Investor-State arbitration claims in the field of energy are likely to continue rising as the energy transition gathers pace, buoyed by the recent COP26 climate summit in Glasgow which saw more states commit to net-zero targets. These claims may relate to, for example, states’ decisions to phase out certain forms of energy, in particular fossil fuels such as coal, but also changes to the investment framework for renewables as the roll-out of solar and wind power gains momentum and the underlying economics of renewable generation changes.

Investor-State dispute settlement (ISDS) enables a foreign investor to bring a claim against the state in which it invested. The case will then be heard by an independent arbitral tribunal instead of the domestic courts of the host state. These claims, however, can only be brought if there is an international investment agreement in place between the host state in which the investor invests, and the home state of the investor. This could be, for example, a bilateral investment treaty between two states or a multilateral international agreement that involves several states, such as the Energy Charter Treaty. In addition to access to investor-State arbitration, these international investment agreements can provide various protections to foreign investors, such as fair and equitable treatment, full protection and security, and protections against unlawful expropriation.

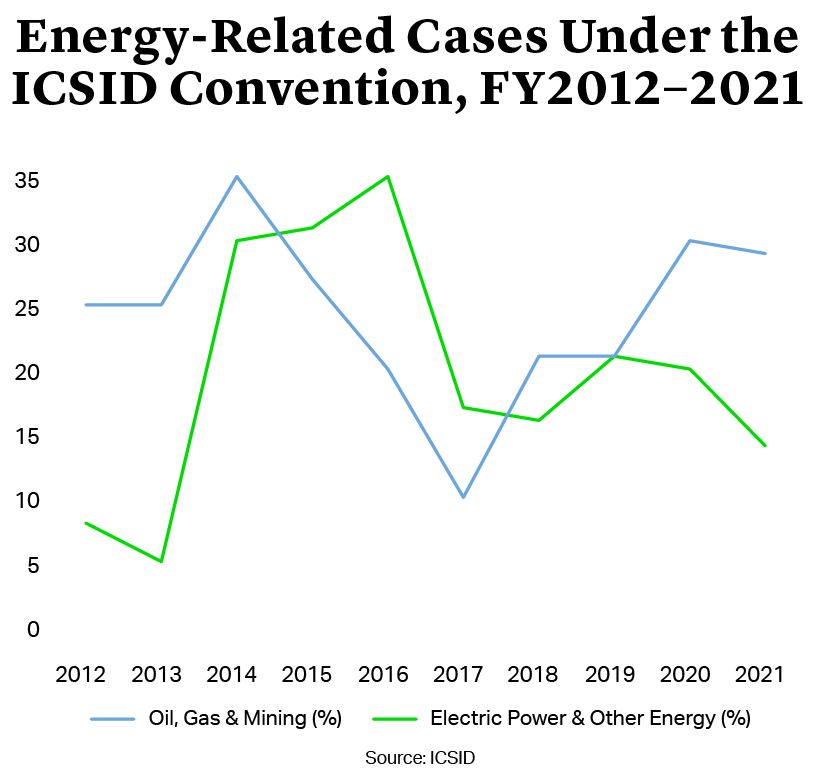

The number of disputes related to climate change and the energy transition is increasing rapidly. The International Centre for Settlement of Investment Disputes (ICSID), the body administering most investor-State arbitrations, registered a record number of 70 new cases in fiscal year 2021 of which 29% were related to oil, gas and mining and 14% to electric power and other energy1.

Investor-State arbitration claims in the field of energy are likely to continue rising as the energy transition gathers pace, buoyed by the recent COP26 climate summit in Glasgow which saw more states commit to net-zero targets. These claims may relate to, for example, states’ decisions to phase out certain forms of energy, in particular fossil fuels such as coal, but also changes to the investment framework for renewables as the roll-out of solar and wind power gains momentum and the underlying economics of renewable generation changes.

Investor-State dispute settlement (ISDS) enables a foreign investor to bring a claim against the state in which it invested. The case will then be heard by an independent arbitral tribunal instead of the domestic courts of the host state. These claims, however, can only be brought if there is an international investment agreement in place between the host state in which the investor invests, and the home state of the investor. This could be, for example, a bilateral investment treaty between two states or a multilateral international agreement that involves several states, such as the Energy Charter Treaty. In addition to access to investor-State arbitration, these international investment agreements can provide various protections to foreign investors, such as fair and equitable treatment, full protection and security, and protections against unlawful expropriation.

