Private Equity

Secondaries

Market Matures

and Expands

The secondaries market has evolved from a niche within the private equity industry to a fully-fledged asset class in a little over a decade. Today it encompasses not only traditional private equity investments, but also venture capital, real estate, infrastructure and, increasingly, private credit. The sector’s growth reflects demand among institutional investors for liquidity in an intrinsically illiquid space, as well as increasingly the need for general partners to find solutions for long-hold assets in mature funds.

By end-2019, the private equity secondaries sector was some five times larger than in 2008, with $280 billion of assets under management globally, according to Preqin data1. While Europe is less mature than the U.S. for deal activity, it is home to some of the most established secondaries funds – including Ardian, Coller Capital, Pantheon and Alpinvest (part of The Carlyle Group). As the European private equity universe grows, the potential for European secondaries is also expanding.

Growing Market for Secondaries Transactions

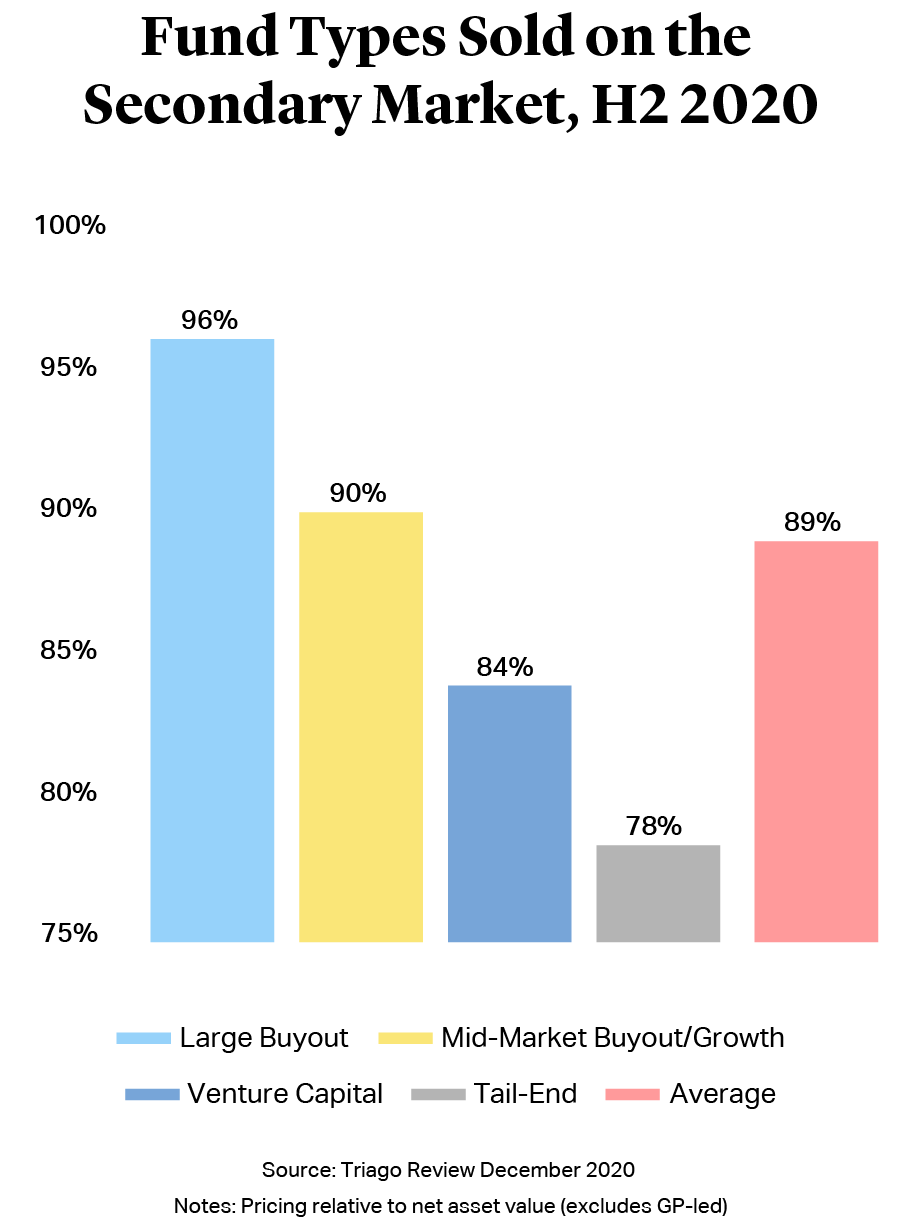

Secondaries investment sustained a hit in 2020 as the COVID-19 crisis made it difficult to assess the outlook for assets. The lack of visibility compounded challenges for buyers struggling to analyse often large portfolios of funds and company holdings. The consequence was a contraction in global deal volume to $71 billion last year from a record of $83 billion in 2019, advisory firm Triago estimates. However, that activity was heavily skewed, with $50 billion of deals agreed in the second half as markets started to rebound2.

