The global sustainable investment market is growing at a rapid rate – and shows no signs of slowing down. In 2020, the value of sustainable investment in major markets stood at $35.3tn1. The value of global ESG assets could surpass $50tn by 20252.

While the market for sustainable investment in the Middle East is relatively small compared to global competitors, the region has also seen high levels of growth in this field. Last year, sustainable investments accounted for 33% of investment portfolios in the region – with investors expecting this to rise to over 50% within five years3.

While individual investors in the Middle East have demonstrated strong and growing interest in the potential of sustainable investment4, the most important players in the region continue to be its sovereign wealth funds, including the Abu Dhabi Investment Authority (ADIA), Mubadala, ADQ, Saudi Arabia’s Public Investment Fund (PIF), and the Qatar Investment Authority.

With the UAE hosting the COP28 climate conference, it is likely that governments across the region will increasingly look to their powerful sovereign wealth funds to drive finance and commerce in the Middle East towards a more sustainable future.

But why are these funds so central to the sustainable investment landscape in the Middle East – and how are they likely to influence its future development?

In this deep-dive article, we look at why Sovereign Wealth Funds are playing a growing role investing in sustainable projects in the Middle East and further afield, the sectors where these funds see opportunity, and how they compare to their peers in other parts of the globe. As part of this in-depth article, the Cleary Gottlieb team has spoken to the following experts to get their insight on why these sovereign wealth funds are increasingly important players in ESG:

Click to find out more

With the UAE hosting the COP28 climate conference, it is likely that governments across the region will increasingly look to their powerful sovereign wealth funds to drive finance and commerce in the Middle East towards a more sustainable future.

But why are these funds so central to the sustainable investment landscape in the Middle East – and how are they likely to influence its future development?

In this deep-dive article, we look at why Sovereign Wealth Funds are playing a growing role investing in sustainable projects in the Middle East and further afield, the sectors where these funds see opportunity, and how they compare to their peers in other parts of the globe. As part of this in-depth article, the Cleary Gottlieb team has spoken to the following experts to get their insight on why these sovereign wealth funds are increasingly important players in ESG:

Click to find out more

The Importance of Sovereign Wealth Funds

While sustainable investments have been on the rise in the Middle East across various types of financial institutions, sovereign wealth funds have undoubtedly emerged as the most influential players. Indeed, sustainable deals conducted by sovereign wealth funds alone account for more than half of the overall deal value in the Middle East5, although they mostly invest in projects outside of the region.

The Importance of Sovereign Wealth Funds

While sustainable investments have been on the rise in the Middle East across various types of financial institutions, sovereign wealth funds have undoubtedly emerged as the most influential players. Indeed, sustainable deals conducted by sovereign wealth funds alone account for more than half of the overall deal value in the Middle East5, although they mostly invest in projects outside of the region.

Part of the reason for this dominance is the sheer size of the funds. Collectively, sovereign wealth funds in the Gulf manage around $3.7tn6. Last year, they spent almost $89bn on investments globally7, double the previous year.

Furthermore, the International Monetary Fund (IMF) predicts that the energy-rich states of the Middle East could reap an additional $1.3tn in revenues over the next four years8, as a result of the elevated oil and gas prices of the last twelve months. In 2022, Saudi Aramco, in which PIF has an 8% stake, including 4% through a wholly owned subsidiary, reported earnings of $161bn, the highest ever recorded by a publicly listed company9. These trends suggest that the cash reserves of the region’s sovereign wealth funds are likely to grow even bigger. Their ability to invest in a range of sustainable projects will continue to far surpass those of private financial institutions in the Middle East, meaning they will naturally play an increasingly large role in the development of the region’s growing sustainable investment market.

Part of the reason for this dominance is the sheer size of the funds. Collectively, sovereign wealth funds in the Gulf manage around $3.7tn6. Last year, they spent almost $89bn on investments globally7, double the previous year.

Furthermore, the International Monetary Fund (IMF) predicts that the energy-rich states of the Middle East could reap an additional $1.3tn in revenues over the next four years8, as a result of the elevated oil and gas prices of the last twelve months. In 2022, Saudi Aramco, in which PIF has an 8% stake, including 4% through a wholly owned subsidiary, reported earnings of $161bn, the highest ever recorded by a publicly listed company9. These trends suggest that the cash reserves of the region’s sovereign wealth funds are likely to grow even bigger. Their ability to invest in a range of sustainable projects will continue to far surpass those of private financial institutions in the Middle East, meaning they will naturally play an increasingly large role in the development of the region’s growing sustainable investment market.

Indeed, Diego López, Founder and Managing Director at Global SWF, says that “according to our GSR Scoreboard, which tracks responsible investing trends around the world, Saudi Arabia’s PIF and two of Abu Dhabi’s investment companies, Mubadala and ADQ, are acting as trailblazers when it comes to sustainability practices.”

This is reflected in some sizeable numbers. In 2021, PIF announced a plan to add $300bn to Saudi Arabia’s non-oil GDP by 202510, driven by investments in renewable energy, carbon management, and other sustainable projects. PIF expects to invest more than $10bn by 2026 in green projects11.

Indeed, Diego López, Founder and Managing Director at Global SWF, says that “according to our GSR Scoreboard, which tracks responsible investing trends around the world, Saudi Arabia’s PIF and two of Abu Dhabi’s investment companies, Mubadala and ADQ, are acting as trailblazers when it comes to sustainability practices.”

This is reflected in some sizeable numbers. In 2021, PIF announced a plan to add $300bn to Saudi Arabia’s non-oil GDP by 202510, driven by investments in renewable energy, carbon management, and other sustainable projects. PIF expects to invest more than $10bn by 2026 in green projects11.

Mubadala and ADQ have both made high-profile investments in similar initiatives, such as Mubadala’s $525mn joint investment with BlackRock in Tata Power Renewables12, one of India’s largest renewable energy companies.

In light of these numbers, Dr Steffen Hertog, Associate Professor in Comparative Politics at the London School of Economics (LSE), agrees that sovereign wealth funds are central to the Middle East’s sustainable investment landscape and its future progress.

“The process is definitely led by public entities rather than private ones, even if the private sector is gradually following,” he says. The largest players with the most significant immediate impact are ACWA and Masdar.” The former is part-owned by PIF, while Masdar is owned by three shareholders: ADNOC, the Abu Dhabi National Energy Company PJSC (TAQA), and the Mubadala Investment Company.

