New UK Asset Holding Company Regime For Funds

Over summer 2021, HM Treasury published a response (the “response paper”) to its consultation on the tax treatment of asset holding companies (“AHCs”) in alternative fund structures. The response paper confirms the government’s intention to introduce a new elective tax regime for “qualifying” AHCs, to take effect from April 2022. Draft legislation was published simultaneously.

The proposal overall is welcome, if somewhat narrower and more complex than AHC regimes in other countries. Further refinement is expected in the coming months, but we are hopeful that it will result in significant positive changes to the UK tax landscape for AHCs.

Why is a new regime being proposed?

In 2020, the government ran a consultation to explore why AHCs are not typically established in the UK. In its initial response, HM Treasury indicated that it saw the case for a new tax regime, to attract AHCs to the UK and build on the UK’s depth of asset management expertise.

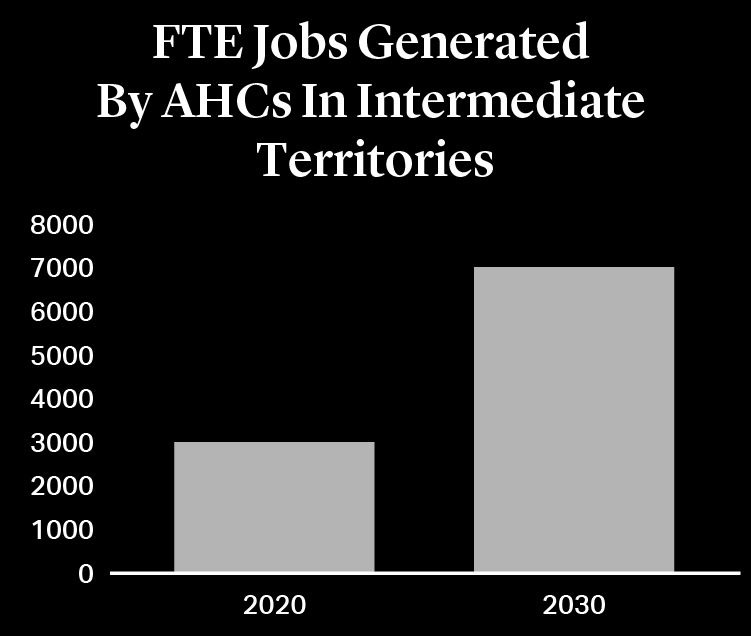

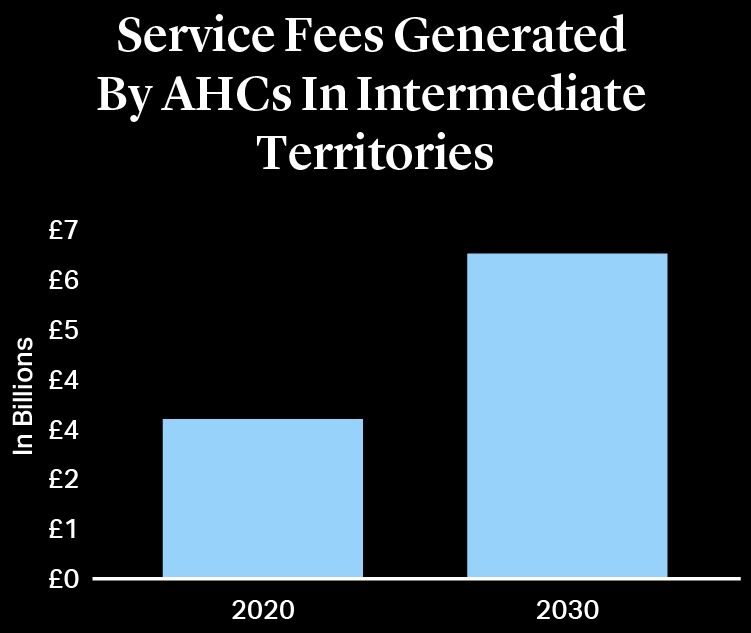

In support, the government quoted a study concluding that every £1 billion capital invested in UK-domiciled authorised investment funds generates nearly £1 million tax receipts in relation to costs linked to the domicile of the fund.1 The government also referred to research estimating that, amongst the subset of alternative funds investing in infrastructure, there are currently over 7,000 AHCs located in ‘intermediary’ territories (e.g. Luxembourg), generating around 3,000 full time equivalent jobs and £3.2 billion service fees, growing to a projected 7,000 jobs and £6.5 billion of fees by 2030.2

Although it is mindful of the potential Exchequer impact, the risk of tax avoidance and the need to adhere to international tax standards, the new response paper indicates that the government remains convinced of the case for a new regime and the importance of being attractive compared to existing overseas hubs.

How would the proposed new rules work?

Eligibility

UK-resident companies that qualify for the new regime (“qualifying” AHCs, or “QAHCs”) will need to meet a series of eligibility criteria. The criteria proposed in the response paper are summarised at a high level below. AHCs will also need to elect in to the regime, before it can apply.

Ownership.

The rules will categorise investors in AHCs in two ways: “category A” or “category B”.

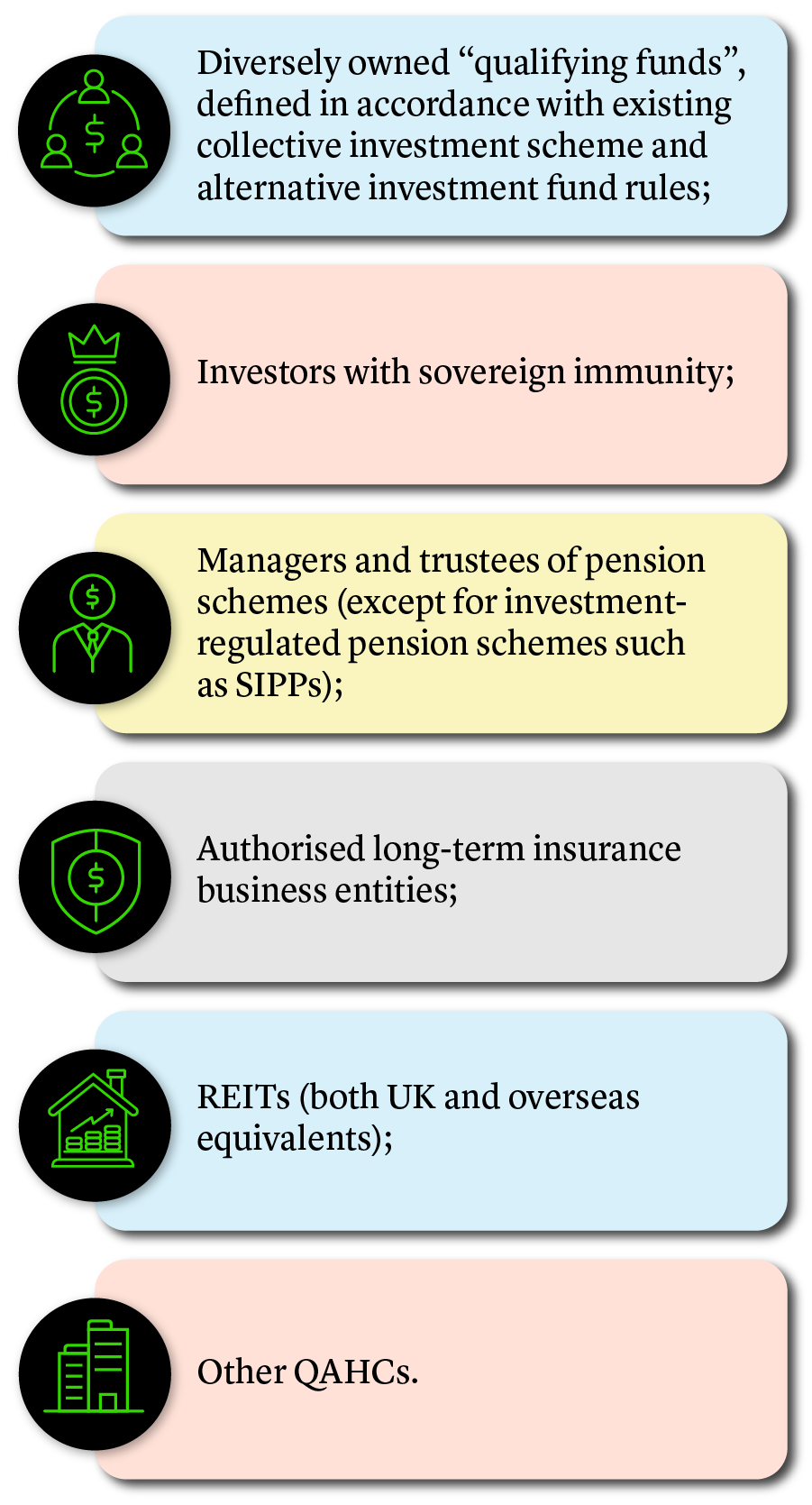

Category A includes:

Any investor not expressly within category A will be within category B.

Qualifying AHCs will require at least 70% ownership by category A investors, tested by reference to voting rights, entitlement to distributions and rights to assets on a winding up.

The 70% figure is higher than many stakeholders had hoped, but appears to be aimed at preventing a scenario where a category B investor has significant influence over a QAHC.

Role and activities.

All or substantially all of the activities of a QAHC must consist of investment activities undertaken with the aim of spreading investment risk and giving investors the benefit of the results of the management of its funds. Investment activities will then be divided into qualifying and non-qualifying categories. Whilst no minimum level of qualifying investment activity will be required, only qualifying activity will attract the benefits of the new regime.

Investment in shares, creditor relationships, and overseas real estate, as well as certain related investments in derivative contracts, will be regarded as qualifying. All other investment activities (like investment in UK real estate and any non-substantial trading activity) will be non-qualifying.

Interestingly, the response paper acknowledges the uncertainty which can arise in distinguishing between trading and investment activity. It contemplates a new test of investment activity to offer greater certainty than existing law. However, no further details have yet been provided.

Tax Treatment

The government intends that QAHCs should be taxed using a modified version of normal corporation tax rules. The modifications are intended, broadly, to ensure that most income and gains can be returned to investors without significant UK tax being paid by the QAHC. The underlying principle is that the UK tax paid by the QAHC should be proportionate to the intermediate role it plays in the fund structure.

Specific items include:

Loan relationships.

Certain existing rules will need to be adjusted to achieve taxation based on a QAHC’s commercial margin. This means, for example, that rules which treat payments on profit-participating and results-dependent loans as non-deductible will be modified to allow deductions. Corresponding changes will be needed so that UK tax-paying recipients of those amounts are subject to tax on receipt.

Chargeable gains.

Whilst consideration was given to a wide-ranging exemption for all chargeable gains of a QAHC, the government intends to proceed with a targeted exemption applicable to gains on disposals of shares (other than shares deriving at least 75% of their value from UK land), and gains on disposals of overseas real estate. Losses generated on the disposal of such assets will not be allowable. Although the scope of related anti-avoidance rules has not yet been decided, this new exemption would appear to address the various shortcomings associated with the existing “substantial shareholding exemption”.

Withholding tax.

The UK has a general 20% withholding tax on payments of yearly interest. Although exemption is often available (e.g. under double tax treaties, or under the so-called “quoted Eurobond” exemption), access can be burdensome. The government is therefore proposing to switch off the withholding obligation for interest in respect of securities held by investors in a QAHC.

What are the next steps?

The government is currently engaging with stakeholders to refine the proposals, and to close out certain other open items, to finalise the drafting of the legislation for inclusion in the next Finance Bill.

Richard Sultman

Partner

London

T: +44 20 7614 2271

rsultman@cgsh.com

V-Card

Jennifer Maskell

Counsel

London

T: +44 20 7614 2325

jmaskell@cgsh.com

V-Card

Beth Leggate

Associate

London

T: +44 20 7614 2281

bleggate@cgsh.com

V-Card

Laura Mullarkey

Associate