While investment initially slowed in the first half of 2020, fundraising grew strongly as investors committed capital in the expectation of opportunities in the recovery. Four funds raised more than $10 billion in 2020, led by French manager Ardian with $19 billion, followed by New York-based Lexington on $14 billion. They propelled capital raising to almost $100 billion for the year, according to Secondaries Investor, almost triple the total for 2019 – with the strategy accounting for around 15% of total fundraising3.

Growing Market for Secondaries Transactions

Secondaries investment sustained a hit in 2020 as the COVID-19 crisis made it difficult to assess the outlook for assets. The lack of visibility compounded challenges for buyers struggling to analyse often large portfolios of funds and company holdings. The consequence was a contraction in global deal volume to $71 billion last year from a record of $83 billion in 2019, advisory firm Triago estimates. However, that activity was heavily skewed, with $50 billion of deals agreed in the second half as markets started to rebound2.

While investment initially slowed in the first half of 2020, fundraising grew strongly as investors committed capital in the expectation of opportunities in the recovery. Four funds raised more than $10 billion in 2020, led by French manager Ardian with $19 billion, followed by New York-based Lexington on $14 billion. They propelled capital raising to almost $100 billion for the year, according to Secondaries Investor, almost triple the total for 2019 – with the strategy accounting for around 15% of total fundraising3.

New Entrants Drawn to Secondaries

The secondaries boom has attracted most of private equity’s largest players. Apollo Global Management was recently reported to have launched a search for talent to lead its push into secondaries4. Meanwhile, TPG, which formed a North America and Europe secondaries unit last year, is reported to be preparing a debut fund of up to $2 billion5.

While some firms are entering the space through new hires and the organic growth of new business units, others are acquiring established players. In late March, Los Angeles-based Ares Management bought Landmark Partners6, which manages nearly $19 billion of assets globally, in a deal worth $1.1 billion. The arrival of global players is a clear signal they expect the sector to grow and generate a steady stream of management and performance fees.

Expanding Asset Class

The private equity secondaries market has expanded well beyond the buying and selling of positions in buyout funds. As start-ups stay private longer, venture capital secondaries have become more prevalent, as have funds focused on private equity real estate and infrastructure. The growth in credit funds as alternative lenders is also spurring the development of private credit secondaries strategies. Unrealised private credit value hit $576 billion at the end of 2019, according to Pantheon, driving demand for liquidity solutions for investors7.

Rise in GP-led Transactions

Following the global financial crisis, secondaries grew quickly on the back of large investors’ need for liquidity, as well as the requirement among banks and insurers to dispose of assets to meet new regulatory standards. However, more recently, increasingly the impetus is coming from general partners who are looking to manage tail-end fund assets and provide exits to investors.