Hertog also notes that the region’s sovereign wealth funds have stronger mandates than private institutions when it comes to sustainable investment. This is partly because of the broad top-down guidance they receive from national governments, who are keen that the funds, while remaining entirely independent when it comes to investment decisions, invest in strategic industries and in some cases that they be a driver of the economy’s diversification away from oil and gas.

“Sovereign wealth funds undoubtedly have stronger ESG mandates than most other institutions in the region. This is because of their higher political visibility, a mandate that often also includes a soft power dimension, and their sovereign backing and longer time horizons, allowing them to focus on sustainability-related investment as part of a broader national diversification strategy, while private investors tend to be more short-term and purely commercial in their orientation,” Hertog argues.

While national governments will hope that these stronger mandates “trickle down” to the level of private institutions, this more conservative approach on the part of private investors might also be related to the fact that, while the sustainable investment market is a rapidly growing industry, it remains one in its infancy.

Jamil Wyne, Co-Founder of venture capital fund Riffle Ventures, which invests in climate-related and sustainable projects globally, says that the private sector is keen to see the results of public investments take shape before committing more substantial amounts of its own capital to sustainable investment.

“Generally speaking, whenever a government or sovereign wealth fund puts funding behind a certain area, including sustainability, this has a ‘de-risking’ effect for private investors, both in and outside the country,” Wyne says. “For instance, if a country becomes more proactive in supporting ESG standards in its financial sector, it sends a signal to the market and investors gradually respond.”

“For any country to reach its net zero targets or achieve sustainability goals, the government will have to play at least some leading role – both by investing, such as through sovereign wealth funds, and providing the correct set of incentives or punishments for others to follow suit,” Wyne adds.

“The alternative is simply to wait for private investors and businesses to individually adopt sustainable investment practices, but they’re heterogeneous of a group for it to happen in a coordinated way, at the speed we need it to.”

Mubadala and ADQ have both made high-profile investments in similar initiatives, such as Mubadala’s $525mn joint investment with BlackRock in Tata Power Renewables12, one of India’s largest renewable energy companies.

In light of these numbers, Dr Steffen Hertog, Associate Professor in Comparative Politics at the London School of Economics (LSE), agrees that sovereign wealth funds are central to the Middle East’s sustainable investment landscape and its future progress.

“The process is definitely led by public entities rather than private ones, even if the private sector is gradually following,” he says. The largest players with the most significant immediate impact are ACWA and Masdar.” The former is part-owned by PIF, while Masdar is owned by three shareholders: ADNOC, the Abu Dhabi National Energy Company PJSC (TAQA), and the Mubadala Investment Company.

Hertog also notes that the region’s sovereign wealth funds have stronger mandates than private institutions when it comes to sustainable investment. This is partly because of the broad top-down guidance they receive from national governments, who are keen that the funds, while remaining entirely independent when it comes to investment decisions, invest in strategic industries and in some cases that they be a driver of the economy’s diversification away from oil and gas.

“Sovereign wealth funds undoubtedly have stronger ESG mandates than most other institutions in the region. This is because of their higher political visibility, a mandate that often also includes a soft power dimension, and their sovereign backing and longer time horizons, allowing them to focus on sustainability-related investment as part of a broader national diversification strategy, while private investors tend to be more short-term and purely commercial in their orientation,” Hertog argues.

While national governments will hope that these stronger mandates “trickle down” to the level of private institutions, this more conservative approach on the part of private investors might also be related to the fact that, while the sustainable investment market is a rapidly growing industry, it remains one in its infancy.

Jamil Wyne, Co-Founder of venture capital fund Riffle Ventures, which invests in climate-related and sustainable projects globally, says that the private sector is keen to see the results of public investments take shape before committing more substantial amounts of its own capital to sustainable investment.

“Generally speaking, whenever a government or sovereign wealth fund puts funding behind a certain area, including sustainability, this has a ‘de-risking’ effect for private investors, both in and outside the country,” Wyne says. “For instance, if a country becomes more proactive in supporting ESG standards in its financial sector, it sends a signal to the market and investors gradually respond.”

“For any country to reach its net zero targets or achieve sustainability goals, the government will have to play at least some leading role – both by investing, such as through sovereign wealth funds, and providing the correct set of incentives or punishments for others to follow suit,” Wyne adds.

“The alternative is simply to wait for private investors and businesses to individually adopt sustainable investment practices, but they’re heterogeneous of a group for it to happen in a coordinated way, at the speed we need it to.”

Jeffrey Beyer, Founder and Director at Zest Associates, a sustainability-focused consultancy firm in Dubai, similarly notes that the unique mandate of sovereign wealth funds makes them better suited to investing in next-generation industries.

“Sovereign wealth funds have a mandate to invest in sectors and industries that will provide long-term economic value and deliver prosperity to the populations they serve. That includes investing in international markets that deliver solid financial returns, and domestic markets that advance the policy priorities of the government, like jobs and economic diversification,” he says.

“Increasingly, governments in the Middle East are acknowledging the value delivered by green industries. They help both to diversify and futureproof economies that will be subjected to huge change as the impacts of global climate commitments ripple through the real economy, especially energy markets. Getting out in front of that change by investing in industries of the future helps to smooth the transition and provides the long-term economic prosperity that sovereign wealth funds are meant to deliver,” Beyer adds.

Given these financial and political dynamics, it is likely that sovereign wealth funds will influence the Middle East’s sustainable investment industry both directly and indirectly in the years to come. There is both the direct impact of billions of dollars deployed in sustainable investments, and the indirect impact of “clearing the way” for higher levels of sustainable investment amongst private investors.

Jeffrey Beyer, Founder and Director at Zest Associates, a sustainability-focused consultancy firm in Dubai, similarly notes that the unique mandate of sovereign wealth funds makes them better suited to investing in next-generation industries.

“Sovereign wealth funds have a mandate to invest in sectors and industries that will provide long-term economic value and deliver prosperity to the populations they serve. That includes investing in international markets that deliver solid financial returns, and domestic markets that advance the policy priorities of the government, like jobs and economic diversification,” he says.

“Increasingly, governments in the Middle East are acknowledging the value delivered by green industries. They help both to diversify and futureproof economies that will be subjected to huge change as the impacts of global climate commitments ripple through the real economy, especially energy markets. Getting out in front of that change by investing in industries of the future helps to smooth the transition and provides the long-term economic prosperity that sovereign wealth funds are meant to deliver,” Beyer adds.

Given these financial and political dynamics, it is likely that sovereign wealth funds will influence the Middle East’s sustainable investment industry both directly and indirectly in the years to come. There is both the direct impact of billions of dollars deployed in sustainable investments, and the indirect impact of “clearing the way” for higher levels of sustainable investment amongst private investors.

SWF Sustainable Investments by Sector

It is clear that sovereign wealth funds in the Middle East are already committing substantial amounts of capital to the sustainable investment space. However, which sectors within the broader sustainability space are these funds going to?

While funding for climate tech globally has been subdued in light of a tough general environment for fundraising13, Middle Eastern investors have sought to position themselves as leaders in the space. As of March this year, PwC identified 98 climate tech start-ups in the region that are currently receiving funding and estimated that the first half of 2022 alone saw $1.6bn invested in this industry in the region14.

Our experts highlighted three main sectors within climate tech in which they have identified significant investment on the part of sovereign wealth funds. This gives a strong indication of where wider sustainable investment activity may be headed in the Middle East – and where opportunities for private sector investors may lie:

1. Renewable Energy

Wyne notes that “while it is hard to know the precise dollar value of sustainable investment and how it is allotted in the Middle East, most investment dollars are going towards renewable energy – and rightly so, because the business case is compelling and universal. This is unsurprising: the region has played a significant role in the global energy industry, albeit a fossil fuel-driven one, so it’s familiar territory.”

Interest in renewable energy has grown particularly strong as many Middle Eastern governments, such as Saudi Arabia and the UAE, have taken steps to try and diversify their economies away from oil and gas – and given the huge potential the region has in this industry.

The UAE, for example, is reported to be “best placed when it comes to utilizing solar power potential in the world,” with “more than 90% of the country’s land mass having the capability to produce solar energy”15. The price of solar power systems has dropped by more than three-quarters since 2019 thanks to government investments in infrastructure and accommodative regulations, further incentivizing the adoption of solar power for commercial or industrial purposes16.

It is little wonder, then, that the UAE’s sovereign wealth funds have taken strides into this space. Mubadala has already deployed more than $20bn in clean energy projects17.

Within the renewable energy space, Hertog says that “solar energy is the most important sector by some margin.”

In this space, we see increasing investment not only directed by the SWFs themselves but also through their renewables-focused subsidiaries, especially in solar energy.

In May this year, PIF’s wholly owned company Badeel and ACWA, in which PIF has a 44% stake, signed a power purchase agreement with the Saudi Power Procurement Company to develop three new major solar projects in the Kingdom18. This means that PIF is now developing a total of five solar projects, having invested over $6bn in the industry. Saudi Arabia’s sovereign wealth fund has committed to developing 70% of the country’s renewable energy by 2030.

Masdar (majority held by ADQ-owned TAQA and Mubadala) recently inaugurated the world’s largest solar power plant in Al Dhafra, Abu Dhabi.

SWF Sustainable Investments by Sector

It is clear that sovereign wealth funds in the Middle East are already committing substantial amounts of capital to the sustainable investment space. However, which sectors within the broader sustainability space are these funds going to?

While funding for climate tech globally has been subdued in light of a tough general environment for fundraising13, Middle Eastern investors have sought to position themselves as leaders in the space. As of March this year, PwC identified 98 climate tech start-ups in the region that are currently receiving funding and estimated that the first half of 2022 alone saw $1.6bn invested in this industry in the region14.

Our experts highlighted three main sectors within climate tech in which they have identified significant investment on the part of sovereign wealth funds. This gives a strong indication of where wider sustainable investment activity may be headed in the Middle East – and where opportunities for private sector investors may lie:

1. Renewable Energy

Wyne notes that “while it is hard to know the precise dollar value of sustainable investment and how it is allotted in the Middle East, most investment dollars are going towards renewable energy – and rightly so, because the business case is compelling and universal. This is unsurprising: the region has played a significant role in the global energy industry, albeit a fossil fuel-driven one, so it’s familiar territory.”

Interest in renewable energy has grown particularly strong as many Middle Eastern governments, such as Saudi Arabia and the UAE, have taken steps to try and diversify their economies away from oil and gas – and given the huge potential the region has in this industry.

The UAE, for example, is reported to be “best placed when it comes to utilizing solar power potential in the world,” with “more than 90% of the country’s land mass having the capability to produce solar energy”15. The price of solar power systems has dropped by more than three-quarters since 2019 thanks to government investments in infrastructure and accommodative regulations, further incentivizing the adoption of solar power for commercial or industrial purposes16.

It is little wonder, then, that the UAE’s sovereign wealth funds have taken strides into this space. Mubadala has already deployed more than $20bn in clean energy projects17.

Within the renewable energy space, Hertog says that “solar energy is the most important sector by some margin.”

In this space, we see increasing investment not only directed by the SWFs themselves but also through their renewables-focused subsidiaries, especially in solar energy.

In May this year, PIF’s wholly owned company Badeel and ACWA, in which PIF has a 44% stake, signed a power purchase agreement with the Saudi Power Procurement Company to develop three new major solar projects in the Kingdom18. This means that PIF is now developing a total of five solar projects, having invested over $6bn in the industry. Saudi Arabia’s sovereign wealth fund has committed to developing 70% of the country’s renewable energy by 2030.

Masdar (majority held by ADQ-owned TAQA and Mubadala) recently inaugurated the world’s largest solar power plant in Al Dhafra, Abu Dhabi.

“The commercial rationale for solar in the Middle East and North Africa (MENA) is obvious,” Hertog says, “as the region has a lot of sun and the production cycle of electricity is broadly synchronized with electricity use through air conditioning. Using solar to replace crude and diesel burn for local power generation makes a lot of commercial sense.”

It is therefore unsurprising that substantial amounts of investment have been flowing from MENA sovereign wealth funds to innovative solar energy and other clean energy projects. In 2020, Mumtalakat, Bahrain’s sovereign wealth fund, said the organization would be focusing on solar power as it seeks to take advantage of the economic potential of sustainability-related sectors19.

