2021 Private Equity

Market Roundup

Deal activity rebounded in the second half of 2020 and kept accelerating throughout 2021. By early November, global private equity investment was on the cusp of hitting $1tn, more than double the previous year and far ahead of the prior 2007 peak, according to Refinitiv data. Across all deal sizes, investment was firing on all cylinders, from large-cap buyouts to mid-market and venture capital, fuelled by large reserves of dry powder and attractive financing terms from banks and private debt providers.

Not all themes persisted in 2021, however. The boom in SPAC issuance reached a peak in March before tapering off, while activity in Europe remained at low levels throughout the year. Nevertheless, the fast start for SPAC listings put the segment well into record territory with over 550 listings and gross proceeds in excess of $150bn by late November1.

Tech and Early-Stage Companies Fuel European Investment

Private equity’s focus on the fast-growing tech sector was evident throughout 2021. Swedish fintech Klarna raised capital in closely spaced funding rounds in March and June from venture capital and private equity investors, including Softbank, Silver Lake and Permira. The latter deal propelled its valuation to $46bn2, over four times the level it achieved in September 2020.

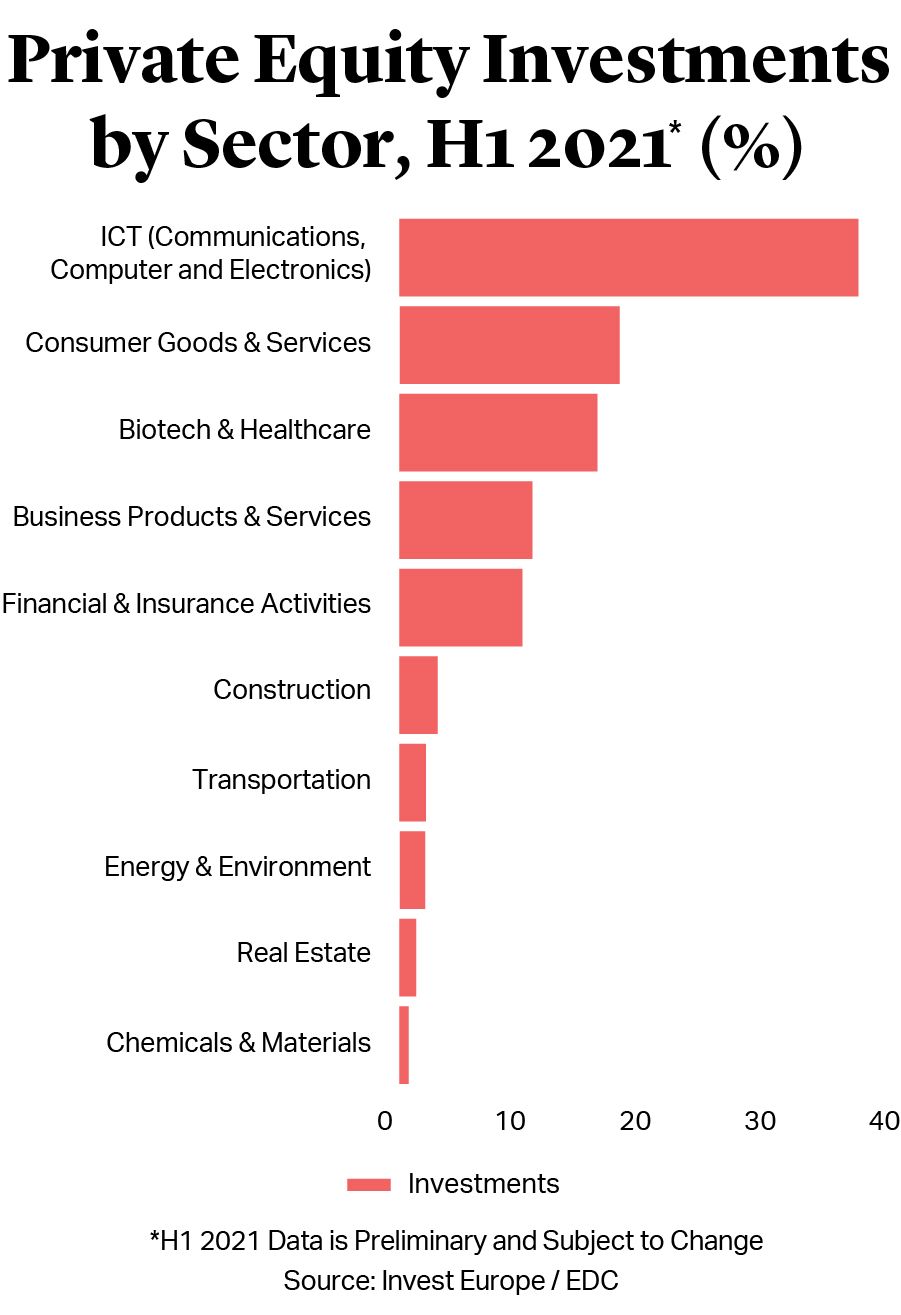

The deal reflects the rise of Europe’s tech sector, which accounted for almost 40% of a record €57bn invested in the first half of 2021, according to data from Invest Europe3. At the same time, it points to increased maturity in the start-up and scale-up ecosystem in Europe. A record €10.2bn of venture capital was invested into European companies in the first half, an increase of 85% on the same period last year. In addition, €17.5bn of growth capital was invested into fast-growing European companies, almost three times the first half of last year.

While the UK continues to be the major European destination for tech investment, other countries have been catching up in 2021 due to an increased focus by governments on promoting innovation and entrepreneurship. On a record-setting day in September, two French start-ups – Mirakl and Sorare – raised over $1bn from investors at multi-billion-dollar valuations4.

More established European tech companies also saw investment interest. Just one year after a deal with TPG and Warburg Pincus at a $12bn valuation, Norwegian enterprise software company Visma brought in Norway’s government pension fund, Singapore’s GIC and Aeternum Capital at $19bn in September5, an investment that also highlighted strengthening sovereign investment appetite for co-investment and co-sponsorship deals.

Tech and Early-Stage Companies Fuel European Investment

Private equity’s focus on the fast-growing tech sector was evident throughout 2021. Swedish fintech Klarna raised capital in closely spaced funding rounds in March and June from venture capital and private equity investors, including Softbank, Silver Lake and Permira. The latter deal propelled its valuation to $46bn2, over four times the level it achieved in September 2020.

The deal reflects the rise of Europe’s tech sector, which accounted for almost 40% of a record €57bn invested in the first half of 2021, according to data from Invest Europe3. At the same time, it points to increased maturity in the start-up and scale-up ecosystem in Europe. A record €10.2bn of venture capital was invested into European companies in the first half, an increase of 85% on the same period last year. In addition, €17.5bn of growth capital was invested into fast-growing European companies, almost three times the first half of last year.

While the UK continues to be the major European destination for tech investment, other countries have been catching up in 2021 due to an increased focus by governments on promoting innovation and entrepreneurship. On a record-setting day in September, two French start-ups – Mirakl and Sorare – raised over $1bn from investors at multi-billion-dollar valuations4.

More established European tech companies also saw investment interest. Just one year after a deal with TPG and Warburg Pincus at a $12bn valuation, Norwegian enterprise software company Visma brought in Norway’s government pension fund, Singapore’s GIC and Aeternum Capital at $19bn in September5, an investment that also highlighted strengthening sovereign investment appetite for co-investment and co-sponsorship deals.

Attractive Valuations Drive Foreign Investment in UK Companies

Across Europe as a whole, 2021 private equity investment levels are well into record territory. However, at the country or regional level, activity is more varied. According to Invest Europe data, France & Benelux and the Nordics witnessed record investment in the first half of the year6, while investment in DACH, Southern Europe and Central and Eastern Europe were all below previous highs. However, the largest region for investment during the period was the UK & Ireland.

As European equities markets recovered strongly in the first half of 2021, lagging valuations for UK-listed companies and weakness in sterling following Brexit combined to draw more U.S. capital to the UK. By end-August, 39 bids had been tabled to take British companies private. This was just two fewer than the total for 2020, according to Dealogic7.

Among the inbound investments were numerous multi-billion-pound deals, including the consortium takeover of private jet services business Signature Aviation, and KKR’s buyout of infrastructure group John Laing. The high point was the takeover of supermarket chain Wm Morrison (Morrisons) by Clayton, Dubilier & Rice for £10bn in October after the UK’s Takeover Panel intervened to organise a formal auction, following months of pursuit by the U.S. firm and a rival consortium led by Fortress Group.

Inbound private equity investment in the UK was not without controversy, however. Bain Capital’s £530mn buyout of insurance mutual LV= prompted press criticism, forcing the life insurance firm to mount a strong defence of the deal and outline the benefits to members more fully8.

Regulatory Scrutiny Increases as International Capital Flows Increase

Inbound investment scrutiny has not been confined to press commentary in 2021. During the takeover battle for Morrisons, British business minister Kwasi Kwarteng sought assurances from company management about the impact of private equity investment on jobs, pensions, and operations. In August, the planned takeover of UK-listed defence technology group Ultra Electronics by Advent-owned Cobham was also referred to the Competition and Markets Authority under the Enterprise Act.

These actions marked a step up in foreign direct investment scrutiny, focussed on the fields of technology and other businesses with national interest angles. Powers to investigate mergers and acquisitions are set to increase with the new National Security and Investment Act. The regime will come into force in January 2022 and will give the UK government significantly enhanced powers to impose conditions on deals, or potentially unwind and block investments.

Elsewhere in Europe, other jurisdictions have been taking a more muscular approach to foreign investment. France’s opposition to the proposed takeover of retailer Carrefour by Canada’s Alimentation Couche-Tard in January set the tone for the country’s stance on takeovers. Neighbouring Germany has also tightened its rules, enhancing foreign direct investment oversight across a range of technology sectors, healthcare, and the food industry9.

International investors are more aware of the potential for deal scrutiny and how that may impact deals. Prospective buyers seek to keep the list of potential regulatory filings short to remain competitive in auction processes. They may also offer concessions such as retaining staff and management in the company’s original home to ease the passage of investments.

Michael J. Preston

Partner

London

T: +44 20 7614 2255

mpreston@cgsh.com

V-Card

Gabriele Antonazzo

Partner

London

T: +44 20 7614 2353

gantonazzo@cgsh.com

V-Card

Michael James

Partner

United Kingdom

UK Core PE Group:

Extended Private Equity Practice:

Italy

Italian Core PE Group:

Extended Private Equity Practice:

France

French Core PE Group:

Extended Private Equity Practice:

Belgium

Belgian Core PE Group:

Extended Private Equity Practice:

Germany

German Core PE Group:

UAE