Private Equity

Market Snapshot

October 2021

Private equity investment continued strongly last month, reflecting broader M&A markets that have stepped up to a new level of activity in 2021. Global third quarter M&A hit a new record at over $1.5tn according to Refinitiv1. Dealmaking for the year to date has already blown past 2015’s full-year record and puts 2021 on a path that could see $6tn of deals concluded by year-end2.

Within this global picture, European private equity is punching its full weight: European deal count (for investments over €50mn) has been tracking at over 180 deals a quarter for the nine months since September 2020 – some 70% above the pre-pandemic average for 20193.

Mid-Market Deals Fuel Activity

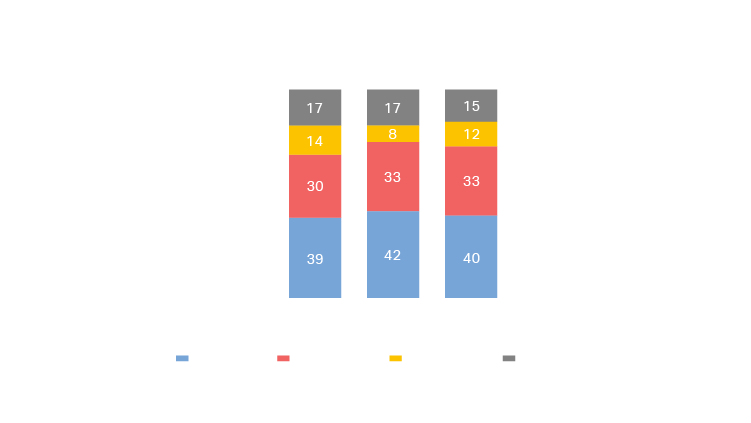

Increased European private equity investment has led to larger numbers of mid-sized deals, including buyouts and minority investments. Data hints at the direction of travel, with the percentage of deals worth more than €250mn dipping to 27% in the first half of 2021 versus 31% in 2019, according to Baird.

One the one hand, market dynamics reflect the fact that there are relatively few multi-billion transactions to be done in Europe, and on the other, that valuation expectations may be causing some sponsors to pause. Across the continent and all deal sizes, Baird found that pricing has hit an average of 12.5x EBITDA. The most hotly contested auctions can result in significantly higher valuations.

Mega-deals were not completely absent in September. Following a protracted period of courtship by two private equity bidders for Wm Morrison, Clayton, Dubilier & Rice won the process with an offer of 287 pence per share, topping the rival Fortress-led consortium. The price was 61% above the company’s share price before the takeover process and equated to an enterprise value of £9.97bn4, as well as a multiple of 11.8x the company’s underlying profit for the year to January 2021.

The deal has prompted speculation that private equity will take an interest in other UK retail groups perceived to be undervalued, including Sainsbury’s and Tesco. It also drew attention to the high premia paid by sponsors and the low valuations ascribed by public markets. The average premium paid in a European take-private was 45% in 2021, the highest level since Refinitiv’s records began, with some deals agreed at almost 70% above the undisturbed share price5.

Tech Investment Wave Fuels Wider Efficiencies

The proliferation of European deals focused on technology has hit new highs. According to Baird, the tech sector has accounted for 28% of European private equity deals in 2021, making it the largest sector for investment, up from 10% in 2015.

Deals span buyouts, minority investments and larger VC funding rounds. In September, Silver Lake led a $555mn funding round for Mirakl, a provider of cloud-based marketplace technology, valuing the French start-up at $3.5bn. Buyers are also looking for investments that can add value to other companies. Also in September, Vista agreed a £1.1bn takeover of UK-based software group Blue Prism, which it intends to merge with its Silicon Valley-based data analytics firm Tibco.

Optimism in the Face of Disruption

Ongoing strength in investment does not only reflect capital market drivers, but also broad improvement in the outlook across Europe. An accelerated inoculation drive has seen Portugal become the country with the highest vaccination rate in Europe, closely followed by Spain. Other countries have followed the UK in fully reopening, leading to improved economic activity – indicators such as public transport use and box office receipts have recovered strongly across Europe6.

The economic recovery has though led to growing pains. Brexit appears to have exacerbated supply chain issues, with these only now becoming apparent as consumer behaviour returns to normal. And with fewer workers available to meet growing consumer demand, UK pay increased by 8.8% in the second quarter, according to the Office for National Statistics7. In turn, supply chain pressures and the spike in energy costs have been pushing up consumer prices more broadly. According to ONS data, inflation rose to 3.0% across both the Euro area8 and the UK 9 in August.

Notwithstanding the disruption and ongoing uncertainty around COVID-19 infection levels, long-term optimism among sponsors that we advise remains buoyant.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

Michael J. Preston

Partner

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

David J. Billington

Partner

T: +44 20 7614 2263

dbillington@cgsh.com

V-Card

Gabriele Antonazzo

Partner

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Nallini Puri

Partner

T: +44 207 6142289

npuri@cgsh.com

V-Card

Michael James

Partner

T: +44 20 7614 2219

mjames@cgsh.com

V-Card

Lawale Ladapo

Associate

France

Amélie Champsaur

Partner

T: +33 1 40 74 68 00

achampsaur@cgsh.com

V-Card

Charles Masson

Partner

Germany

Michael J. Ulmer

Partner

T: +49 69 97103 180

mulmer@cgsh.com

V-Card

Mirko von Bieberstein

Senior Attorney

Italy

Roberto Bonsignore

Partner

T: +39 02 7260 8230

rbonsignore@cgsh.com

V-Card

Carlo de Vito Piscicelli

Partner

T: +44 20 7614 2257

cpiscicelli@cgsh.com

V-Card

David Singer

Associate