Adding Flexibility for

GP-Led Secondary Transactions

As GP-led secondaries transactions (“GP-leds”) have become more common and accepted by investors, sponsors and investors have increasingly questioned how the process for such transactions could be streamlined while still providing relevant protections to address investor concerns regarding conflicts. The result is an emerging trend of incorporating provisions in fund documents that contemplate and pave the way for future GP-led transactions.

GP-Leds on the Rise

Over recent years, GP-led transactions have gained significant momentum. Just a few years ago, traditional LP-led transactions represented the overwhelming majority of deal volume, but GP-leds now account for more than half, reaching approximately $63bn in deal volume in 20211.

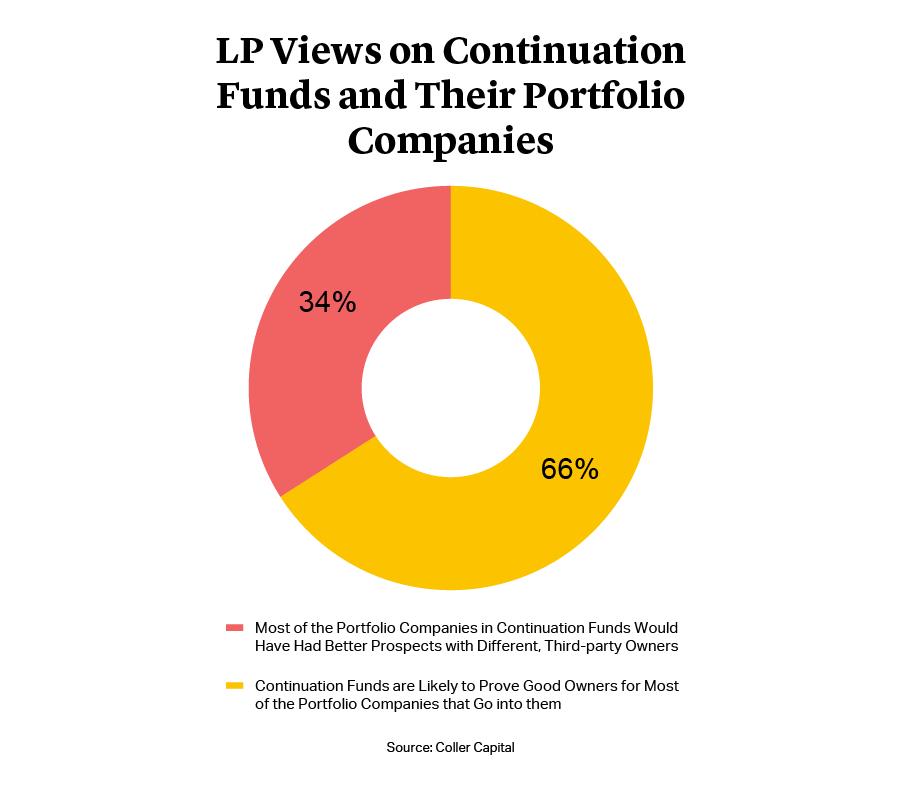

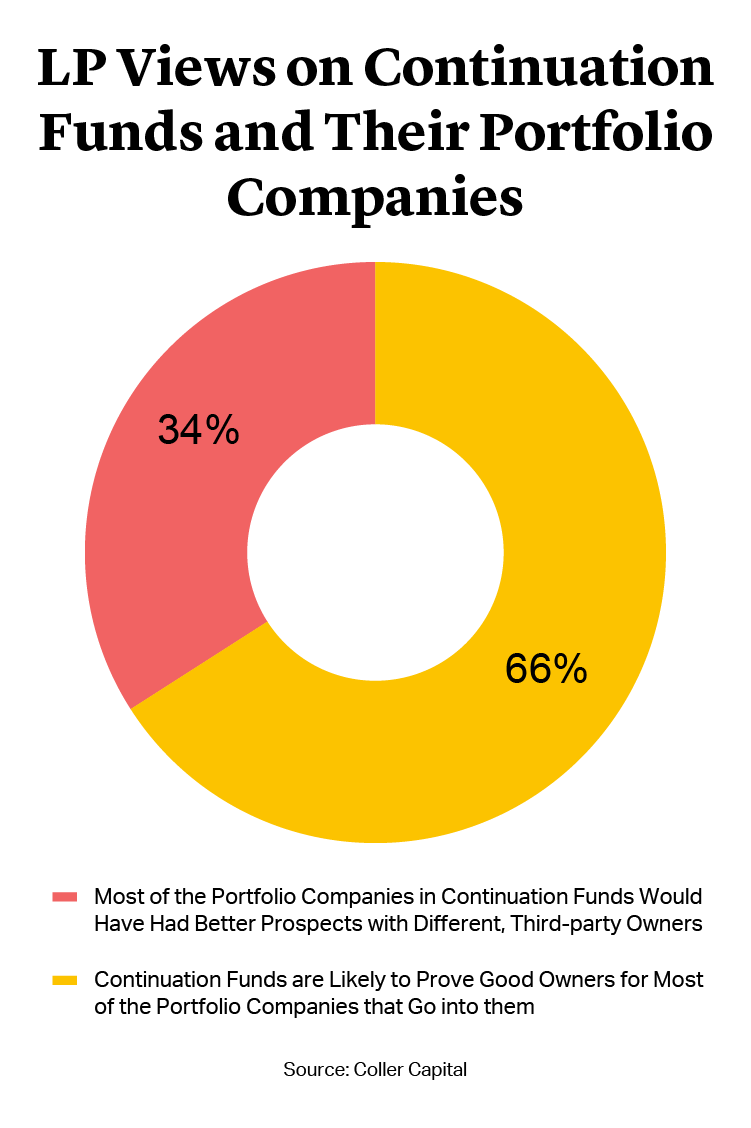

The surge reflects a significant shift in the assets and sponsors involved in GP-led transactions, and the resulting shift in investor perception. In the past, such processes may have been used with respect to assets in distress. However, they now frequently involve a sponsor’s marquee investments, where it sees significant potential upside in holding the assets for longer than the traditional private equity fund lifecycle or investor liquidity expectations will allow. In addition, many of the largest and most reputable sponsors have completed such transactions, lending their credibility and eliminating prior stigma associated with such transactions2. Investors are also increasingly comfortable with these transactions, increasing the field of potential participants3.

GP-Leds on the Rise

Over recent years, GP-led transactions have gained significant momentum. Just a few years ago, traditional LP-led transactions represented the overwhelming majority of deal volume, but GP-leds now account for more than half, reaching approximately $63bn in deal volume in 20211.

The surge reflects a significant shift in the assets and sponsors involved in GP-led transactions, and the resulting shift in investor perception. In the past, such processes may have been used with respect to assets in distress. However, they now frequently involve a sponsor’s marquee investments, where it sees significant potential upside in holding the assets for longer than the traditional private equity fund lifecycle or investor liquidity expectations will allow. In addition, many of the largest and most reputable sponsors have completed such transactions, lending their credibility and eliminating prior stigma associated with such transactions2. Investors are also increasingly comfortable with these transactions, increasing the field of potential participants3.

Highly Bespoke

Sponsors who wish to include express provisions governing GP-led transactions should consider that such transactions are highly bespoke and subject to a rapidly evolving market.

Growth of GP-Led Transaction Provisions

Continuation funds and other GP-led processes are now a viable way to provide investor liquidity while allowing general partners to continue to grow winning assets. As a result, some sponsors and their counsel are considering how and to what extent they should hardwire specific processes into the governing documents of new funds being raised. That might be easier said than done, however.

Sponsors who wish to include express provisions governing GP-led transactions should consider that such transactions are highly bespoke and subject to a rapidly evolving market. Even sponsors experienced in such transactions should keep in mind that the next deal may look very different than the last in terms of structure, process and/or economics. Given that there is no ‘one size fits all’ approach, any such provisions should provide guardrails to the process, with the understanding that there are limits on what can and should be hardwired.

With respect to consents in particular, sponsors should note that despite receiving investor pre-approval for certain types of conflicted transactions, a general partner may ultimately determine that it should seek some form of investor approval for a particular transaction, based on the facts and circumstances of the particular deal.

Points to Consider When Drafting a GP-Led Transaction Provision

A provision regarding GP-led transactions could address the following:

1. Approval Process and How Conflicts of Interest Will be Addressed

Transactions of this kind carry innate conflicts of interest, as typically buyers and sellers will both be participating in the transaction via entities managed by the sponsor. While limited partnership agreements generally address the approval process for transactions where the general partner is conflicted, a provision regarding GP-leds could specify a particular approval process. This could be the approval by the fund’s limited partner advisory committee (LPAC), or even provide that certain kinds of transactions are permissible without transaction-specific approval.

For example, a GP-led provision might provide that transactions which comply with certain price discovery requirements (as discussed below) require notice only and not any specific investor or LPAC consent. Such carveouts from consent are consistent with the larger trend of sponsors limiting the types of conflicted transactions that require prior approval.

Although some sponsors may wish to hardwire a fund’s governing documents to permit GP-led transactions without specific approvals – and investors may be willing to provide the general partner with that authority if it is dependent on particular price discovery requirements – as noted above a sponsor may determine that, despite the general partner’s contractual authority, it is advisable from an investor relations perspective to seek some form of investor or LPAC approval.