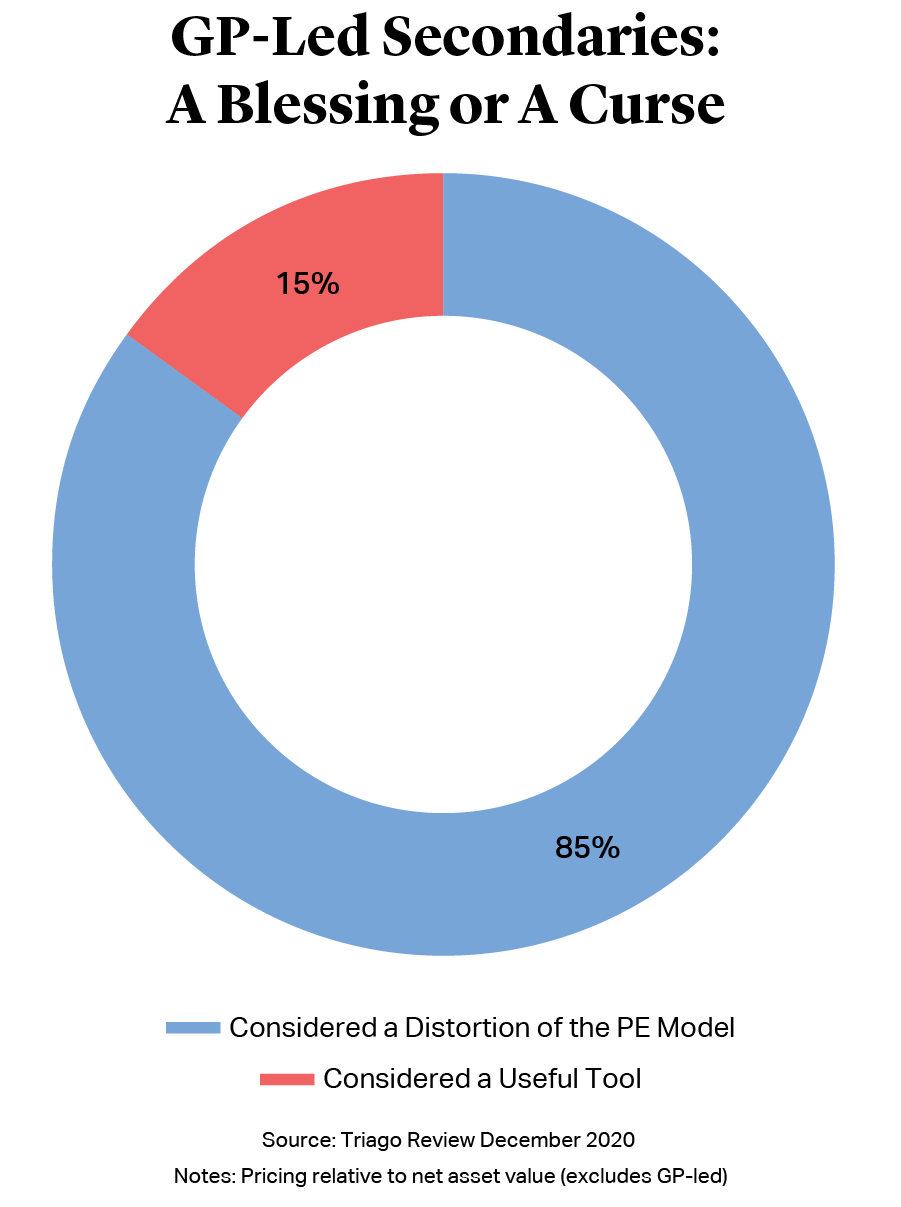

Estimates show that GP-led transactions accounted for roughly half of secondary deals in 20208. Those deals are increasingly large due to the size of maturing funds combined with longer holds for portfolio companies. The completion of Leonard Green’s deal for a $2.5 billion portfolio of 2007 fund assets was roughly on a par with the Coller-led deal for a portfolio of Nordic Capital assets in 2018.

Rise in GP-led Transactions

Following the global financial crisis, secondaries grew quickly on the back of large investors’ need for liquidity, as well as the requirement among banks and insurers to dispose of assets to meet new regulatory standards. However, more recently, increasingly the impetus is coming from general partners who are looking to manage tail-end fund assets and provide exits to investors.

Estimates show that GP-led transactions accounted for roughly half of secondary deals in 20208. Those deals are increasingly large due to the size of maturing funds combined with longer holds for portfolio companies. The completion of Leonard Green’s deal for a $2.5 billion portfolio of 2007 fund assets was roughly on a par with the Coller-led deal for a portfolio of Nordic Capital assets in 2018.

Competitive Auctions and Consortium Deals

Larger pools of assets mean more consortium deals for GP-led secondaries. Secondaries transactions are rarely leveraged – although the funds themselves may have some moderate gearing – so few sponsors alone have the firepower for multi-billion-dollar investments. We are seeing sellers take control of transactions and putting secondaries funds together to negotiate deals. There is also rising demand for syndication, with Ardian’s latest fundraising including $5 billion of potential co-investment capital.

Secondaries processes echo buyouts in other ways. Auctions are prevalent with competitive bidding processes among large fields of secondaries specialists. Buyer and seller focus is on valuation, the level of carried interest and management fees that secondaries investors are prepared to pay the GP managing the assets, as well as waterfall structures.

In competitive processes with little seller recourse, secondaries sponsors are looking outside the sale agreement to protect any potential downside. Warranty and indemnity insurance is becoming available to buyers in the space, another indication that the private equity secondaries market is coming of age.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner