Emerging Market

Debt Restructuring:

Deferred, Not Cancelled

The global investor community predicted choppy waters for emerging market debt this year. Unsurprisingly, given the economic shocks that were described in the spring edition of Cleary Gottlieb’s Emerging Markets Restructuring Journal, it was widely assumed that credit metrics throughout the emerging market universe would deteriorate. The main drivers of this deterioration, many forecast, would be weaker than expected growth arising from the public health crisis, twinned with rising fiscal deficits and high public debt.

After all, as the IMF reported in April 2021,

double-digit deficits in many emerging markets contributed to a surge in average government debt ratios to 64.4% of GDP at the end of 2020, a rise of 10 percentage points from the previous year. The IMF forecast that sizeable fiscal deficits would weigh on debt, which it expected to rise further in two-thirds of emerging market economies in 20211.

These dynamics were expected to constrain access among emerging market public and private borrowers to international capital markets. Concerns about the potential for tighter monetary policy and so-called taper tantrum added to the uncertainty for emerging market issuers with substantial dollar liabilities.

The IMF cautioned in April that “higher and rising debt leaves government and nonfinancial firms more exposed to abrupt changes in financial conditions from the current accommodative levels”. Meanwhile, the Fund’s Fiscal Monitor highlighted concerns about ‘an abrupt surge in yields’, potentially due to diverging approaches to economic recovery and policy response, as well as investors losing confidence in the fiscal credibility and ability to repay debt.

At the time, the IMF warned that these factors could ‘worsen financing constraints for emerging market and developing economies, particularly those with large financing needs or debt denominated in foreign currencies’2.

Surprising Resilience?

As expected, there have been a series of sovereign debt crises in developing countries since the outbreak of the COVID-19 pandemic, most notably in Zambia and Ethiopia. But the resilience of indebted emerging markets has largely surprised on the upside over the last 18 months.

Fiscal support packages in emerging economies have been smaller than those provided by governments in most developed markets. Emerging markets have generally been beneficiaries of the extraordinary policy response to the pandemic in advanced economies, however. This response, buttressed by an extension in benign monetary conditions, has limited capital outflows from emerging markets.