The number of disputes related to climate change and the energy transition is increasing rapidly. The International Centre for Settlement of Investment Disputes (ICSID), the body administering most investor-State arbitrations, registered a record number of 70 new cases in fiscal year 2021 of which 29% were related to oil, gas and mining and 14% to electric power and other energy1.

As an increasing number of states commit to net-zero emissions or carbon neutrality by 2050 or later, as well as interim targets for CO2 reductions, the number of arbitration claims from investors is expected to grow at an even faster rate. Before looking to the future, however, it is worth examining a few examples from the recent past which illustrate how investors may be exposed to regulatory risk relating to the energy transition and climate change mitigation.

In 2010, the Czech Republic introduced retroactive changes to its Feed-in-Tariff support scheme for solar power production that was first put in place in 2005. This led to a reduction in fixed tariffs and revenues for generators.

A number of foreign investors in Czech solar power projects challenged the decision before international tribunals. The outcomes of the arbitrations were broadly favorable for the Czech state as most of the tribunals took the view that the retroactive changes introduced were reasonable and proportionate. However, in the so-called Natland case, involving foreign investors in a solar PV project in the Czech Republic, a tribunal found in an interim award that the retroactive changes breached the fair and equitable treatment standard under the Energy Charter Treaty.

States have been eager to incentivise the energy transition, and investors have been receptive. According to the International Energy Agency (IEA), since 2015 global energy supply investment in renewable power grew steadily to reach $359bn in 20202. In 2021, the figure is expected to have risen again to $367bn3. However, evolving investment environments and policy frameworks create risks and tensions, and incentive programs under which investors invest may be modified as the economic and policy context changes. These tensions will play out in investor-state claims going forward.

As an increasing number of states commit to net-zero emissions or carbon neutrality by 2050 or later, as well as interim targets for CO2 reductions, the number of arbitration claims from investors is expected to grow at an even faster rate. Before looking to the future, however, it is worth examining a few examples from the recent past which illustrate how investors may be exposed to regulatory risk relating to the energy transition and climate change mitigation.

In 2010, the Czech Republic introduced retroactive changes to its Feed-in-Tariff support scheme for solar power production that was first put in place in 2005. This led to a reduction in fixed tariffs and revenues for generators.

A number of foreign investors in Czech solar power projects challenged the decision before international tribunals. The outcomes of the arbitrations were broadly favorable for the Czech state as most of the tribunals took the view that the retroactive changes introduced were reasonable and proportionate. However, in the so-called Natland case, involving four foreign investors in a solar PV project in the Czech Republic, a tribunal found that the retroactive changes breached the fair and equitable treatment standard under the Energy Charter Treaty.

States have been eager to incentivise the energy transition, and investors have been receptive. According to the International Energy Agency (IEA), since 2015 global energy supply investment in renewable power grew steadily to reach $359bn in 20202. In 2021, the figure is expected to have risen again to $367bn3. However, evolving investment environments and policy frameworks create risks and tensions, and incentive programs under which investors invest may be modified as the economic and policy context changes. These tensions will play out in investor-state claims going forward.

Exposure to Regulatory Risk

The fact that many states have set targets to phase-out of fossil fuel power generation in the wake of the COP21 Paris Agreement on climate change and the COP26 summit in Glasgow is likely to lead to a growing number of claims from energy companies that have invested in fossil fuel power generation. Much of the investment that has taken place in fossil fuels, including both coal and gas, is recent. Assets including pipelines and power plants were built and are being built as the energy transition was already starting to take place. In Germany, for example, state-of-the-art hard coal power plants built only a few years ago have opted for voluntary closure in auctions in return for compensation payments4.

Many other European states have also set specific phase-out dates for coal-fired generation. In response, in February 2021, German utility RWE filed a claim against the Netherlands under the ECT, seeking up to €1bn in compensation for the Dutch government’s decision to phase out coal power by 2030. RWE says its Eemshaven coal-fired plant, which was completed in 2015 at a cost of €3bn, was built at the request of the Dutch government5. In April, Uniper, another German utility, filed a similar claim under the ECT against the Dutch state6.

Exposure to Regulatory Risk

The fact that many states have set targets to phase-out of fossil fuel power generation in the wake of the COP21 Paris Agreement on climate change and the COP26 summit in Glasgow is likely to lead to a growing number of claims from energy companies that have invested in fossil fuel power generation. Much of the investment that has taken place in fossil fuels, including both coal and gas, is recent. Assets including pipelines and power plants were built and are being built as the energy transition was already starting to take place. In Germany, for example, state-of-the-art hard coal power plants built only a few years ago have opted for voluntary closure in auctions in return for compensation payments4.

Many other European states have also set specific phase-out dates for coal-fired generation. In response, in February 2021, German utility RWE filed a claim against the Netherlands under the ECT, seeking up to €1bn in compensation for the Dutch government’s decision to phase out coal power by 2030. RWE says its Eemshaven coal-fired plant, which was completed in 2015 at a cost of €3bn, was built at the request of the Dutch government5. In April, Uniper, another German utility, filed a similar claim under the ECT against the Dutch state6.

A number of European states have also announced plans to phase out nuclear power, by 2022 and 2025 respectively in the case of Germany and Belgium. Germany made this decision shortly after the Fukushima disaster in Japan in 2011.

In 2012, Swedish investor Vattenfall commenced an arbitration claim against Germany before the International Centre for Settlement of Investment Disputes (ICSID) relating to the nuclear phase-out plans. After years of wrangling, the German government recently entered into a settlement agreement with Vattenfall and will pay €1.4bn to the Swedish investor. Although investor-state arbitration is the preserve of the foreign investor, German companies affected by the phase-out decision will also receive compensation from the government: RWE, for example, was awarded €880mn.

As for Belgium, if the 2025 nuclear phase-out goes ahead, the country will lose around 35% of its generation capacity7. In a move aimed to ensure security of supply, grid operator Elia carried out the first capacity auction in October whereby power generators could bid for capacity contracts with a duration of up to 15 years. Generators receiving capacity contracts are guaranteed a fixed revenue stream on top of the market price for the electricity they produce. The capacity remuneration market (CRM) is effectively a subsidy scheme and was approved by the European Commission in August 2021 despite initial doubts over its compatibility with state aid rules8. A number of European states have introduced CRMs, the UK, France and Poland among them, in order to prevent power plant closures and foster new investment in generation capacity.

The participation of foreign investors planning new capacity was quite limited in the first Belgian auction, but this may well change in subsequent auctions. Belgium will likely need plenty of new investment in gas-fired power generation to compensate for nuclear reactors going offline. The long duration of some of the contracts increases the risk that investors will be exposed to incentive changes, for example if the CRM proves too costly once implemented.

Investors in nuclear power are also exposed to regulatory risks in states with no phase-out plans. Nuclear power is fundamentally dependent on government-backed subsidies, such as Contracts for Difference (CfDs). The UK’s Hinkley Point C, for example, has secured a CfD agreement worth £92.50/MWh over a 35-year period, meaning the government will guarantee that price even if wholesale market prices are lower9. But a lot can change in a 35-year period as governments come and go and energy markets evolve.

It is worth noting that the UK has since moved away from the CfD model to support nuclear power. The government says CfDs put too much construction risk on developers and that this has led to investors walking away from big projects. This was exemplified by Japanese firm Hitachi’s decision to cancel the 2.9 GW Wylfa plant in Wales last year10. In October 2021, the government put forward a new funding model for nuclear power known as Regulated Asset Base (RAB). Under the RAB model, investment costs for nuclear projects are passed on to end-users’ bills during the construction period.

Scaling Up Climate Targets

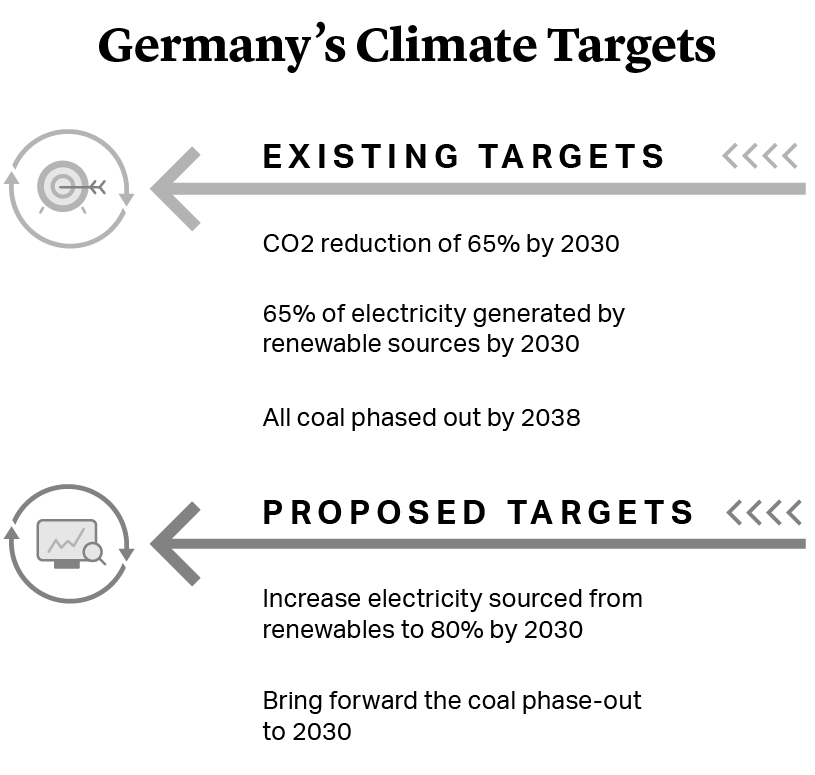

Government intervention does not usually target specific forms of power generation directly. Many states and jurisdictions have set interim targets for CO2 emissions reductions on the pathway to achieving net-zero emissions by 2050. The U.S., UK, Japan and the EU are examples of this. The U.S. has also set a clean electricity target by 2035 and the UK has said it will do the same, with the caveat that this is “subject to security of supply.” Moreover, in the EU, some member states have set targets which go beyond the EU-wide target of 55% CO2 reductions by 2030 (compared with 1990 levels). Germany, for example, has set a CO2 reduction target of 65% by 2030. It has also set a target of 65% of electricity to be generated by renewable sources by 2030. The new coalition government in Germany has proposed to increase the renewables target to 80% and bring the coal phase-out forward by eight years to 203011. The proposals, presented in the coalition agreement, need approval by the Bundesrat – Germany’s legislative body – and the Bundestag – which is the federal parliament – to be passed into law.

Scaling Up Climate Targets

Government intervention does not usually target specific forms of power generation directly. Many states and jurisdictions have set interim targets for CO2 emissions reductions on the pathway to achieving net-zero emissions by 2050. The U.S., UK, Japan and the EU are examples of this. The U.S. has also set a clean electricity target by 2035 and the UK has said it will do the same, with the caveat that this is “subject to security of supply.” Moreover, in the EU, some member states have set targets which go beyond the EU-wide target of 55% CO2 reductions by 2030 (compared with 1990 levels). Germany, for example, has set a CO2 reduction target of 65% by 2030. It has also set a target of 65% of electricity to be generated by renewable sources by 2030. The new coalition government in Germany has proposed to increase the renewables target to 80% and bring the coal phase-out forward by eight years to 203011. The proposals, presented in the coalition agreement, need approval by the Bundesrat – Germany’s legislative body – and the Bundestag – which is the federal parliament – to be passed into law. [CGSH1]

Even though these climate goals do not target ‘brown’ investments directly, it is evident that they will have an impact on their profitability and lifespan over time. The renewables expansion means that coal and gas plants will not run as many hours as anticipated when the investments were made. These plants may also be exposed to lower wholesale prices driven down by periods of ‘cheap’ electricity from wind and solar plants which do not incur fuel costs. This increases the risk of assets being “stranded” as the investment environment changes, particularly for coal plants, but also for gas plants in the longer term.

Data compiled by Jamie Donovan of Monument Economics Group and Kenneth Grant of Berkeley Research Group show that the cost of generating power from coal is higher compared with combined cycle gas turbine plants used in natural gas generation and offshore wind and far higher compared with onshore wind and solar PV12. As the economics of energy generation change, investors may seek to recoup diminishing returns by bringing claims.

To this end, some countries have set up compensation or subsidy schemes for conventional power plants. In Germany, which aims to phase out coal power by 2038, regular auctions take place in order to compensate investors who are willing to retire hard coal plants early. There is also a separate compensation scheme for lignite power plants. Plants built as recently as 201413 and 2015 have successfully bid for closure payments in auctions14.

A number of countries announced at the COP26 climate summit in Glasgow that they will phase out coal in the 2030s and 2040s. Vietnam and Indonesia are among the noteworthy signatories to the agreement as these states derive 40-50% of their energy from coal15.

The UK government has said it will close the country’s few remaining coal-fired plants by 2024. Whether this is achievable is an open question. A number of the country’s ageing nuclear reactors are also coming offline by the mid-2020s and Hinkley Point C will not start generating electricity before 2026 at the earliest. With much capacity going offline, the UK could see capacity shortages during cold spells16.

