Risks and Opportunities

in Venture Capital

Since taking office last year, SEC Chair Gary Gensler has made it clear that private fund advisers are going to face greater scrutiny and regulatory reform. In the same period, venture capital has experienced unprecedented levels of activity, with record valuations and crossover investing activity. In this new environment, growing numbers of traditional venture capital (VC) firms are considering where to go from here, including weighing the pros and cons of remaining an exempt reporting adviser (ERA) versus registering with the SEC to explore new investment opportunities.

To Register, or Not to Register?

Since the Dodd-Frank Act first created ERA status, it has been the preferred option for most eligible VC firms. ERA status has historically provided VC firms and small private fund advisers with relief from the most onerous compliance and reporting obligations of advisers that are registered or required to register under the Advisers Act. However, VC firms that qualify for ERA status via the venture capital adviser exemption may only advise “venture capital funds” as defined under the Advisers Act, which are limited in the types of investments they can make, as well as the leverage they can incur and the liquidity terms they can provide investors.

In recent years, several VC firms, like General Catalyst, Andreessen Horowitz and Sequoia, have chosen to become registered advisers (RIAs) in order to gain flexibility in their business and to offer new products and strategies.

VC firms on the fence about whether to follow suit may want to take pause, however, in light of recent regulatory proposals from the SEC. In particular, certain rules set forth in the February 9, 2022 proposing release relating to private fund advisers would, as currently drafted, apply to ERAs and RIAs, while others would apply to RIAs only. Depending on the scope of the final rules if and when adopted, some VC firms may find that the burden of registration is simply too great. Others may determine that the new obligations on ERAs are such that the increased obligations of RIA status are incremental and worth the additional business flexibility RIA status affords.

To Register, or Not to Register?

Since the Dodd-Frank Act first created ERA status, it has been the preferred option for most eligible VC firms. ERA status has historically provided VC firms and small private fund advisers with relief from the most onerous compliance and reporting obligations of advisers that are registered or required to register under the Advisers Act. However, VC firms that qualify for ERA status via the venture capital adviser exemption may only advise “venture capital funds” as defined under the Advisers Act, which are limited in the types of investments they can make, as well as the leverage they can incur and the liquidity terms they can provide investors.

In recent years, several VC firms, like General Catalyst, Andreessen Horowitz and Sequoia, have chosen to become registered advisers (RIAs) in order to gain flexibility in their business and to offer new products and strategies.

VC firms on the fence about whether to follow suit may want to take pause, however, in light of recent regulatory proposals from the SEC. In particular, certain rules set forth in the February 9, 2022 proposing release relating to private fund advisers would, as currently drafted, apply to ERAs and RIAs, while others would apply to RIAs only. Depending on the scope of the final rules if and when adopted, some VC firms may find that the burden of registration is simply too great. Others may determine that the new obligations on ERAs are such that the increased obligations of RIA status are incremental and worth the additional business flexibility RIA status affords.

New Products and Strategies

VC firms, like General Catalyst and Sequoia, have become RIAs in order to gain flexibility in their business and to offer new products and strategies.

Proposed SEC Rule Changes Applicable to ERAs

Although the proposed private fund adviser rules regarding quarterly reporting, audits and adviser-led secondary transactions would apply to RIAs only, the proposed rules regarding prohibited activities and preferential treatment would apply to all advisers, including ERAs1. These prohibited adviser activities would include:

- Charging a portfolio company for monitoring, servicing, consulting or other fees for unperformed services

- Charging a private fund for expenses relating to the adviser’s or its related person’s examination, investigation or regulatory or compliance obligations

- Allocating expenses related to a portfolio company among clients on a non-pro rata basis

- Directly or indirectly borrowing from a private fund client

Perhaps most notably, the proposals would also prohibit reduction of clawbacks for actual or hypothetical taxes, as well as indemnification of an adviser by a fund client for conduct constituting simple negligence. These changes could, among other things, expose VC managers to greater litigation risks and impact investment strategy.

The proposals would also prohibit all private fund advisers from providing an investor with preferential terms regarding liquidity or portfolio information, if the adviser reasonably expects that it will have a material, negative effect on other investors in that private fund or in a substantially similar pool of assets. In addition, any other preferential term granted to an investor would be prohibited unless the adviser provides pre-investment disclosure to other investors regarding the preferential treatment and annual disclosure of preferential terms thereafter.

While some of these prohibitions may seem reasonable on the surface, each has nuances and wrinkles that could in practice cause problems for advisers. For example, it may be appropriate for an anchor investor seeding a startup VC adviser business to bear, directly or indirectly, a portion of the adviser’s compliance expenses or for the adviser to grant special redemption rights to such anchor investor.

