GP-led Secondaries

Come to Asia

The GP-led secondaries market has experienced significant growth in both the U.S. and Europe in recent years. A technology that was once reserved for legacy assets, and which often carried connotations of an exit of last resort, is now enabling sponsors to retain future upside in strong assets and provide liquidity for its investors.

Indeed, global GP-led secondaries volumes have quadrupled in the past five years, according to Jefferies, increasing from $14bn in 2017 to $52bn in both 2022 and 2023, with a peak of $68bn in 20211.

The popularity of GP-leds continues to grow amongst the sponsor community, particularly against the backdrop of a protracted exit environment. Private equity firms are exploring creative ways to accelerate DPI to support new rounds of fundraising. This has led to an uptick in NAV financing, as well as continuation vehicles, which accounted for 8% of all distributions in 2023, according to Baird2.

The Asia Story So Far

In contrast to the more mature U.S. and European markets, GP-led deals have remained relatively few and far between in Asia. But there are signs that Asia may follow a similar trajectory of significant growth. GP-led activity has been heating up in the region over the past few years with a number of landmark deals, including MBK Partners’ completion of a GP-led deal involving BHC, one of Korea’s leading franchise restaurant operators, with secondaries buyers led by Partners Group.

Other recent examples of GP-led secondaries include India’s Samara Capital, which completed a $150mn continuation vehicle involving three companies, led by TR Capital, and a $360mn continuation vehicle put together by L Catterton around a number of Asian consumer products companies, with secondaries buyers led by Hamilton Lane.

The Asia Story So Far

In contrast to the more mature U.S. and European markets, GP-led deals have remained relatively few and far between in Asia. But there are signs that Asia may follow a similar trajectory of significant growth. GP-led activity has been heating up in the region over the past few years with a number of landmark deals, including MBK Partners’ completion of a GP-led deal involving BHC, one of Korea’s leading franchise restaurant operators, with secondaries buyers led by Partners Group.

Other recent examples of GP-led secondaries include India’s Samara Capital, which completed a $150mn continuation vehicle involving three companies, led by TR Capital, and a $360mn continuation vehicle put together by L Catterton around a number of Asian consumer products companies, with secondaries buyers led by Hamilton Lane.

Where Next?

The underlying commercial rationale and dynamics that have been fueling the growth of GP-led secondary activities in the U.S. and Europe also exist in Asia. As the volume and frequency of GP-led activities continue to grow globally, and global institutional investors become more familiar and comfortable with such transactions, Asia will also likely become an increasingly larger part of such growth. The Asia private equity market has a long history of tracking the growth and trends in the U.S and Europe.

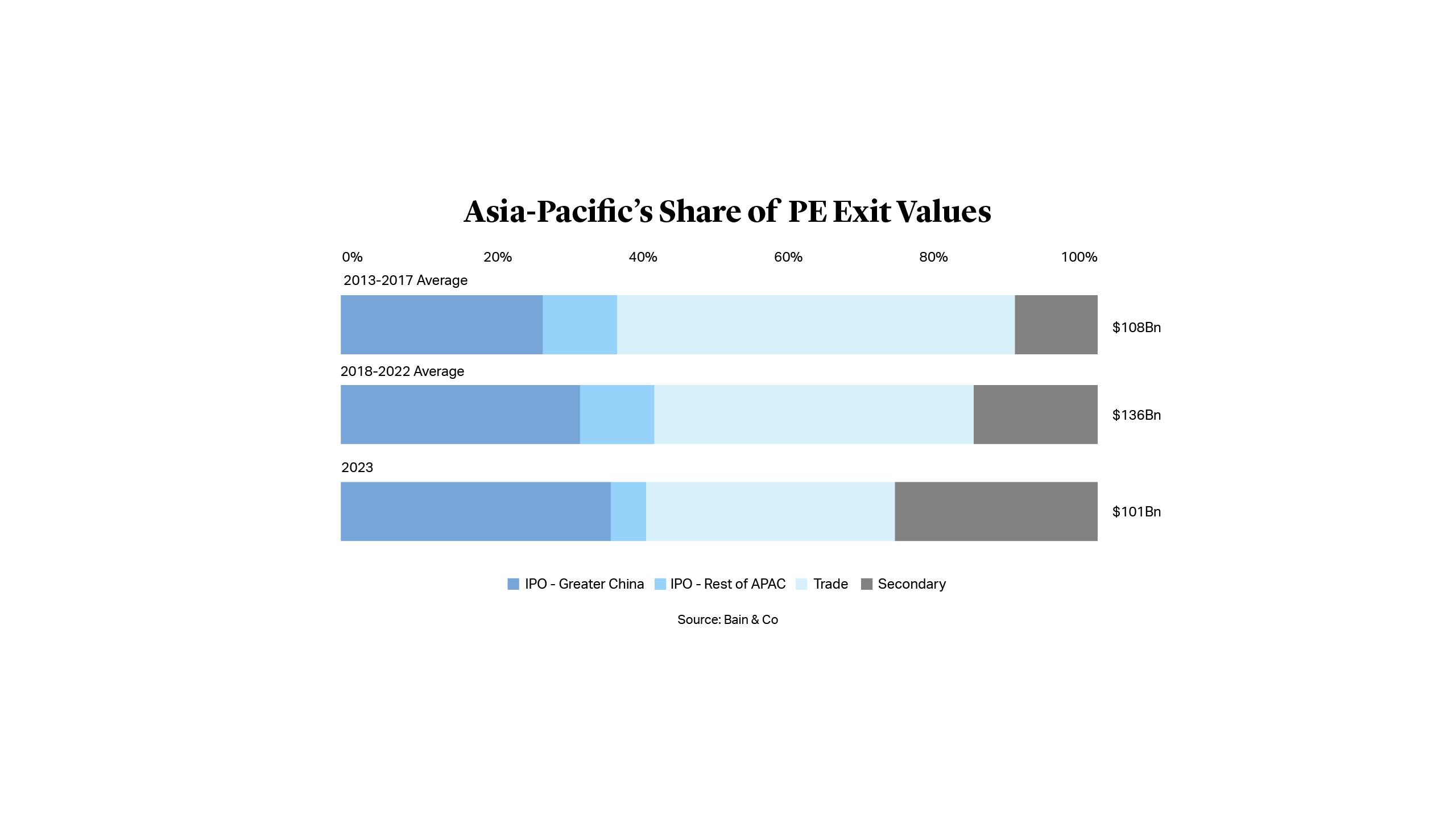

The macroeconomic dynamics in Asia are further fueling the push towards utilization of GP-leds by sponsors in the region. Asia is facing similar exit pressures as the U.S. – in fact, the situation is, if anything, more acute. Exits dropped 26% against the previous five-year average in 2023 and declined 51% from the record-breaking level achieved in 2021, according to Bain & Company. Only 22% of GPs recently surveyed said they had made successful exits as planned in 2023 and 30% had made no exits at all3.

Meanwhile, private equity funds focused on the Asia Pacific region raised just $100bn in 20234, the lowest level in a decade, highlighting the need for sponsors to generate distributions in order to secure re-ups.

The evolution of Asia’s GP-led secondaries market is being further bolstered by the growing on-the-ground presence of the world’s biggest secondaries houses. Coller Capital, for example, now has offices in Hong Kong, Beijing and Seoul. This expansion has been matched by many of Coller’s peers including Ares and Apollo, while the secondaries advisory industry is also maturing. Over the past couple of years, PJT Park Hill, for example, has built a team specifically to target Asia’s burgeoning GP-led market, while Jefferies, Evercore and Morgan Stanley have also been active in the space.

Where Next?

The underlying commercial rationale and dynamics that have been fueling the growth of GP-led secondary activities in the U.S. and Europe also exist in Asia. As the volume and frequency of GP-led activities continue to grow globally, and global institutional investors become more familiar and comfortable with such transactions, Asia will also likely become an increasingly larger part of such growth. The Asia private equity market has a long history of tracking the growth and trends in the U.S and Europe.

The macroeconomic dynamics in Asia are further fueling the push towards utilization of GP-leds by sponsors in the region. Asia is facing similar exit pressures as the U.S. – in fact, the situation is, if anything, more acute. Exits dropped 26% against the previous five-year average in 2023 and declined 51% from the record-breaking level achieved in 2021, according to Bain & Company. Only 22% of GPs recently surveyed said they had made successful exits as planned in 2023 and 30% had made no exits at all3.

Meanwhile, private equity funds focused on the Asia Pacific region raised just $100bn in 20234, the lowest level in a decade, highlighting the need for sponsors to generate distributions in order to secure re-ups.

The evolution of Asia’s GP-led secondaries market is being further bolstered by the growing on-the-ground presence of the world’s biggest secondaries houses. Coller Capital, for example, now has offices in Hong Kong, Beijing and Seoul. This expansion has been matched by many of Coller’s peers including Ares and Apollo, while the secondaries advisory industry is also maturing. Over the past couple of years, PJT Park Hill, for example, has built a team specifically to target Asia’s burgeoning GP-led market, while Jefferies, Evercore and Morgan Stanley have also been active in the space.

Leapfrogging

Asia has the added advantage of being able to benefit from lessons learned in Europe and the U.S. As such, the evolution of Asia’s GP-led market is likely to be accelerated. For example, while GP-led secondaries initially began in the U.S. and Europe as a tool for cleaning up legacy portfolios in more mature markets, early deals in Asia are already focusing on growth opportunities, including for “trophy” assets.

Also, sponsors in Asia are able to adopt the latest technology in the GP-led documents and best practices in the GP-led deal processes, which have developed over many years in the U.S. and Europe.

Leapfrogging

Asia has the added advantage of being able to benefit from lessons learned in Europe and the U.S. As such, the evolution of Asia’s GP-led market is likely to be accelerated. For example, while GP-led secondaries initially began in the U.S. and Europe as a tool for cleaning up legacy portfolios in more mature markets, early deals in Asia are already focusing on growth opportunities, including for “trophy” assets.

Also, sponsors in Asia are able to adopt the latest technology in the GP-led documents and best practices in the GP-led deal processes, which have developed over many years in the U.S. and Europe.

The Asia Opportunity

In addition to market expansion based on international trends, there may also be some specific opportunities for continuation vehicles in the Asia market. In particular, the ability to isolate one or a handful of assets and move them into a new shorter-life fund could prove a good match for local investors looking to invest in local currency in identified assets, especially in jurisdictions with tight currency control restrictions.

In short, all the ingredients are in place for a rapid escalation in GP-led secondaries activity in Asia and we expect to see a marked increase in deal volumes in the coming years.