Even though the UK has been quite successful in phasing out coal in power, closing around 15 coal-fired plants over the last decade or so, the country still needs coal for steel production. This is exemplified by the planned new coal mine in Cumbria, for which a final investment decision is expected this year. If built, the mine would be highly exposed to regulatory risks, such as early closure, as the UK will need to continue to cut CO2 emissions to meet the 78% emissions reduction target by 2035.

Even though these climate goals do not target ‘brown’ investments directly, it is evident that they will have an impact on their profitability and lifespan over time. The renewables expansion means that coal and gas plants will not run as many hours as anticipated when the investments were made. These plants may also be exposed to lower wholesale prices driven down by periods of ‘cheap’ electricity from wind and solar plants which do not incur fuel costs. This increases the risk of assets being “stranded” as the investment environment changes, particularly for coal plants, but also for gas plants in the longer term.

Data compiled by Jamie Donovan of Monument Economics Group and Kenneth Grant of Berkeley Research Group show that the cost of generating power from coal is higher compared with combined cycle gas turbine plants used in natural gas generation and offshore wind and far higher compared with onshore wind and solar PV12. As the economics of energy generation change, investors may seek to recoup diminishing returns by bringing claims.

To this end, some countries have set up compensation or subsidy schemes for conventional power plants. In Germany, which aims to phase out coal power by 2038, regular auctions take place in order to compensate investors who are willing to retire hard coal plants early. There is also a separate compensation scheme for lignite power plants. Plants built as recently as 201413 and 2015 have successfully bid for closure payments in auctions14.

A number of countries announced at the COP26 climate summit in Glasgow that they will phase out coal in the 2030s and 2040s. Vietnam and Indonesia are among the noteworthy signatories to the agreement as these states derive 40-50% of their energy from coal15.

The UK government has said it will close the country’s few remaining coal-fired plants by 2024. Whether this is achievable is an open question. A number of the country’s ageing nuclear reactors are also coming offline by the mid-2020s and Hinkley Point C will not start generating electricity before 2026 at the earliest. With much capacity going offline, the UK could see capacity shortages during cold spells16.

Even though the UK has been quite successful in phasing out coal in power, closing around 15 coal-fired plants over the last decade or so, the country still needs coal for steel production. This is exemplified by the planned new coal mine in Cumbria, for which a final investment decision is expected this year. If built, the mine would be highly exposed to regulatory risks, such as early closure, as the UK will need to continue to cut CO2 emissions to meet the 78% emissions reduction target by 2035.

Carbon Trading – Winners and Losers

Prices for carbon allowances under the EU’s emission trading cap-and-trade system have surged in recent years, eating into the profitability of coal-fired power generation in particular. Gas-fired power generators, particularly older and less efficient plants, may also see profit margins reduced if carbon prices continue to rise in the future.

Regulatory intervention by the EU, effectively by taking a large number of allowances out of the market and reducing the supply of new credits, has supported the surge in carbon prices. The benchmark Dec 21 contract – the standard contract for the trading of EU Allowances on exchanges - is now trading above €75/t, compared with less than €5/t only a few years ago17.

The only case so far listed by ICSID concerning carbon trading is related to Ontario’s cap-and-trade system which was launched in 2016 but cancelled in 201818. The case was initiated in late 2020 by U.S. companies Koch Industries and Koch Supply & Trading under NAFTA/USMCA. The companies’ claims relate to the lack of compensation received following the revocation of the system in 2018 after they allegedly purchased allowances for over $30mn19.

In 2020, 44 renewables investors initiated ECT arbitration against Romania concerning the country’s green certificate scheme, according to press reports. Green certificates are issued in exchange for electricity produced by renewable installations and are tradable. Changes in the quotas of certificates allocated to producers are said to have triggered the legal action.

With an increasing number of states introducing cap-and-trade, green certificates or other types of carbon markets, there is also likely to be a rise in the number of arbitration cases as these types of schemes will ultimately create winners and losers among investors.

Regulatory intervention by the EU, effectively by taking a large number of allowances out of the market and reducing the supply of new credits, has supported the surge in carbon prices. The benchmark Dec 21 contract – the standard contract for the trading of EU Allowances on exchanges - is now trading above €75/t, compared with less than €5/t only a few years ago17.

The only case so far listed by ICSID concerning carbon trading is related to Ontario’s cap-and-trade system which was launched in 2016 but cancelled in 201818. The case was initiated in late 2020 by U.S. companies Koch Industries and Koch Supply & Trading under NAFTA/USMCA. The companies’ claims relate to the lack of compensation received following the revocation of the system in 2018 after they allegedly purchased allowances for over $30mn19.