Earlier in November, ADIA held an energy transition summit in Abu Dhabi and announced its intention “to actively consider how to invest into one of the major themes shaping the global economy, both now and into the future.”20

The Sovereign Fund of Egypt (TSFE) has similarly put solar and clean energy at the front and center of its investment strategy – such as agreeing to a $5bn joint investment with the Oman Investment Authority in a green hydrogen project – and has worked with the Egyptian government to put in place fiscal and financial incentives for private investors to follow suit.

Even funds that have traditionally been highly exposed to fossil fuels are changing course. 44% of QIA’s infrastructure projects are already zero emission investments21 – and this green shift is likely to become more marked as sovereign wealth funds increasingly look to seize the opportunities associated with the green transition.

“The commercial rationale for solar in the Middle East and North Africa (MENA) is obvious,” Hertog says, “as the region has a lot of sun and the production cycle of electricity is broadly synchronized with electricity use through air conditioning. Using solar to replace crude and diesel burn for local power generation makes a lot of commercial sense.”

It is therefore unsurprising that substantial amounts of investment have been flowing from MENA sovereign wealth funds to innovative solar energy and other clean energy projects. In 2020, Mumtalakat, Bahrain’s sovereign wealth fund, said the organization would be focusing on solar power as it seeks to take advantage of the economic potential of sustainability-related sectors19.

Earlier in November, ADIA held an energy transition summit in Abu Dhabi and announced its intention “to actively consider how to invest into one of the major themes shaping the global economy, both now and into the future.”20

The Sovereign Fund of Egypt (TSFE) has similarly put solar and clean energy at the front and center of its investment strategy – such as agreeing to a $5bn joint investment with the Oman Investment Authority in a green hydrogen project – and has worked with the Egyptian government to put in place fiscal and financial incentives for private investors to follow suit.

Even funds that have traditionally been highly exposed to fossil fuels are changing course. 44% of QIA’s infrastructure projects are already zero emission investments21 – and this green shift is likely to become more marked as sovereign wealth funds increasingly look to seize the opportunities associated with the green transition.

2. Decarbonization

In a region whose economies remain dependent on fossil fuel production, sovereign wealth funds have taken steps to invest in decarbonization projects. In many cases the strategic goal of decarbonization or fossil fuel diversification is embedded in the funds’ mandates. PIF, for example, operates with a clear strategic mandate to support Saudi Arabia’s Vision 2030 plan, which aims to reduce the Kingdom’s dependence on oil exports.

Jessica Robinson, MENA Sustainable Finance Leader for EY-Parthenon in Dubai shares that one area of sustainable investment has been in carbon capture and storage (CCS) technology. Robinson says that “something that has been quite interesting is, across the region, there’s been a lot of talk about the circular carbon economy – many governments in the Middle East believe that we’re spending too much time looking at emission reductions, when actually we should be investing in other aspects.”

While this is a relatively nascent industry, there are early signs that sovereign wealth funds are taking an interest, though they are focusing more on how to deal with and recycle carbon rather than just trying to remove it from the picture entirely “This is leading them to consider technologies such as CCS, as well as the potential of carbon offset markets,” Robinson adds.

2. Decarbonization

In a region whose economies remain dependent on fossil fuel production, sovereign wealth funds have taken steps to invest in decarbonization projects. In many cases the strategic goal of decarbonization or fossil fuel diversification is embedded in the funds’ mandates. PIF, for example, operates with a clear strategic mandate to support Saudi Arabia’s Vision 2030 plan, which aims to reduce the Kingdom’s dependence on oil exports.

Jessica Robinson, MENA Sustainable Finance Leader for EY-Parthenon in Dubai shares that one area of sustainable investment has been in carbon capture and storage (CCS) technology. Robinson says that “something that has been quite interesting is, across the region, there’s been a lot of talk about the circular carbon economy – many governments in the Middle East believe that we’re spending too much time looking at emission reductions, when actually we should be investing in other aspects.”

While this is a relatively nascent industry, there are early signs that sovereign wealth funds are taking an interest, though they are focusing more on how to deal with and recycle carbon rather than just trying to remove it from the picture entirely “This is leading them to consider technologies such as CCS, as well as the potential of carbon offset markets,” Robinson adds.

“If you’re an investor, or a bank, you really need to be getting your head around what these carbon offsets represent – because in the MENA region, we’re going to see a boom around carbon offsetting to reach net zero targets, and we’ve seen a lot of investment go into this space.”

These developments have been ongoing for a number of years in Abu Dhabi: in 2016, for example, the Abu Dhabi National Oil Company (ADNOC) began operating the Middle East’s first CCS facility, which has the capacity to capture 800,000 tons of carbon dioxide. ADNOC plans to expand its capacity six-fold by 203022.

PIF is an active player in the region’s voluntary carbon markets, which connect the supply of “carbon credits” with organizations around the world looking to reduce their carbon footprint. The fund, along with the Saudi Stock Exchange, has announced a plan to establish a voluntary carbon market early next year23. Mubadala Investment Company acquired a strategic stake in Singapore-based AirCarbon Exchange (ACX), and recently ACX began operations in the Abu Dhabi Global Market (ADGM) as the world’s first regulated carbon trading exchange and trading house.

While carbon credit markets in the Gulf Cooperation Council (GCC) lag behind those of the U.S., India, China, and other major players, it is clear that funds are taking steps in the right direction. The MENA carbon market is forecast to reach up to 150 million tons by 203024, with sovereign wealth funds likely to play a key role in their development and growth.

“If you’re an investor, or a bank, you really need to be getting your head around what these carbon offsets represent – because in the MENA region, we’re going to see a boom around carbon offsetting to reach net zero targets, and we’ve seen a lot of investment go into this space.”

These developments have been ongoing for a number of years in Abu Dhabi: in 2016, for example, the Abu Dhabi National Oil Company (ADNOC) began operating the Middle East’s first CCS facility, which has the capacity to capture 800,000 tons of carbon dioxide. ADNOC plans to expand its capacity six-fold by 203022.

PIF is an active player in the region’s voluntary carbon markets, which connect the supply of “carbon credits” with organizations around the world looking to reduce their carbon footprint. The fund, along with the Saudi Stock Exchange, has announced a plan to establish a voluntary carbon market early next year23. Mubadala Investment Company acquired a strategic stake in Singapore-based AirCarbon Exchange (ACX), and recently ACX began operations in the Abu Dhabi Global Market (ADGM) as the world’s first regulated carbon trading exchange and trading house.

While carbon credit markets in the Gulf Cooperation Council (GCC) lag behind those of the U.S., India, China, and other major players, it is clear that funds are taking steps in the right direction. The MENA carbon market is forecast to reach up to 150 million tons by 203024, with sovereign wealth funds likely to play a key role in their development and growth.

3. Electric Vehicles

All our experts pointed to electric vehicles as another area of interest for the Middle East’s sovereign wealth funds and their sustainability-linked investments. The growth potential for this industry is widely expected to be very significant, with the growth rate forecast to be about 30% per year in the Middle East alone until 203025. López says that “electric vehicles, and other sustainability-related transport infrastructure, have seen high levels of investment from regional sovereign wealth funds.”

Last month, PIF announced a partnership with the Saudi Electricity Company to launch an electric vehicles infrastructure company, taking a 75% stake26. In September, the Oman Investment Authority invested an undisclosed amount in U.S. firm Our Next Energy27, which specializes in the batteries used for electric vehicles.

Wyne is encouraged that sovereign wealth funds’ investments in electric vehicles and other sustainability-lined sectors are slowly but surely encouraging the private sector to follow suit. “Of course, organizations such as PIF continue to write the largest check sizes, but we have also seen smaller, private funds emerge,” he notes. “One example is Catalyst Investment Management in Jordan, which is mandated to solely focus on climate-related investments, as well as groups like Venture Souq in the UAE, which have included climate and impact investments alongside their purely commercial investments.”

“You also have groups like Ashoka, Al Fanar, and other nonprofits in the region that have supported social enterprises which fit squarely within the sustainable investment space – all of this is to say that MENA is home to numerous examples of sustainable investment,” Wyne says.

With significant levels of public money flowing into these sustainable industries, it is hoped that further such private groups will emerge to take advantage of the financial opportunities.

3. Electric Vehicles

All our experts pointed to electric vehicles as another area of interest for the Middle East’s sovereign wealth funds and their sustainability-linked investments. The growth potential for this industry is widely expected to be very significant, with the growth rate forecast to be about 30% per year in the Middle East alone until 203025. López says that “electric vehicles, and other sustainability-related transport infrastructure, have seen high levels of investment from regional sovereign wealth funds.”

Last month, PIF announced a partnership with the Saudi Electricity Company to launch an electric vehicles infrastructure company, taking a 75% stake26. In September, the Oman Investment Authority invested an undisclosed amount in U.S. firm Our Next Energy27, which specializes in the batteries used for electric vehicles.

Wyne is encouraged that sovereign wealth funds’ investments in electric vehicles and other sustainability-lined sectors are slowly but surely encouraging the private sector to follow suit. “Of course, organizations such as PIF continue to write the largest check sizes, but we have also seen smaller, private funds emerge,” he notes. “One example is Catalyst Investment Management in Jordan, which is mandated to solely focus on climate-related investments, as well as groups like Venture Souq in the UAE, which have included climate and impact investments alongside their purely commercial investments.”

“You also have groups like Ashoka, Al Fanar, and other nonprofits in the region that have supported social enterprises which fit squarely within the sustainable investment space – all of this is to say that MENA is home to numerous examples of sustainable investment,” Wyne says.

With significant levels of public money flowing into these sustainable industries, it is hoped that further such private groups will emerge to take advantage of the financial opportunities.

Are Middle Eastern SWFs Lagging Behind?

Sovereign wealth funds in the Middle East have undoubtedly made huge strides in the realm of sustainable investment, as the investments above indicate. However, all our experts believe that more work needs to be done as the region continues to lag other markets.

Wyne believes that “globally, European sovereign wealth funds, such as Norway’s Norges, have helped to set the standard for sustainable investment” – a standard which Hertog argues funds in the Middle East are yet to reach.

“Sovereign wealth funds in the region do not yet have a consistent ESG agenda across their portfolio like Norges does. Instead, there are significant individual projects, while many also continue to invest in polluting industries, including conventional hydrocarbons – see Mubadala’s substantial overseas hydrocarbons portfolio, for example,” he says.

Robinson similarly points out that, “While the carbon offset market has exploded into life recently, the issue is that sovereign wealth funds in the region still need to do a lot more to embed the ESG integration process across their entire portfolios – the Scandinavian funds have been doing this for a long time and committed substantial resources and substantial rigor.” While sovereign wealth funds are benefiting from increasingly sophisticated and well-established sustainability teams, she suggests they do not necessarily yet have the same in-depth experience as fully ESG-focused investors.

It has been suggested by some that to fully realize the potential sustainable investing influence of sovereign wealth, each jurisdiction should establish separate fully ESG-focused SWFs. This may not be on the cards any time soon, but there are reasons to be optimistic that existing SWFs’ sustainable investing activities could ramp up significantly in the years ahead.

Plenty of the region’s activity in this area has already been focused in Abu Dhabi. In January 2022, the ADGM became the first “carbon neutral” international finance center in the world28. In July 2023, the ADGM implemented its sustainable finance regulatory framework, which consists of the region’s most comprehensive ESG disclosure requirements. The framework also provides direction for funds, discretionary managed portfolios, bonds, and sukuks designed to accelerate the UAE’s transition to net zero29.

For one, the region’s increasingly ambitious goals surrounding net zero and climate change are likely to lead to a greater mobilization of green capital through their sovereign wealth funds.

Ahmad notes that “governments’ net zero targets have undoubtedly driven greater sustainable investments in the Middle East’s giga-projects, with sovereign wealth funds and national strategies as driving forces. More interestingly, however, governments’ net zero targets have also drawn investments from outside the MENA region. With such a strong voice at the top and robust, though evolving, regulatory landscape, companies in the region have started investing in their own sustainability initiatives such as developing their own decarbonization plans and targets.”

Beyer similarly believes that, while there is still much room for improvement, the region’s sovereign wealth funds have demonstrated the right ambitions. He points out that the funds of Abu Dhabi, Kuwait, Saudi Arabia, and Qatar are founding members of the One Planet Sovereign Wealth Funds Initiative, for example.

This was launched in 2017, following the 2015 Paris Accord, and aims “to accelerate efforts to integrate financial risks and opportunities related to climate change in the management of large, long-term asset pools”30. The hope is that, given the size and influence of sovereign wealth funds, this can “promote long-term value creation and sustainable market outcomes.” Another encouraging sign is that Abu Dhabi’s Mubadala and the TSFE joined the initiative in 2020 and 2021 respectively, Beyer suggests.

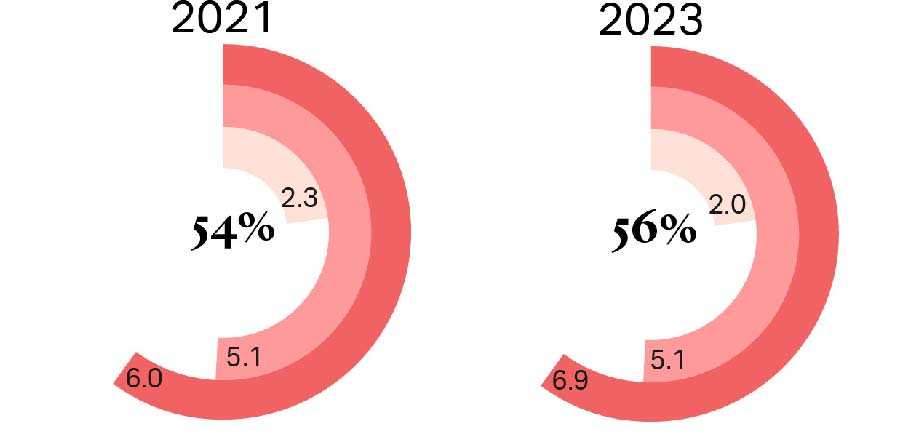

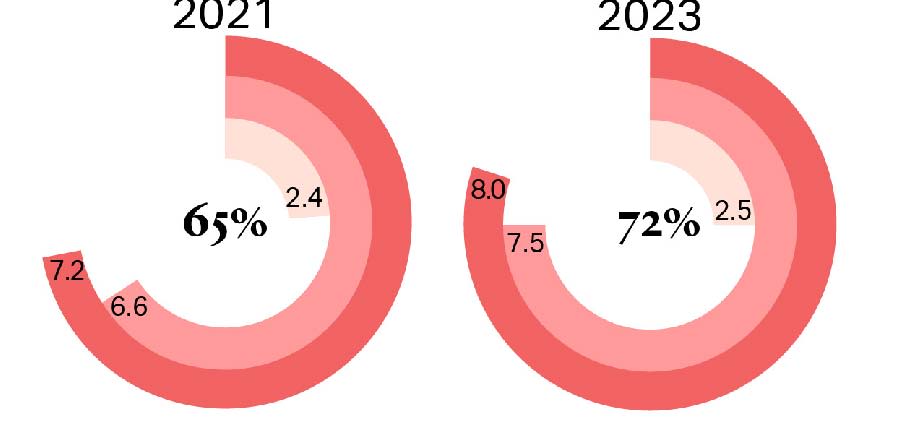

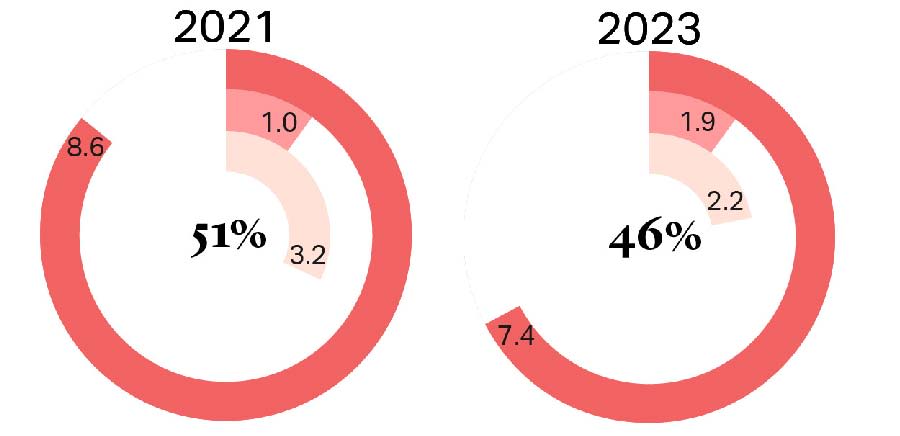

“And yet, in 2021, all state-owned investors in the region scored below average in the 2021 Sovereign Wealth Fund Governance, Sustainability, and Resilience scorecard, which assesses the world’s 100 largest state-owned funds. Six of the region’s 14 funds scored at the bottom,” he says.

