Regulatory Review

in the Spotlight

In May, the EU’s second highest court annulled a European Commission prohibition of the previously-proposed takeover of the UK’s O2 network by rival telecoms group Three (owned by Hong Kong’s CK Hutchison). The judgment is controversial but could set a higher bar for the Commission to block M&A deals, potentially paving the way for further consolidation in certain sectors.

The Commission has only blocked 10 transactions on competition law grounds over the past decade, while approving over 3,000 deals – the large majority without conditions. The Commission has, though, been more aggressive in recent years, blocking three deals in 2019 alone. These included a Franco-German tie-up between Alstom’s rail transport business and Siemens Mobility, and a deal between Germany’s Thyssenkrupp and Tata Steel (Europe) which would have created Europe’s second-largest steel producer.

Both those decisions took place against a backdrop of opportunities for private equity dealmaking. Caisse de dépôt et placement du Québec became the largest shareholder in Alstom through an investment in connection with the French group’s subsequent acquisition of Bombardier Transportation, while a private equity-led consortium agreed to buy Thyssenkrupp’s elevators division in a carve-out following the Commission’s rejection of its attempted steel venture merger.

More broadly, M&A scrutiny around the globe is increasingly moving beyond competition issues, as governments look to review deals based on a broader range of considerations. Foreign direct investment (“FDI”) review was already in the spotlight prior to the COVID-19 outbreak as a result of this trend. But the pandemic has elevated those concerns and supplemented them with fears that overseas investors might take advantage of company distress to acquire businesses, technology, and critical healthcare resources. The result may be more opportunities for private equity, but also a more complex environment for sponsors to navigate.

Expansion of FDI Review

In March, as many European countries were introducing or tightening lockdowns, the European Commission released a policy paper urging Member States to establish and use screening mechanisms to investigate FDI, particularly into healthcare capacity (such as personal protective equipment), research (including vaccines), and other critical sectors.

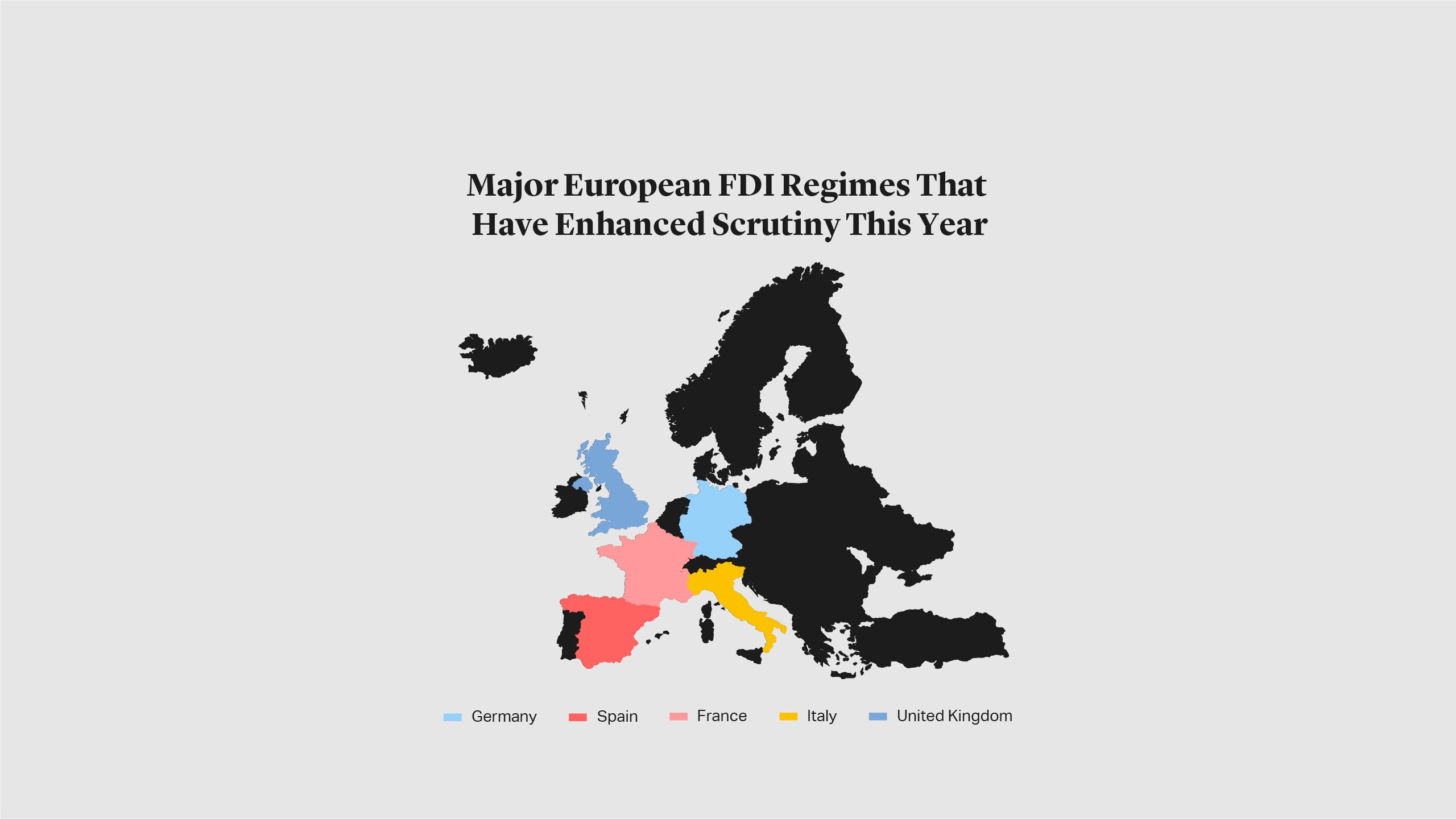

Since the COVID-19 outbreak, several EU countries have enhanced FDI scrutiny or made statements about increased oversight. For example, Spain amended its FDI regime in March, making it necessary to obtain approval for certain types of FDI involving businesses in “strategic sectors” (which correspond largely to those envisaged in the FDI Regulation passed by the European Commission that will come into force later this year). In April, Italy expanded its pre-existing power to review transactions involving FDI to cover additional market sectors, including those related to food security and high technology business. France and Germany have also revised their FDI regimes in the past few months.

While the pandemic and its social pressures are easing in Europe, FDI scrutiny is likely to remain a permanent feature. Later this year, following the creation of the first EU regulation on foreign direct investment screening, the European Commission will be able to involve itself in FDI reviews carried out by Member States. While national governments are not obliged to follow the Commission’s views, this may result in increasing convergence on how FDI reviews are conducted in Europe.

There are also signals that the UK could follow a stricter line. Regulators last year looked into the private equity takeovers of defence contractor Cobham and satellite communications operator Inmarsat. While both takeovers were eventually cleared, the reconsideration of Huawei’s role in the UK’s 5G network rollout, and the proposal that the Chinese telecoms group be removed from the network by 2023, both reflect increased domestic scrutiny of deals by international groups. Indeed, the UK government just announced the expansion of its public interest rules to cover public health emergencies, and expanded merger control jurisdiction for targets active in artificial intelligence, cryptographic authentication technology, and advanced materials.

Risks and Opportunities for Private Equity

Increased regulatory scrutiny of M&A will have implications for private equity firms. More businesses and sectors may be deemed critical, and even relatively small minority investments may be subject to FDI screening. As a result, deals may take longer to complete, and acquisition costs may increase.

However, new opportunities will arise for private equity, as international corporates or state-backed enterprises decide not to pursue investments likely to trigger investigation. Sponsors that are established and have a track record in European jurisdictions could have an advantage. For countries and companies still keen to attract inward investment, investors that can provide assurances about protecting critical technology and maintaining resources in a target company’s home country may be viewed as a particularly attractive option.

In the face of increasing scrutiny, private equity investors in sensitive businesses should be able to present the positives for the target and allay any fears. They should also give thought to potential exit routes as greater scrutiny of foreign direct investment is likely to be part of the market for the foreseeable future.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner