Private Equity Secondaries Entrants Bring New Demands and Dynamics

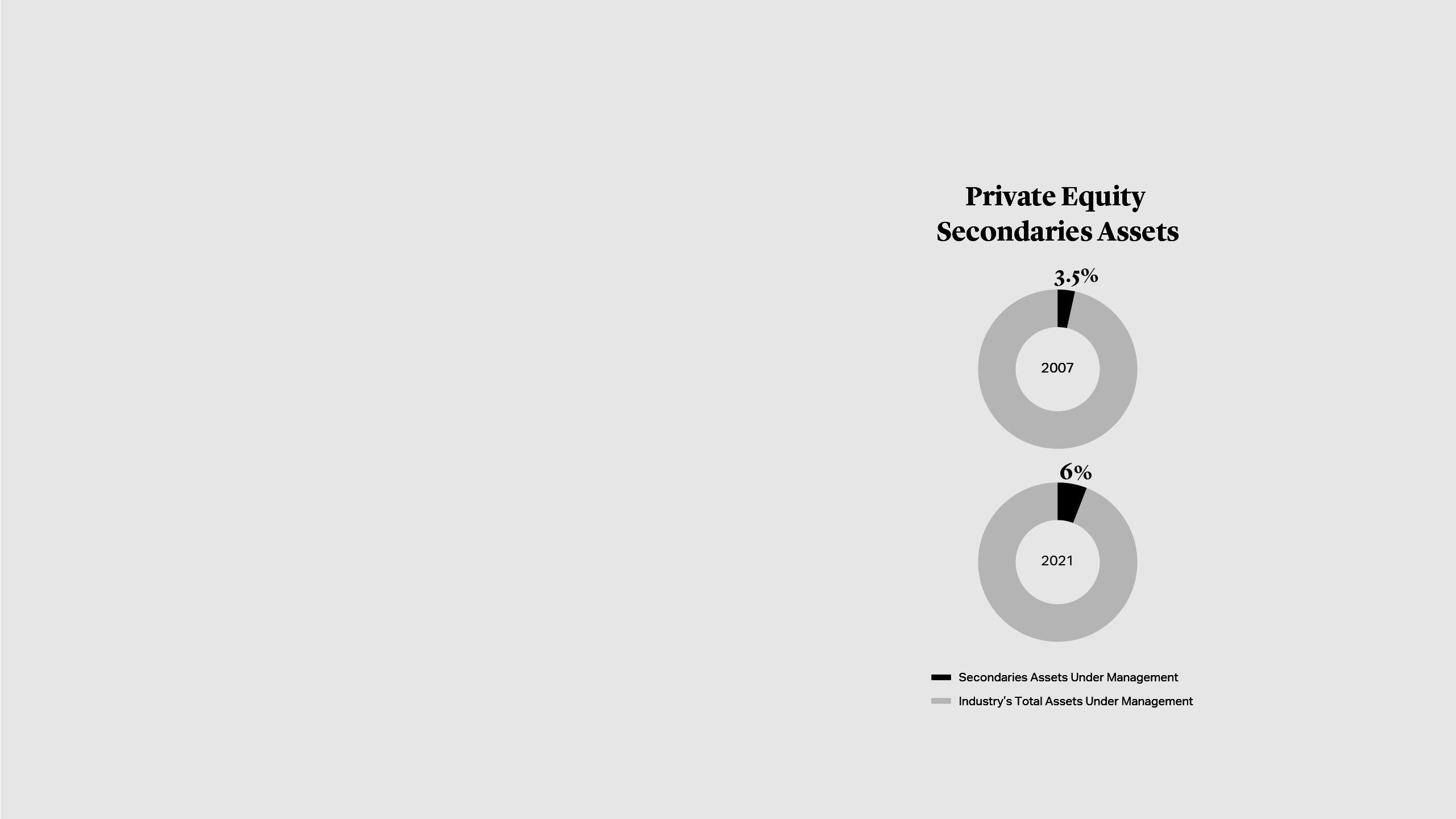

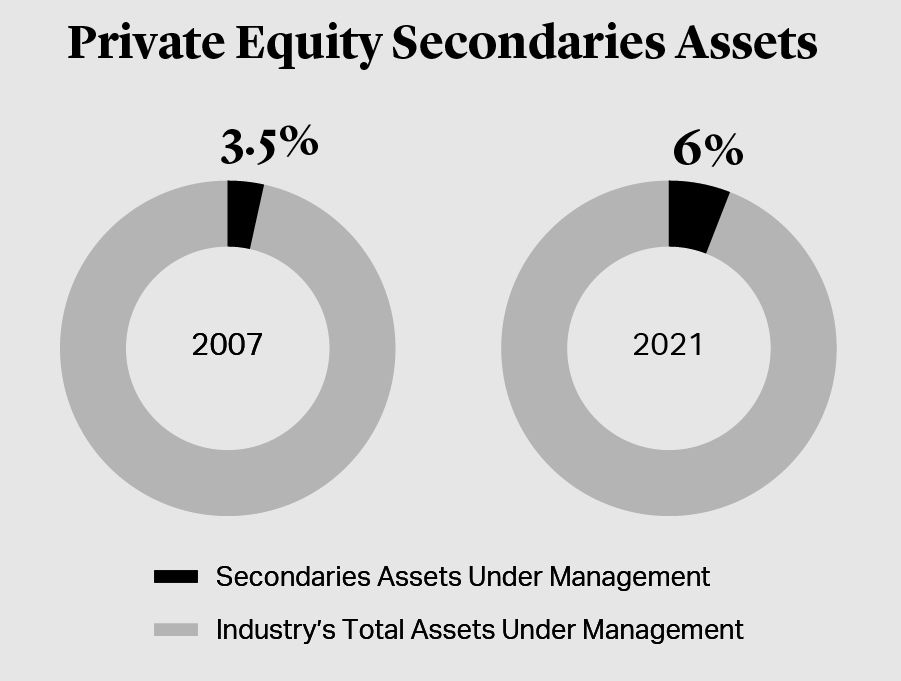

The private equity secondaries space is a growing segment of the ever-expanding private equity asset class. By end-June, secondaries assets under management were approaching $300bn worldwide, accounting for over 6% of the industry’s total assets under management compared with some 3.5% in 2007. Over that same period, total private equity assets increased more than threefold to $4.7tn, according to Preqin data1.

Secondaries emerged to provide investors with much-needed liquidity in times of financial stress. However, in a growing asset class they increasingly serve limited partners’ needs for portfolio management, while generating strengthening returns for secondaries fund investors. Private equity fund managers are also turning to secondaries deals as they look for ways to manage remaining portfolio companies in funds that are reaching the end of their lifecycles. In October, London-based firm Pantheon closed a new $624mn fund dedicated entirely to the GP-led secondaries segment2. It is being joined by more mainstream private equity players entering the space, bringing with them new demands and proposed deal structures.

The private equity secondaries space is a growing segment of the ever-expanding private equity asset class. By end-June, secondaries assets under management were approaching $300bn worldwide, accounting for over 6% of the industry’s total assets under management compared with some 3.5% in 2007. Over that same period, total private equity assets increased more than threefold to $4.7tn, according to Preqin data1.

Secondaries emerged to provide investors with much-needed liquidity in times of financial stress. However, in a growing asset class they increasingly serve limited partners’ needs for portfolio management, while generating strengthening returns for secondaries fund investors. Private equity fund managers are also turning to secondaries deals as they look for ways to manage remaining portfolio companies in funds that are reaching the end of their lifecycles. In October, London-based firm Pantheon closed a new $624mn fund dedicated entirely to the GP-led secondaries segment2. It is being joined by more mainstream private equity players entering the space, bringing with them new demands and proposed deal structures.

Fundraising Steps Up as Performance Accelerates

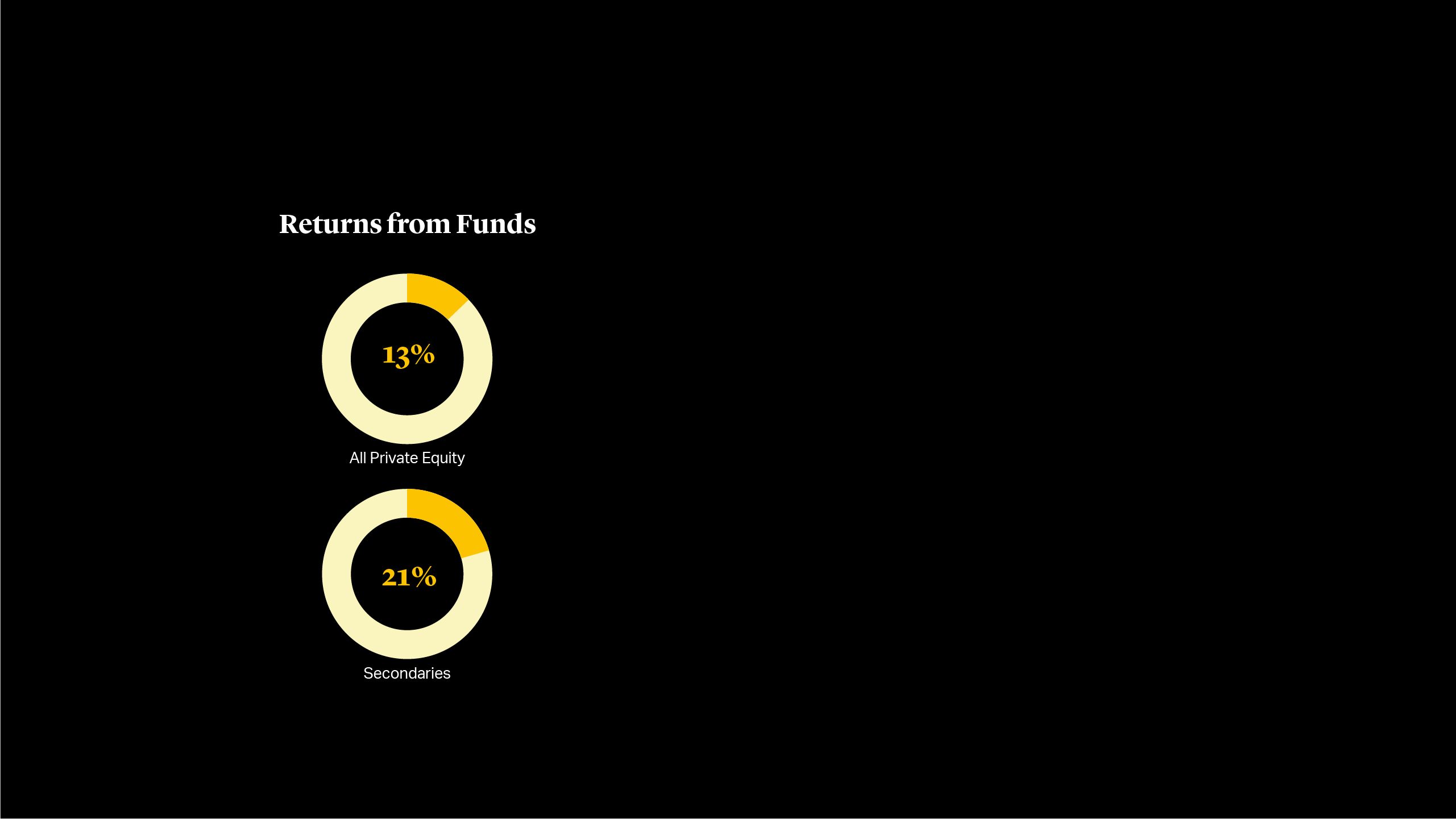

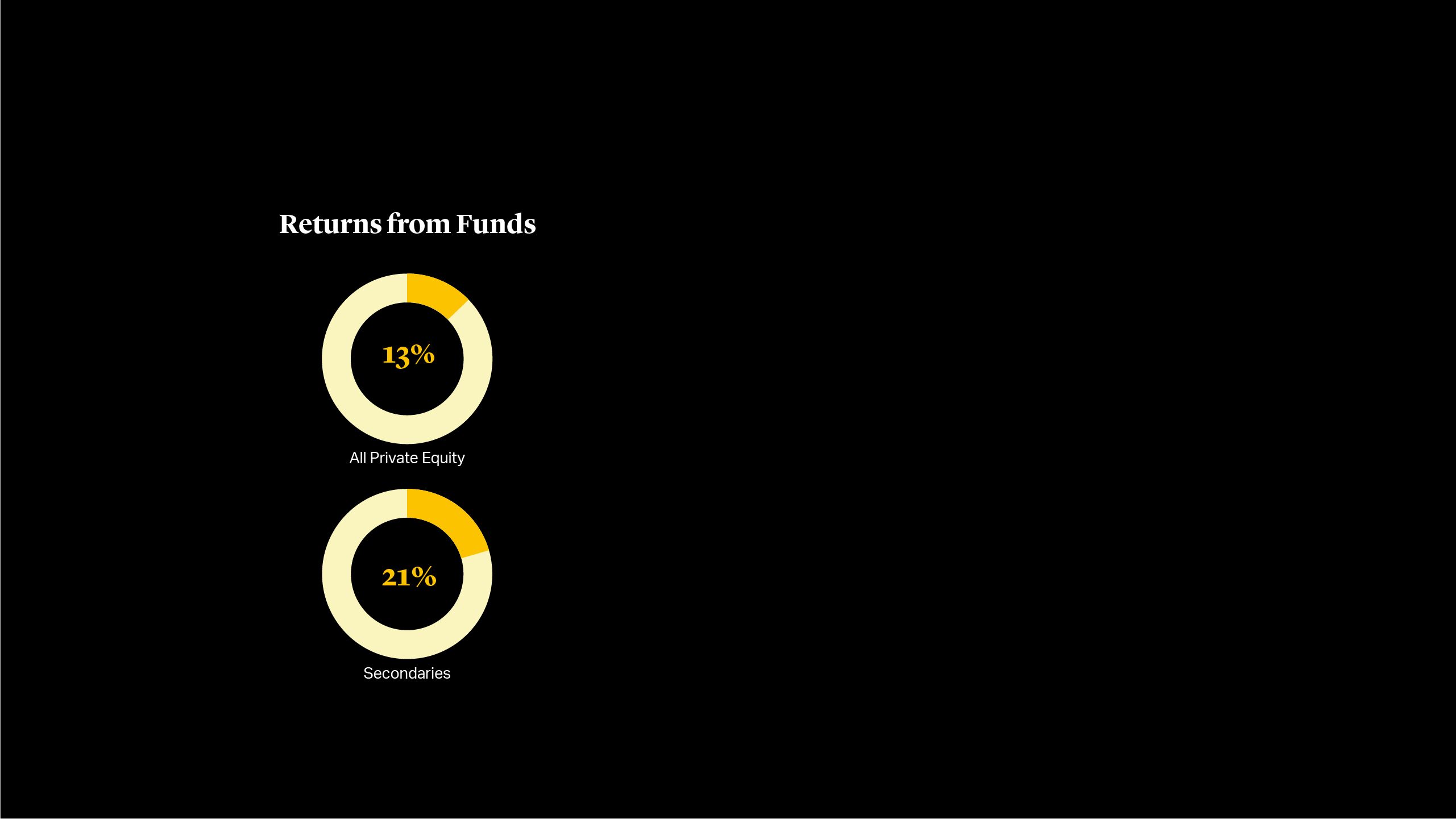

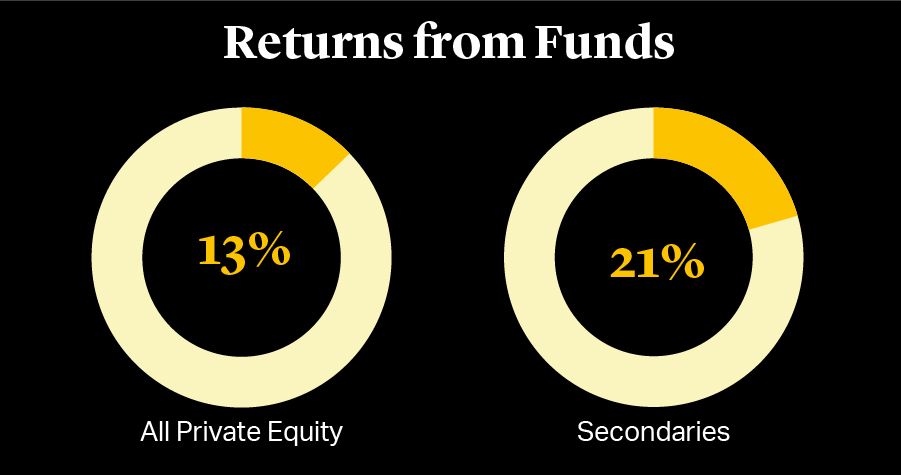

The growth in the opportunity set for secondaries funds has been matched by strengthening investment performance. Following the financial crisis, returns from secondaries funds closely mirrored the wider private equity asset class, delivering annualized returns in the low-to-mid double digits, according to Preqin research. After 2013, performance began to diverge and for the 2017 vintage – the latest year covered in Preqin’s 2021 Private Equity Report – secondaries delivered a 21% return versus 13% for all private equity.

The combination of an expanding market and strong returns have been drawing more investment into the space. Secondaries fundraising accelerated sharply in 2020 to an aggregate $76bn as established specialists gathered ever-larger funds. Among them, France’s Ardian raised $19bn for its eighth secondaries fund in mid-2020, the largest ever in the segment. That investor appetite is continuing strongly following the pandemic, with Blackstone’s Strategic Partners arm reported to be nearing $20bn for its ninth fund3.

Fundraising Steps Up as Performance Accelerates

The growth in the opportunity set for secondaries funds has been matched by strengthening investment performance. Following the financial crisis, returns from secondaries funds closely mirrored the wider private equity asset class, delivering annualized returns in the low-to-mid double digits, according to Preqin research. After 2013, performance began to diverge and for the 2017 vintage – the latest year covered in Preqin’s 2021 Private Equity Report – secondaries delivered a 21% return versus 13% for all private equity.

The combination of an expanding market and strong returns have been drawing more investment into the space. Secondaries fundraising accelerated sharply in 2020 to an aggregate $76bn as established specialists gathered ever-larger funds. Among them, France’s Ardian raised $19bn for its eighth secondaries fund in mid-2020, the largest ever in the segment. That investor appetite is continuing strongly following the pandemic, with Blackstone’s Strategic Partners arm reported to be nearing $20bn for its ninth fund3.

Private Equity Secondaries Appeal Goes Mainstream

The scale of the private equity secondaries market continues to attract new entrants, drawn by the prospect of investment opportunities and the potential for strong flows of management fees and carried interest. In April, New York-listed Apollo Management unveiled a new $1bn credit secondaries strategy4, following TPG that formed a secondaries unit in 2020 and was reported earlier this year to be preparing a debut fund of up to $2bn5.

Attention on the space, and the increasingly mainstream appeal of private equity secondaries, has prompted some specialists to sell to larger investment groups. In November, New York-based Lexington Partners became the latest secondaries player to take advantage of industry consolidation, agreeing a $1.75bn deal with U.S. asset manager Franklin Templeton, which manages over $1.5tn of assets globally6.

New Entrants Come with New Demands

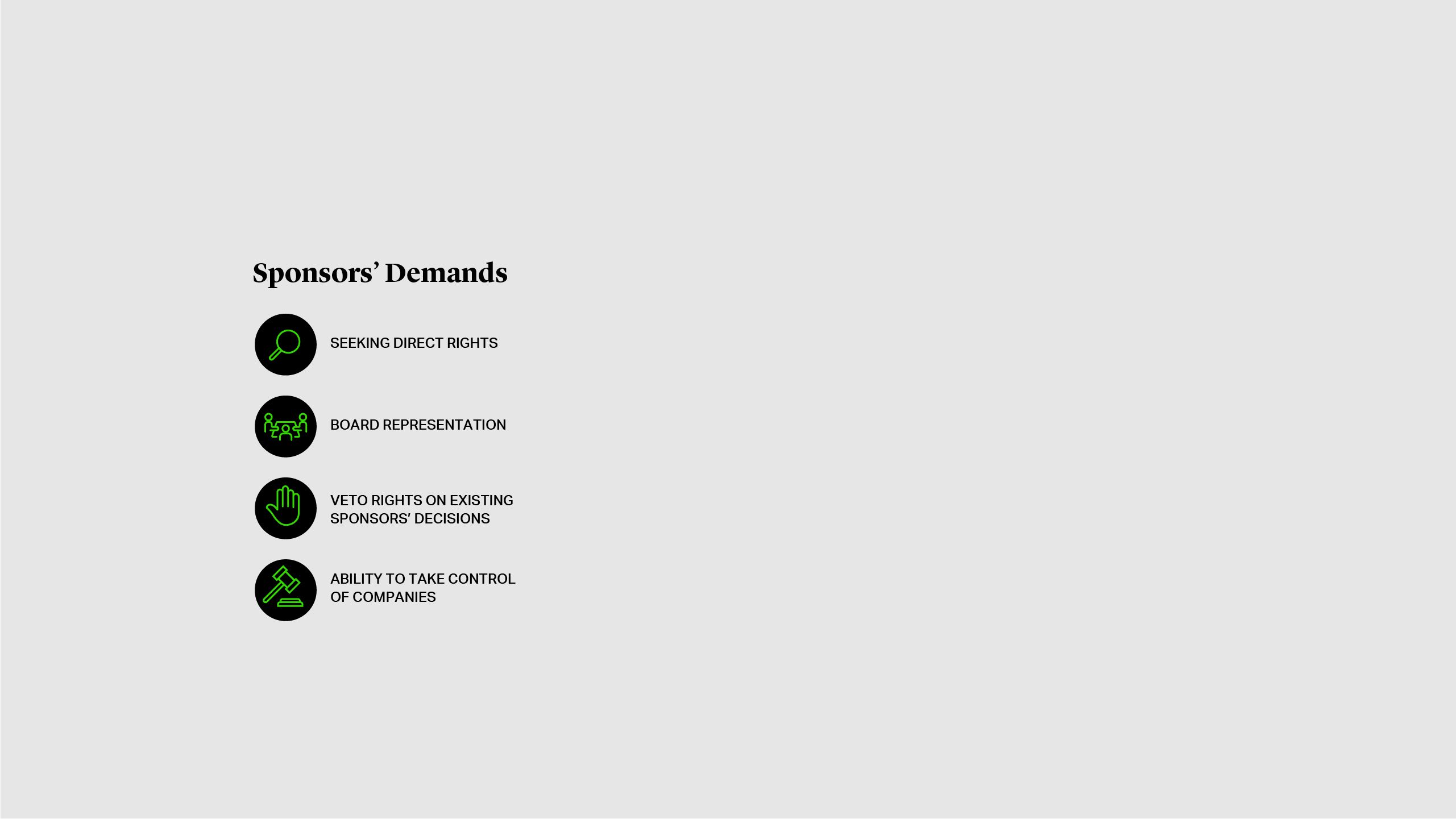

The presence of a wider range of private equity firms is altering deal dynamics in the secondaries space. Firms with a history in buyouts are bringing that private equity M&A approach to due diligence and offers. Sponsors are taking a forensic approach to assessing portfolios of investments, digging deep into the performance of every underlying asset. And many are also seeking direct rights within portfolio companies, asking for board representation, veto rights on existing sponsors’ decisions, and even the ability to step in to take control of companies should they underperform.

Incumbent general partners appear wary about such deals for now. With ample capital, attractive valuations and less onerous terms potentially available from the more established secondaries players, there is little impetus for the existing managers to accept more onerous clauses. However, with the right pricing and the ability for incoming general partners to add more value to companies through their experience, there are likely to be growing opportunities for the buyout-focused managers.

New Entrants Come with New Demands

The presence of a wider range of private equity firms is altering deal dynamics in the secondaries space. Firms with a history in buyouts are bringing that private equity M&A approach to due diligence and offers. Sponsors are taking a forensic approach to assessing portfolios of investments, digging deep into the performance of every underlying asset. And many are also seeking direct rights within portfolio companies, asking for board representation, veto rights on existing sponsors’ decisions, and even the ability to step in to take control of companies should they underperform.

Incumbent general partners appear wary about such deals for now. With ample capital, attractive valuations and less onerous terms potentially available from the more established secondaries players, there is little impetus for the existing managers to accept more onerous clauses. However, with the right pricing and the ability for incoming general partners to add more value to companies through their experience, there are likely to be growing opportunities for the buyout-focused managers.

Maturing Private Equity Universe Drives Emerging Segments

New entrants into secondaries are driving the expansion of the market into new segments. Apollo is pushing the development of credit secondaries, echoing French group Tikehau which has been raising a fund dedicated to credit deals7. Infrastructure secondaries strategies are also attracting more capital. European group Stafford Capital is currently in the market with a target of €750mn for its fourth fund8. Meanwhile, Pantheon has unveiled plans to list a £300mn London-listed infrastructure fund that will tap into both primary and secondaries investments9, underlining the sector’s maturity and broad appeal.

Venture capital is also seeing strong growth in secondaries activity. Following its acquisition of VC and growth equity manager Greenspring earlier this year, U.S. firm StepStone is aiming to raise its largest-ever fund for VC secondaries. As start-ups raise ever-larger funding rounds and stay private for longer, VC secondaries will become more prevalent as some investors seek ways to cash in on strong valuations and others look for ways to gain toeholds in fast-growing companies.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

Michael J. Preston

Partner

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

David J. Billington

Partner

T: +44 20 7614 2263

dbillington@cgsh.com

V-Card

Gabriele Antonazzo

Partner

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Nallini Puri

Partner

T: +44 207 6142289

npuri@cgsh.com

V-Card

Michael James

Partner

T: +44 20 7614 2219

mjames@cgsh.com

V-Card

Lawale Ladapo

Associate

France

Amélie Champsaur

Partner

T: +33 1 40 74 68 00

achampsaur@cgsh.com

V-Card

Charles Masson

Partner

Germany

Michael J. Ulmer

Partner

T: +49 69 97103 180

mulmer@cgsh.com

V-Card

Mirko von Bieberstein

Senior Attorney

Italy

Roberto Bonsignore

Partner

T: +39 02 7260 8230

rbonsignore@cgsh.com

V-Card

Carlo de Vito Piscicelli

Partner

T: +44 20 7614 2257

cpiscicelli@cgsh.com

V-Card

David Singer

Associate