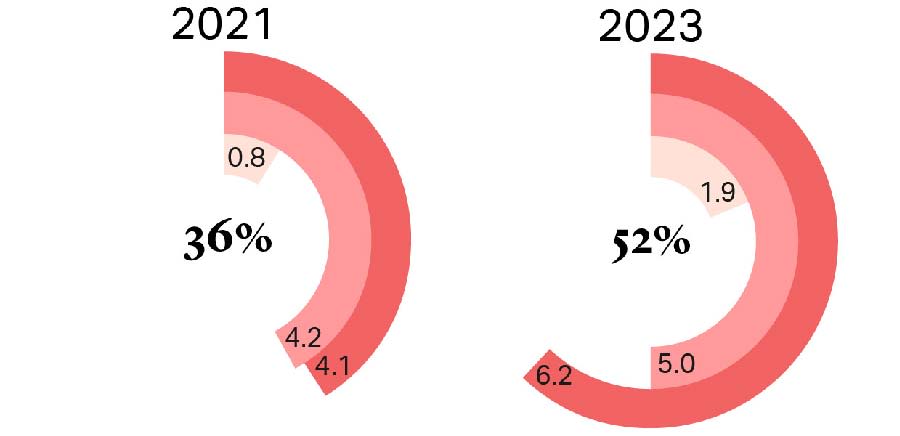

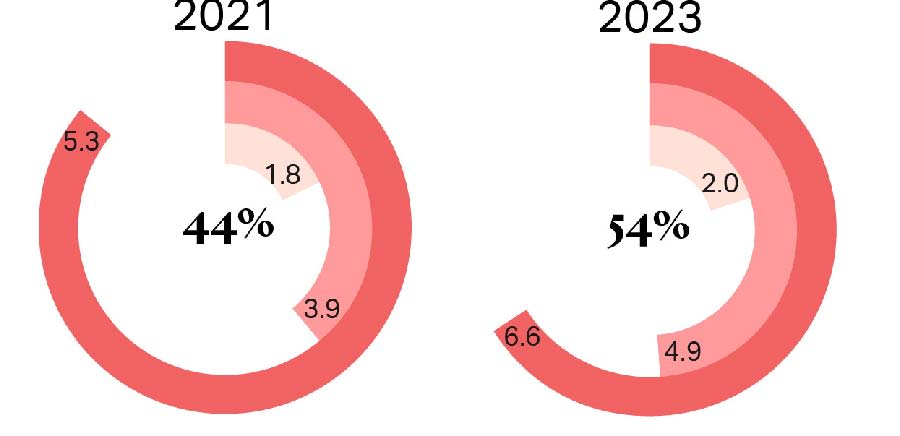

“But there’s been huge momentum in the right direction since then. This year’s index states that “the Middle East has seen the largest improvement, from 32% in 2020 to 52% in 2023. PIF is leading the way with some unprecedented efforts around sustainability in the region.” This shows how much the region’s sovereign wealth funds are prioritizing sustainability.

Are Middle Eastern SWFs Lagging Behind?

Sovereign wealth funds in the Middle East have undoubtedly made huge strides in the realm of sustainable investment, as the investments above indicate. However, all our experts believe that more work needs to be done as the region continues to lag other markets.

Wyne believes that “globally, European sovereign wealth funds, such as Norway’s Norges, have helped to set the standard for sustainable investment” – a standard which Hertog argues funds in the Middle East are yet to reach.

“Sovereign wealth funds in the region do not yet have a consistent ESG agenda across their portfolio like Norges does. Instead, there are significant individual projects, while many also continue to invest in polluting industries, including conventional hydrocarbons – see Mubadala’s substantial overseas hydrocarbons portfolio, for example,” he says.

Robinson similarly points out that, “While the carbon offset market has exploded into life recently, the issue is that sovereign wealth funds in the region still need to do a lot more to embed the ESG integration process across their entire portfolios – the Scandinavian funds have been doing this for a long time and committed substantial resources and substantial rigor.” While sovereign wealth funds are benefiting from increasingly sophisticated and well-established sustainability teams, she suggests they do not necessarily yet have the same in-depth experience as fully ESG-focused investors.

It has been suggested by some that to fully realize the potential sustainable investing influence of sovereign wealth, each jurisdiction should establish separate fully ESG-focused SWFs. This may not be on the cards any time soon, but there are reasons to be optimistic that existing SWFs’ sustainable investing activities could ramp up significantly in the years ahead.

Plenty of the region’s activity in this area has already been focused in Abu Dhabi. In January 2022, the ADGM became the first “carbon neutral” international finance center in the world28. In July 2023, the ADGM implemented its sustainable finance regulatory framework, which consists of the region’s most comprehensive ESG disclosure requirements. The framework also provides direction for funds, discretionary managed portfolios, bonds, and sukuks designed to accelerate the UAE’s transition to net zero29.

For one, the region’s increasingly ambitious goals surrounding net zero and climate change are likely to lead to a greater mobilization of green capital through their sovereign wealth funds.

Ahmad notes that “governments’ net zero targets have undoubtedly driven greater sustainable investments in the Middle East’s giga-projects, with sovereign wealth funds and national strategies as driving forces. More interestingly, however, governments’ net zero targets have also drawn investments from outside the MENA region. With such a strong voice at the top and robust, though evolving, regulatory landscape, companies in the region have started investing in their own sustainability initiatives such as developing their own decarbonization plans and targets.”

Beyer similarly believes that, while there is still much room for improvement, the region’s sovereign wealth funds have demonstrated the right ambitions. He points out that the funds of Abu Dhabi, Kuwait, Saudi Arabia, and Qatar are founding members of the One Planet Sovereign Wealth Funds Initiative, for example.

This was launched in 2017, following the 2015 Paris Accord, and aims “to accelerate efforts to integrate financial risks and opportunities related to climate change in the management of large, long-term asset pools”30. The hope is that, given the size and influence of sovereign wealth funds, this can “promote long-term value creation and sustainable market outcomes.” Another encouraging sign is that Abu Dhabi’s Mubadala and the TSFE joined the initiative in 2020 and 2021 respectively, Beyer suggests.

“And yet, in 2021, all state-owned investors in the region scored below average in the 2021 Sovereign Wealth Fund Governance, Sustainability, and Resilience scorecard, which assesses the world’s 100 largest state-owned funds. Six of the region’s 14 funds scored at the bottom,” he says.

“But there’s been huge momentum in the right direction since then. This year’s index states that “the Middle East has seen the largest improvement, from 32% in 2020 to 52% in 2023. PIF is leading the way with some unprecedented efforts around sustainability in the region.” This shows how much the region’s sovereign wealth funds are prioritizing sustainability.

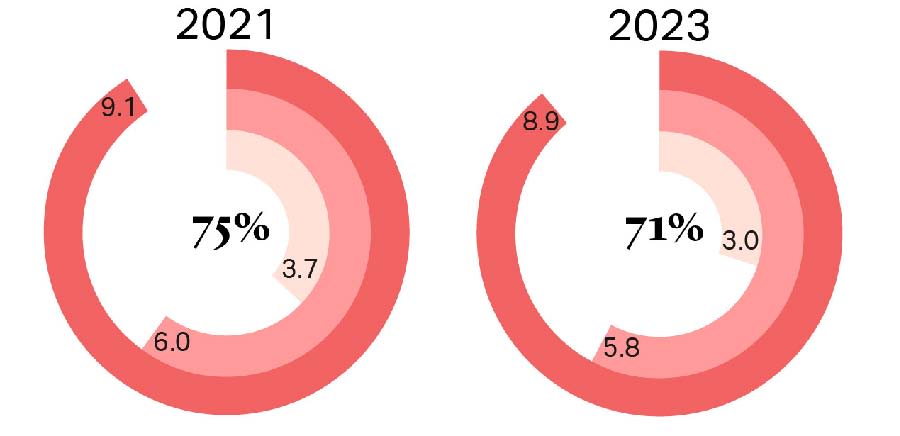

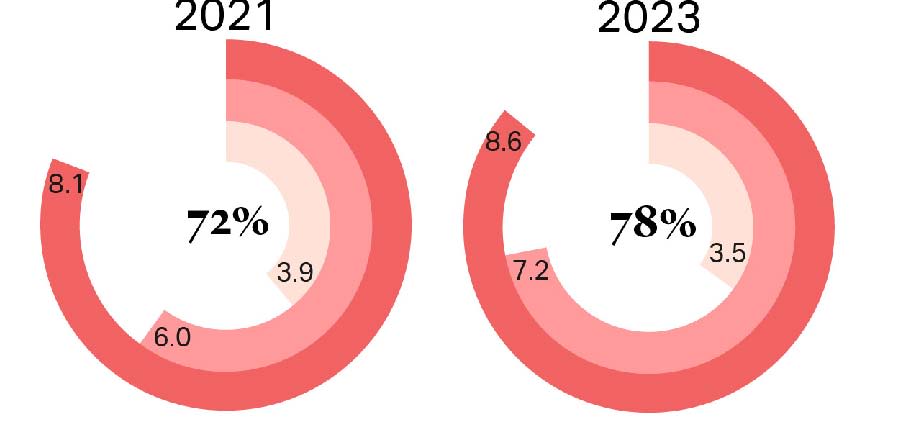

How Sovereign Wealth Funds Score on Governance, Sustainability, and Resilience

Asia

Europe

Latin America

Middle East and North Africa

North America

Oceania

Sub-Saharan Africa

Source: GlobalSWF

Ahmad agrees that PIF is leading the way. “We have seen the major development in KSA (Kingdom of Saudi Arabia) where PIF has published its own Sustainable Finance Framework – leading by example for other SWFs to follow suit,” he says.

Furthermore, López points out that, “while the region is still trailing, since 2021 we have seen a major switch in investing preferences – sovereign wealth funds now deploy more capital in ‘green energy’ than in ‘black energy’ every year.”

“This does not necessarily mean that the portfolio of green assets is now larger – PIF still has a $160bn stake in Aramco, for example – but if the trends continue, we may see the overall portfolio weights tilt over time,” López adds. While there is still a long way to go, the trajectory is promising.

Ahmad agrees that PIF is leading the way. “We have seen the major development in KSA (Kingdom of Saudi Arabia) where PIF has published its own Sustainable Finance Framework – leading by example for other SWFs to follow suit,” he says.

Furthermore, López points out that, “while the region is still trailing, since 2021 we have seen a major switch in investing preferences – sovereign wealth funds now deploy more capital in ‘green energy’ than in ‘black energy’ every year.”

“This does not necessarily mean that the portfolio of green assets is now larger – PIF still has a $160bn stake in Aramco, for example – but if the trends continue, we may see the overall portfolio weights tilt over time,” López adds. While there is still a long way to go, the trajectory is promising.

Conclusion

The Middle East’s sovereign wealth funds are likely to become an ever-stronger presence in the region’s – and indeed the world’s – sustainable investment space in the years ahead. Robust and growing financial reserves, along with the political backing to invest in green industries, means they are in a strong position to take ever-greater strides into the growing sustainability industry.

In turn, this could help spawn much broader investment from the private sector, including international and regional banks, which for now remain more conservative in committing funds to an industry still in its infancy.

While the region’s sovereign wealth funds currently lag their European and American counterparts, mainly because ESG processes still need to be integrated consistently across their entire portfolios, there is every reason to believe this will change as governments become increasingly more committed to bold climate goals.

This is likely to lead to ever-greater activity in sustainable investments from MENA sovereign wealth funds who have already proven themselves to be highly ambitious in this space.The Middle East’s sovereign wealth funds are likely to become an ever-stronger presence in the region’s – and indeed the world’s – sustainable investment space in the years ahead. Robust and growing financial reserves, along with the political backing to invest in green industries, means they are in a strong position to take ever-greater strides into the growing sustainability industry.

In turn, this could help spawn much broader investment from the private sector, including international and regional banks, which for now remain more conservative in committing funds to an industry still in its infancy.

While the region’s sovereign wealth funds currently lag their European and American counterparts, mainly because ESG processes still need to be integrated consistently across their entire portfolios, there is every reason to believe this will change as governments become increasingly more committed to bold climate goals.

This is likely to lead to ever-greater activity in sustainable investments from MENA sovereign wealth funds who have already proven themselves to be highly ambitious in this space.

Conclusion

The Middle East’s sovereign wealth funds are likely to become an ever-stronger presence in the region’s – and indeed the world’s – sustainable investment space in the years ahead. Robust and growing financial reserves, along with the political backing to invest in green industries, means they are in a strong position to take ever-greater strides into the growing sustainability industry.

In turn, this could help spawn much broader investment from the private sector, including international and regional banks, which for now remain more conservative in committing funds to an industry still in its infancy.

While the region’s sovereign wealth funds currently lag their European and American counterparts, mainly because ESG processes still need to be integrated consistently across their entire portfolios, there is every reason to believe this will change as governments become increasingly more committed to bold climate goals.

This is likely to lead to ever-greater activity in sustainable investments from MENA sovereign wealth funds who have already proven themselves to be highly ambitious in this space.The Middle East’s sovereign wealth funds are likely to become an ever-stronger presence in the region’s – and indeed the world’s – sustainable investment space in the years ahead. Robust and growing financial reserves, along with the political backing to invest in green industries, means they are in a strong position to take ever-greater strides into the growing sustainability industry.

In turn, this could help spawn much broader investment from the private sector, including international and regional banks, which for now remain more conservative in committing funds to an industry still in its infancy.

While the region’s sovereign wealth funds currently lag their European and American counterparts, mainly because ESG processes still need to be integrated consistently across their entire portfolios, there is every reason to believe this will change as governments become increasingly more committed to bold climate goals.

This is likely to lead to ever-greater activity in sustainable investments from MENA sovereign wealth funds who have already proven themselves to be highly ambitious in this space.