Private Equity Market Snapshot

July 2023

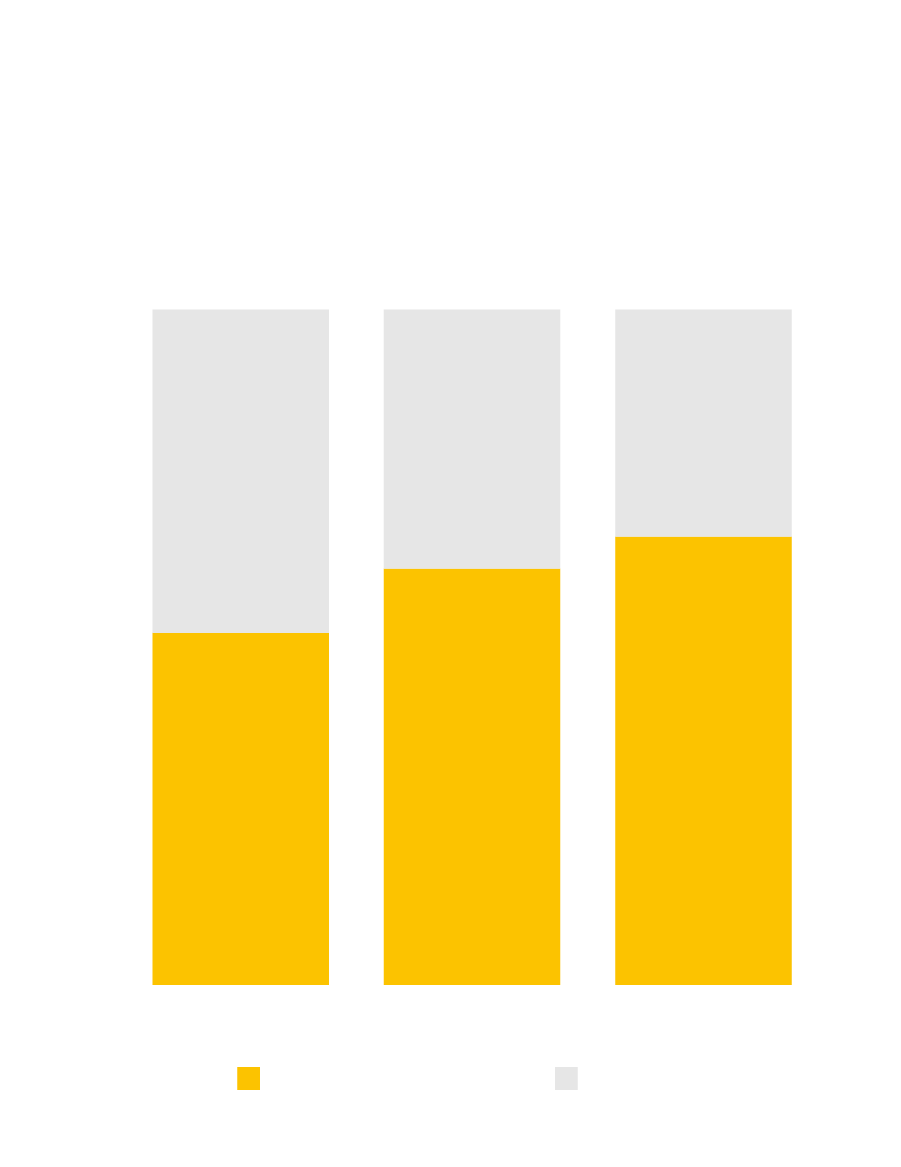

Having passed the halfway point of the year, research continues to illustrate how challenging the last six months have been for private equity. There were 276 buyouts completed in Europe in the first half of the year, the lowest number since 2013 (excluding during the pandemic), according to data from the Centre for Private Equity and MBO Research, based at Nottingham University1. The number of deals over £1bn was down to 10 for the period, including just two in the UK market. Cumulative deal value and average deal size were also the lowest since 2016.

While the headline numbers are significantly lower than at the peak, private equity firms have not just been sitting on the sidelines. Some activity has been maintained in the mid-market, including take-privates of listed companies in the FTSE 250 and 350 segments in the UK, as well as bolt ons and opportunities in less-explored markets. In late May, The Carlyle Group announced a deal to acquire Czech optics maker Meopta for a figure reported to be about €700mn2.

The mood among sponsors is also showing early signs of improvement, fueled by a number of cautiously positive trends. Inflation is slowing across much of Europe and interest rates are believed to be close to their peak; funds continue to have high levels of dry powder and appetite to make higher equity contributions if needed; and banks are starting to return to the market for buyout lending, adding to the financing that private credit funds have been providing in the interim.

As the potential ingredients for a brighter outlook start to come together, there appears to be increasing pressure on GPs to engineer liquidity for LPs. Firms globally are estimated to have some $2.8tn of unexited assets, more than four times the level they held during the financial crisis, according to research from Bain & Co3. As a result, some 60% of LPs surveyed said they would be more inclined to cash out of an investment than roll over into a GP-led secondary.

Another solution to generate liquidity and return cash to LPs – while continuing to hold portfolio investments – are NAV loans secured against a fund or group of companies. European private equity firms including Hg, Nordic Capital and The Carlyle Group are reported to have recently used or be investigating NAV facilities to generate liquidity4. While secondary activity and (despite their increased interest cost) NAV facilities are expected to continue to be a feature in the market, an increase in the overall level of exits would be needed to generate significantly more liquidity for investors – and may force some reappraisal of exit multiples on the sell-side to a level which resonates with a slightly more optimistic tone on the buy-side.

While the headline numbers are significantly lower than at the peak, private equity firms have not just been sitting on the sidelines. Some activity has been maintained in the mid-market, including take-privates of listed companies in the FTSE 250 and 350 segments in the UK, as well as bolt ons and opportunities in less-explored markets. In late May, The Carlyle Group announced a deal to acquire Czech optics maker Meopta for a figure reported to be about €700mn2.

The mood among sponsors is also showing early signs of improvement, fueled by a number of cautiously positive trends. Inflation is slowing across much of Europe and interest rates are believed to be close to their peak; funds continue to have high levels of dry powder and appetite to make higher equity contributions if needed; and banks are starting to return to the market for buyout lending, adding to the financing that private credit funds have been providing in the interim.

As the potential ingredients for a brighter outlook start to come together, there appears to be increasing pressure on GPs to engineer liquidity for LPs. Firms globally are estimated to have some $2.8tn of unexited assets, more than four times the level they held during the financial crisis, according to research from Bain & Co3. As a result, some 60% of LPs surveyed said they would be more inclined to cash out of an investment than roll over into a GP-led secondary.

Another solution to generate liquidity and return cash to LPs – while continuing to hold portfolio investments – are NAV loans secured against a fund or group of companies. European private equity firms including Hg, Nordic Capital and The Carlyle Group are reported to have recently used or be investigating NAV facilities to generate liquidity4. While secondary activity and (despite their increased interest cost) NAV facilities are expected to continue to be a feature in the market, an increase in the overall level of exits would be needed to generate significantly more liquidity for investors – and may force some reappraisal of exit multiples on the sell-side to a level which resonates with a slightly more optimistic tone on the buy-side.

Banks Return to Buyout Lending Markets

Does that optimism extend to debt funding? Some of the blockages and uncertainty that curtailed lending more recently have eased. Underwriting banks globally have sold down much of their exposure in the syndicated loan space – although lending for Elon Musk’s Twitter buyout last year remains ‘hung’, according to a report in The Wall Street Journal5.

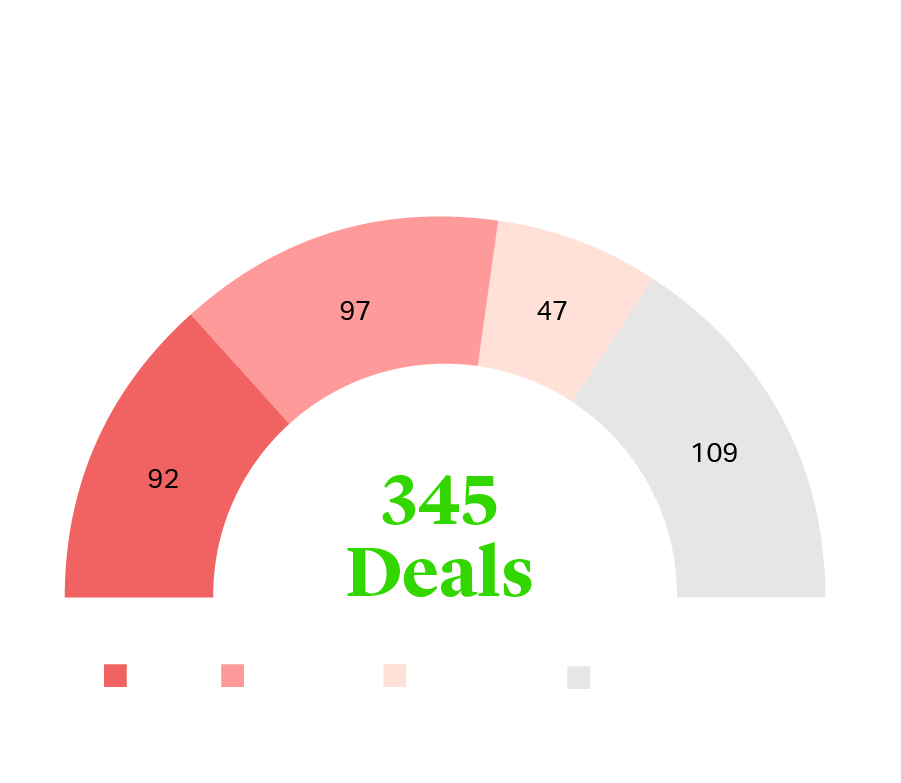

The market remains challenging, but the return of traditional lenders is a positive development. The pullback in bank financing opened the door for private debt funds to become a more available and attractive option for private equity deals. There were 345 private debt deals in the second half of 2022, according to Deloitte’s latest Private Debt Deal Tracker, down 15% on the first half, but significantly less than the comparative slowdown in syndicated loan issuance. Among the deals, Astorg’s agreement to acquire German contract drug development and manufacturing business Corden Pharma for about $2.6bn was one of the largest, securing lending from a consortium of three private lenders6.

Alternative lenders also beat traditional banks to provide the debt package for a £4.5bn recommended offer for the UK listed veterinary pharmaceuticals business Dechra7 in June by an EQT-led consortium, a high profile demonstration of the debt funds’ offering across a range of transactions, including public-to-privates.

Now that banks are showing signs of increased appetite to lend for buyouts at more competitive pricing, private equity firms are again able to run processes to find the most attractive financing options.

However, the picture around pricing is complex. While headline bank lending rates and fees may appear cheaper than the terms offered by private debt, market flex can increase margins or upfront fees to levels which are potentially no longer competitive. Moreover, the risk that banks are unable to syndicate the loans during another bout of volatility cannot be completely discounted, especially given the implications of relatively thin volumes for European CLOs and in particular those denominated in sterling.

It remains to be seen whether the recovery in the finance market is just around the corner. Positive indicators are certainly there now, but only time will tell. In the meantime, portfolio companies with portable debt facilities may find themselves towards the top of any list of likely exit candidates.

The market remains challenging, but the return of traditional lenders is a positive development. The pullback in bank financing opened the door for private debt funds to become a more available and attractive option for private equity deals. There were 345 private debt deals in the second half of 2022, according to Deloitte’s latest Private Debt Deal Tracker, down 15% on the first half, but significantly less than the comparative slowdown in syndicated loan issuance. Among the deals, Astorg’s agreement to acquire German contract drug development and manufacturing business Corden Pharma for about $2.6bn was one of the largest, securing lending from a consortium of three private lenders6.

Alternative lenders also beat traditional banks to provide the debt package for a £4.5bn recommended offer for the UK listed veterinary pharmaceuticals business Dechra7 in June by an EQT-led consortium, a high profile demonstration of the debt funds’ offering across a range of transactions, including public-to-privates.

Now that banks are showing signs of increased appetite to lend for buyouts at more competitive pricing, private equity firms are again able to run processes to find the most attractive financing options.

However, the picture around pricing is complex. While headline bank lending rates and fees may appear cheaper than the terms offered by private debt, market flex can increase margins or upfront fees to levels which are potentially no longer competitive. Moreover, the risk that banks are unable to syndicate the loans during another bout of volatility cannot be completely discounted, especially given the implications of relatively thin volumes for European CLOs and in particular those denominated in sterling.

It remains to be seen whether the recovery in the finance market is just around the corner. Positive indicators are certainly there now, but only time will tell. In the meantime, portfolio companies with portable debt facilities may find themselves towards the top of any list of likely exit candidates.

Hybrid Financing Options a Permanent Feature of European Landscape

Hybrid financing tools came into focus during COVID-19 as an option for companies that were faced with liquidity challenges. Since then, they have proved their worth across a wide range of transactions, and not only during periods of stress or distress. One of the attractions for companies is that hybrid capital can effectively replace debt or equity funding, and is not typically treated as debt, so does not increase leverage levels. While more expensive than traditional debt funding, hybrid capital is flexible enough to be used for different purposes, such as investment into companies for M&A or large capex projects, generating free cash to pay dividends to shareholders, exits for some equity owners – or a combination of all the above.

For sponsors, hybrid capital is an equally flexible way to deploy capital in a range of situations that might otherwise be captured by a combination of traditional equity and debt investments. Deals are typically structured as convertible preferred equity or preferred equity with warrants, combining elements of debt and equity investments. As such, preferred equity can pay an attractive annual coupon and come with equity upside to capture a share of any growth in the company. Preferred equity also ranks above common equity in the capital structure, giving holders greater downside protection and enhanced rights. Given the attractions, sponsors such as Apollo have raised dedicated hybrid capital vehicles, with the firm’s second Hybrid Value fund gathering $4.6bn from investors in 20228, a 40% increase on the prior fund. Many other firms are using the flexibility in the investment mandates of their flagship buyout funds to invest in companies through preferred equity structures.

Even as lending conditions normalize further, we expect hybrid capital to remain a feature of active private equity deal markets, given the flexibility of solutions it offers both sponsors and businesses needing capital.

Ian Shawyer

Partner

London

T: +44 20 7614 2242

ishawyer@cgsh.com

V-Card

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Ed Aldred

Partner

London

T: +44 20 7614 2302

ealdred@cgsh.com

V-Card

Michael James

Partner