2. Price Discovery

The pricing for a GP-led transaction often poses particular conflicts of interest, and the process for determining that a price is fair for investors on either side of the deal is of paramount importance. As a result, a provision on GP-led transactions may specify how a fair price can be determined. Options could include negotiating directly with buy-side and/or sell-side minority investors, third-party bids or auctions and valuations from independent valuation agents. Sponsors can also authorize the LPAC to pre-approve other methods of establishing a price sufficient to remove the need for any additional transaction-specific approvals.

A GP-led provision may also require a formal fairness opinion in conjunction with one or more of these pricing mechanisms. Sponsors should take note of the SEC’s recent rule proposals regarding private fund advisers. These include a rule that would require an SEC registered investment adviser to procure a fairness opinion from an independent opinion provider with respect to each of its GP-led secondaries transactions. The proposals would also require the adviser to disclose to investors the material business relationships between the adviser and the opinion provider over the past two years4.

Points to Consider When Drafting a GP-Led Transaction Provision

A provision regarding GP-led transactions could address the following:

1. Approval Process and How Conflicts of Interest Will be Addressed

Transactions of this kind carry innate conflicts of interest, as typically buyers and sellers will both be participating in the transaction via entities managed by the sponsor. While limited partnership agreements generally address the approval process for transactions where the general partner is conflicted, a provision regarding GP-leds could specify a particular approval process. This could be the approval by the fund’s limited partner advisory committee (LPAC), or even provide that certain kinds of transactions are permissible without transaction-specific approval.

For example, a GP-led provision might provide that transactions which comply with certain price discovery requirements (as discussed below) require notice only and not any specific investor or LPAC consent. Such carveouts from consent are consistent with the larger trend of sponsors limiting the types of conflicted transactions that require prior approval.

Although some sponsors may wish to hardwire a fund’s governing documents to permit GP-led transactions without specific approvals – and investors may be willing to provide the general partner with that authority if it is dependent on particular price discovery requirements – as noted above a sponsor may determine that, despite the general partner’s contractual authority, it is advisable from an investor relations perspective to seek some form of investor or LPAC approval.

2. Price Discovery

The pricing for a GP-led transaction often poses particular conflicts of interest, and the process for determining that a price is fair for investors on either side of the deal is of paramount importance. As a result, a provision on GP-led transactions may specify how a fair price can be determined. Options could include negotiating directly with buy-side and/or sell-side minority investors, third-party bids or auctions and valuations from independent valuation agents. Sponsors can also authorize the LPAC to pre-approve other methods of establishing a price sufficient to remove the need for any additional transaction-specific approvals.

A GP-led provision may also require a formal fairness opinion in conjunction with one or more of these pricing mechanisms. Sponsors should take note of the SEC’s recent rule proposals regarding private fund advisers. These include a rule that would require an SEC registered investment adviser to procure a fairness opinion from an independent opinion provider with respect to each of its GP-led secondaries transactions. The proposals would also require the adviser to disclose to investors the material business relationships between the adviser and the opinion provider over the past two years4.

Other Provisions That May Facilitate GP-Leds

Whether or not a sponsor includes an express provision on GP-leds, it may wish to consider evaluating other provisions in a fund’s governing documents and how they could be modified to facilitate future GP-led transactions. For example, sponsors may want to ensure that expense provisions would permit the special allocation of expenses relating to GP-leds to particular investors, such as investors electing liquidity. In addition, sponsors may want to provide mechanics for allocations of broken deal expenses relating to GP-led transactions that are not completed. To facilitate the structuring of GP-led transactions, sponsors may also wish to review provisions permitting distributions in kind to make sure they afford the flexibility necessary for tax-free rollovers.

Additional Considerations

Sponsors contemplating GP-led provisions in fund organizational documents may also wish to consider the following:

As GP-led secondary transactions become increasingly commonplace, sponsors may wish to modify or supplement their fund agreements to facilitate these transactions. While GP-led provisions can offer greater confidence and certainty, sponsors should proceed with caution. Given that no two GP-led transactions are the same, as well as the rapidly changing secondaries market and regulatory landscape, any such provision should be guiding, but not limiting, focusing primarily on the resolution of conflicts. Sponsors and their counsel may also wish to explore other ways to enhance the general partner’s ability to engage in these transactions, as well as alternative ways they may be able to continue growing their prize investments.

For information on Cleary’s Private Funds Liquidity and Alternative Transactions capabilities and team, please click here.

Maurice R. Gindi

Partner

New York

T: +1 212 225 2826

mgindi@cgsh.com

V-Card

Kenneth S. Blazejewski

Partner