In 2020, 44 renewables investors initiated ECT arbitration against Romania concerning the country’s green certificate scheme, according to press reports. Green certificates are issued in exchange for electricity produced by renewable installations and are tradable. Changes in the quotas of certificates allocated to producers are said to have triggered the legal action.

With an increasing number of states introducing cap-and-trade, green certificates or other types of carbon markets, there is also likely to be a rise in the number of arbitration cases as these types of schemes will ultimately create winners and losers among investors.

ECT - Fit for the Future?

The ECT is the most frequently invoked investment treaty in investment arbitrations. Over 140 investment arbitrations have been initiated under the ECT, mostly relating to renewables20. To date, a violation of the treaty has been identified and damages were granted in 44% of the cases initiated21. Established in 1994, there are 54 signatories to the treaty including the EU, Japan, Switzerland, Turkey, Ukraine, Afghanistan and Azerbaijan.

However, the European Commission has expressed concern that the ECT is not fit for the green transition. In November 2021, the Eighth Negotiation Round on the modernisation of the ECT was held. Among a number of proposals addressed is the proposed inclusion in the ECT of articles addressing sustainable development and corporate social responsibility.

Additional uncertainties relate to the aftermath of the September 2021 decision of the Court of Justice of the EU in the Komstroy case that the investor-State arbitration clause in the ECT is inapplicable to disputes between investors and states in the EU. Although the practical consequences of this decision are unclear, the future for investor-state arbitration will likely revolve around disputes brought by investors from outside the trading bloc.

Commitments Could Gather Pace in 2022

A number of states pledged net-zero emissions targets in the build-up to or during the COP26 climate summit in Glasgow. They include Australia (2050), China (2060), Nigeria (2060), Saudi Arabia (2060) and India (2070). Although these net-zero plans are often short on details and the headline target may seem far into the future, these pledges will nevertheless lead to a massive transformation of energy and transport systems in the coming years and decades. This begs the question: Could investors in fossil assets reasonably have foreseen that this was coming? Or is the acceleration of the energy transition happening faster than anticipated just a few years ago, even after the Paris Agreement in 2015? Are policies directly targeting or discriminating against certain sectors or technologies (coal in particular) or are they reasonably needed for decarbonisation to take place and to curb global warming?

As states update their Nationally Determined Contributions (NDCs) in the coming months and years, and perhaps set more ambitious interim targets for 2030, the debate surrounding investor protection will intensify and the number of claims will likely rise. The Glasgow Climate Pact requests that states must “revisit and strengthen” their NDCs by the end of 2022, taking different national circumstances into account22. This is a big ask, not least in the context of the Covid-19 pandemic, and it will be interesting to see to what extent states take advantage of the economic recovery to scale up ambition on climate.

Commitments Could Gather Pace in 2022

A number of states pledged net-zero emissions targets in the build-up to or during the COP26 climate summit in Glasgow. They include Australia (2050), China (2060), Nigeria (2060), Saudi Arabia (2060) and India (2070). Although these net-zero plans are often short on details and the headline target may seem far into the future, these pledges will nevertheless lead to a massive transformation of energy and transport systems in the coming years and decades. This begs the question: Could investors in fossil assets reasonably have foreseen that this was coming? Or is the acceleration of the energy transition happening faster than anticipated just a few years ago, even after the Paris Agreement in 2015? Are policies directly targeting or discriminating against certain sectors or technologies (coal in particular) or are they reasonably needed for decarbonisation to take place and to curb global warming?

As states update their Nationally Determined Contributions (NDCs) in the coming months and years, and perhaps set more ambitious interim targets for 2030, the debate surrounding investor protection will intensify and the number of claims will likely rise. The Glasgow Climate Pact requests that states must “revisit and strengthen” their NDCs by the end of 2022, taking different national circumstances into account22. This is a big ask, not least in the context of the Covid-19 pandemic, and it will be interesting to see to what extent states take advantage of the economic recovery to scale up ambition on climate.

Christopher P. Moore

Partner

London

T: +44 20 7614 2227

New York

T: +1 212 225 2836

cmoore@cgsh.com

V-Card

Laurie Achtouk‑Spivak

Counsel

Paris

T: +33 1 40 74 68 00

lachtoukspivak@cgsh.com

V-Card

J. Cameron Murphy

Counsel

London

T: +44 20 7614 2396

cmurphy@cgsh.com

V-Card