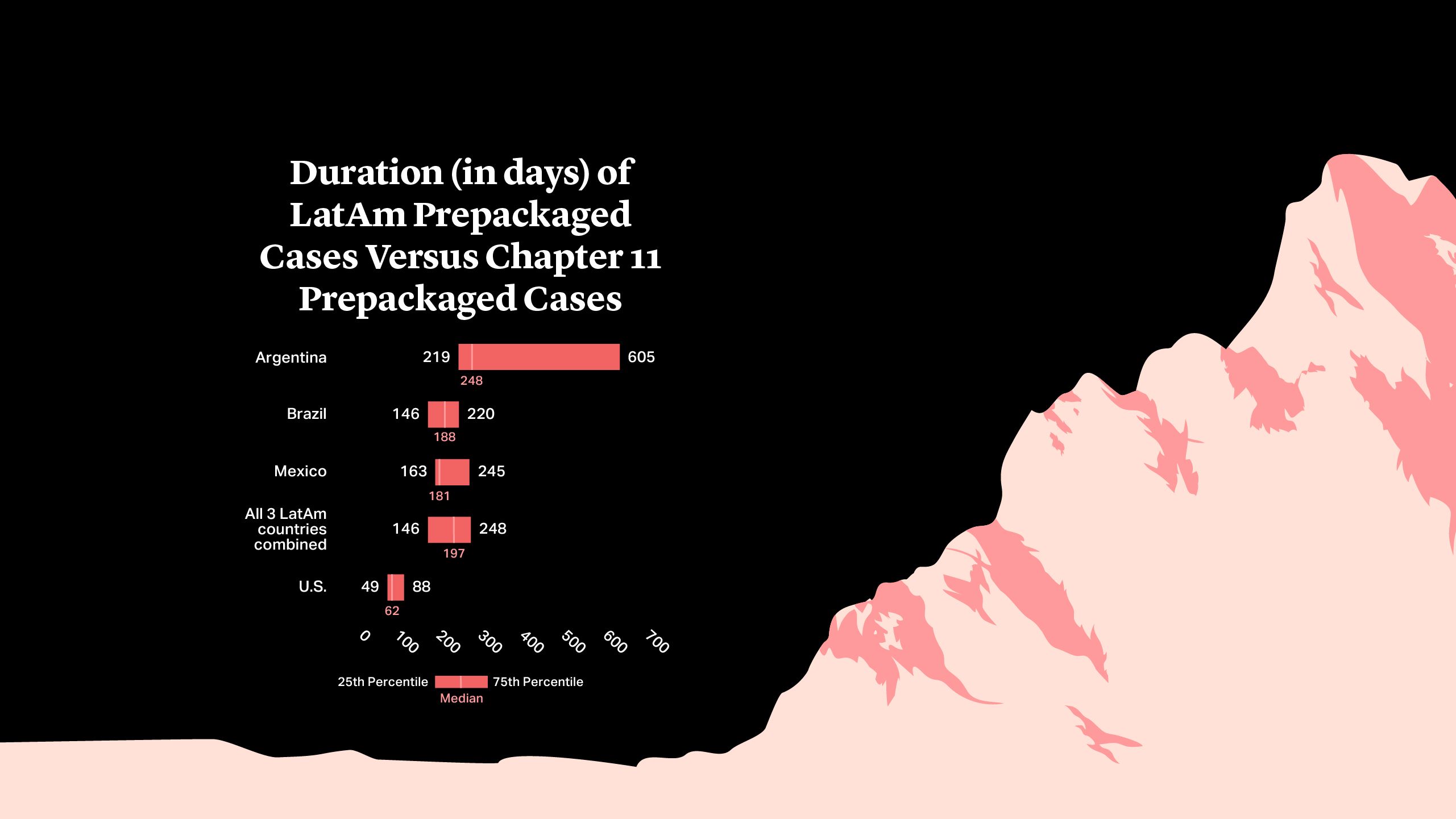

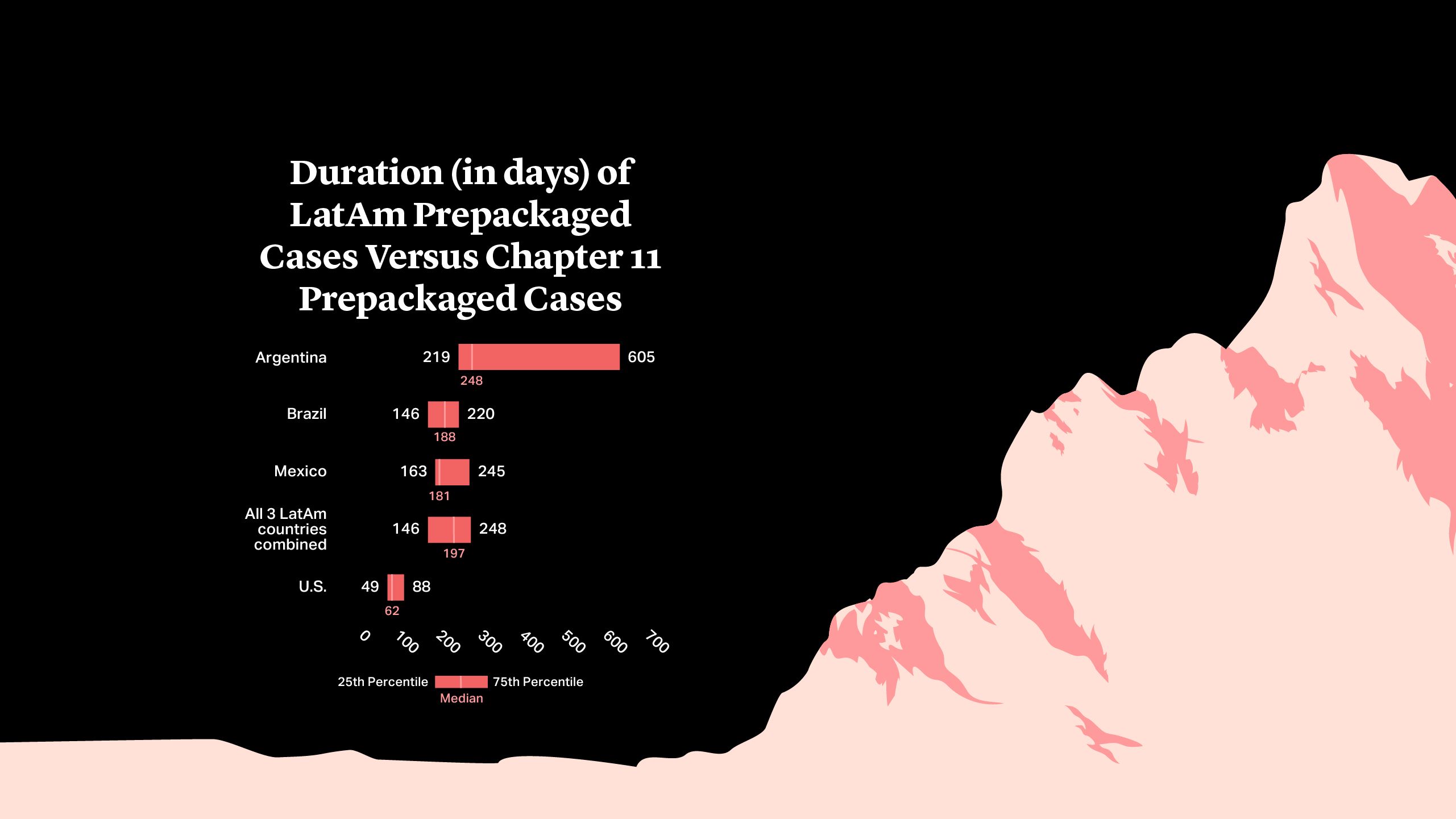

The results are even more striking when we compare the duration of prepackaged bankruptcy cases in Latin America to the U.S. The results are shown in the graph below.5

As with regular bankruptcies, Latin American prepacks typically take far longer than their U.S. peers6. In the aggregate, cases in Brazil, Mexico and Argentina had a median duration of 197 days, which is 218% higher than that of the Chapter 11 proceedings (62 days)7.

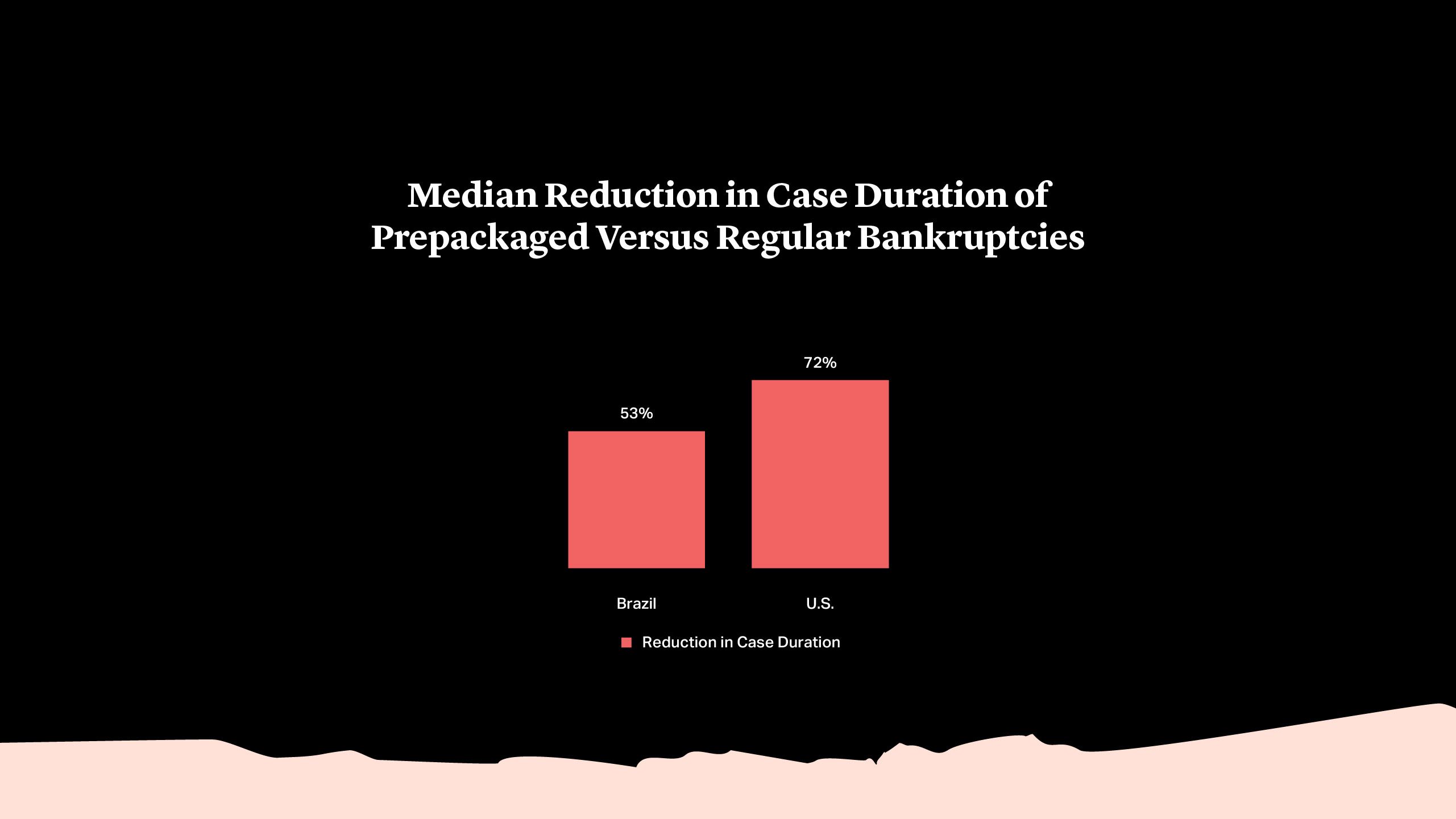

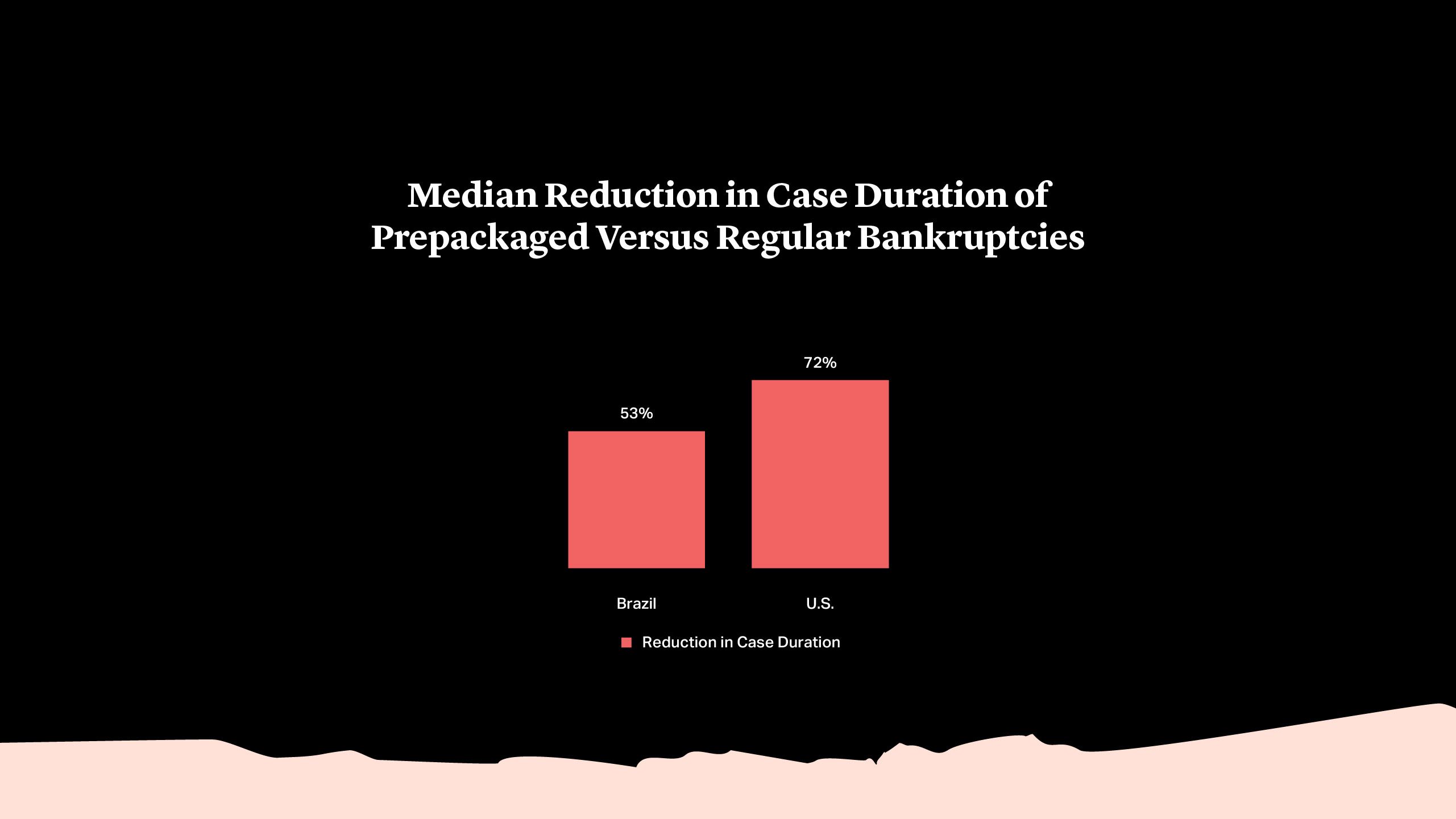

Similarly, in terms of prepackaging efficiency from a timing standpoint8– that is the time that prepackaging saves a company compared to opting for a non-prepackaged proceeding – Latin American courts fare much worse than U.S. ones. As shown below, the median prepackaged Chapter 11 in our data set was 72% shorter than a regular Chapter 11 proceeding. The median duration of prepackaged cases in Brazil, however, was only 53% shorter than regular cases9.

Given these results, it should not come as a surprise that many Latin American companies in financial distress are opting for prepackaged restructuring proceedings in the U.S. rather than the alternatives back home.

We started from the hypothesis that bankruptcy cases in Latin American countries take significantly longer to reach resolution than Chapter 11 cases in the U.S. To test this hypothesis, we looked at the timeline of a subset of bankruptcy cases in Argentina, Brazil, Mexico and Chile and compared them to a subset of Chapter 11 cases2. Our analysis only includes debtors of significant size (at least $100mn) in order to focus on complex cases in which sophisticated investors were involved. We then subdivided these proceedings in each jurisdiction between prepackaged bankruptcies and non-prepackaged bankruptcies. For both types of proceedings, we measured the ‘case duration’ as the number of days from the petition date until the confirmation date3.

The results largely confirmed our hypothesis: with the exception of Chile, companies that restructure through Chapter 11 proceedings tend to come out of bankruptcy significantly sooner than companies that choose to restructure in their home countries in Latin America. The chart to the right shows the duration of regular bankruptcy cases in Argentina, Brazil, Mexico, Chile and the U.S. (Chapter 11)4:

In the aggregate, non-prepackaged cases in the four highlighted Latin American jurisdictions had a median duration of 371 days, which is 65% higher than that of Chapter 11 proceedings (225 days). Indeed, the duration of the fastest 25% of cases in these countries (212 days) was similar to the median duration for the U.S.

Not only do companies typically remain in Latin American bankruptcy courts significantly longer than companies in Chapter 11 – in many instances, the process also far exceeds the deadlines stipulated by law.

- The Mexican insolvency regime states that if a plan of reorganization has not been approved within one year of the petition date, the debtor must liquidate. Notwithstanding this provision, 55% of the Mexican bankruptcies in our sample set (excluding prepackaged cases) took longer than one year.

- The Argentine bankruptcy code stipulates that if a plan of reorganization is not approved within 90 days of the petition date, the court must commence a process akin to liquidation. Nevertheless, none of the Argentine companies in our sample set came close to meeting this deadline, and we are unaware of the deadline ever being invoked in a major case.

- Brazilian law stipulates that a debtor must liquidate if a plan of reorganization is not approved within 180 days of the petition date. When this limit was tested in the early days of the 2005 bankruptcy code, courts creatively interpreted “180 days” to mean “180 business days”. Later, when cases started to push up against the 180-business-day mark, courts simply ignored the deadline altogether.

The results are even more striking when we compare the duration of prepackaged bankruptcy cases in Latin America to the U.S. The results are shown in the graph on the left.5

As with regular bankruptcies, Latin American prepacks typically take far longer than their U.S. peers6. In the aggregate, cases in Brazil, Mexico and Argentina had a median duration of 197 days, which is 218% higher than that of the Chapter 11 proceedings (62 days)7.

Similarly, in terms of prepackaging efficiency from a timing standpoint8– that is the time that prepackaging saves a company compared to opting for a non-prepackaged proceeding – Latin American courts fare much worse than U.S. ones. As shown below, the median prepackaged Chapter 11 in our data set was 72% shorter than a regular Chapter 11 proceeding. The median duration of prepackaged cases in Brazil, however, was only 53% shorter than regular cases9.

Given these results, it should not come as a surprise that many Latin American companies in financial distress are opting for prepackaged restructuring proceedings in the U.S. rather than the alternatives back home.

In Part II, we will discuss some potential explanations for why durations of bankruptcy proceedings vary so significantly between Latin American jurisdictions and the U.S.

Marcelo Messer

Managing Director

Rothschild & Co

Richard J. Cooper

Partner

New York

T: +1 212 225 2276

rcooper@cgsh.com

V-Card

Maria (Kiki) Manzur

Associate

New York

T: +1 212 225 2217

mmanzur@cgsh.com

V-Card