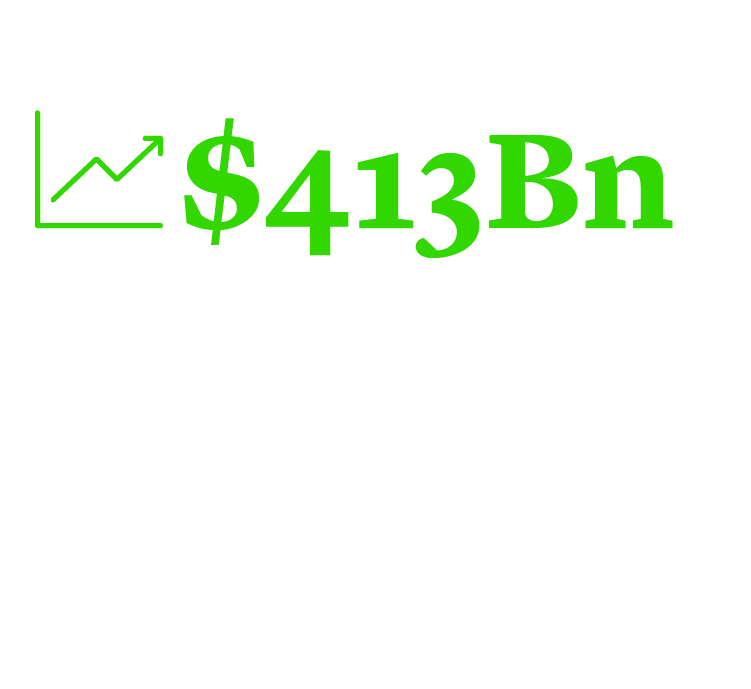

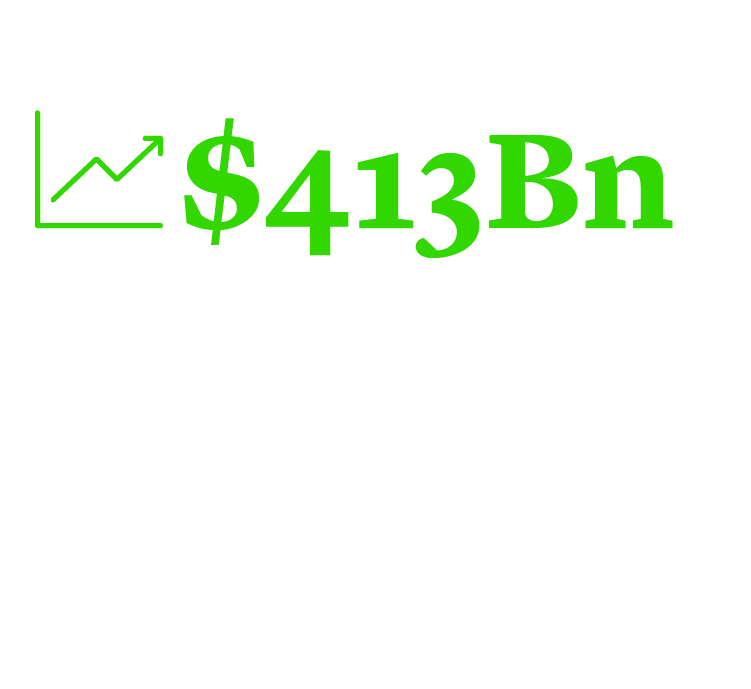

As foreshadowed in the Emerging Markets Restructuring Journal published back in May, this has kept the spigots of international capital flowing. More specifically, it has allowed for dollar issuance from emerging market corporates to continue at a ‘frantic pace’, according to an update published by CreditSights in August3. This reported that with new supply reaching almost $300bn in the first seven months of 2021, corporate issuance this year is on track to surpass 2020’s annual record of $413bn.

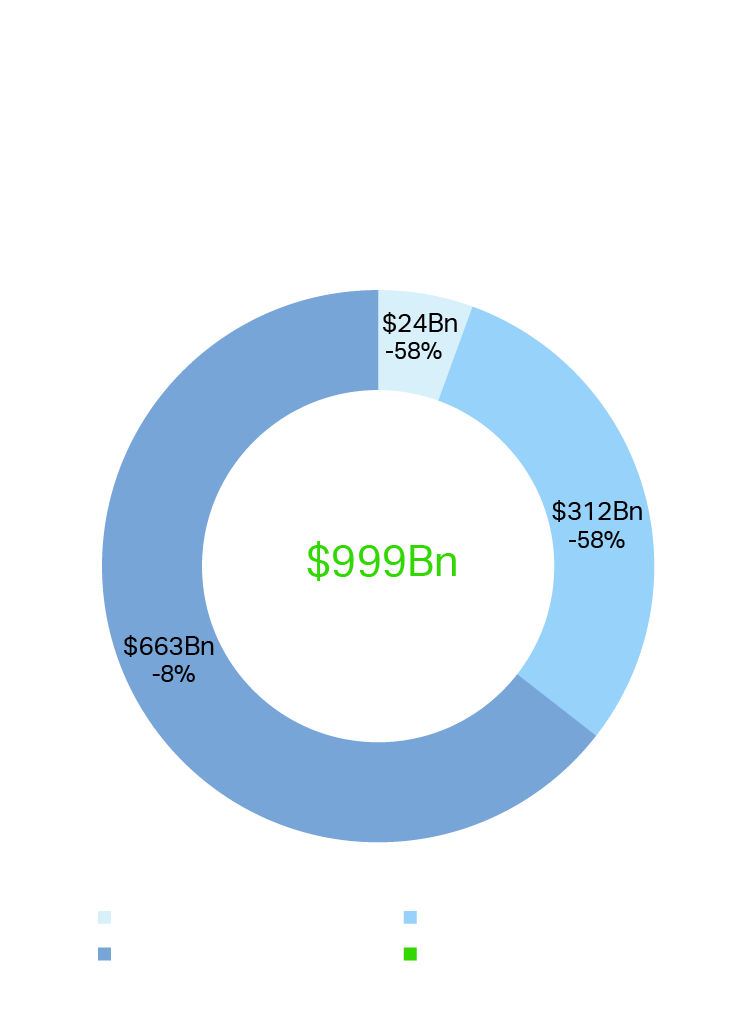

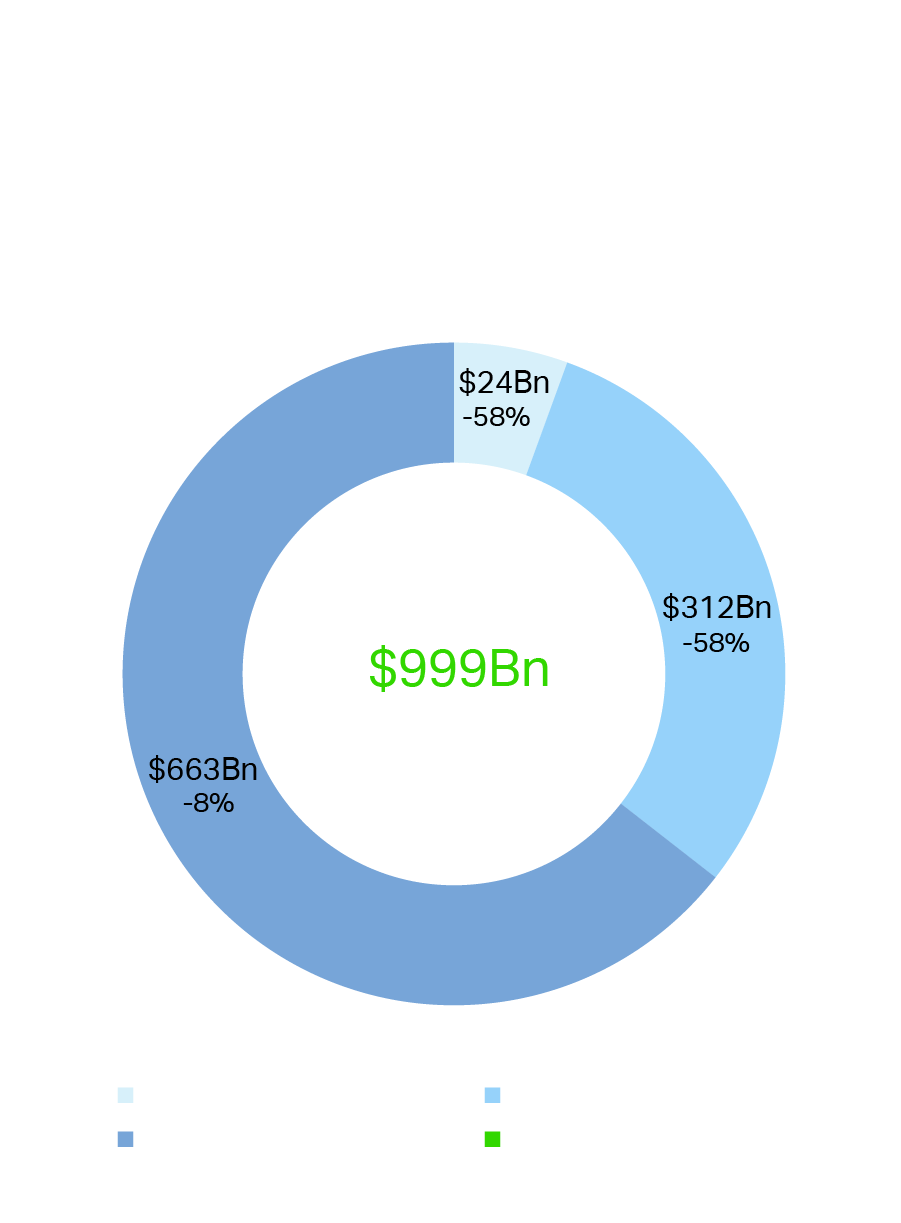

Inflows of foreign direct investment (FDI) into emerging economies have also surprised to the upside since the onset of the global public health crisis. According to UNCTAD’s World Investment Report 2021, published in June, FDI flows plunged globally by 35% in 2020, from $1.5tn to $1tn4. This decline was heavily skewed towards developed economies, however, where FDI fell by 58%. By contrast, FDI in developing countries was down by a modest 8%.

This outperformance was driven largely by flows to Asia, which were up 4% in 2020. Africa was also relatively resilient, with flows falling by 16%. Although flows to Latin America and the Caribbean were down 45%, the region still outperformed the global average.

The resilience of some developing economies has also been underpinned by the Debt Service Suspension Initiative (DSSI), launched by the World Bank and the IMF in May 2020. More than 40 of the 73 countries eligible to participate in this initiative have benefited from a temporary suspension of debt service payments to official creditors of more than $5bn in aggregate.

Surprising Resilience?

As expected, there have been a series of sovereign debt crises in developing countries since the outbreak of the COVID-19 pandemic, most notably in Zambia and Ethiopia. But the resilience of indebted emerging markets has largely surprised on the upside over the last 18 months.

Fiscal support packages in emerging economies have been smaller than those provided by governments in most developed markets. Emerging markets have generally been beneficiaries of the extraordinary policy response to the pandemic in advanced economies, however. This response, buttressed by an extension in benign monetary conditions, has limited capital outflows from emerging markets.

As foreshadowed in the Emerging Markets Restructuring Journal published back in May, this has kept the spigots of international capital flowing. More specifically, it has allowed for dollar issuance from emerging market corporates to continue at a ‘frantic pace’, according to an update published by CreditSights in August3. This reported that with new supply reaching almost $300bn in the first seven months of 2021, corporate issuance this year is on track to surpass 2020’s annual record of $413bn.

Inflows of foreign direct investment (FDI) into emerging economies have also surprised to the upside since the onset of the global public health crisis. According to UNCTAD’s World Investment Report 2021, published in June, FDI flows plunged globally by 35% in 2020, from $1.5tn to $1tn4. This decline was heavily skewed towards developed economies, however, where FDI fell by 58%. By contrast, FDI in developing countries was down by a modest 8%.

This outperformance was driven largely by flows to Asia, which were up 4% in 2020. Africa was also relatively resilient, with flows falling by 16%. Although flows to Latin America and the Caribbean were down 45%, the region still outperformed the global average.

The resilience of some developing economies has also been underpinned by the Debt Service Suspension Initiative (DSSI), launched by the World Bank and the IMF in May 2020. More than 40 of the 73 countries eligible to participate in this initiative have benefited from a temporary suspension of debt service payments to official creditors of more than $5bn in aggregate.

Not Out of The Woods

None of this should be interpreted as a signal that the likelihood of extensive debt restructurings across emerging economies has receded. The IMF’s forecast that low-income countries will require assistance through grants, concessional financing and, in some cases, debt restructuring remains as relevant today as it did in April 2021.

Widening emerging market credit spreads in some countries are a visible indicator of investor expectations of future sovereign defaults, with the bonds of governments such as Sri Lanka trading at distressed levels. Global FDI flows, meanwhile, are expected to bottom out in 2021, rebounding towards pre-pandemic levels in 2022. But as UNCTAD cautions, the FDI recovery is likely to be uneven, and led mainly by developed economies.

This heightens the expectation that a flood of insolvencies and restructurings in emerging markets has been deferred rather than cancelled. It also strengthens the belief that defaults will extend into the financial and corporate markets as well as in the sovereign space. This will be driven in part by an increase in the number of so-called zombie companies. This refers to public and private sector companies with unserviceable debt mountains and unviable business models kept afloat by government support, which is unlikely to be sustainable over the medium-term.

The first phase in the expected restructuring process is likely to see an intensification of the turmoil that has beset the sectors most vulnerable to the pandemic. Industries most visibly in the firing line are hospitality, tourism and transportation. Airlines in a number of emerging market economies have and continue to buckle under the pressure due to decreasing passenger numbers and over-extended balance sheets.

Cleary Gottlieb is advising on notable restructurings of three airlines in Latin America and Asia. The largest of these is the leading Latin American carrier, LATAM Airlines, which filed for bankruptcy in May 2020. The following month, Aeromexico also entered into Chapter 11. In Asia, meanwhile, the firm is advising Garuda Indonesia on the restructuring of its $4.9bn debt.

Restructurings such as these, which have arisen as a direct result of the economic turmoil created by the COVID-19 crisis, have inevitably commanded the attention of the media, as well as of lenders, investors and policymakers. However, several other long-term trends are driving far-reaching transformation across the corporate sector in developed and emerging markets alike.

The most prominent and well-documented of these trends was visible long before the outbreak of the pandemic. This is a function of the pressure that companies are under to adopt strategies to support the global push towards net zero emissions and deliver on the UN’s 17 Sustainable Development Goals (SDGs). Energy projects initially commissioned less than a decade ago may have been made uneconomic due to the downward price pressure created by green energy suppliers.

Projects, which appeared to be viable when they were implemented, are experiencing ESG-related pressures requiring significant strategic and financial restructuring. The next edition of Cleary Gottlieb’s Emerging Markets Restructuring Journal will provide an update on how climate change is driving restructuring in the corporate sector. It will also look at the implications of increased use of green financing by emerging market sovereigns.

Not Out of The Woods

None of this should be interpreted as a signal that the likelihood of extensive debt restructurings across emerging economies has receded. The IMF’s forecast that low-income countries will require assistance through grants, concessional financing and, in some cases, debt restructuring remains as relevant today as it did in April 2021.

Widening emerging market credit spreads in some countries are a visible indicator of investor expectations of future sovereign defaults, with the bonds of governments such as Sri Lanka trading at distressed levels. Global FDI flows, meanwhile, are expected to bottom out in 2021, rebounding towards pre-pandemic levels in 2022. But as UNCTAD cautions, the FDI recovery is likely to be uneven, and led mainly by developed economies.

This heightens the expectation that a flood of insolvencies and restructurings in emerging markets has been deferred rather than cancelled. It also strengthens the belief that defaults will extend into the financial and corporate markets as well as in the sovereign space. This will be driven in part by an increase in the number of so-called zombie companies. This refers to public and private sector companies with unserviceable debt mountains and unviable business models kept afloat by government support, which is unlikely to be sustainable over the medium-term.

The first phase in the expected restructuring process is likely to see an intensification of the turmoil that has beset the sectors most vulnerable to the pandemic. Industries most visibly in the firing line are hospitality, tourism and transportation. Airlines in a number of emerging market economies have and continue to buckle under the pressure due to decreasing passenger numbers and over-extended balance sheets.

Cleary Gottlieb is advising on notable restructurings of three airlines in Latin America and Asia. The largest of these is the leading Latin American carrier, LATAM Airlines, which filed for bankruptcy in May 2020. The following month, Aeromexico also entered into Chapter 11. In Asia, meanwhile, the firm is advising Garuda Indonesia on the restructuring of its $4.9bn debt.

Restructurings such as these, which have arisen as a direct result of the economic turmoil created by the COVID-19 crisis, have inevitably commanded the attention of the media, as well as of lenders, investors and policymakers. However, several other long-term trends are driving far-reaching transformation across the corporate sector in developed and emerging markets alike.

The most prominent and well-documented of these trends was visible long before the outbreak of the pandemic. This is a function of the pressure that companies are under to adopt strategies to support the global push towards net zero emissions and deliver on the UN’s 17 Sustainable Development Goals (SDGs). Energy projects initially commissioned less than a decade ago may have been made uneconomic due to the downward price pressure created by green energy suppliers.

Projects, which appeared to be viable when they were implemented, are experiencing ESG-related pressures requiring significant strategic and financial restructuring. The next edition of Cleary Gottlieb’s Emerging Markets Restructuring Journal will provide an update on how climate change is driving restructuring in the corporate sector. It will also look at the implications of increased use of green financing by emerging market sovereigns.

Creditor Composition Adds to Complexities

Many of the emerging market debt restructurings that are expected to proliferate over the coming 12 to 18 months are likely to be complicated by the changing composition of creditor groups that has gathered pace since the global financial crisis. With bond financing gaining popularity at the expense of loans, relatively homogenous syndicates of bank lenders have been replaced by investment funds in many instances. This can generate protracted holdout difficulties aggravated by funds resisting large debt write-downs and relatively simple exchanges.

The most notable change in the composition of emerging market creditors in recent years, however, has been the increasingly influential role of Chinese lenders, which are not members of the Paris Club of official creditors. This has in turn created a “race to seniority”, with collateralised facilities to emerging market sovereigns such as Angola and Zambia giving Chinese creditors seniority over multilateral lenders such as the IMF and the World Bank.The recent report titled “How China Lends” by the Center for Global Development in March 2021 provides an insight into 100 Chinese debt contracts with foreign governments including the collateral arrangements Chinese lenders have put in place with borrowers5 .

The winter edition of Cleary Gottlieb’s Emerging Markets Restructuring Journal, due to be published in November, will look in more detail at the likely impact of the change in creditor groups on debt restructuring situations.

Polina Lyadnova

Partner

London

T: +44 20 7614 2355

plyadnova@cgsh.com

V-Card

Adam Brenneman

Partner

New York

T: +1 212 225 2704

abrenneman@cgsh.com

V-Card

Jim Ho

Partner

The Emerging Markets Restructuring Journal was founded in 2016 by Cleary Gottlieb lawyers and features contributions from Cleary Gottlieb authors and other professionals around the world, focusing on recent developments relevant to the practice of debt restructurings, distressed investments and related topics in emerging markets.

The upcoming Winter Edition shines a spotlight on several areas, including climate change, airline restructurings and our predictions for 2022. Enter your details to receive a copy once published.