These are still proposals – and any final rules could vary substantially in terms of substance and scope. Even so, ERAs should start thinking about the steps they would need to take to comply with the new rules applicable to ERAs if adopted as proposed, and the potential impact the changes could have on their business. In particular, ERAs should consider what additional legal and compliance resources they will need and the changes to internal policies and procedures that would be required to comply. It should also be noted that the proposals as drafted contemplate a one-year transition period following adoption, but do not include a grandfathering provision for existing funds.

Proposed SEC Rule Changes Applicable to ERAs

Although the proposed private fund adviser rules regarding quarterly reporting, audits and adviser-led secondary transactions would apply to RIAs only, the proposed rules regarding prohibited activities and preferential treatment would apply to all advisers, including ERAs1. These prohibited adviser activities would include:

- Charging a portfolio company for monitoring, servicing, consulting or other fees for unperformed services

- Charging a private fund for expenses relating to the adviser’s or its related person’s examination, investigation or regulatory or compliance obligations

- Allocating expenses related to a portfolio company among clients on a non-pro rata basis

- Directly or indirectly borrowing from a private fund client

Perhaps most notably, the proposals would also prohibit reduction of clawbacks for actual or hypothetical taxes, as well as indemnification of an adviser by a fund client for conduct constituting simple negligence. These changes could, among other things, expose VC managers to greater litigation risks and impact investment strategy.

The proposals would also prohibit all private fund advisers from providing an investor with preferential terms regarding liquidity or portfolio information, if the adviser reasonably expects that it will have a material, negative effect on other investors in that private fund or in a substantially similar pool of assets. In addition, any other preferential term granted to an investor would be prohibited unless the adviser provides pre-investment disclosure to other investors regarding the preferential treatment and annual disclosure of preferential terms thereafter.

While some of these prohibitions may seem reasonable on the surface, each has nuances and wrinkles that could in practice cause problems for advisers. For example, it may be appropriate for an anchor investor seeding a startup VC adviser business to bear, directly or indirectly, a portion of the adviser’s compliance expenses or for the adviser to grant special redemption rights to such anchor investor.

These are still proposals – and any final rules could vary substantially in terms of substance and scope. Even so, ERAs should start thinking about the steps they would need to take to comply with the new rules applicable to ERAs if adopted as proposed, and the potential impact the changes could have on their business. In particular, ERAs should consider what additional legal and compliance resources they will need and the changes to internal policies and procedures that would be required to comply. It should also be noted that the proposals as drafted contemplate a one-year transition period following adoption, but do not include a grandfathering provision for existing funds.

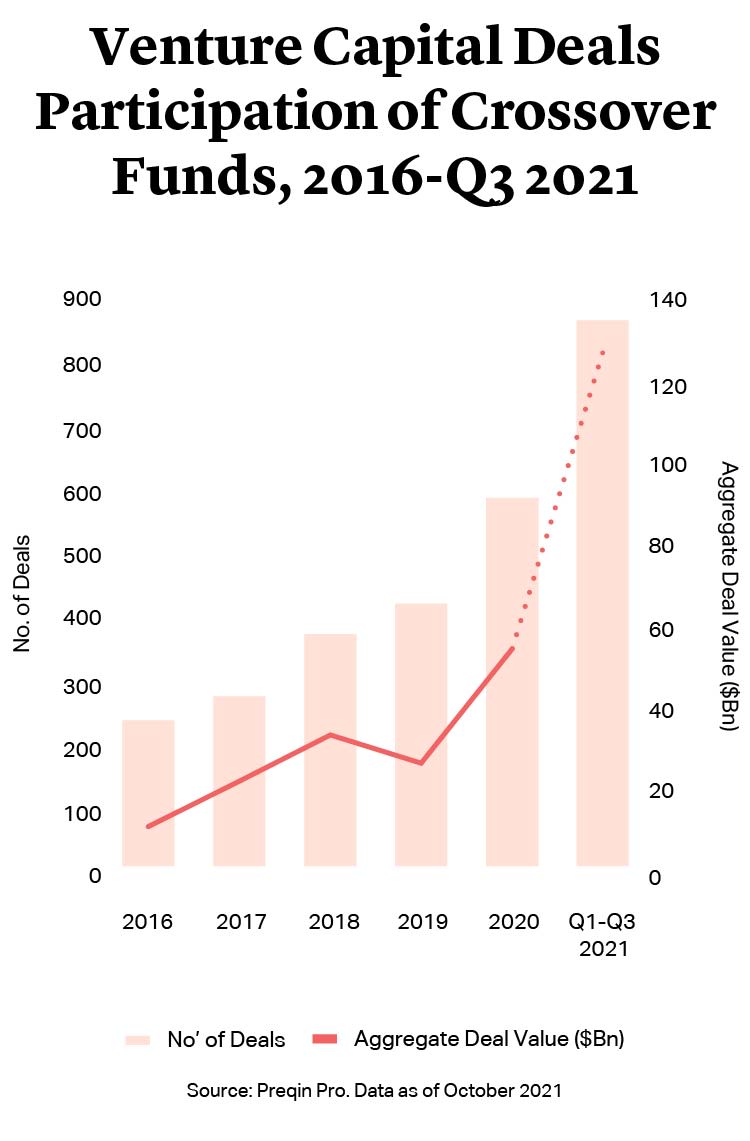

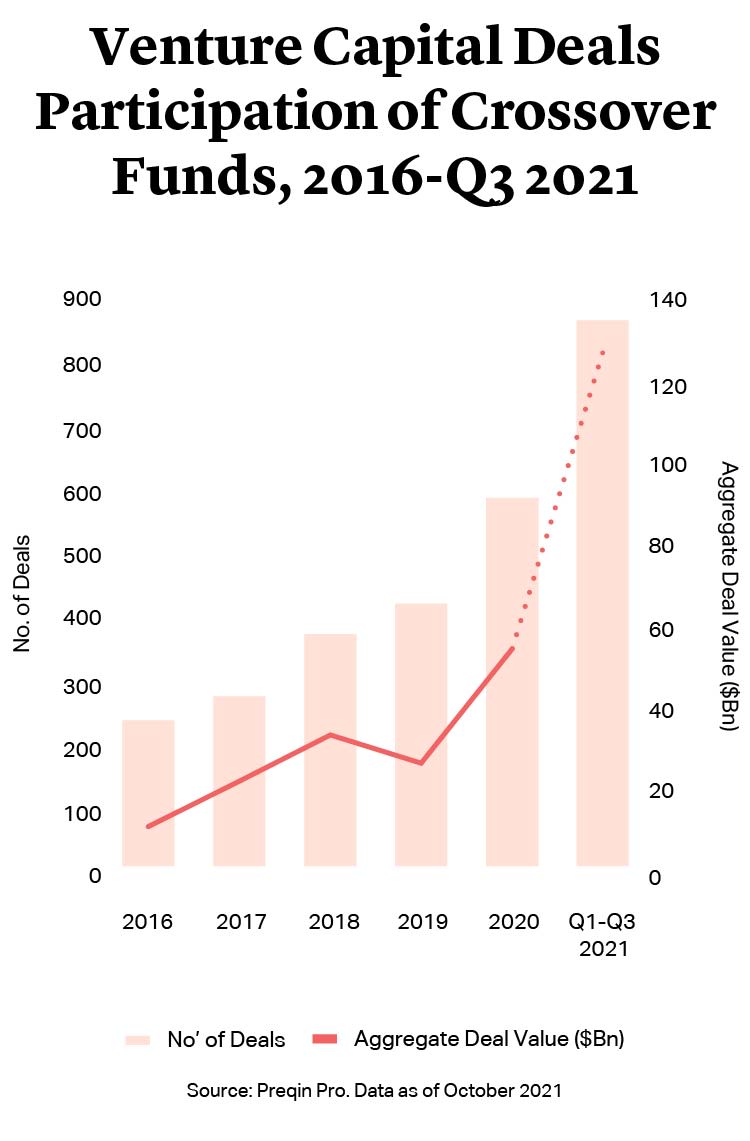

The Rise of the Crossover Investor

One reason VC firms may choose to make the leap into RIA status is the increase in competition resulting from last year’s surge in crossover investing. Venture capital experienced stellar performance last year, even by 2021 standards. For example, top-quartile net IRRs for vintage 2018 VC funds reached 47.0%, median net IRRs rose above 30% for the first time and even bottom-quartile net IRRs reached 15.4% – outperforming private equity in all three categories for the same vintage year2.

The performance of venture capital investments was likely a key factor in the surge of “crossover” VC investors. Private equity funds, hedge funds and hybrid funds, with their own coffers full of dry powder, have been drawn to earlier stage investments. The aggregate value of crossover funds’ venture investments more than doubled – from $53bn in 2020 to $126bn in the first three quarters of 20213.

As crossover investors moved into VC, increasing numbers of VC firms also moved outside their own sandbox, exploring alternative structures and business strategies to invest in different kinds of assets and to hold assets for longer periods of time. For example, Sequoia’s innovative restructuring means it can now continue to hold investments in portfolio companies after they have gone public.

The increased flexibility afforded by RIA status may also benefit a VC firm in the event of a prolonged economic downturn. Preliminary data for Q1 2022 suggests a correction in portfolio company valuations, with markdowns disproportionately affecting VC funds compared to other private fund asset classes4. RIA status may enable a VC firm to offer additional products that are responsive to changes in the market environment and investor sentiment.

Moving Outside the Sandbox

Increasing numbers of VC firms are moving outside their own sandbox, exploring alternative structures and business strategies to invest in different kinds of assets and to hold assets for longer periods of time.

The Future of Unicorns

Chair Gensler, as well as Commissioners Lee and Crenshaw, have often voiced their concerns regarding the growth of private markets. In addition to private funds, the trend of companies staying private for longer, and the related rise in “unicorns”– start-ups with valuations of $1bn or more – has drawn significant attention from the SEC.

340 Unicorns

In the U.S., venture capital minted a record 340 unicorns in 2021 – more than the prior five years combined4.

In the U.S., venture capital, bolstered by the rush of crossover and other non-traditional VC investors, minted a record 340 unicorns in 2021 – more than the prior five years combined5. Although many of those involved later-stage mega-deals, the first nine months of 2021 saw 23 early-stage transactions with unicorn valuations in the U.S., compared to 13 in 2020 and 12 in 20196. There are now over 1,000 unicorns worldwide, as well as an ever-expanding group of “decacorns” with valuations worth $10bn or more7.

As part of its initiative to increase the transparency of private markets and private companies, the SEC has indicated its interest in “seeing under the hood” of unicorns. To accomplish this, the SEC is considering revising the counting rules that determine which companies must file periodic public reports7. Exchange Act Section 12(g) requires registration of a class of securities “held of record” by either (i) 2,000 persons or (ii) 500 persons who are not accredited investors, although the definition of a “holder of record” generally allows companies to treat investors with multiple beneficial owners as one person. Companies that exceed this threshold are subject to burdensome periodic public reporting requirements. Commissioner Lee in particular has questioned whether there should be a look-through of record ownership for counting purposes, in order to get unicorns within the periodic public reporting framework8. While a single private fund may not have enough investors to trigger the threshold, changes to Section 12(g) could have a significant impact on unicorns held by multiple funds. To avoid triggering these requirements, private funds investing in such companies could look to limit the number of their investors, and certain funds, particularly those investing in later stages, may find themselves with fewer investment opportunities.

While venture capital markets hold great opportunity, VC firms also face new risks and challenges with a changing regulatory landscape, heightened competition and valuation corrections. As growing numbers of VC firms respond with innovative business models, now is a good time to take stock of future rule changes and anticipated market trends, and plan ahead.

In the U.S., venture capital, bolstered by the rush of crossover and other non-traditional VC investors, minted a record 340 unicorns in 2021 – more than the prior five years combined5. Although many of those involved later-stage mega-deals, the first nine months of 2021 saw 23 early-stage transactions with unicorn valuations in the U.S., compared to 13 in 2020 and 12 in 20196. There are now over 1,000 unicorns worldwide, as well as an ever-expanding group of “decacorns” with valuations worth $10bn or more7.

As part of its initiative to increase the transparency of private markets and private companies, the SEC has indicated its interest in “seeing under the hood” of unicorns. To accomplish this, the SEC is considering revising the counting rules that determine which companies must file periodic public reports7. Exchange Act Section 12(g) requires registration of a class of securities “held of record” by either (i) 2,000 persons or (ii) 500 persons who are not accredited investors, although the definition of a “holder of record” generally allows companies to treat investors with multiple beneficial owners as one person. Companies that exceed this threshold are subject to burdensome periodic public reporting requirements. Commissioner Lee in particular has questioned whether there should be a look-through of record ownership for counting purposes, in order to get unicorns within the periodic public reporting framework8. While a single private fund may not have enough investors to trigger the threshold, changes to Section 12(g) could have a significant impact on unicorns held by multiple funds. To avoid triggering these requirements, private funds investing in such companies could look to limit the number of their investors, and certain funds, particularly those investing in later stages, may find themselves with fewer investment opportunities.

While venture capital markets hold great opportunity, VC firms also face new risks and challenges with a changing regulatory landscape, heightened competition and valuation corrections. As growing numbers of VC firms respond with innovative business models, now is a good time to take stock of future rule changes and anticipated market trends, and plan ahead.